Solidarity, donations, sanctions, the choice of the encryption community under the flames of "Russia-Ukraine" war

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

Author | Qin Xiaofeng

Editor | Hao FangzhouProduced | OdailyOn February 24, Russia took military action against Ukraine.

This war has had an impact on global finance, and encrypted finance has not been spared. On the same day, the price of Bitcoin once fell below $35,000, hitting a new low in more than a month.

Analysts believe that Bitcoin sell-off sentiment may intensify further until tensions in Eastern Europe subside.

However, as the United States and the European Union announced that they would not intervene militarily in the situation in Ukraine (currently only economic sanctions are the mainstay), the global financial market generally stopped falling and rebounded.

In addition to price fluctuations, the "Russia-Ukraine" war also engulfs the entire Crypto industry: solidarity, donations, bans, and sanctions. The concept of "decentralization" exposes many vulnerabilities in the face of national sovereignty.

secondary title

1. Cryptocurrencies become a safe haven in Ukraine

As the Russia-Ukraine conflict heats up, Ukrainians are looking to cryptocurrencies as a safe haven for their assets.

According to CoinGecko data, as Russia took military action, the trading volume of Kuna, a local Ukrainian crypto exchange, more than tripled in 24 hours (note: Kuna has about 40,000 active accounts, 90% of which belong to Ukrainian residents).

However, due to the centralized rectification and banning of a number of encryption trading platforms in Ukraine in the second half of last year (on the grounds that the process of exchanging fiat hryvnia for cryptocurrency may involve money laundering), the number of local encryption trading platforms has shrunk significantly. During this crisis, the exchange demand of Ukrainian residents has seriously exceeded the available supply of exchanges, and the premium of cryptocurrencies has soared.

The trading price of Bitcoin on the Kuna exchange was as high as US$42,106, which was US$3,000 higher than that of other encrypted exchanges; USDT was once as high as US$1.08, while the average price of other exchanges was US$0.99, with a premium of 9%.

Why Ukraine "prefers" cryptocurrencies? The reason is the sharp depreciation of Ukrainian fiat currency and the relatively clear Bitcoin regulatory framework.

In September last year, the Ukrainian Parliament passed the Virtual Assets Act, which stipulates that virtual assets cannot be used as a means of payment in the country, but citizens can legally hold and trade them. On February 17 this year, Ukrainian Minister of Digital Transformation Mikhailo Federov (Mykhailo Federov) stated on Twitter that Ukraine officially announced the legalization of cryptocurrencies such as Bitcoin.

In today's turbulent situation, Ukraine's fiat currency credit system is on the verge of collapse, and the public is more inclined to choose to hedge traditional financial risks through cryptocurrencies such as USDT. Especially on the eve of the war, in order to prevent the outflow of funds, the Ukrainian government limited the daily cash withdrawal amount to 100,000 hryvnias, which further stimulated the people to convert legal currency into cryptocurrency.

“Ukrainians are facing a financial panic and they want to get rid of cash. Here, your cash can’t do anything. We don’t trust the government, we don’t trust the banking system, we don’t trust the local currency. Most people have no choice but cryptocurrencies.” Kuna In a worst-case scenario, Ukraine’s internet and entire banking system could collapse, and cryptocurrencies could be a safe haven, according to founder Michael Chobanian.

secondary titleVitalik Buterin2. Crypto field donated more than 36 million U.S. dollars to Ukraine

The situation in Russia and Ukraine has affected all parties, and the encrypted world is also actively paying attention to the development of the incident.@KremlinRussiaTwo weeks ago (February 11), the founder of Ethereum

(V God) called on Russian President Vladimir Putin not to invade Ukraine on Twitter in his native language (Russian)."The attack on Ukraine will only hurt Russia, Ukraine and humanity. Whether the situation will return to the path of peace or war, it is not Zelensky (President of Ukraine) nor NATO that can decide now, but. I hope they choose wisely. V God said. In the tweet, V God tagged the Kremlin Twitter account @KremlinRussia, but did not receive a response.

February 24,

V God

Tweeted again: "Putin's decision to abandon a peaceful resolution of the dispute with Ukraine and choose war is a crime against the people of Ukraine and Russia. I want to wish you all peace, although I know you will not feel safe now. Glory to Ukraine. He then added, "Ethereum is neutral, but I am not," showing his firm support for Ukraine's political stance.

Although some practitioners have not expressed their political stance as clearly as V God, they have donated to Ukraine from a humanitarian perspective.

Donations are mainly divided into four ways: one is to donate through the official account of the Ukrainian government; the other is to donate through the non-governmental organization Come Back Alive; the third is to donate spontaneously through UkraineDAO; the fourth is to donate actively by major blockchain companies.

