Delphi: 4D Detailed Explanation of L1 Public Chain Valuation Methodology

The main points

Compilation: Aididiao

The main points

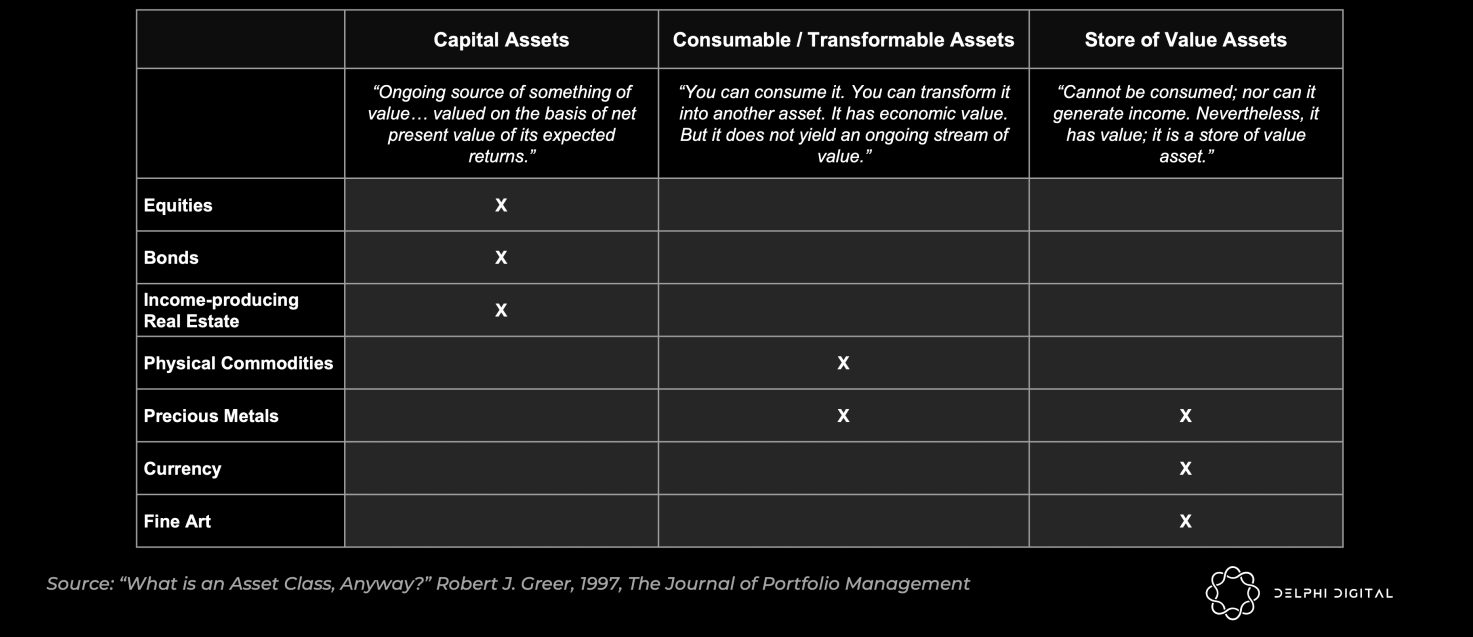

Traditional assets generally fall into three categories - capital assets, consumable/convertible assets, and store-of-value assets. Cryptocurrencies offer the unique ability to combine all three.

Capturing value from network fees and MEV generates a strong token economy, which directly brings very substantial real benefits to native assets.

While obtaining long-term benefits, it must be guaranteed not to increase user transaction costs (network expansion is a must). Monolithic blockchains may not be able to achieve the scale needed to capture the majority of revenue.

Multi-chain ecosystems such as Avalanche and Cosmos can reach very large scale. However, this fragmented security model is inherently difficult to feed back the underlying layer assets.

