Gamification of Finance: An In-Depth Look at the Meme Trading Frenzy in the Age of Social Media

Original translation: Block unicorn

Original translation: Block unicorn

How social media, zero-commission brokerage, and the "democratization of finance" changed the investing world forever.

How social media, zero-commission brokerage, and the "democratization of finance" changed the investing world forever.

Launched on the AppStore in December 2014, Robinhood's mission is to "democratize finance for everyone." The company introduced zero-commission trading and relatively low account minimums to appeal to users whose traditional financial institutions were too costly and cumbersome. The gamble was almost unbelievably successful—within two years, Robinhood was valued at more than $1 billion, and other brokers were forced to slash commissions to compete. Today, Robinhood has more than 22 million funded accounts and nearly 19 million monthly active users.

Due to increased social media usage and increased visitation to the financial world, investing and trading communities have sprung up on various social media networks: Fintwit (financial twitter), content creators on YouTube and now the famous Reddit community (such as WallStreetBets stock retail community). People share investment ideas, discuss recent market moves, and post their incredible gains or devastating losses. The rise of the encrypted economy has also increased the speculative enthusiasm of the entire digital community, and corporate giants like Elon Musk have become social media stars. The pandemic has caused extreme changes in the market, while leaving many people feeling bored, lonely and with too much time on their hands, which has only accelerated the growth of the online financial community.

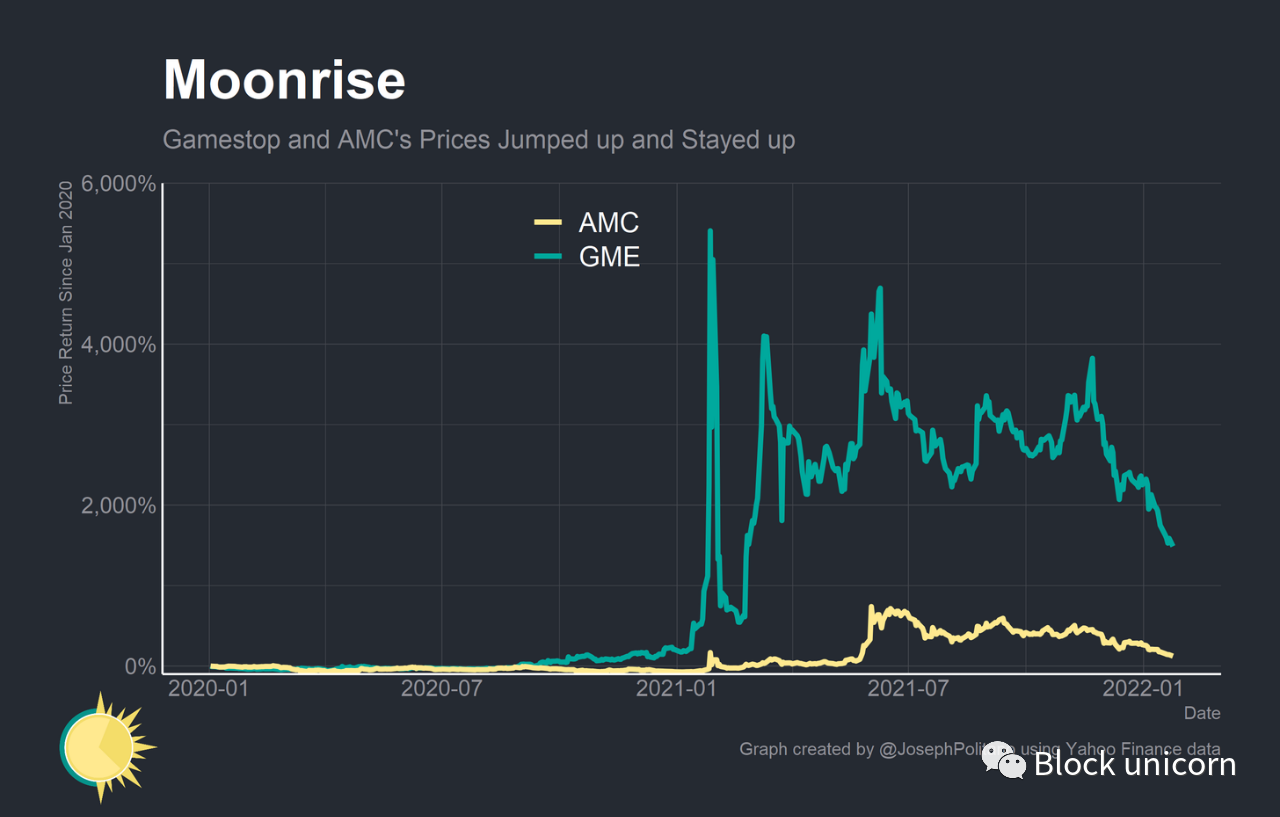

All of this came to a head in January 2021, when struggling video game retailer GameStop took the financial spotlight. The story goes that the hedge fund shorted the stock -- borrowing the stock and selling it immediately, betting that GameStop's stock price would go down. Users of WallStreetBets see the extremely high level of short interest (the number of shares sold short over existing shares) as an opportunity. If they can push the price of GameStop stock higher, short sellers will have to buy at a higher price to cover their positions at significant losses. So they bought GameStop in bulk, sending its price soaring, and Wall Street hedge funds betting on the company. After GameStop's stock price rose from $20 before the squeeze to nearly $500, after its success, traders turned to other stocks with a lot of short interest (such as struggling movie theater company AMC). Until Robinhood and other brokerages completely suspended trading in GameStop, AMC, and several other "meme stocks" -- effectively cutting off the momentum of the meme mania.

