Blockchain Revolution or Blockchain Scam? An overview of the current crypto market

overview

Original translation: Block unicorn

overview

The last double bull cycle in 2020 and 2021 is characterized by "narrative" dominance, a new outstanding project token is determined by the quality of their marketing and memes, trading companies turn to VC in the first part, the second part Anonymous influencers dominated the traditional VC market in 2017.

We have seen that from DeFi, NFT, DAO, L2 (second layer), earning Metaverse while playing, to Web3, and then back to NFT, the L1 (first-layer main network) battle spanned the last 5 common narratives. The cryptocurrency space is catching on to new narratives to justify the deployment of new capital to satisfy investors' appetite for outsized returns, returns that were fundamentally possible earlier but are now only achievable by reducing complex capital. Acts as each previous holder gradually exits liquidity.

Many years ago, I would have considered this a disgrace, the misallocation of capital with no productive value, the predatory extraction of stimulus checks from TikTok users who dream of getting rich as a way out of the day-to-day monotony. Every industry has bottom employees, and today, I think very differently. I see each bull cycle as an avatar of the natural life cycle in the animal kingdom, where we have a ravenous food chain being eaten by our slightly smarter but equally ravenous self. Ugly but inevitable, I now believe in crypto accelerationism.

For years we have been unable to make progress in the industry from logic, reasoning, or any kind of verbal dialectics. We can only learn by witnessing the results of most experiments that are doomed to fail (although some experiments do succeed, at least for now). Small block vs big block debate, PoW vs PoS, this PoS vs that PoS, this L1 vs that L1, L1 vs L2, (3,3) vs (-3,-3), Punks vs Apes, DOGE vs SHIB , CLOB vs. AMM etc. can't be solved without actually seeing how they behave in reality.

No amount of theory about mechanism design, drawing models and directions, using historical analogies, or hardcore text can convince a community to drop their holy cow and join another industry. As an industry, we have to viscerally experience the good and the bad, what works and what doesn’t, until it fits into our zeitgeist and forms our collective memory, and then we can move on.

The introduction of jargon is an interesting development in crypto culture, as it serves a dual purpose in traditionally protected and supply-constrained fields such as medicine and law.

First, it saves time when both communicating parties share a library of understanding languages. Second, it prevents outsiders from easily extracting value that "rightly" belongs to insiders. In cryptocurrencies, this is no different. As we become a richer industry, we further disguise ourselves with insider jargon so dirty outsiders can't come and eat our lunch. This should spark more M&A activity as non-crypto companies without in-house expertise look to penetrate this lucrative but very impenetrable space. It's only natural that I'm not making canonical judgments here whether it's good or bad.

Capital allocation always lags behind the emergence of new things and innovations,During the course of the bull market cycle, more and more capital chases lower and lower quality projects.Entrepreneurs and scammers alike are more than happy to start new half-baked ideas, creating supply to meet demand from new fiat currencies (new users) that are about to enter the space.

It is when the counter-narrative naked emperor fears backlash from hornet's nests and bags that people start self-censoring at their most, that this narrative reaches its greatest upward reflexivity. At the height of the mania, people only buy what they think can pass on to the next marginal buyer; valuations become ridiculous and common sense is drowned out by waves of tribal chants and rain dances, driving prices up. If it weren't for a turn in the macro environment, we might have reached even more absurd heights, and the frenzy has yet to reach its natural peak.

