币安计划大举并购进军传统市场,目标是「做大加密行业」

本文来自英国《金融时报》,原文作者:Joshua Oliver & Philip Stafford & Siddharth Venkataramakrishnan

Odaily 星球日报译者 | 念银思唐

币安正计划大举收购,以进军新市场。与此同时,其庞大的数字资产交易平台正受到监管机构的持续审查。

币安首席执行官赵长鹏在接受采访时表示,作为数字资产行业最大的公司之一,币安今年早些时候对美国商业刊物《福布斯》(Forbes)进行 2 亿美元战略投资后,正寻求收购在传统市场运营的业务。

“我们希望在每个经济领域确定并投资一到两个目标,并尝试将它们引入加密领域,”赵长鹏表示。他补充说,推动媒体等行业的一家公司接受加密将加剧竞争,并促使其他现有集团纷纷效仿。

在币安推出这一收购业务之际,其核心交易业务已受到一系列监管指责。赵长鹏表示,币安约 90% 的总收入来自交易费,而交易费随比特币和其他加密货币的价格波动。

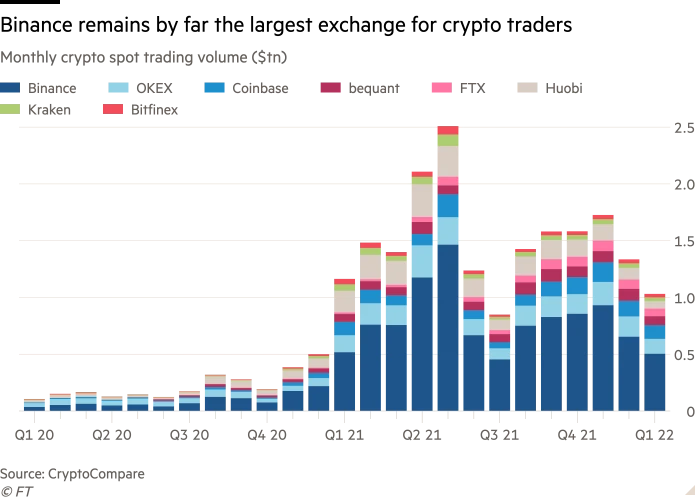

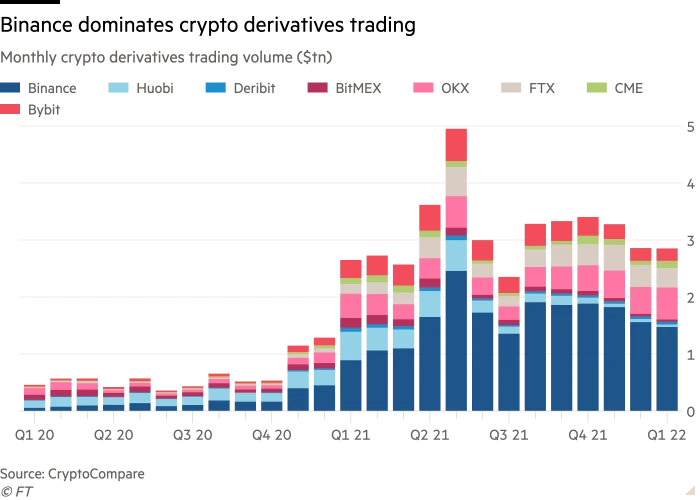

在开曼群岛注册的币安是加密交易领域的主要参与者。根据 CryptoCompare 的最新数据,币安 1 月份的现货加密交易额略高于 5000 亿美元,位居首位,是第二名的近四倍。其 1.5 万亿美元的名义加密衍生品交易量是第二名的两倍多。

去年,世界各地的监管机构就在币安交易的消费者面临的风险发出了警告。他们还对该组织防止洗钱的程序表示担忧。

赵长鹏表示,该公司正在聘用数十名合规和执法专业人员,并使用银行合规部门使用的客户检查软件。他补充称,该交易所目前在英国有 70 名员工,其中许多人专注于监管问题。

然而,币安一再与英国监管机构——金融市场行为监管局(FCA)发生冲突。FCA 在 2 月中旬表示,它对币安与支付提供商 Paysafe 达成的一项协议感到“担忧”,该协议旨在让币安重新获得一家大型英国支付网络的接入权。去年夏天,该交易所被切断了与该支付系统的联系。

本周,FCA 还对币安的“复杂和高风险金融产品”发出了新的警告。币安最近向加密货币公司 Econex 提供了 3600 万美元的可转换贷款,该公司很可能成为 Econex 的子公司 DigiVault 的受益所有人。对此,FCA 官网发布公告称:“Binance Markets Limited 目前不得在未经 FCA 书面同意的情况下从事任何受监管的活动。Binance 集团提供复杂和高风险的金融产品,对消费者构成重大风险。如果 FCA 认为该合同不合适,则 FCA 可以采取措施暂停或取消其加密资产业务的注册。FCA 还有权以多种理由暂停或取消公司的加密资产注册,包括公司未遵守《洗钱条例》规定的义务。”

币安曾试图通过一家位于伦敦的关联公司进入 FCA 批准的数字资产公司名单,但去年撤回了申请,因为 FCA 要求“全面披露”并提交数百页与反洗钱控制有关的文件。FCA 后来表示,币安的英国子公司未能回应其一些基本询问。

话分两头。币安此次宣布进军传统领域可能会扩大其商业利益。作为这一战略的一部分,币安向《福布斯》投资了 2 亿美元,获得了两个董事会席位。赵长鹏表示,币安现在将瞄准其他行业,如零售、电子商务和游戏。

尽管进入了新的业务领域,但赵长鹏表示,他并没有试图把币安打造成一个“企业集团”。相反,他认为该公司正在打造将数字资产整合到现有行业的基础设施。

“我们的战略是要把加密行业做大,”赵长鹏说道。