image description

image description

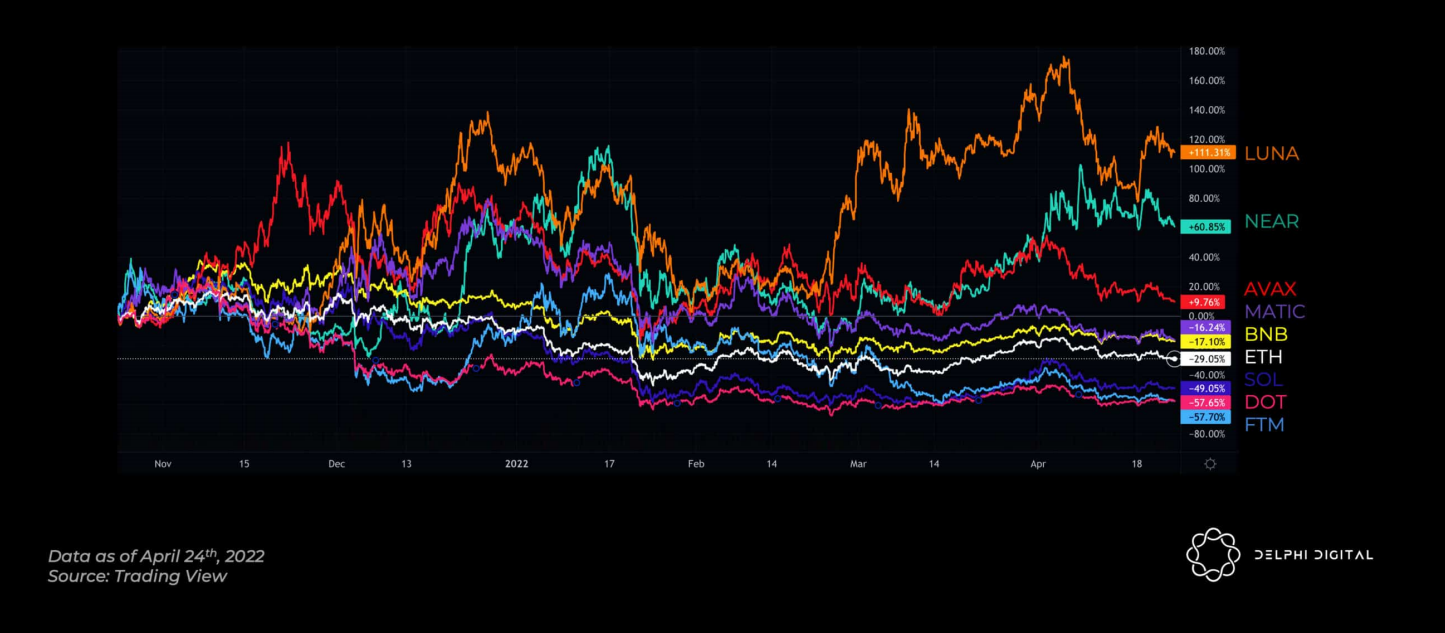

L1 price performance in the past six months

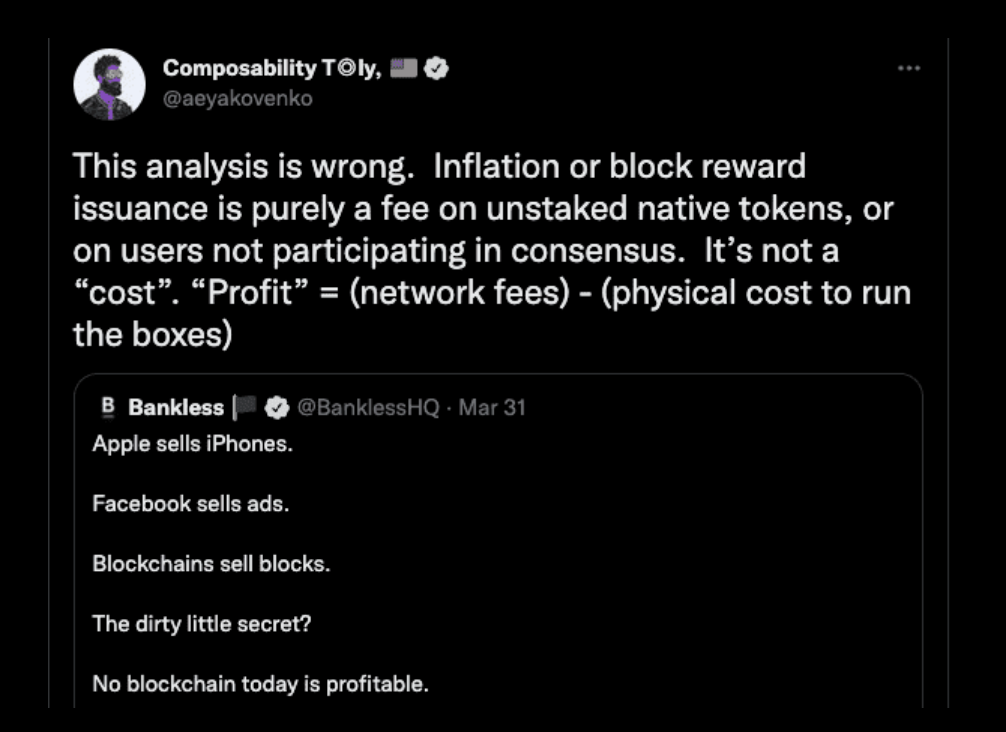

If you ask a banker, how is Apple valued? The answers you get are more or less related to discounted cash flow, price-to-earnings ratio, etc. But if you ask cryptocurrency professionals, how do they value ETH? In fact, ask them why the token has value? Are cryptocurrencies real money? Or commodities, stocks or bonds? You will get different answers.

So, how exactly is a token valued? Some business valuation tools may work quite well for your favorite DEX. But if the token includes a stake in governance and financial control, valuation becomes difficult. Just look at "Curve Wars" to see how valuable governance might be. Prioritizing growth metrics for early-stage startups, applying DCF (discounted cash flow) to more established cash flow protocols sounds more reasonable.

Things get tricky when we introduce native L1 tokens. Governance? Not too possible. Generate income for holders? uncertain. Specifically, miners in a PoW network take away block rewards, transaction fees, and MEV profits; both Bitcoin and Ethereum are fully governed off-chain. BTC and ETH have dominated the crypto market for a long time, and these things are important, but it shows a bigger picture.

Taking Solana as an example, token holders directly obtain network value through staking. In Anatoly's words, Solana is an information bus. Other than your stake entitles you to MEV, SOL is just "something to prevent spam in the message bus, that's all", and any value beyond that is unknown. So, should the value of SOL be equal to the net present value of its future expected MEV? Even in the most aggressive forecasts, SOL's market cap would be shaved.

For the sake of simplicity, this report mainly uses ETH and SOL when discussing, which represent:

ETH - A public chain that tries to obtain sustainable value, that is, a type of public chain that continues to increase the value of tokens and is critical to network development;

SOL - Public chains that try to minimize fees and value extraction from users, where the development status of such public chains has a low correlation with token prices.

The reason for using SOL as an example is that Anatoly has explained it thoroughly and clearly, which is a prerequisite for a healthy debate. While I disagree with many of his arguments, I will respect the process of arguing this one.

Why do tokens have value?

image description

Asset Class

The L1 cryptocurrency is the first asset to show characteristics of all three.

Capital Assets: Continuously bring real benefits to stakers and holders

Some call it an indefinite bond, some call it a dividend stock, whatever you call it, it's all about yield. Capital assets are sought after against a backdrop of negative real (inflation-adjusted) yields on fiat currencies. When other things are equal, investors want positive real yields (e.g. staking ETH) rather than severely negative yields (e.g. U.S. Treasuries).

ETH pledged - future cash flow is issued in the form of deflationary currency ETH (this makes the real yield more attractive)

U.S. Treasuries - future cash flow depreciated by inflation the moment you receive it

Whereas with ETH, if you denominate your returns in USD, your yield is subject to ETH/USD volatility; if you denominate in ETH, you happily accumulate deflationary assets. It's a matter of perception, and it's crucial: Ethereum needs to convince holders to denominate their investments in ETH (like we do in USD today).

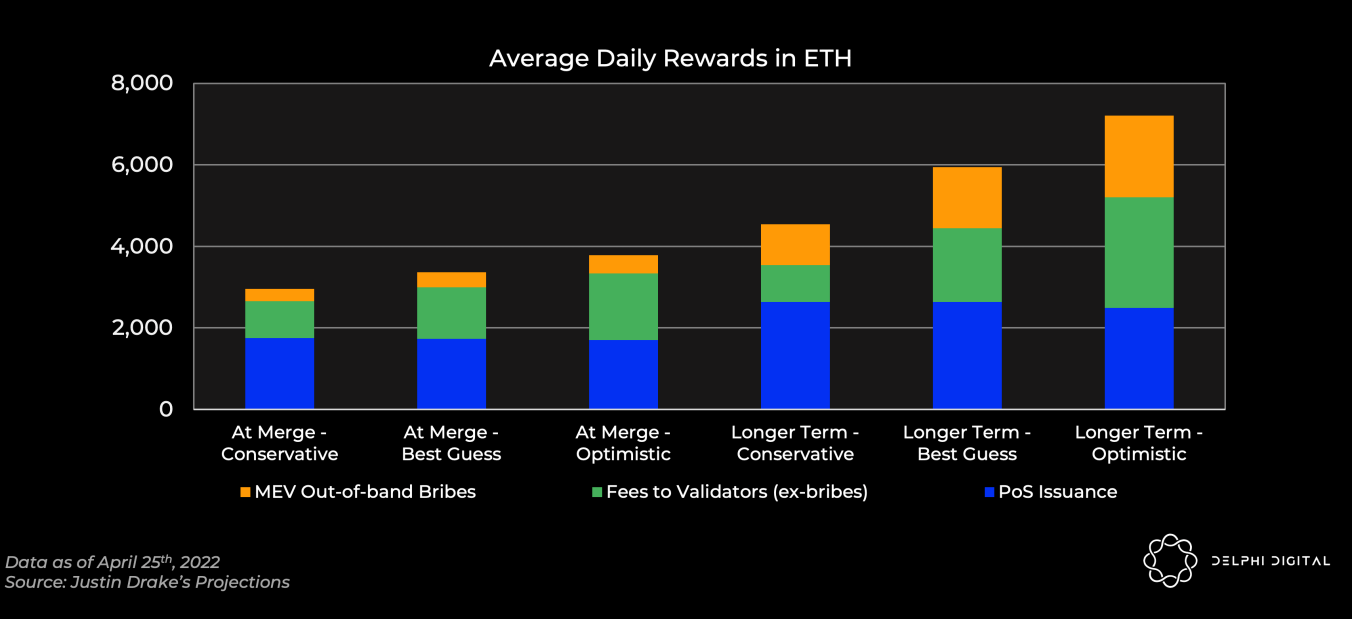

The emphasis here is on real returns (as opposed to nominal returns). So how do we make the benefits sustainable? Staking rewards consist of three parts.

Inflation block reward

Block rewards increase notional yield, but it does not increase the value of proof of stake. Stakers simply receive rewards from holders. The hype surrounding the Ethereum merger revolves aroundMassive reduction in block rewards-- Subsidies to miners are expensive and result in a loss of value from the entire token ecosystem.

MEV

MEV strengthens safety budgets and increases real profitability. In an efficient market (with the help of projects like Flashbots), searchers should end up paying the full value of MEV as fees to validators.

Users don't line up left and right for a sandwich attack, though. Pragmatism calls for reducing exploitative MEV as much as possible, and then socializing the remainder (e.g., giving stakers or funding public goods). Avalanche's Snowman++ is a recent example of a protocol-level update aimed at reducing MEV.

In some cases, Flashbots cap Ethereum MEV in the $500M or so range in 2021. From August 1 to December 31, the MEV of Ethereum, BSC, Avalanche, and Polygon were at least $179.5 million, $34.79 million, $18.84 million, and $11 million, respectively. Be aware that these are extreme lower bound estimates, and without even tracking major categories of MEV such as sandwich attacks, flash loans, and liquidations, the true extent remains a mystery.