But it's just a story -- and to tell the story of that story, we have to start from scratch.

democratization of finance

Given the influence of attention on buying and selling behavior, the technological advantages investors are able to unite through an easy-to-use app appear to be making profitable day trading more difficult rather than easier.

Ben Felix, Commission-Free Day Trading

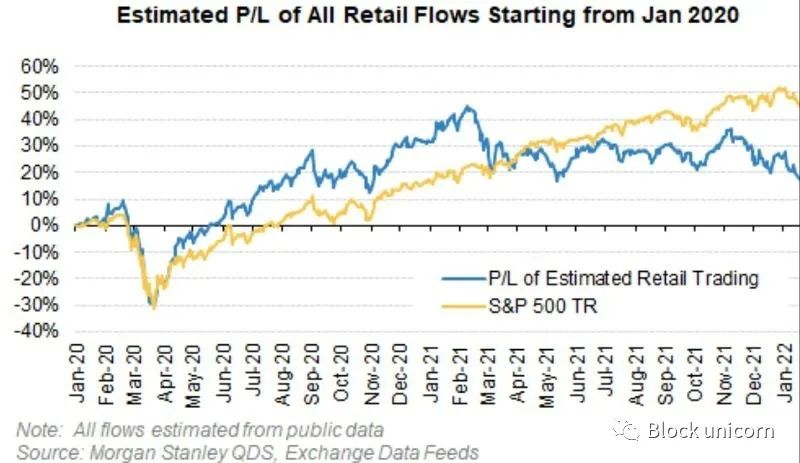

For the vast majority of people, trading is a money-losing proposition. Decades of academic research has shown that retail investors who try to pick their own stocks lag behind risk-appropriate benchmarks, and those who trade regularly fare worse. This should come as no surprise—professional fund managers have consistently underperformed the index, so why are ordinary folks able to outperform? The essence of the efficient market hypothesis is that, because asset prices reflect all relevant available information, investors cannot achieve reliable alpha (alpha refers to achieving super high rates of return). Real world markets are unlikely to be perfectly efficient, but they are close enough that alpha is often hard to come by. Those who outperform the major indexes often do so because they took extra risk (like Warren Buffett's value investing), unearthed new information (like Renaissance Technologies' famous Medallion fund), or just plain luck.

Robinhood comes at a time when low-cost passive index funds are taking the financial world by storm. The relative underperformance of costly actively managed funds and the rise of low-cost index fund providers such as Vanguard has led to trillions of dollars of everyday retirement savings being poured into index funds. Robinhood is on a mission to break down the last barriers to the financial world for ordinary people: high transaction costs and opening a brokerage account. Traditional brokerage firms have no interest in managing millions of accounts at $500 each, and thus only focus on a small subset of high net worth individuals. Many brokerages are unwieldy and charge high fees per trade, making them inaccessible to young, tech-savvy and low-net-worth users.

A big part of the appeal isn't that "finance is fun," but that trading stocks or cryptocurrencies seems like an easy way to make money. Obviously, I don't think this is true.

Srivatsan Prakash (host of Market Champions podcast)

However, the introduction of brokerage to smartphones is starting to undercut the passive investing trend, with people trading on their phones more likely to buy riskier, popular, lottery-like assets. They are also more likely to chase past returns, succumbing to well-known behavioral biases that hinder investor performance. The effects may not be temporary, either — investors who start trading over the phone start exhibiting similar behavior on other platforms. Robinhood currently has 18.9 million monthly active users out of 22.4 million total funded accounts, which means most users check their accounts frequently -- which also reduces long-term returns. For many, active trading is starting to become less and less Attractive - they can get rich quick this way too.

