This article takes stock of five LUNA derivatives, which one has the highest pledge return?

Original author: SJ, encryption KOL

Original compilation: 0xCC

This article is based on the views of encrypted KOL SJ on personal social media platforms, and BlockBeats organizes and translates them as follows:

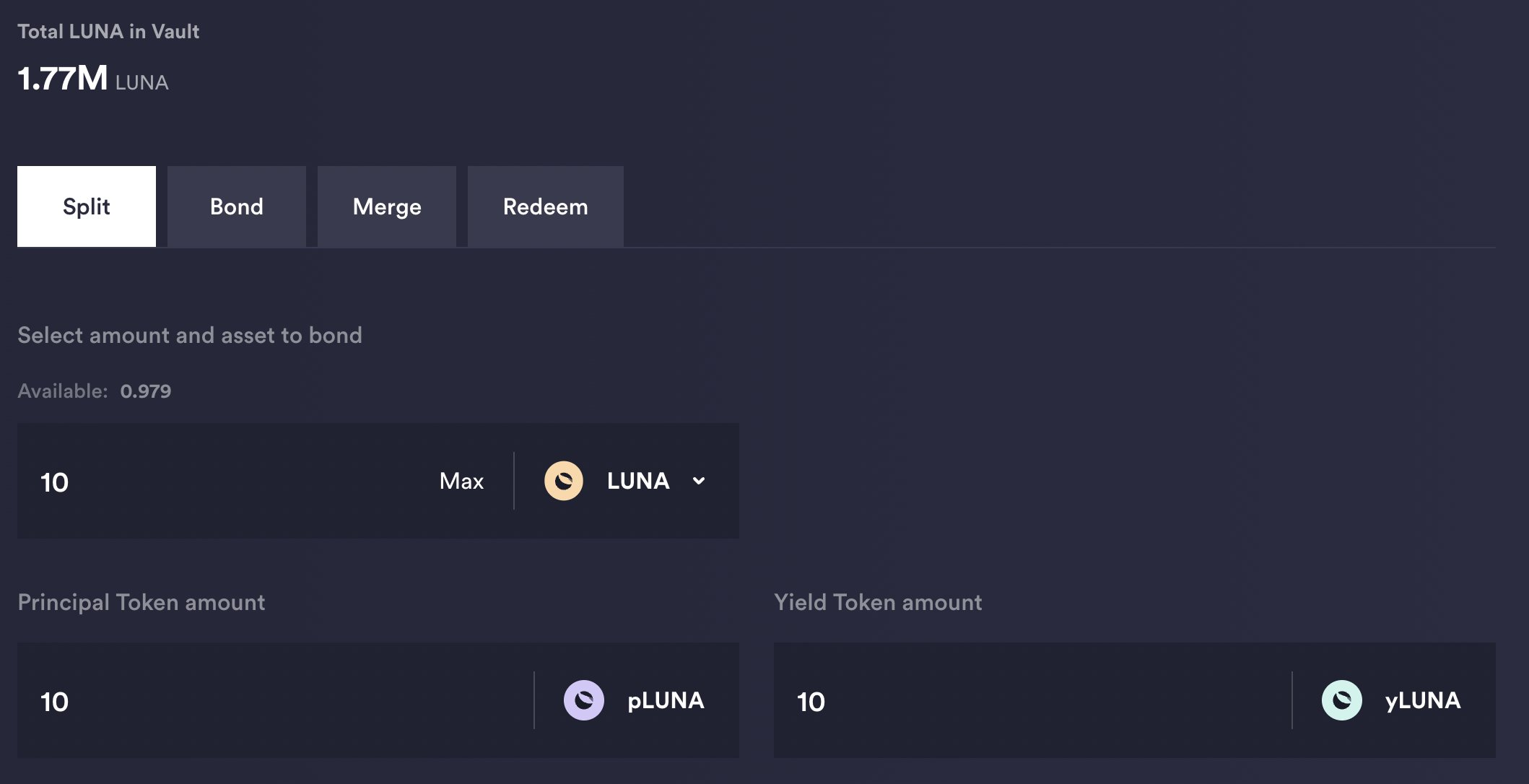

Today, there are bLUNA, stLUNA, LUNAx, nLUNA, cLUNA, yLUNA, pLUNA, and many more on the market. What are these derivatives of LUNA? How do I use them?

