What is the role of Bitcoin reserve in UST's new anchor mechanism?

Written by: danku_r

Compile: angelilu

governancegovernanceProposals began to dig deeper.

1/ First of all, it is important to emphasize that neither BTC reserves nor LUNA are direct collaterals of UST. Unlike other stablecoins that are backed by fiat currencies or over-collateralized by crypto assets, the value stability of UST is guaranteed by an algorithm.

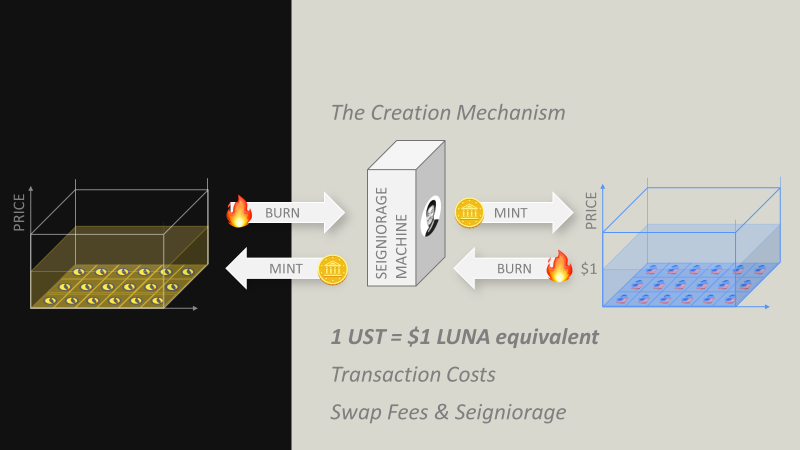

2/UST maintains its price through arbitrage system and agreement mechanism. LUNA acts as a reserve asset in the process. Market participants can mint UST by burning equivalent LUNA. And vice versa, 1 UST can be destroyed and exchanged for equivalent LUNA.

3/ Therefore, if the demand for UST exceeds the current supply, assuming the price is $1.01, arbitrageurs have the opportunity to destroy LUNA on the chain, mint UST, and use the difference as profit on the open market.

4/ Of course, if UST trades below $1, the process goes in the other direction. Arbitrageurs are incentivized to burn UST to drive up prices. They buy 1 UST for less than $1 and get $1 of LUNA. To profit, arbitrageurs sell LUNA on the open market.

5/ In other words, LUNA is like goldSame, you can mint it into other stake-related coins as a medium of exchange. The coin is still gold, so you can melt it back into gold. UST is still LUNA in essence, and the two have an intrinsic value connection.

6/ Of course, this leads to a positive feedback loop for LUNA. The higher the demand for stablecoins, the more LUNA will be destroyed on the supply side. Based on the regular demand for LUNA based on the value of the Terra blockchain, the price is likely to increase.

7/ This uptick is an incentive for coin holders as they are also risking fluctuations in demand for stablecoins. If stablecoin demand is low, the minting volume of LUNA will increase, and the price of LUNA will be subject to selling pressure and decline.

8/ Here comes the problem, by design, the price of LUNA is not critical for the Terra protocol to ensure UST price stability; arbitrage is still possible. However, there is an intrinsic link between LUNA's performance and UST's price stability.

death spiraldeath spiral. If the demand for UST contracts, the price of LUNA may drop. If the market loses trust in LUNA due to price, it may lose trust in UST and sell. To keep the peg, LUNA was minted in larger quantities, and the consequences were obvious.

