The arrival of the NFT "Cambrian", a comprehensive interpretation of the development status and trends of the NFT market

Original compilation: Block unicorn

Original compilation: Block unicorn

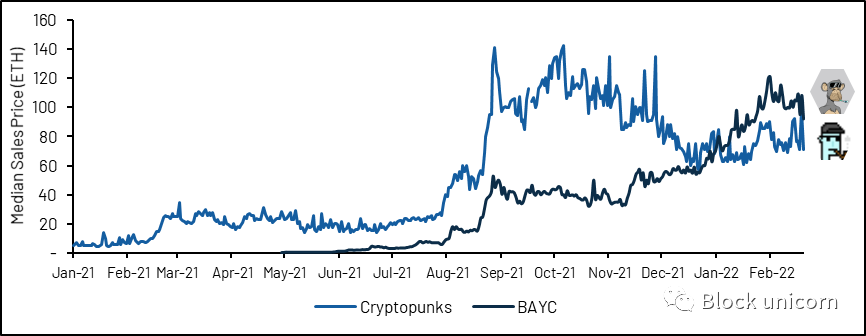

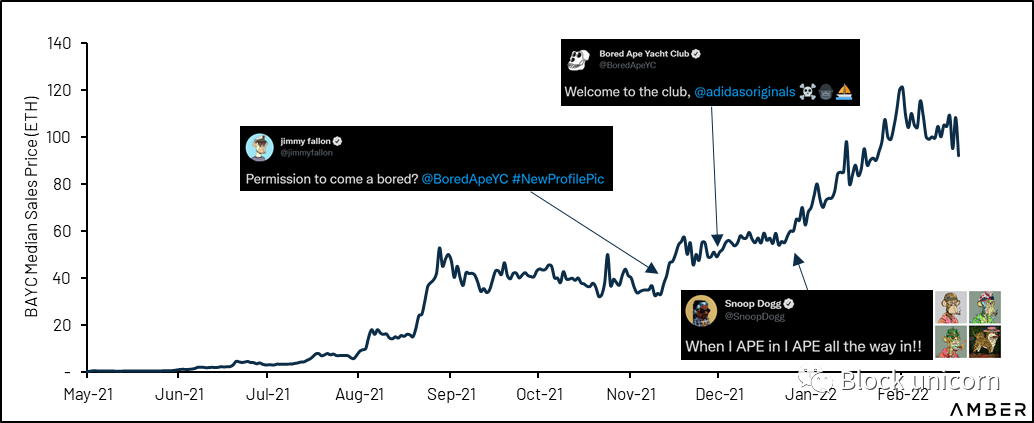

Non-fungible tokens (NFTs) have come a long way and have captured the zeitgeist over the past few years. Mainstream focus has largely been on Personal NFT Avatar (PFP) projects, fueled by the growing attention (and value) of CryptoPunks and Bored Ape Yacht Club (Bored Ape Yacht Club).

CryptoPunks and BAYC prices skyrocket...

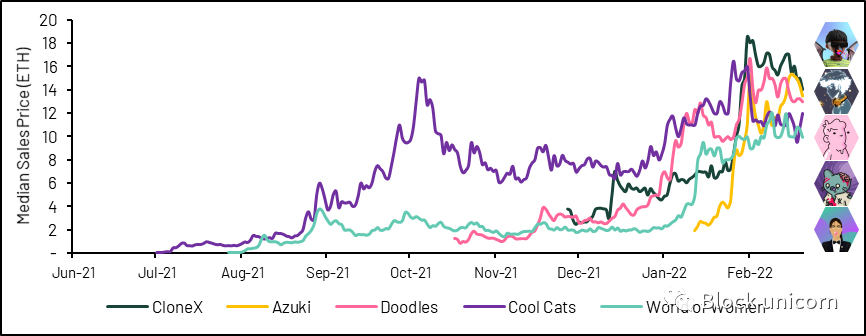

Triggered an upsurge of NFT avatars...

These projects illustrate some of the emerging properties and behaviors enabled by NFTs. First, NFTs provide true digital ownership of unique assets. Because people are confident that they actually own these assets, they can (and often do) use them as representations of their digital identities. Even Web2 platforms like Twitter feature NFTs as profile pictures. And, just like in the physical world, these avatars generate social attributes, such as status signals, closed communities, social hierarchies, and other related behaviors, with ownership that transcends the original document itself. For example, members of the Boring Ape Yacht Club own the IP rights to Ape, allowing them to use Ape to launch a beer brand, comics, and even a virtual band.

Second, the programmable nature of these assets enables a wide range of use cases that are not usually available with real-world objects. NFTs can be programmed to respond to actions taken by the owner, react to external triggers, or change over time. They can embed royalties, enabling creators to participate in future earnings with their communities. And because all of this happens on the blockchain, creators can identify and reward owners with airdrops or early access to future projects.