Except for cLUNA, nLUNA, and pLUNA, the rest are pledged derivatives. What does it mean? This means that you can get a lockup reward for holding them, and each reward will be slightly different.

image description

(Data source: APE BOARD)

Since stakers are not paid inflationary rewards, the yield increases when the price of LUNA falls and vice versa. This mechanism is unique to LUNA.

The table below shows the minimum yield of LUNA at different prices.

secondary title

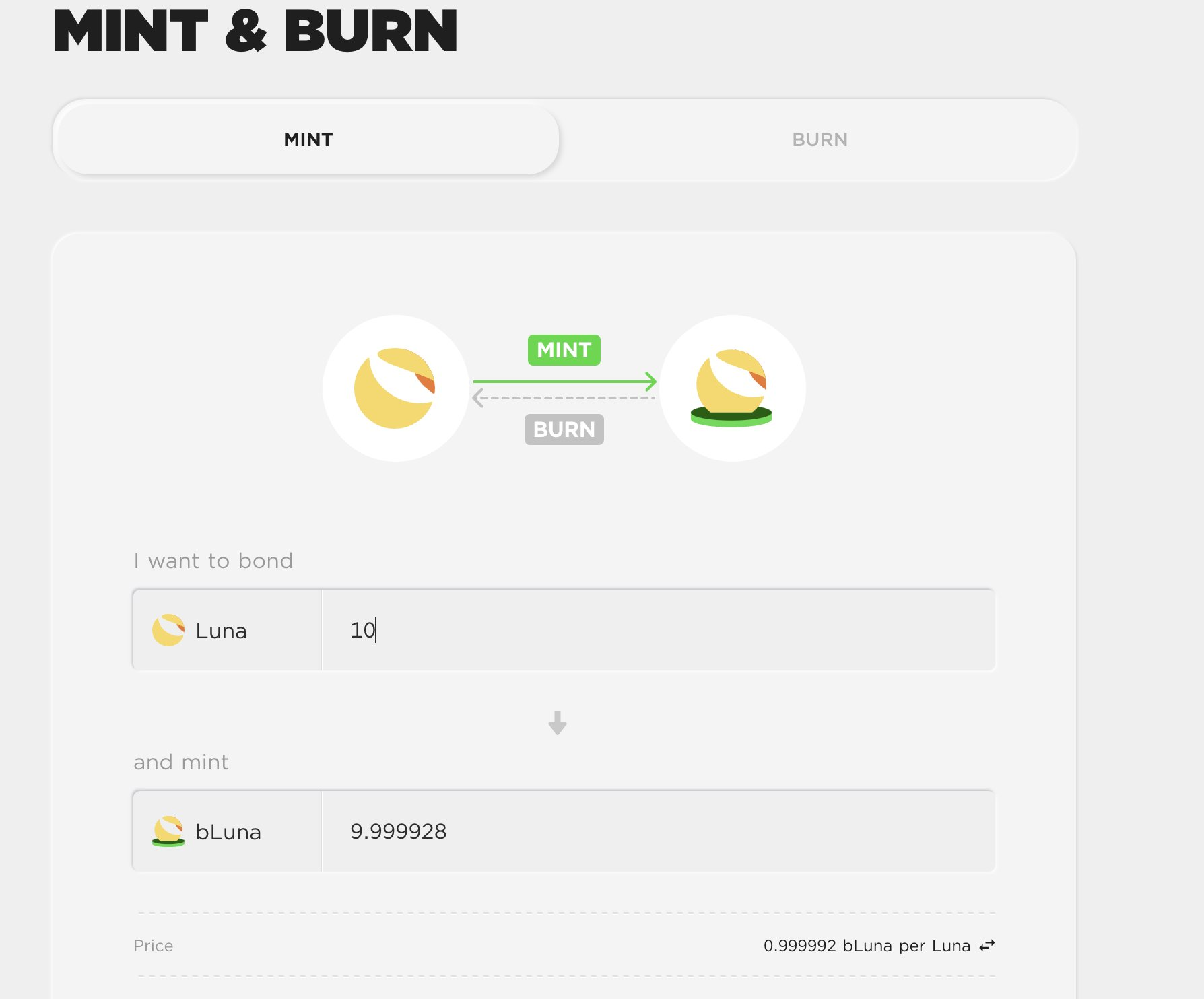

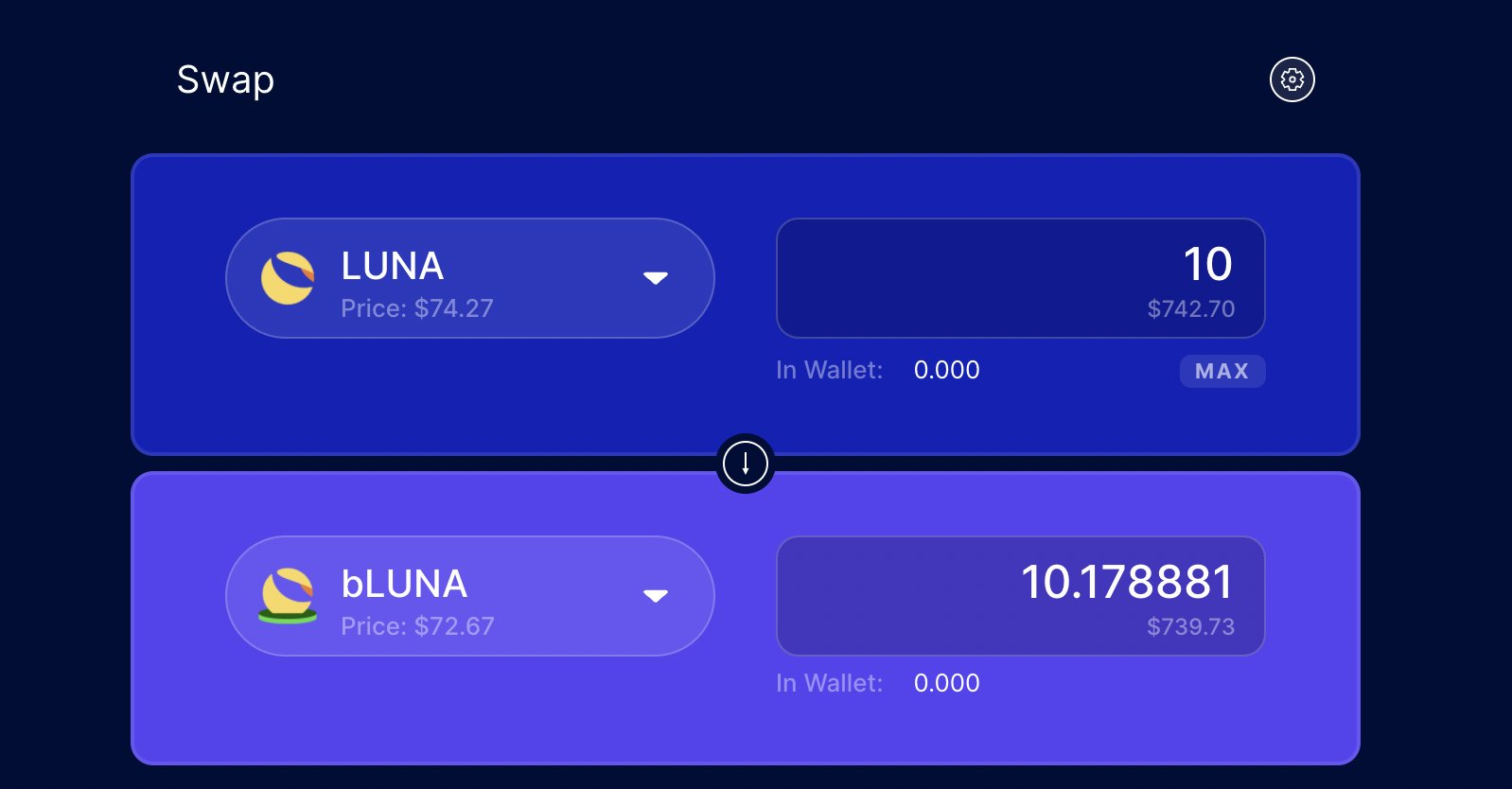

bLUNA

image description

image description

(buy bLUNA)

