Comprehensive interpretation of the status quo of Uniswap V3: Can multi-chain development regain the lost ground of DEX?

After the launch of Uniswap V3, the first thing that attracted attention was the improvement of the capital efficiency of liquidity providers through liquidity aggregation. After more than half a year of development, PANews discovered a feature that might have been overlooked at one time—customizable transaction fees, making Uniswap a near-monopoly position in the transaction volume of DEX. By analyzing the transaction data of Uniswap and other DEXs, we found that the current advantages of Uniswap V3 include:

• Provide lower transaction fees, 72.31% of transactions occur in transaction pairs with a 0.05% transaction fee.

• Due to the increase in trading volume, the liquidity provider's income for the 0.05% transaction pair is higher than that of the 0.3% transaction pair.

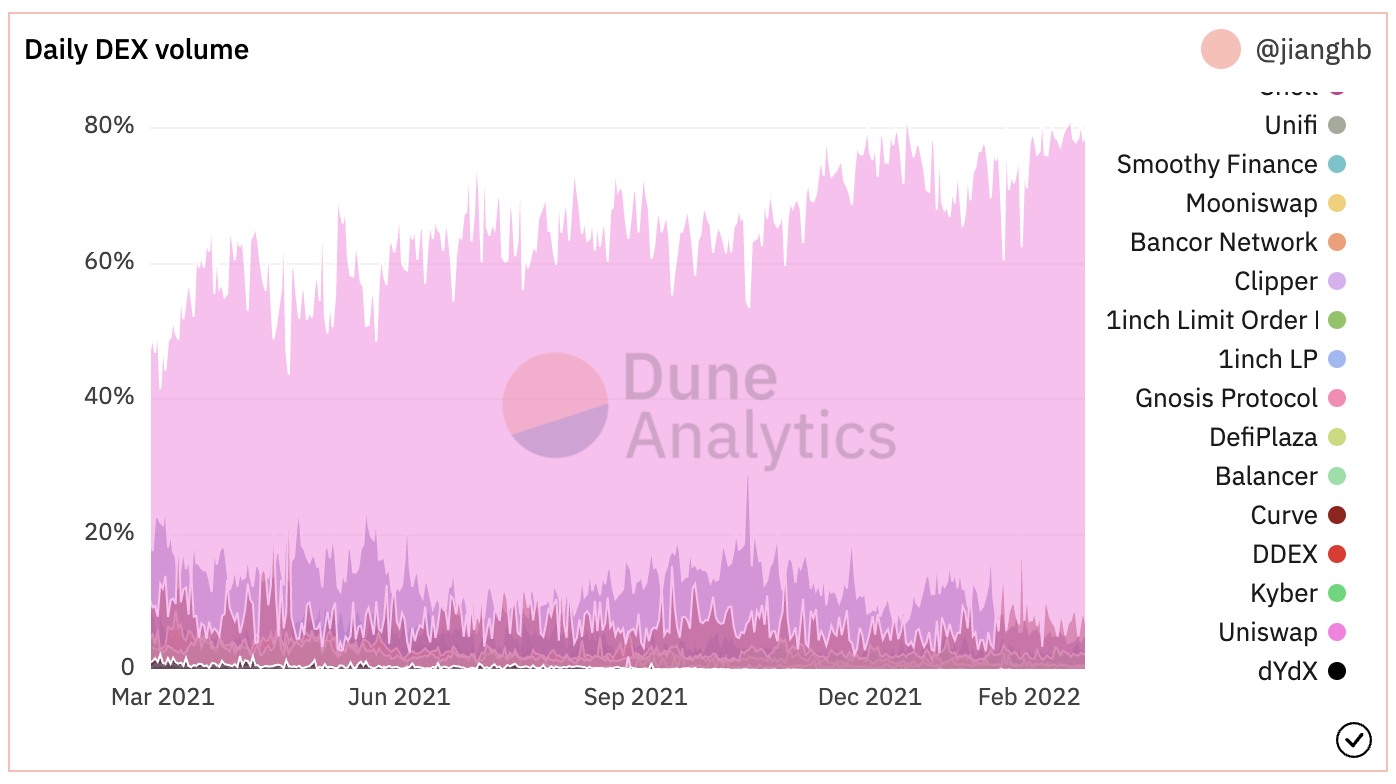

• The proportion of Uniswap's transaction volume on Ethereum increased from 47.2% to 80.4%, while the total transaction volume of other DEXs decreased during the same period.