All of these features combined can trigger a virtuous cycle, with community members creating value from grassroots initiatives, driving demand for their assets, and providing creators with higher revenue through sales royalties, which they can use to further expand the scope of their projects.

first level title

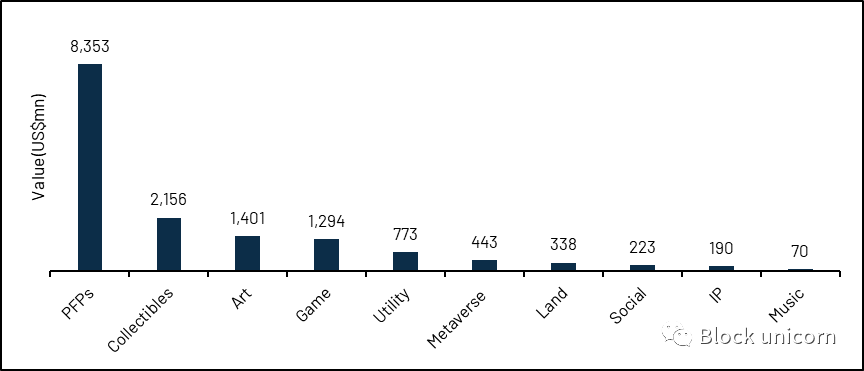

NFT Market Cap by Category

secondary title

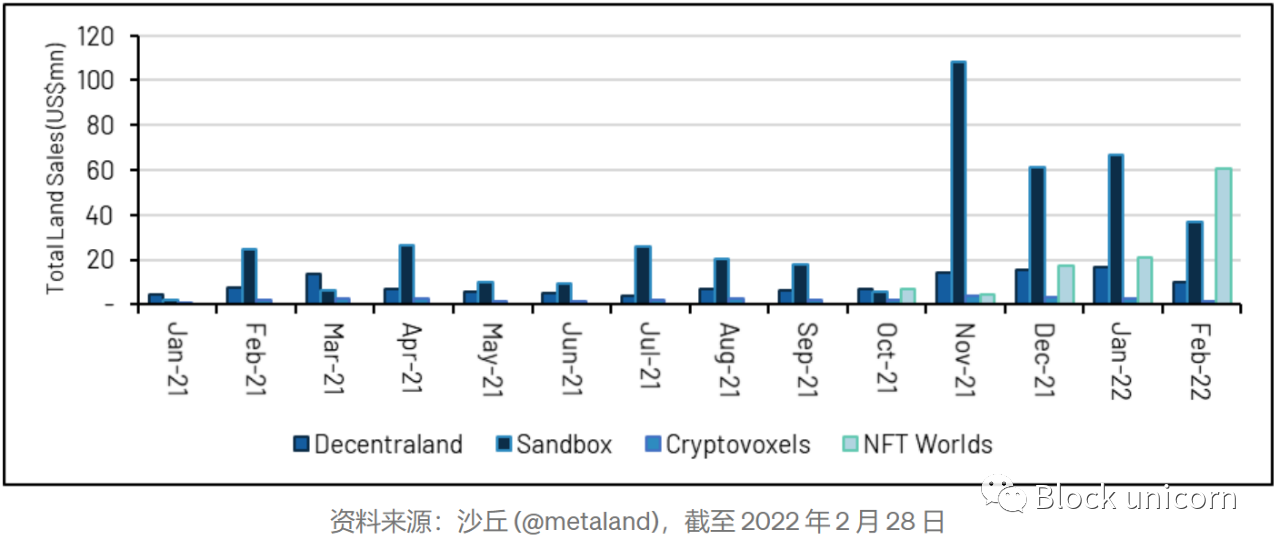

land grab

secondary title

digital land grab

One of the rationales behind purchasing the land was to host Metaverse events and experiences, however, both Decentraland and Sandbox are relatively new platforms that have yet to build out the infrastructure to accommodate high traffic loads. For example, Samsung attempted to hold a Galaxy smartphone launch event in Decentraland, but encountered technical difficulties as people tried to gain access. The co-founder of Decentraland suggested that the maximum concurrency of the platform is only 1~2,500. Even existing open-world platforms with mature server infrastructure still struggle to handle environments with hundreds of players - Free Fire, a mobile-only battle royale game where every competitive Arenas can only hold up to 50 people, while Roblox can only handle up to 700 people in beta testing.

first level title

NFT world

NFT Worlds is a community-driven metaverse platform built on top of Minecraft's open-source ecosystem. By bootstrapping an open world on top of Minecraft, NFT Worlds can take advantage of cross-platform support and existing world building tools.

There are 10,000 unique worlds in total, and the metaverse data covers 39 categories, including resources such as land area, water area, annual rainfall, wood, and metal. These characteristics determine the rarity of each world and can be used for different game elements. Holders of these worlds can use the existing Minecraft Launcher or the upcoming NFT Worlds Launcher to build and edit worlds they own.

secondary title

NFT Worlds has seen over $20 million in monthly trading volume over the past three months

So far, more than 100 NFT communities have publicly announced the acquisition of NFT Worlds, including RTFKT, Zipcy’s Supernormal, and WVRPS. Anyone can view specific worlds in a web browser, such as World #9856, which has been customized.

