An in-depth discussion of the consensus capital market in the encryption era

Original translation: Block unicorn

Original translation: Block unicorn

introduce:

introduce:

block space

block space

All economic activities on the public blockchain are built on the block space. Consensus producers, such as miners and staked validators, provide block space, which is required for every transaction. When on-chain activity increases, network fees increase, and when the value of the block subsidy and fees increase, more people have an incentive to compete to append the next block to the blockchain.

Since blockspace is a commodity, it can be used as the basis for financial instruments - to hedge production or enhance returns. This financialization culminated in a full-fledged capital market, similar to how all major commodities have evolved throughout history.

first level title

Commodity Markets: A Historical Overview

As early as 4500 BC, residents of ancient Sumer used clay tokens and slates to determine the date of future delivery of goods and settlement rules, essentially a futures contract. Nearly 3,000 years later, a code of law from Hammurabi outlined the rules for payments to farmers who mortgaged their property. Farmers had to pay their debts with the food they produced, but reserved the right not to pay back when crops failed. These ground rules help producers manage risk, which in turn promotes more stable agricultural production.

These financial arrangements would continue to develop and be standardized, and one of the first formal commodity exchanges was the Dojima Rice Exchange in 1697. Instead of actual rice, merchants would trade "rice tickets," the right to claim rice in their warehouses. Based on rice tickets, merchants developed many derivative contracts that are now commonly traded, such as short sales, forwards, and options. More than a century later, the Chicago Board of Trade was founded and has grown to become the global leader in food and agricultural commodity futures and options markets, financial contracts that trade in far greater volumes than physical commodities.

image description

Dojima Rice Exchange

As commodity markets mature and become more complex, so do the types of financial instruments available to help manage the associated risks. Today, they cover nearly every commodity, from sugar to coffee to gold and energy markets.

first level title

Era of the Metaverse

As more aspects of everyday activities go digital, the value of associated resources such as data and computing soars. While the underlying technology of the digital age is still in its infancy, its acceleration is astounding due to Moore's Law and the abstraction of software development. For these reasons, phrases like "data is the new oil" have become relatively common.

As Dijkstra (who conducted a questionnaire survey of 1,000 computer scientists) commented in 1972, "I do not know of any other technology that can cover ratios of 10¹⁰ or higher: computers, with their incredible speed, seem to be the first We provide environments of highly layered artifacts, both possible and necessary.” At this point, it is no longer useful to think of the digital universe as a physical phenomenon. Instead, software is what Abelson (PhD, Nuclear, UC Berkeley) and Sussman (Professor of Computing, MIT) call "program epistemology". It has become an infinite medium of human expression.

This naturally makes people wonder-where will this road lead us in the end? Many works of science fiction depict different versions of the metaverse, but they all seem to be built on one baseline: a digital reality parallel to physical reality, filled with its own worlds, economies, and digital assets. Matthew Ball more specifically describes it as "a large-scale and interoperable network of real-time rendered 3D virtual worlds that can be simultaneously and continuously experienced by an unlimited number of users, with a sense of personal presence and continuity of data such as identity, history, Rights, Objects, Communications, and Payments.” Ball further mentioned that encrypted networks will span and advance several categories that are critical to enabling the Metaverse, primarily computing, interoperability tools and standards, and payments.

In fact, given enough time and technological advancement, a distributed network powered by a cryptoeconomic scheme will dominate: how Metaverse data is stored, presented, and accessed is tenable. It may also guide the development of Metaversal's social fabric; we've seen how DeFi and crypto games drive users to prefer user-owned protocols and share specific usage economic incentives over rent extraction.

first level title

Block Space Commodities

We have built massive markets across the globe to ensure we have a steady supply of food and energy to sustain our society. So, what kind of market will emerge in the basic commodity block space of Metaverse?

Fundamentally, a blockspace is a representative unit of shared computing layers and state across multiple users; the blockchain exists as a record of changes and additions to that state, and the cryptographic network serves as a marketplace for the production and use of blockspace .

Users issue transactions with additional fees indicating that they need to purchase block space to change the global state of the network, and node operators (miners, validators, etc.) participating in the consensus provide security for the network by producing block space composed of these state changes . While this sounds simple, block space market dynamics are quite complex.

