HashKey Capital: Comprehensive Analysis of NFT Market Overview and Application Scenarios

NFT is an emerging niche encryption field, and it has become more and more attractive since 2020. More and more celebrities and high-net-worth collectors have entered the market to participate in investing in NFT products, and well-known institutions have participated in the deployment of NFT projects. The rapid development of NFT has benefited Due to the popularity of DeFi, it has become one of the future directions that the chain circle has high hopes for after DeFi.

The current market value of NFT is small, but the industry is becoming more and more active. The landing application scenarios are mainly in the fields of game props, encrypted artworks and social tokens. The uniqueness and scarcity of NFT make it very suitable for marking the ownership of assets in the blockchain, and truly realizing the connection between digital assets and real assets in the virtual world.

first level title

1. Market overview

In the field of blockchain, from the perspective of exchangeability, tokens can be divided into two types: homogeneous and non-homogeneous. Homogeneous tokens, namely FT (Fungible Token), with ERC20 as the basic standard, are interchangeable tokens that can be split almost infinitely.

But homogeneous tokens have limitations. Things of real value in real life are often irreplaceable and cannot be split infinitely. Unique assets cannot be anchored with homogeneous tokens.

Non-homogeneous token NFT (Non-Fungible Token) is the only and indivisible Token, such as tokenized game props, tickets, artwork, etc. NFT uses ERC721 as the standard, and then the ERC1155 protocol appeared, that is, each ID represents not a single asset, but a category of assets, allowing multiple tokens to be created in batches at a time.

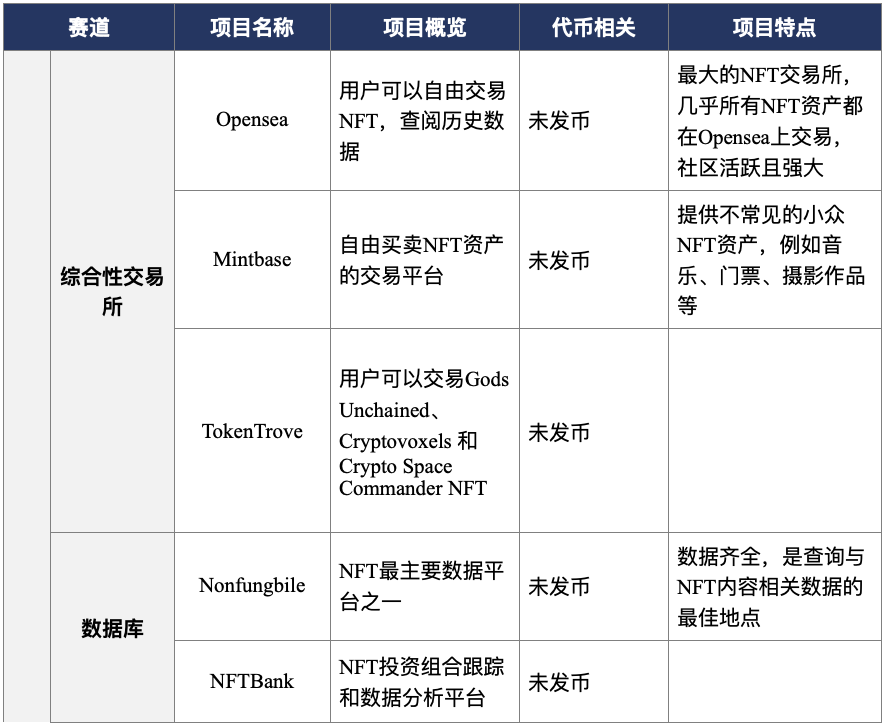

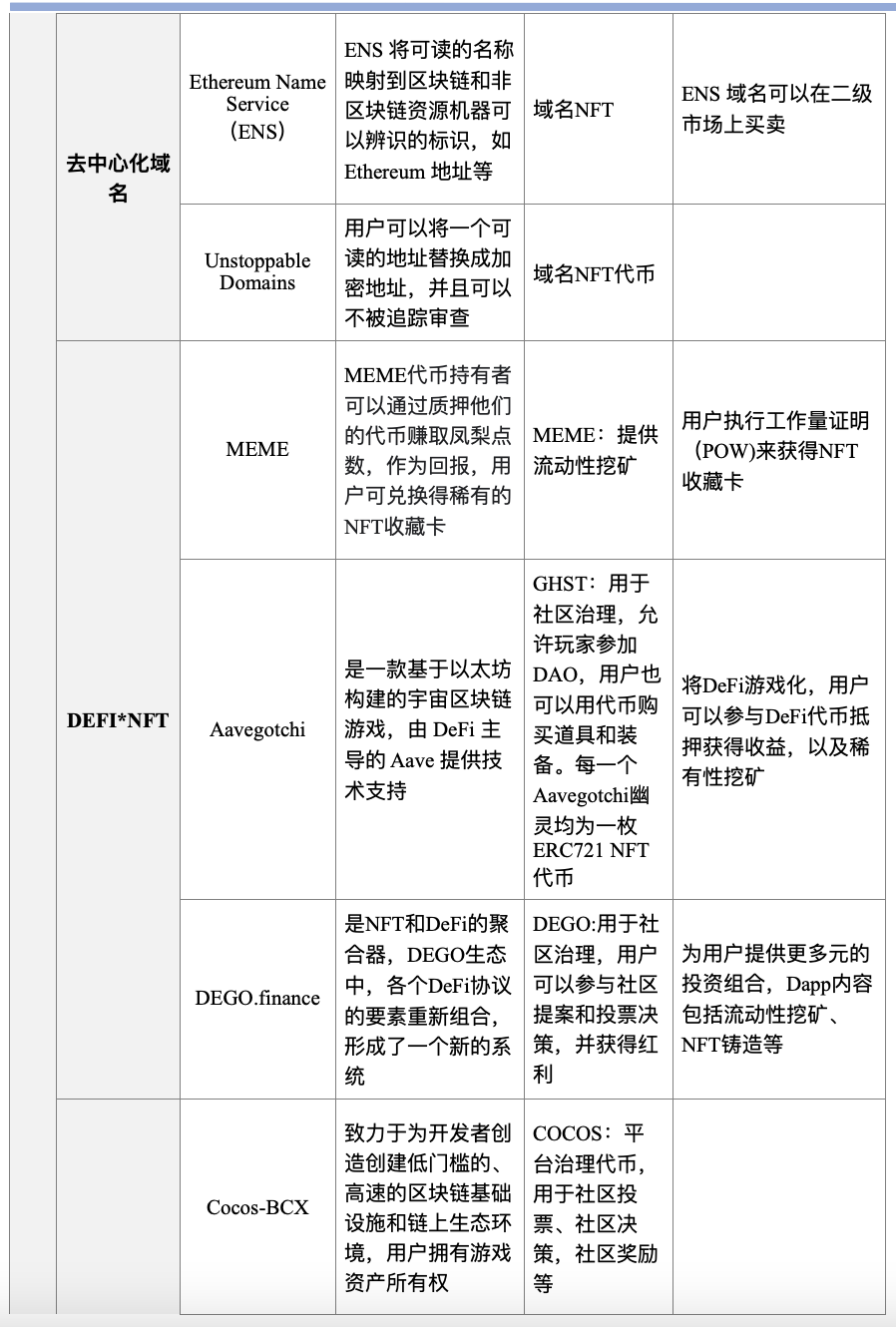

1.1 The NFT industry is becoming more and more active: Since CryptoKitties in 2017, the NFT market has existed for more than three years, and almost all NFT projects are active on the Ethereum and WAX chains.