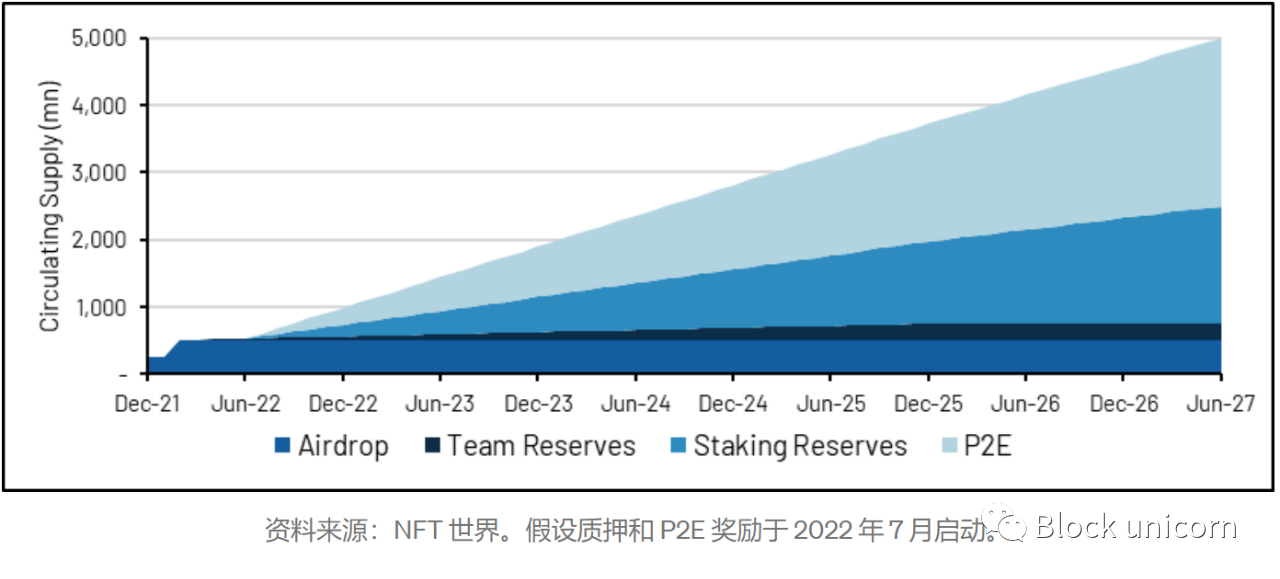

NFT Worlds owners will receive two airdrops of WRLD tokens. They can also stake and/or lease out their land for additional tokens. WRLD has a maximum supply of 5 billion tokens, of which approximately 85% are distributed over five years.

WRLD Distribution Schedule

The team recently launched a WLRD-centric payments layer that will be used as the primary medium of exchange within the ecosystem, including upcoming game earning and rewards mechanisms. Transaction fees are also paid in WLRD, freeing players from managing costs with other tokens.

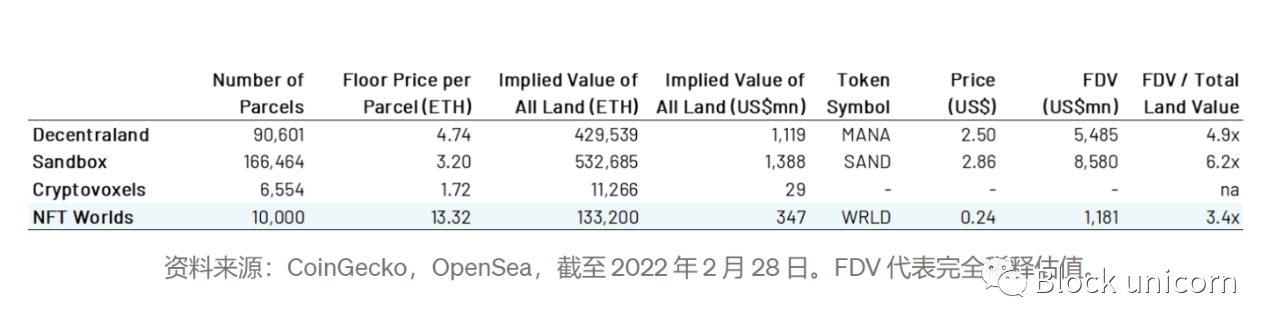

Despite the recent hype surrounding NFT Worlds, the implied value of its land and fully diluted valuation of the WLRD token is still orders of magnitude lower than the top two crypto-native open world platforms.

