Dune的崛起之路:成为区块链世界的Google

原文来源:readthegeneralist

原文作者:Mario Gabriele

本文来自FastDaily。

可操作的见解

如果你只有几分钟的时间,以下是投资者、运营者和创始人应该了解的关于Dune的内容:

精益经营,坚持不懈。如果Dune的烧钱速度更快,该公司几乎肯定会在加密货币的寒冬中失败。相反,创始人Fredrik Haga和Mats Olsen保守地支出,使他们有机会在更好的条件下发展壮大。

专注于独特的东西。Dune 1.0提供加密货币数据的付费仪表板产品。鉴于可以免费获得区块链信息,投资者对这一预设需求进行了反驳。Haga和Olsen没有反抗,而是认识到这种反馈的智慧。Dune2.0产品便增加了这个特点。

“巫师”创造“魔法”(和金钱)。在Dune的 "八字飞轮 "商业模式中心是平台的创造者,更多的是被称为 "巫师"。这些数据分析师创建了供消费者查看的仪表板。在这个过程中,他们构建了自己的技能简历,通过赏金获得报酬,并发现职业机会。

谨慎地进行代币化。乍一看,Dune似乎完全适合于代币。它有一个繁荣的社区,为加密货币生态系统做着有意义的工作。虽然他们并不反对原生货币的可能性,但Haga和Olsen对过早这样做持谨慎态度。

Omnichain(全链)是未来。或者,也许是现在。Solana的出现催生了一波特定链的项目。Dune 需要支持消费者更好地了解这些举措背后的数据的愿望。该公司即将推出的 "Dune引擎V2",在内部被称为 "Arrakis",试图做到这一点。

在2019年,Dune已经死了。

这个结果对当时以一个核心产品驱动的公司来说,差不多相当于关门了。创始人Fredrik Haga和Mats Olsen花了一年多的时间,试图为他们的区块链数据分析平台筹集资金,但投资者没有认真对待他们。超过一百次的与投资人的对话都换来了同样无情的回应:不!

不,我们不会给你钱。

不,我们不相信加密货币是未来。

不,我们不认为加密货币分析工具有一个大市场。

不,我们不认为你会成功。

剧作家萧伯纳有句名言:「合理的人使自己适应这个世界,不合理的人坚持让世界适应自己,因此所有的进步都有赖不合理的人。」这句话已经成为企业家的标语--但不合理是什么意思?那是什么样子的?

Haga和Olsen的脑子里一定想过,坚持下去没有什么意义。他俩七个多月都没有拿过工资了。而且,市场不仅说了话,而且还重复了很多次。

面对失败,Dune的创始人做了一件不合理的事情:他们坚持了下来。如果只需要一个支持者就能改变他们的命运,那么十几次的拒绝又算得了什么呢?值得庆幸的是,对于该公司和更广泛的加密货币生态系统来说,Haga和Olsen找到了他们的信徒。

在濒临死亡的两年半后,Dune不仅生存下来,而且还在蓬勃发展。这个数据分析平台已经确立了自己作为区块链数据标准的地位,它接受了一个创新的用户生成模式,使世界上的数据分析师--用Dune的话说是 "巫师"--能够展示他们的技能并谋生。这是一个强大的、可获得的实用工具,为消费者提供了一个潜在的代际业务的网络效应。现在,投资者已经意识到了这个机会,他们已经投入了8000万美元,Dune最近一轮的估值达到了10亿美元。

Haga和Olsen从近乎崩溃的状态中,铸造了一个独角兽,突出了加密数据的独特优势。这是一个英雄的旅程,即使是与《Dune》同名的科幻小说的作者弗兰克-赫伯特也会觉得特别毫无违和感。事实上,『Dune』的创始人似乎很喜欢对这个心爱的传奇故事进行演绎,借用词汇和隐喻来描述他们帮助理解的奇怪的区块链荒野求生故事。在今天的文章中,我们将详细解读《Dune》的迭代“进化论”,讲述:

一定会面临的失败。在其历史上,Dune曾数次面临倒闭,为筹集资金而挣扎,调整方向,并为其客户承担风险。它的存在证明了其创始人的耐力和迭代方法的价值。

加密货币数据。金融数据通常是按季度报告的。区块链改变了这种配置,使大量的信息可以即时获得。Dune是为这个激进的新现实而建立的。

多边平台。Dune的天才在于它如何协调三个利益相关者之间的互利关系。它类似于Github,具有超维度扭曲。

商业模式。你如何从免费数据中赚钱?Dune似乎已经找到了一种方法,用类似于大型企业的货币化运动来创建一个消费者平台。

充满活力的文化。濒临死亡的经历应该给幸存者带来新的生命力。Dune似乎证明,公司也是如此。很少有初创公司看起来如此坚决地沉浸在工作的喜悦中。

风险。即使是看起来最无懈可击的加密货币公司也会发现他们的立足点被破坏。尽管Dune似乎正在做出正确的战略决策,但总是有可能出现混乱。

未来。Dune的核心平台正在经历一次重大革新。"Dune Engine v2 "将允许大规模的跨区块链查询。一个新的API也可能有助于释放产品功能、增长用户,以便带来平台质的飞跃。

让我们开始吧。

起源:陌生的水

每个创始人的旅程都需要勇气,但很少有像Dune那样需要勇气的。这家分析公司在成为爆款之前多次躲过了死亡。

Dune初心

2018年,Mats Olsen决定是时候做出改变了。他在希布斯特德媒体集团(Schibsted Media Group)担任了两年的软件工程师,在该公司的奥斯陆办公室工作。他很喜欢在这家企业集团的工作,该集团拥有北欧最著名的出版社和几个大型在线市场。Schibsted给了Olsen一个机会,让他为货运业建立一系列的智能合约,作为内部实验的一部分。

虽然这已经满足了他三个月的兴趣,但跟随他的好奇心深入到加密货币世界的愿望迫使他决定动手。那年夏天,Olsen递交了辞呈。他立即告诉他现在的前同事Fredrik Haga,他做了什么。

虽然Haga和Olsen在一年前才认识,但他们很快就成了朋友。和Olsen一样,Haga在几年前就对区块链产生了兴趣,发现它比他的经济学硕士课程更具有智力刺激性。Haga回忆说:"它让我思考了很多我没有真正学到或问过自己的深层次问题,"他促使我思考诸如 "货币究竟是什么 "的问题。

和他的朋友一样,他成功地将他最初在Schibsted的传统角色变成了一个实验性的角色,从广告组转到了Olsen的两人区块链团队中。Schibsted表现出探索新领域的意愿,但Haga很快意识到,在一个大型传统企业的背景下,这种灵活性意味着什么。世界上所有的信仰都无法说服一家成立于1839年、以报纸为中心的公司接受一个激进的新金融和计算范式。