• In the USDC/USDT trading pair, Uniswap V3 has a better conversion ratio than Curve in transactions of hundreds of billions of dollars.

first level title

Uniswap V3 transaction volume distribution: 0.05% transaction fee accounted for 72.31%

In common DEXs, the general transaction fee ratio is 0.3%, and Uniswap V3 can not only improve the liquidity of transactions and reduce slippage through liquidity aggregation, but now also improves its own trading through lower fees. Competitiveness in regular transactions.

According to the data of Uniswap V3 that occurred on February 23, 2022, in the past 7 days, there were 45 trading pairs with a trading volume of more than $10,000. Among them, 15 have a handling fee of 0.05%, mainly trading pairs between ETH and stablecoins or stablecoins; 4 have a handling fee of 0.01%, all of which are trading pairs between stablecoins; There are 20 trading pairs with a fee ratio of 0.3%, including trading pairs composed of commonly used assets and ETH; there are 6 trading pairs with a fee ratio of 1%, and their TVL and other data are all low.

From the perspective of trading volume, the sum of the trading volume of these 45 trading pairs in the past 7 days was 10.4 billion US dollars. Among them, the transaction volume brought by the 0.05% handling fee has accounted for the vast majority. The transaction volume in the past 7 days was 7.54 billion US dollars, accounting for 72.31% of the total transaction volume. Followed by trading pairs with a 0.3% handling fee, the trading volume was 2.03 billion US dollars, accounting for 26.92%. The transaction volume of stablecoin trading pairs corresponding to 0.01% handling fee only accounted for 7.73%, while the trading volume of 1% handling fee only accounted for 0.5%.