NFT Worlds and other metaverse platforms

Of course, NFT World's approach has some drawbacks. For example, Microsoft (owner of Minecraft) could shut down the project. While the NFT Worlds team says they've been in close contact with Microsoft's IP team and have encountered no issues so far, open worlds often run the risk of misconduct beyond the control of the founding team.

first level title

NFT-enabled DAO

Decentralized Autonomous Organizations (DAOs) are groups organized around a common mission and values. Typically, these DAOs are formed through fungible tokens such as BitDAO (BIT), ConstitutionDAO (PEOPLE), and Friends with Benefits DAO (FWB ).

secondary title

Stupid Nouns Gallery

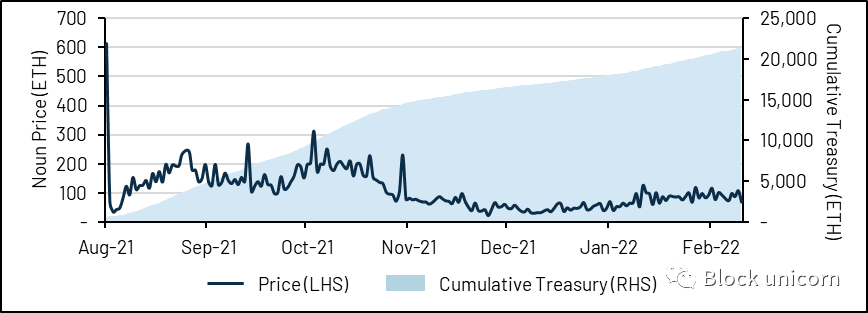

NounsDAO is an open source project - the code to create the nouns and the artwork itself are placed in the public domain. 100% of the auction proceeds go directly to the NounDAO treasury, and each Noun NFT owner has one vote for the use of treasury funds.

secondary title

Nouns price stabilization after initial hype

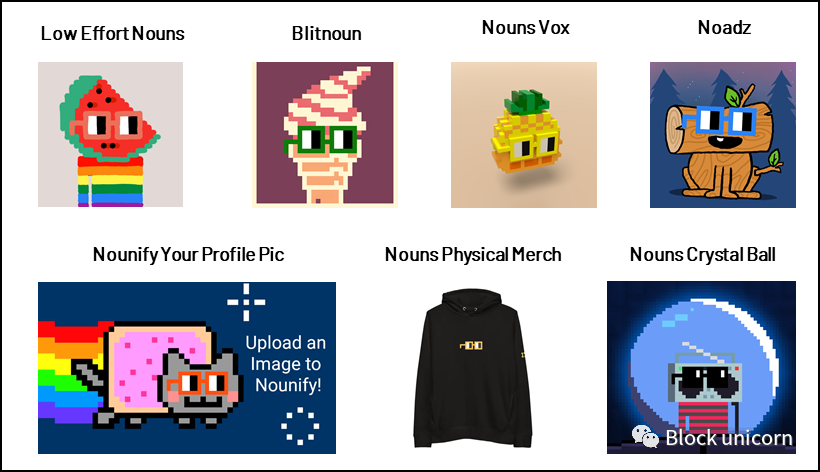

Since the license is available in the public domain, a wide range of community-driven initiatives and spin-off artworks have sprung up in the ecosystem, including an app that "notifies" your existing profile picture and one that seeks to generate what might be the next Nouns.