因此,当Olsen告诉他的朋友他已经辞职时,Haga花了 "半秒钟就意识到他也会这么做"。是时候进行一次冒险了。

Dune公司

根据他俩自身的优势,Olsen和Haga选择了一个完美又可怕的时间点来启动加密货币业务。2018年1月,加密货币价格暴跌,比特币从19,000美元以上的高位跌至4,000美元以下。随着热情凝结成恐惧,骗子和投机者逃离了这个行业,只留下那些对技术真正感兴趣并愿意忍受未经证实、动荡的市场可能产生的痛苦的人。

这是个好消息。坏消息是,许多风险资本家也在撤退的队伍中。虽然任何半吊子的代币项目都能在12个月前筹集到数百万美元,但熊市的阴霾意味着即使是认真的建设者在2018年也在挣扎。

Haga和Olsen就是其中之一。经过几周的构思,这对创业搭档确定了一个符合谚语的想法,即在淘金热中,出售镐头、铁锹,卖水是最好的生意。如果加密货币变成了两人认为的那种史诗般的动荡,那么拥有基础设施会被证明是非常有影响的。特别是,他们决定建立分析和可视化区块链活动的工具,正如Haga所描述的,"Mixpanel或谷歌分析的加密货币"。虽然这种工具的需求在今天看来是显而易见的,但Olsen回忆说,它在当时是 "不存在的"。

他们在没有过多考虑的情况下确定了 "Dune "这个名字。这是一个强烈的、令人回味的词。更妙的是,Dune的起伏让人联想到数据集的波动,每座小山和驼峰都是价值的变化。Olsen和Haga知道弗兰克-赫伯特的同名经典著作,尽管他们的公司早于这部大片的拍摄时间。如果熟悉它们,赫伯特的话可能是对接下来几个月的恰当描述:“生存能力就是在陌生的水域中游泳。想要生存下去,就必须在这些陌生的水域中找出水流和他们的模式。”

Dune的生活开始得很简单。公司成立后不久,就赢得了挪威政府的资助,使其创始人能够参加世界各地的区块链会议。这笔钱不多--几千美元--但足以让Olsen和Haga前往柏林,然后是旧金山。他们通过在每个城市的不太富裕的地方预订破旧的房间来省钱。他们还共用房间,甚至共用床铺,尽管Haga的鼾声令人印象深刻。

虽然Dune的两个创始人的旅行意味着资助金很快见底,但Haga和Olsen也确实成功地带来了一点收入。在旧金山ETH会议上,两人说服了Dharma的联合创始人Nadav Hollander(现在是OpenSea的CTO)成为了他们的第一个客户,每月支付600美元。这表明Dune还没有巩固其价值主张。虽然Hollander对该公司的仪表盘没有兴趣,但是却非常关注他们为创建仪表盘而清理的数据。

紧随其后的是第二个客户,CredMark,一个加密货币的金融建模平台。他们一起给Dune带来了1000美元的月收入--这不是一个令人瞠目结舌的数字,但却是需求的具体证明。在加密货币经常是虚无缥缈的世界里,真正的美元流入能使Dune成为精英公司。"我们有一个付费客户,"Haga说,"这在当时的加密货币中是非常、非常罕见的。"

Haga和Olsen很快了解到,这并不重要。这对搭档在进入第一轮筹资时的任何乐观情绪都被一连串的拒绝打消了。他们一次又一次地听到同样的声音。

为什么会有人为区块链上免费提供的数据付费?

这个市场的价值怎么可能超过几亿美元?

"那绝对是残酷的,"Haga谈到那段时间时说,"我们被拒绝了50次。而进入圣诞节后,我们绝对破产了。"

Dune社区

丧失了几十个投资者足以结束许多人的冒险。Haga和Olsen可以说他们已经尝试过了,尽管他们尽了最大努力,但还是失败了。市场根本没有为他们这样的产品做好准备。

Dune的创始人并没有放弃,而是强迫自己进行总结。他们真的相信基本的应用程序会建立在以太坊和其他协议上吗?他们确实相信。投资者给了他们什么反馈——他们应该记住多少?

在一系列的融资对话中,Olsen和Haga意识到风险投资公司有一个观点。"Olsen记得,"这不是一个快速增长的业务,也不是那么容易辩护的。仅仅清理公共数据就足以吸引一些客户,但不足以建立一个新的全球巨人。

在回到绘图板时,这对搭档发现了一个新的方向。如果加密货币数据可以免费获得这一事实不是一个错误,而是一个特点,那会怎么样?这对他们的模式意味着什么?Olsen回忆起灯泡亮起的那一刻:

我们正在使用仪表盘来展示我们数据的价值。我们意识到,我们拥有任何人为任何以太坊项目或协议创建仪表盘所需的一切。

Haga想:与其说Dune是创建仪表盘和数据集的瓶颈,不如说它是一个平台,其他人可以在此基础上进行建设。"让我们用仪表盘来淹没世界,并成为加密货币市场的应用层吧!"。

尽管两位创始人都看到了将Dune的最大弱点转化为独特优势的好处,但他们还是为这种转变对他们的业务意味着什么而纠结。首先,他们将不得不放弃他们辛苦赢得的现金流。"我们真的要放弃这笔收入吗?" Haga想。

到了2019年,创始人已经做出了决定:是时候推出Dune2.0,一个社区产品了。

这一转变并没有立即体现出财富的变化。Haga试图在两个多月内完成一轮融资,但又收到了50多份被拒绝的文件。团队的信心在ETH丹佛会议上达到了最低谷。事后看来,Haga认为他和Olsen还有两周就会放弃。

进入币安

Teck Chia对他所看到的一切印象深刻。币安加速器的负责人没有看到许多具有真正吸引力的初创企业,因为该集团的重点是早期企业。尽管Dune已经放弃了他们的付费客户,但在Chia看来,他们拥有这些客户的事实使他们处于行业领先地位。此外,该团队正在攻克一个明显的问题市场 - Chia知道加密货币分析是一个充足的机会。他决定在这两个挪威人身上下注,邀请他们参加币安的项目,这个提议带来了25万美元的投资。

Haga回忆起那一刻提供的抚慰:

在获得加速器录取之后,我记得我和Olsen通了电话,然后干脆躺在地板上,因为我们终于确保了《Dune》的继续存在而感到高兴和欣慰。接下来的4000美元工资是我在七个月没有工资的情况下人生中最好的工资。

Dune正式成为一家有资金支持的企业,背后有世界上最大的加密货币公司。但这并不意味着与风险资本家的讨论变得顺利了。根据Haga的统计,在接下来的15个月里,他曾四次试图筹集种子轮融资,但都没有成功。到旧金山的旅行创造了良好的关系,这些关系后来被证明是有影响力的,但在当时看来,这不过是没有资本的行业友谊而已。

在筹款方面挣扎的同时,Dune开始在新客户和用户中找到了自己的立足点。在很大程度上,该公司的成功依赖于其创始人的坚韧和承诺。Haga和Olsen紧握拳头管理业务,给自己的工资很低,以最大限度地提高跑道。直到2020年底,Dune才会再雇佣一名全职员工。

