Vitalik Buterin: Two Thought Experiments for Evaluating Algorithmic Stablecoins

Article author: Vitalik Buterin

Article compilation: Block unicorn

Special thanks to Dan Robinson, Hayden Adams, and Dankrad Feist for their feedback and review.

The recent LUNA debacle, which resulted in losses of tens of billions of dollars, has sparked a firestorm of criticism against the category of "algorithmic stablecoins," with many arguing that they are a "fundamentally flawed product." Increased scrutiny of DeFi financial mechanisms, especially those algorithmic stablecoin mechanisms that work very hard to optimize "capital efficiency", are very welcome. A greater acknowledgment that current performance is no guarantee of future returns (or even that the future will not crash completely) is more welcome. However, where the market sentiment is very wrong is that it uses the same statement to describe all decentralized encryption algorithm stablecoins, and kills all algorithmic stablecoin projects with one stick.

secondary title

What are Algorithmic Stablecoins?

For the purposes of this article, an algorithmic stablecoin is a system with the following properties:

1. It issues a stable currency, trying to anchor a specific price index. Usually, the goal is $1, but there are other options. There are targeting mechanisms that consistently push the price towards the Stability Index ($1) when the price deviates in either direction. This makes ETH and BTC not stablecoins.

2. The target mechanism is completely decentralized, and the protocol does not rely on specific trusted participants. In particular, it must not rely on asset custodians, which makes USDT and USDC not stablecoins.

In practice, (2) means that the target mechanism must be some kind of smart contract that manages a reserve of cryptoassets and uses those cryptoassets to prop up prices when prices fall.

How does Terra work?

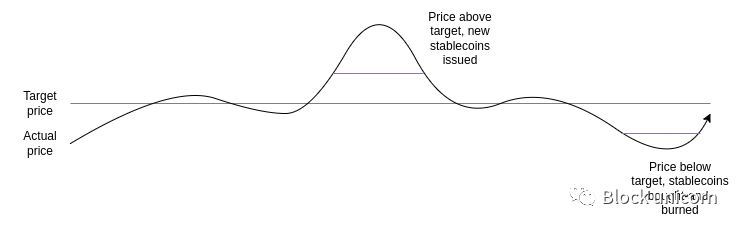

Terra-style stablecoins (roughly the same as Minting Stake, though with many implementation details different) work by having two currencies, which we refer to as stablecoins and volatilecoins (in Terra, UST is the stablecoin and LUNA is the volcoin ( volatilecoins)), stablecoins use a simple mechanism to maintain stability:

1. If the price of the stablecoin exceeds the target price, the system auctions new stablecoins (and uses the revenue to burn LUNA) until the stablecoin price returns to the target price.

2. If the price of the stable currency is lower than the target price, the system will repurchase and burn the stable currency (new LUNA is issued to fund the burning) until the stable currency price returns to the target price.

secondary title

How does RAI work?

In this post, I focus on RAI rather than DAI, as RAI better represents a pure (decentralized) "ideal type" of algorithmic stablecoins, backed only by ETH. DAI is a hybrid system backed by both centralized and decentralized collateral, which is a reasonable choice for their product, but it does make analysis trickier.

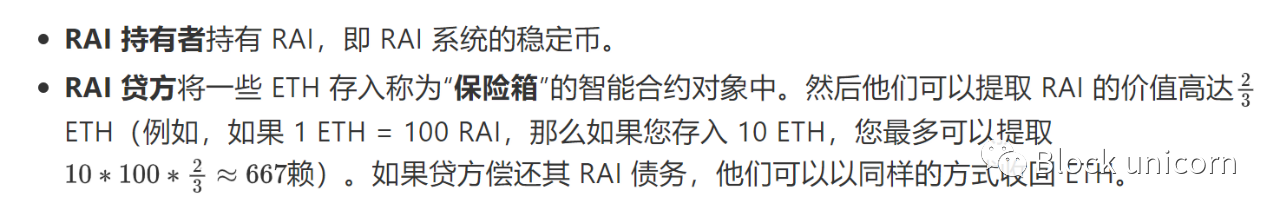

In RAI there are two main categories of participants (there are also holders of FLX, speculative tokens, but they play a less important role):

There are two main reasons to become an RAI lender:

1. Go long on ETH: If you deposit 10 ETH and withdraw 500 RAI in the example above, you end up with a position worth 500 RAI but with 10 ETH exposure, so for every 1% change in ETH price, it Will go up/down 2%.

2. Arbitrage If you find that an investment denominated in fiat currency is rising faster than RAI, you can borrow RAI, put funds into this investment, and profit from the difference.

If the price of ETH falls, and the safe no longer has sufficient collateral (meaning, RAI debt is now more than two-thirds times the value of ETH deposited), a liquidation event will occur. By offering more collateral, the safe is auctioned off for others to buy.