secondary title

NFTs as utilities

secondary title

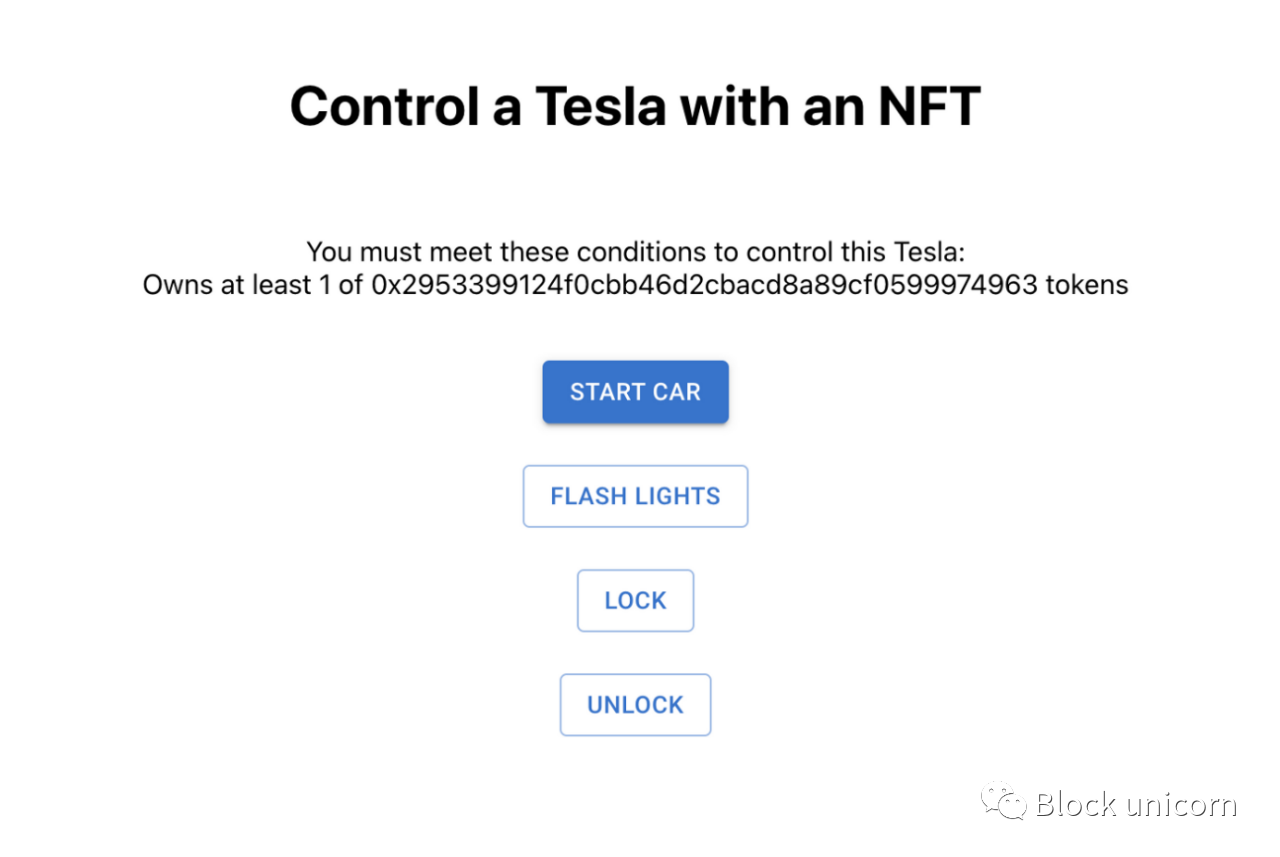

ignite tesla

text

Control Tesla with NFT

secondary title

Superfluid (mobile payment)

secondary title

Membership and Access

Some organizations are experimenting with using NFTs for gated access to membership passes. LinksDAO, whose members include NBA players Stephen Curry and JJ Redick, is trying to create a golf and leisure club with NFT-certified memberships. Flyfish Club also aims to create a private dining club exclusively for NFT holders. 10 NFT keys for Coachella grant lifetime access to Coachella events and are auctioned off for $55,000.

first level title

secondary title

Blue Ocean and Opensea

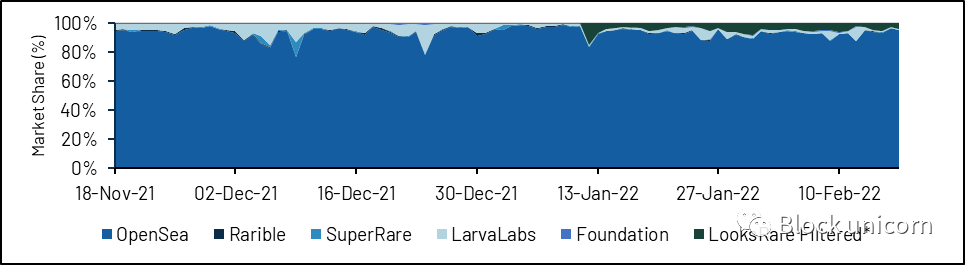

Most users' first foray into NFTs is through OpenSea, which has over 95% market share based on transaction volume. However, many new platforms have entered the market, targeting specific sub-industries (e.g., generative art), different use cases (e.g., NFT swapping), or just a fraction of OpenSea's market share.

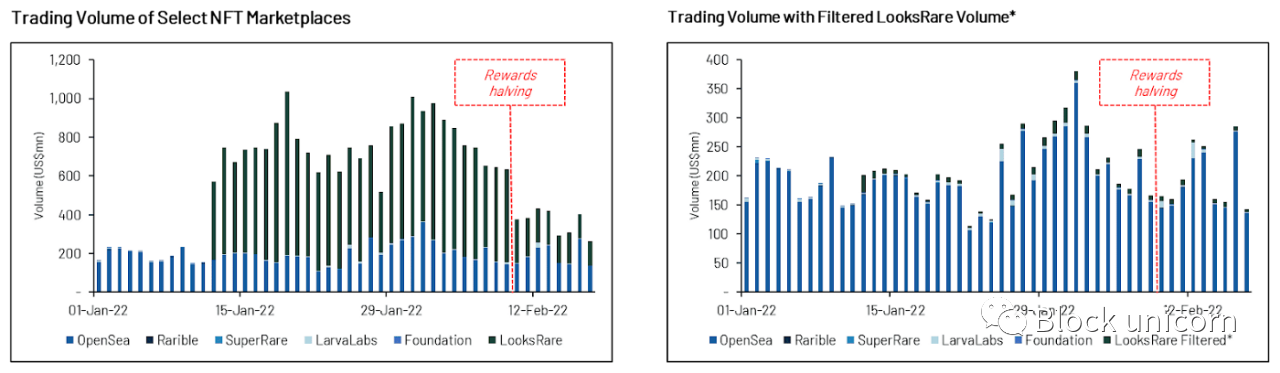

In January, LooksRare “vampire attacked” OpenSea when it launched its platform by airdropping native tokens to OpenSea users. LooksRare has managed to gain a wide range of users in crypto, capitalizing on the disappointment that OpenSea may have an initial public offering (IPO) instead of generating tokens for users.