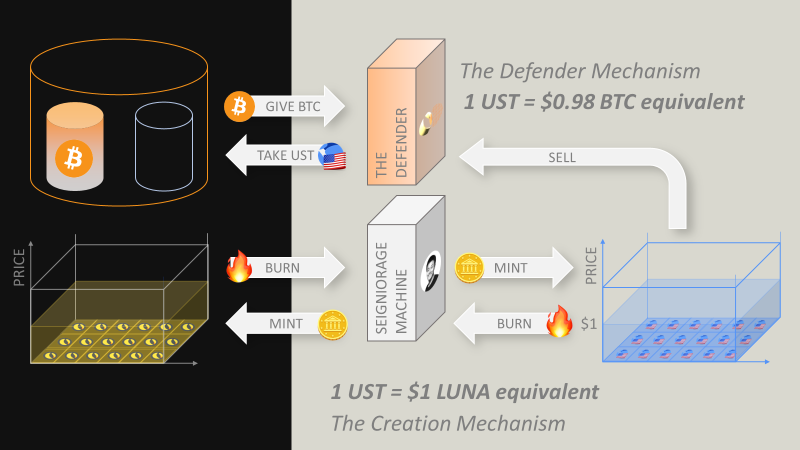

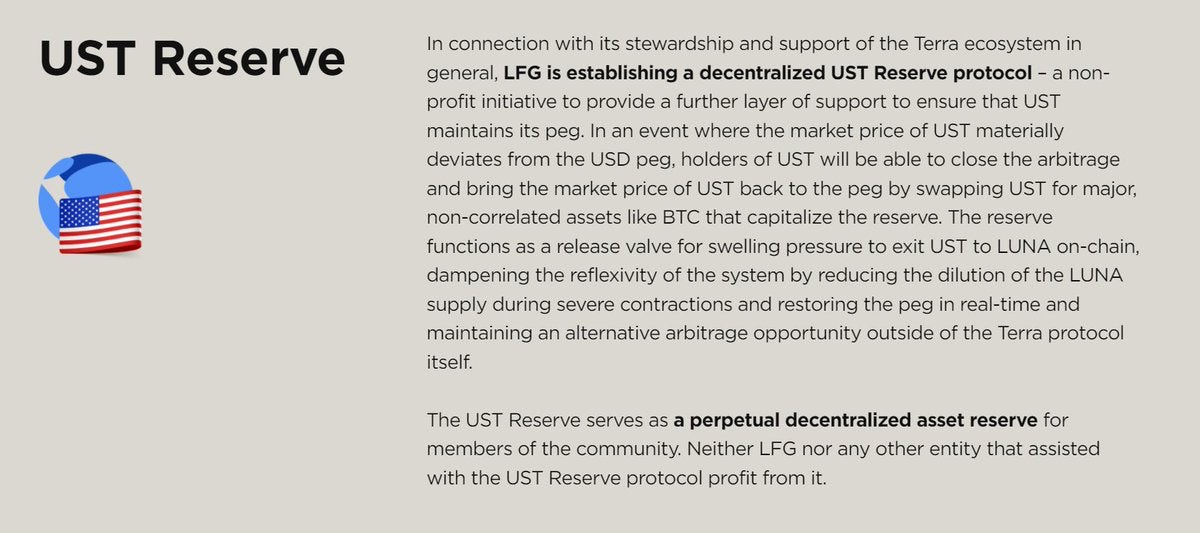

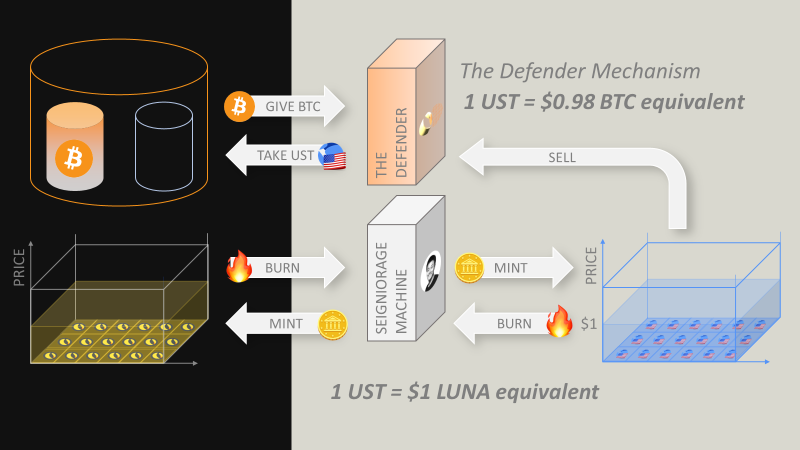

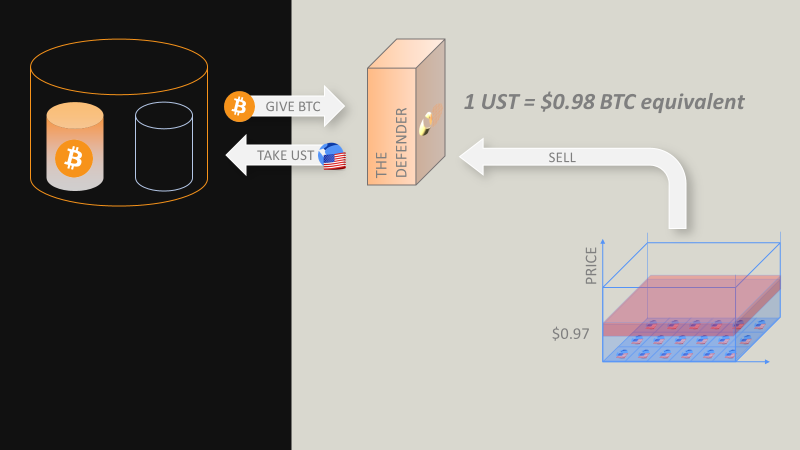

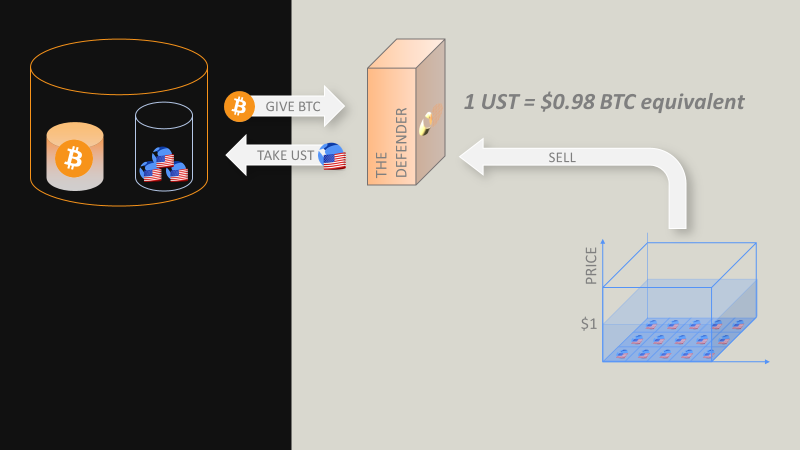

10/ This is where the value of BTC joining the game lies. LFG wrote in a statement:

"Bitcoin can act as a release valve for inflationary pressure. When exchanging UST to LUNA on the chain, it can control the occurrence of death spiral by reducing the new supply of LUNA, so as to improve the anti-risk ability of the entire system... "

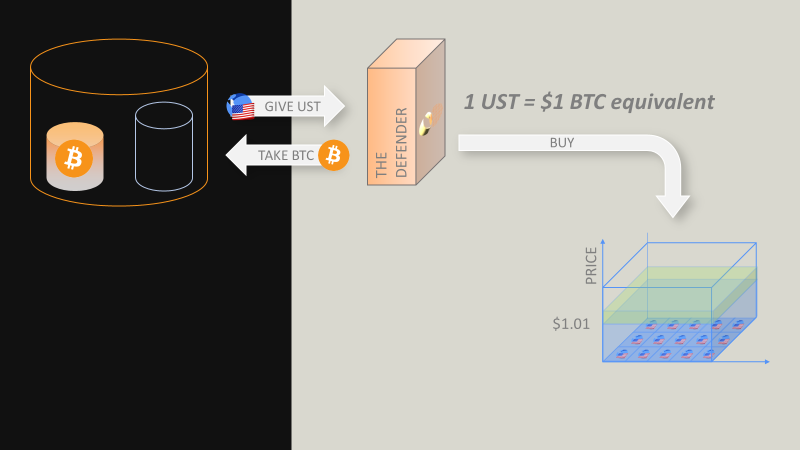

11/ BTC reserves will not be used directly to support UST, but act as a market participant to relieve the pressure on LUNA as an asset when the market demand for UST declines. A death spiral due to market uncertainty is avoided. But how to avoid it?

12/ Jump proposed how this could be done on-chain in the Agora Research Forum. In short: market participants have a higher incentive to interact with the Bitcoin Reserve and not have to rely on burning UST to avoid unpegging. BTC reserves will become decentralized UST buyers.

13/ As proposed by Jump, a new on-chain mechanism has been added to the Terra blockchain to ensure that 1 UST token is always exchanged for $0.98 in BTC. Now, if UST trades off-chain for less than $0.98, market participants can buy bitcoin at a discount from the reserve.

14/ I call this new virtual AMM mechanism "THE DEFENDER", until UST trades above $0.98, there is no better way to buy bitcoin in the crypto market, the reserve will add UST and distribute BTC. This provides a hard support for UST's price anchor.

15/ Once UST is depegged, participants will be incentivized to sell BTC at a premium in exchange for UST. This is critical because the reserve pool has no impact on LUNA burns in the long run. This mechanism is only a release valve for inflation pressure when UST is exchanged for LUNA.

16/ Most likely, no UST will be minted until THE DEFENDER has exhausted their holdings of UST. But remember, the only way to create more stablecoins is still LUNA. You can only create more UST by destroying LUNA, you cannot mint UST through BTC.

17/ So what does all this mean? Let's look at some major issues:

Will UST be collateralized by Bitcoin? No, it's just a new mechanism to defend price stability.

Will this reduce the burning of LUNA to mint UST? No, LUNA will be the only way to create more stablecoins.

18/A warning on LUNA destruction: In the future, part of LUNA destruction may be used as seigniorage to increase the reserves of THE DEFENDER. This is already part of the Terra protocol for funding community pools.

click here

click hereCheck out danku_r's YouTube video on the topic.