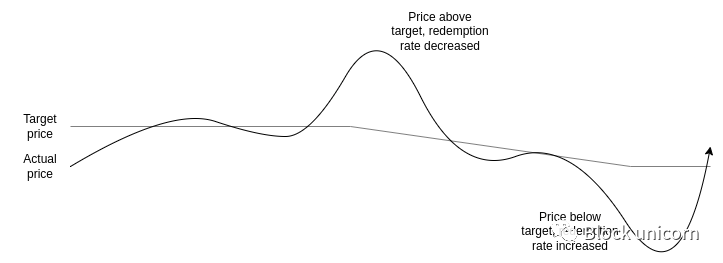

Another major mechanism to understand is the redemption rate adjustment. In RAI, the target is not a fixed amount of dollars; instead, it moves up or down, and the rate at which it moves up or down is adjusted according to market conditions:

1. If the price of RAI is higher than the target, the redemption rate decreases, reducing the incentive to hold RAI and increasing the incentive to hold negative RAI as a lender. This drives the price down.

secondary title

Thought Experiment 1

Can stablecoins be theoretically safely reduced to "zero users"?

In the non-encrypted real world, nothing lasts forever. Companies always fail, either because they failed to find enough users in the first place, because the once-robust demand for their products no longer exists, or because they were replaced by a stronger competitor. Sometimes, there is a partial breakdown, from mainstream status to niche status. MySpace). Something like this has to happen to make room for new products. But in the non-crypto world, when a product shuts down or declines, users usually don't suffer much. Of course there are instances where some people have been overlooked, but overall, the shutdown is orderly and the problems are manageable.

But what about algorithmic stablecoins? If we look at algorithmic stablecoins from a bold and radical perspective, they have the ability to avoid system crashes and lose a large number of users and funds, and should not rely on a constant influx of new users.

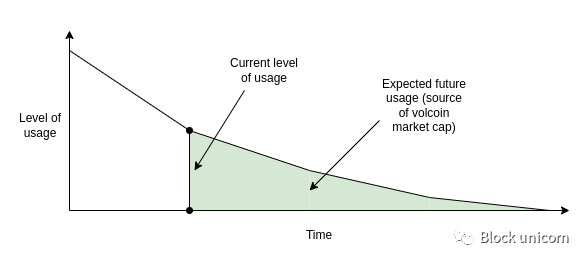

Is Terra safe to exit?

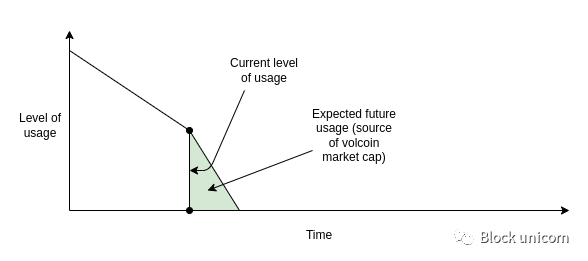

In Terra, the price of Luna (LUNA) is derived from the expectation of future activity fees on the system. So what happens if expected future activity drops to near-zero levels? LUNA’s market cap drops until it becomes considerably smaller relative to stablecoins. At this point, the system becomes very fragile: even a small shock to the demand for the stablecoin will cause the targeted mechanism to print a large amount of volcoin (LUNA), which causes LUNA to overinflate, at which point the stablecoin also loses its value.

The collapse of this system can even become a self-fulfilling prophecy: if it seems likely to collapse, it will reduce the expected value of LUNA in the future, which will lead to a decline in the market value of Volcoin (LUNA), making the system more fragile and can trigger very serious collapse, as we saw in May.

First, the LUNA price dropped. Then, the stablecoin started to falter. The system attempts to support the demand for stablecoins by issuing more LUNA. Due to lack of confidence in the market and few buyers, the price of LUNA dropped rapidly. Finally, once the price of LUNA approaches zero, the stablecoin will also collapse.

In principle, if the decline is very slow, the future cost of LUNA's ecological expectations and its market value and stable currency are relatively better. However, it is unlikely that it will be managed successfully to allow it to drop slowly, more likely to drop rapidly in a split second, followed by a bang.

Safe Gradual Exit: Each step will ensure that the LUNA market cap has enough revenue expected in the future to keep the stablecoin safe at its current level.

Unsafe phase-out: At some point, there is not enough expected future revenue to justify a sufficient LUNA market cap to keep the stablecoin safe, and there is a risk that it will crash.

Can RAI exit safely?

The security of RAI relies on assets outside the RAI system (ETH), so RAI is easier to exit safely. If the drop in demand creates an imbalance (thus, either holding demand falls faster or loan demand falls faster), the redemption rate adjusts to bring the two into balance. Lenders hold leveraged positions in ETH, not FLX, so there is no risk of a positive feedback loop where confidence in RAI decreases leading to a decrease in demand for loans.

If, in an extreme case, the need to hold RAI disappears at the same time for all but one holder, redemption rates will skyrocket until eventually every lender's security is liquidated. The only remaining holders will be able to buy safes in a liquidation auction, use their RAI to instantly liquidate their debt, and withdraw ETH. This gives them the opportunity to get a fair price for their RAI, bought from ETH in the safe.

secondary title

Thought Experiment Two

What happens if you try to peg a stablecoin to an index that goes up 20% a year?

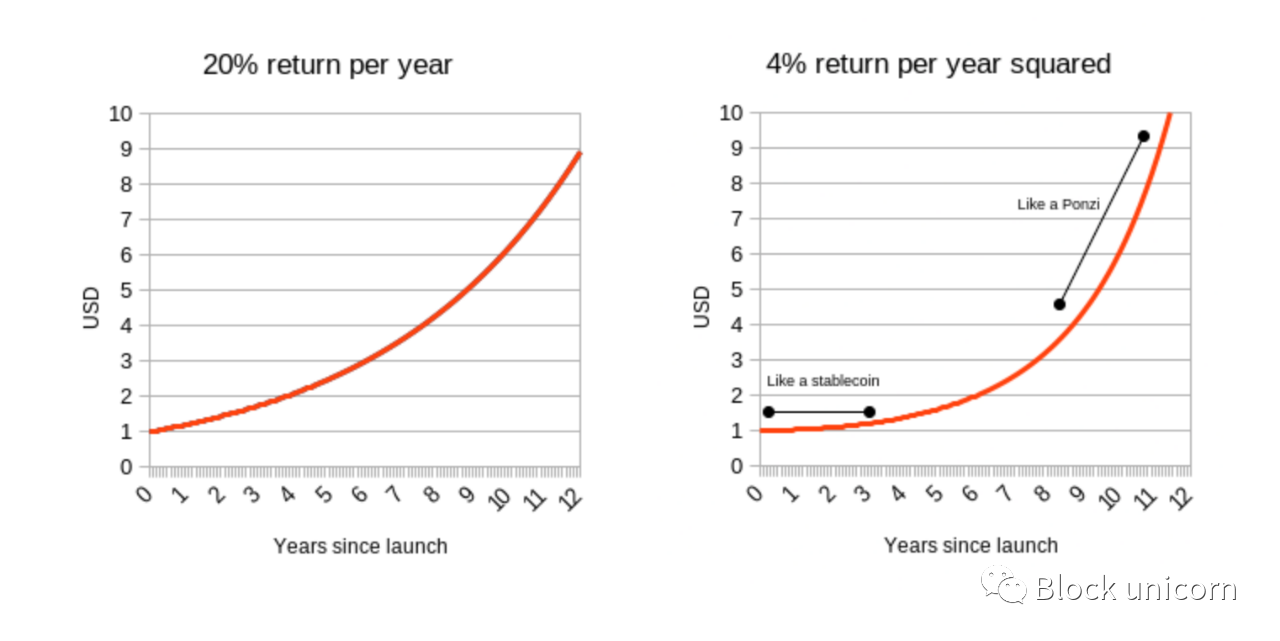

Currently, stablecoins tend to be pegged to the U.S. dollar. RAI is a minor exception, as its peg moves up and down as the exchange rate changes, and the peg starts at $3.14, not $1 (the exact starting value is subject to math in general Human friendly, as a real math nerd would choose tau = $6.28). But they don't have to. You can compare a stablecoin to a basket of assets, a consumer price index, or any complex formula (“a value sufficient to buy a hectare of land in the Yakut forests (i.e., global average CO2 concentration minus 375}) ’) for hooking. As long as you can find an oracle to prove the index, and there are people from all parties in the market, you can make such a stablecoin work.

Obviously, there is no real investment that will return anywhere near 20% a year, and absolutely no real investment that will return 4% a year forever. But what happens if you try?

What I'm trying to say is that there are basically two ways for stablecoins to track such an index:

1. It charges holders some kind of negative interest rate to basically offset the dollar-denominated growth rate in the index.

2. It became a Ponzi scheme, giving stablecoin holders amazing returns for a while, until one day it suddenly crashed.

This should make it easy to understand why RAI(1) and LUNA(2), so RAI is better than LUNA. But it also speaks to a deeper, more important truth about stablecoins: For a secured algorithmic stablecoin to be sustainable, it must somehow include the possibility of implementing negative interest rates. If RAI is programmatically prevented from implementing negative interest rates (which was the basic practice of early single-collateral DAI), it can also become a Ponzi scheme if it is pegged to a rapidly appreciating price index.

Even outside of the crazy assumption that you build a stablecoin to track a Ponzi index, the stablecoin has to somehow be able to cope with holding demand outstripping borrowing demand even at zero interest rates. If you don't, the price will rise above the peg, and the stablecoin becomes vulnerable to price swings in both directions, which can be quite unpredictable.

Negative interest rates can be achieved in two ways:

1. RAI dstyle, with a floating target that can decrease over time if the redemption rate is negative.

2. In reality, the balance will decrease over time.

secondary title

what can we learn

In general, the crypto space needs to change the attitude that it depends on endless growth to be safe. It is certainly unacceptable to maintain this attitude by saying "the world could work the same way". Because the world is not trying to provide any return, the economy does not rise according to rationality, but rises pathologically, and of course there must be fierce criticism.

Instead, while we should expect growth, we should assess how safe systems are by looking at their steady state, or even the pessimistic state of how they behave under extreme conditions, and whether they can eventually exit safely. If a system passes this test, it does not mean it is secure, it may still be vulnerable for other reasons. Collateral ratios are insufficient, or there are flaws or governance holes, but corner cases and robustness should be the first things we check.