Solo Capitalist: An emerging force that spins off traditional VC investments

Author: Mario Gabriele

Compilation of the original text: Cheng Tianyi

Original Source: Overseas Unicorns

Just last Thursday, TechCrunch reporter Natasha Mascarenhas tweeted a link to an SEC filing. The fund, Buckley Ventures III, LP, intends to raise $500 million, according to the filing.VCs have been raising funds at a rapid rate recently, with Kleiner Perkins, a16z, and Paradigm all completing large-scale fundraisings in 2022.

But what's special about Buckley Ventures is that it's run by Joshua Buckley alone.

As the sole general partner (GP), he not only manages a larger fund than many institutions, but is also the co-founder of Prologue, a holding company that manages Product Hunt and its affiliated accelerator, Hyper. Moreover, independent fund managers like Buckley are not alone.As Nikhil Basu Trivedi lays out in his classic article, "The Rise of the Sole Proprietor," a new wave of investors has emerged, managing huge sums of money and taking a slice of the pie from established funds.

Conventional wisdom has it that these independents succeed because they can understand founders better and move faster—the nimble speedboats of venture capital circling slow-moving legacy institutions.

How should we think about this movement, and where is it headed? In this article, we'll try to answer these questions, while diving into what a solo capitalist is, how it's played, and the challenges.

The following is the table of contents of this article, and it is recommended to read it in combination with the main points.

The following is the table of contents of this article, and it is recommended to read it in combination with the main points.

01 Give a definition

02 rise

03 Players

04 The development path towards solo

05 win

06 challenge

07 Advance and Counterattack

first level title

01

first level title

give a definition

In Basu Trivedi's article, he highlights five characteristics that define a solo capitalist:

They are the sole general partners (GPs) of their funds.

Solo capitalist is the only member of its investment team.

Fund brand = personal brand.

They typically raise larger funds and write bigger checks than super angels -- i.e. raise $50M+ and are able to invest $5M+ in a single round.

They compete with traditional VC firms for seed, A and later round lead rounds.Perhaps due to its cultural influence, the term solo capitalist is used more and more loosely. In addition to the above definition, solo capitalist also accommodates those solo GPs (or super angle).

When I ask on twitter who is the best representative of the solo capitalist movement, I get a range of responses - angel investors mixed with managers of funds and syndicates.

first level title

02

first level title

to rise

What led to the rise of individual investors? Many factors are mixed together and influence each other. Here are the five most critical in my opinion:

secondary title

Shift 1: Individuals can accumulate power to distribute information

The emergence of social media has disrupted the supply chain of "ideas", replacing traditional storytellers. Individuals are now free to express their thoughts online without waiting for their stories to be picked up by local newspapers.

Of course, the movement isn't limited to social media. The Internet platform enables blogging, newsletter, podcasting and other creative activities to flourish. Each of these activities can attract a large number of followers.Of course, the result of this transformation is thatIndividuals become media companies, on par with traditional publishers

. In the flat information flow, the most active and successful people gain a large number of followers and win the trust of consumers. Although a large amount of the proceeds have flowed to the platform, individual creators can still benefit from it.Many solo GPs emerged from this transition. Creators like Packy McCormick, Lenny Rachitsky, Nik Milanović, Turner Novak, and Harry Stebbings leverage large followings to ensure they grab share.And the magnitude of funds they can raise is much higher than the funds that they can personally invest.