该公司的创始人还效仿Y Combinator的经典建议,即 "做没有规模的事情"。这包括教用户使用SQL,这是一种用于导航和查询数据库的编程语言。

Matteo Leibowitz就是这样一个学生。2019年,现在的Uniswap实验室负责人在加密货币媒体《The Block》担任研究分析员。Haga对生态系统保持着敏锐的关注,他注意到Leibowitz在DeFi上的文章,并认识到他是Dune需要争取的有影响力的用户。他联系了Leibowitz,看看他是否有兴趣使用该平台。他有兴趣--但有一个问题。"Leibowitz说:"我不知道如何写SQL语句。

Haga没有让这成为谈话的结束,而是建立了一个不太可能的辅导关系。每周,Haga都会与Leibowitz通话,教他基础知识。"他非常有耐心,"Leibowitz指出,"我并不总是做我的SQL作业。" Olsen还把他的Telegram账号给了Leibowitz,让他可以回答任何问题。据报道,Leibowitz一开始觉得这很有挑战性,但 "奇迹般地,几个月后,它就开始了"。事后看来,很容易看出Haga和Olsen愿意做这类无法扩展的活动是如何帮助Dune的。通过让Leibowitz加入,他们确保了他们的仪表盘会在《Block》的文章中占据突出位置,给他们带来了原本难以管理的传播。

进入2020年,Dune继续其崛起。数据 "巫师 "们涌入该平台,建立和展示他们自己的仪表盘,而消费者则访问该平台,收集他们可能正在探索的任何项目的信息。由于有了付费的高级计划,Haga和Olsen的年度经常性收入(ARR)达到了60,000美元。

2020年初,一次失败的旧金山筹款之旅使这一势头受到影响,Dune未能筹集到100万美元的种子轮。正如Haga后来写的那样。

事后看来,相当荒谬的是,有人在不到两年前就能以100万美元的价格获得Dune公司~10%的股份,但硅谷没有一个投资者感兴趣。

Haga和Olsen决定以精简的预算运作,在2020年夏天开始得到回报。在加密货币圈子里被称为 "DeFi之夏",它标志着Dune所处的熊市的结束。突然间,投资者和消费者的热情回到了这个市场。随着美元涌入不同的链上游戏,Dune确立了自己作为一个重要的信息来源。"一夜之间,Dune无处不在,"Olsen回忆说。"到那个夏天结束的时候,我们已经在很多人的雷达上了。"

在Dune游动的陌生水域,潮水似乎已经转向。2020年9月,Dune从包括Multicoin Capital在内的一些加密货币最具有前瞻性的投资者那里筹集了一笔种子轮资金。这轮200万美元的融资包括蜻蜓资本、Coinbase Ventures、Alameda Research和Hashed。

Dune崛起

Haga和Olsen将这笔钱用于工作,雇佣了两名全职员工。Olsen回忆说:瓶颈很快到了。尽管DeFi Summer为Dune的发展带来了好消息,根据大多数关键指标,业务每周增长5%,但它也给核心架构带来了压力。"我们的基础设施被撕成了碎片"。

在很大程度上,这是由Dune的潦倒出身造成的。为了启动和运行,Olsen分叉了一个开源的分析工具,叫做Redash。虽然它有一个足够好的基础,但它并不是为了处理成千上万的同步用户而建立的。新的工程技术人员Vegard Stikbakke记得,"如果你试图执行一个查询,就会花很长时间"。

现在是提升水平的时候了。在一个只有四名全职员工的团队中,Dune从头开始重建其整个应用程序和查询执行层。这是一种大规模的升级,如果是一个更大的团队,可能需要一年或更长时间才能完成,但在Olsen的领导下,Dune的工程师们只用了两个半月就完成了。"Stikbakke说:"我越想我们所建造的东西,我就越感到了不起。

在改进的基础设施的帮助下,Dune继续其显著的有机增长。很快,它的仪表盘似乎无处不在,“点缀”在博客文章中,充斥着Twitter的时间线,并浮现在Discord频道中。随着Dune知名度的提高,投资者的兴趣也在升级。Haga从他的外联邮件没有得到回应到风险资本家向他伸出援手。

由于大部分种子资金仍在银行,Dune不需要融资,但他们决定抓住这个机会。特别是,他们联系了联合广场风险投资公司(USV)的普通合伙人尼克-格罗斯曼。2020年初,在斯坦福大学校园的一次散步中,格罗斯曼给Haga和Olsen留下了深刻的印象,表现出了在筹资讨论中并不常见的体贴和人性。这种热情的接待是相互的。格罗斯曼记得,他对他们两个人有一种 "真实的、内在的个人反应"。

尽管USV最终没有对种子轮进行投资,但双方仍保持着联系。在此后的几个月里,格罗斯曼对Dune的信念不断增强。随着加密货币重新焕发生机,他比以往任何时候都更清楚,"区块链的信息宇宙正在成倍地扩大"。Dune不会只支持几十个协议或项目,而是支持几千个。当Haga再次联系时,格罗斯曼已经准备好了--尽管他和USV投资团队没有多少时间过会讨论该项目。

与Dune以前的尝试形成鲜明对比的是,这次募捐以闪电般的速度进行。Haga记得,他和Olsen在周五决定开启A轮融资。为了启动这轮融资,他们给一些投资者发了电子邮件。周末,Haga整理了一套资料,并预约了几个电话。到了星期二,Dune有了两份协议书。"Haga说:"这完全改变了我们以前的所有经验。

接下来是Haga一生中 "最紧张的一周"。突然间,他发现自己处在欧洲和美国之间的合作伙伴电话中,因为风险投资公司都在争相考虑最新的融资。格罗斯曼记得,Haga和Olsen在介绍USV的合作时,"把所有人都吓了一跳"。竞争性报价提高了Dune的估值,但最终,Haga和Olsen知道他们想与谁合作。

在那个周五,也就是开始合作的一周后,两人与USV签署了一份条款协议。Haga将该公司描述为他的 "梦想 "合作伙伴,它结合了对加密货币、基于社区的业务和纯游戏软件的深刻理解。

Dune的月亮

如果说Dune的A轮融资让Haga和Olsen看到了什么是高需求,那么B轮融资则展示了被追求的感觉。

随着800万美元的A轮融资在2021年夏末结束,Dune发现自己处于一个舒适的财务状况。它扩大了自己的团队,但做得很谨慎,没有过度扩张。

但投资者不断打电话来。开始时可能是涓涓细流,后来变成了滔滔洪水,Haga每天都会收到 "很多很多 "信息。尽管Dune公司拒绝了绝大多数人,但还是有一个人设法溜了进来:Coatue公司。

在三十分钟的通话中,现已离职的合伙人Kris Frederickson表现出对Dune正在建造的东西的强烈理解,并询问了筹资的情况。尽管Haga礼貌地告诉他们Dune不希望增加投资者,但Fredrickson在几周后跟进了最新情况。在这期间,Coatue从外部对该公司进行了深入的尽职调查,并留下了深刻的印象。也许他可以带领Haga了解他们的调查结果?