After the merger, MEV will accrue to ETH stakers instead of miners. Via Flashbots (which socializes MEV among validators), Seekers can now pay indirectly for inclusion in transactions through high gas fees, or they can set fees to zero and pay rewards directly to miners/validators .

image description

Transaction Fees

Transaction Fees

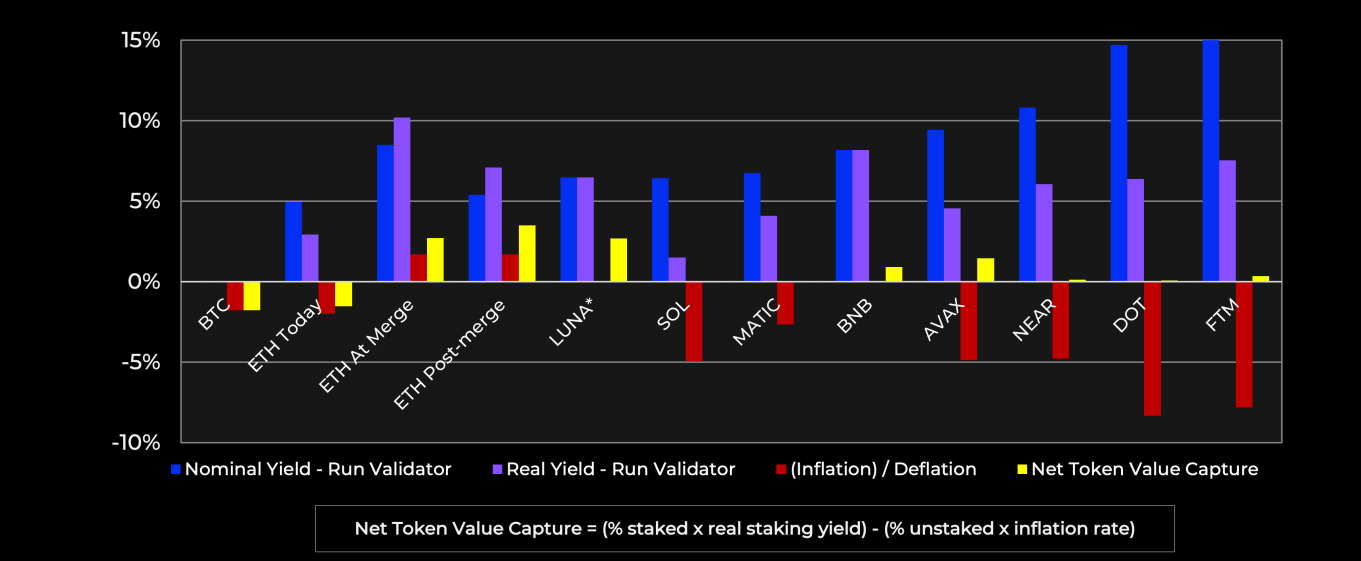

image description

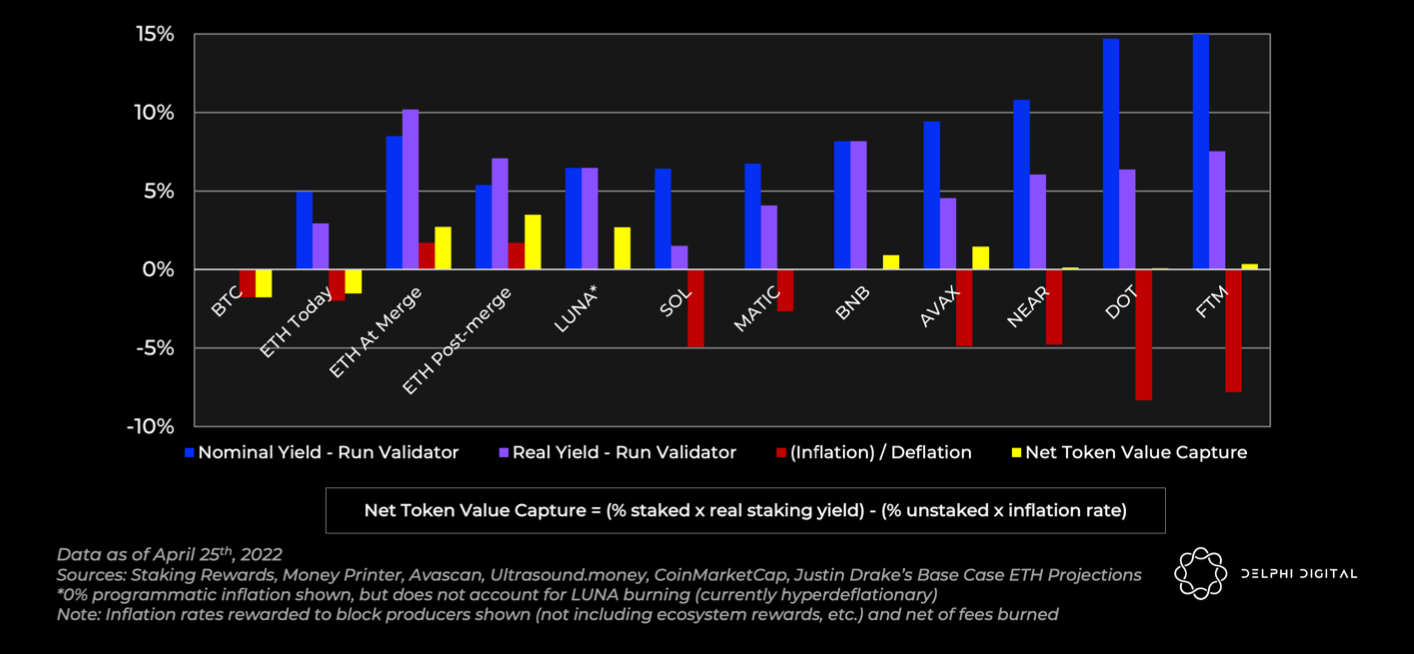

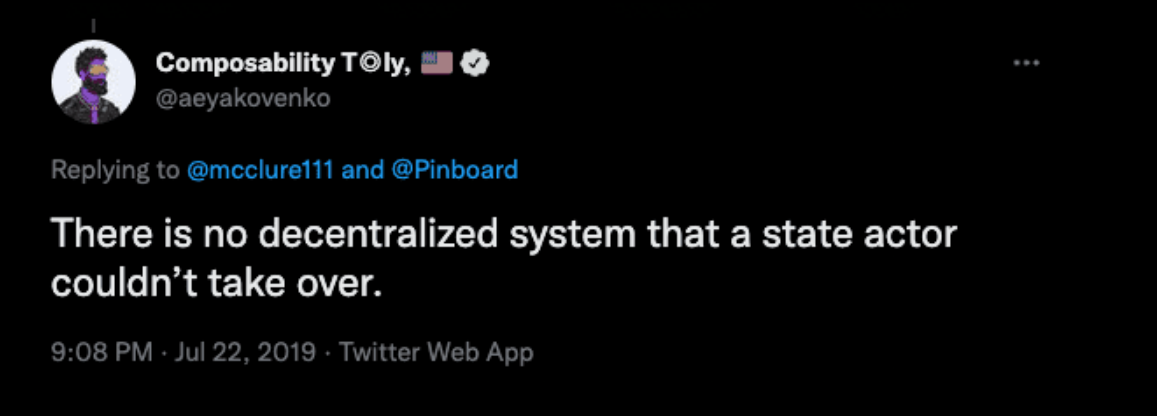

Comparison chart of public chain nominal rate of return and actual rate of return, the merged Ethereum and Luna are unique

Net Token Value Capture = (Staked Ratio x Actual Staking Yield) - (Unstaked Ratio x Inflation Rate)

The nominal rate of return is the headline rate and the real rate of return is inflation after token burns are deducted.