first level title

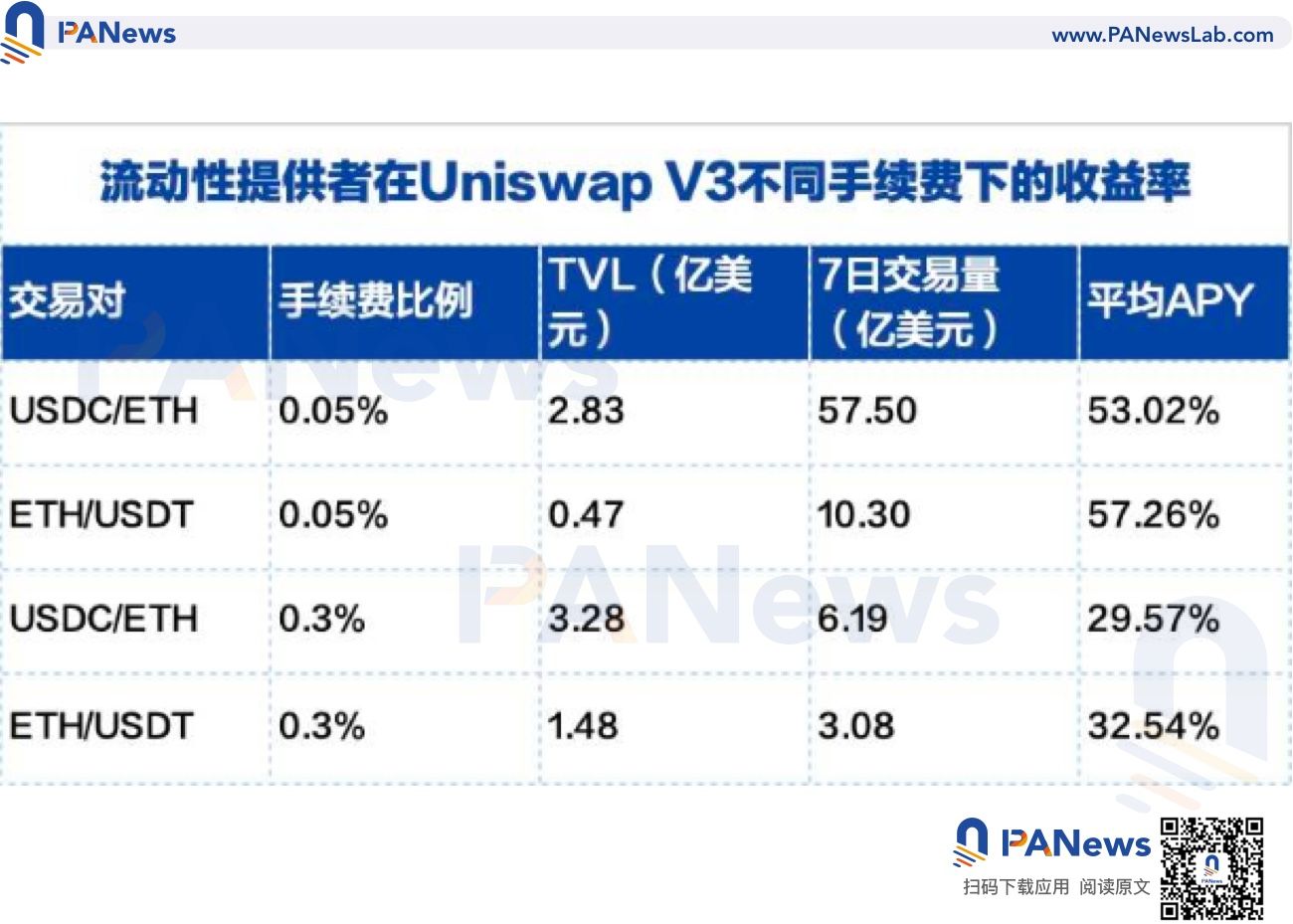

Liquidity provider: The average APY of a liquidity provider with a handling fee of 0.05% is higher than 0.3%.

Under the 0.05% handling fee, there are two possibilities for the income of the liquidity provider. One is that the income of the lower handling fee will reduce the income of the liquidity provider, and the other may be caused by the low handling fee. More trading volume, making profits increase.

What is the actual situation?

PANews compares the transactions of USDC/ETH and ETH/USDT with the largest transaction volume under different handling fee ratios. It is found that the USDC/ETH trading pair with a 0.05% handling fee has a 7-day trading volume close to ten times that of the 0.3% level when the TVL is lower than the 0.3% level. On the whole, without considering the distribution of liquidity, the average yield of liquidity providers with a handling fee of 0.05% is higher than that of a handling fee of 0.3%.

Market share: Uniswap’s share of trading volume on Ethereum rose from 47.2% to 80.4%