这些发现变成了一个详细的40张幻灯片。Fredrickson再次问道,Dune是否会考虑融资。同样,答案是否定的。

两周后,Fredrickson回来了,带着一份条款表。5000万美元,5亿美元的估值如何?这个数字比几个月前结束的那轮融资有了很大的提升。虽然很诱人,但Haga和Olsen发现自己在谈判中处于优势地位。他们没有直接接受这些条款,而是进行了反驳。如果Coatue的估值翻倍,使Dune成为独角兽,他们会考虑接受交易。

四十八小时后,Coatue同意了。不久之后,Dune宣布以10亿美元的估值获得69,420,000美元的融资。B轮融资的规模是Haga和Olsen的主意--还有什么比用幽默感来庆祝这样一个疯狂的里程碑更好的方式呢?

三年前,Olsen和Haga曾一起在奥斯陆的一家传统出版企业工作。他们在2022年第一季度完成了对加密货币的最新独角兽的掌舵。

产品:革命不会每季度报告一次

Haga和Olsen创造了一个服务于加密货币行业并利用其独特特性的业务。其结果是,产品的简单性掩盖了其力量。

加密货币数据是一个有生命的东西

任何放弃了Dune早期融资的投资者都应该得到一些理解。虽然该公司的价值在今天是显而易见的,但Haga和Olsen已经建立了一个新颖的业务,一个依赖于新型数据的业务。

传统金融信息和加密货币数据之间有四个主要区别:

可用性

可操作性

连接性

规模

最明显的是可用性。因为加密货币项目是建立在透明的可审计的区块链上,信息是立即可见的。在讨论这一点时,尼克-格罗斯曼将加密货币数据描述为 "7X24小时实时可用"。将这一点与一个活动不在链上运行的企业相比较。如果你想看看星巴克在上周带来了多少收入,你必须等到收益时间的到来。Dune团队阐明了这种区别,指出 "革命不会按季度报告"。

由于数据是持续可用的,它也更具有可操作性。消费者、投资者和开发者可以根据从一个时刻到下一个时刻发生的变化做出决定。例如,一个DeFi农民可能会追踪利率的微小变化,以提高他们的收益。或者,一个NFT收集者可能会跟踪一个项目的精确的财务健康状况,以证明或打折加入。更细化的数据促进了不同类型的活动。

由于以太坊、Solana和其他协议的可组合性,加密货币数据从根本上说也更有关联性。生态系统中的一个部分的行动对其他地方有直接影响。由于这个原因,格罗斯曼将加密货币数据描述为接近 "有机体 "的东西,而Dune的一篇博客文章将其称为相当于一个 "活生生的季度报告"。

最后,有一个根本性的规模差异在起作用--至少,当推断出一个项目成熟的状态的时候是如此。今天,大多数传统的商业数据被束缚在孤岛上,只有大型企业才能访问。Crypto使其几乎完全开放。突然间,一个自上而下的B2B行业变成了一个自下而上的消费者行业。其影响是数据工具基础设施供应商的大规模TAM扩展,因为他们管理的信息和复杂性要多很多倍。这就是为什么把Dune和web2商业分析平台并列在一起在逻辑上是站不住脚的部分原因,有点像把Ctrl-F和Google比较。两者都能帮助你找到东西,但所查询的信息范围却不同。

为了理解这一点,我们必须仔细研究一下Dune的产品。

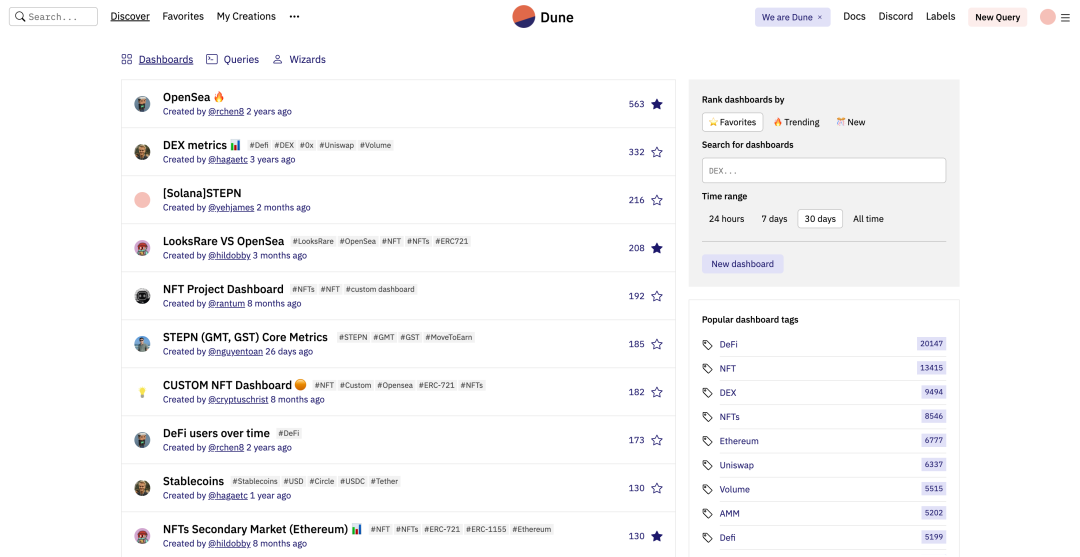

消费者和仪表盘

Dune的大多数访问者是以消费者的身份来到这里的。他们正在寻找关于特定协议或项目的信息,并将Haga和Olsen的创作作为一种发现方法。

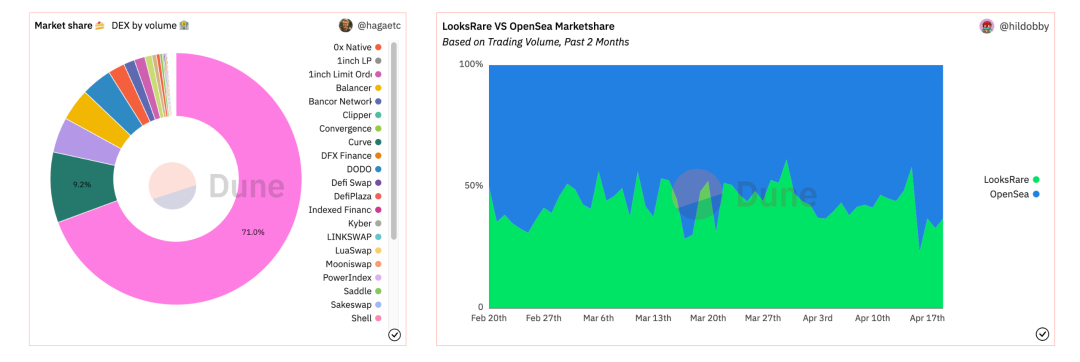

想知道OpenSea的月产量?有一个仪表板来显示。

想把它与LooksRare进行比较?没问题。

对STEPN最近的上涨感到好奇?Dune为您你提供。

Dune总共有超过22,000个不同的仪表盘。鉴于这些都是用户生成的,质量各不相同。有些可能是专业级的,容易扫描,而有些则是SQL学生早期课程的成果。这些都是可以通过名字或标签来搜索的。