The formula then captures the weighted average real rate of return for all token holders, which includes stakers and non-stakers. The first half measures the actual return for stakers, and the second half measures the actual return for unstaked holders.

Actual staking rewards come from transaction fees, MEV earned by validators, and token burning (which also benefits all holders).

Note that this does not penalize high PoS inflation as it would with a simple value capture model such as fees minus issuance. Inflationary block rewards left in the protocol simply transfer value from holders to stakers. A higher inflation rate would change my personal opportunity cost and decision to bet or not. However, it doesn't actually account for the value capture of the entire token itself. You are just judging whether it is in favor of the staker or other holders. Either way, value capture is neutral, and the difference lies in which participant benefits.

This is similar to deciding whether to burn fees or give them to validators. In this case, the value is both captured, you just decide who it is better for.

If you are going to buy tokens for a long-term investment, then you would logically want to stake your tokens. Therefore, higher block rewards should not directly harm any valuation method. The maturity of liquid staking derivatives will also make staking more ubiquitous. Most L1s already have the majority of their supply tokens staked (ETH is currently the outlier for obvious reasons), and this should increase over time. Come to think of it, if 100% of the tokens are staked, I really don't care if the inflation rate is 5% or 10%. It's all just value moving and I'm breaking even.

However, this metric does reflect the fact that PoW block rewards do dilute the token value in the hands of all holders. As a BTC holder, I don't really care directly if network fees are high at all, because I can't capture them through staking. BTC did not capture any upside opportunities. Therefore, under inflation, the real rate of return of BTC will always be negative.

While there is no direct accusation of value capture in highly inflationary PoS here, I still believe that relatively low inflation rates are beneficial for monetary stability and premiums. If these L1s hope to one day transform from "speculative investments" into real "money" (becoming a measure of value and a medium of exchange), high inflation rates are untenable. Even if it doesn't directly hurt valuations, it can lead to price instability and make it difficult for users to use the assets they have on hand to spend.

It is important to consider post-burn inflation net value here, especially since several of the largest L1s such as Ethereum, Avalanche, and Solana are implementing burns. While Solana burns half of all fees (the other half goes to validators), it doesn't have much of an impact considering the fees are small.

Outside of Ethereum, Avalanche is the only meaningful on-chain fee burn.in the past 30 days, it burns more than 10,000 AVAX every day. That's enough to offset about 1% annual inflation, which I've netted out in the graph above.

However, most of all the recent Avalanche activity has actually come from one game, Crabada, which is about totransfer to its own subnet, and many of its current usersseems to be a robot, so pay more attention to the data.

Avalanche's C-Chain implements a mechanism similar to EIP-1559, the basic fee is burned, and the tip goes to the miners. However, for the sake of consistency in the comparison, we used the pre-burn inflation rate of 5.8%, while also excluding the inflationary impact of other incentives being distributed, such as on Aave. When idiosyncratic factors such as these are taken into account, the inflation picture becomes tangled. The inflation portion issued through rewards will directly bleed value from the hands of AVAX holders since it is not cycled into tokens through staking rewards.

The combined ETH and LUNA have unique advantages in value capture. Other ecosystems are relatively stable, and the income is essentially a tax, which is transferred from the holder's pocket to the pledger's pocket. AVAX is a close second, but it is important to consider the mitigating factors mentioned above.

The burning of EIP-1559 offsets some of the inflation. After the merger of Ethereum, the miner subsidy disappears, and ETH will become a deflationary asset. Additionally, priority fees and MEV rewards will go to validators.

At the time of the merger, the pledge rate of ETH may be quite low, so the pledge yield will be very high. Yields will then be diluted back down after the merger, assuming the stake ratio rises to about a third in the slightly longer forecast.

Terra's mechanism is very special. LUNA has multiple sources of staking income:

Gas Fee - Transactions incur a small gas fee, which is very small for Terra.

Stability Fee Tax - A fee was charged on all stablecoin transactions prior to January, capped at 1 SDT per transaction, a small fraction of overall revenue. In Proposition 172, the stability fee tax was set to zero.

Market transactions - this is the main way of earning income.

Terra charges a fee when exchanging between Terra stablecoins or between them and LUNA using Terra Station's transaction function. (Terra Station also integrates Astroport and Terraswap without this fee, but you use their respective LPs and fees, not Terra's marketplace functionality.)

Fees flow into the oracle reward pool and are distributed to validators (in return for providing exchange rate data). Validators then distribute these fees to delegators in the form of staking rewards over two years.

These charges come in one of two forms:

Tobin Tax - Flat fee for transactions between Terra stablecoins, set at 35 bps most of the time

Spread Fee - A fee for swapping between LUNA and any Terra stablecoin. Set to a minimum of 50bps, but can be increased during periods of volatility to maintain a constant product between the quorum values of the Terra pool and the LUNA pool for stability.

The graph above shows LUNA with 0% inflation (block rewards without inflation). However, this ignores the LUNADeflation Facts. Given that seigniorage burn breaks the graph above, and since deflation rates can fluctuate, it's hard to compare.

Before the Columbus-5 upgrade at the end of 2021, part of the LUNA used to mint UST was sent to a community fund to fund the development of the Terra ecosystem, part was rewarded to validators, and the rest was burned. After Columbus-5, when new USTs were minted, the corresponding LUNAs were all burned. Therefore, for every $1 of UST minted, $1 of LUNA is burned.