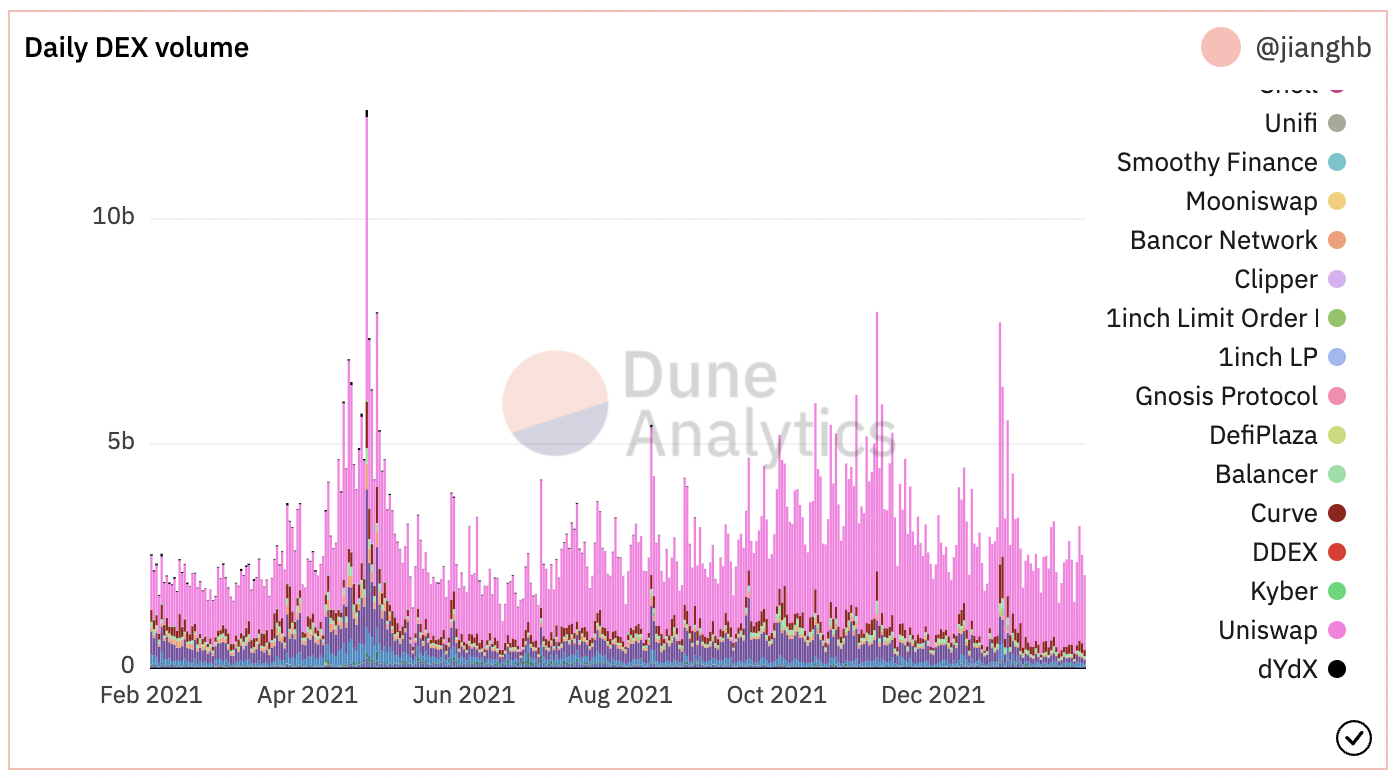

Before Uniswap V3, the advantage of Uniswap may only lie in the moat formed by its brand effect, so a series of DEXs that can compete with each other appeared. Now, this situation seems to be over, and Sushi, once the strongest competitor, has gradually faded away. In terms of the absolute value of the transaction volume, except for Uniswap, the sum of the transaction volume of other DEXs on Ethereum has also declined in the past year.

From the perspective of transaction volume ratio, Uniswap’s transaction ratio in Ethereum ecological DEX has risen from 47.2% to 80.4%.

Stablecoin trading pairs: The main stablecoin trading is better than Curve, and the overall stablecoin trading volume is lower than Curve

Previously, because Curve gathered liquidity in a small range, and usually only required a transaction fee of 0.05%, it almost formed a rigid demand for transactions between stablecoins and other similar assets. However, after the launch of Uniswap V3, it has the same advantages as Curve. Today, with sufficient liquidity, transactions with 0.05% and 0.01% fees may provide stablecoin transactions comparable to or even better than Curve.

According to Uniswap V3 data, stablecoin transactions in the agreement have now shifted to trading pairs with 0.05% and 0.01% handling fees.

In the past 7 days, the total trading volume between stablecoins was $1.06 billion, accounting for 10.18% of the total trading volume of Uniswap V3. Among them, transactions with a 0.05% handling fee accounted for 24.06%, while transactions with a 0.01% handling fee accounted for 75.94%.

It can be seen that the 0.01% transaction fee in Uniswap V3 has occupied a major position in the protocol's stablecoin transactions. Curve's transaction fee is usually 0.05%, and it is difficult to compete with Uniswap V3 even in the transaction fee of stable currency.

