Weekly Editors' Picks (0305-0311)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

secondary title

Now, come and read with us:

invest

Investing Essentials: How to Evaluate a Project’s Token Supply?

invest

Investing Essentials: How to Evaluate a Project’s Token Supply?

"Most protocols will distribute a large part of the tokens as LP rewards. On the surface, this approach is very community-based. Anyone can buy tokens, create liquidity, and participate in staking to earn more Multi-token, however, this approach may also help the founding team or insiders significantly increase their token share.”

Bear Market Survival Guide: How to Get the Most Out of a Bear Market?

"In a bear market, there is no longer a steady stream of funds flowing in, which becomes a competition between players and players, which is a zero-sum game." In a bear market, poorer projects and teams are eliminated, but the advantage is that they can It’s cheaper to accumulate good cryptocurrencies, and at the same time, instead of checking your portfolio countless times a day, you have more time to build your skill set.

DeFi

The article also talked about how to increase off-market earning power or create a second source of income, upgrade DeFi skills, and cultivate the ability to predict bear markets, etc.

Do you really understand the token economy of top DEX?

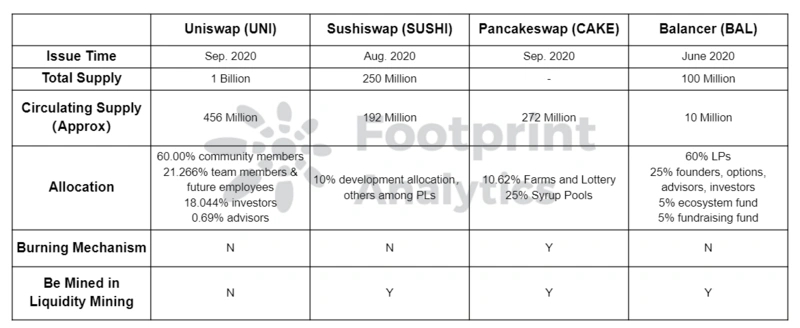

Footprint's new research report, this time focusing on the token economy, compared the top 5 DEXs (Curve, Uniswap, Sushiswap, Pancakeswap, and Balancer) by TVL horizontally. In terms of currency prices, as of February 25, the BAL currency price is the highest, about 12 US dollars. Secondly, UNI is about $9, and the overall currency price of DEX is not high. In terms of market capitalization, UNI ranks first with US$4.2 billion. From the perspective of daily trading volume, the daily trading volume of UNI, SUSHI, and CAKE are all in the forefront. The final conclusion is that only a truly valuable protocol can add more TVL to the platform through the incentive policy of liquidity mining, and make the platform more decentralized through the community. Attached is the economic comparison table of UNI, SUSHI, CAKE, and BAL tokens↓

Talking about the half-life of DeFi games: How does the protocol complete self-salvation?

The article believes that "all DeFi projects are actually GameFi. Since it is a game, it will naturally face customer losses, and they all have their own half-life." The similarities between the two include: the isomorphism of activities (that is, both are all about maximizing rewards), the nature of competition between players, overlapping communities, same analytical skill set.

At the end of the article, suggestions are given on "how the protocol can make itself as invincible as possible": 1. Make it unsolvable; 2. Continue to build the protocol on it; 3. Let the protocol evolve by itself.

I really like this DeFi industry article by Rhythm. "In AC's view, "Deposit And Forget" is the spirit and soul of DeFi products. "

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

Return 250 times in half a year, 8 experiences teach you how to invest in NFT

Avoid the "contact effect", distinguish between short-term speculation and long-term holding, sell "speculative NFTs" when/before the hype is the highest, and judge blue-chip NFTs based on team, community, artistry/practicability, partnerships, and holders. Hold NFT derivatives for a long time, make good use of tools, focus on creators rather than big V, and judge the NFT macro cycle.

As the NFT market ecosystem heats up, with increasingly diverse customer bases and use cases, it is challenging for a market to maintain such a large market share. This was also the case in the Web2 field, where a new generation of professional players will begin to replace the dominant position of the original leader (such as eBay).

Web 3.0

In-depth analysis of Arweave: Web3.0 storage breaker

Ethereum and scaling

Ethereum and scaling

4D Interpretation of the Past and Present of Ethereum's Scalability

“Ethereum wants to use both layer 1 and layer 2 solutions to solve the scalability trilemma, sharding is Ethereum’s layer 1 solution, and Rollup is Ethereum’s layer 2 solution.”

stable currency

Leaked Biden directive focuses on stablecoins? How Much the Fed Loves Stablecoins

DAO

secondary title

The New York Times looks at DAO: When reality invades the vision of crypto utopia

The reality of setting up and running these DAOs is often complex. A lot of the problems with DAOs usually stem from the anonymity of DAOs and cryptocurrencies. "VCs based in the digital world are connected to the real world. We need to comply with laws and regulations."

hot spots of the week

secondary titlehot spots of the weekIn the past week, Biden signedExecutive Order Regarding CryptocurrenciesSingaporeSwitzerland、Singapore、Japan、European UnionJapanEuropean Union,Regions such as Russia have extended financial sanctions against Russia to the encryption field, Coinbase,Commitment to Comply with Sanctions LawBlock more than 25,000 Russian-related addressescentral bank of russia,Ordinary Russians and financial institutions banned from using cryptocurrencies, NYDIG says;Ukrainian Citizens Turn to Bitcoin for Everyday Purchases Amid ConflictUkraine Has Received Nearly $100 Million in Crypto DonationsTiger Global FundBain CapitalGoldman SachsGoldman SachsBinanceProvide ETH funds to customers through Galaxy Digital,BinanceTo "bigger the encryption industry" plan to enter the traditional market through large-scale mergers and acquisitions;Bitcoin's Third Largest WhaleBuy 750 BTC at a low cost of about 29 million US dollars,TerraTotal locked positions of EthereumFor the first time, the proportion of all networks fell below 55%,On TVL broke through the record high;Andre Cronje and Anton Nell Exit the Crypto Field、, will terminate 25 apps and services on April 3 (attachedAC "Biography"Whether the underlying assets are affectedJustin Sun suspected of insider trading and other chargesJustin Sun responded, the FBI and the Internal Revenue Service have launched investigations,OpenSeaJustin Sun respondedClaiming that he spread rumors, he has hired a top US law firm to pursue his legal responsibility;A system that can automatically verify NFT series is being designed,Azuki Fragmentation Project BobuCompleting the casting issue,zkSyncPortal

With "Editor's Picks of the Week" seriesPortal。

See you next time~