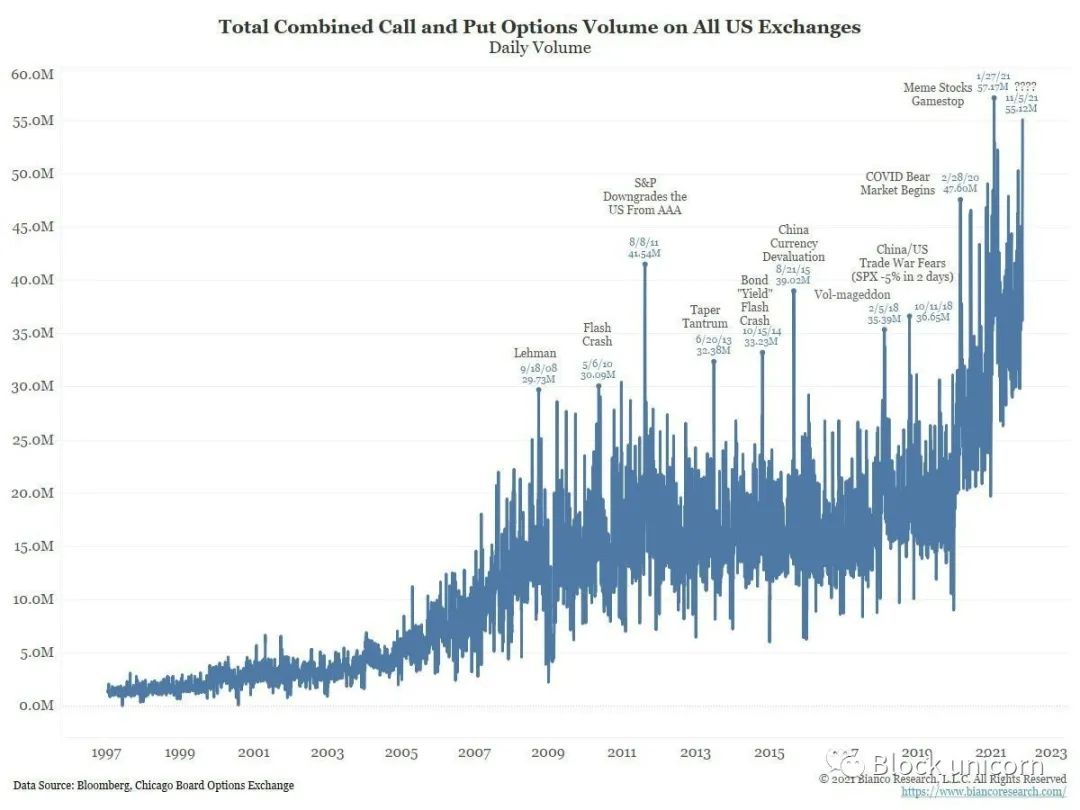

Over time, users of zero-cost brokers began to switch to riskier and more volatile financial products. Puts and calls are risky financial derivatives typically used for hedging and are increasingly used by retail traders to make leveraged bets on the movement of different stocks. The explosion of memecoins has come alongside an already volatile cryptocurrency market. Crucially, Robinhood earns some of its money through payment for order flow (PFOF), in which market makers compensate brokers based on how they direct trades. The process is legal, improving on the high transaction fees of bygone eras, and may be cheaper for users than other options, but it still gives Robinhood an incentive to get users to trade as often as possible and trade market makers willing Riskier, less liquid assets that pay more to trade.Last quarter (Q4 2021), $164 million of Robinhood's transaction-based revenue came from options, another $51 million came from cryptocurrencies, and $50 million came from common stocks.

financial memes

Society has always been a meme war, but before that it was fought with sticks and stones. Yet the Internet has engaged in an arms race, trench warfare against meme-driven brains in many domains. They haven't captured all the realms of thought yet, but I fear the meme gap will only widen.

CGP Grey, meme commentary answer. CGP Gray is an educational blogger with over 5.2 million YouTube followers.

With the rise of retail investing and the ubiquity of social media, corporate executives and high-profile investors have become social media stars (and, to a lesser extent, vice versa). Elon Musk, Tesla's Technoking (Techno is a genre of electronic music, that's his official title), is without a doubt the biggest star in the world of financial social media, with a staggering 71 million Twitter followers.

The way finance works now is that the value of things is not based on their cash flow, but on how close they are to Elon Musk.

Matt Levine (Valuation Analyst) Elon Musk's Market Hypothesis

Elon's social media status has made him a market mover throughout the world of traditional and crypto finance, and his tweets about GameStop, Dogecoin, Bitcoin, and his own company, Tesla, have generated huge, immediate reactions from financial markets . Many crypto projects were created with the explicit intentions of Elon's Twitter feed, and CEOs of other public companies tried to associate themselves with Elon's social media fame as much as possible.