As the tides turned, both in the crypto space and beyond our shores, the “narrative” was weakened, and many projects were revealed to be scams at best; outright scams at worst.When madness is the rule, nuance and careful consideration are labeled heresy.Only after the "narrative" has waned can these ideas be published without policing for false ideas.

first level title

Hoax and Utopianism

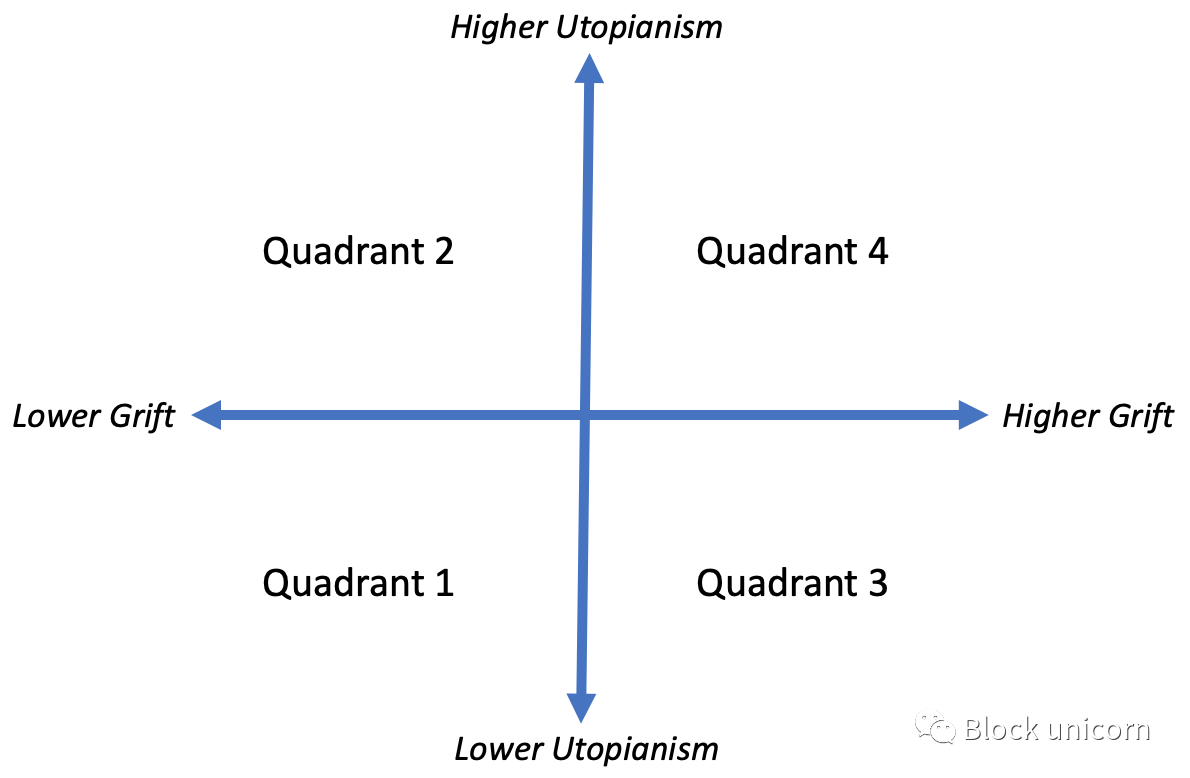

I've been thinking lately about two new dimensions within which we can classify various ciphers: deception and utopianism. For example, in the dimension of fraud, I think OHM is not as serious as TIME, and TIME is not as serious as OHM fork. Now I'm not making any absolute claims about how roughly each item is, only relatively, that they can be reasonably sorted in this way. In general, the rule is that copies are rougher than originals. In the dimension of utopianism, an example is that BTC is not as utopian as ETH, and ETH is not as utopian as SOL, LUNA, AVAX and other new L1s. In general, the rule is that new projects try to "solve" problems inherent in old projects, and are therefore more utopian. Now that we understand these dimensions, we can talk about investability, rate of return, and consideration time for each of the 4 projects:

1) Vulgar, low utopianism.

2) Lowbrow, high utopia.

3) High grandiosity, low utopianism.

4) Difficulty; high degree of utopianism.

1 item (low con, low utopianism)

1 means that the project is an honest effort to solve a solvable problem without some kind of fundamental scientific or technological breakthrough. Examples include (past) cryptocurrency exchanges, new cryptocurrency infrastructure, and possibly some early successful cryptocurrencies such as BTC. These tend to be good long-term investments while being considered poor short-term ones, especially during the frenetic phase of a bull market.