image description

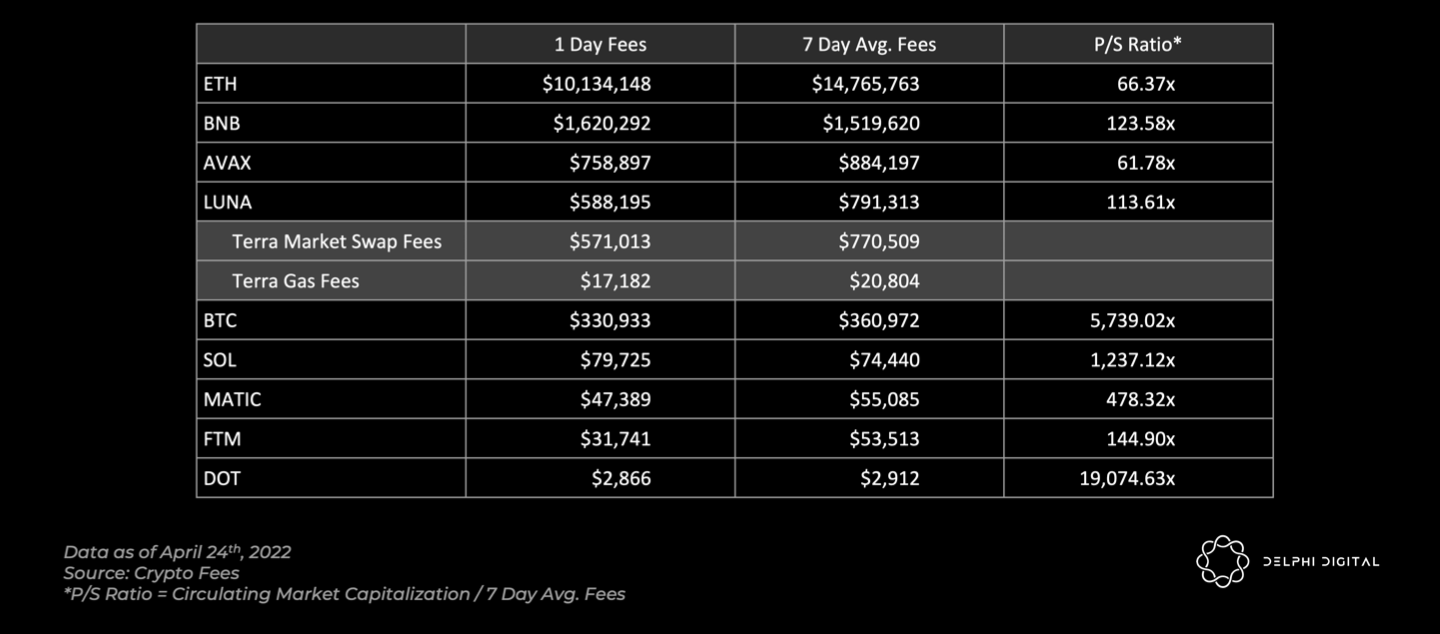

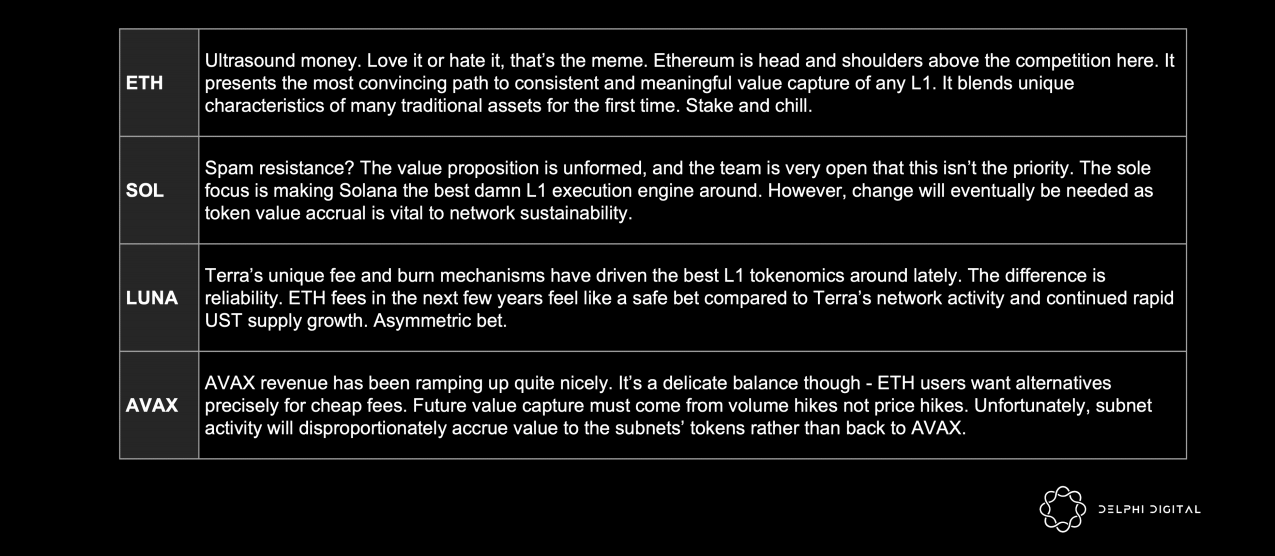

L1 Fee Leaderboard

Almost all of LUNA's revenue comes from the native stablecoin trading market. This sheds light on other L1s - implementing native stablecoin mechanisms internally can provide meaningful organic revenue. Note that this is in stark contrast to Near's recently launched USN, which was created by the independent DAO Decentral Bank image description

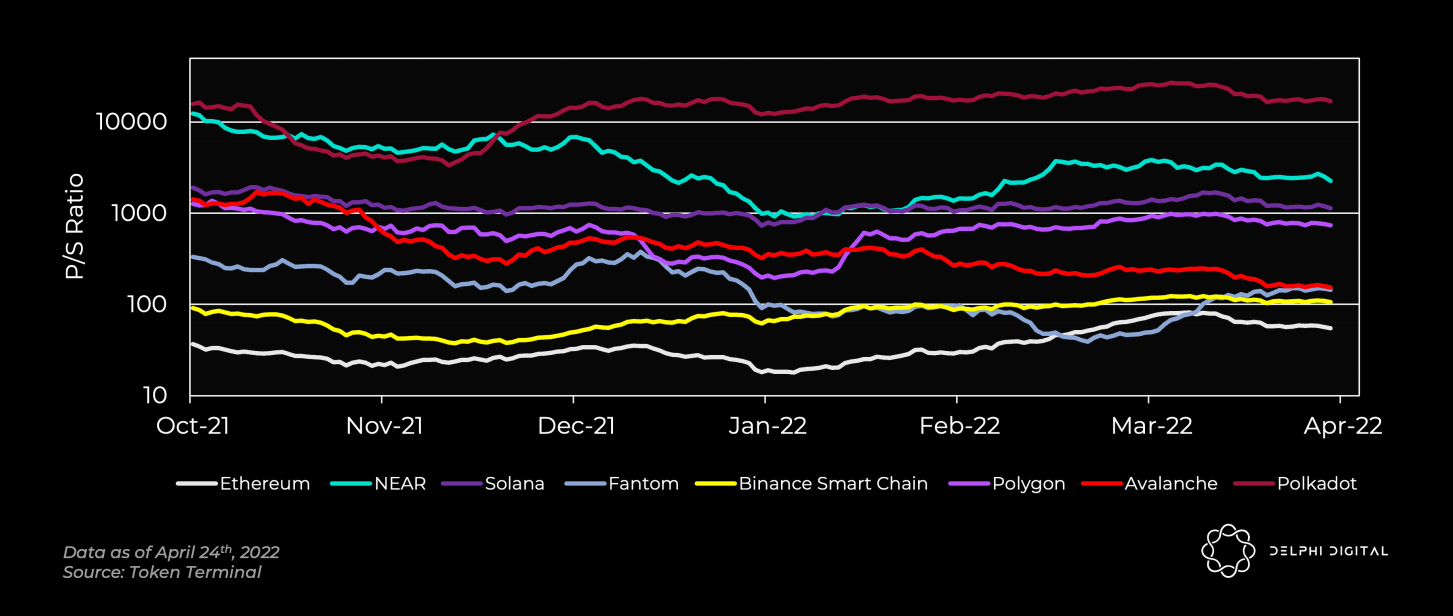

Ethereum’s price-to-sales ratio (P/S) has been leading (fully diluted market cap divided by annualized total revenue)

Except for a short period of time when Fantom surpassed Ethereum, Ethereum has always been the leader in terms of P/S. BNB Chain and Fantom are not far behind, and Avalanche is also a strong contender.

The level of P/S symbolizes the real demand, but it is unreasonable to over-interpret it in isolation, and the growth factor should be considered at the same time. For example, Fantom and BNB have low P/S, but there is no innovation catalyst and the growth rate is not high. While AVAX is trading at a premium, they have stronger growth prospects.