secondary title

Shift 2: Venture capital has grown as an asset class

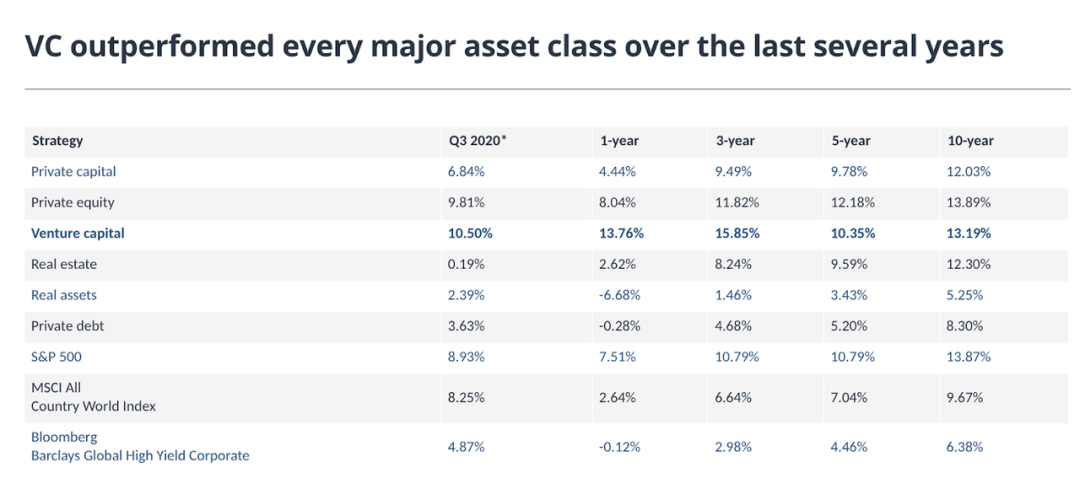

In 2012, the scale of venture capital investment was about 60 billion US dollars. In 2021, this figure will reach USD 643 billion. From 2020 to 2021, the amount of funds deployed to these assets will almost double, growing by 92%.In the three years through 2021, venture capital outperformed all major asset classes with an annualized return of 15.85%, according to Pitchbook.

Pitchbook

image descriptionThose numbers have enticed limited partners (LPs) to increase their allocations to existing funds and dabble in newer forms of investing. Emerging managers tend to outperform established managers.But perhaps more importantly, large funds are already oversaturated.

GPs of large institutions pointed out that they usually cannot invest as much money as LPs want to give. And the new personal GP can give LPs a place to deploy their funds and benefit from it.The surge in capital has helped many individual GPs enter the business,Speed is more important now.

Whereas previous investors might have taken weeks or more to get to know the management team, today's investors need to move faster, sometimes in hours.

Solo GPs thrive in this blitz version of the game. A single decision maker is an advantage when speed is the primary variable. These new drivers help individual investors grab cases, improve their status and attract more capital.

Shift 3: Knowledge services have been formalized and best practices have emerged

text

Starting a business has never been easier - but there's no question it's gotten easier than it used to be. This is partly thanks to the formalization of best practice and the dissemination of knowledge. In the early days of Silicon Valley, few people knew how to create and run high-growth businesses. Now, the world is full of entrepreneurs and practitioners. They have successes and failures, but everyone has corresponding lessons.

But the market is constantly evolving, undermining the advantages of traditional institutions. While institutional knowledge is still valuable, many best practices are now publicly available. So today's entrepreneurs may not need old bones as much as they once did. Individual investors have a relative advantage when traditional advantages are eliminated.

secondary title

Shift 4: Technology and investment go mainstream

Technology is the story of our time — and it permeates business, politics and the arts. As this happens, so do the backers behind those tech winners. The stories of Adam Neumann (Wework founder), Travis Kalanick (Uber founder), Benchmark and SoftBank are on screens big and small.

Interest in joining the industry is also increasing. Venture capital attracts applicants from startups, big tech companies, banking, consulting and journalism, among other fields. The human efficiency of traditional institutions is still very high, and a few investors can manage hundreds of millions or even more money relatively simply. This means that even as the industry grows, it cannot match the magnitude of the candidates.

Many of the individual investors I spoke to said they started their own funds because they had no other options. Others felt that no agency was acting on the opportunities they saw.

“I am particularly passionate about working with early stage founders who are innovating at the intersection of consumer and science. I see becoming a solo GP as a way to realize my vision of pioneering and supporting founders at this intersection. At first there was no institution like Conscience in the market, so I took the initiative to build it."

secondary title

Shift 5: Infrastructure makes it easier to go it aloneIn addition to broader technology upgrades, there has also been a dramatic evolution in the fund management space.

first level title

03

first level title

I'm going to do my best to distinguish a solo capitalist from others like him, as defined by Basu Trivedi. We'll also highlight funds that are participating in this trend and discuss how to go solo.

Solo Capitalists

secondary titleIf we make these restrictions, the number of solo capitalists will be quite small:

Funding over $50M, participation in the lead round, and no other investors on the team.