As can be seen from the figure below, the current top ten NFT tokens include Enjin, Flow, Decentraland, RedFOX Labs, Gala, SAND, Ultra, NFTX, WAX, Bondly, and the transaction volume of Enjin tokens within 24 hours can reach about 100 million US dollars.

According to DappRadar's NFT industry report for the third quarter of 2020, in terms of Ethereum, compared with the previous quarter, the number of NFT daily active wallets has increased by 350%, and the volume of NFT transactions has increased by 57%. CryptoPunks has the largest daily active wallet address and transaction volume. Regarding the WAX blockchain, compared with the previous quarter, the number of WAX NFT daily active wallets increased by 24,375%, and the transaction volume increased by 10,086%.

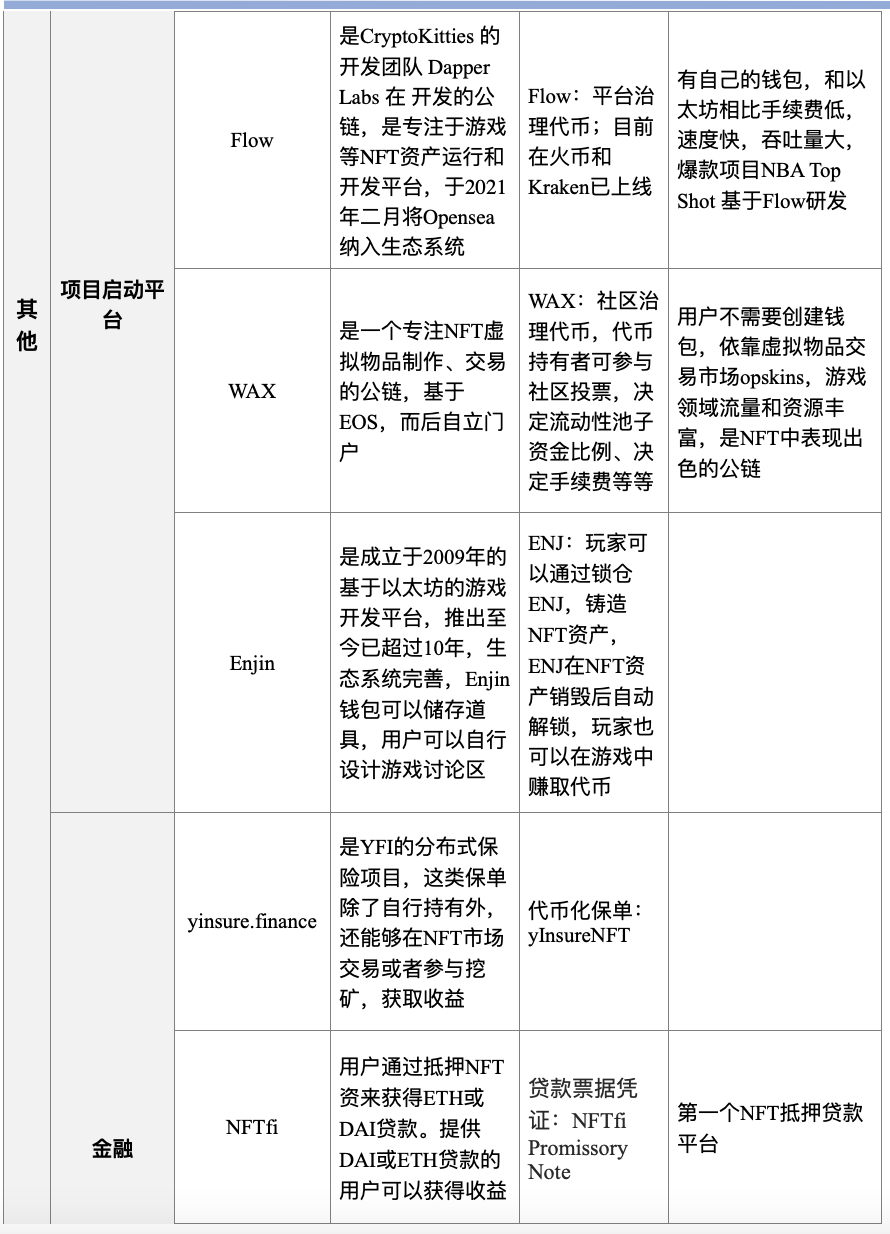

In addition, it is worth mentioning that Flow is another public chain focusing on NFT encrypted games and encrypted art in 2021. It was developed and created by Dapper Labs, the development team of CryptoKitties. , Flow achieves expansion without reducing blockchain fragmentation: nodes no longer participate in the verification process of the entire transaction, and there is a division of labor between nodes.

Only participate in one of the links of collection, consensus, execution, and verification, so the speed is greatly improved and the throughput is improved. The 2021 card project NBA Top Shot was developed based on Flow, and in February 2021, Flow announced that the NFT trading platform Opensea will be included in the ecosystem.

1.2 The total market value is growing rapidly, but the scale is small: as of February 25, 2021, the market value of NFT has reached about 3 billion US dollars, of which the market value of Enjin currency accounts for 16.7% of the market value of NFT market. The total historical turnover reached 3.23 billion US dollars, with a total of 5.31 million NFT works sold, with an average transaction price of 60 US dollars.

The basis for the growth of total transaction volume is the rise of individual NFT assets. The average price of NFT reached a peak of 4334.21 USD on February 22, 2021. However, this figure was about 100 USD half a year ago, an increase of forty times. On February 21, the price of NFT assets The historical turnover has also reached a new peak of 20 million US dollars, about 45 times that of half a year ago.

In terms of total transaction volume, the total transaction volume in 2020 is 1.8 times that of 2019. From 2020 to February 25, 2021, the total transaction volume reached 170 million. The transaction volume in the first two months of 2021 is 2020. 2.7 times. It can be seen from these data that the industry's interest in the NFT market continues to heat up. At present, NFT only accounts for 0.2% of the market value of the entire encryption market, and the market value is very small. The NFT market is still in its infancy and is a niche field.