image description

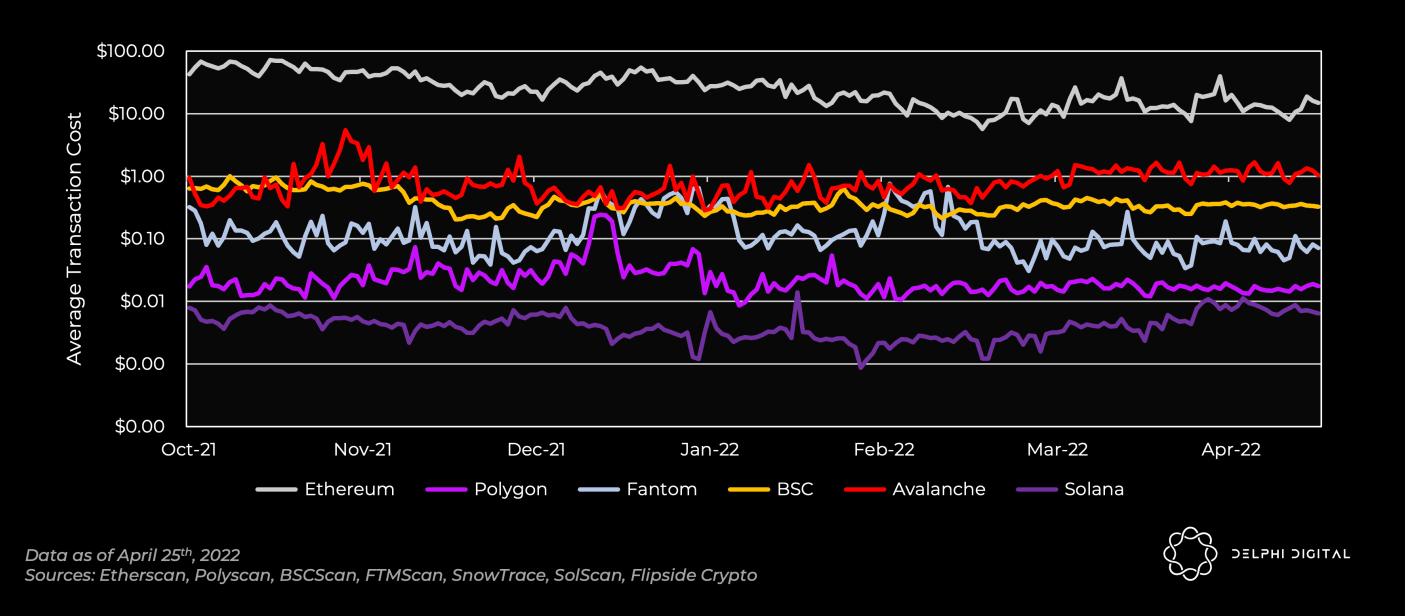

L1 average transaction fee (total revenue divided by number of daily transactions)

Consumable / convertible assets GAS

Cryptocurrency is a commodity. For Ethereum, the ETH token is the engine that keeps the public chain running. More network transaction users need to buy a lot of ETH to pay Gas fees.

This model has changed on Rollup. At L2, users can choose other tokens to pay Gas fees. The upshot is that L2 user growth brings less demand for ETH than L1 growth.

Still, Rollup will handle the conversion and pay rent to the main chain in ETH. Ethereum will get a cut of Rollup, which hosts massive amounts of data, while also coordinating settlements and transfers.

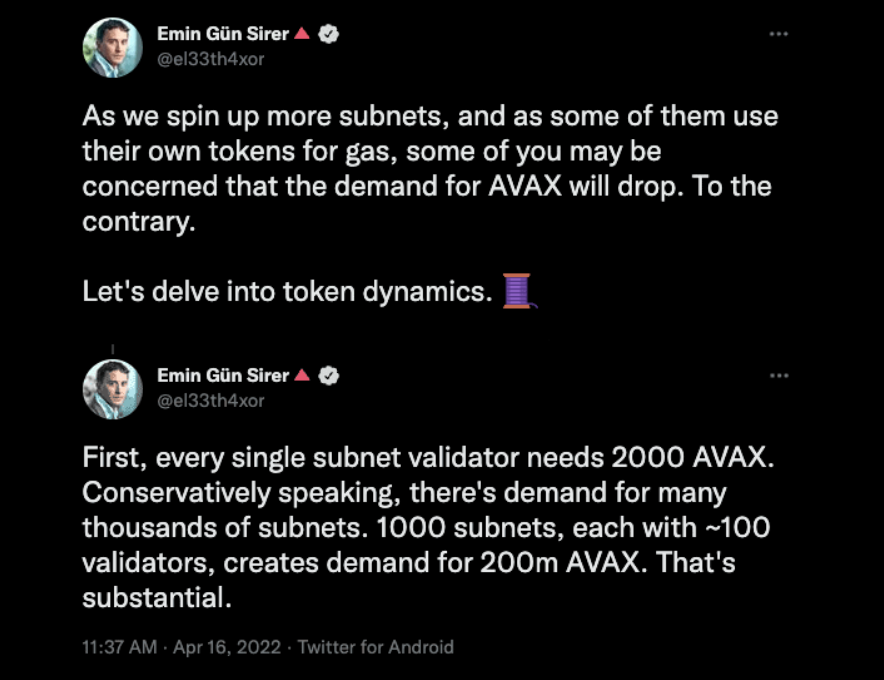

This is in stark contrast to multi-chain monolithic ecosystems like Avalanche, which lack shared security and settlement, and new subnets can pay for Gas with their native token of choice. However, the subnet must launch its own validator set, so fees will be paid to the subnet validators (rather than the mainnet's AVAX validators). A potential benefit to AVAX is that new subnets must validate the mainnet by staking at least 2000 AVAX. Emin recentlyproposed an idea:

First, thousands of subnets each have around 100 validators, which is not a "conservative" estimate. Even having 100 subnets in any reasonable time period is a bold assumption.

100 validators per subnet, which is the same asAvalanche DocumentationIn stark contrast to the recommendations for subnets, "For network security and stability, we recommend 5 validators per subnet (each in a different region) per subnet in a minimal production setup, 10 validators should be sufficient to balance security, Stability and future needs.” Having 100 validators in a long tail subnet is not realistic.

It also assumes that each subnet validator is a brand new AVAX validator (bringing 2000 AVAX new market buying pressure). In fact, many may be existing Avalanche mainnet stakers locked today. Expect similar block producing entities to emerge throughout the ecosystem. As a result, the 2000 AVAX new buying pressure is gone. Staking requirements from subnets will be negligible.

Emin also argues:

The assumption that AVAX is "demanded" by validators on the subnet seems unlikely. For example, the DFK subnet only uses JEWEL as Gas, and some of these fees are burned and another part is paid to subnet validators. It is in the subnet's self-interest to capture value in this way. It pays no rent to Avalanche. At best, a user-aware subnet could allow Gas to be paid in several different coins for convenience (in which case AVAX is certainly an option).

The biggest factor is capturing value back to the AVAX, which subnets basically don't do. Subnet fees are borne by its own validators. It will only directly benefit AVAX if the subnet asks for Gas to be paid in AVAX for some reason and burns it (which seems unlikely).

Even in a bull market scenario with more AVAX staking for a long period of time, this is similar to the Polkadot model where DOTs are locked for parachain security. Locking in more supply doesn't hurt, but it doesn't make AVAX a more productive asset, and productivity comes from additional revenue capture. But unlike Rollup, subnets are useless here.

an articlean article, describing why productive assets (where a fixed supply is not enough) are a superior form of long-term store of value. This shouldn't be hard to understand, since we've seen this today. Do you want to deposit gold or the S&P 500 over a long period of time? The best long-term store of value needs to be more than just a solid rock, it needs to capture meaningful value over the long term.

Subnets will drive exciting and innovative activity, but proceeds will go disproportionately to Subnet tokens that receive transaction fees and token burns, rather than AVAX. As the Cosmos ecosystem grows, this situation looks closer to what happened on ATOM than Ethereum Rollup.

Of the non-Ethereum chains shown, Avalanche has the clearest scaling roadmap as it spans many chains (subnets), the same applies to Cosmos. However, this approach breaks security, and by its very nature main chain tokens cannot capture most of the value capture.

Store of Value Assets -- Currency Premium

"Cryptocurrency" isn't usually the right word, but sometimes it isn't. So can our magic Internet money really become money? Store of value? medium of exchange? Just look at ETH's "hypersonic currency" meme and you'll see at least an effort to make it happen.

It also makes sense to treat their tokens like real money if we are building an entire digital economy and nation.

Asset Price = Quantifiable utilitarian value (eg, discounted future cash flows) +/- some speculative or monetary premium. As long as the dollar's dominance holds, and you can park that cash somewhere to earn a yield (Treasuries), it will remain the global reserve asset (with the highest currency premium).

Likewise, what a cryptocurrency investor would like to see is:

Strong economic system: Which L1 has the most economic activity? Where do most users want to spend their money?

Balanced Budget: Is it running a deficit and inflating the currency, or is it getting enough income?

Positive real yields -- As with any country today, higher real yields attract capital inflows and strengthen the currency.

The U.S. dollar is the preferred medium of exchange for global trade. Consider the benefits of the petrodollar system to the United States. It makes the dollar the global reserve -- exporters receive payments in dollars, and importers need dollar reserves to buy oil. The trend of ETH as a quote currency comes with the ICO boom. With the recent boom in NFTs, it enhances its ability to quote currencies. Whether you want to participate in the hottest ICO or NFT transaction, you need ETH. As people start denominating their wealth entirely in ETH, these effects just snowball.

The U.S. dollar is the preferred medium of exchange for global trade. Look at the benefits of the petrodollar system for the US, it drives global reserves of dollars - exporters receive payments in dollars, importers need dollar reserves to buy oil.

The germination of ETH as a quote currency came with the ICO boom. This has been further strengthened with the recent NFT boom. Whether you want to participate in the hottest ICOs or NFT launches, you need ETH. These effects have a snowball effect when people start denominating their wealth in ETH.

However, if ETH's only role was as a circulating currency (like the US dollar) that you only wanted to spend, then it wouldn't have the value it has today. Large U.S. investors don't hold actual cash, they own higher-yielding dollar investments such as Treasuries. The ETH in your wallet is the dollars of the Ethereum ecosystem, and the ETH pledged is the U.S. Treasury bond, the benchmark risk-free rate for the entire economy. Also, Ethereum has more sustainable economics (i.e. deflation + real pledge yield vs inflation far outweighs incredibly low US Treasury yields).

Not to mention unique crypto-native innovations such as liquid collateralized tokens (like stETH) that give you extra cake to eat — liquidity, yield, and the ability to stack assets on top of building blocks.

ETH's ability to combine currency denominations with an attractive investment (deflation + yield) is a good benchmark for fund managers to beat the new S&P 500.

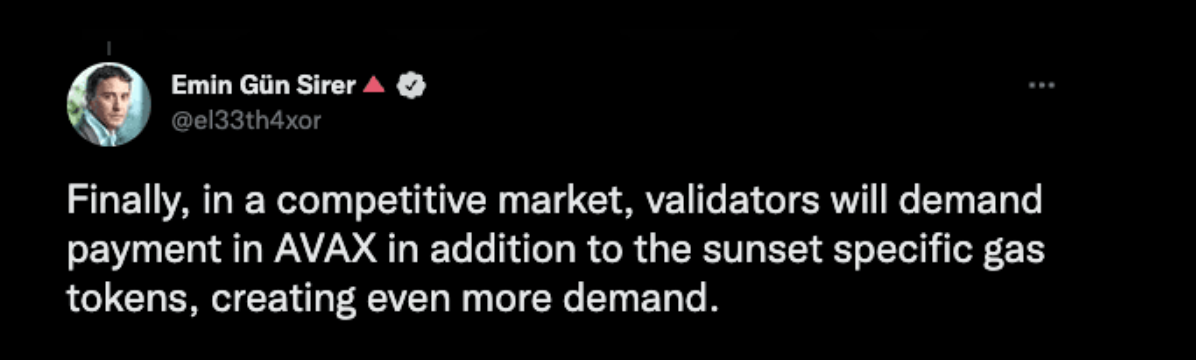

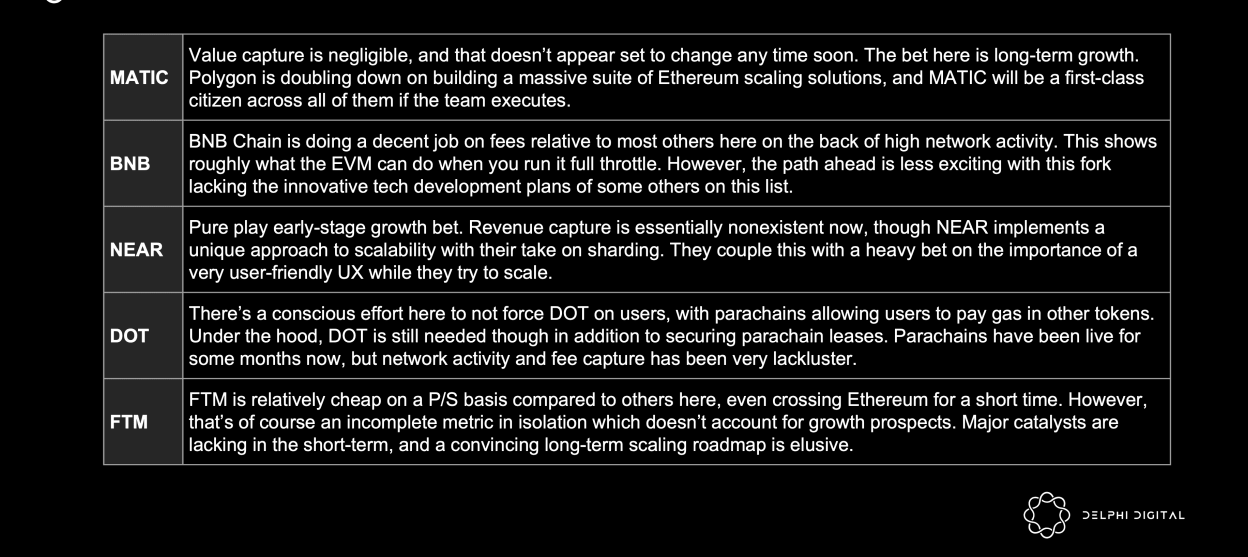

image description

Diversification of DeFi TVL in L1 (Terra and Near remain highly centralized)

what's under the hood

If Ethereum’s scaling roadmap fails, the demand and interest for holding ETH will be greatly reduced. . If the US budget is balanced, but its GDP declines, the dollar will no longer be a global reserve asset.

A country cannot be built without land and resources, and a cryptocurrency economy cannot be built without block space. The high cost of use will drive incremental customers to switch to cheaper alternatives, making the pie bigger requires increasing throughput while reducing transaction costs for individual users. Block space requirements are fairly elastic, and scaling can support new use cases and attract new users.

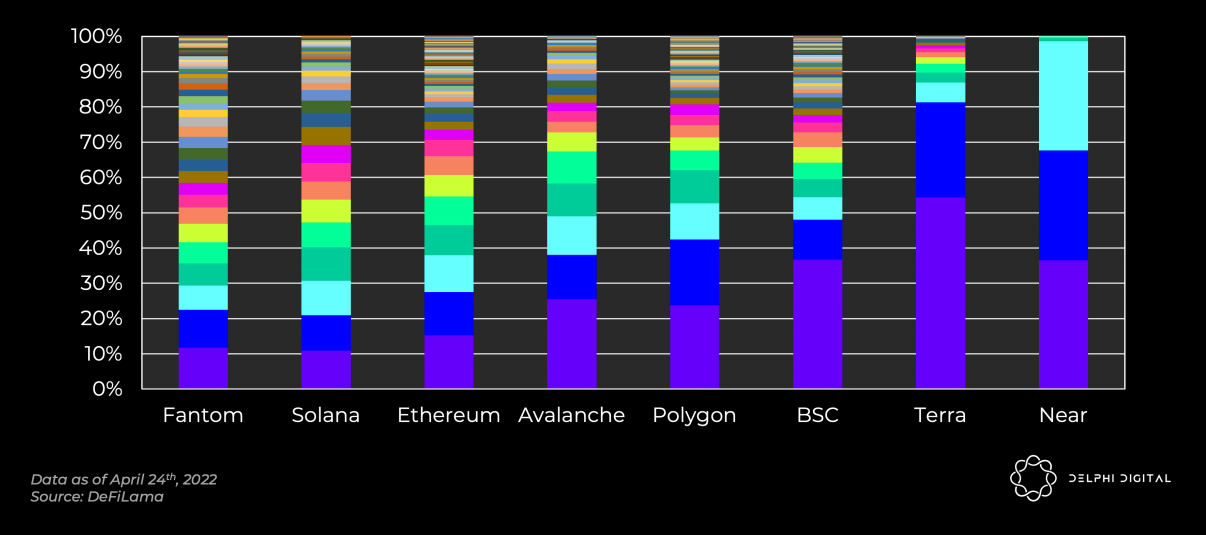

Without repeating too much our recentsegment report, the achieved TPS is generally in the double digits (Ethereum) to sub-1,000 range for Solana, well below the marketing numbers we typically see. Avalanche claims its current transaction throughput is "unlimited TPS (including subnets)" relative to other L1s. While theoretically correct, the point is that we see many TPS claims that are simply unfounded.

Dragonfly recently performeda testimage description

Dragonfly's AMM test

Ethereum's delta is there, but it's a far cry from the insane TPS numbers we often see, even Solana only has 273.3 transactions per second. Note that, unlike other chains, Solana's internal consensus information usage transactions account for 80% of the TPS. Also, this test only tests Solana's single-threaded execution. This doesn't capture Solana's key advantage -- parallel transaction processing utilizing multiple cores. However, this is a realistic benchmark because whenever Solana has network congestion issues, it tends to be from a hot market (eg, Raydium IDO). Based on this, throughput becomes the bottleneck for single-core execution.

Many chains require exponential scaling. This realization is already running deep — Cosmos zones are gaining traction, Avalanche is launching new subnets, and Ethereum and Celestia are targeting Rollup.

conflicting visions

The metrics shown here are of great value in diagnosing these network states. While short-term value is difficult to grasp, it is important to understand the long-term dynamics of value creation.

Let's consider the two extreme approaches as case studies.

Solana's Vision

Solana's goal is not to simply drive up the price of the native token. The claimed value of SOL is simply the net discounted present value of future MEV cash flows.

The discount rate will be determined around the risk-adjusted cost of capital of holding SOL, at which point validators will stake in exchange for the right to acquire MEV. The number of future MEVs required to match SOL's current market capitalization is considerable, and in any case they will need to scale by several orders of magnitude.

Network transaction fees in an efficient market should be settled at the validator's operating costs:

Cumulative Fee = Bandwidth Cost + Hardware Cost + SOL Voting Transaction Fee

MEV will effectively cover your capex (staking SOL), while fees need to cover your opex (bandwidth, hardware, and voting transactions).

Any transaction fees beyond this will be considered extracted from users, representing profits for validators. In this case, competitors should theoretically emerge and weaken the network, eventually reaching zero profit. If it turns out to be feasible to provide this service to the world at near-zero cost, that would be an aspirational vision. But it does raise the issue of value capture that we discuss in our research.

Ethereum's vision

The Ethereum community has made significant efforts to give ETH value beyond minimum utility. They want investors to buy, hold and stake ETH because it is an attractive capital asset. At the same time, it is a large liquid asset that you can safely use to denominate your wealth, and its staking return will serve as the benchmark risk-free rate for the emerging cryptocurrency economy. The key to getting the most value is to construct an attractive monetary policy (such as EIP-1559), so that native assets can obtain a monetary premium.

Does token price matter?

OK, so we've settled on two models. Infuse value into the token, making it an attractive asset for holders, or run the network at the most basic cost and let the market calculate the value of the token. If the number is very low, that's okay.

But is the second way enough? Does the network care about whether the number of users will increase? Or are ETH maximalists just sitting there eager to burn tokens?

As Anatoly mentioned, you need transaction fees to prevent "spam", to prevent DOS attacks on the network, but the real reason is to maximize the cost of attacking the network. All other bells and whistles are optional, the fundamental reason these tokens need to exist in a proof-of-stake system is to resist Sybil attacks.

This is why it is difficult to strike a balance between transaction fees and MEV. They are a sustainable source of income for token holders, but if left unchecked, they can extract value from users and churn them out. You can have the most deflationary currency in the world and it will be worthless if no one uses your blockchain.

In turn, you could be settling trillions of dollars in value every day because everyone loves your cheap fees. However, if this high-value network is secured by low-value pledged assets (because no one wants to hold your monopoly funds), then you have a big security risk and are vulnerable to attack. Future growth expectations may attract speculative bets in the short term to support the current market cap size. However, an order of magnitude more staked value would mean attracting large amounts of long-term sticky capital.

How much does the staked amount affect security? In the case of Solana, "safety" is defined by the cost of destroying all replication chains, since that is truly indestructible.

The goal of Solana's "decentralization" (which is important against censorship and liveness) is to maximize the Satoshi coefficient (the number of colluding validators required to stop the network). In theory, increasing the Satoshi coefficient would improve network defenses.

The Satoshi coefficient might be a trillion, but that would mean nothing if their cumulative stake was $1. This is an extreme example where the number of validators alone doesn't mean much, especially assuming a large attacker masquerading itself behind many entities is logically possible. A high Satoshi coefficient helps defend against attackers compromising many distributed nodes, but it does nothing to prevent economic attacks. In this regard, Solana maximizes the Satoshi coefficient while also needing to focus on token value capture.

This is especially worrisome since Solana is not equipped to deal with this type of attack. Anyone can fully verify Solana, but this requires a lot of money and effort that 99% of users will never be able to do. Networks like Ethereum or Celestia allow everyday users to enjoy full node security (low capital and hardware requirements) and are more capable of handling and recovering from 51% attacks. Cryptographic guarantees are always better than cryptoeconomic guarantees. If all light clients knew not to accept the invalid chain being attacked, the possible damage could be greatly mitigated.

Anatoly often says that Solana is optimized to "stop the first strike in a nuclear war" (by maximizing the Satoshi coefficient and real-time censorship resistance to prevent majority attacks), while Ethereum is optimized to "clean up the mess" . A staking value beyond the reach of ordinary people is as important as the Nakamoto coefficient to prevent strikes.

The argument here probably boils down to this: Even with a low market cap, attacking a network is very difficult for individuals to profit from. It seems unlikely that someone would try to spend tens of billions of dollars hacking a blockchain in the hopes of making a quick buck and getting away with it. It is more likely that state actors would act to sanction a globally significant network, causing significant damage at relatively low economic cost. At this point, it may come down to a completely different point of view from the community:

Anatoly made it clear: "If you don't have trouble in the US, Europe or China, that's ok, nothing else matters. If you have one of those problems, then there's nothing that can help you. So that's why I don't worry about these attacks Reason. I just don't care."

So if the only attack a huge market cap protects you from is state actors, why bother? Just admit that there is a threat, then ignore it and build the best mechanics you can, and Solana is trying to do just that.

If we do build France's future on top of these networks, I want the strongest possible guarantees, even against state actors. Building a systemically important network for the global economy seems irresponsible because it is easily attacked by hostile governments, and economic and cyber warfare are increasingly the preferred methods of attack. These systems must be designed so that these attacks, costing trillions of dollars, are rendered invulnerable.

Modular vs Monolithic Value Capture

Ethereum requires rapid growth in network value to ensure the security of the entire system.

Going back to the multi-chain monolithic system, you will understand why huge token prices are not necessary. AVAX's price won't directly benefit from the growth of its subnet ecosystem, nor does it really need to. His basic design vision does not provide shared security without tracking the growth of the surrounding ecosystem at the price of the largest asset in a multi-chain system.

Monolithic chains are inherently disadvantaged when it comes to acquisition fees, as they are capped at:

Fees = throughput x value users will pay for monolithic chain transactions

Modular data availability, consensus and settlement layers (such as Ethereum) will capture more value. They are capped at:

Fees = throughput x value a user will pay for all transactions

This is a key point for future fee revenue forecasts.

Compared to what a single user is willing to pay for a transaction on the Avalanche C-Chain, a rollup will pay a huge fee to Ethereum in a single transaction to secure a rollup block that may contain thousands of user transactions. Furthermore, it is technically possible to securely scale data availability layers such as Celestia or Ethereum's design. Compared to monomeric chains, both parts of the equation are now maximized.

An important negative externality to note for Rollup base layer assets is MEV extraction. Individual users may all eventually leave Ethereum L1, and as this happens, MEV acquisition will gradually shift to Rollup block producers. This shift will coincide with a massive increase in Rollup fees paid to L1. Pure data availability and consensus layers, such as Celestia and Polygon Avail, do not acquire MEV in the first place, they can only rely on transaction fees.

If L1's crypto-economy is to reach a scale of global importance, sustainable value capture is critical to its long-term health.

image description

Original link