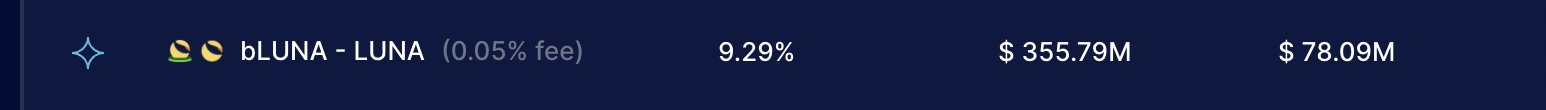

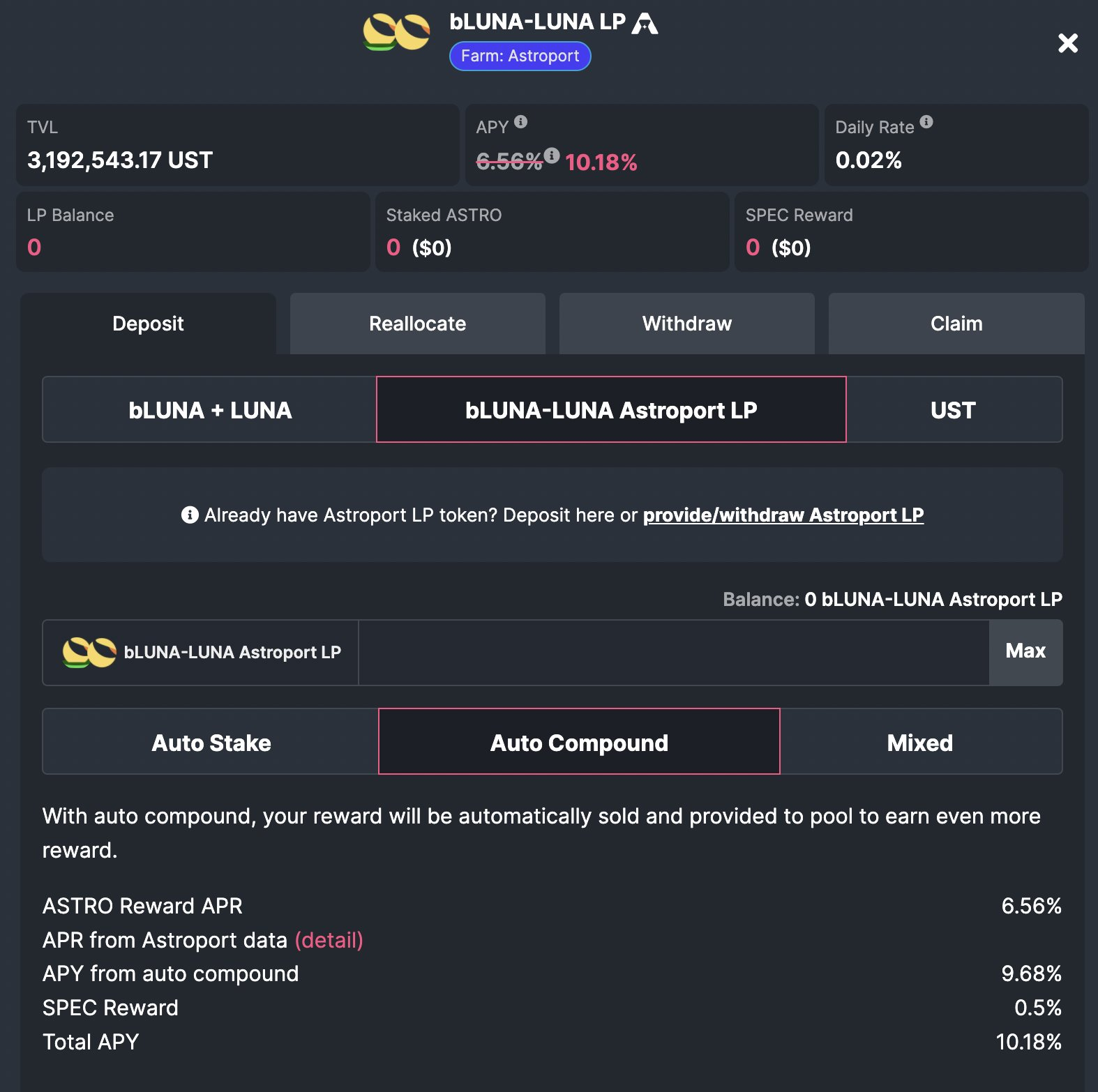

Once $bLUNA is held, staking rewards will be paid in UST and can be redeemed on the bASSET page on Anchor. You can also use bLUNA as collateral to borrow on Anchor, or form a bluna-luna currency pair to provide LP.

It should be noted that you will not be able to get most of the airdrops by doing this, and the rewards cannot be automatically compounded.