(1) Uzbekistan official address: 10 million US dollars

On February 26, Ukrainian Deputy Prime Minister and Minister of Digital Transformation Mykhailo Fedorov announced on Twitter that he would accept cryptocurrency donations, and announced the donation addresses of BTC, ETH and USDT (TRC20):

BTC address: 357a3So9CbsNfBBgFYACGvxxS6tMaDoa1P;

ETH address: 0x165CD37b4C644C2921454429E7F9358d18A45e14;

Come Back AliveUSDT (TRC20) address: TEFccmfQ38cZS1DTZVhsxKVDckA8Y6VfCy.

V God then confirmed the legitimacy and authenticity of the above address through multiple sources. As of now, the donation address of the Ukrainian government has received 113 BTC and 2,001 ETH, totaling nearly $10 million.

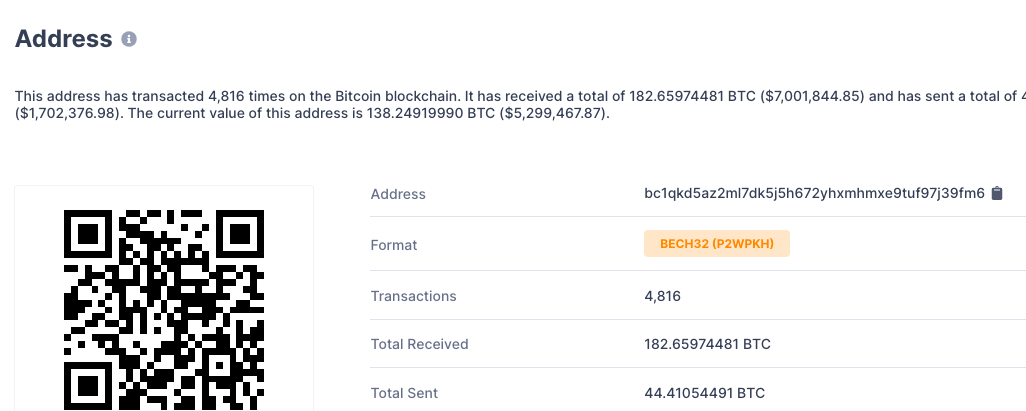

(2) Armed group Come Back Alive: $7 million

Blockchain.com Founded in 2014, it is a non-governmental organization that mainly raises funds to provide armor and medical equipment for Ukrainian fighters.

According to research by blockchain analysis company Elliptic, throughout 2021, the organization has received a total of $570,000 worth of Bitcoin donations; after the second half of last year, monthly donations were only $5,000, but starting around February 22 this year, Donations have exploded. After the Feb. 24 clashes, the group received $400,000 in bitcoin donations in a single day, with the average amount ranging between $1,000 and $2,000.

However, due to the strong military attributes of the organization, it was "titled" by the crowdfunding platform Patreon and its fundraising activities were suspended. Patreon removed the NGO's page from its website, adding: "Patreon does not allow funds raised on its platform to be used to support violence or purchase military equipment,"

According to the data, as of now, the bitcoin wallet of "Come Back Alive" has received 182 bitcoin donations, worth about 7 million US dollars.

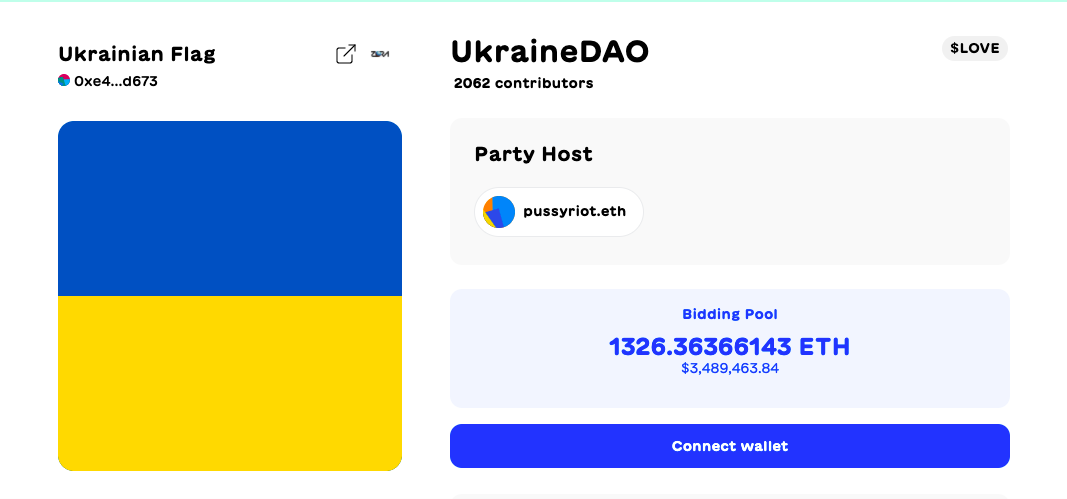

(3) UkraineDAO: $3.49 million

Ukraine DAOOn February 25, Nadezhda Tolokonnikova, a political activist and founding member of punk rock band Pussy Riot, announced the launch of Ukraine DAO with members of Trippy Labs (Trippy Jetpack DAO) and PleasrDAO.Party Bid Pussy Riot tweeted, "Our goal is to raise funds, donate to Ukrainian civil organizations, and help those who suffer from Putin's war in Ukraine. We will buy a Ukrainian flag NFT."

