Otherside is officially on sale, can it be rushed now?

At 9:00 on May 1, Beijing time, the long-awaited and long-awaited "king of heaven" NFT project Otherside officially launched the public sale of its plot (Otherdeed).

As the "ultimate move" of Yuga Labs, the parent company of BAYC, in the metaverse field, there is no suspense. The release of Otherside quickly ignited market sentiment. After 9:00, the gas price of Ethereum soared rapidly like a rocket, and remained high as the casting progressed. According to the highest data observed by Odaily, the average gas cost once approached 10,000 gwei, and It lasted nearly 3 hours near 6000 gwei, which can be described as witnessing history.

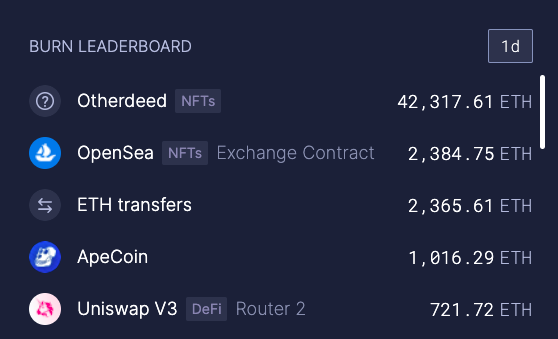

According to Ultrasound’s on-chain data, as of 11:05 Beijing time, the number of ETH directly destroyed due to Otherdeed’s casting activities has reached 42,317.61, which has not included other indirect related on-chain activities, such as the purchase of APE, OpenSea Level 2 Market transactions and more.

Regarding the reasons for such high gas, it can be attributed to the following points in general:

One of them is naturally the unparalleled enthusiasm of Otherside;

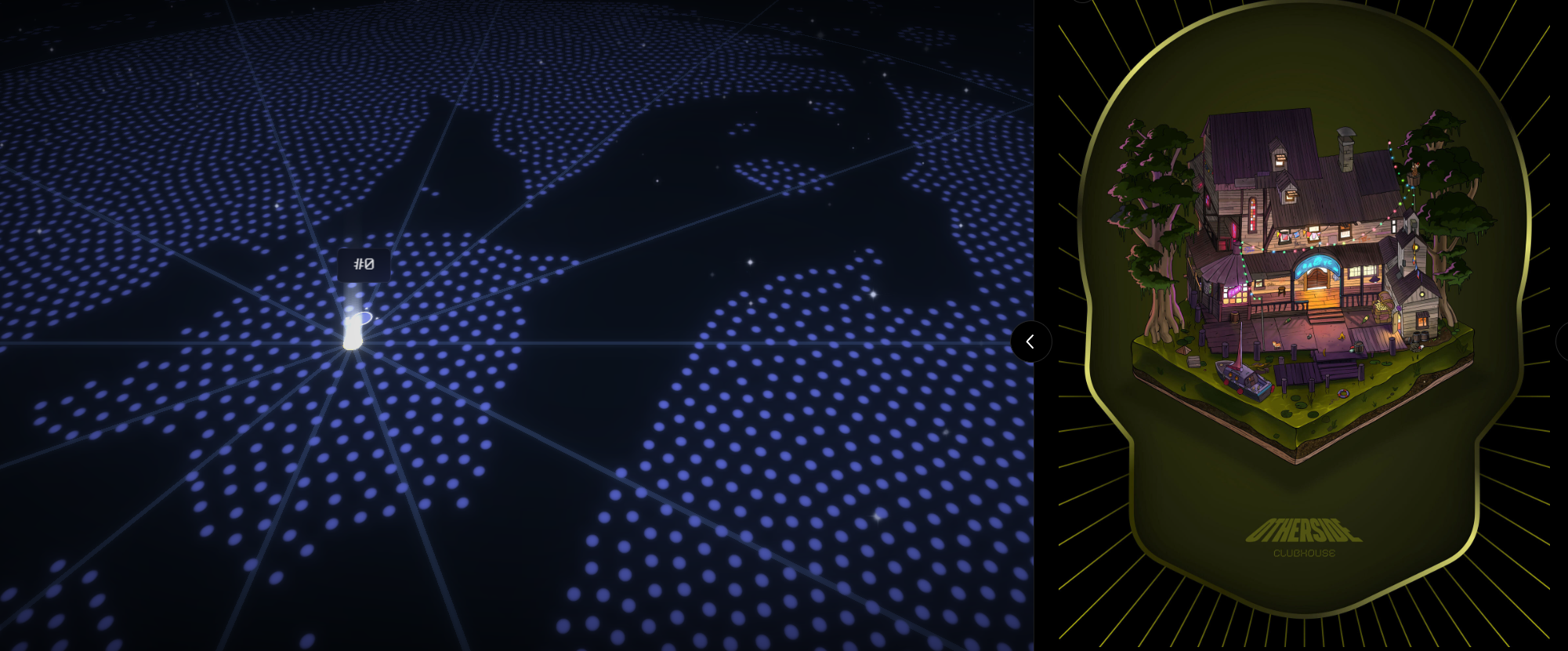

The second is related to the number of Otherdeed. It is said that the map of Otherside is distributed in a circle, which means that the smaller the number, the closer the plot is to the center point, and the value will be higher in theory, so a large number of users do not hesitate to The expensive gas should also be minted first to snatch Otherdeed with a smaller number. (However, it is also said that the current number is not the number of the plot in the picture)

The third is related to EIP-1559. According to the analysis of Rui, the investment manager of HashKey Capital: In the EIP-1559 model, the gas is divided into base fee and tip. Normally, the gas limit will only be half filled, and the remaining half depends on the network congestion. The more blocked the base fee is, the higher the base fee is. The first batch of gas war users used higher tips to push up the gas limit of the block. As the block is fuller, the base fee rises, resulting in a high total gas.

According to the sale rules of Otherside, Otherdeed will be sold at a fixed price of 305 APE, and a total of 55,000 Otherdeed can be purchased by wallets that have completed KYC. At the same time, in order to "ensure the widest possible distribution and reduce the possibility of large-scale" Gas War, Otherside has adopted a segmented minting rule. In the first phase (wave 1) of the sale, each wallet will be limited Only 2 NFTs can be minted. As the minting continues, the second phase (wave2) will start after the gas price returns to the normal level. At that time, each wallet will be able to mint more Otherdeed.

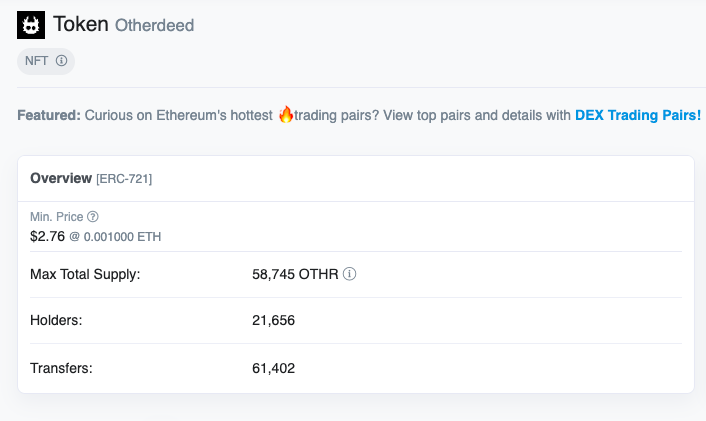

Odaily Note: The total supply of Otherdeed is 200,000, of which 55,000 will be used for this sale, and 15,000 will be reserved for the team. BAYC and MAYC holders can claim for free within 21 days after the end of the sale. A total of 3 10,000, and the remaining 100,000 will be rewarded to users who hold Otherdeed and participate in the construction in the future.

However, as of 11:05 Beijing time, Otherside has not officially announced the start of the second phase, and etherscan shows that 43,745 (58,745 minus the 15,000 reserved by the team) Otherdeeds have been minted. From this point of view, casting is possible It will end directly in the wave1 stage, and wave2 will not be opened again.

In terms of the secondary market, OpenSea data shows that as of 11:10 Beijing time, even with such a high gas price, the total transaction volume of Otherdeed has exceeded the 7000 ETH mark, and the floor price is temporarily around 5 ETH.

According to the exchange quotation of APE/ETH at the beginning of casting, 305 APE is roughly equal to 2.15 ETH. In addition, according to users who have successfully minted, the gas price setting of 5000 gwei needs to pay about 1.7 ETH, and 8000 gwei needs to pay 2.8 ETH.It can be inferred from this that if a user mints two Otherdeeds at a gas price of 5,000 gwei, the theoretical total cost is about 6 ETH (two NFTs), and 7.1 ETH at 8,000 gwei, even after deducting the subsequent tax in the secondary market And gas, compared with the current floor price (about 5 ETH), there is still a certain profit margin.

However, this calculation is only based on some specific assumptions, and the actual casting cost will fluctuate according to the actual cost of APE purchased by users and the actual gas setting.

Considering that the casting is still not over and the gas is high, and after the sale of 55,000 Otherdeed is completed, subsequent BAYC and MAYC holders can also mint a total of 30,000 Otherdeed for free, so if you intend to buy Otherdeed in the secondary market, It is recommended to wait and see clearly the market trend first, and combine your own imagination and comprehensive judgment on the future value of Otherside, DYOR.

Otherside: Connect everything

《Otherside: Connect everything》

《The next blue-chip explosion: Koda, the new protagonist of Yuga Labs' Metaverse》