Souce:nonfungible.com

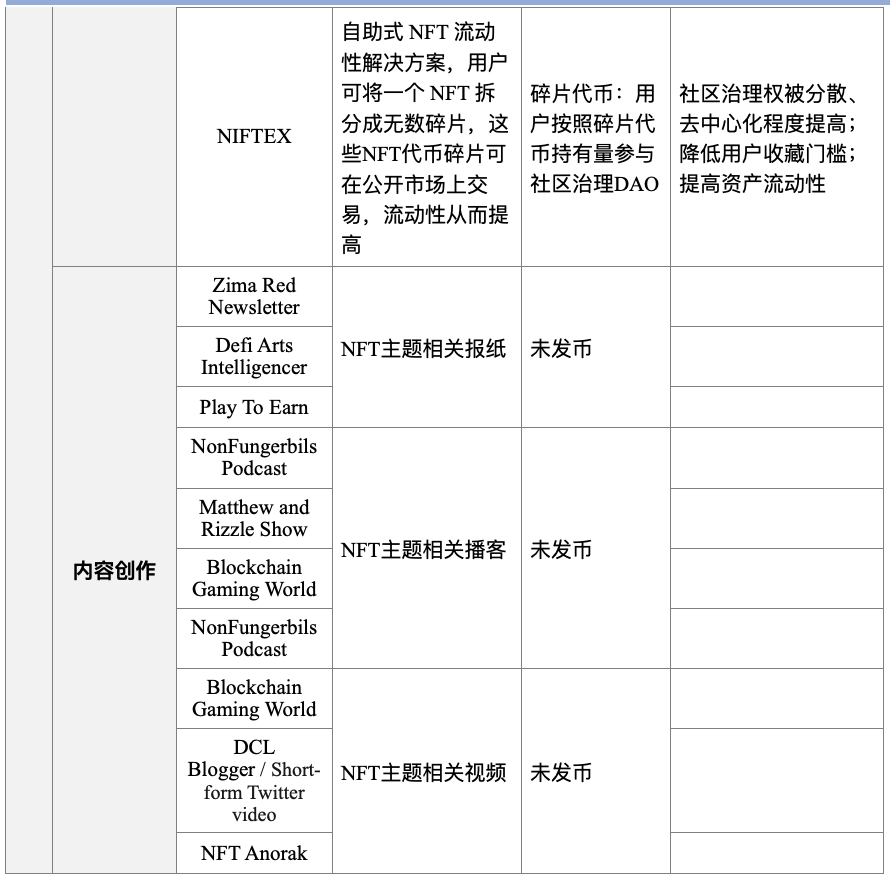

1.3 Well-known institutions participate in deployment, celebrities participate in investment, and popular projects perform well: Some projects in the NFT field, such as MEME, NBA Top Shot, Hashmask, etc., have brought great economic benefits and performed well, making many participants believe that NFT will become a new outbreak plate.

first level title

secondary title

2. 1 Encryption game - the earliest landing attempt, one of the main applications of NFT

We believe that NFT gives players real ownership of game assets, disintermediates game player asset transactions, and seamlessly transfers and uses them in multiple games. Game data is safely stored on the chain, and the game code is open source, allowing players to create game rules with creativity. In the future, the degree of decentralization of encrypted games will be more thorough, and there will be more high-quality public chains dedicated to game development.

2.1.1 Development History

Since 2013, some online games have been born that incorporate Bitcoin, which is the inspiration behind blockchain games today. At the end of 2017, CryptoKitties (CryptoKitties) was born, which is generally considered to be the beginning of the blockchain game industry. CryptoKitties once created a record of 14,000 + daily active addresses in a single day (2017-12-09), which once caused Ethereum Square trading jam.

As of April 30, the total transaction volume was 43067.04 ETH, about 200 million RMB. Launched in April 2018, Ether Go, the first blockchain idle game, once had nearly 5,000 daily active users, and completed more than 40,000 transactions in just over a day. In the following two years, the number of blockchain games has achieved tremendous growth, especially represented by platforms such as EOS and Ethereum, and a number of phenomenal games have sprung up, but all of them have maintained their popularity for a while.

2.1.2 Main items

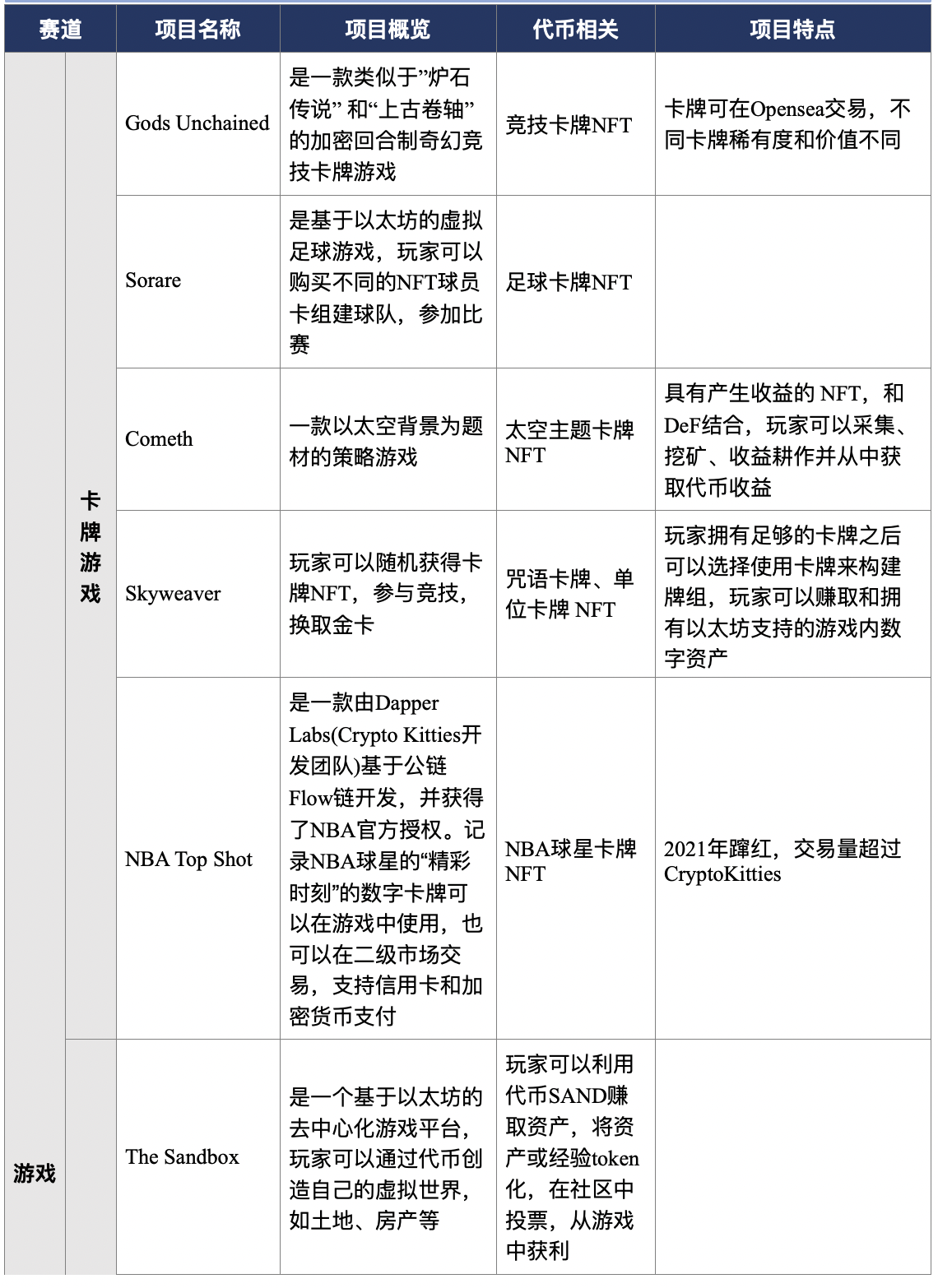

The table below shows some of the major projects in the blockchain gaming space:

2.1.3 Featured Items - NBA Top Shot

2.1.3.1 Market Overview

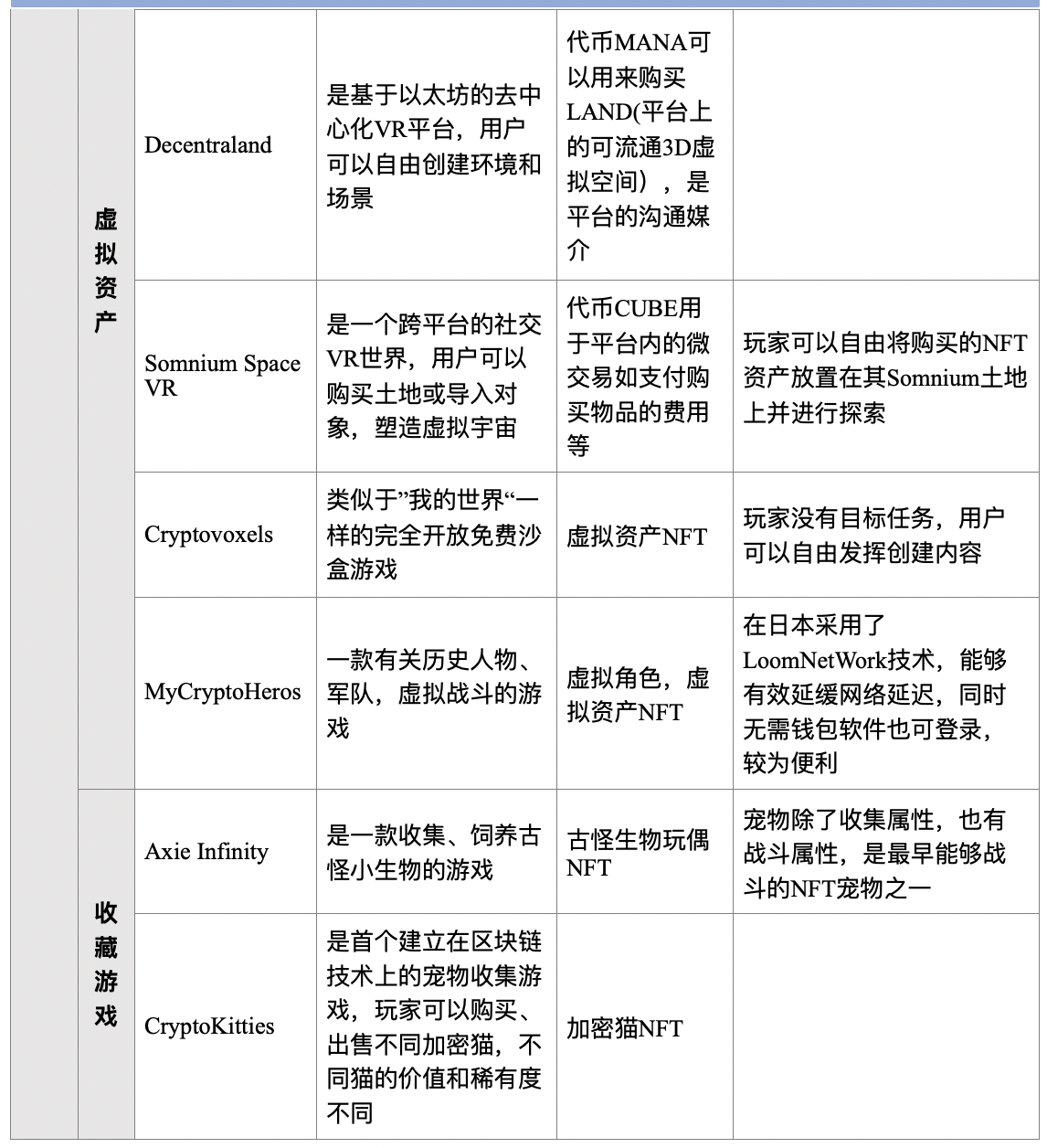

2.1.3.1a The total transaction volume ranks first. Less than half a year after the open beta of the NBA Top Shot collection card game, it will quickly become popular in 2021. Calculated by the total historical turnover, the turnover of NBA Top Shot has now reached more than 200 million US dollars, ranking first among encrypted collectibles.

image description

Source: Cryptoslam

2.1.3.1b is developed based on the Flow blockchain. Unlike most NFT projects based on Ethereum and WAX, NBA Top Shot is developed based on the Flow blockchain. Flow is a public chain developed by Dapper Labs, the development team of CryptoKitties. It adopts the cryptographic technology of Professional Proof of Secret Knowledge (SPoCK), Decentralized high performance with Layer 2.

Flow uses the PoSy consensus algorithm to protect developers' code upgrades. It is highly friendly to developers, has strong security, and high throughput. It can better meet the needs of centralized games. The ecology is also constantly improving. The famous NFT exchange Opensea Join the Flow ecosystem on February 24, 2021.

2.1.3.2 History of traditional star cards

2.1.3.2a originated in the United States, mainly based on baseball cards. The earliest baseball cards were issued in the 1880s, which was also the era when baseball professionalization appeared. A card had a photo of a player printed on it. This kind of star card was called Trade Card. Early player cards were mainly used as gifts for buying cigarettes, and candy and toy manufacturers followed suit, gradually becoming a collectible in the United States.

Goodwin & Co.,maker of Old Judge and Gypsy Queen The tobacco maker was the first company to manufacture star cards, and Topps was the first company to officially produce player cards, monopolizing the market for a while after 1951. After the introduction of the Antitrust Act, Topps only retained the right to issue NBA basketball superstar cards, and the American player card market entered the Warring States Period.

2.1.3.2b Carries cultural values. Traditional sports such as baseball and basketball are an important part of American culture, and player cards sometimes represent a legendary era or a great team and are highly collectible. In addition to baseball, the influence of basketball culture represented by the NBA in the world is self-evident, and there is no shortage of super sports superstars such as James and Kobe.

The current star card is no longer just a photo of one or two players printed on the card, there are more new ways to play, such as limited cards, rookie cards, jersey cards, autographed cards, etc. These cards are scarce. As time goes by, the collection value is getting higher and higher.

2.1.3.3 Advantages of NFT player cards over traditional player cards

2.1.3.3a The form of expression is more abundant: In addition to the star pictures and basic information on the traditional star card, the NFT star card also has the form of short video or GIF animation, recording the "wonderful moments" of NBA stars, NFT Star cards have more diverse forms of expression, are more attractive and interesting, and have higher investment and collection value.

2.1.3.3b Low difficulty in storage: Cards may have problems such as oxidation, discoloration, and damage during storage as time goes by. The ink on autographed cards may also fade. After the NFT star card is put on the chain as an asset, there will be no storage or transportation problems of the physical star card. NFT assets can be stored in the wallet, and the storage cost is almost zero. This also reduces the collection threshold of the star card and attracts more players. In addition, the stronger circulation of assets on the chain endows the NFT star card collection with more ideal investment attributes.

2.1.3.3c Reduce the risk of counterfeit cards: The traditional star card trading market is not regulated. After the official release of cards, the secondary market transactions between individuals are likely to sell counterfeit cards. Players may buy at a high price if they make a wrong judgment counterfeit products at a very low cost. With the help of smart contracts, the origin of the NFT star card and every address that holds or transfers it can be tracked. Each card is unique and cannot be copied, and the information cannot be tampered with. The chance of a fake card is very low .

2.1.4 Advantages of encrypted games

Compared with traditional games, encrypted games have the following advantages:

2.1.4.1 Players have ownership of game assets: In traditional games, the ownership of game assets belongs to the developer, and players only have the right to use them. Developers can transfer or change users’ game assets at will. In encrypted games, through smart contracts, Users can truly own the ownership of game assets.

2.1.4.2 Game data can be permanently and securely stored: In traditional games, game data is at risk of being stolen by hackers, while encrypted games are based on blockchain technology, hackers cannot invade and attack distributed ledgers, so game data can be permanently stored. Do not tamper with.