2 items (low con, high utopianism)

2 stands for projects that are honestly trying to build grand designs to lead us into a brave new world. These designs usually require at least one, but sometimes multiple, technological breakthroughs to function. You'll often find that proponents of these items bash and discard items in item 1 because it doesn't justify why their item 2 was necessary in the first place.

Utopia is only worth pursuing if the already existing world is deeply flawed. Project 2 tends to be a good investment in the early stages because the founders are serious and it passes the buy-in. This allows for the creation of a founder myth, and should last long enough to secure at least one or two rounds of funding. At later stages, these projects are good investments only if they break through and "realize" utopia. It’s unclear whether these utopian pursuits will succeed, and to make up for all the failed investments, VCs only need to bet on one of them to win.

Part of the game here is to make 2 items look as much like 1 item as possible. This makes the project look less risky and makes investors feel better. From a game theory and mechanism design perspective, the real requirement for a breakthrough is often waved away, and the proposed design is continually reiterated as perfectly feasible and compatible with perfect incentives. These are higher risk, higher reward analogs of Project 1, diverging in risk but not in potential reward.

It's unclear whether these utopian pursuits will succeed, but VCs only need a few of them to win to make up for all the losers. Part of the game here is to make 2 items look as much like 1 item as possible. This makes the project look less risky and makes investors feel better.

3 items (high grandiosity, low utopianism)

3 stands for money-grabbing projects with weak execution, an example of this is Bitconnect (a scam project in 2018). It was obvious to everyone in the environment that this was a scam. This is exactly why Bitconnect is targeting people outside of the crypto community, and frankly less sophisticated in general, 3 projects seem more utopian to less sophisticated people, which is exactly what these projects are trying to do, Integrate with project 2. Ultimately, utopianism often masks deceit. That's why Project 3 represents the worst of our industry, a real bottom-heavy harvester, where the greedy dupe the stupid. Project debacles are what regulators eventually use to justify tougher regulation of the entire environment. Can you think of any other projects in the crypto environment right now that are intentionally only aimed at people outside the environment? If it quacks like a duck.

4 (highly grandiose, highly utopian)

4 represents our industry's Rube Goldberg (Complex Mechanism Composition) machines and perpetual motion machines, which are like item 3. The execution is so good that even industry insiders have a hard time reasoning about these complex contraptions, and even skeptics can only conclude, "it probably doesn't work, but maybe it does because I can't be entirely sure what the problem is ". Does the Gordian Knot have a loose end? Can it be untied? Item 4 does its best to pretend to be in Item 2. Over time, if the project is successful in the short term, they will likely actually try to turn the scam into a real business and migrate to Project 2.

What's the difference between WeWork (a shared office venture) and Theranos (a scam that checks your body with a drop of blood)? The former migrated from project 4 to project 2, the latter did not. The full 4 project is a good short term investment for many in the field, sad but true. Partly because project tokens are able to achieve liquidity faster than private companies have in the past, they can effectively "IPO". All the incentives of a public company come with "going public": short-term orientation a few quarters into the future, founders can retire before it's revealed whether the product actually works or whether it has real, unsubsidized product-market fit , especially when using the token itself to pay for usage. Most seemingly successful crypto projects are 4 projects because the incentive to cash out quickly is too great for participants to ignore. Founders, employees, investors, traders, exchanges, market makers, OTC desks, SAFT slingers, lawyers, other 3rd party service providers have all benefited from these 4 project scams. The only people who don't benefit are the last ones in the car, drinking Kool-Aids in their crappy car and desperately clinging to a utopian dream sold to them by someone smarter and darker than themselves .