Elad Gil, formerly CEO of Color Genomics, takes a similar approach to investing. In August 2021, rumors surfaced that he was raising a $620 million fund. He also recently led a Series F round for workforce management platform Lattice.

image description

Elad Gil, a former product manager at Google and director of strategy at Twitter, whose credits include Airbnb, Clubhouse, Coinbase, Pinterest, and Stripe

Shana Fisher, founder of Third Kind, is a pioneer in this field. The former Microsoft executive has exited two funds since he started investing in 2010. Her 2019 fundraising round was $65 million. Fisher also leads rounds, albeit usually early ones, such as in creator platform Bubblehouse.

Of course, the Josh Buckley mentioned above is also in this category. He has managed hundreds of millions of dollars and led investments in gaming startup Playco and Pakistani freight platform Bridgelinx, among others.

Lachy Groom was an early member of Stripe. Last July, Groom reportedly raised a $250 million Fund III and led investments in companies including Stark Bank, Ethyca and ContainIQ.

Shruti Gandhi of Array Ventures raised $56 million in December and led several funding rounds, including a recent investment in product management tool Chisel. Like Third Kind, Array is focused on early-stage investing, so they're a little different from the strictest definition of a solo capitalist.

The above list is not exhaustive—the definition of a solo capitalist is still fuzzy, but the six we've highlighted represent its original definition.

Solo GP

secondary title

Solo capitalists represent a small group of people, while solo GPs are a much larger number. These investors differ from those above in that they may be running smaller funds or not yet leading the round.In addition, Stebbings of 20VC Fund manages a larger fund with at least $140 million in assets under management.

image description

The difference between this group and super angels is that they have raised money from institutional investors. Of course, they will flow between different categories - today's solo GP may become a solo capitalist tomorrow.

secondary title

super angel

Mixed in with the solo capitalists is a group we might call super angels. These people don't take money from institutions, they either invest with their own money, or manage some money for their friends. Some may manage considerable assets and occupy important positions on the equity structure table.

People like Lenny Rachitsky fall into this category. In addition to pitching cases for traditional funds, Rachitsky helps manage AirAngels and invests his own money. He's been so successful that a recent Angelist article highlighted him as one of the top 20 "external co-investors" on the platform. In our interaction, Rachitsky elaborates on this performance nicely:"You can look at the money I've invested, and the current value of all my angel activity (carry to traditional funds and my own syndicate push case), it's up 25 times overall. This data may not be accurate, but it is indeed very true in the end ,

It shows the leverage available to angel investors. "

Regardless of the definition, each of the three categories above are individual investors who have had a significant impact on this ecosystem and are changing the way the game is played.

LP

secondary title

No other industry is more susceptible to "key man risk" than venture capital. This vulnerability is highly amplified by companies founded by individual investors.

Monique Woodard of Cake Ventures noted that LPs are already aware of this risk:"I've dealt with a number of institutions trying to invest in solo capitalists. Some see operational risk, some of them see accidental risk.

I'm sure that solo capitalists have enough resources and their operations are no worse than those with multiple partners. And frankly, accidents can happen to anyone. "

While some LPs think the risk is too great, others think otherwise. A source who used to work at agency LPs sees it as nothing:

"Venture investment is a minority equity investment. Even if the GP is dissolved, its basic investment will not be hurt too much (if it is a buyout, if the GP is dissolved, then the managers of the underlying company's assets will also be dissolved)."

Another glaring difference between the solo and team modes is that the former has an expiration point - another "key man risk". Teams can ride out a partner's retirement and may be more resilient to generational changes, but when a solo GP wants to retire, their agency is due to dissolve.Another issue was highlighted.

If these solo GPs don't succeed in raising a lot of money, management fees won't sustain them in the long run. But if a lot of money is raised, their financial situation will become so good that they may choose to convert their business into a family office or pursue leisure activities.

Likewise, while some LPs prefer funds that have spent several management generations, others prefer dark horses trying to build a new empire. As a fund's assets under management continue to grow, its returns tend to suffer. Therefore, the retirement plan of solo GP may be beneficial instead. Basu Trived made this point, saying:

"At some point, you have to turn off the lights and go to sleep ... I think some organizations view this kind of predictable due date as a feature point, not a bug."Big endowments are getting involved, though Yale's prestigious investment team has eschewed individual investors in favor of institutions that work in teams. Harvard shows no such inclination.

first level title

04

first level title

How to become an individual investor? While everyone's story is different, there are some general paradigms for "individual investors":

secondary title

gain audience

The few individual investors we mentioned all started out as creators. Rachitsky, McCormick and Wittenborn all write Newsletter, Stebbings and Beshara run podcasts, and Turner Novak is one of VC's meme kings.

Liquidity’s founder, who goes by the pseudonym Lit, emphasized the power of audiences to build consensus and find new cases:

"Investors can gain followers, build marketing channels, and communicate their ideas to a specific group, allowing them to see differentiated deal flow on a more personal level."

While attention and intimacy translate well into trading opportunities, individual investors also need outside firepower. Milanović started raising the master fund after realizing he was putting too many opportunities on hold:The bad thing is, we didn't use up our share, so we wanted to raise a fund..."

secondary title

divested from the fund

These individuals benefit from established investment styles, proven track records and their own networks of investors, entrepreneurs and LPs.

secondary title

start a company

Entrepreneurial experience can bring operational expertise, which is difficult for those who have been investing. Naval Ravikant, Jack Altman and Josh Buckley are high-profile examples. Companies that ally with them gain a mentor. They are able to offer more faithful advice than those who have spent their careers in more traditional industries.

A former LP who participated in solo GP investment thinks this may be the best configuration:

As we'll show below, owning a corporate "gangster" also brings networking benefits.

secondary title

professional knowledge

Some individual investors have found success by tapping into markets that other funds have overlooked. For example, Cantos' Ian Rountree has a solid reputation for early-stage investing in hard tech, while Soona Amhaz's Volt Capital focuses on cryptocurrencies. Amhaz emphasizes this as part of her strengths:

"I've been through multiple bull-bear cycles, so I have a longer-term view on the space, unlike those VCs who are just getting into the crypto space. Also, I'm able to provide insights that are unique to the industry."

Professionalism doesn’t have to be limited to new technologies. For example, Andreas Klinger launched Remote Work Capital to capitalize on global trends:

"I was struggling trying to convince my VC friends to invest in companies that I thought were great. So I raised money from a couple of people who also believed in the remote work trend and started investing myself. Post-COVID, the world is watching to the potential of the subject."

Woodard invests in different cultural trends, focusing on "companies involved in areas of demographic change," including aging populations, female consumers, and the "new majority," a trend made up primarily of formerly "minority" groups. Woodard feels her focus on these areas is outside the purview of traditional VC work, but could be invaluable to founders:

"After investing in an agency, it became clear to me that my thesis would not fit in a VC agency. I've always been a builder and entrepreneur, so I applied that entrepreneurial spirit to start a VC firm.

The founders were willing to take my money because they knew I had a point of view and understanding on population-related topics. At the end of the day, I think my ability to demonstrate expertise in areas like aging resonates most with founders. "

"Given DAOs, community fundraising, NFTs, etc., I believe the traditional structure of VC is not suitable for cryptocurrency ... the best funds will be a hybrid of VC and hedge funds. I have reached out to some smaller players, they are willing to Let me experiment with the idea and be open to more flexible configurations."

secondary title

Many individual investors have risen after working in new economy companies. Rachitsky spent seven years at Airbnb, Groom seven years at Stripe, and Rajaram at Google, Facebook, and Doordash.

Groom was employee 30 at Stripe

image description

He voted for Figma and Notion

The company ecology they are in is rich in talents. These talents may start their own businesses or be dug into member companies. Rachitsky mentions this usually as part of his pitch:

first level title

05

first level title

winMost importantly, the triumph of individual investors is a feat of "reverse positioning".

While every investor has their own strengths and weaknesses, there is always something close to the benchmark paradigm. Almost every individual investor and other source I spoke to highlighted the following:

secondary title

act fast

Every venture capital firm needs a Domino's pizza tracker. What stage is your deal in? Are you still in the due diligence stage or are you meeting? Do you have to hold on for another month, or do you have an answer by the end of the week?

The variability and opacity of the traditional financing process are the flaws of venture capital. Unfortunately, this pain point is difficult to solve. A myriad of factors—cases, partners, other member firms, boards of directors, investment committees—combined to impede the process.Individual investors can solve this pain point. Because of their unilateral stance, they are able to make investment decisions quickly, winning share through decisiveness.

Shruti Gandhi of Array Ventures pointed out, "We usually make decisions on the call and spend more time on additional due diligence and negotiating terms and so on."

This cycle appears to be common among individual investors and represents a dramatic shift from traditional investment cycles.

secondary title

timely responseThis velocity continues after the investment is made. Several of the individual investors I spoke to said part of their value is responsiveness. For example, Nik Milanović said: “”

You can ask any founder I invest in, and I almost always reply in seconds.

Lenny Rachitsky elaborates on this topic:

While some traditional investors have done well in this area, individual investors stand out. In some ways, this may be because many people are entrepreneurs themselves, so they are more compatible with founders.

secondary title

empathetic

Individual investors are also founders, and many run startups in addition to investing. But even without that, the act of formalizing individual investing practices is entrepreneurial.Starting a company is not easy, so these solo capitalists are closer to the founders than traditional venture capitalists. As Cantos' Ian Rountree puts it, "Solo GP is the founder himself.

Ariana Thacker of Conscience also described this phenomenon:"The birth of Conscience allowed me to connect emotionally and intellectually with the founders in a deeper, empathetic and understanding way. I felt like we were like-minded underdogs fighting alongside each other to accomplish what we each "did not May" consistent mission...”

I am not alone in this journey, most of my fellow solo capitalists are working 60-80+ hours a week and we are pulling out all the stops to make this happen.

As one individual investor described it to me: "I'm your friend first...no extra distractions, just you and me. We'll go for it together."

secondary title

Professional guidance

Some individual investors attract founders with their insights into a field. As Julian Shapiro puts it, “The solo itself is not important. The fun is being an investor in the company.” Those who fit this bill have the empathy mentioned above, as well as valuable expertise.

For example, Lachy Groom contributes to Stripe's finance business. Such experience is rare and could be valuable to many startups. Lenny Rachitsky is a brilliant product and growth guru - both vital components of any business.He's known for being bullish on Tesla's arguments. His expertise in the field has brought him to board Arcimoto, a publicly traded electric vehicle company. With new players emerging in this ecosystem, Gali could become the partner many would like to have on the capital side.

image description

Gali Russell Shares Tesla on TV

Finally, Andreas Klinger succinctly summarizes this element of individual investor appeal:

The most successful individual investors bring professional guidance through sophisticated insight or a wealth of relevant experience.

secondary title

help marketing

Social media advertising has reached saturation, making it increasingly difficult for businesses to stand out. Effective marketing channels are therefore more valuable than ever. Few traditional VC firms provide meaningful support in this space. Of course, many can introduce PR firms to member businesses, or help them hire in-house marketing experts and creators.

But founders often can't count on investors to tell their company's story.

Creator-turned-investors are stepping in. Since they already have a large audience, these investors can help increase the company's popularity and replace the company's marketing investment.

Gali, for example, points out that when he was at a pitch company, he would clearly demonstrate his contribution in this area: "I would say we do a podcast, or let me introduce you on Twitter, and you will see my value." Usually , traditional investors would “overpromise and underdeliver,” but these creators can make a difference and demonstrate their influence from the start.This type of marketing probably works best when paired with great storytelling skills.

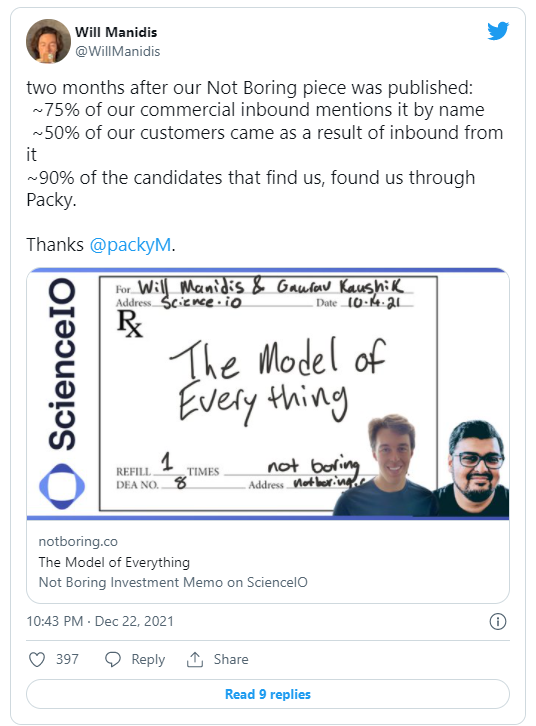

While improving your social media presence is beneficial, creating stories for your business through podcasts and written work can be even more valuable. One of the best examples is Packy McCormick of Not Boring. ScienceIO founder Will Manidis highlighted the impact of a Not Boring article on his business:

It's almost crazy, traditional funds need to do a lot of work to achieve half of these numbers, but Not Boring Capital only relied on an article written by Packy himself.

first level title

06

challenge

challenge

Running a fund alone is not easy. From the outside, it might look like it's all about writing checks and tweeting, but behind the scenes there are complex operations, real struggles, and obvious trade-offs. As Thacker puts it:

Individual investors face challenges at every stage of the investment process, and there are several beyond investing.

secondary title

find item

As the startup ecosystem grows in size, so does the number of high-quality companies. This makes finding projects an increasingly important part of a VC's job. Analysts and investment managers are tasked with finding the next big thing and getting there first. Individual investors may have a little difficulty with this. The single-player mode makes it almost impossible for them to achieve the same coverage.While some individual investors I interviewed mentioned that they saw cases before other investors, many relied on referrals from other institutions.

As long as individual investors don't take up too much of a share, established institutions are happy to include someone who might be helpful to the company.

But as individual investors raise more money, the relationship becomes more complicated — as one anonymous source puts it, those people could be "crowded out of their access points" as AUM grows. ". In order to thrive with greater management scale, individual investors need to have access to cases differently than traditional funds.

For an investor like Groom, it might come from his Stripe network. Someone like Buckley can leverage Product Hunt's influence and his exposure to products within the Hyper ecosystem. Creators and community builders can leverage their audiences. Lit notes that they "have an audience of over 1 million individuals and have built a network that allows them to access deal flow." Milanović mentions that over 90% of his deals come from "passionate recommendations" from community members and readers. Amhaz points to crypto meetups like P2P Miami as a valuable sourcing avenue

Interestingly, Rachitsky candidly stated that his audience and community have proven to be more profitable for him than uncovering new cases:

While most individual investors can happily stay small enough to work with large institutions, reducing the need for massive sourcing, a small minority must rely on other strategies.

secondary title

due diligence

Individual investors often don't have the time and energy to thoroughly research the companies they're evaluating because one of their core appeals is speed. And even without other interactions, a deeper understanding of the company often takes more than a few days. Some investors are taking a more measured approach, though that's uncommon.To make a more determined shot, individual investors rely on others in their network.

For example, Neil Murray, the full-time CEO who runs The Nordic Web Ventures and Playmaker, mentioned that he often outsources due diligence to his LPs or others with relevant expertise. Others point out that once a lead investor is in place, they do little due diligence.

What’s interesting about this trend is that it effectively splits venture capital: one party is only responsible for winning deals, and the research and analysis process is stripped away. While traditional institutions are also going through this shift, solo capitalists are the more visible case and may herald shifts to come. Perhaps in the future, firms will differentiate between the "front-end" traders responsible for attracting entrepreneurs and the "back-end" analysts who form the investment case.

From a certain point of view, this is a perfectly reasonable approach. Individual investors almost certainly cannot do as much due diligence as large funds (at least not with the same breadth), so why not trust their judgment? Just like "no one has ever been fired for buying IBM", few individual investors will be cheated for following Sequoia into a certain round.

“If a solo capitalist chooses to put $1 million in a round without doing a lot of research work, I would be very nervous. But I see this happening all the time.”

secondary title

post-investment support

"You basically can't be a major investor in 100 companies," Basu Trivedi points out. Part of the reason is that venture capital firms have taken on new responsibilities over the past decade. Many funds are now moving beyond just advising — which is itself time-intensive — to specializing in recruiting, marketing and operating practices.

Individual investors usually do not have the time and energy to provide similar services. Murray pointed out that there are many initiatives he might want to do for his founder, but is not a good fit:

”Even if it’s your full-time job, it’s still going to be a problem. Because you want to focus on the things that are really driving change, finding new investments and helping businesses that have already invested. Although you know there are many other things Helps run the business (schedule face-to-face events, maintain an engaging Slack channel with all your founders and LPs, connect with great people for your founders), but there's only one person with it all, you It's hard to find time."Perhaps the most salient issues are:

Do entrepreneurs want these additional services? Do they expect individual investors to do the same?

Some founders sure will. a16z is probably the most advanced company in terms of post-investment support. For founders like Levels' Sam Corcos, this has been a huge boon. Last October, he tweeted about the company's value:

How does one individual investor compete with 94 others. For someone like Corcos, replacing a16z with an individual investor will almost certainly not be the right thing to do. Corcos has apparently found a way to take full advantage of this pattern. However, Corcos is also an unusual case. He's a quirky manager with superpowers in terms of productivity and networking. It's not surprising that someone who maintains a spreadsheet of 1,000 people and keeps in touch with them might maximize this post-investment value.

Other founders may prefer a peer-to-peer personal relationship. While individual investors may not be able to do everything, they can meet this need better than institutions. In some cases, they may have unique knowledge or access.Finally, we should return to the McCormick example mentioned earlier.

To use the entrepreneurial metaphor, entrepreneurs should be "T-shaped", applying their knowledge to a variety of scenarios, but with a deep understanding of a specific industry. The solo trend favors “T-shaped” investors—those smart enough to analyze different businesses and possess a specific killer cognition.

secondary title

administrative work

While the level of technology has improved considerably, individual investors still face many administrative challenges. To be successful, many hire additional support staff. Several big-name individual capitalists are handling operations through chief of staff, while some others have begun building a back-office team. Soona Amhaz commented:

"Solo capitalist is a misnomer, as many solo capitalists are not operating alone. Investors may represent the fund brand and sole GP, but there is often a team to support operations, finance, administration, back office and procurement/due diligence. For example, At Volt Capital, we hired a CFO, an analyst and an investment partner."

Some investors have increased headcount, while others are wary of new tools. Fern Gouveia noted that starting a company that was a mix of venture capital and hedge funds made him aware of the scarcity of infrastructure:

As investing continues to enter the mainstream and bring in new fund managers, we should expect to see new products emerge to serve increasingly complex use cases.

secondary title

scale up

Most individual investors have funds in the tens of millions, not hundreds of millions. In many cases, this means they may not be able to take full advantage of the benefits of co-investing in subsequent rounds. If they do not choose to exercise proportionally, their stake will be diluted in subsequent rounds. There doesn't seem to be a perfect solution to this problem.

A common solution is to top up and invest funds through an SPV. The money does not come from individual investor funds, but from LPs, other founders, and community members. Amhaz talks about this:

"Typically, I can get more co-investment in subsequent rounds - in this case, I launch an SPV to maximize exposure. Volt Capital LP usually has priority exercise and enters the SPV .”

Julian Shapiro noted that he follows a similar strategy, preferring to work with LPs who want to invest in run-off companies for their funds. "I want them to get value from me so that I'm not just their commodity," he said.Not everyone agrees that SPV works. Andreas Klinger says they are "often too slow". Gathering interest can be difficult, especially if a company isn't well-known. "”

Once the company catches fire," he added, "it's basically too late.

For the sake of simplicity, some individual investors just allocate the right to co-invest to large LPs, thereby eliminating the pressure to operate a public syndicate. Many of these LPs may be GPs in larger funds. While some of these relationships involve shared interests, in other cases it may serve as an interest to support the solo capitalist.

A former manager of a large fund made a similar claim:

secondary title

identity

identity

A more esoteric challenge is that of identity. As Jackson Dahl mentioned in his article "What to Watch for Cryptocurrency in 2022", more and more influencers are using aliases and aliases. This is especially true in the cryptocurrency world, where Gmoney, 0xMaki, and various people using the CryptoPunk codename have amassed large and influential audiences.

How do they handle identity issues? After all, investing in relationships often falls to the individual. I asked Lit from Litquidity how they handle identities and learned that they only reveal identities with signed NDAs. They added:This relationship is based on trust.

first level title

07

advance and counterattack

text

Should Traditional VCs Worry About Individual Investors? For leading institutions, this trend may not be a significant threat. When I asked Basu Trivedi what he thinks about the success rate of solo capitalists, he replied: "Are they higher than the big institutions? I don't think so." He also emphasized that the competitiveness of practitioners also varies greatly.Although the top institutions may be more worried about Tiger Global than the solo capitalists, they may still want to take positive action. Moreover, the effects of these "rogues" are almost certainly being felt by funds below the head. Given that so many investors offer the same value for money,Now is the time for VCs to react and fight back.

secondary title

There's something illogical about the nickname Solo capitalist. Indeed, there are structural advantages to maintaining a small team. As we mentioned, this enables quick decision-making and closer relationships.

but,but,Is there really that much difference between a single GP company and a dual GP institution?

What about three? Are individual investors really that fast? Is it that tight?

Individual investors automatically reap the benefits of having no baggage and going it alone. They are always compared with VC on favorable dimensions, but almost never on unfavorable dimensions. As Gouveia points out, “VCs (when compared) are not always positive symbols, so being seen as individuals rather than companies also humanizes us in the eyes of founders.”

"There's always a pendulum swinging somewhere. The founders in a few years may say they don't have enough support because the solo capitalists are too spread out and some of us may have to band together... "

secondary title

Make institutions more like individual investorsUndercutting individual investors is a dangerous game - it's far smarter to learn from them. Rather than critiquing individual-run institutions, traditional organizations need to embrace this new wave of service, individuality, and empathy.

Perhaps the most obvious way is to boost a partner's personal brand. Julian Shapiro advises VC partners to "go YouTube" or "write long-form blogs."

Failing that, companies can also try to attract individual investors to join them. Some people want to keep their independence, but adding strong backend support and more stability may appeal to many. Attracting creator-turned-investors could be a killer weapon, as they solve many of the marketing clout challenges of incumbents.a16z is the clear leader in this regard, with a series of podcasts. It's too early to tell the success of Future, its online publishing platform, but the foray shows its understanding of ecosystem change.

image description

a16z launches Future to disrupt the future of the media industry

Few other funds have followed in a16z's and Redpoint's footsteps, suggesting they either didn't notice or felt unable to develop new capabilities. Those who don't want to be out should wake up and start expanding their skill set.

secondary title

Established GPs often write first checks to funds managed by individual investors. Not only is this a way to facilitate the next wave of development in the industry, but it also allows them to see new deal opportunities earlier. These institutions should formalize this LP investment. It can allocate a fixed amount every year to invest in emerging fund managers, or let each GP get the funds and distribute them. Some could roll out educational resources for budding fund managers, or create a platform that makes it easier for this group to leverage the institution's infrastructure.

For example,For example,Index Ventures can select 5 new solo GPs to invest in seed funds of US$10 million every year.

first level title

08

future

future

Will the individual investor trend continue? Will we see relatively more asset management managed by this group, or less? While many members of this group are optimistic about the future (unsurprisingly), those outside the group seem to think so too. The aforementioned former fund manager said:

Let's consider how contemporary individual investors have developed their investing practices in time.

secondary title

scale out

Operating independently does not have to be a permanent status. For many, it's more a matter of circumstances than a clear personal preference. Monique Woodard said:

"Starting a company in partnership is like getting married to me. It's not something you can do with just anyone. I'm more confident in running Cake as a solo GP than getting married with a child."

And sometimes, even those who would rather operate independently may find a permanent business partner. We've seen this happen many times in recent years. Jeff Morris, Jr. was once a well-known solo GP, but later included new investors in the fund he founded, Chapter One. Xuezhao Lan of Basis Set is another example. Lan outlines Basis Set's growth process like this:

Others may follow Lan's lead, branching out into solo investing status and building funds with multiple partners at the helm.

secondary title

form an alliance

The other is alliances. The venture capital world is already dominated by different alliances based on the sharing of information and deal opportunities. Individual investors can join forces to obtain post-investment resources similar to those provided by large institutions. An individual investor expressed interest in this approach:"Maybe a network of alliances could be created for individual investors to enable each other's "platforms."

My BD ability, Packy/Mario's writing/research, Ryan's product ability, Shrug's influencer relationship, etc. "

Ultimately, investors may find new and mutually beneficial ways to collaborate to increase their bandwidth.

secondary title

improve fairness

Women and minorities remain underrepresented in venture capital. Such problems seem to exist in the individual investor community as well. For the independent investor movement to mature, these marginalized groups need further support. Shruti Gandhi pointed out that there is "no diversity" among solo GPs and "very few people trust women who invest independently".

Elaborating on this topic, Woodard noted that a more diverse pool of individual investors can empower founders, industries and geographies that are often overlooked:

first level title

09

epilogue

epilogueAs Jim Barker said, there are only two ways to make money:。

Bundle and unbundle

Venture capital may be returning to where it started. An industry founded by solitary wolves like Arthur Rock is teaming up—agencies growing and thriving with their unique expertise, clearer information, and richer services.

This represents a great spin-off movement, and it seems like it's just getting started.