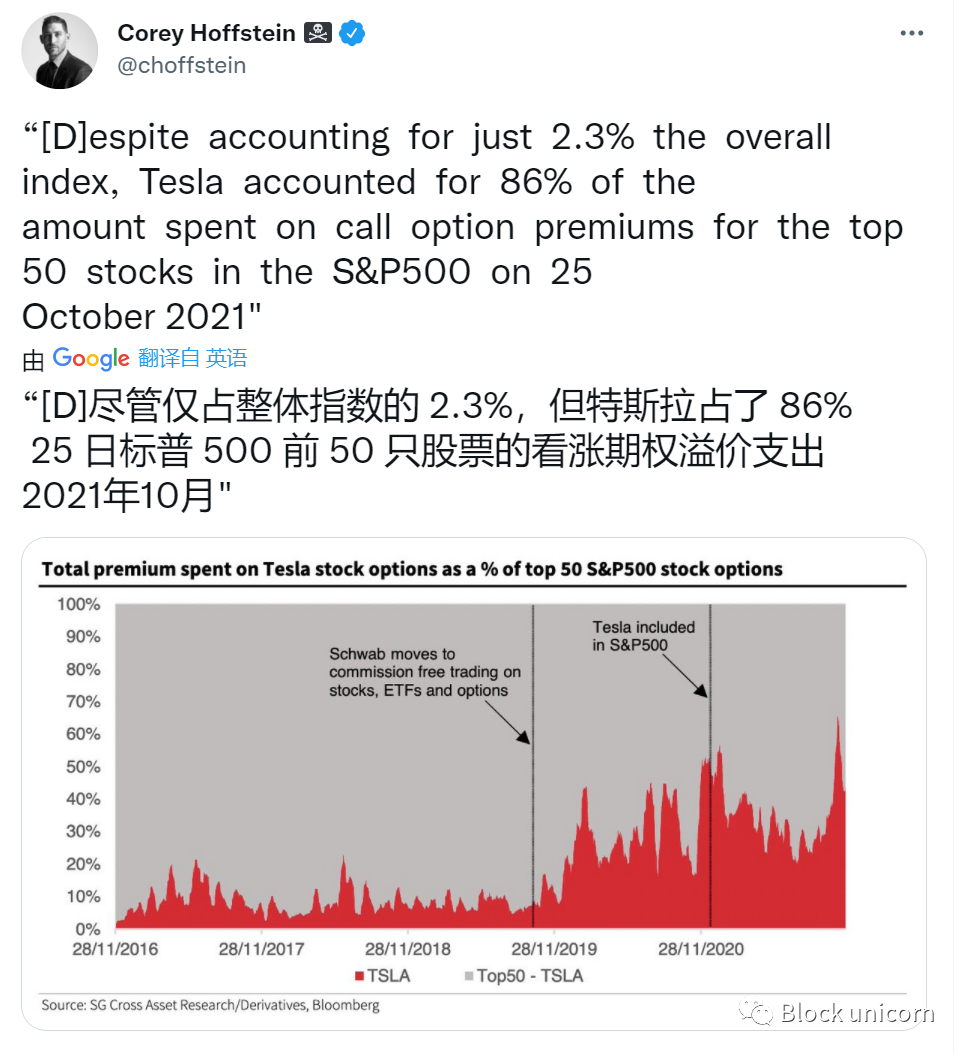

Elon Musk used his social media fame to attract a group of highly loyal retail investors, and used these loyal retail investors to achieve business success in a virtuous circle. Tesla is a nearly $1 trillion company today, yet it trades at a very high price-to-earnings ratio of about 270. By comparison, Apple trades at a paltry 28 times earnings at the time of writing, making Tesla an extremely competitive company. A company that is valuable relative to profitability. This partly reflects high growth expectations, but partly reflects Elon's unique ability to attract capital from retail investors at sky-high prices. Tesla’s share price rose after a December 2020 additional offering, the third time that year the company raised money at a higher valuation than today. Elon was able to use this cheap money to quickly scale up actual production and use his social media fame to boost Tesla's brand image and popularity.

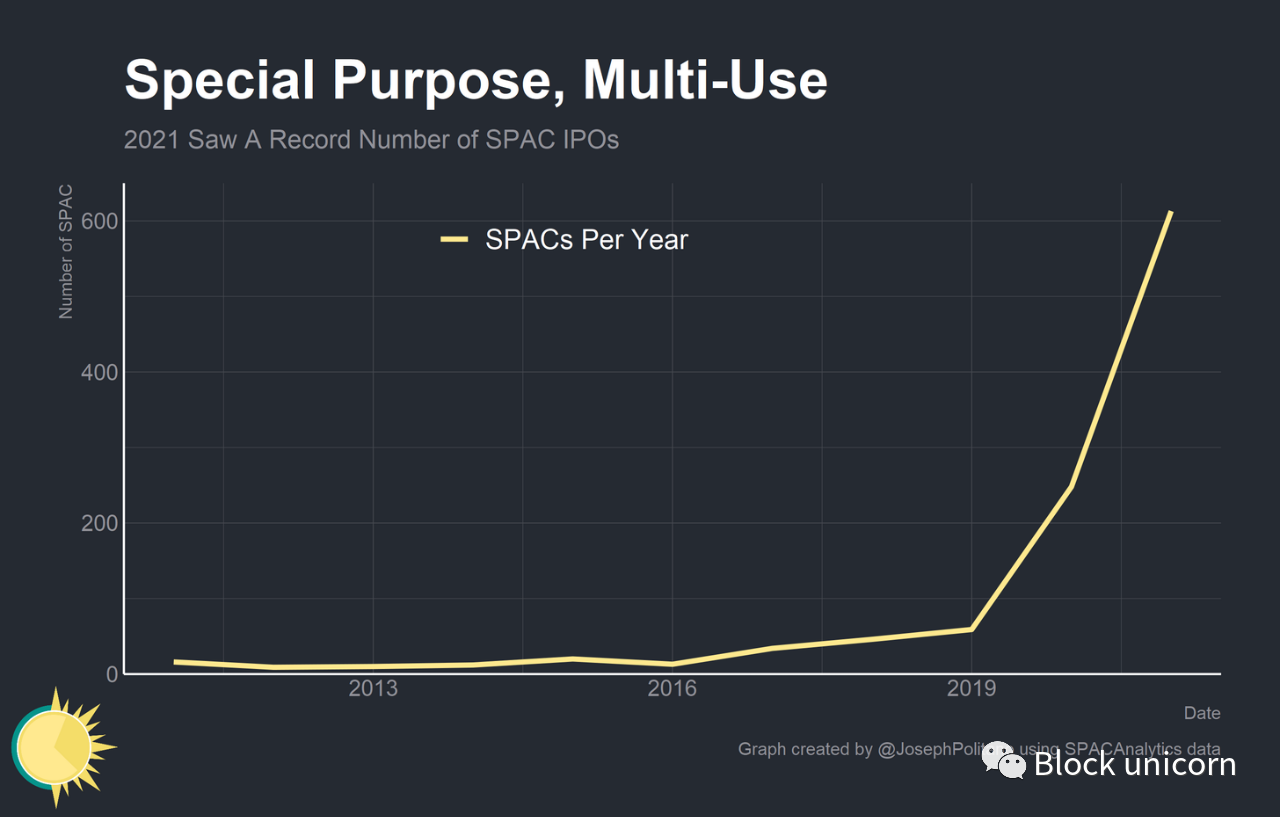

Retail traders are emotionally attached to Tesla's success, thanks to their connections to Elon Musk's quasi-society (that is, the one-sided relationship media users engage with media characters). Their emotional connection makes them stickier investors and willing to buy Tesla stock at a premium valuation. Seeing this, other corporate executives and fund managers started building their social media followings on social media. Michael Saylor of Microstrategy Inc built a following based on his company buying Bitcoin, Cathie Wood built a following based on her "disruptive" investment fund, and Chamath Palihapitiya (SocialCapital CEO) built a following by using special Special Purpose Acquisition Companies take private technology companies public to build a following (SPAC).

As young adults, part of our reaction to memes is everything, so I wouldn't be surprised if this does become a style of investing.

Kyla Scanlon (Twitter KOL)

The beauty and curse of social media is its ability to create narrative communities and parasocial relationships. Humans are narrative, social, and tribal creatures; we form communities based on ingroups and outgroups, and learn from the stories our ingroup members tell us. Memes are not just funny pictures, but short expressions of any complex idea that is sharable, imitable, and adaptable—they are the lifeblood of narrative communication on the Internet. An effective meme defines an ingroup and outgroup simply by who gets the joke (and therefore who the social media content delivery algorithm will show the joke to) and communicates complex ideas through familiar templates (think how many people Use the famous "distracted boyfriend meme" to comment on a variety of different situations). Consider the recent crypto memes of WAGMI (we'll all make it) and NGMI (it won't). They clearly define an ingroup ("we" who invest in cryptocurrencies or specific coins/projects), an outgroup ("you" who don't invest), and tell narrative stories about both groups (are you Will "realize it financially or socially depending on their relationship to the coin/project (implying a substantial increase in value in the future).

The social media narrative has been the basis for the explosion in SPAC usage over the past few years. In a SPAC, a shell company is listed on a stock exchange in order to finance a merger or acquisition of a privately held company. Since SPAC (listed financing method integrates the characteristics and purposes of financial products such as direct listing, overseas mergers and acquisitions, reverse acquisitions, and private placements, and optimizes the characteristics of each financial product to complete the purpose of corporate listing and financing.) in the absence of real affiliated companies They are launched under circumstances and have to find acquisition targets, so they rely on investors' trust in the SPAC founders to raise funds. In the age of social media, someone with a large and loyal digital following (like Chamath Palihapitiya) can leverage the quasi-social relationship they have with their fans to generate substantial funding for SPACs based solely on ideas and narratives.

Online communities are formed through constant exposure to memes that convey similar narratives. Eventually they start to catalyze themselves. The growing popularity of memes drives people who were previously uninterested to get involved in the community. These individuals, so convinced of the core principles of community-defining beliefs, began creating and sharing more memes. The memes convince more people who were previously uninterested to participate, and the cycle starts again. Which brings us back to GameStop and WallStreetBets.

Financial gamification

WallStreetBets expanded dramatically early in the pandemic as COVID-induced unprecedented volatility in the stock market left stranded high earners with time and money to spare. It shouldn't be forgotten that the subreddit also attracts many desperate people looking for ways to improve their financial situation, as well as many who have lost social interaction during the pandemic and are looking for a sense of community. Notorious for either winning a lot of money or (more likely) losing it all.

Our brains are still adapting to this online space, and the way they deal with loneliness is through the "dude, all I do is talk to people on Zoom all day long."

Cool Scanlon

In late 2020 and early 2021, part of the WallStreetBets community on Reddit became concerned about GameStop. The company appears to be making some important changes to its organization and strategy in response to years of declining profits, and WallStreetBets users see record short interest in the company as an opportunity. They started pumping money into the company's stock in an attempt to squeeze short sellers out, and the rest is history.

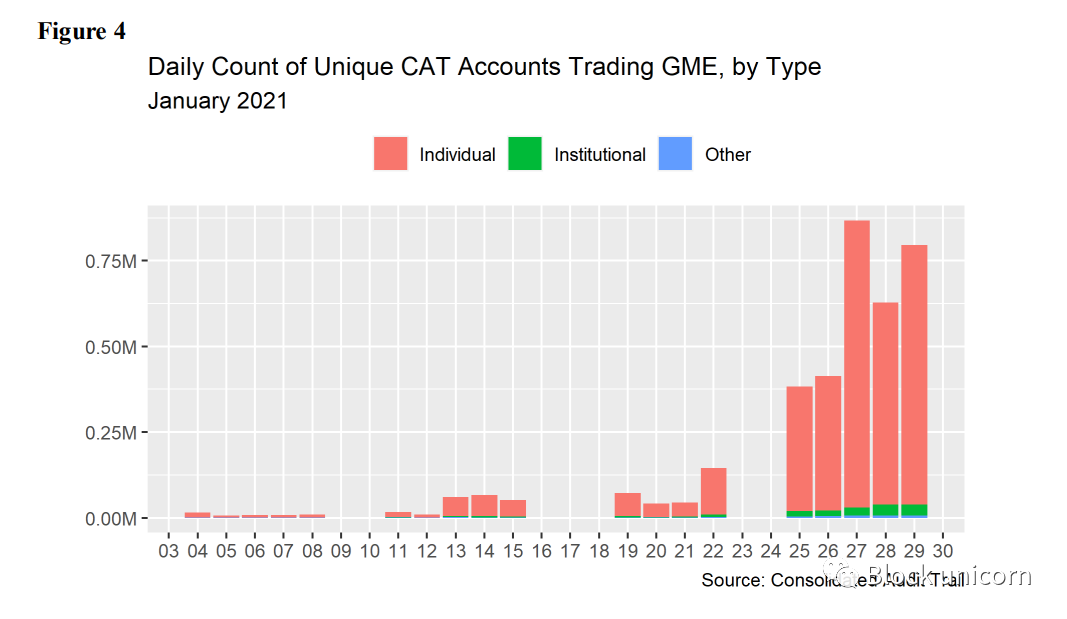

At the height of the mania, more than 750,000 individual accounts were trading GameStop, attracted by the narrative (meme) that they were glued to hedge funds by buying shares. If retail traders just push prices high enough, they can destroy Wall Street suits in one fell swoop while making themselves rich. The meme started on WallStreetBets, but spread quickly: first to the rest of Reddit, then to Twitter and other social media platforms, then to television and mainstream media, then to millions of American dining tables, and finally To the halls of Congress and the White House. Social media influencers like Elon Musk spread the meme further, amplifying its influence by attaching their influence to the frenzy, and the meme spread to other companies' stocks - AMC, BlackBerry and others had plenty Struggling retailer with short interest.

Whether driven by a desire to squeeze short sellers to profit from rising prices, or belief in GameStop's fundamentals, it's positivity that's sustained the weeks-long price, not buying to cover GameStop stock appreciation.

SEC Staff Report on the State of Stock and Options Market Structure in Early 2021

The beauty of social media is its ability to create narrative communities and parasocial relationships. The curse of social media is that these narratives don’t have to be grounded in fact, and these communities can be led astray by groupthink in-group and out-group dynamics. The GameStop saga identified a definite insider group—the online community of forgotten ordinary Americans—and a definite outgroup—who hollowed out the country's Wall Street suit. It established a clear narrative: by buying GameStop stock, you're sticking it to the hedge fund outgroup and enriching the online ingroup, a meme that caused GameStop's price to squeeze out a lot of shorts.

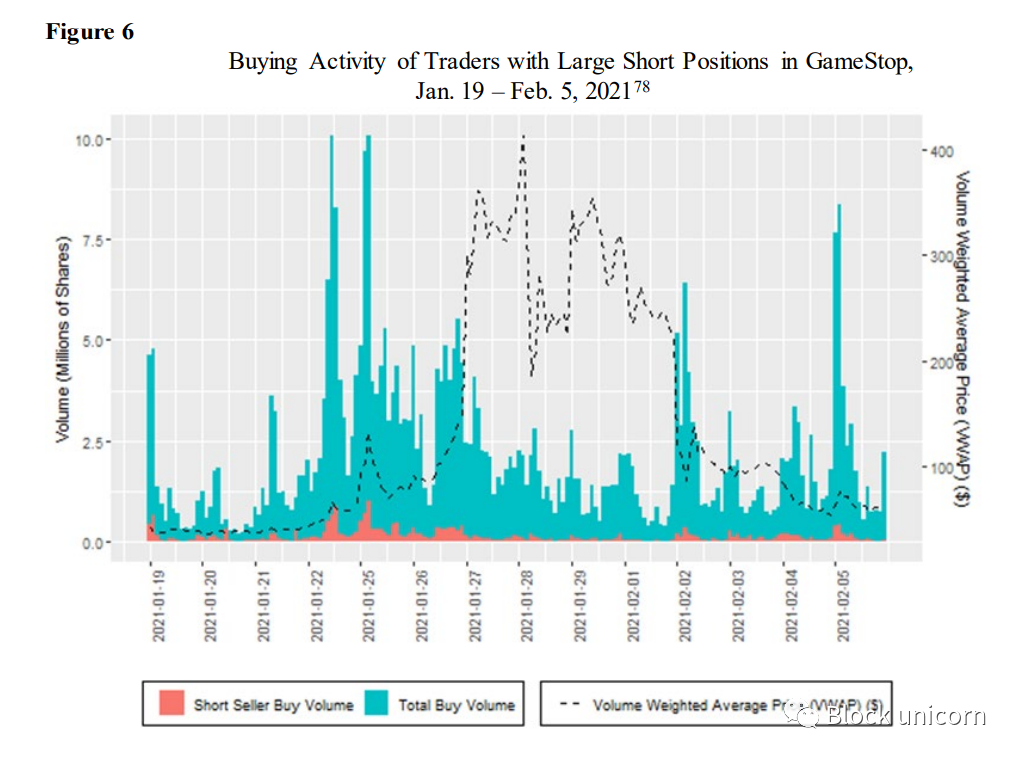

In fact, a Securities and Exchange Commission (SEC) report released after the GameStop event showed that short sellers accounted for a small percentage of the total buying, and that most short sellers were in the market long before GameStop reached its peak price. Capitulating, retail (individual) buying, with an additional boost from some institutions, pushed GameStop stock to new all-time highs. The short squeeze wasn't the driving force behind GameStop's price rise, but the flood of retail money that pushed the stock higher. Crucially, continued interest from retail traders has kept GameStop shares so high -- as of this writing, the company is trading at four times its pre-mania level and nearly twenty times its pre-pandemic level. .

One of the main drivers of the GameStop squeeze was the massive purchase of call options, which caused market makers to hedge their call holdings by buying the underlying stock, driving up the stock price. While staff did see a significant increase in GME options volume for individual clients, from $58.5 million on Jan. 21 to $563.4 million on Jan. 22, before peaking at $2.4 billion on Jan. The increase was primarily driven by the purchase of puts, not calls. Additionally, the data shows that market makers are buying rather than selling calls, observations that are themselves at odds with the GameStop squeeze.

SEC Staff Report on the State of Stock and Options Market Structure in Early 2021

Just to dispel other myths, GameStop compression isn't what causes GameStop mania either. A GameStop squeeze is slightly more complicated than a short squeeze, but essentially involves traders buying call options (a bet on an increase in the price of the underlying asset) from a market maker, forcing the market maker to buy the underlying asset to hedge the call options they wrote. . When buying the underlying asset, market makers drive the price up, so retail traders buying enough call options can drive the price up. This will force short sellers to buy the underlying asset to hedge their positions, pushing prices higher. However, retail traders are net buyers of puts, while market makers are net buyers of calls - a situation that is inconsistent with the GameStop squeeze.

In the end, there was no conspiracy by hedge funds or other financial institutions to ruin the GameStop saga. When Robinhood and other brokers suspended trading in meme (the meme here refers to GameStop) stock, it wasn't to protect the bottom line of financial institutions suffering from the squeeze. Instead, the extreme volatility forced the clearinghouse to request substantial deposits from Robinhood to cover the settlement period for meme stock trades. The deposit amount was ten times Robinhood's normal level, and the company simply couldn't pay it out right away.

When a naked short sale occurs, where the seller fails to deliver the security to the buyer, the staff did observe spikes in GME's non-delivery. However, a miss-delivery can occur with either a short or a long sale, making it an imperfect measure of a naked short sale. In addition, GME did not experience persistent underdelivery at the individual clearing member level, based on a staff review of available data. Specifically, staff observed that most clearing members were able to clear any failures relatively quickly, within a few days, and most did not experience multi-day failures.

SEC Staff Report on the State of Stock and Options Market Structure in Early 2021

There is also no conspiracy around non-delivery, which occurs when a party to a deal contract fails to meet its obligations, as with the conspiracy around GameStop, where short sellers failed to deliver when they closed their positions, partially destroying shorts extrusion. But the vast majority of non-deliveries were quickly resolved, with delivery failures falling sharply after the initial market turmoil.