On the one hand, block spaces have an implicit temporal value. In Ethereum Blockspace - Who Gets What and Why, we discussed why future blockspaces are inherently less valuable than current ones. As a contrived example, a user trying to deposit money in an on-chain money market would rather lock in a current rate than lock in a future rate that may or may not be lower. Likewise, users trying to purchase NFTs would rather complete the transaction before it is snapped up by someone else.

Historically, this time value was quantified through network fees, and block producers defaulted to inclusion based on the transaction containing the highest fee. It also means that users are incentivized to pay higher fees for more urgent transactions, which can lead to phenomena such as miner extractable value (MEV).

Even solutions that attempt to add a global clock to the blockchain, such as Solana's proof-of-history, which uses serial hashing to timestamp transactions entering the network, still have an implicit time value in their chain. Sequence-based inclusion models are more susceptible to latency than fee-based models; those who want their transactions included at the time of record on a network of clocks will optimize for favorable network topologies and physical and Digital proximity to ensure their deals are prioritized. This is the same as the principle of competing for proximity to exchanges in traditional high-frequency trading.

Likewise, for suppliers (consensus node operators), blockspace materialized now is more valuable than in the future.

Profit for consensus producers is calculated as the difference between consensus incentives and node operating costs. Rewards for node operators are subject to volatility: spot prices, transaction fees, and the probability of finding a block are all factors in reward uncertainty. Different networks have different incentives for paying node operators, which adds further complexity.

The cost of running a node also varies widely, as different networks often have vastly different requirements for participation as a validator. Proof-of-work networks are driven by a market for mining hardware, cheap and reliable electricity, and more. In contrast, considerations for running a Proof-of-Stake (POS) ETH2.0 node depend on minimal electricity consumption and the funds required to stake.

We can further break down the supply side into OPEX and CAPEX costs. Capex tends to be high for networks that require higher levels of computing at the base layer. Besides Bitcoin and Ethereum mining, other examples include Arweave and Filecoin, where validators scale storage capacity and RAM for fast processing, Solana proof-of-history nodes get high computational requirements due to serial hashing involved, and any Zero knowledge. GPUs and other processing units capable of fast linear operations can significantly speed up proof calculations.

However, it is important to note that each node of the network incurs some capital expenditures that may end up being repetitive in nature due to factors such as state inflation. Capital expenditures can be on the high side and usually pay back over time.

As for operating expenses, miners incur operating expenses in the form of electricity and maintenance costs. Staking validators generate OpEx in the form of staking requirements and tokens. For other consensus algorithms, the OpEx cost is between token-intensive and physical resource-intensive.

Almost every consensus algorithm treats the right to block production as a probability function weighted by a node operator's share of validating power versus global validating power. This means that in order to maintain a certain probability of block generation, operators need to correspondingly increase the rights and interests of the network's "verification ability". For example, if other validators suddenly decide to stake another 5,000 ATOMs to maintain a 10% block probability, an ATOM validator with 1,000 ATOMs and a total of 10,000 ATOMs staked across the network will need to buy another 500 ATOMs . The same goes for other popular PoS networks such as Terra, Avalanche, and Near. There may be slight differences in the actual mechanics (i.e. Avalanche has a different cap on the total possible amount delegated to a node than other networks).

This volatility causes additional volatility in validator rewards and can lead to unforeseen opex costs, so some network incentives favor accelerating the fight for a dominant share of network stake (beyond the ability of the majority to attack the network), such as the distribution in Solana In an inflationary system:

As the network scales in utility, the healthy growth of node operators increases the network's security budget, making it resilient to consensus-breaking attacks. Ideally, the cost of running a node should be offset by the revenue generated by consensus. However, as we explain in The Alchemy of Hashpower, consensus producers go through four prototype market stages, some of which may bring producers out of business.

first level title

consensus capital market

Primitive forms of financial instruments for blockspace exist today; hash rate indices, gas tokens, and staking derivatives are all attempts to create consensus capital markets. However, hashrate indices/futures and gas tokens have failed to gain significant liquidity, and these markets tend to be opaque and onerous for buyers and sellers.

