Weekly Editors' Picks Weekly Editors' Picks (0416-0422)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Texas Hold'em, Werewolf Killing and the Art of Venture Capital

A lighthearted article for investors. Invest in the early team to see if the CEO has a strong influence, invest in one, and ignore the rest. When teams and directions are in conflict, status is more important than logic (track analysis). Focus on a great neglected need and the great products that fill it. Don't be intimidated by high valuations (for extremely strong founders and teams). Don't paddle, and replay less.

Lesson sharing: How to build a low-budget portfolio?

Suggestions and thoughts written for individual investors. Most people should focus on increasing their income, reducing their expenses, investing in blue chip cryptocurrencies with dollar cost averaging, having the patience to achieve their small goals in 5-10 years, and not investing in an investment framework that they cannot afford to lose.

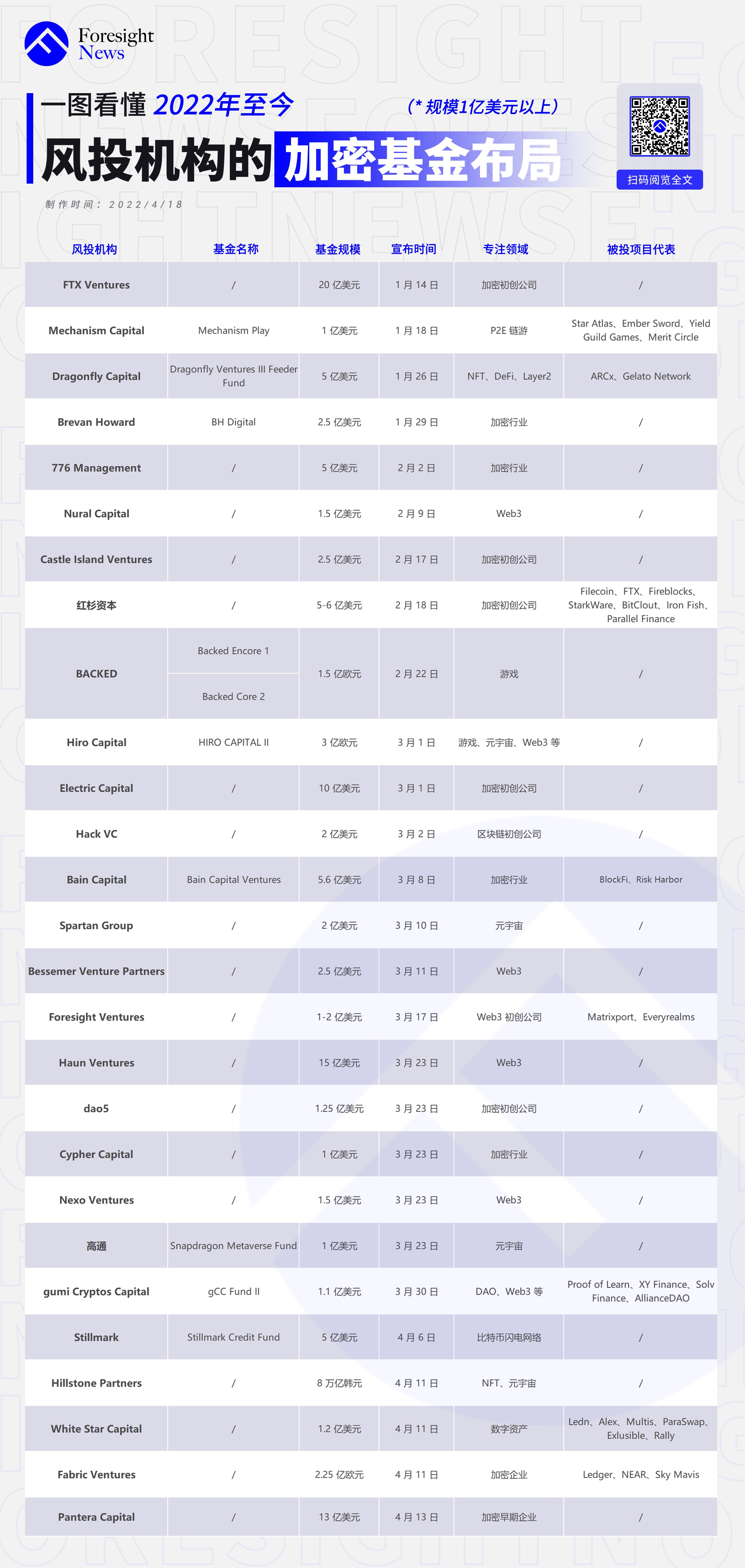

Traditional institutions run into the market, a quick overview of the crypto fund layout of venture capital institutions

Framework Ventures: What will the Crypto market look like in 2030?

DeFi

Framework Ventures, which manages about US$1.4 billion in assets, predicts that the Crypto market will have 1-3 billion daily active users in 2030, and the total TVL will exceed US$10 trillion; the demand for block space will increase from large terminals such as games, content and commerce market users, Crypto will financialize most existing Web2 use cases, replace ad-based monetization with tokenized attention loops, and the most valuable assets on-chain will be tokenized, large-scale machine learning models ; Positive changes in global Crypto policies; transaction costs on the chain are around 10 cents, and most SaaS companies have their own L2 on Ethereum, replacing their public-facing API; P2E games have become the largest human employer in the world, with global The most popular sports team is the on-chain gaming guild, with 5-10 P2E games with over 100 million MAUs; 10 DAOs each managing over $100 billion; DeFi is still the vertical with the largest revenue and profit share.

iZUMi Research 4D Report: Current Status and Future Prospects of DeFi Liquidity

From the perspective of liquidity, I reviewed the development history of DeFi, introduced the classic projects and models, and predicted the next development of DeFi.

The Lord of the Rings Dream of Algorithmic Stablecoins: After LUNA, there will be no next UST

The success of LUNA requires accurate positioning, proper timing, team operation, and strong capital thrust, which is difficult to replicate. LUNA has abandoned the road that the public chain should emulate. The only endorsement of UST now is the "money" ability of LFG and the capital behind it, which provides unlimited bullets for maintaining the liquidity of UST. To solve such a problem is inseparable from endorsement (kidnapping BTC) and liquidity (elimination of 3Crv).

Also recommend "Also recommend "》。

NFT, GameFi and Metaverse

In-depth Analysis of the Inherent Vulnerability of Algorithmic Stablecoins: Born to Fail?

NFT, GameFi and Metaverse

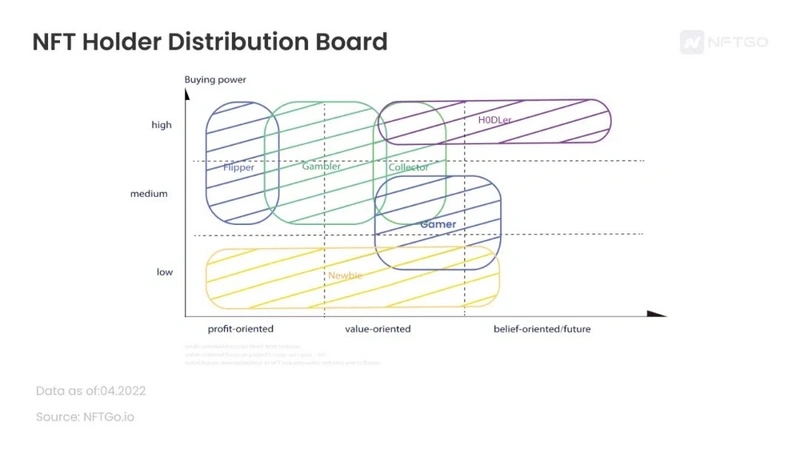

Exploring NFT, what types of NFT holders are there besides giant whales?

In addition to whales, common participants in the market include: HODLer- Crab, Flipper- Shark, Newbie- Shrimp, Collector- Octopus, Gambler- Shells, Gamer- Penguin. Different category ratios will set the tone for the community as follows:

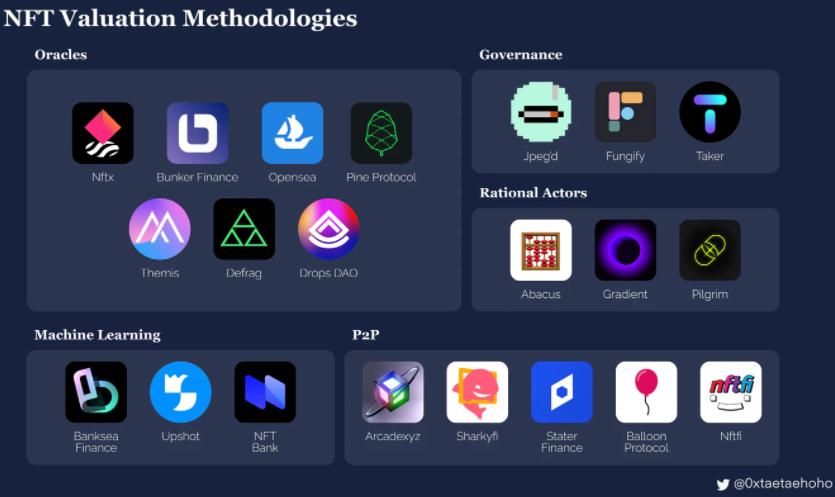

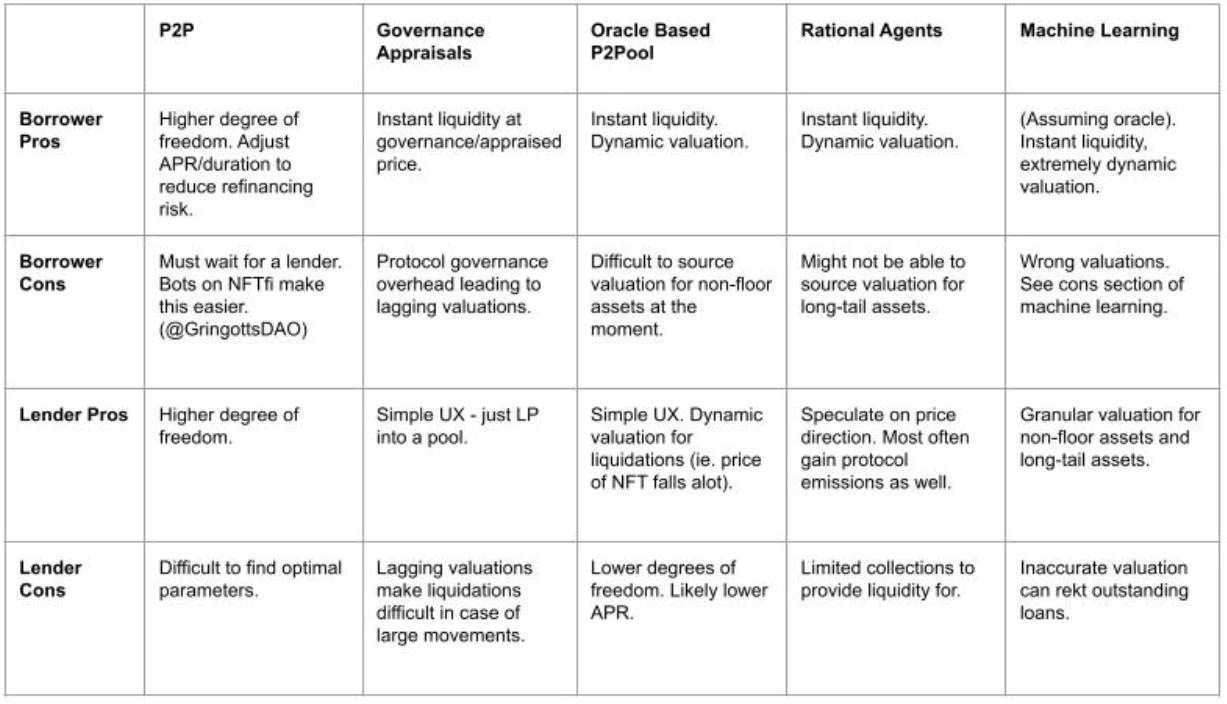

Protocols in NFT mortgages use 5 main vectors to determine valuation: P2P, governance/evaluation, oracles and P2Pool using oracles, Rational Agents (rational agents), machine learning.

Data Interpretation Moonbirds: What are the factors behind the soaring floor prices?

The advantages and disadvantages of each vector are as follows:

Data Interpretation Moonbirds: What are the factors behind the soaring floor prices?

From April 16th to 18th, the trading volume of Moonbirds accounted for 25% of the entire NFT trading market. At the same time, with the rapid rise in the price of Moonbirds, the rate of pending orders was good, and the participation of giant whales was high."At present, Pass+PFP projects are becoming a new trend, and the project can consolidate the floor price by creating a diamond hand mechanism."Lower the barriers to community entry → acquire more users → seize the market

Web 3.0

secondary title

Dialogue with Chris Dixon, Partner of a16z: Deep Reflection on Web2 and Hard Thinking on Web3

a16z's Web3 team now has about 60 people, and has expanded rapidly in the past few years. About 15 of them belong to the investment team, with a management fund of about 3 billion US dollars. Teams tend to let the individual decision makers who know the project best make decisions, rather than collective decisions by committees.

"I see the Internet today as millions of sub-communities, and I think NFT is a way for sub-communities to have cultural products and create a small economy in them."

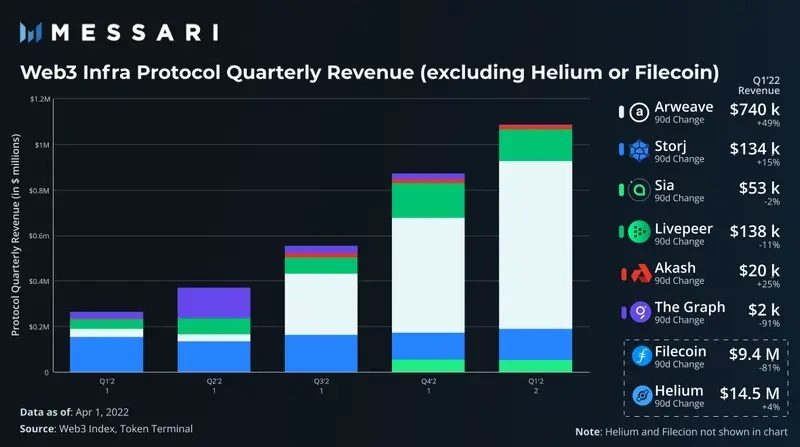

Messari Report: Most Web3 infrastructure protocol revenues increased significantly, Arweave Q1 revenue increased by 49% quarter-on-quarter

While the adoption of Web3 protocols is growing, it can be argued that many protocols are overvalued on a revenue basis. These revenues are primarily derived from network usage - fees paid to the Web3 network - rather than token reward distribution. The exorbitant valuation propped up by meager fees compared to Web2 companies suggests that crypto investors are mispricing in the valuation methodology.

A Comprehensive Interpretation of SocialFi: A Shining Star in the Web3 Era

Social tokens can be divided into three categories: personal tokens (such as Whale), community tokens (such as Rally), and platform tokens (such as Mirror). According to the current penetration growth rate of Web3, it will take another 5 years to reach 1 billion users. The explosive growth of Web2 social media came after 1 billion users. In the social token ecosystem, once a new technology reaches a billion user base, the gravitational pull of mass-market adoption begins to explode.

Ethereum and scaling

Ethereum and scaling

ConsenSys: Four Key Points for Ethereum Merger

1. Openness and diversity: All types of participants can more easily access Ethereum, further enabling decentralization.

2. Energy saving: The computing power required for network operation is reduced by several orders of magnitude, reducing the carbon footprint of each Ethereum transaction by 99.95%.

4. Ultra Sound Money: The updated encryption economic model makes Ethereum more secure, scarce, and improves the finality of transactions.

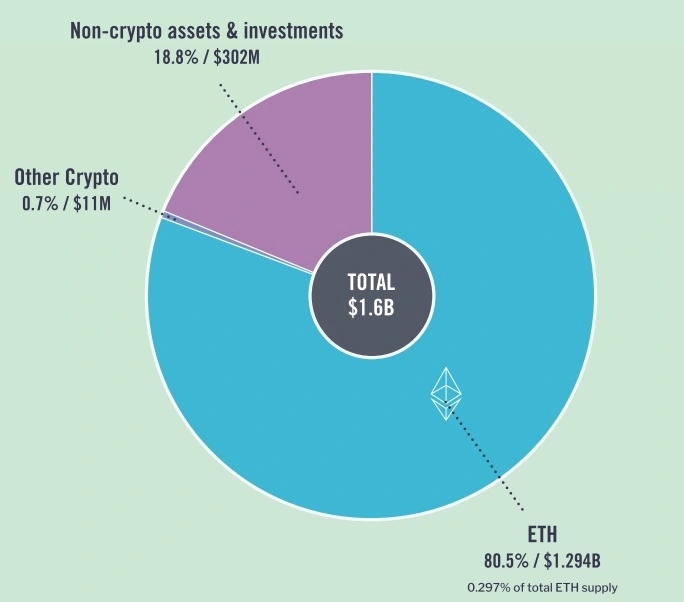

Comprehensive interpretation of "Ethereum Foundation 2021 Financial Report"

As of March 31, 2022, the distribution of Ethereum Foundation reserves is as follows:

New ecology and cross-chain

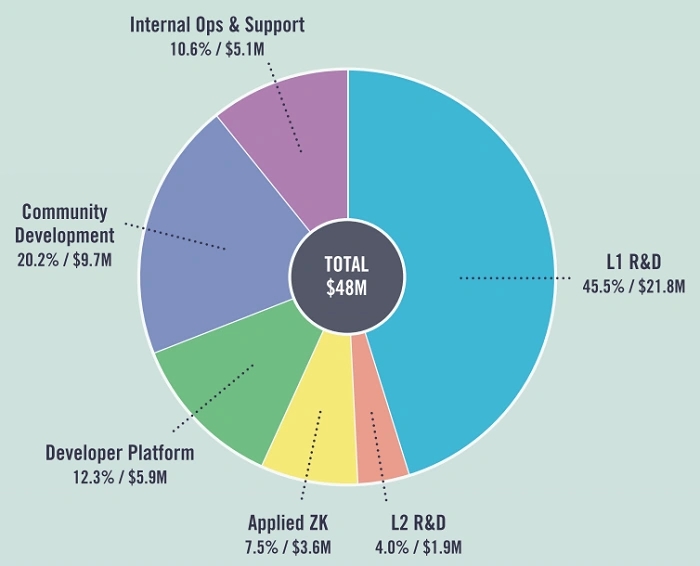

The expenditure of the Ethereum Foundation in 2021 is as follows:

New ecology and cross-chain

Dialogue between Terra and the two founders of the Avalanche protocol: the intersection of parallel universes

A very long dialogue, aside from the commercial bragging, there are still a lot of dry thinking. A few excerpts:

Bringing stable use cases is one of the main purposes of Terra. Crypto should have a sovereign currency, which is absolutely beneficial to all ecosystems, and this sovereign currency should be backed by industry-leading assets. In order to do this, it makes sense to diversify reserves into assets like Bitcoin and AVAX. Bitcoin can provide UST with a neutrality that a single ecological asset cannot provide. The growth of UST also helps to bring incentives to other parts of the Avalanche ecosystem. Because UST on the Avalanche chain is endorsed by AVAX, as UST grows, the supply of AVAX will also decrease.

Cosmos has the SDK and IBC to connect many things together. Avalanche currently does not have a vertical expansion solution, because its consensus is very delicate and beautiful, and the performance of the Avalanche C chain is good enough. Avalanche's current expansion method is to build subnets for different applications and perform horizontal expansion. I have seen some successful cases. The DeFi Kingdoms subnet is a good proof of concept that proves the feasibility of this technology.

Cross-chain talk: In-depth analysis of 16 cross-chain solution trade-offs

The biggest outlet in the decentralized crypto world is Terra Stablecoin, the decentralized currency. The first thing Avalanche will do is to use UST as a banknote, build it in our ecology, use it, and increase its usage rate. Another thing we want to do is explore what we can do in the subnet.

Cross-chain talk: In-depth analysis of 16 cross-chain solution trade-offs

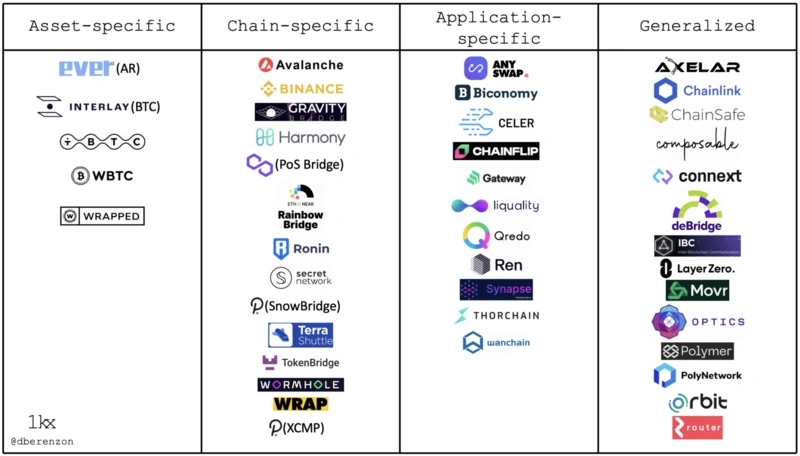

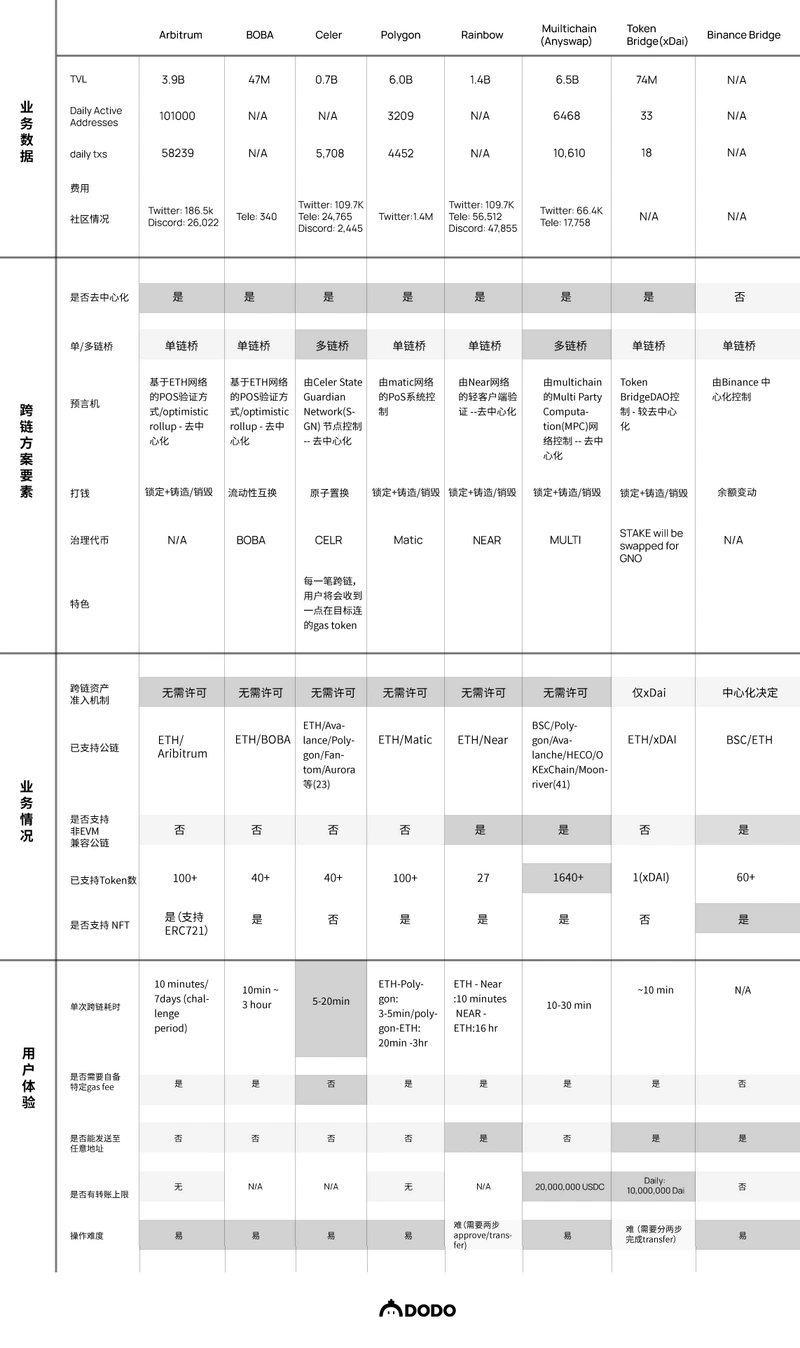

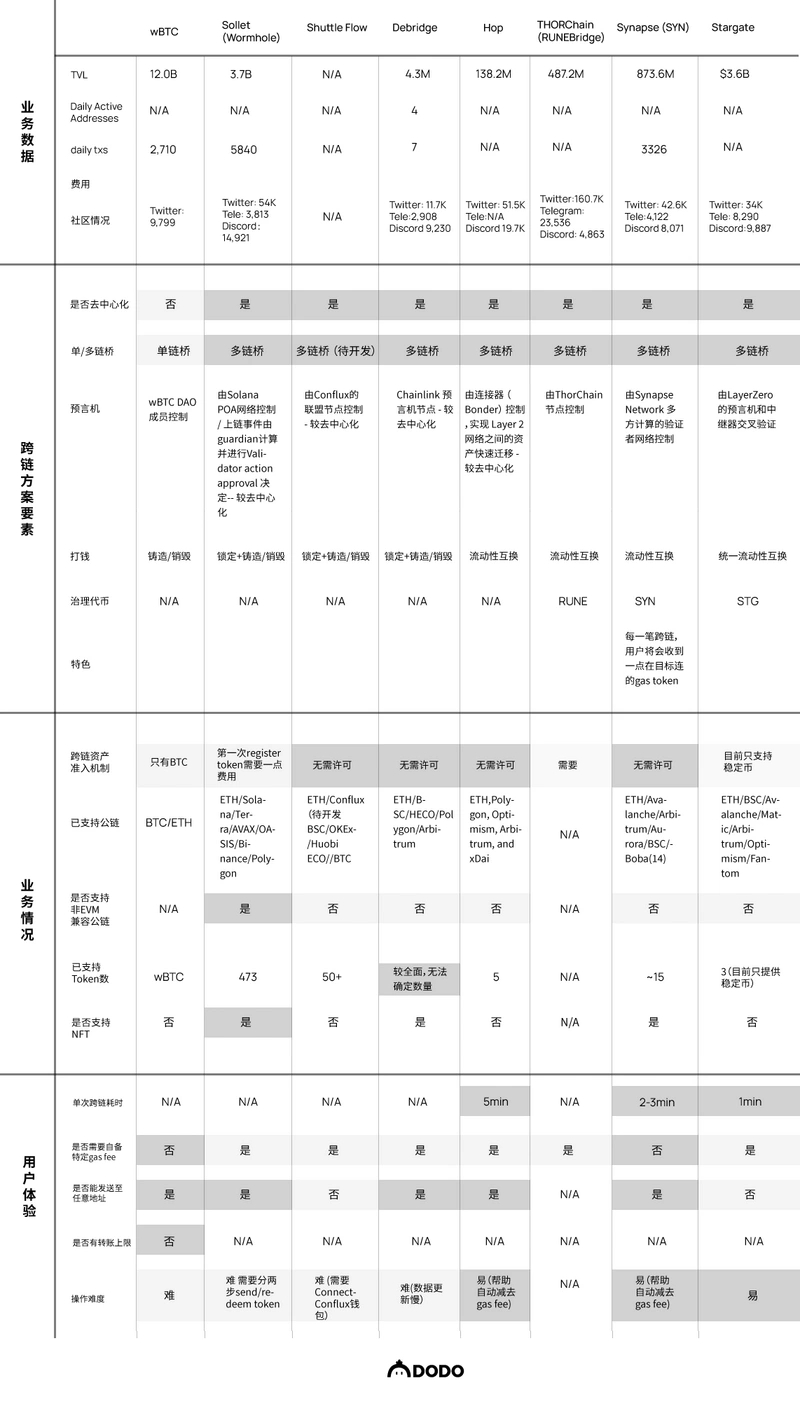

Based on the investigation of 16 cross-chain bridges, DODO analyzes and compares the performance of the bridges in all aspects.

According to the data on DeFi Llama, as of March 2022, the cryptocurrencies locked in cross-chain bridges are as high as $21.8B, of which Wrapped Bitcoin accounts for the largest market share, with a TVL of $10.2B, and Multichain ranks second with a TVL of $7B. Arbitrum is the bridge with the highest TVL in the Ethereum ecosystem, accounting for about $6B, followed by Polygon, accounting for about $5B.