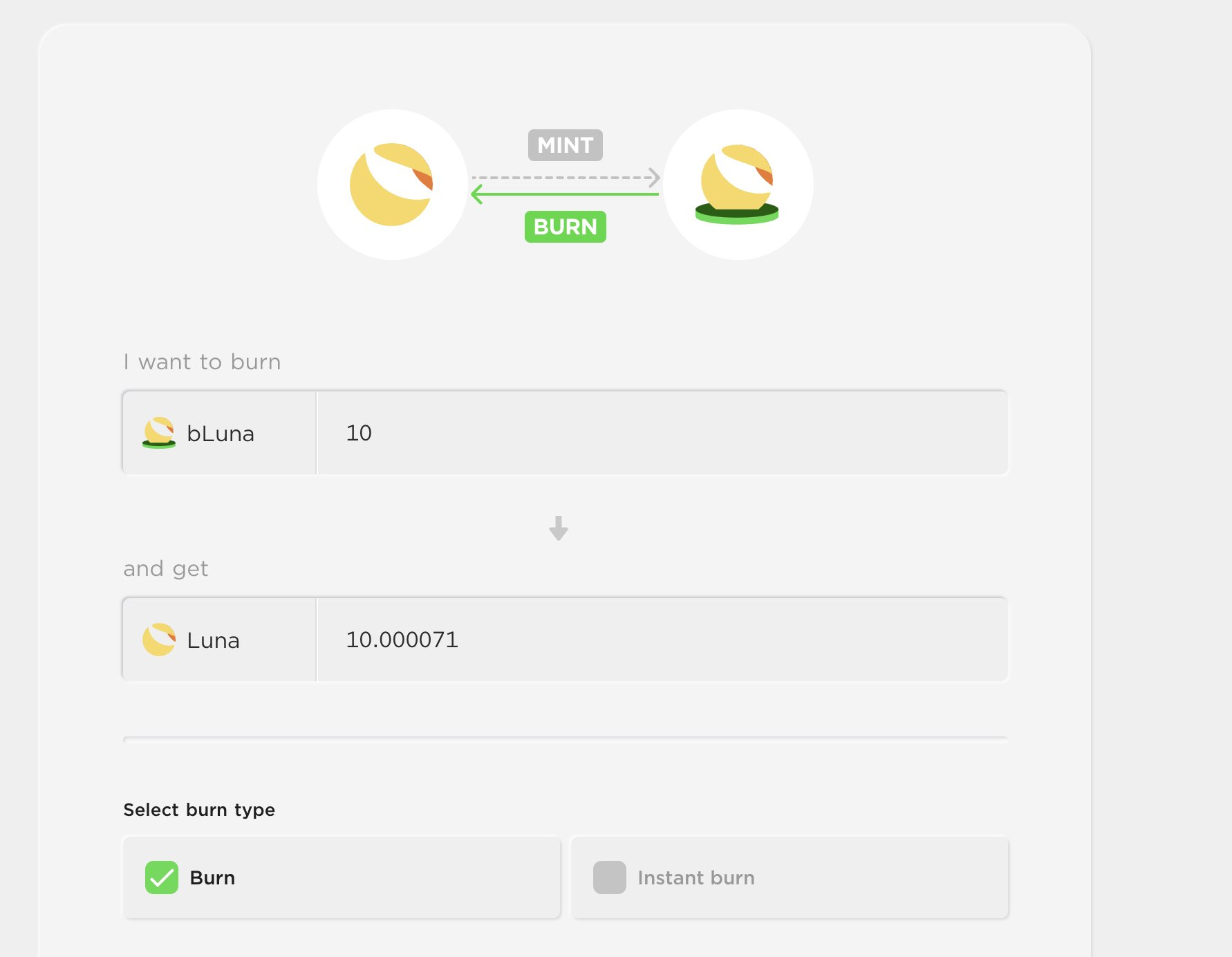

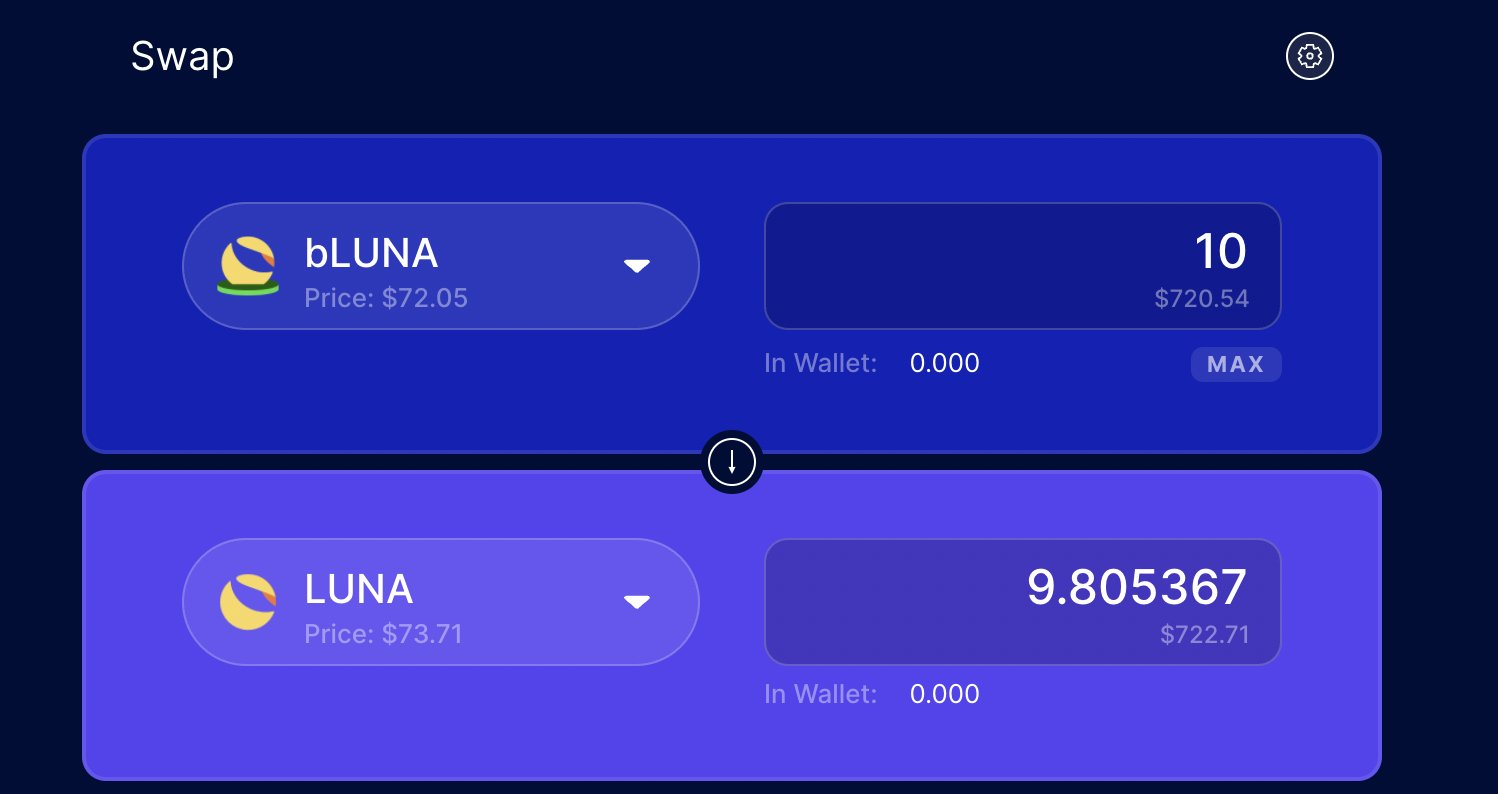

Trading on Astro or Terraswap, or destroying bLUNA on Anchor can get back normal LUNA.

Note that bLUNA-LUNA trades may have a premium, so you may not get the same amount of LUNA. You can also burn at a ratio of 1:1, but you will have to face a 21-day waiting period before you can withdraw.