secondary title

secondary title

OpenSea continues to dominate

LooksRare Filtered minus "back and forth" transaction activity between two wallets and unusually high value transactions.

first level title

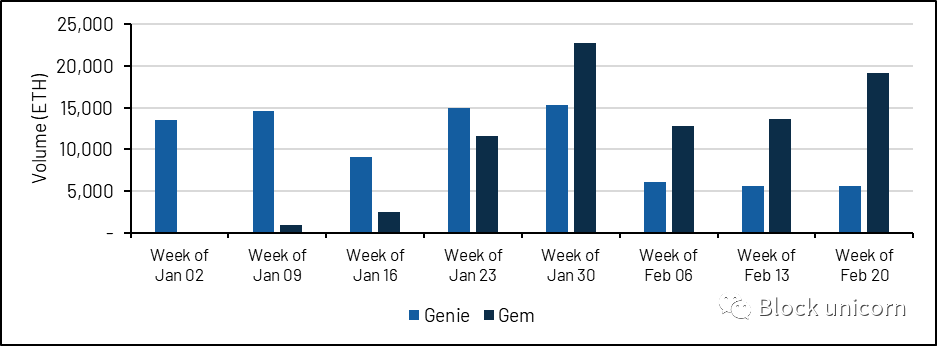

NFT transaction aggregator

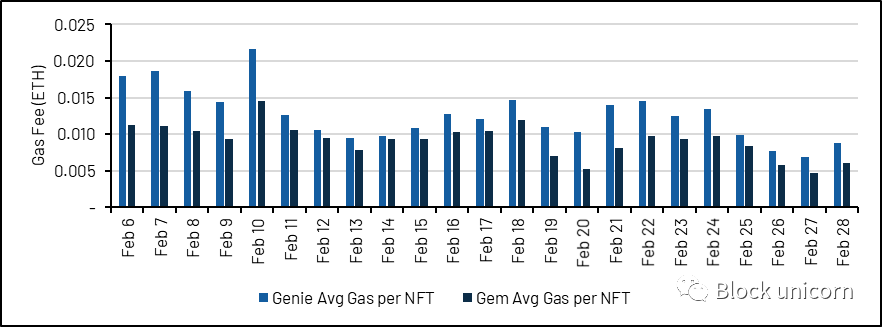

We are keeping a close eye on NFT transaction aggregators in this space as new marketplace platforms launch. These aggregators serve a variety of functions, including finding the best prices and seamlessly listing NFTs for sale across multiple platforms. They also allow bulk buying, allowing users to easily "sweep the floor" (increase the floor price of a collection by buying the cheapest collection listed) and shop across multiple collections.

secondary title

secondary title

Gem saves more handling fees for users

first level title

NFT financialization

As the price of certain NFT collectibles rises, a new pain point for some owners is the tokenization of their holdings. Some platforms now offer loans backed by NFT collateral, mimicking collateral-backed loans for real-world non-fungible goods such as houses, cars, and luxury goods.

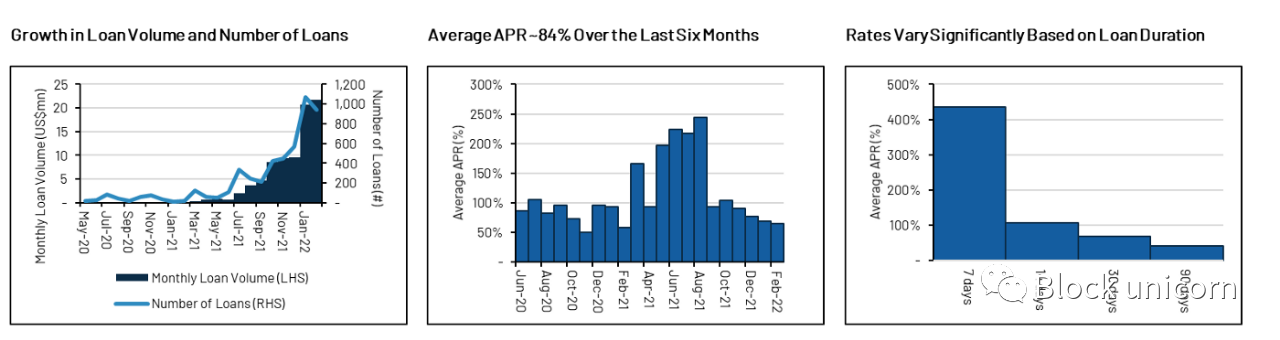

NFTfi is the largest peer-to-peer platform for NFT decentralized lending. Borrowers can list and stake selected NFTs on the platform to solicit loan terms from lenders. These WETH or DAI based loans can last up to 90 days and carry an average annual interest rate of around 70%. If the borrower defaults on the loan, the lender can seize the underlying NFT collateral.