According to Tolokonnikova, the Drop will include 10,000 Ukrainian flag NFTs minted on Ethereum, and all proceeds will be donated to the Return Alive Foundation and the non-governmental organization Proliska (which mainly helps residents near the contact line in eastern Ukraine). Additionally, the project will release a unique flag NFT to allow for greater contributor participation.

It was quickly recommended by V god, and in

(4) Crypto institutions/KOL donationsZhao ChangpengRepresentatives of some encryption institutions and companies also extended a helping hand to Ukraine.

CEO of BinanceKris Marszalek Zhao Changpeng

CEO of Crypto.comJustin SunCrypto.com has donated $1 million to the International Committee of the Red Cross (ICRC) to help the people of Ukraine. He also urged the crypto community to do what it can to support humanitarian initiatives.

Founder of TRONSam Bankman-Fried(SBF)Justin Sun

Said that TRON DAO donated 200,000 US dollars to the Ukrainian people in the form of TRON USDT.Gavin WoodCEO of crypto exchange FTX

Founder of Polkadot

Said that if Ukraine releases the Polkadot address, it will donate $5 million.

At present, more institutions are announcing assistance plans one after another, and we will update the list in time.

secondary title FlexPool 3. Russia is facing "encryption sanctions"

With the opening of the Russia-Ukraine war, the United States, the European Union and others have successively announced severe economic sanctions against Russia. Last Friday, Russia was kicked out of the global payment system SWIFT (Worldwide Interbank System) by many countries. Now, the wave of sanctions against Russia has swept the encryption market, how will the encryption institutions respond?

The fourth-ranked Ethereum mining pool with more than 5% of the computing power of the entire network Whit GibbsReact first. According to the announcement, the mining pool will cancel all IPs from Russia for mining.

Said that the company's own facilities in Russia are "completely isolated from any geopolitical turmoil" and "unless sanctions affect mining pool providers, it is unlikely that the computing power will go offline."

according toBloombergAccording to data from the Cambridge Alternative Finance Center, as of July 2021, Russia accounts for more than 11% of the global bitcoin computing power. It is still unknown whether it will shut down in the future.

according toMaria AgranovskayaBloomberg

According to reports, J. Ashley Ebersole, a partner at the law firm, believes that all centralized cryptocurrency platforms that register with any national agency such as the US SEC and FinCEN and provide currency trading services must comply with US sanctions. However, crypto exchanges have had mixed responses to Russian sanctions.

Binance Exchange Representative and Lawyer in Russia

Said: "As of today the government has not announced any specific initiatives involving cryptocurrencies, the UK has set certain restrictions on banks for Russian citizens, but this has nothing to do with cryptocurrencies. Maybe it will affect cryptocurrencies at some point, but no Now."

Binance told Bloomberg: “We have assembled a dedicated global compliance task force, including world-renowned sanctions experts, and are taking the necessary actions to fully comply with any sanctions while minimizing harm to innocent users. Influence."

Another crypto platform, Gemini Trust Co., is said to have complied with U.S. sanctions by not operating in Russia and Ukraine. Gemini Trust said: "We are conducting a rigorous review of customer accounts and activities to reduce risks associated with sanctioned parties or territories and will take appropriate action where necessary."

Alesia Haas, Coinbase's chief financial officer, said: "We do not have a very specific forecast at this time on how this event will affect the cryptocurrency economy. It is not a material part of our business and will not have an impact on our financial condition."

The Ukrainian government's encryption request was first responded by the NFT platform DMarket. The platform announced that, as a start-up company born in Ukraine, it has decided to sever all ties with Russia and Belarus: Russian and Belarusian users are prohibited from registering on the platform; previously registered user accounts in these regions are frozen; all assets and skins remain in the user account, but access to its use is currently restricted; the platform no longer supports Russian rubles. If someone's account is frozen by mistake, or they are not citizens of Russia or Belarus, please confirm through KYC, and the platform will reopen their account.

write at the end

With the exception of DMarket, Mykhailo Fedorov’s “demand” has not been widely responded to by the crypto community, with Kraken CEO Jesse Powell responding that such an action cannot be taken without a legal requirement. But he added that Russian users should be aware that such an order "may come soon."

secondary title

write at the end