According to the service purpose of the bridge, the article divides the cross-chain bridges into four categories: those focusing on asset cross-chain, cross-chain between two chains, application-focused cross-chain, and universal cross-chain bridges;

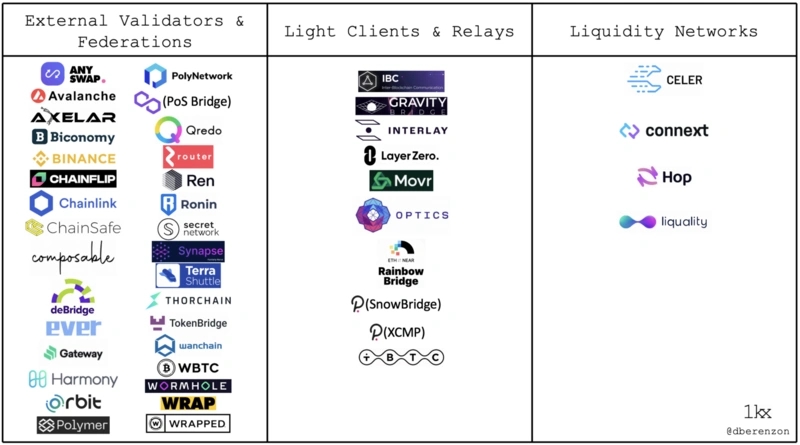

According to the asset cross-chain verification mechanism/technology, it can be divided into three categories: single-point multi-point verification, relay + light client/native verification, and liquidity network;

Divide the money-making mechanism into three types: liquidity replacement (i.e. need to deploy a liquidity pool), lock + cast/destroy (no need to deploy a liquidity pool) and atomic replacement;