This may seem like a lot of ink has been spewed out to debunk some of the false theories surrounding GameStop fandom, but it's necessary in order to dispel a common narrative that is fundamentally misleading about the whole situation. The GameStop saga isn't about short selling or sticking it to Wall Street -- it's about millions of people convinced by a meme on the internet to gamble their meager funds on the stock of a dying video game retailer. Wall Street has won because while a handful of hedge funds have suffered huge losses, brokerages, market makers, asset managers and other large financial institutions have reaped handsome profits from the uptick in trading volume. Retail investors lost money as volume increased -- lowering returns -- and were lured into risky assets by the buzz on social media.

In the end, what matters is what people think, not actual facts. As long as people think that this is "retail investors versus institutions," they won't think too much about the facts.

Srivatsan Prakash

Crucially, GameStop's story doesn't end when it disappears from the public eye in early 2021. WallStreetBets had just under 2 million subscribers as of January 2021 and has since grown to nearly 12 million subscribers. Subscribers for GameStop and AMC's subreddits "Superstonk" and "AMCstock" rose to 730,000 and 450,000, respectively. Their front pages often contain posts predicting a total financial market meltdown, the mother of all short squeezes (MOASS - another meme), and GameStop/AMC's meteoric rise. They often promote conspiracy theories about financial firms, the Federal Reserve, and media organizations. It's this highly focused niche internet community and the memes it believes in that keeps GameStop's stock price high. Crucially, they’re a community for lonely people—there’s a discussion thread, and this winter, Superstonk even donated more than $100,000 to the charity Toys for Tots together.

When WallStreetBets grew from 2 million to 9 million subscribers almost overnight, most of the new subscribers didn't realize what was right and what was wrong. They're just from Twitter or Instagram, often inspired by meme pages or their friends. These are the people I worry about.

Taylor Shiroff

in conclusion

in conclusion

Markets are no longer driven by fundamentals, but by memes. It is no longer a metaphor, but a living structure - the market.

Kyla Scanlon

Many people think that a single event — like a market crash, a recession, or the end of a pandemic — will put an end to the meme-trading frenzy, and I largely don’t see it that way. The main drivers of meme trading are the sociological forces brought about by the age of social media and increased access to financial markets. These processes were accelerated by the economic forces of the pandemic era, but began before the pandemic emerged. Corporate social media stars, online trading communities, and increased access to financial services will become increasingly important as the digital age evolves. The meme-trading frenzy isn't going away, it's just moving from asset to asset, and platform to platform, looking for another narrative to grab hold of. Even the memes themselves are dedicated to keeping traders in the frenzy. “HODL” and “Diamond Hands” are both very popular memes for holding financial assets despite their wildly fluctuating values. Exiting can be very difficult when people with whom you have quasi-social relationships, as well as online communities you frequent, are constantly encouraging you to trade.

I also don't think the meme stock mania is fundamentally disrupting the normal functioning of financial markets as a whole, and while there's evidence that Robinhood day traders cause extra volatility in the tickers they care about, retail traders only account for a fraction of the total volume. small portion. While margin debt is at an all-time high, it is still a normal percentage of overall market value. The main victims of the retail trading boom are the traders themselves, who may suffer lower returns due to their trading behavior.

Consideration should be given to whether game-like features and celebratory animations, which may be designed to generate positive feedback from trades, lead investors to more trades. Additionally, payment for order flow and the incentives it generates may drive broker-dealers to find new ways to increase client trading, including through the use of digital engagement practices.

SEC Staff Report on the State of Stock and Options Market Structure in Early 2021

There are two main beneficiaries of this retail trading boom, the first is that financial institutions are deploying behavioral nudges and gamification to encourage their user base to trade more. Retail investors have more money in their pockets with each transaction, and the riskier the transaction, the more money they make.

The second beneficiary is that people who shape social media narratives — for lack of a better term — create memes. Their ability to channel retail investor money will become an increasingly important part of corporate and fund strategies going forward. The quasi-social relationships they develop with their audiences give them a unique ability to leverage cheap capital to influence outcomes in the real economy — while enriching themselves.

In the age of social media, it's important to remember that you are not immune to publicity. Propaganda in this context means not just political campaigns, but any message that promotes a particular narrative. Narratives formed on Twitter or Facebook may not be top-down strategies for shaping public opinion, but the flow of information from content delivery algorithms is nonetheless shaped and shaped by the opinions of their users — whether those opinions are true or not. Some memes are harmless, but others are deadly — and in a competitive attention economy, it's increasingly difficult to tell the two apart. The natural tribalism of the human mind means that propaganda in the age of social media is created in an extremely decentralized manner. There are millions of small communities with their own ingroups and outgroups competing to control the narrative. All social media influencers — and yes, that includes me — have biases, flaws, and incentives that make them not entirely trustworthy institutions. The only way to stay safe in the modern age is to confront your own biases and sensitivities while constantly challenging your sources of information.