How to estimate the value of Metaverse plots?

This article comes fromDecentralisedThis article comes from

, the original author: Joel John, compiled by Odaily translator Katie Ku.

Someone recently paid $450,000 just to be the metaverse neighbor of rapper Snoop Dogg.

In order to answer these questions, we need to make a clear positioning and classification of the "asset attributes" and "functions" of the plots.

secondary title

Let’s first understand these industry benchmarks

Even in the Metaverse, parcel assets are new. Compared with the $22 billion in NFT purchases in the past few years, it only completed about $1.9 billion in transaction volume (less than the price of a single boring ape NFT). The total market capitalization of all available land parcels in the Metaverse is only around $3.6 billion, while the total market capitalization of cryptoassets is in the trillions.As of January 2022, there are approximately 57,000 wallets holding parcel-related assets.Compared with the 4 million wallets that have interacted with DeFi, the land parcel market is still early.

Why do people spend so much money to buy a piece of virtual land? In order to understand this, we first need to define metaverse parcels.

secondary title

In metaverse based projects like Cryptovoxels, Decentraland or The Sandbox, plots are lands where you can digitally express anything, like Sotheby's art gallery in Decentraland, metaverse music by Snoop Dogg on The Sandbox meeting.

This million-dollar homepage could be the real predecessor to the Metaverse plot

In 2006, 21-year-old Alex Tew set up a website selling 10*10 pixel blocks for $100. He managed to sell those pixels to random advertisers and made $1 million. This is somewhat similar to the prototype of the NFT block.

Unless the neighbors of the plot coordinate with each other, this dense and chaotic picture lacks a unified visual effect. This is also benchmarked against real life: real estate prices are jointly determined by the interests of the local community and the quality of life.

Metaverse plots combine user-generated content with 3D or VR experiences, and verify asset ownership through on-chain proofs. Those who own the plot can create a unique experience according to their wishes. According to data from the Cryptovoxels website, the site received about 187,000 visits.

Next, we will come to the topic that everyone is most concerned about: what determines the price of a certain land?

secondary title

Five factors that determine the price of a plot of land

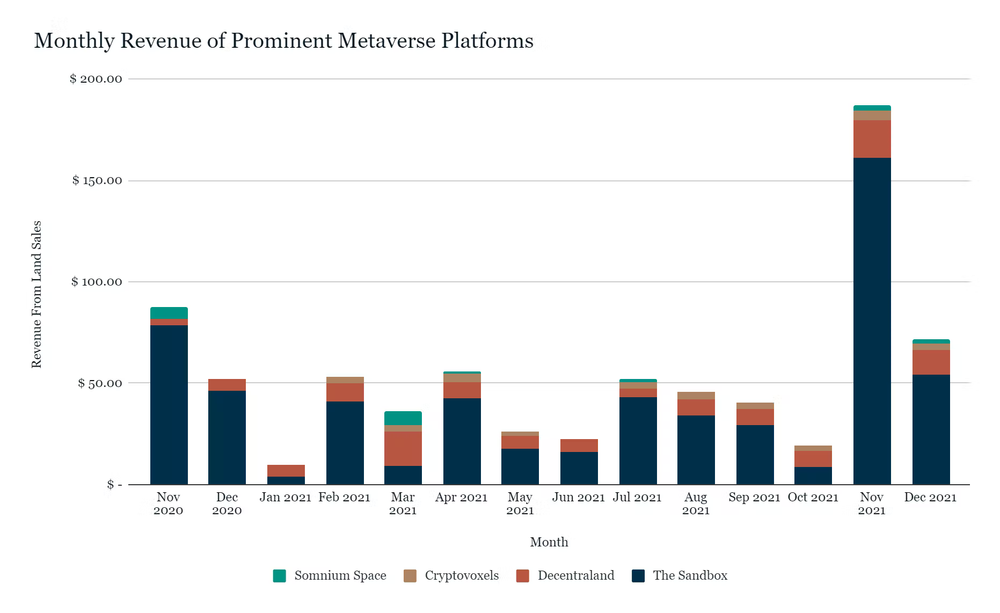

The figure above shows the land-related income of the four major metaverse platforms. The Sandbox has a 77% share of the four, and Decentraland only has a market share of around 16%. What is the reason for this difference?

