The Terra Revival Plan is officially passed, and the ten things you care about most are here

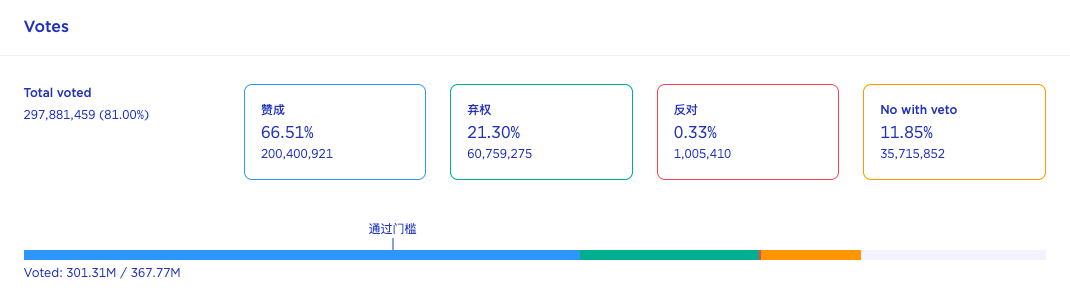

On the evening of May 24th, Beijing time, Do Kwon, the founder of Terra, put forward the proposal of "Reconstructing the Terra Ecosystem 2" (Prop 1623) was officially approved by the community vote (the pass rate exceeded the 50% threshold set earlier).

Current voting data shows that a total of 81% of LUNA holders voted for Prop 1623, of which 66.51% (200 million) supported, 21.3% abstained, and 0.33% opposed. According to the voting rules, the total number of votes is about 367 million. According to the voting rules, the total number of votes is about 367 million, and 50% is the pass threshold. At present, the support of 200 million has exceeded 50%, which means that the vote has been passed.

Regarding the Terra revival plan, Odaily has compiled ten things that everyone is most concerned about:

1. The revival plan is not to hard fork the existing Terra blockchain, but to create a new chain; the new chain is called Terra (the token is LUNA), and the old chain is called Terra Classic (the token is Luna Classic , LUNC), andThe new chain will not share all of its historical data with the original chain. It is important to note that the new Terra chain will not have the algorithmic stablecoin UST.

2. The total amount of new LUNA tokens is 1 billion, and the network security is stimulated through token inflation. The inflation rate is temporarily set at 7% per year; and, Luna Classic pledgers, holders, aUST and UST will also be held Airdrops to developers and important application developers of Terra Classic.

3. Odaily calculates according to specific airdrop rulesInitial circulation of each part: (The time of the snapshot before the attack is Beijing time 2022.05.07 22:59:37)

The community pool receives 30% (300 million) airdrops: 20% of which are controlled by pledge governance, and there is no specified lock-up time, which can be regarded as part of the initial liquidity; 10% is dedicated to developers, of which 0.5% belongs to "emergency distribution" , will be allocated to developers to build products immediately after the new network is launched, and the remaining 9.5% basically needs to be unlocked to complete. Therefore, the total initial liquidity in this section is 205 million.

Before the attack, LUNA holders received 35% (350 million) airdrops: among them, wallet addresses with less than 10,000 Luna tokens accounted for 6.45%, that is, 22.57 million new coins were obtained, and these new coins were unlocked at the time of creation 30%, or 6.77 million, the remaining tokens will be unlocked within 2 years after being locked for 6 months; if the wallet address Luna is between 10,000 and 1 million, it will be locked for one year and unlocked for two years; if the wallet address Luna is between 100 For more than 10,000, the warehouse will be locked for one year and unlocked for four years. Therefore, the final initial liquidity of this part is 6.77 million.

Before the attack, holders of aUST (Anchor pledge) received a 10% airdrop: 30% of which were unlocked at the time of creation, and 70% were unlocked within 2 years after being locked for 6 months. Therefore, the final initial liquidity of this part is 30 million.

After the attack, LUNA holders will receive a 10% airdrop: 30% of which will be unlocked at the time of creation, and 70% will be unlocked within 2 years after being locked for 6 months. Therefore, the final initial liquidity of this part is 30 million.

After the attack, UST holders will get a 15% airdrop: 30% of which will be unlocked at the time of creation, and 70% will be unlocked within 2 years after being locked for 6 months. Therefore, the final initial liquidity of this part is 45 million.

To sum up, the initial liquidity of new Luna tokens is 311.77 million.

4. The new LUNA chain willTake a snapshot at Terra Classic block 7790000 (estimated at 3:59:51 on May 27, Beijing time), the first genesis block was born. At present, the major exchanges have not yet issued an announcement to support snapshots. Therefore, users who hold LUNA and UST after the attack are recommended to lift the tokens to the Terra wallet and wait for the snapshot, so as not to miss the airdrop.

5. Do Kwon saidTFL wallet (click to view)Will be removed from the airdrop whitelist, making Terra a fully community-owned chain. Currently, there are 300 million LUNA and more than 3 million UST in this address. If you participate in the airdrop distribution, you will get nearly 110 million SGD.

6. Luna Foundation Guard (LFG) currently has 1.85 billion UST and 2.3 billion LUNA in the wallet, ifParticipate in the airdrop and get 25 million SGD, so some community members proposed to remove the LFG wallet from the LUNA 2 airdrop whitelist. The request has been officially approved, and the LFG address does not participate in this airdrop. In addition, LFG promises to give priority to compensating UST small holders, but has not yet come up with specific plans and standards.

7. Previously, the community put forward the Prop 1188 proposal, trying to "destroy the remaining UST in the community pool + cross-chain liquidity incentive UST", so that ordinary UST holders can get more airdrops. Although the proposal was finally passed, it was not successfully implemented due to technical failures caused by parameter settings, and then the community revised it againProp 1747. The proposal is currently being voted on, but it has not reached the 50% pass threshold. There is still one day left before the voting closes, and it is unclear whether it can be successfully deployed and implemented before the snapshot on the 27th.

8. After Terra rebuilds, it will not share history with Terra Classic,DApps or assets from the old chain will also not pre-exist on Terra, so DAPPs built on Terra Classic need to be migrated. At present, many applications including PRISM, Stader Labs, RandomEarth, OnePlanet, etc. have made commitments to migrate to the new chain, and some applications have chosen to move to Ethereum or other blockchains. Of course, the old chain will not be abandoned, there are still nodes (validators) who will choose to maintain and operate, and the Terra Foundation has not announced that it will completely abandon the old chain.

9. Recently, some community members have sent LUNA tokens directly to the destruction address. Do Kwon tweeted to remind that this action "has no effect other than losing your own tokens."

10. UST’s de-anchor thunderstorm also reminds investors that they need to be rational and cautious when facing high-yield projects, and at the same time diversify their investment portfolios as much as possible, and don’t put all their savings in one basket.