2.1.4.3 Game open source development: The code of traditional games is not open source, that is, game manufacturers formulate game rules. Encrypted games are different from traditional games with single point of trust. They are peer-to-peer ecosystems. Users can use their creativity to innovate freely, making the game more playable, which also reflects the concept of Web 3.0.

2.1.5 Development prospect

2.1.5.1 The degree of centralization is more thorough, and decentralized community governance (DAO) empowers NFT games: The underlying facilities in the game ecology are not perfect, and the incomplete degree of decentralization is one of the problems of NFT games. Even if players nominally own the ownership of game assets, the form of NFT presentation on the front end is determined by the centralized server of the game manufacturer.

DAO refers to a series of open and transparent rules that are recognized by community members, and the community can operate autonomously without governance. Any token rewards, voting, and transactions in the NFT game community are recognized by the entire community. The data is open and transparent, any member can query and cannot be tampered with, and once deployed, it will not be affected by the creator and external forces. DAO will play an important role in the "decentralization" struggle in NFT games.

2.1.5.2 Build a game-specific public chain ecology: At present, most NFT games are developed based on Ethereum, but Ethereum has shortcomings such as low TPS and high Gas costs. The high-quality public chain infrastructure dedicated to NFT game development is also the foundation of future NFT games. One of the directions of development.

secondary title

2.2 Encrypted art - the most suitable application for NFT

We believe that the market for encrypted works of art can bring economic benefits that cannot be achieved by traditional systems. Through smart contracts, the historical transaction information of artworks, including senders, exhibition records, and sales records, is completely open and transparent, which greatly reduces the transaction cost of artworks.

And the creator also has the ownership of the artwork in essence, and the artist can also obtain secondary sales compensation through a provable programming method. The artwork anchored by NFT is scarce and unique, and it is this scarcity that drives people's demand for artwork.

2.2.1 Disadvantages of traditional digital artwork transactions

In addition to the on-chain conditions of the art itself, the disadvantages of traditional art transactions are also an important reason for the creation of encrypted art. The disadvantages of traditional artworks are as follows:

2.2.1.1 Poor mobility of works: In the traditional art market, trading places are mainly galleries, auction houses, etc. Creatives exhibit their works in galleries or auction houses through intermediaries, and after buyers pay, they can use USB to copy art Taste. The disadvantages of this trading model are obvious: the exposure of works is low, it is greatly restricted by time, region, and crowd, its liquidity and popularity are low, and its liquidity is poor.

2.2.1.2 The creator cannot own the real copyright: After the buyer obtains the work from the creator, he can copy an identical work and continue to trade it on the secondary market. Collectibles drop in value. Compared with the initial sales income, the economic benefits of secondary sales and resale appreciation are objective.

Over the years, the original creators have been fighting for the royalties of the secondary sales, that is, the "resale right". In 1920, France first introduced the concept of "resale right". The resale tax rate is usually very low. % dividends, in countries that follow the European Union's 2001 Directive on the Protection of Resale Rights of Authors of Artistic Works, artists can earn 4% in resale.

In the United States, California legislated to recognize the resale right in 1976. In 1991 and 2011, Congress asked the public for opinions on the resale right system, but none of them passed. In 2012, the California Resale Right Act was abolished. In addition to the imperfect legislation, law enforcement is also very difficult. It often requires the participation of the legal layer before the original creator can collect the proceeds of the secondary sale, and the legal cost is relatively high.

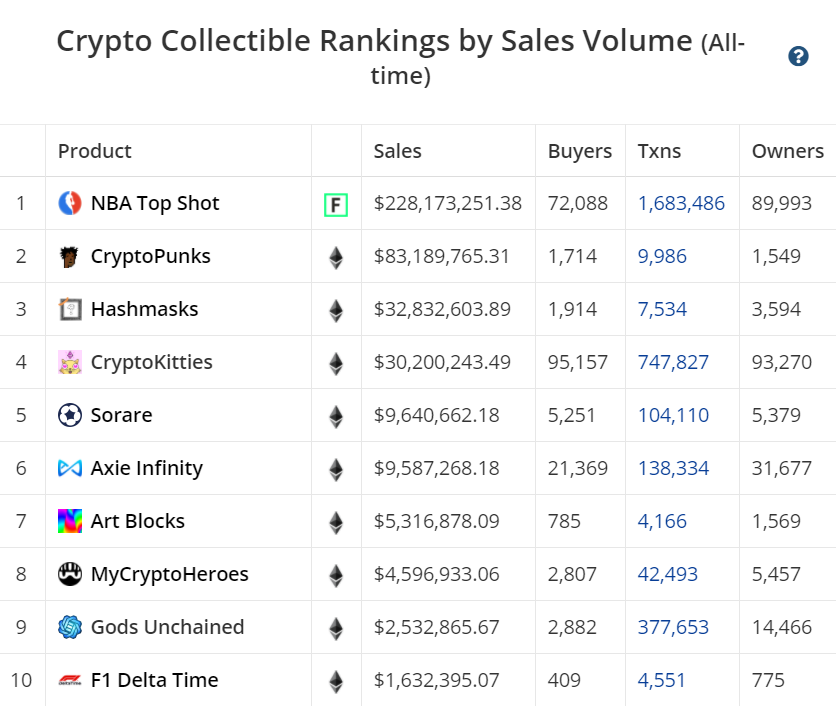

2.2.2 Main items

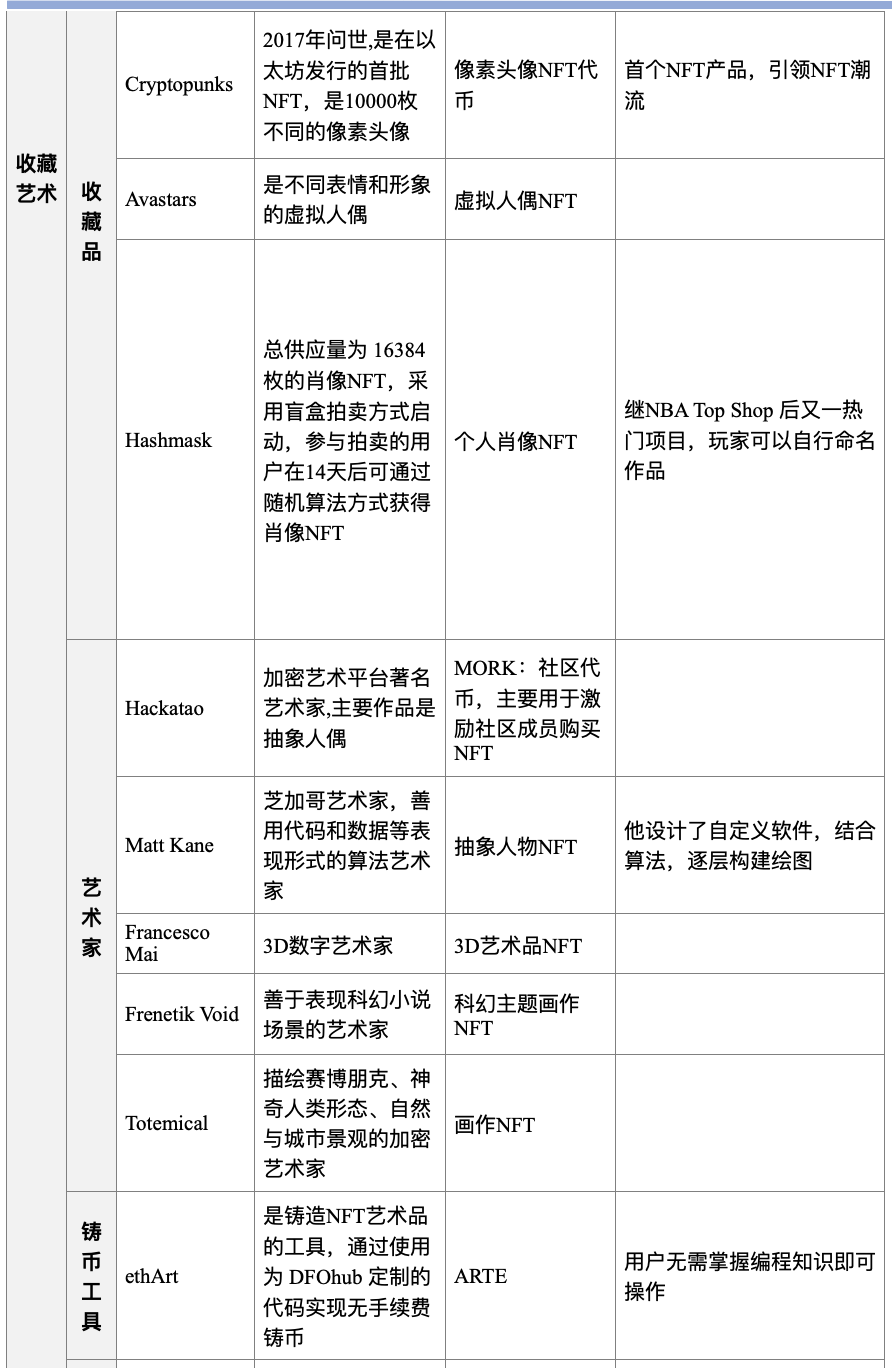

The following table summarizes the main projects of NFT in the field of encrypted art and the characteristics of each project:

exampleexample

2.2.3.1 SuperRare Market Overview

image description

Source:nonfungible.com

image description

Source: Dune Analytics, queried by rchen8

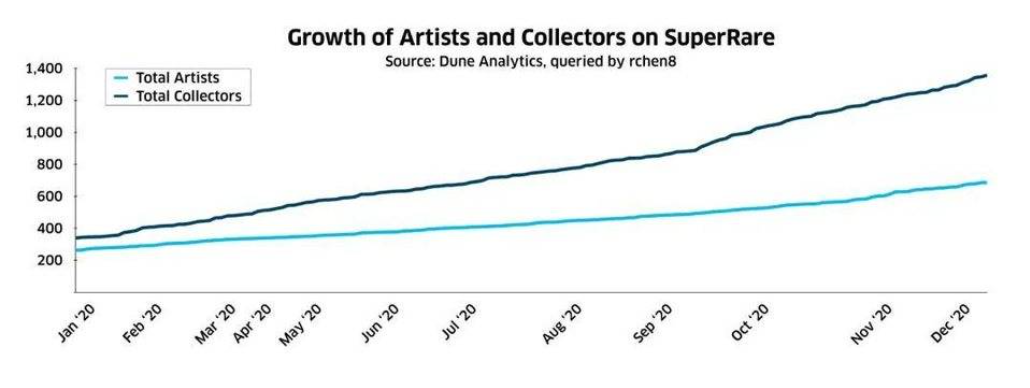

2.2.3.1b Rising demand for collectibles: The figure above shows the growth of the number of artists and collectors in SuperRare in 2020. The gap between collectors and artists is widening. At the end of 2020, the number of collectors is about The total number of collectors and artists is increasing, which shows that the demand for collections continues to rise.

2.2.3.2 SuperRare empowers art transactions

2.2.3.2a The income from primary sales of artists increases: investors all over the world can appreciate the works of artists through the platform, and the exposure of the works is higher than that of traditional auction houses, and in the peer-to-peer decentralized ecosystem of the encrypted art market, artists are not subject to auction Influenced by the high commissions of intermediaries such as banks and dealers, 85% of the income from primary sales belongs to themselves (the platform charges 15% commission), and the income of artists from primary sales increases.

2.2.3.2b Binding of artist and secondary sales rights: The Ethereum smart contract has added a secondary market sales franchise. In the Superare trading market, after the artwork is traded in the secondary market, the original creator can get 10% of the Commission, get passive income from being resold. Because the smart contract has the power to control the assets, the payment will be made automatically immediately after the second transaction, and no third-party legal personnel are required to execute it. The artist really has the right to the second sale.

2.2.4 Advantages of encryption art

Overall, the advantages of encrypted art over traditional art can be summarized in the following three points:

2.2.4.1 Cost reduction: Compared with traditional art transactions, encrypted artwork reduces high transportation costs, storage costs, maintenance costs, legal costs, etc.

2.2.4.2 Increase exposure and mobility: At present, traditional art transactions are very limited in time, region, and audience. The main art exhibitions are only concentrated in big cities such as New York, Berlin, Paris, and Hong Kong. The audience is also mainly rich in society. class, but encrypted art has successfully connected the global market through blockchain and smart contracts, integrated global art resources, and brought together artists, collectors, investors, and critics from all over the world. Players can choose to invest in NFT asset fragments, collect The threshold is lowered, and artworks can be browsed at any time on the encrypted art comprehensive trading platform.

2.2.4.3 Clarify the ownership of works: All the exhibition and circulation information of encrypted art will be recorded on the chain, which is convenient for auditing and tracking specific artworks, and the possibility of counterfeit and counterfeit products will be greatly reduced. The ERC721 protocol clarifies the source of the token and the ownership of the work, and the remaining value of the secondary sale belongs to the creator.

2.2.5 Envisioning the Future of Encrypted Art

There are four main points about the future development trend of encryption art:

2.2.5.1 Combining or bundling with more elements to form new asset classes: such as finance, construction, etc., these innovative bundled combinations will release the greater potential of encrypted art.

2.2.5.2 Artworks will be combined with more trendy products or toys: the cash flow income of the trendy toy market is higher than that of artworks, and personalized design and trendy attributes have become the consumption logic of many young people today, and the popular scale of the trendy toy market will continue to expand . There is already this trend in the traditional art world of the trendy toy market, such as the works of artist Takashi Murakami, whose paintings and sculptures have strong toy attributes.

2.2.5.3 Increased liquidity: There may be more comprehensive trading platforms and second-hand trading platforms like Opensea in the future. Secondly, another source of liquidity is DeFi. After users mortgage high-quality NFT assets in the DeFi agreement, they take out loans to purchase new assets, and the liquidity of NFT will increase.

In addition, in addition to single-edition limited artworks, there will be more multi-edition limited artworks traded and circulated. Multi-edition works of art are a series of identical works of art commissioned or produced by artists according to their own ideas. For players, multi-edition artworks have lower collection thresholds, stronger social attributes, increased liquidity, and higher appreciation space.

secondary title

2.3 Social tokens - one of the most potential incremental markets for NFT in the future

We believe that social tokens embody the connotation of Web3.0 peer-to-peer transmission, help to reduce the dependence of creatives on centralized platforms, increase the circulation and liquidity of creative works, and truly realize the binding of creatives and rights. Compared with the chaining of physical assets, the value capture of native assets in such Internet communities will be higher. At present, people have only touched the shallow potential of social tokens, and social tokens may become one of the most potential incremental markets for NFT in the future.

2.3.1 Classification of Social Tokens

Social tokens, tokens backed by a person's reputation, brand, or community, are a relatively new application in the NFT space. Social tokens are built on the premise that community value will continue to increase. Social tokens broadly fall into two categories: personal tokens and community tokens.

2.3.1.1 Personal tokens: Created by individuals, they will appreciate in value with the growth of personal value, but the capture value is limited and greatly influenced by personal brands. Creators can manage the communities they create by issuing tokens.

2.3.1.2 Community tokens: usually used to enter communities with specific membership qualifications. For example, you must have the tokens issued by the creator of the community before you can enter a specific telegram discussion group, obtain information or services, etc., and at the same time These communities will also encourage people to contribute to the community by issuing tokens. Community tokens are mostly decentralized autonomous organization (DAO) governance tokens. Communities are usually broader than individual achievements and have greater growth potential.

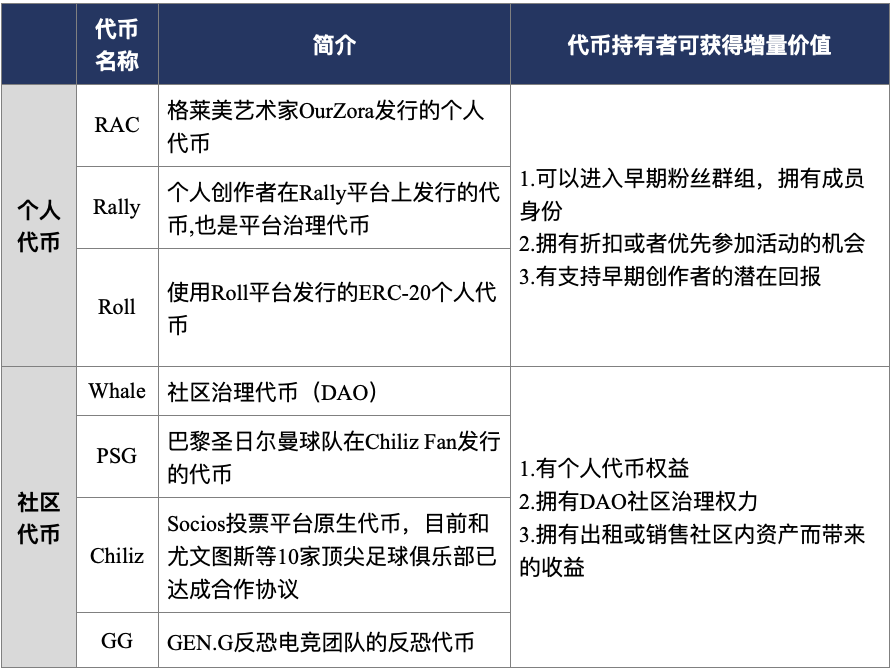

image description

Source: organized according to Messari

2.3.2 Social Token Value

2.3.2.1 Increase the monetization ability of creative works. The Internet provides a platform for creatives to share their works, but the commercialization ability of creatives' works, work sharing, dissemination capabilities, and value-added space are all limited, that is, the creatives' work is not capable of monetization.

However, the emergence of Web 3.0 is expected to solve this problem. Creators can issue social tokens in the community to allow supporters to share their favorite works, thereby improving liquidity and achieving the purpose of increasing the value of works. The user's activity and contribution are divided into levels and enjoy tokenized rights and interests.

2.3.2.2 Creators and rights are bound. Creators can use social tokens to allow fans to access the works of the creator's entire social platform, and fans can no longer rely on the platform to support creators and favorite works. This method supports creators uniformly through tokenization tools. Creators can enjoy all the profits in the value-added space of their works, realizing the binding of creators and rights, which also reflects the core connotation of the peer-to-peer ecosystem of Web 3.0.

2.3.3 Featured Project - Whale

The current featured project of social tokens is Whale issued by WhaleShack. WhaleShark was first released in May 2020. It is supported by a large treasury of NFT assets, including a large number of artworks, collectibles, virtual item tokens, creators His work is available for sale on Opensea with a price of Whale.

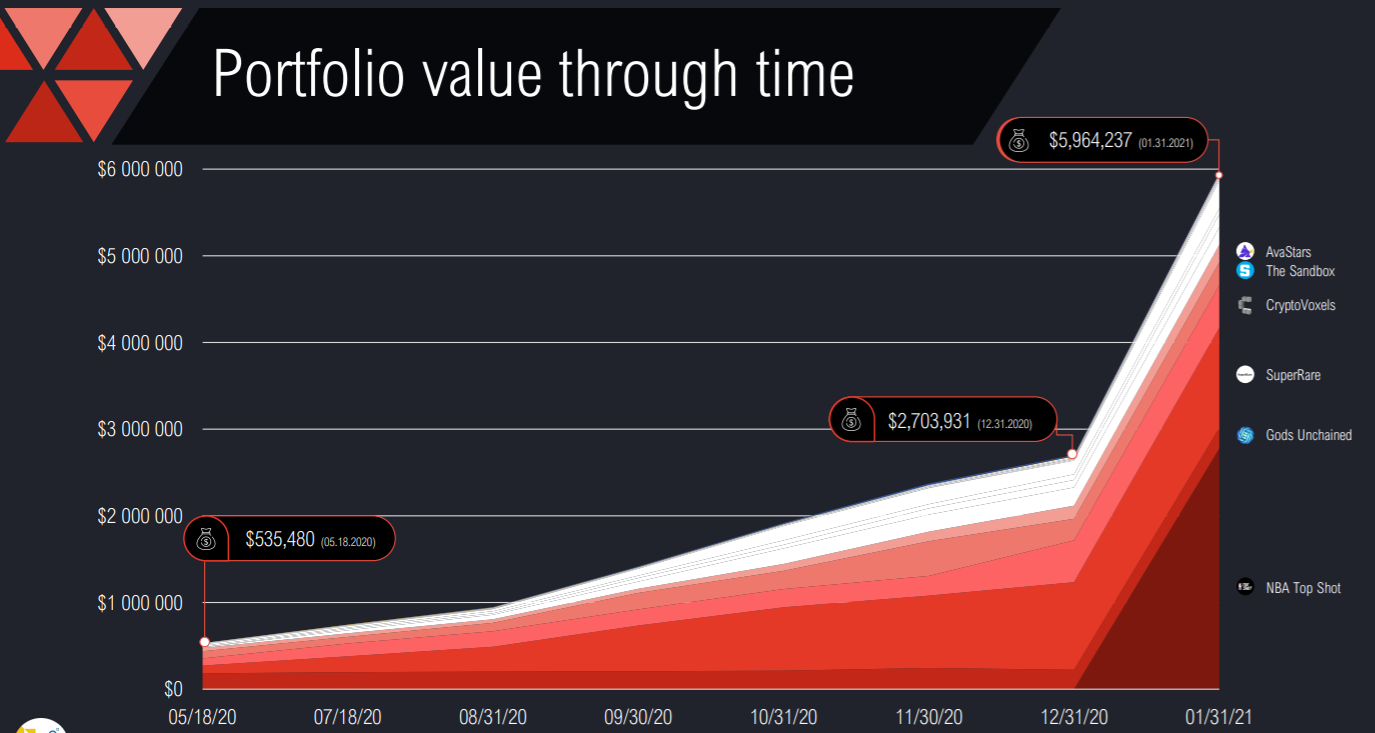

The figure below shows the estimated value of WhaleShark's NFT asset library (Nonfungible.com's January 2021 audit results). The NFT assets in the asset library have been on the rise for several consecutive months. On December 31, 2020, the value was about 2.7 million US dollars. At the end of January 2021, the value was close to 6 million US dollars, a one-month increase of 120%.

image description

Souce: Nonfungible

Whale is not only supported by the NFT asset library, but also has other different functions in the community, such as games, purchasing virtual assets, etc. Whale also created a DAO (Decentralized Autonomous Organization), that is, Whale is completely governed by participants without centralization organization.

