Weekly Editors' Picks Weekly Editors' Picks (0312-0318)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Do you really understand the Fear and Greed Index?

"The Fear and Greed Index is more of a daily indicator than a tool for long-term trading... It is very important to analyze the trading activities recorded in the log, eliminate irrelevant content, and polish valuable content of."

Dismantling the management methods of 10 top Web3 companies: what makes them strong)

Mario Gabriele, who has contacted and researched a large number of companies, summed up ten most influential lessons from nine outstanding companies and encryption projects, namely: 1. Be a persistent recruiter (Stripe); 2. The largest 3. Be obsessed with your customers (Coupang); 4. Align incentives (AngelList); 5. Think like a nation-state (Terra); 6. Invest in soft power (FTX); 7. Retain optionality (OpenSea); 8. Strengthen your strengths (Tiger Global); 9. Find your anti-positioning (Telegram); 10. Actively reinvent yourself.

Foresight Ventures: Chronicle of the Crypto Thought (1997 - 2022)

A very long article, revisiting the important viewpoints and narratives in the history of Crypto development in chronological order (contains about 40 articles, like a "25-year editor's selection"), you can see the industry in different periods It is very interesting to understand the comments of people inside and outside on Crypto and how they viewed and predicted the industry at the beginning, and they can intuitively feel that the industry is accelerating.

Crypto Trader Ansem: Crypto Market Outlook for Q2 2022

DeFi

Ansem also shared his personal favorite trading pairs: long Luna/short Eth, long Rune/short Fantom, long BTC/short Doge, long Avax/short ONE.

In-depth analysis of 7 common design architectures: Why is there no perfect decentralized stable currency?

The decentralized stablecoin mechanism currently has two main methods, the over-mortgage + liquidation model, and the liquidity filling model combined with project Token credit. The latter model improves capital utilization efficiency. Stablecoin liquidity is a very critical part, and the current mechanism has cleverly used various methods to control phased stability. In the long run, the foundation of a successful stablecoin is the need for a sufficiently strong ecological support.

Jump Crypto: Five basic ways for DeFi players to earn stable and high returns

This article explains yield farming through basic economic principles, and focuses on two issues: 1. What core value does DeFi investors create? And get rewarded for it? 2. Whether overtly or secretly, who paid the bounty?

NFT

NFT's CC0 fog: When we hold NFT, what rights do we actually have?

DeFi investors passively provide five forms of value: operating the network, providing loans, providing liquidity, managing agreements, and promoting agreements. Rewards for these activities of DeFi investors are jointly provided by protocol owners, users and investors. Investors should be alert to the potential risks (vulnerabilities) of "reward-driven marketing". In practice, yield farming requires many abilities, such as discovering opportunities for value depressions, quickly adjusting positions, and understanding subtle risks in smart contracts. Sophisticated investors should be prepared to make mistakes and lose their assets at any time.

NFT's CC0 fog: When we hold NFT, what rights do we actually have?

CC0 is actually an issue of legal confirmation and decentralization of NFT. "The so-called CC0 means that the creator uses a general agreement to tell everyone that I have given up the copyright, and the copyright I gave up has entered the public domain (public domain), and everyone can use it freely; but trademark rights or patent rights or I did not mention it. The right to access does not mean that the declaration of CC0 must be renounced and entered the public domain."

Panoramic scanning of the NFT ecology: What are the top projects in each segment?

The article introduces the basic situation of representative projects by subdivided sections (the map is as follows). "Liquidity solutions have brought more composability to the NFT ecology. Although the current new paradigm and lack of innovation make it difficult to sustain the value of NFT for a long time, its potential and value are becoming clearer."

Real Vision: Has the NFT bear market arrived? How should we respond?

a16z: Analysis of the principle and prevention of the new NFT deception "Sleep Minting""chain"chain

Xiao Sa: Analysis of the recent domestic and foreign NFT regulatory trends

Ethereum and scaling

Ethereum and scaling

5 strategies: How to earn more ETH with your ETH

The five "coin-based financial management methods" are: Vesper's ETH Grow Pools (estimated APY: 2.31%), using Rocket Pool for liquid staking (rETH) (estimated APY: 4.3%), Stake DAO's Passive stETH strategy (estimated APY 6.2%), Jones DAO’s ETH Vault (estimated APY: 10.6%), Ribbon’s ETH Covered Call Vault (estimated APY: 21.7%).

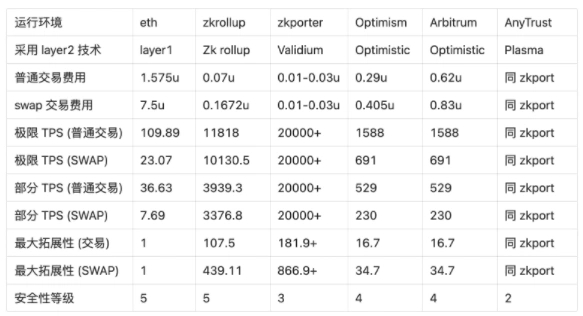

The author introduced the gas mechanism, calculation method, advantages and disadvantages of each L2 scheme. The premise of cost calculation is that the current ETH price is 2500 U, the block gas limit is 30000000, the gas fee is 30Gwei, and the block is produced in an average of 13 seconds. The limit TPS means that the corresponding operating environment occupies all the Ethereum block space (in the proof verification It costs 500,000 gas), ordinary TPS means that the corresponding operating environment occupies 1/3 of the block space of all Ethereum. The result is shown in the figure below:

Zero-knowledge solutions are quietly changing the industry landscape

Zero-knowledge solutions are quietly changing the industry landscape

New ecology and cross-chain

New ecology and cross-chain

hot spots of the week

hot spots of the week

In the past week,the fedIn the past week,the fedUS SECUkraineReceived a bipartisan U.S. letter on cryptocurrency regulation,UkraineRussian investorsHongkongHongkongEl SalvadorA comprehensive regulatory system will be established for the development of virtual assets,Coinbase PayEl SalvadorBitcoin bonds to launch; Coinbase launchesTo simplify the wallet top-up process, will be carried out in the United StatesCrypto Derivativesbusiness,MetaMaskCoinbase WalletSupports the Solana blockchain,The number of users exceeds 30 million, DAO will be launched and tokens will be issued,Newly launched version v10.11.1Added functions such as contract viewing, Trezor's EIP-712 signature support, and updated the UI interface of gas settings;InstagramLINE's NFT platformWill cooperate with Softbank, Visa and other 26 companies to build a global NFT ecosystem, Mark Zuckerberg saidWill soon support NFT,Meta, Xiaoice, NVIDIAThe establishment of the Asian metaverse full ecological alliance; the hedge fund Fir Tree is making a big moveShort USDTCan the price of LUNA surpass $88 in one year?Three Arrows CapitalBet millions of dollars against each other,Three Arrows CapitalIncreased holdings of 40,500 ETH (valued at 112 million US dollars), Parity's stolen funds changed in 2017,Andre Cronje990 ETHis transferred to Tornado Cash;Deploy 6 foreign exchange stable currency pools on Curve,Aave launches V3 version, introducing functions such as cross-chain assets,Juno Network's Governance Proposal 16 Weakening Whales (Strong Taxation)Sparking heated debate, says FTX Ventures headThere is a disconnect between crypto startup valuations and the market, and it will soon drop,; BAYC parent company Yuga LabsAcquisition of CryptoPunks and Meebits IP and some NFTsWill open virtual land sale and launch MetaRPG game,and APECoin, 15% of the total supply will beAirdrop to BAYC/MAYC NFT holdersNFTflowWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~