secondary title

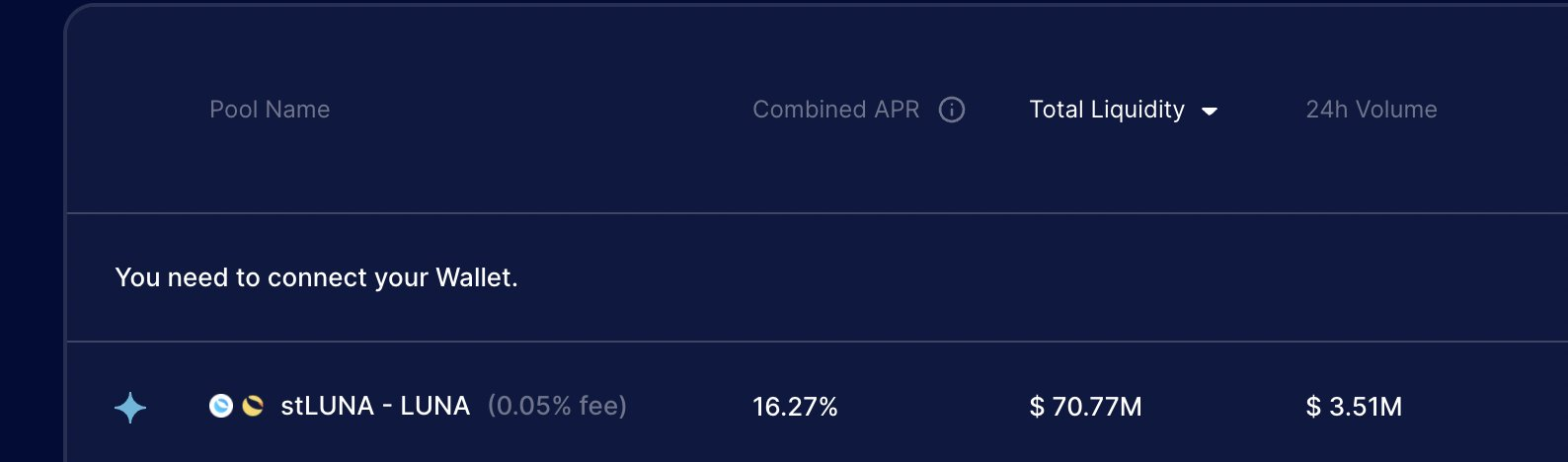

stLUNA

secondary title

LUNAx

LUNAx is Stader Labs' LUNA staking derivative. Staking rewards can be automatically compounded and can receive airdrops.

secondary title

nLUNA

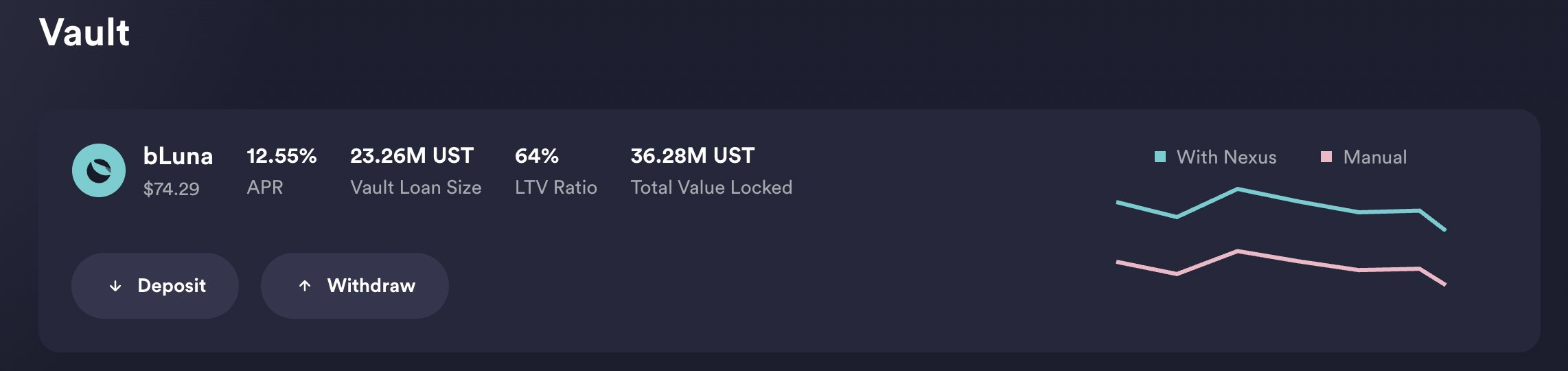

You can provide bLUNA to Nexus Protocol's bLUNA vault, and in return, you can get nLUNA, which represents your share in the vault.

secondary title

cLUNA、yLUNA、pLUNA

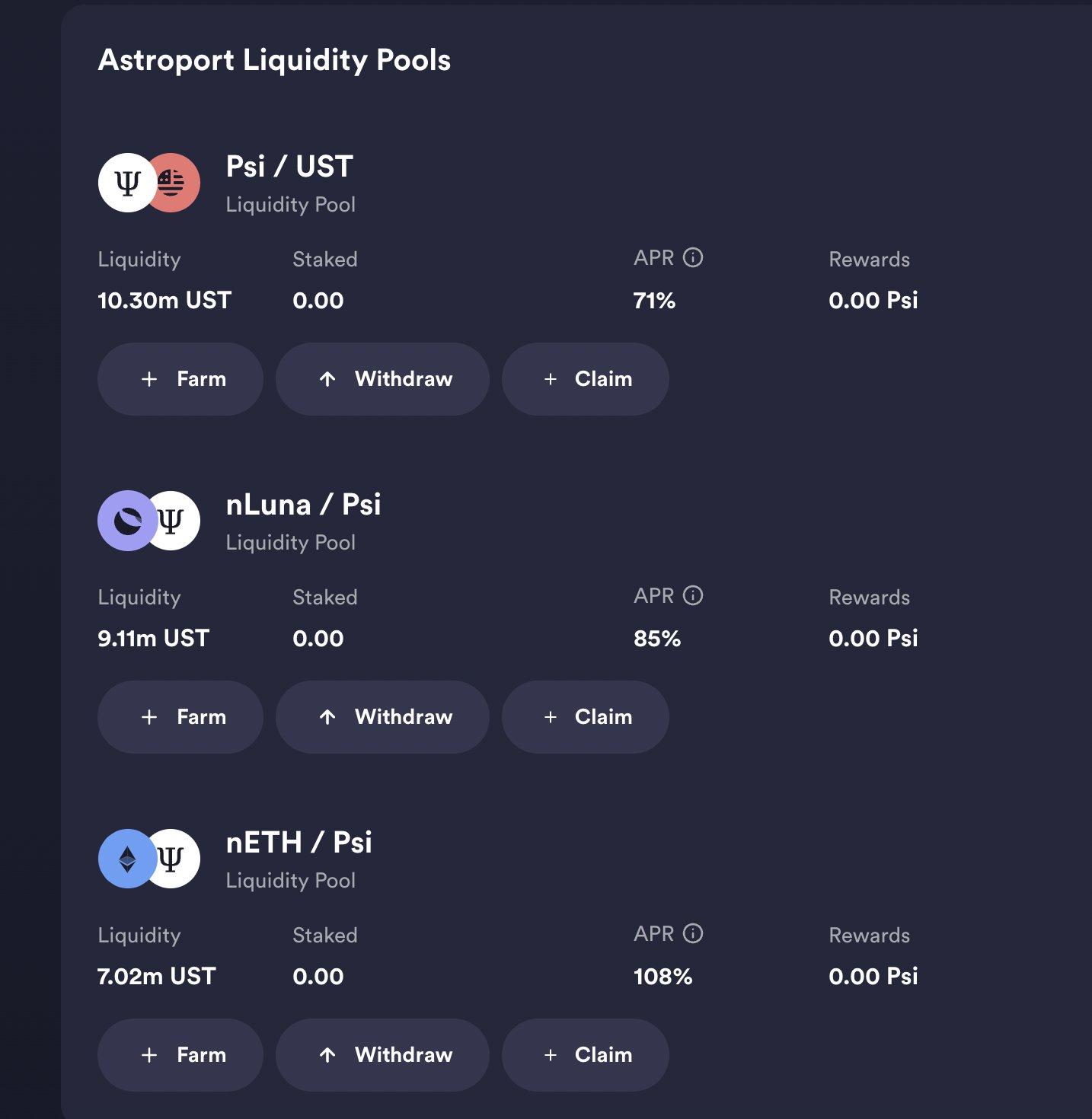

Using Prism Protocol, you can split LUNA or cLUNA into pLUNA and yLUNA. The reverse operation can also combine them. As shown below:

After the LUNA split, LUNA becomes a principal part (pLUNA) and a revenue part (yLUNA).

10LUNA = 10pLUNA + 10yLUNA

The prices of pLUNA and yLUNA depend on market demand, and yLUNA is more popular at present (as can be seen from the price).

Stake yLUNA to get staking rewards and airdrops. There isn't much more you can do with pLUNA, which is why most people prefer to swap it for yLUNA.

Merge pLUNA and yLUNA to get cLUNA, which basically represents your original LUNA in Prism. Users can also form LPs to provision to PRISM pools.

References:

References:

https://app.alphadefi.fund/farmers-market