In other cases, demand never materialized as difficulties in pricing assets such as gas tokens confounded the supply of liquidity on-chain and on centralized exchanges.

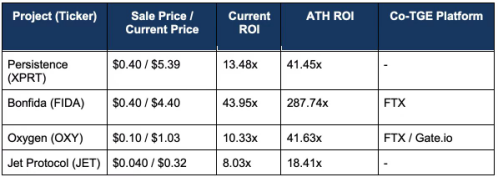

image description

ETH sent to ETH 2.0 pledge contract

In the absence of a complete hedging solution, validators are exposed to risk from network assets (due to their stake) and volatility risk requirements (fees) related to block space. With staking derivatives, validators on a PoS network will sell token representations of their staked assets in exchange for whatever asset they want denominated (i.e., a PoS validator will sell their staked ETH in exchange for a stablecoin), to hedge against Risks Related to Fees. The value of pledged assets is equal to the basic network assets plus the expectation of accrual of future network fees. Holding pledged assets means facing the volatility of verifying future cash flows. Selling assets at market prices “locks in” a fixed price for these future cash flows (represented by the price difference between the pledged asset and the underlying asset).

Since validators need to transact with the market to do this hedging, they incur a lot of price risk as they need to buy the staked assets at market prices when they want to gain exposure to network activity again or unlock their stake. Given that pledged assets typically trade at tight parity with the underlying asset, validators end up not being able to fully hedge the risk due to Delta (hedged value) exposure. Additional tools are needed by cost-conscious validators who want to minimize risk without needing to be active traders, especially in volatile markets.

Ideally, when constructing a hedge for blockspace production, it should satisfy the following two properties:

1. Isolation of network activity risks (block space demand fees quantified by the network).

2. Isolation of network asset price risk (a function of the external market).

These two requirements are met in an exchange-based arrangement.

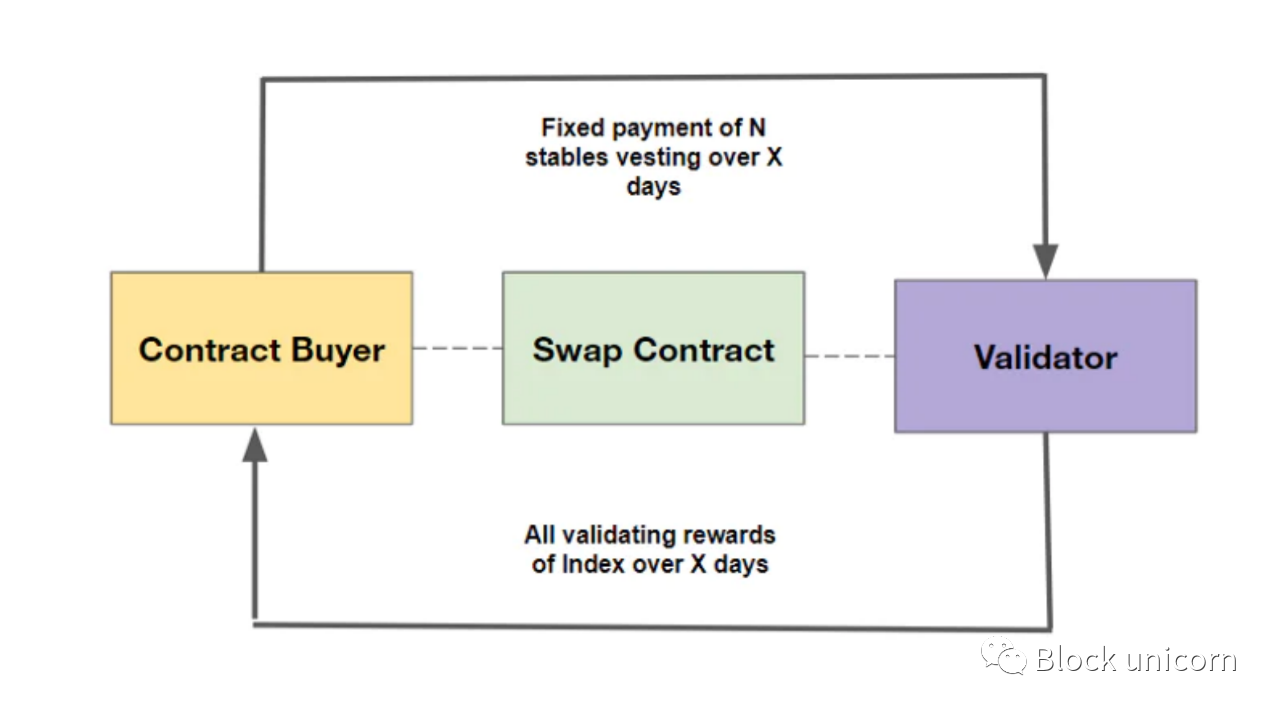

A high-level diagram of Alkimiya's construction can be found below. It mirrors the energy exchange found in traditional commodity markets: buyers pay fixed stablecoin payments to producers (in this case, miners/network validators), vested over the duration of the contract, while producers pay all rewards based on validation A certain metric (specific to the consensus algorithm) over the same time period.

During this period, contract buyers receive potential block space demand in the form of network fees and block subsidies, while validators insulate themselves from network activity and asset price risk.

We broadly categorize indices as units of verification power per unit index time. The most commonly discussed index in proof-of-work mining is hashes per second. For an Ethereum 2.0 Proof-of-Stake, this might look like a stake of ETH per epoch (the period of time during which selected validators can propose blocks).

This index is particularly important for verifying that validators deliver their promised share of rewards. Our design allows validators to list contracts that commit to any index up to their maximum available resources, i.e. a miner on Ethereum with 10 TH/s can list a contract that promises a reward index of up to 10 TH/s (10 trillion calculations) (as long as the sum of all their contracts equals this amount). As an example, if the same ETH miner sells 1 Th/s worth of rewards to a 15-day contract, and the global hash rate remains around 1,000 Th/s over the same period, we expect validators to provide approximately 0.1 Th/s for that time period Percentage of inner block rewards (before considering factors such as randomness, mining pool fees, contract transaction fees, etc.).

first level title

further application

We contextualize the needs of consensus capital markets by hedging production costs for suppliers. However, no strong market can exist without considering the needs of buyers. While the need for block space in its raw form is quite obvious, the need for the aforementioned swap-based structure may not seem so obvious. However, the use of such swaps has important promise beyond simple guesswork.

On the one hand, swaps provide an interesting new primitive that can be incorporated into more complex DeFi structures. With the success of platforms such as Ribbon Finance and Friktion Labs, it is clear that there is a strong demand for simple, intuitive financial products that give end users automatic and permanent exposure to a range of different financial strategies, such as covered options. So far, none of these strategies or structured products have given users direct access to the value of blockspace. As a concrete example, on days of token airdrops, NFT mints, or market volatility and generally high on-chain activity, the value of blockspace typically increases significantly. Investing in block space through an exchange integration product allows buyers to place directional bets on event-driven network congestion and profit from these anticipated events.

Another exciting application of this type of swap in general is the opportunity for fee stabilization. For several platforms and services that integrate with encrypted networks, such as Coinbase or similar exchanges, end users typically must pay network fees on top of platform fees when using said platform to interact with the blockchain. For many services, this can hurt the user experience and make the platform unusable at times. Instead, if these services know how much block space they occupy on average, they can buy an exchange equal to that percentage of validating power at a fixed price.

in conclusion

in conclusion

As the use of crypto networks — and the need for block space to scale — becomes more common, the attractiveness of participating in incentive programs to become block space producers through consensus will grow. This means that a healthy and robust market will almost certainly be needed to hedge blockspace production, so consensus capital markets will become as ubiquitous as the networks they build upon.

By creating more reliable income security for block space producers and a way to hedge against the inherent volatility of block space production, consensus capital markets are expected to lower the barriers to entry as network validators, helping these areas in the long run continuous decentralized network.

Each network has different economic considerations, what we present here is a general framework for consensus swaps; Alkimiya is working on developing these products in various networks, as well as products that generate cash flow on top of them. We also previously published documentation and research on what a consensus exchange looks like for proof-of-work mining in Alkimiya. In future research and releases, we will delve into specific network structures, including but not limited to common proof-of-stake (ETH 2.0, Cosmos), storage, ZK verification, Solana, etc.