Interpretation of the ecological development of chain games from the perspective of "government": Taking stepn, ilv, Axie and Xingsha as examples

Author: Jack Ding|W3.Hitchhiker

Revised: Marina, Evelyn | W3. Hitchhiker

The core point of this article is that the positioning of chain games in the future must not be that of traditional game companies that charge fees in the form of selling goods and services. Their positioning will be transformed into a "government" that implements appropriate fiscal and monetary policies to realize game development. The ecological balance inside and the expansion outside the ecology make the game strong and durable.

This article takes the most common dual-token model in the GameFi field as an example to explore the feasibility of two ideas:

Keep the gold tokens stable in a certain range

Let governance tokens achieve price growth as much as possible

To use a simple and understandable metaphor as an example, if we compare the game to a small country, the gold token represents a country’s currency in circulation, U still represents the US dollar, and the governance token represents the country’s sovereign fund. No country in the world, whether it is a fixed exchange rate system or a floating exchange rate system, will not allow the exchange rate of its currency to increase in value. One of the impacts of the appreciation of the local currency is the difficulty in exporting. Corresponding to chain games, external incremental funds cannot enter due to high thresholds, and newcomers cannot enter, which leads to the collapse of the economic system within the ecosystem.

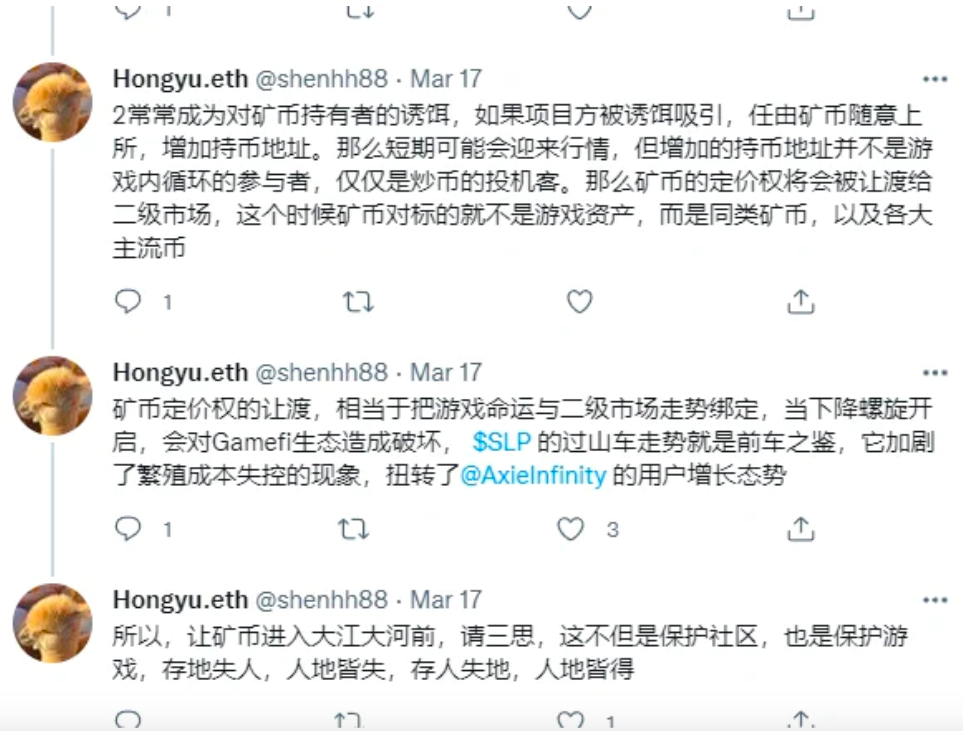

This is what the author intercepted on Twitter, and I deeply agree with it:

If you agree with the author's above point of view, then you can continue reading.

first level title

The first idea: keep the gold tokens stable in a certain range

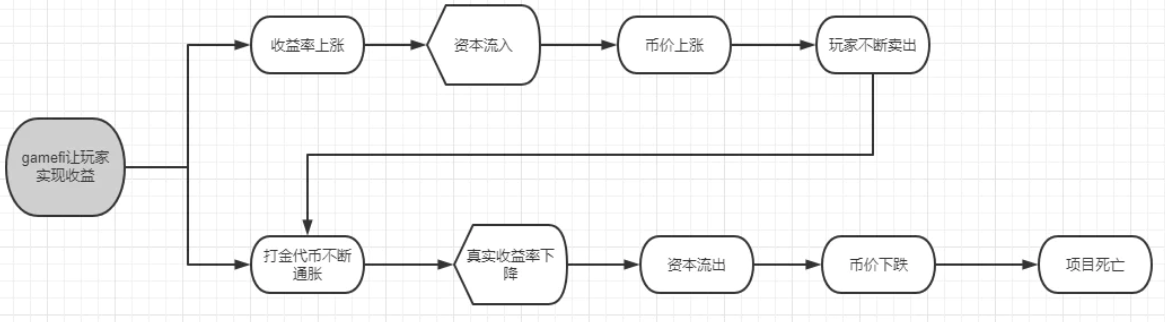

The above picture is the life cycle diagram of the early GameFi drawn by the author. At the same time, there must be two forces in the market that lead to the rise and fall of the currency price. Most of the early GameFi projects are attracted by the high yield and low return cycle in the early stage. Funds continue to pour in and promote the first wave of rise in currency prices, and then when early players continue to sell at a profit and cause token inflation, and the new funds are not enough to bear the inflation (the power of the lower side continues to be greater than the power of the upper side), the project will be launched will gradually die.

Then we might as well think about it, in fact, the tokens of a country are also constantly inflating, so how does the government solve this problem? The author believes that the way a country reduces inflation has the following behaviors:

**Increase consumption C: **Consumption is divided into survival consumption (daily food and drink expenses) and spiritual consumption (luxury purchases);

**Increase investment I: **Investment is divided into investment in means of production and real estate investment;

**Increase government spending: **The government issues national bonds, carries out infrastructure construction, and gathers money to do big things;

**Increase the effectiveness of monetary policy, common monetary policy operations: **Adjust currency issuance, open market operations, adjust deposit reserve ratio

The above behaviors actually have certain guiding significance for chain games:

1. Subsistence consumption

In fact, the blockchain is already very high for users' survival consumption education. We need to pay gas fees for our actions on the chain, and most of the games are currently operated on centralized servers. Spending has actually been cut. However, illuvium introduces the concept of travel fees. When users enter the P2E area to capture illuvial (elves), they need to consume travel fees, and elves are the cornerstone of players playing games, so this part of the expenditure is attributed to survival consumption;

2. Spiritual consumption

This part is not difficult for most gamers to understand. The simplest example is the skin in League of Legends. The skin itself has no bonus to the battle, but it can still attract a large number of players to buy.

The above two points actually require the game to have a certain degree of playability. A game without playability will not attract players, and players will not spend money in it. Players can obtain happiness and satisfaction (consumer utility) through the game, which is actually a manifestation of income, and this part of income does not need to be realized by token inflation, but will lead to token deflation due to increased consumption .

3. Investment in means of production

Taking Axie as an example, breeding new sprites for recasting is the simplest example. The key to this part lies in the length and complexity of the investment path. Axie’s reproduction path is actually very simple, and the profit point is relatively easy to calculate. During the investment process, too many inflation tokens cannot be stored. It only reduces the current inflation, but the potential The increase of future inflation, the author thinks this is not a good way.

Compared with Axie's inflation model, Star Shark has made certain improvements, which are reflected in the following points:

Turn reproduction into synthesis

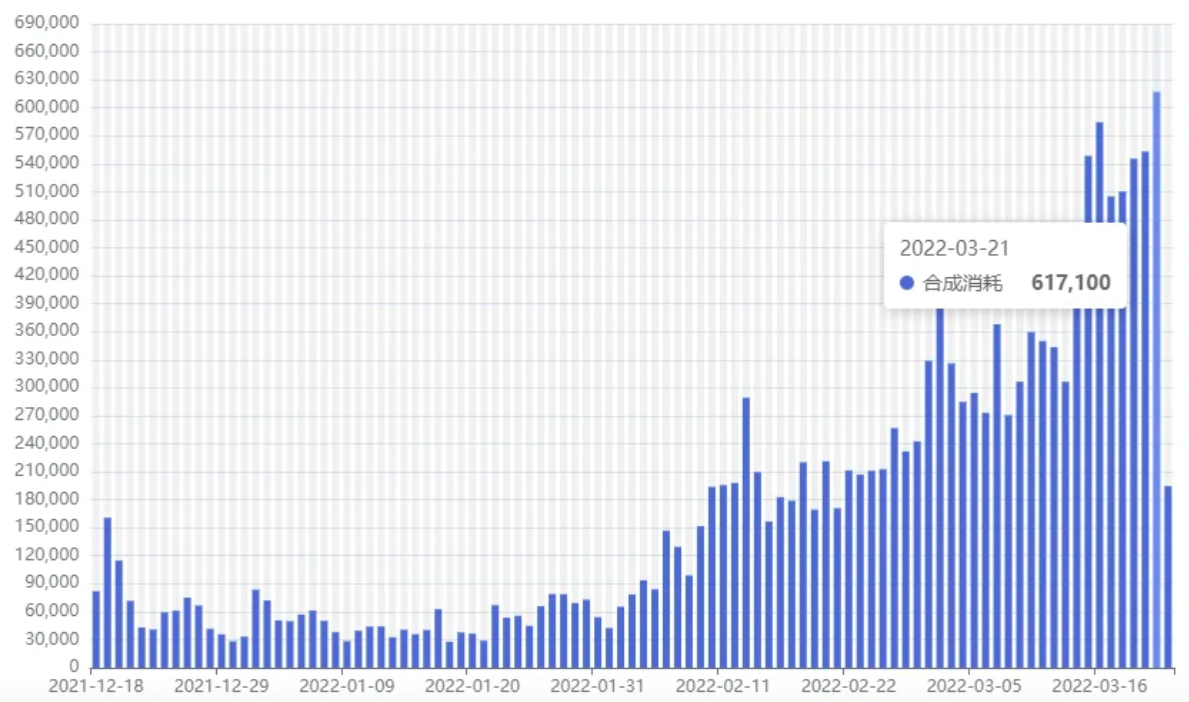

image description

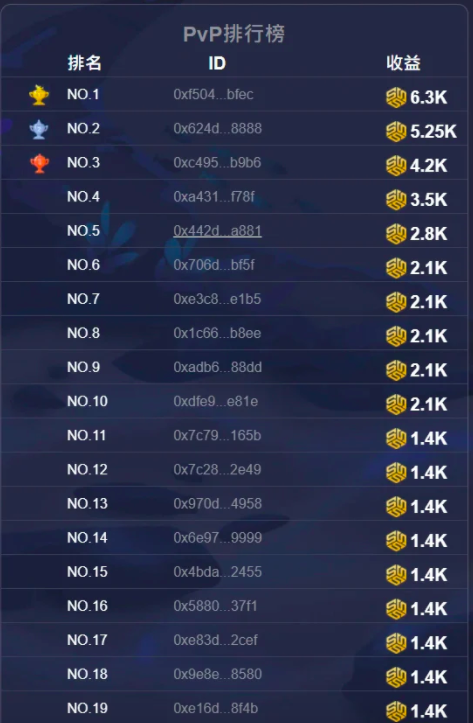

Star Shark PVP Reward Chart

The lineup configurations of the optimal solution for gold mining and the optimal solution for PVP are conflicted.

The optimal configuration for Star Shark Gold is 3 1 1 1 1 1 1, a combination of one 3-star shark and six 1-star sharks. But on March 25, Star Shark will introduce the Grand Prix mode. The entry threshold is at least 3 4-star sharks, and the market price of 3 sharks is about 18,000 to 20,000 dollars. This is very different from the optimal gold mining configuration, which complicates and diversifies the user's investment, thereby stimulating consumption.

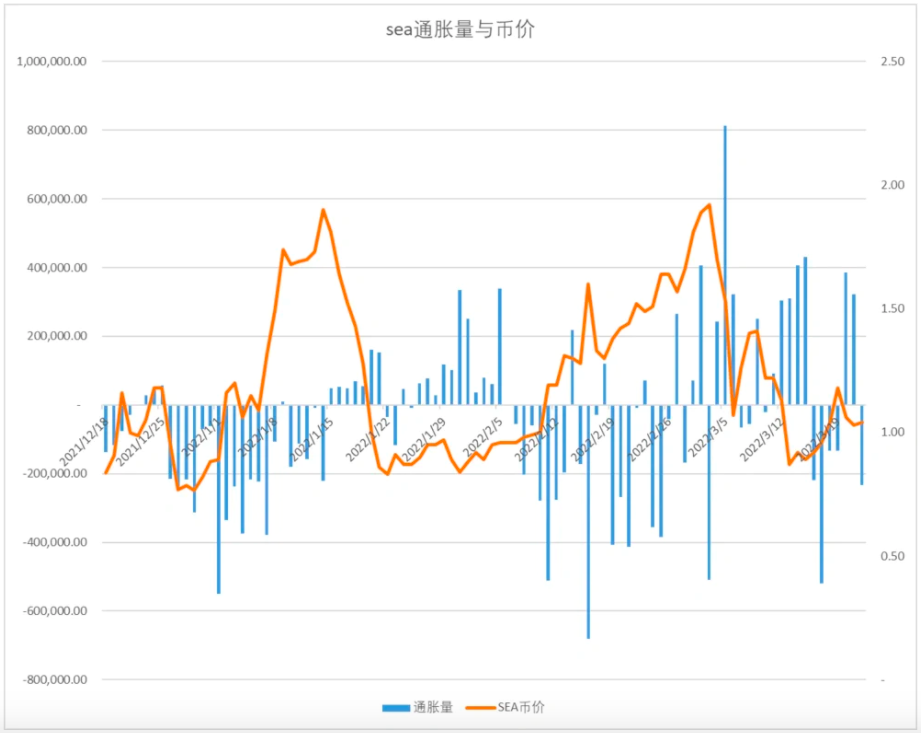

From the picture above, we can see that after the news of the Grand Prix was announced, the daily synthetic consumption of SEA increased significantly.

4. Introduce land instead of real estate to undertake bubbles

Many games are released before they are developed, and the prices are exaggerated. In fact, the author does not approve of this behavior. First, the excessive hype has created an excessively high threshold for new gamers; second, if the land is released when the game tokens are inflated, it will be a trump card to undertake the bubble. Star Shark launched the land game in June. I don’t know if it’s this way of thinking. The pure P2E mode will eventually decline. (Refer to the author's previous article:Starting from the history of GameFi, in-depth discussion on the mode and gameplay of chain games)

5. Increase government spending

The chain game project party uses its own income for part of the token repurchase. This method itself is not new. The key point is how to increase the non-ecological income of the project party. At present, the only thing I can think of is to hold game events to obtain Sponsorship and in-game advertising revenue.

6. Increase the effectiveness of monetary policy

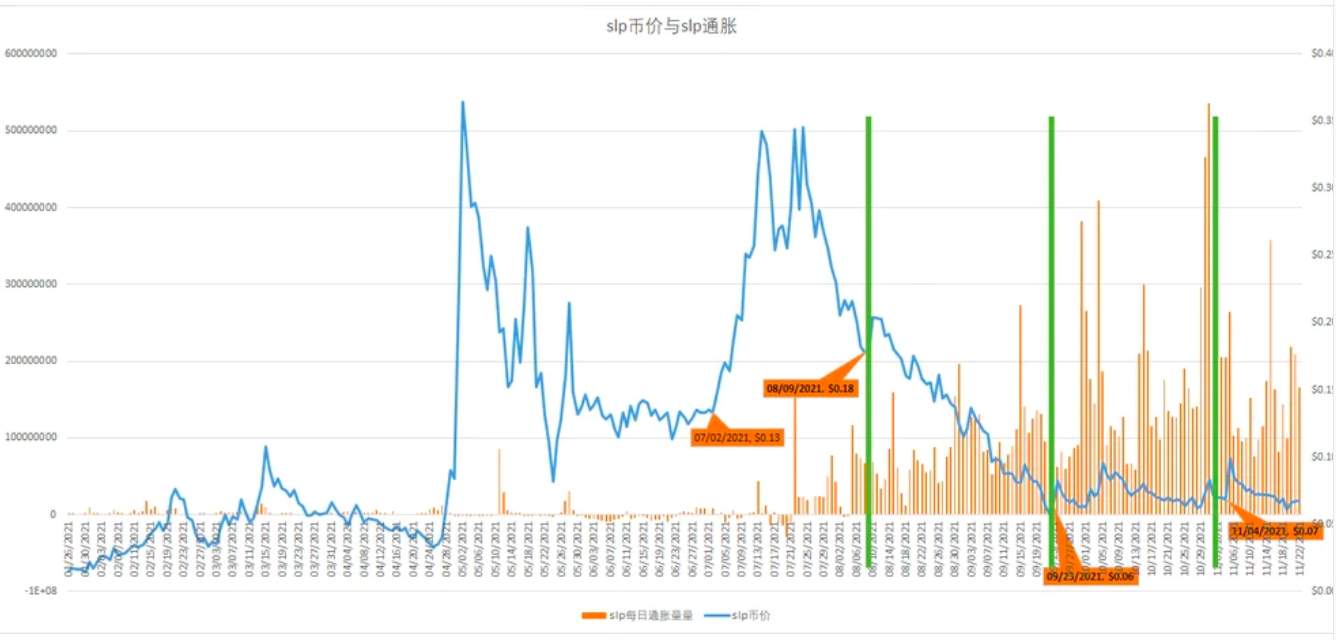

The author has observed that, except for stepn, the monetary policies of most games are ineffective at present. Axie’s repeated adjustments to game output and breeding consumption have not changed the outcome of the decline in SLP currency prices due to high inflation.

In this regard, the author believes that the reasons are as follows:

In real life, only the central bank has money printing machines, so the central bank's control over this aspect is absolutely powerful. But the game is different. In the game, each player is a money printing machine, the gold player is a high-load money printing machine, and the script is a high-tech money printing machine. The game project party can only control the daily output of each money printing machine. There is an upper limit, but it cannot control the number of new printing machines, the speed of production, and the cost of each token produced by the printing machine.

There are three ways to strengthen the monetary policy of the project party (that is, the control of gold tokens):

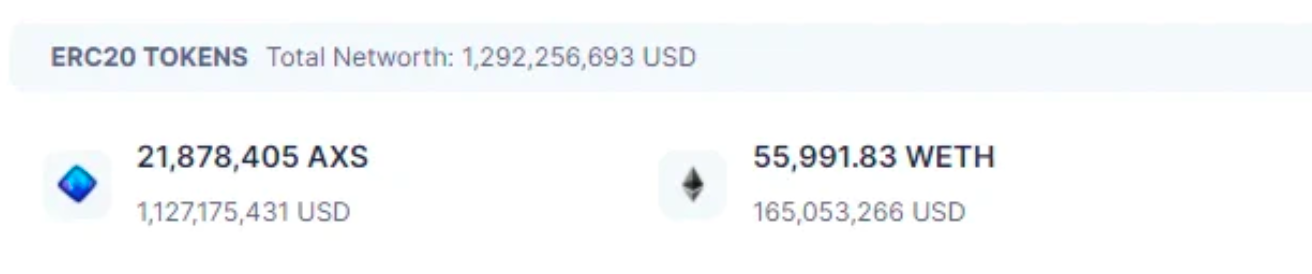

**Foreign exchange reserve capacity:** Throughout the running of the game, the project party agreement will include a large amount of income, that is, the income from selling NFT and the handling fee income from NFT transactions. A large part of this income is collected in the form of ETH or U.

Taking Axie as an example, in this process, 165 million income was obtained through transaction fees, while the market value of the entire SLP is only 673 million. If the project party can use this income to properly repurchase and control the SLP, will its life cycle be Maybe longer? This kind of behavior is actually not new in DeFi. For example, Sushi will take 1/6 of the 0.3% handling fee generated by each transaction for token repurchase.

**Production speed of means of production:** From the perspective of the game, this part of the control is relatively difficult, because the player's behavior of breeding is spontaneous, but stepn and star shark can give us some inspiration.

Stepn has been very popular recently. The governance token GMT has achieved an 8-fold increase in the secondary market, but the price of its NFT assets has remained stable at around 10 SOL since it was listed on Binance, and the daily new shoes are between 1100-1400 Fluctuation, such stability is inseparable from the strong control ability of the project party. In addition, there will be a chance of twins when breeding shoes, that is, two NFTs will be produced once breeding. The author boldly guesses that the probability of this twins is constantly regulated by the project party to control the profits of the breeders, so that the number of new shoes added every day is relatively stable, and the selling pressure of the gold token GST is relatively controllable . Star Shark, on the other hand, adopts the method that NFT can only be sold by the official, and users cannot reproduce by themselves. However, the purchase of the entire NFT has not been subject to any restrictions. More than 90% of the income of players buying NFT will be destroyed. Through this A way to achieve a good deflationary situation for tokens.

**Try to keep the production cost of each coin consistent: **Previous P2E games such as Axie, Star Shark, and dxct can be completed in batches through scripts to complete daily gold mining, and the cost paid by the studio for this is only a few degrees Electricity and script fees, and ordinary players may need to pay 1-2 hours of game time to complete the daily gold mining. Compared with the output of ordinary players, the batch gold production of the studio is undoubtedly the party that has a greater impact on the market. Due to the low production cost of tokens, they sold a large number of tokens in their hands, which in turn caused the currency price A cliff-like fall.

For this stepn adopts the GPS positioning function, and the exercise process/user status/exercise results can be mutually verified. Aiko (stepn economic model designer) said: "If you can't even do 'proof-of-move', how can you ensure the fairness of 'move-to-earn'?"

Of course, we believe that the follow-up game will be more complicated, and there may be more arbitrage links in the middle, not just limited to the breeding link, but the author believes that at least the arbitrage efficiency of different links should be proportional to the risk, because the risk itself is a cost.

first level title

The second idea: Let governance tokens achieve price growth as much as possible

Before discussing this issue, we might as well think about it, where does the value of a game’s governance token come from?

The author believes that the value of game governance tokens comes from two parts: use value and consensus value.

use valueIt is easy to understand that governance tokens are required to participate in most aspects of the game, such as the reproduction of Axie and the synthesis of star sharks. These tokens are actually used and consumed by players into the national treasury during the development of the game. Taking Axie as an example, as of March 23, the cumulative breeding income was 21.88 million AXS, and the current circulation of AXS is 77.24 million, accounting for 28% of the usage, which means that only about 1/4 of the tokens exist For real usage requirements, the author believes that the remaining 3/4 value comes from the consensus value.

consensus value, It can also be called the expected value, or the hype value. The author thinks this part of the value is invisible. It is the expectation of the entire market for the project. It may come from the value of the 2.67 million holding addresses, the value of the Ronin chain, and the recognition of its future scalability value. The existence of 2.67 million holding addresses has traffic value in itself, so axie has become the leader of P2E. the author thinksConsensus value is equal to traffic value, the more traffic and users a protocol engulfs, it will be of great help to its subsequent development, because the world of web2 has told us that traffic is everything. How to coerce more traffic to allow more players to participate needs to be considered, but in any case, it is inseparable from a stable economic endogenous system, which is what we discussed in the first point. Only by living longer can we coerce more traffic!

For many early game projects, the price increase of governance tokens in the early stage was not as fast as the market value of NFT. Let's take Xingshark as an example. The current circulation of SSS tokens is about 3.23 million, and the game has been running for 3 months, and the accumulated synthetic consumption of tokens is only 86,000, and the usage rate is only about 2.6%. When the game is in the early stages, the consensus value has not been formed, so the low usage rate will not bring about the price increase. In fact, this situation also occurred in the early days of Axie. Before July 21, the price fluctuation of its governance token AXS was relatively small, and it had been in the state of accumulating users. AXS changed from 1 to 2, plus a certain number of users have been accumulated in the past, the price of AXS skyrocketed later and became a legend of chain games. I don't know if the same plot will appear in other games, but it is worth imagining.

Just like the government's efforts to regulate the economic market, chain game project parties also need to implement appropriate "policies" to stimulate the balanced development of the game ecology. If the chain game project wants to live better and longer on the basis of providing playability, it needs to constantly think and explore more effective ways. In fact, the stability of gold tokens and the rise in the price of governance tokens are inseparable from each other. A stable price system of gold tokens is conducive to the entry of more users and brings stronger consensus value to governance tokens , and a stronger consensus value will further attract funds and players to invest in the game's ecology, making the price of gold tokens more stable.

Just like the mission of Chain Games is to explore the infinite possibilities of NFT as a creative infrastructure, subvert the existing content and value sharing model and co-create and share with the community, so that creativity and value can flourish in the community again, GameFi has just begun , their future has infinite possibilities.