Dune

为了帮助消费者找到最好的资源,Dune利用了一个基于 "星级 "的排名系统。如果你喜欢一个仪表板,你可以选择 "给它加星"。那些拥有最多星星的人被放在最显眼的位置,激励创作者做他们最好的工作。例如,如果你搜索OpenSea,Dune的搜索会提升那些在特定时间范围内的 "趋势"。在该时间段内,星星的积累大致定义了这个排名。

消费者可以在仪表板内深入到不同的数据集,以获得更细化的视图。如果他们愿意,他们可以重新运行查询以刷新数据,为他们的网站获得一个嵌入代码,或分叉查询。一旦消费者开始写他们自己的SQL和创建新的仪表盘,他们就会加入Dune创造者的军团,更多的被称为 "巫师"。

巫师,巫师,巫师

在Dune的内部年度回顾报告中,Haga概述了2022年公司的重点:"巫师,巫师,巫师"。就像史蒂夫-鲍尔默在微软会议上大喊 "开发者 "这个词直到声嘶力竭一样,Haga和团队狂热地希望为处于Dune模式核心的利益相关者服务。

“巫师”是内容的创造者。这些利益相关者利用他们的SQL技能,创建了消费者查看的仪表盘。Dune平台上的每张图或表都是用户生成的,是由这一群体组建的。

为什么“巫师们”要做这些工作?

简短的回答是,有经济和社会的激励,推动了创造性的贡献。为了更好地了解这个小组的工作,我在Dune上与该平台最著名的巫师之一Hildebert Moulié或Hildobby谈话。

作为一个好奇的数据科学硕士生,Hildobby倾向于Dune。他喜欢更好地了解不同的协议活动,并很快开始自己创建仪表盘。在迁移到NFTs世界之前,他开始关注DeFi。这让Hildobby第一次尝到了消费者需求的滋味。"我看到有些人喜欢我的工作,所以我让我的仪表盘对每个人来说都更容易查看。

很快,Hildobby的工作吸引了人们的注意。不同的web3项目的负责人开始联系,询问他是否会为他们创建仪表盘。其中一些工作可能是高薪的。例如,在推出之前,去中心化的NFT市场LooksRare向Hildobby支付了几千美元来制作三个这样的仪表板--这项任务花了他一个多月的时间。除了内向的兴趣,Hildobby还通过参与Dune的 "赏金 "计划来补充收入,该计划为巫师们提供了有偿的web3机会来完成。

Hildobby除了经济奖励外,还积累了社会和职业资本。他不仅认为Dune明星在这一行中 "和Twitter粉丝一样有价值",而且正如他所解释的,"在Dune上的工作比我的学业更有价值"。因此,也许毫不奇怪,Hildobby已经离开了他的硕士课程,全职专注于Dune。

虽然Hildobby是《Dune》中排名第三的巫师,因此需求量很大,但他的故事并不是孤立的。由于这个平台,还有几十个巫师正在茁壮成长,要么获得新的工作,要么获得高额的赏金。该公司在2021年10月进行的一项调查显示,92%的巫师是积极的支持者,没有人是反对者。Haga和Olsen希望在Dune的全职巫师人口达到数千人时,能够保持这样一个令人印象深刻的满意度水平。

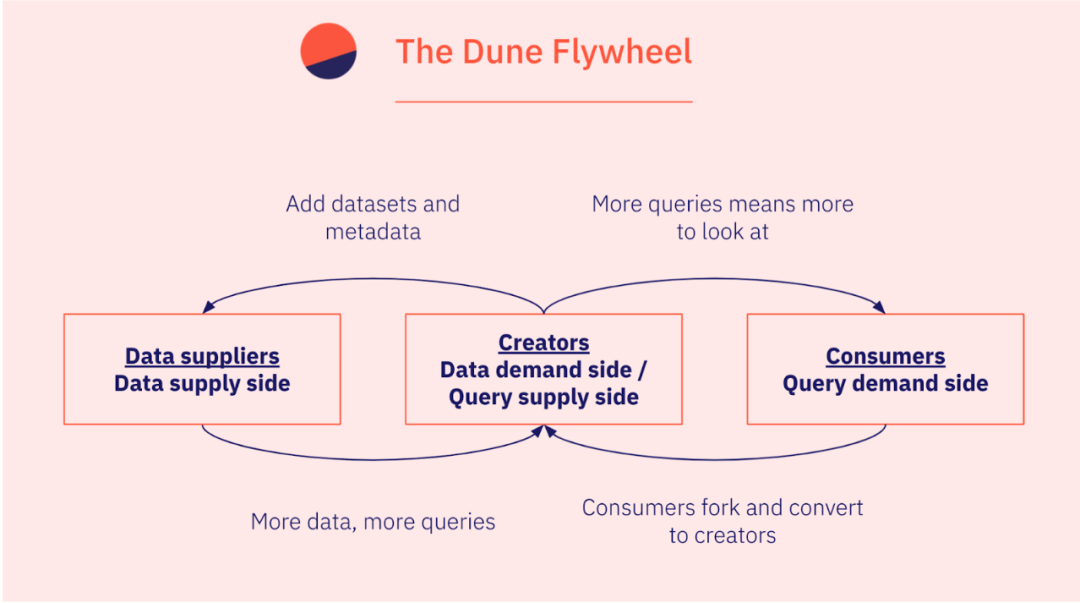

循环内循环

Dune与什么公司最相似?在我的谈话中,有一个名字出现的频率最高——Github !

很容易看到这种比较的优点。Dune是一个让技术用户托管和分享他们的工作,并将他人的努力分叉的地方。Dragonfly Capital的合伙人Tom Schmidt说,"它是开源软件,但用于数据"。

Haga指出,虽然这种比较很有价值,但Dune在组合中增加了另一个利益相关者:消费者。虽然托管在Github上的代码吸引了其他开发者,但没有非技术用户的使用案例。在Dune上,这与事实相差甚远,大多数访问者是作为读者而不是创造者。

其结果是一个有趣的“飞轮”,Olsen将其称为公司的 "八字飞轮"。当创作者建立更多的仪表盘时,更多的消费者来到平台上观看。这激励了创作者改进和扩大他们的工作,带来新的数据供应商。随着更多的数据变得可用,更多的仪表盘被创建,更多的消费者访问。这是一个良性循环,能够从多个利益相关者那里加快速度。

Dune

模型:货币化“香料”

弗兰克-赫伯特的《Dune》中最稀缺的资源是虚构的麻醉品 "香料",也被称为 "Melange"。正如评论员Jon Michaud曾经就这个问题写道:"想象一下,一种物质的全球价值相当于可卡因和石油的总和,你就会对Melange的力量有一些了解。"

在某种程度上,数据就是Olsen和Haga的《Dune》中的混合物,是平台价值的来源。不过,与赫伯特的香料不同,数据是现成的。它不是一种稀缺资源,而是丰富的资源,而且--至少在理论上--很容易获得。

这就提出了一个挑战:你如何实现货币化?通过对以某种方式无处不在的混合物收费,可以获得什么收入?