Here are some assumptions I made based on my observations:—Think about Times Square in New York or the Burj Khalifa. Part of what drives the value of these two properties is their foot traffic. The more people appearing on these properties per unit time, the higher the land value. This also hints at a risk in the metaverse: you're betting on your ability to attract attention.

celebrity effectcelebrity effect

- NFTs are an interesting asset class because they can reduce the cost of "connecting" with celebrities. Let's say I put enough money down on a lot next to Snoop Dogg's "virtual property", in which case I can not only claim to be close to his property, but also attract visitors to his Metaverse lot People's eyeballs, that's why people buy land near celebrities. But what if a celebrity decides to shop around for land? Isn't this value dispersed? It is also true that celebrities buying land in bulk will continue to dilute the attention paid to individual land.geographical advantage

——The celebrity effect depends more on the reputation, while the geographical advantage depends on the funds "handled" by the surrounding commercial places. If you go into JPMorgan's virtual office in the Decentraland metaverse, you'll notice that CoinGecko's virtual office is right next door. It's a bit like traditional real estate. As more and more brands join the Metaverse, and their users use these platforms for business experiences beyond reputation, land prices near functional venues will soar.financial play- The core innovation of Axie Infinity is to connect the most well-known financial institutions (such as hedge funds) and players from emerging markets through guilds.The financialization of Metaverse assets could be a key factor in future lot prices.For land owners, the income of the metaverse-related plots mainly comes from: short-term lease and sale at a higher price. For game developers, consider pre-selling strategic land to raise funds. For creators such as artists, the land used to host events can be sold to third parties for early funding, and third parties can sell tickets to events such as metaverse concerts to recoup funds.

(Note: Justin Bieber and Travis Scott have already made millions from hosting Metaverse concerts.)Art Design

- If a game has amazing interior art, game developers can auction off specific locations in the game. Land parcel owners can advertise, charge, or communicate specific information to users passing by. Some people bought land early on in the belief that in the future a large number of players would pass by their doorstep for art or level design.

Some people think that the land value of the metaverse cannot be very high, because it can be generated infinitely at will.Qualitatively, the value of a piece of the Metaverse is directly proportional to the attention it receives at different points in time.

Therefore, in order to maintain prices, issuers will limit the amount of land available. Cryptovoxels, The Sandbox, and Decentraland all have caps on their "purchasable land." As demand for Metaverse real estate increases, the final price of the plots will be prohibitively high and will only be owned by professional financial institutions. This means that ordinary users conduct more "small and micro transactions" in the early stage.

If there is no user base, or the lack of economic motivation to "acquire land", or if it cannot attract enough attention, the Metaverse platform will lose its value. This is the key risk of investing in metaverse plots.

Some projects are already exploring this model, such as PangeaDAO. DAO users use the pool of assets to buy plots in different metaverse projects. Afterwards, through user-generated content, a unique business model is unlocked, similar to how the game itself becomes a platform, and players publish small programs and games in the game. This will open up a whole new avenue of monetization for AAA games. In addition, “DAOization” also makes it easier for indie game studios to raise funds directly from users: as land parcel owners become user acquisition channels, customer acquisition costs decrease.

Three predictions for the future of the metaverse

in my opinion,in my opinion,Metaverse plots will not circulate at a high speed like homogeneous tokens.

Even with collective ownership to lower barriers to entry, the collective is incentivized to develop and renovate the plot rather than resell it immediately for short-term gains.The land value will increase substantially.

Because ultimate value comes from digital experience (and engaging users), not just holding.

Will retail users be completely squeezed out given the high barrier to purchase? The answer is probably not. The split of NFT plots will become a new theme, and the collective investment model will prevail.Another emerging and underexploited factor is the power of community.

I wouldn't be surprised to see new Metaverse platforms offering discounted plots to the community to liven up activity on the platform.

The vast majority of businesses that join the Metaverse today are likely to study its future possibilities. Even spending $20,000 on a small lot can get a lot of media coverage and interest from potential clients. A whole new wave of investment banks focused on the Metaverse will emerge in the next few years. They will help traditional asset distribution purchase and custody Metaverse assets. Similar to what Falcon X and Fireblocks do with tokens today.

The challenge for traditional companies with metaverse strategies is to strike a line between the old ways of monetizing (data mining and advertising on users) and the new ways of monetizing (allowing users to take ownership and generate revenue through sales commissions like OpenSea) The choice is between appeasing Wall Street and keeping users.