secondary title

NFTFi Statistics

NFTfi expects to launch “NFTfi V2” this quarter, which includes several new features, including unlimited loans, loan deferrals, and loan renegotiations. The team also plans to reward previous users with an airdrop of eventual NFTfi tokens.

NFTfi has successfully capitalized on the growing demand for NFT-backed loans. However, its peer-to-peer model also has some drawbacks. Borrowers do not have immediate access to liquidity; they must wait for lenders to offer acceptable terms. Lenders, on the other hand, have to manually provide loan terms for each asset listed on the platform. Lenders must also hold sufficient WETH/DAI in their wallets until the loan is accepted, risking idle, unproductive capital.

We see similarities between NFT finance and the early stages of DeFi. EtherDelta (OpenDAO founder Qu Jiawei, who later ran to the UK and was defended by others) provides peer-to-peer exchange transactions.

first level title

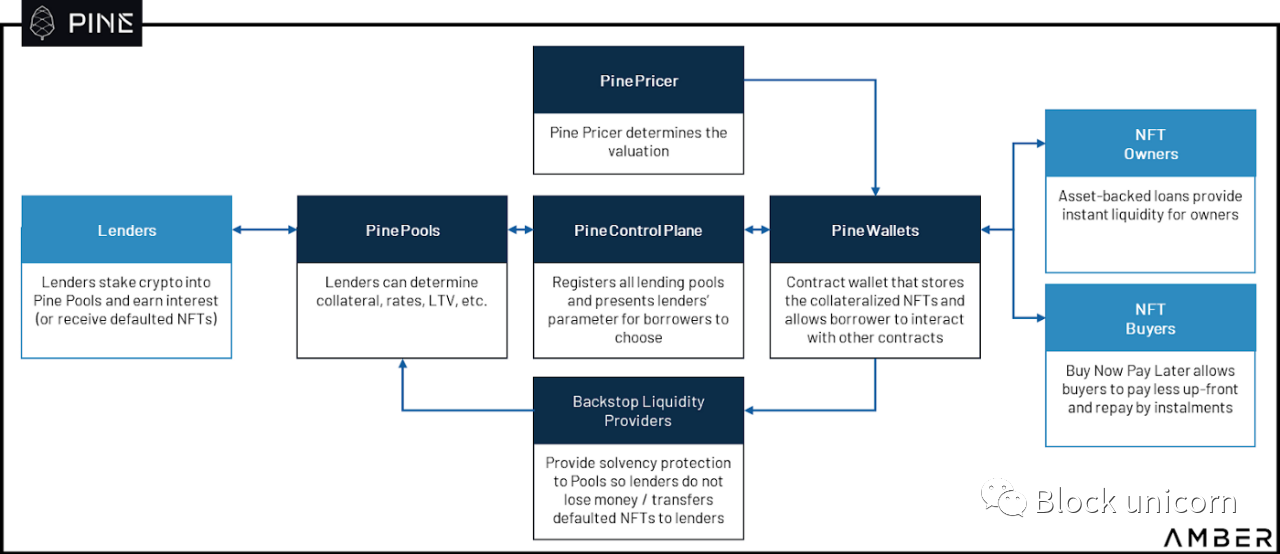

Pine

Pine is an early-stage project that aims to solve two problems: providing instant liquidity for owned NFTs, and “buy now, pay later” financing for aspiring buyers of high-priced NFTs. They plan to launch instant liquidity for a handful of whitelisted NFTs this month.

secondary title

Pine protocol design

Pine's borrowing functionality is currently in alpha (excess return) stage as the team tests the platform and expands the suite of collections they support, Pine aims to release its Buy Now Pay Later (BNPL) solution in Q2 2022 .

first level title

beyond the hype

There appears to be limited use cases for borrowing ETH at interest rates above 40% for a few weeks at the moment. We speculate that most of the demand comes from leveraged NFT trading, where one NFT is used as collateral to buy another NFT for the purpose of making a quick profit.

It’s still early days, and in the real world, the financialization of non-fungible goods clearly improves accessibility and creates new asset classes (e.g., mortgage and auto loans expand home and car ownership).

first level title

Do NFTs belong in investors' portfolios?