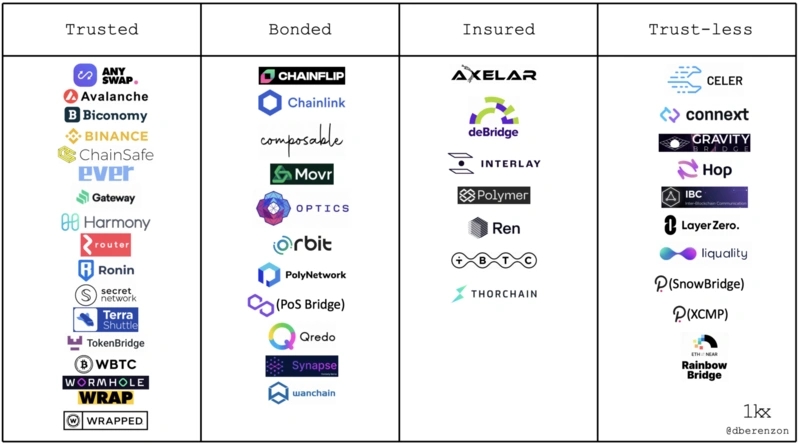

Sort by bridge security from high to low: bridge without trust (trustless) > bridge with insurance (insured) > bridge with debt (bonded) > bridge with trust (trusted);

Dmitriy Berenzon evaluates the performance of cross-chain bridges from five perspectives: security, speed, scalability, efficiency capital, and status:The last part of the article also makes suggestions for the future development of cross-chain bridges.Why do we need cross-chain bridges? What are the current popular cross-chain projects?

DAO

secondary title

Comprehensive interpretation of investment DAO: or will it become the next trend?

The article introduces the history, current situation, and representative projects of investing in DAO in turn, and summarizes the possible problems and risks of investing in DAO.

The most active investing DAOs in 2021 are CSP DAO, DuckDAO, The LAO, and Metacartel Ventures. Compared with traditional encrypted VCs, investing in DAO allows more people to participate in the investment process of early encrypted projects, and can use the wisdom of the group to make strategic investment decisions, move the operating investment funds to the chain, and increase investment The transparency of decision-making, and the "in and out" of its members are more flexible; but at the same time, there are legal and tax restrictions, security issues, investment authority and efficiency issues, and credit issues for investment projects.

Security & Tools

Inventory of Rug Pulls types: perpetrators' "fancy" deception methods

An easy-to-smile article with bright emojis. Fancy Rugs are Code Vulnerabilities, Tired, Apologetic, Reckless, Lying Flat, Silent, Crying to Catch Thieves, Collusion, Magic, and Rug+."Dune's Rise: Becoming the Google of the Blockchain World"Dune has come back to life several times, from the trough of 2019, when he was unable to pay wages, to the latest round of valuation reaching 1 billion US dollars. Dune 1.0 offers a paid dashboard product for encrypted data. Investors have pushed back on this presupposed need, given that blockchain information is freely available. Instead of fighting, Haga and Olsen recognize the wisdom of this feedback. The Dune2.0 product has added this feature and moved towards community. in Dune"Figure 8 flywheel"The business model center is the creator of the platform, more commonly known as

wizard". These data analysts create dashboards for consumers to view. In the process, they build a resume of their skills, get paid through bounties, and discover career opportunities."Consumers, in turn, visit the platform to gather information on any items they may be exploring. Thanks to the paid premium plan, Haga and Olsen hit $60,000 in annual recurring revenue (ARR). To help consumers find the best resources, Dune utilizes a"the star"ranking system. If you prefer a dashboard, you can choose"Dune Pro"secondary title

hot spots of the week

In the past week,hot spots of the weekIn the past week,UkraineBuying bitcoins with local currency is prohibited during martial law,Coinbaseturkish regulatorApproval for the establishment of a digital Islamic bank;a16z encryption research teampost, to promote the development of Web3, ACpostDiscuss the rise and fall of encryption culture, saidThe Crypto Industry Needs Regulation More Than EverTry to participate and grow a regulated cryptocurrencyethereum mergerethereum mergerV Godwill revolutionize the way Ethereum is built and accessed,OptimismV GodSaid that its influence on Ethereum continues to decline, and the second layer of Ethereum expands the networkOr Token OP will be launched soon; IRS planTaxing NFT Investors,, JP Morgan predictsNFT may dominate the scale of the digital asset field in the futureMoonbirdsMarket value of NFT avatar projectsexceeded 10 billion US dollars,,LVPublic casting sold out and raised $66 million,NBAThe team behind Proof was accused of price manipulationIntroduced NFT rewards in its mobile game "Louis: The Game",Introducing the Playoffs "Dynamic" NFT The Association,Beanstalk FarmsWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~