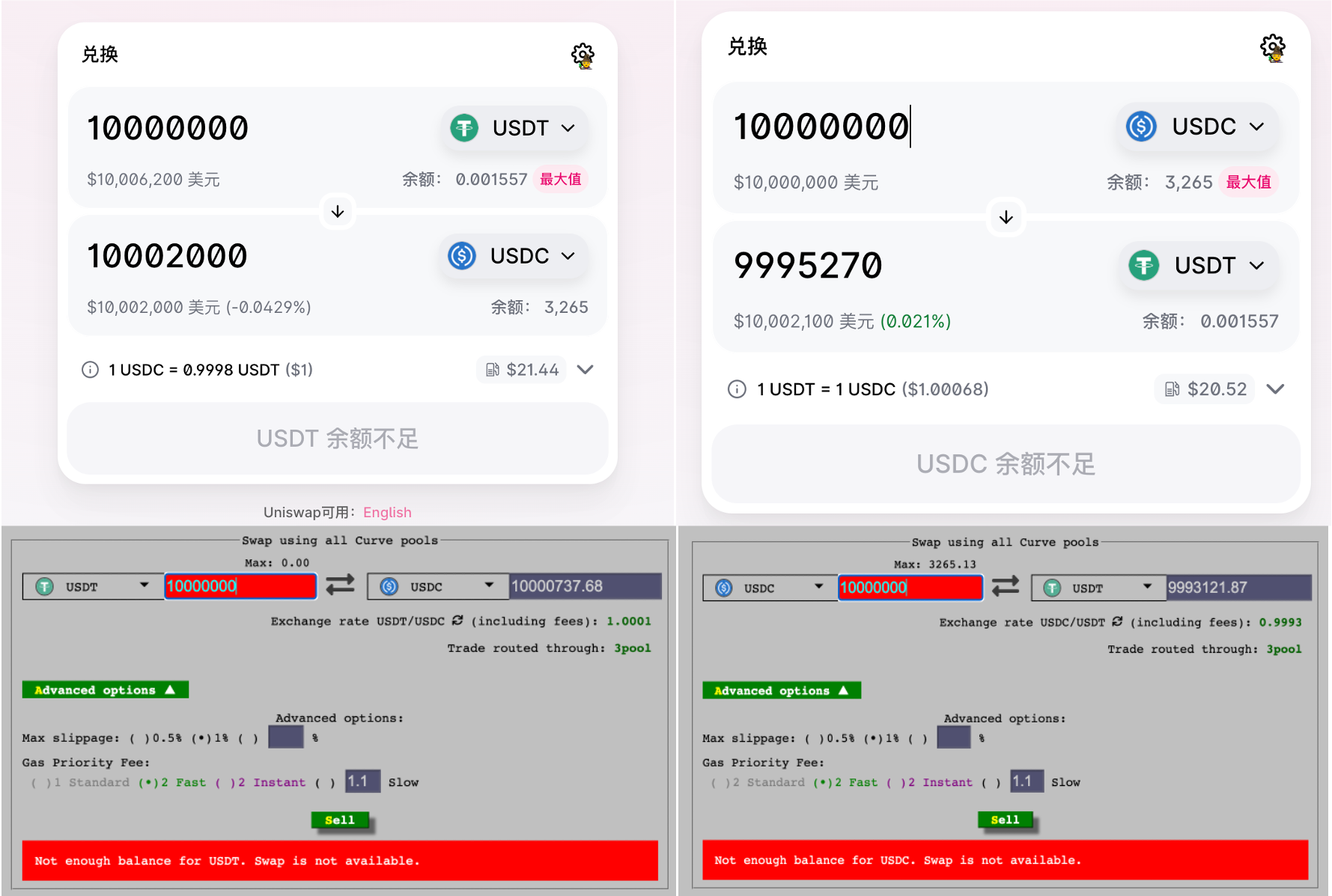

In the actual transaction, taking the transaction between 10 million USDT and USDC as an example, the conversion ratio obtained by Uniswap V3 is better than that of Curve. In Uniswap V3, 10 million USDT can be converted to 10,002,000 USDC, and in Curve it can be converted to 10,000,732 USDC; while in Uniswap V3, 10 million USDC can be converted to 9,995,280 USDT, and in Curve it can be converted to 9,993,122 USDT.

However, in a single exchange of stablecoins at the level of hundreds of millions of dollars, due to the liquidity restrictions of Uniswap V3, there will be more than 1% slippage, and Curve's exchange ratio will be better than that of Uniswap V3. But on the whole, because the handling fee for stablecoin transactions in Uniswap V3 is usually 0.01%, except for very large transactions, the conversion ratio is already better than Curve.

first level title

Uniswap V3 in the multi-chain era: Going online on Polygon will surpass QuickSwap

Uniswap V3 has now launched Polygon, Arbitrum and Optimism. Taking Polygon as an example, after Uniswap V3 launched on Polygon in December last year, it has surpassed the former king QuickSwap in a short period of time.

During the 7 days from February 17th to February 23rd, the average daily trading volume of Uniswap V3 on Polygon was 91.91 million US dollars, and the average daily trading volume of QuickSwap was 57.63 million US dollars. The TVL of Uniswap V3 is $114 million and that of QuickSwap is $675 million. Uniswap V3 achieved a transaction volume equivalent to 159% of QuickSwap only relying on QuickSwap's 16.89% TVL.

Comparing the distribution of trading volume between the two, the trading pairs with the highest trading volume in the past 7 days on Uniswap V3 are USDC/WETH, MATIC/USDC, MATIC/WETH, and WBTC/WETH, and the transaction fees are all 0.05%. The trading pairs with the highest trading volume in QuickSwap are USDC/WETH, MATIC/USDC, MATIC/WETH, WETH/USDT, which highly overlap with Uniswap V3. This means that Uniswap V3 wins in direct competition with QuickSwap.

summary

summary

In the case of a decline in the overall transaction volume in DEX on Ethereum, Uniswap V3 ushered in an increase, and its market share rose from 47.2% to 80.4%. This may be because transactions with a 0.05% fee began to dominate in Uniswap V3 and attracted trading volume from other DEXs. Because of this, it may be difficult for other DEXs to compete with Uniswap, and all this happens without liquidity incentives.

In other markets, Uniswap still shows its advantages. In stable currency transactions, because only 0.01% handling fee is required, it provides an exchange ratio better than Curve in USDT/USDC exchange; in Polygon, it will surpass the previous one when it goes online King QuickSwap.