I find these illusory and utopian dimensions to have great explanatory power for the phenomena we see in this environment, cycle after cycle. All in all, project 1 is a long-term project, but not suitable for the short-term.

first level title

NFT

first,

first,Let's take a look at the categories of art and NFT avatars. Since they are status/signal symbols, Veblen/luxury items, or heirloom/prestige items, we can say that some of them will hold value for a long time. Just like there are a dozen or two top fashion houses in the real world, we could see a similar number of NFT collections with enough brand value to sustain. Having said that, there certainly aren't 1,000+ top fashion houses, so most NFT collections probably don't have much value. So, at best, we have a power law distribution where the winner gets the most value. We could also argue that status symbols are only useful when shown to others. For fashion brands in real-world settings, this will be limited to foot traffic in the wearer's real-world space.

Secondly,

Secondly,I do think a vampire attack similar to LOOKS has some reasonable chance of gaining market share. They were able to directly target the right demographic that would be the perfect user for their platform. Having said that, both the price and market cap of LOOKS have fallen sharply recently, most of the trading volume is wash volume, and the founders have been cashing out. If this is all a scam, it wouldn't be surprising considering the team is anonymous and the token price has reached very high prices in a very short period of time. Still, the idea of having multiple NFT exchanges competing makes sense, as fees are high and there is room for competition. Additionally, there are no order book-like liquidity network effects, so it is easier for challengers to compete with incumbents.

first level title

L1s (one layer public chain)

Since technological superiority is completely irrelevant until it finally rears its head at some indeterminate time in the future, we shouldn't waste time on it. Suffice it to say, it makes perfect sense what profile to use for each of the different L1s. HFT Chicago Prop Shop prefers SOL, Korean prefers LUNA. Graduate students prefer AVAX (after all it is the only prof token that does well). Andre's (AC) disciple prefers FTM. VC prefers all L1s, because, only need to bet on one public chain, VC can get back the cost. Sometimes a smaller L1 like NEAR, because when its market cap is small, there are billions of dollars left to grow.

ETH extremists are now on the same side as old BTC extremists as they try to fend off attacks from “new” projects. Generally speaking, their defense has been unsuccessful because people like shiny new things. With the new, your greatest hopes and dreams become possible; as things unfold, you see only the cold reality of what actually is.

Behind the scenes of Utopianism is the brutality of the real and ugly truths of human nature. Our innate desire for a perfect world, and our innate desire to exploit that desire in others. In the end, a Girardian scapegoat is needed to satisfy true believers, turned into disaffected disenchanted mobs who fulfill this role better than prophets whose promises never come true. That's not to say that these L1s won't be successful, it's just that the founders are very aware of the sword of Damocles hanging over their heads. Best to win, second best to keep making bigger trade-offs in the principle of decentralization, because it doesn't matter until it happens, who knows when it will happen, and if it will happen. Maybe we're all just scared of Boogeyman; maybe not.

As we reshape the financial and monetary system, we come to empathize with past Fed chairs. The Fed chairs don't want the economy exploding under their watch, so why not pass the blame on to the next guy and kick the can down the line.

In any case, may the best L1 win. Considering the participants makes all the incentives useful, that's what I'm saying. Not everyone likes technology, in fact, not many. Maybe we're all just scared of Boogeyman; maybe not.

At this point, having waited 7+ years, I dare not even ask if we will actually deliver PoS on Ethereum this year. What Happens First: ETH 2.0 or Reawakening Frozen Markets? Haha, who knows.

decentralized finance

decentralized finance

DeFi 2.0 is similar to DeFi 1.0, but 2 is greater than 1, and the bigger the numba (an open source JIT compiler), the better. DeFi 2.0 is characterized by letting the protocol itself, control or own assets. Sometimes it's called PCV (Protocol Controlled Value) or POL (Protocol Owned Liquidity) or whatever. The idea is the same, you now have a DeFi protocol that also runs a hedge fund, good idea or bad idea? Left to the reader to decide, protocols now hold other protocol tokens in treasury and participate in each other's governance votes.