2.3.4 Ecological environment

Today’s social tokens are not only increasing in value, but their ecology is also rising rapidly. The following figure shows the main components of the social token ecology:

Token issuance platform: Provides a platform for token issuers to mint and issue social tokens.

Token Creation Accelerator: The main role is to incubate social tokens, such as helping creators design token models, creating token standards, etc.

Management tools: Mainly used for community governance, the main functions include group verification, identity verification, voting, proposals, launching DAO, airdrops, rewards, asset sales, income farming, etc.

2.3.5 Thinking about the value of social tokens

2.3.5.1 Compared with physical assets on the chain, the value capture of the native assets of social tokens is higher. Social tokens are supported by actual value in the context of the continuous development of the fan economy. Taking personal tokens as an example, the higher the personal influence of the issuer, the higher the price of the token. Brand and prestige endorsement. Compared with assets on the chain, the value of native assets in this type of Internet community will be higher, but it is not obvious enough before the official arrival of the Web3.0 era.

secondary title

2.4 Other applications

first level title

three. Prospects and bottlenecks

3.1 High-quality assets enhance market liquidity.First of all, it is expected that more high-quality comprehensive trading platforms will emerge in the NFT field, providing players around the world with a place to mint or trade NFT. In addition, DeFi can provide liquidity for NFT. High-quality and widely recognized NFT assets can be mortgaged and borrowed in the DeFi agreement. Users can purchase new assets after mortgage NFT. High-quality NFT assets will increase market liquidity.

3.2 More real assets on the chain.The real meaning of NFT is to provide an on-chain channel for real-world items, acting as a bridge between the physical world and the blockchain world. In addition to the existing applications such as game props and art collections, more real assets such as real estate and copyrights can be uploaded to the chain in the future and exist in the form of NFT. In addition, NFT can also be regarded as an on-chain process of real hobbies, such as movies, music, drama, fashion, etc., can be on-chain, and the gameplay will be more diverse.

3.3 Increased financial attributes.Commercial papers such as bonds, insurance policies, etc. need to carry a lot of information in the process of circulation and transaction in the financial market, and are unique. As a non-homogeneous token, NFT can be used to benchmark different physical objects, and the information of the bill can be tracked. NFT can empower the financial field, and financial attributes will increase in the future.

3.4 The ecological environment is not perfect enough.Compared with the previously popular DeFi ecology, the ecological perfection of NFT at this stage is not perfect enough. Unlike the similar business and investment logic of various tracks in the DeFi field, the NFT track is clearly differentiated, with large differences in projects, and only a small number of competitions The development of the road is relatively mature and has investment value, which leads to the lack of synergy between NFT projects and the track, and its influence is limited.

Secondly, concepts such as private keys, wallets, and mnemonics involved in NFT have a high threshold for players, and many players are discouraged. In addition, because the NFT market is an emerging niche field, its liquidity is poorer than that of DeFi projects.

3.5 Higher security risks.first level title

secondary title

4.1. Tracks with investment value include: high-quality public chains, distribution and flow platforms, tokens themselves

4.1.1 High-quality public chain

Ethereum’s high Gas fee, slow speed, and network congestion limit the development of many applications, and the user experience is poor. New types of game-specific blockchains such as Flow or L2 solutions such as Matic and xDai Chain support games or The potential of the streaming industry.

Investing in high-quality public chains or expansion solutions with higher throughput that support the development of NFT projects on L1 or L2 is a potential NFT investment direction. However, broader investments such as public chains may bring less returns than more concentrated investments in tokens themselves.

4.1.2 Distribution and mobile platform

NFT is a non-homogeneous token, which is unique. Unlike homogeneous tokens, its commodity attributes are greater than currency attributes. Since the attributes of NFT commodities are greater, the distribution and flow platforms of commodities are one of the main investment directions, such as trading platforms such as Opensea and Superare.

Opensea and Superare have not yet issued tokens. The platform governance token Rari of the trading platform Rariable allows players to buy and sell NFT commodities, conduct liquidity mining, and obtain token rewards. Investors can deploy such tokens. However, it is not recommended to deploy a trading platform with a small market value that is too small. First, the depth is not enough, the price fluctuates greatly, and users are prone to short-term losses. Second, the standardization of the platform is not guaranteed.

4.1.3 Token itself

The art collections, game props, social tokens, NFT financial products, and platform governance tokens mentioned above all have investment value. Collectibles and works of art often become valuable due to different reasons or backgrounds. These reasons are usually irreproducible and scarce. Investors need to use their own art knowledge reserves to evaluate their collection value. Game props are also based on the popularity and popularity of the game itself. Interesting value is different.

secondary title

4.2 NFT works themselves, artists, trading platform quality, and external evaluation are important indicators for evaluating NFT

Investing in NFT in the cryptocurrency field is similar to alternative investments in traditional investment institutions. Compared with traditional investments, alternative investments have poorer liquidity and weaker information validity, and may earn excess returns, while also helping to reduce overall portfolio volatility in a portfolio and increase investment diversity. Similar to the valuation method of traditional artworks, players' investment in NFT mainly needs to consider the following four elements:

4.2.1 NFT works themselves: NFT works themselves are the most important indicator for evaluating NFTs. The intrinsic value of NFT products such as collectibles and works of art is difficult to estimate, and there are certain requirements for the player's art appreciation level. The premise of maintaining or increasing the value of game props is that the game itself remains attractive to users. Players can choose according to their personal interests. Evaluate the investment value of NFT works from the perspective of hobbies, artistic feelings and appreciation.

4.2.2 Artist: If an artist is well-known, buyers are more inclined to buy the work. Only such artists with high market demand can sell their works at high prices. On the contrary, the possibility of high prices for the works of fledgling artists is very low. Active artists in the NFT field include: Matt Kane, Pak, Josie, Pascal Boyart, Hackatao, Coldie, Trevor Jones, JOY, etc. Players can give priority to the works of these artists.

4.2.3. Trading platform quality: Auction houses play a big role in the traditional art market. If an artist's work is purchased by a well-known auction house, then the artist's status in the art world has been recognized to some extent, and the value of his work will further increase.

Nowadays, there are more and more NFT trading platforms, and players need to evaluate their quality, and must choose a platform with high reputation and guaranteed reputation to purchase, so as to guarantee the quality of NFT works. For example, users can choose platforms such as SuperRare, where artists and their works have been strictly reviewed to purchase NFT assets.

secondary title

4.3 Focus on asset protection and safe collection of NFT

4.3.1 Users should choose a hardware wallet to store NFT: the private key of the hardware wallet is stored separately in the chip, which is not easy to be maliciously attacked. It is a safe way to store NFT assets, unlike software wallets that face more attack vectors.

4.3.2 Users need to consider the security of the way the platform handles metadata: If an NFT project stores its metadata in a third-party centralized server, users will suffer losses if the project eventually goes bankrupt or the third-party server is hacked. For collectors, the degree of on-chain of NFT items is very important, and NFT items with high degree of on-chain and metadata stored on the chain should be selected. For such projects, users can also trace the source of information in the Ethereum browser or other query tools and follow up the status of NFT assets.