目前,Dune已经采取了一种轻巧的方式。规模化的平台货币化可能需要对产品进行补充,并在模式上稍作转变。

免费服务

今天,用户可以访问区块链数据,创建仪表盘,分享图表,以及分叉现有的查询,而无需向Dune支付一分钱。只有当客户需要同时运行几个查询,跳过查询队列,导出结果,保持信息的私密性,或删除水印时,他们才必须升级到 "Dune Pro",这是一个高级计划,每月统一费用为390美元。

Dune在这里的做法是慷慨的。不仅免费层的功能非常全面,而且与其他加密货币数据供应商相比,"专业版 "的成本很低,有些供应商每月收费数千元。活跃的协议和著名的投资者不太可能对这样的数字视而不见。

那么,为什么不提高价格呢?

Dune对以增长为代价的货币化持谨慎态度。正如一份内部文件所解释的那样,Haga和Olsen热衷于确保公司的飞轮可以不受约束地旋转。只要用户为整个平台创造价值--制作仪表盘、分叉查询--就应该允许他们不受限制地这样做。只有当用户 "跳出飞轮 "时,Dune才会抽成。

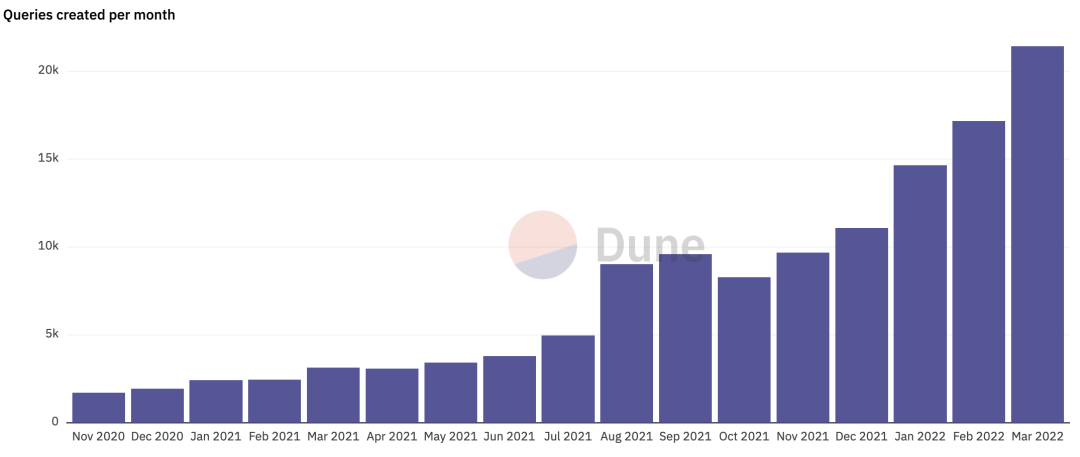

这个策略似乎已经达到了预期效果。Dune的用户和参与数字已经激增到超过15万次查询和17000名“巫师”。每月创建的查询次数从一年前的约3000次上升到约23000次,即增加了766%。

Dune

在过去的一年里,每月的浏览量也有令人印象深刻的增长,上升了670%,达到390万。Dune已经成功地引导了增长,即使它是以牺牲短期收入为代价的。

API

如果Dune想将其收入提高10倍,它可能在一夜之间就能做到。设置一些付费墙,引入费率限制,并提高价格,就可以完成这项工作。但在这个过程中,该公司会毁掉它辛辛苦苦弄出来的飞轮。

一个更好的方法可能是提供一个API。目前的情况是,用户访问Dune数据的唯一途径是通过图形用户界面或通过出口。两者都不理想。图形界面不适合技术性使用,而导出的数据从本质上讲,不是实时的。API将解决这两个问题,允许在不牺牲可用性的情况下进行更复杂的、程序化的使用。

追求这条道路将开辟许多新的--也许是更好的--货币化杠杆。就像目前的 "Pro "计划一样,Dune可以根据使用情况和优先级来定价--但在一个更细的层面上。同时,提供API将加深企业与客户的联系,将其从一个外部数据供应商转变为核心基础设施。

该公司意识到了这个机会,并且似乎正在努力解决这个问题。下面讨论的即将到来的“Arrakis”更新将准确启用这种 API。增长经理 Hugo Sanchez 指出,他与当前和潜在客户的许多对话都集中在这种方法的可用性上。“通过 API 访问Dune数据的需求巨大,”他指出。

文化:永远不会放弃(你)

据说,与死亡的擦肩而过可以让我们中最颓废的人有一种拥抱生活所提供的一切的愿望。Dune》与失败的擦肩而过似乎也产生了类似的快乐感--无论是大事还是小事,Haga和Olsen都致力于为他们的工作带来乐趣。

让我解释一下我的意思。

今年早些时候,Haga完成了对Dune.com域名的购买。购买该域名花费了时间和大量的谈判。在交易最终完成后,到了宣布这一消息的时候。

但是,与 "我们很高兴能与大家分享 "的信息相比,Dune的团队决定采用更有创意的方式。在实现新域名之前,他们重定向到Rick Astley的 "Never Gonna Give You Up "音乐视频上。然后,他们在推特上向他们的粉丝发布了这个消息。

还有谁会用这样的时刻在互联网上进行Rickroll?虽然这个域名后来成为了Dune的主页,但这段插曲说明了弥漫在公司中的趣味感。当面临一个决定时,Haga和Olsen几乎总是寻找一条更好玩的道路。

虽然这可能是Dune最突出的个性特征,但这也是该企业的特殊之处。Haga和Olsen创造了一种饥饿、专注、所有权和工艺的文化。

保持饥饿感

Multicoin Capital的管理合伙人Kyle Samani在谈到Dune的领导人时说:"说实话,从很多意义上讲,他们是我最喜欢的一些创始人"。在解释为什么会这样的时候,萨马尼强调了团队的饥饿感和拼搏精神。由于公司的筹资历史有问题,Haga和Olsen已经学会了少花钱多办事。Haga自己说,"这样的艰难困苦真的塑造了我们"。

这一特质也让Vegard Stikbakke眼前一亮。当他考虑作为工程师加入公司时,让他心动的是Haga和Olsen的强度,再加上上面提到的游戏性。"Stikbakke说:"这真的是对创始人的一个赌注,""他们似乎有这种轻松有趣的氛围,同时还很饥渴和执着。

值得称赞的是,在Coatue投资之后,Dune的创始人并没有让这一特点下滑。虽然招聘的步伐加快了,但公司仍然很小,只有35名全职员工。在B轮融资时,只有16名员工,这意味着Dune的团队有效地成功创造了每人6250万美元的市场价值--像FTX这样的规模大师会为此感到自豪。更值得注意的是,根据Haga的说法,Dune去年的烧钱量只有100万美元。这与许多资本雄厚、高增长的公司形成了鲜明的对比。

在描述自己时,Haga总结了这一特点:"我在追求中获得了愉悦感。几乎总是如此"。

专注,直到疼痛

在增长经理Hugo Sanchez上班的第一天,Haga把他拉到一个业务发展会议上。视频会议电话的另一端是世界上最强大的风险投资公司之一的代表。

据Sanchez回忆,这家风险投资公司想通过API访问Dune的数据,而且他们准备付钱。Haga拒绝了他们。Dune的创始人解释说,公司还没有准备好以这种方式为他们服务,在他们准备好向整个用户群推出API之前,他们不能重新设计他们的路线图。

在Sanchez看来,这非同寻常地证明了Dune的专注。Haga不能被服务于一个有利可图的著名客户的可能性所干扰--他知道企业接下来需要建立什么。"Sanchez说:"这让我大吃一惊。

异步的所有权

Dune公司通过分布在欧洲和北美的团队进行远程操作。员工在伦敦、里斯本、纽约、奥斯陆和多伦多工作。Dune没有试图安排竞争性的时区,而是避免了同步沟通,这与Levels并不一样。根据Olsen的说法,"我们不鼓励经常性的会议,并试图确保沟通以异步方式更好地流动"。

产品经理Bernat Fages描述了该团队的沟通过程。大多数讨论是通过长篇书面备忘录或通过任务管理平台进行的,而不是开会。尽管 "面对面 "的时间很少,但Dune的招聘筛选似乎已经创造了一个具有友情的平衡的团队。Fages回忆说,在意大利的一次场外活动中,他第一次与许多同事面对面,然而,这个团队很快就相处得很好,大家似乎都在同一个波长上。

虽然与正确的沟通工具保持一致是运行异步游戏手册的一个组成部分,但所有权文化则更为重要。社区经理Florian Barth认为这是Dune的核心特质之一。该公司的经理们不牵制或微观管理--相反,员工被期望主动解决出现的问题。"Barth开玩笑说:"如果你不擅长谷歌搜索,你就来错了公司。

为了保持规模化的杠杆作用和成长速度,主人翁意识是不容商量的。

追求美丽

有时,Fredrik Haga似乎是一个不太可能经营加密货币数据分析业务的人。访问他的推特资料,感觉与浏览其他加密货币建设者的网页相当不同。在关于他的公司的更新中,有对艺术电影的观察,对经典说唱专辑的缅怀,以及令人回味的残酷主义建筑的黑白照片。

在描述Dune的CEO时,Vegard Stikbakke指出了Haga的诚信。"不仅仅是在道德意义上,"他澄清说,"在艺术意义上也是如此"。

Stikbakke的观察与其他对话相呼应,包括我与Haga的对话。当我问及他对《Dune》的期望时,Haga把它比作一首伟大的音乐所引发的兴奋。他说:"我希望我们在做的事情中也有这种氛围,"他说,"我点击这个按钮的方式,我得到这种回应的方式。一切都应该有激情交织在一起。"

这种意见、品味的感觉,显示在整个Dune的产品和更广泛的业务中。最近几周,Haga发布了该公司的宣传品系列的外观手册,其中有一句调侃的标语:"Dune是一个通过加密货币数据工具化的街头服饰品牌。"

由国际模特Teo Leibowitz主演的Dune的造型书

这是Dune致力于创造真正美丽的东西的又一个例子,并以一种平衡严肃和异想天开的方式来完成。

风险:恐惧是心灵的杀手

在弗兰克-赫伯特的太空神话中,主人公保罗-阿特雷德斯说出了一个简短的诗句来平静自己。"反对恐惧的颂歌 "的开头是:"我绝不能恐惧,恐惧是思维杀手。恐惧是带来彻底毁灭的小小死神,我将正视恐惧,任它通过我的躯体。当恐惧逝去,我会打开心眼,看清它的轨迹。恐惧所过之处,不留一物,唯我独存。"

初创企业如果花太多时间被失败吓倒,可能会遇到同样的命运。就他们而言,Olsen和Haga没有表现出这样的恐惧,尽管他们仍然意识到他们特定业务的脆弱性。尽管Dune没有显示出任何漏洞或等待修补的洞,但仍有风险需要驾驭。

缓慢的货币化

如前所述,Dune的货币化进程缓慢。它的免费服务是强大的,而且它很少努力向用户追加销售。虽然这种策略促进了用户的增长和参与,但它也有缺点。

首先,这一决定可能对竞争对手有利。其他确保付费客户的数据供应商可能会发现,随着时间的推移,他们能够创造锁定的机会。随着客户将越来越多的业务与他们的数据供应商捆绑在一起,流失就成为一个越来越大的责任。等到Dune准备好提供同等的解决方案时,转换的成本可能已经大大增加了。

其次,Dune并没有通过遵循这种更温和的方法来学习如何转换客户。当需要从其用户群中更有效地提取价值的时候,团队将需要学习拉动哪些杠杆。

这些都是主要的阻碍吗?

Dune已经确立了自己在加密货币工具领域的重要地位,使得它不太可能被大账户锁定--尤其是考虑到市场需求变化的速度。如果这种情况因某种奇怪的命运怪圈而发生,那也没有关系。这个市场正在增长,意味着每天都有新的客户出现。最后,虽然Dune可能没有发展出对客户转换的复杂感觉,但这并不像在企业生命的这个阶段优先考虑的正确专业知识。

总的来说,迟缓的货币化似乎构成了一个最小但存在的风险。

缓慢的代币化

在每个加密货币创始人的生活中,他们会得到同样的问题。"什么时候代币化?"

鉴于Dune的社区重点,乍一看似乎是一个自然的延伸。SPICE可以授予巫师和其他利益相关者,以换取他们建立仪表盘,改进现有工作,或分享平台的创作。激励这些已经存在的行为可以为其增压,加速Dune的扩散并吸引竞争平台的活动。

Haga和Olsen对这样的举动很谨慎,他们认识到这是一个不可逆转的决定。一旦一个生态系统的代币被引入,你就不能移除它。此外,两人似乎都不确定代币会创造有形的长期价值--至少目前是这样。"代币和NFT是你可以用来解决问题的工具," Olsen说。"如果你想启动一个社区,引入一个代币是一个很好的方法。但是我们已经有了一个社区--这不一定是一个适合我们的工具。"

Dune的沉默会不会让他们面临竞争性的入侵?