We are entering an era of systemic risk。

earn while playing

earn while playing

You work to make money, and you spend the money you make on games, isn't that always the case? Jobs are essentially things you don't do on your own terms, and you get paid for doing those unwelcome tasks. Gaming is essentially something you do voluntarily because you like it and maybe even pay for it.

So what the hell is P2E (earn while playing)?If you're someone who earns World of Warcraft gold for a living, that's work. If you play Warcraft and enjoy World of Warcraft, then you're going to buy gold from someone who produces World of Warcraft gold, and that's playing. In P2E, people are using wild nomenclature again, which is a cool-sounding buzzword that makes you look like you can have your cake and eat it. In most games, someone works to make money and someone gets paid to play, with little overlap between these two groups.

In the case of most "P2E" games, there are still people who work to earn money, but the second group is mostly replaced by a new group that buys workers' jobs and eventually sells them to other people, the paid group . In other words, the difference between most games and P2E is that you go from being a player to being a worker and a speculator, and almost no one in the office really wants to play the game.

If there ever was a really interesting game in the P2E space, you'd be just a normal game with workers and players. There is no difference except for one subtle point.

Metaverse

Metaverse

We already have it, and it's a growing industry, in the sense of the term "metaverse." If the term "metaverse" means more than just VR, then we have to define it precisely, lest we start climbing the "sky's abstract ladder" to exaggerate the value of the ordinary. When people say AI, they mean ML; when people say ML, they mean statistical methods; when people say statistical methods, they mean linear regression. Money is already ballooning; let's not exaggerate either. If "metaverse" means virtual communities, we already have it in Telegram chats, Discord communities, and even what used to be called Facebook. If "Metaverse" merely describes a trend that people generally spend more and more time in virtual worlds and less time in physical spaces, then it is happening, Japan's hikikomori ( nerds) is our future. When you print too much money, half the people stop having sex and become closed basement dwellers, while the other half become working-class giant zombie kiretsus, until they inevitably exhaust themselves to death.

first

firstsecondly

secondly, you can let your users conduct commerce with each other without relying on a centralized payment rail. In other words, you can log into Decentraland (MANA), have your avatar walk into a virtual art gallery, find a punk you like, and click it to link directly to an auction on OpenSea. One more click and your Metamask wallet opens and you can buy it from the gallery. Once purchased, you can display it in the gallery or take it off to display in your virtual home, in two places.

Sure, cool. Still, as an example, VRChat could just integrate this functionality, even though their verses are centralized. Does Decentraland have unique strengths and weaknesses compared to VRChat (virtual reality gaming)? Hard to say, but maybe the next topic will shed some light. Does Decentraland have unique strengths and weaknesses compared to VRChat? Hard to say, but maybe the next topic will shed some light. Does Decentraland have unique strengths and weaknesses compared to VRChat? Hard to say, but maybe the next topic will shed some light.

What happens when we transfer land titles to bearer instruments? What happens when we turn virtual land titles into bearer instruments? This is indeed the core difference between Decentraland and Second Life. It creates a level of scarcity for virtual land and unforgeable, inalienable land titles. Although there is still a question of how much the value of the land near the transportation center is related to the value of the land far from the transportation center.

first level title

Web3

Unlike Valve, we actually counted to three this time. To avoid concept/word bloat, let's use Chris Dixon's definition of Web3. Read Web1. Web2 is read/write. Web3 is read/write/own.

So basically, FCoin invented transaction fee mining, which was later popularized as yield farming in DeFi, so Web3 is yield farming. Just kidding, a paradigm shift isn't enough. Web3 is a broad-yield instrument that is a stock-like instrument, and enforcement action by securities regulators will be difficult. May or may not be good, depending on whether you are a regulator or not.

in conclusion

in conclusion

So all in all, all is well in the crypto space. In the long run, I am, as always, optimistic about the cryptocurrency space. In the short term, there is some work and clearing to do. I know some people will call me: midwife, but I don't comment on them: