This article explores the difference between Qredo's decentralized multi-party computation (MPC) and hot and cold wallets

Editor's Note: This article comes fromEditor's Note: This article comes fromQredo Official Blog

, Odaily is authorized to reprint, edit and release.

And Qredo offers a completely new approach: a set of trading, settlement and compliance tools that leveragemulti-party computationmulti-party computation

This post explores Qredo's implementation of MPC - which we calldecentralized hostingfirst level title

hot wallet

hot wallet

Hot wallet: Software used to store the private keys of digital assets, running on a computer connected to the Internet.

A hot wallet is the equivalent of a pocket wallet for physical cash, connected to the internet, and typically used to hold small amounts of digital assets for day-to-day transactions.Bitcoin-Qt- It can be considered a hot wallet as it stores the private key very volatile in a file on the user's desktop. Since then, hot wallets have evolved to be more secure and user-friendly, but they still have the same defining characteristics of storing keys on an internet-connected device.

secondary title

Advantages and disadvantages of hot wallets

easy access

Since hot wallets are connected to the internet, assets can be withdrawn on-demand – and traded in just a few clicks. For individuals, it is very convenient for small purchases. And for companies like cryptocurrency exchanges, it allows customers’ assets to be withdrawn instantly. As a result, many crypto companies use hot wallets to store a fraction of between 2% and 5% of total customer holdings.

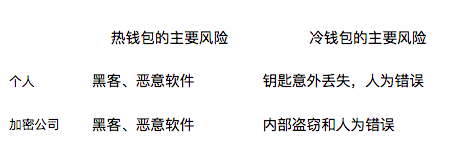

poor securityCountless stories about hot wallet hacks tell us that stolen private keys need to be taken seriously. In fact, over the years, losses have been so great thatvisionary regulator

Legislation has been enacted requiring exchanges to use hot wallets to hold the same amount of cryptocurrency elsewhere in order to compensate users in the event of losses.

Hacking History: Bitfloor, 2012Bitfloorfirst level title

cold wallet

cold wallet

Cold Storage: A method of storing a digital asset's private key on a device that is not connected to the Internet.

Often sold as the most secure method of cryptographic custody, cold storage is in solution stores

The first primitive form of cold storage was a simple printout of private keys known as a paper wallet. Since then, the most popular form of cold storage has become specialized hardware modules that protect private keys in smart chips called secure elements.

secondary title

pros and cons

high security

Private keys kept offline cannot be compromised or stolen by malware. Therefore, cold storage solutions are generally considered safer than hot wallets. However, refrigeration hardware can be as vulnerable to theft and damage as any other electronic device, such as a cracked screen. Therefore, the most secure cold storage solutions rely on the physical security mechanisms that protect the bullion—private keys are stored in steel-steel vaults under Swiss mountains, even protected by armed guards.

low accessibility

Like a pirate's loot buried six feet under the sand, private keys in hardware wallets can be difficult to obtain. For individuals who keep their own funds, this can make withdrawing funds slightly more cumbersome. But for exchanges and crypto firms that can share cold storage facilities between teams, exiting from cold storage can mean a cumbersome and delay-prone workflow that requires human approval and can take hours, days, or even days. weeks, depending on the circumstances. Additionally, storing private keys offline can insulate digital assets from the yield opportunities of DeFi.

Gerald Cotten, founder of Canadian cryptocurrency exchange QuadrigaCX, keeps most of the exchange's assets in cold storage. Then, following his unexpected death, the equivalent of taking assets to the grave left thousands of clients out of pocket. This incident demonstrates that despite its purported strength, cold storage is ultimately only as secure as governance policies that protect funds.

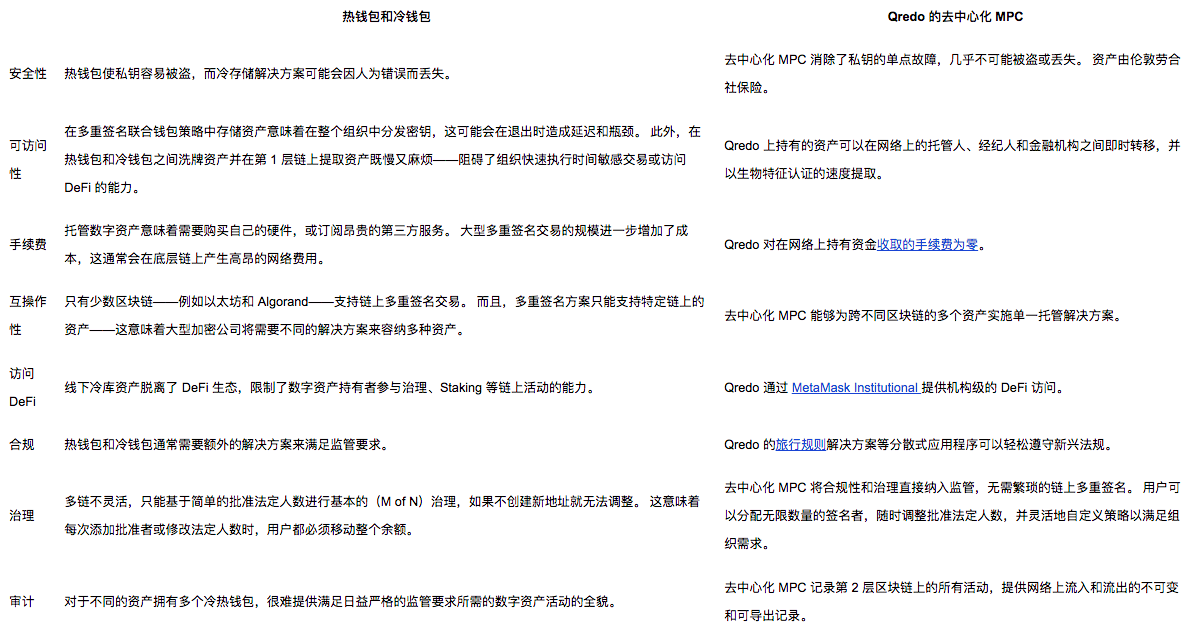

Disadvantages of hot and cold wallets

first level title

Hot and cold wallet combination

, after the hack of the Mt.Gox exchange, multisig became popular as a way of decentralizing signature responsibilities and preventing any individual from being able to compromise assets in wallets. It does this by having multiple individual private keys (N) for each wallet and a set of signatures (M) required to authorize transactions (M out of N).

However, combining hot and cold wallets with multisig (also known as a federated wallet strategy) has significant disadvantages.Both hot and cold wallets are designed from the ground up for individuals. Thus, even combined, they still lack the operational agility that crypto firms need to scale custody of hundreds of digital assets in a growing business.and institutional-grade security. This is especially true when serving millions of customers who increasingly expect instant access to funds while protecting against threats from hackers, human error and rogue insiders.

first level title

Qredo breaks the hot and cold wallet dichotomy with a new approach to managing the private keys that control digital assets:decentralized hosting。

With this method of escrow, the private key uses amulti-party computationmulti-party computation

The encryption technology is distributed in an independent blockchain network.

Moreover, due to compliance andgovernanceIntegrate directly into the Qredo blockchain, so there is no need to rely on inflexible multi-signature schemes. Instead, Qredo users can easily adjust custody strategies through rule-based transactions with unlimited flexibility.

first level title

Qredo's scalable hosting infrastructure

for a set of supporting institutional digital asset requirements (e.g.Travel Rule ComplianceTravel Rule Compliance

)’s decentralized applications provide a flexible and programmable foundation while enabling easy integration with traditional finance’s front, middle, and back-office services.MetaMask Institutional Bridging the gap with DeFi, allowing digital assets to be deployed in decentralized finance protocols, and fine-tuning governance to meet organizational needs (via our partners

These, and other facts, mean that hot and cold wallets cannot compete with decentralized MPC.

first level title