Sushi和LooksRare都分别成功地将用户从Uniswap和OpenSea吸引过来--但只是短暂的。在最初的激增之后,Sushi的交易量已经远远落后于Uniswap;在撰写本文时,该分叉在过去七天里处理了5.87亿美元的交易量,而Uniswap的交易量超过了100亿美元。虽然LooksRare自推出以来已经处理了240亿美元的交易量--超过了OpenSea同期的150亿美元--但它只处理了一小部分用户,而且有人说这一数字大部分是由于鲸鱼的清洗交易造成的。最近几周,在位者重新获得了主导地位。

Dune

尽管如此,尽管Uniswap和OpenSea都没有被推翻,但他们肯定不会因为有能够榨取参与度和窃取市场份额的竞争对手的存在而感到兴奋。

一个新的后起之秀或敢于冒险的竞争者可以对Dune采取类似的行动。这并不意味着Dune本身应该过早地采取这种做法。"我们并不反对代币,"Olsen说,"但如果我们这样做,我们会做得很好。我们总是为长期发展而建设。"

技术上的缓慢

今天对Solana项目的分析需求比一年前高了好几个数量级。这反映了加密货币领域的速度和流动性--这个月看起来无关紧要的东西可能在下个月就变得必不可少。

Dune将需要确保它能在不牺牲其性能的情况下与市场保持同步。在某些方面,它有独特的能力来做到这一点。毕竟,没有其他供应商拥有一支不断创造新的数据可视化和仪表盘的用户队伍。反过来说,这种方法也会产生令人难以置信的负担。作为数百甚至数千次同时查询的焦点,Dune必须承受沉重的负荷而不出现重大延误。该平台必须是灵活、可靠和高效的,以便为其几十个“巫师”服务。它必须适应新的数据集,而不使查询速度减慢到爬行地步。

正如USV的Nick Grossman所指出的,"这在很大程度上是一家数据基础设施公司"。Dune的成功在于它有能力建立能够经受住它自己设定的挑战的技术。

未来:前往Arrakis的航程

与它的名字相称,Dune(沙丘)是一个广阔的景观。在未来的几年里,我们应该期待这个平台与它所支持的经济一起成长,支持新的平台,为它的巫师们带来更大的机会,并扩大其功能。

Arrakis

Dune对前面提到的最后风险的回应是Arrakis。Arrakis以赫伯特小说中收获熔岩的星球命名,代表了Dune架构的一次大规模升级。特别是,它将允许跨越不同的区块链进行查询。

这一转变的影响是深远的。“巫师”最终将有能力为建立在Avalanche、Fantom以及更多的项目创建仪表盘。此外,消费者将看到特定项目的综合数字--跟踪Uniswap的跨链总量。

一旦完成,Arrakis将解锁新的功能,并降低扩展成本。正如Olsen所解释的,由于Dune目前的架构运行在Postgres的开源数据库管理系统上,增加的流量只能通过增加数据库来管理。虽然这些数据库增加了吞吐量,但它们并不是最有效的解决方案,而且可能证明是昂贵的。Arrakis的数据湖建立在Amazon S3之上,利用Apache Spark作为计算层。Olsen预计它将更便宜、更快、更灵活。

开发人员Vegard Stikbakke指出了构建Arrakis的复杂性。他特别指出,例如,支持Solana,需要Dune处理比通过Ethereum处理的数据多三个数量级。

Dune似乎可以应对这一挑战。无论Arrakis何时到来--可能是在未来几个月的某个时候--它都将代表着平台的一步步改进。正如赫伯特所写的,"在Arrakis上你从不谈论可能性。你只说可能性。"

巫师经济

在我们的谈话中,Mats Olsen回忆起他第一次在Dune上完成巫师的赏金时的感受。"这超过了我三个月的工资,"他说。"那是一种既好又坏的感觉,同时也是一种好的感觉--但主要是好的。"

在更有利的财务状况下,Olsen可以带着无可挑剔的自豪感回顾这一事件。这是第一个迹象,表明Dune不仅仅是一种资源,而是通往一种新的经济权力的门户。由于Haga和Olsen的创造,数据科学家可以展示他们的技能,接受客户,并找到新的工作。

然而,当涉及到巫师经济时,还有很多事情要做。一个简单的补充是在Dune上创建一个实际的市场。目前,要雇用巫师,协议必须发布赏金,并通过Twitter分享。所有的协调和支付都发生在平台之外。为了简化这个过程--也许还能确保支付量的份额--Dune可以直接协调这个过程。这样做,该公司可能会使客户更容易提高他们的仪表板页面的水平,为生态系统的其他部分改善产品。

另一种提高巫师收入潜力的方法是给他们提供工具,使他们的创作货币化。虽然这可能会影响消费者的体验,但Dune可以提供付费功能,这样巫师们就可以使他们的一些作品成为独家。如果公司为这批人推出新的工具,这样做可能效果最好。正如产品经理Bernat Fages所说:"我们可以做很多事情来帮助巫师们表达自己和讲述故事"。

无尽的数据,无尽的功能

你看得越久,脑海中涌现的想法就越多。核心平台是如此强大,以至于它似乎能够向任何数量的方向扩展。在与团队成员、投资者和巫师的讨论中,出现了共同的改进领域。如下所示:

协作。Dune现在是一个单人游戏体验。它不一定是这样。在未来,合作者可以一起工作,创建一个具有细微权限的仪表板。像Github一样,Dune可以实现向其他仪表盘提交拉动请求的能力,让忙碌的巫师们接受变化并保持他们的工作功能。多人游戏的体验将代表一个重大的升级。

改进策划。虽然Dune的星级系统是有效的,但它并不是最优雅的解决方案。更加深思熟虑的策划可以改善消费者的体验,让不受欢迎的巫师有更好的机会得到赞赏。

替代协议。Arrakis的建立是为了适应像索拉纳这样的新链。但它是否有足够的扩展性来支持根本不同的项目,如Filecoin、Arweave和Ceramic?这些存储和数据层可能会带来另一种技术挑战,但会为Dune增加有意义的功能。

链外数据源。为什么止步于加密货币数据?一些人认为,Dune最终可以纳入链外数据,无论是来自社交媒体的情感信息还是传统的金融输入。想到通过将链上信息与外部数据源结合起来可能创造出的东西,这很有趣,尽管它确实感觉偏离了核心业务。

不过,比起任何单一的功能增加,Dune的未来最让人兴奋的也许是它可能成为一个整体。当别人把Dune比作Github时,Nick Grossman认为有一个更恰当的比较。谷歌。"Dune非常、非常相似,"格罗斯曼认为。在他看来,谢尔盖-布林和拉里-佩奇的企业为网络的开放、可访问数据编制索引所做的事情,Dune可以为区块链的世界做。

这是一个巨大的野心。Dune的创始人Fredrik Haga和Mats Olsen,最喜欢的就是努力实现这个目标。

"我一直喜欢沙漠,"作家安托万-德-圣-埃克苏佩里曾经写道。"一个人坐在沙漠的沙丘上,什么也看不到,什么也听不到。然而,在一片寂静中,有什么东西在跳动和闪耀。

在加密货币的巨大野性中,它是穿过基岩的数据。就像一个外星的非法麻醉剂,它吸引了人们的注意,同时也掩盖了它的丰硕成果。尽管他们在旅程开始时可能没有意识到这一点,但Haga和Olsen的结构是独特的,能够提取数据并将其带给那些能够赋予它形状的人。

在未来的岁月里,我们可能会发现自己越来越处于圣埃克苏佩里的位置:目光投向Dune,投向地平线,看着它闪闪发光。