There are some advantages to including NFTs in a portfolio. NFTs and related technologies are a key part of the Metaverse and will grow exponentially over the next decade. The performance of the asset class has already begun to deviate from the overall cryptocurrency market. Although historical data is limited, analysis from multiple sources indicates a low correlation between NFTs and cryptocurrencies, a highly desirable attribute in portfolio management. The correlation between different types of NFTs (such as collectibles and 1-of-1 artwork) is also low. Finally, given the nascent nature of the asset class, there is arguably plenty of room for alpha (ultra-high returns).

On the other hand, while we believe that NFTs as a broad asset class will expand significantly in the future, we suspect that most NFT projects will end up with little or no value. Moreover, the market is still dominated by big players. According to NFTGo data, only about 1,100 whales (big players) hold NFTs worth nearly $4 billion, accounting for about 23% of the total market value of NFTs. Not to mention brush trading, insider trading, hacking, scams, undisclosed advertising, get-rich-quick NFT projects, and more.

So, buyers beware. We suggest that, for most people, buying NFTs is primarily for utility, artwork, community, and other intangible benefits, not for potential price appreciation. Still, for those willing to venture further down the risk spectrum, selectively investing in NFTs can provide diversification benefits and help boost returns.

first level title

secondary title

Who is the holder?

secondary title

apes and penguins

price

price

The most common pricing metric for NFT projects is the “floor price” — the price of the cheapest asset on the market right now. Assets in NFT projects usually have different rarity characteristics, floor price items are usually the rarest but most liquid, in contrast, assets with higher rarity are usually less liquid.

secondary title

Celebrity buying and brand endorsements can trigger price increases

If an item does not give an official rarity guide,Rarity Sniffer、Rarity ToolsThese two items can evaluate the rarity of the item.

secondary title

Azuki Flooring Prices

secondary title

Dashboard to display NFT collection range

first level title

NFT: Still in Game 1

With the NFT buzzword entering mainstream discourse and the seemingly absurd prices of certain collections, some commentators have dismissed the entire industry as a bubble or a fad. Of course, there has been some hype and over-excitement, and the space is already filled with lofty promises and unfulfilled roadmaps.

However, in contrast to million dollar punks and derivative apes, NFTs simply encapsulate digital ownership of non-fungible and unique assets. In the real world, most of the items we buy and consume are irreplaceable, from high-value items like houses and cars to low-priced items like music and clothes. Digitally enabling these dynamics greatly expands what we can do online. Therefore, we reaffirm our belief that:The NFT-native digital economy is an important part of the broad metaverse.

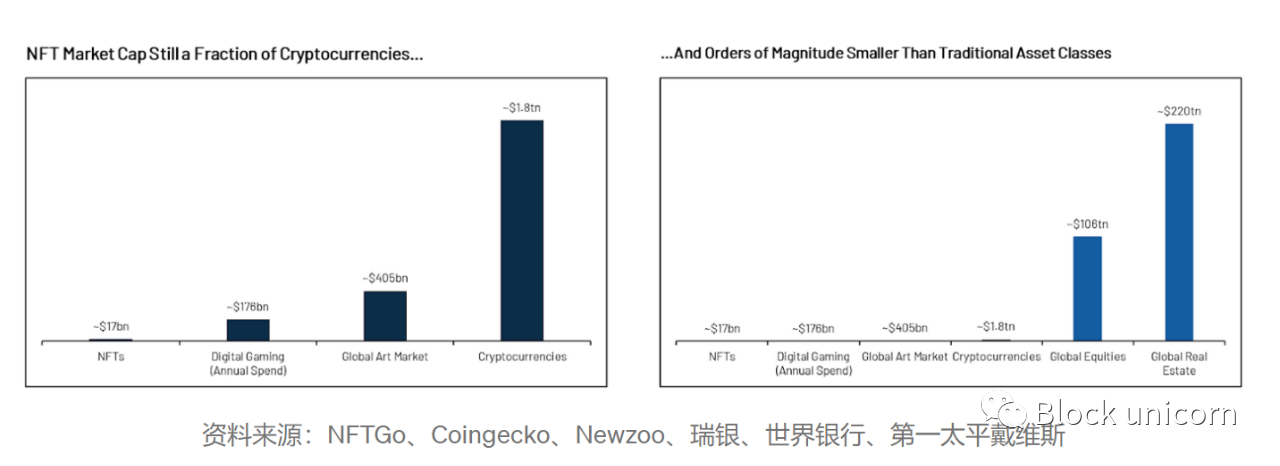

From this perspective, NFT has a long road to growth. The total global market cap of NFTs is estimated at around $16 billion, a far cry from the current TAM (Total Addressable Market) estimate of over $1 trillion. TAM's estimates may also underestimate the eventual market size, as NFTs enable a range of categories that were not previously possible online by granting ownership to a range of digital assets.

This report only scratches the surface of the rapidly evolving space, and we look forward to covering new projects and ideas that push NFTs into new territories in future reports.