Jump Crypto: 2022 will be the year of crypto derivatives

Original translation: Block unicorn

Original translation: Block unicorn

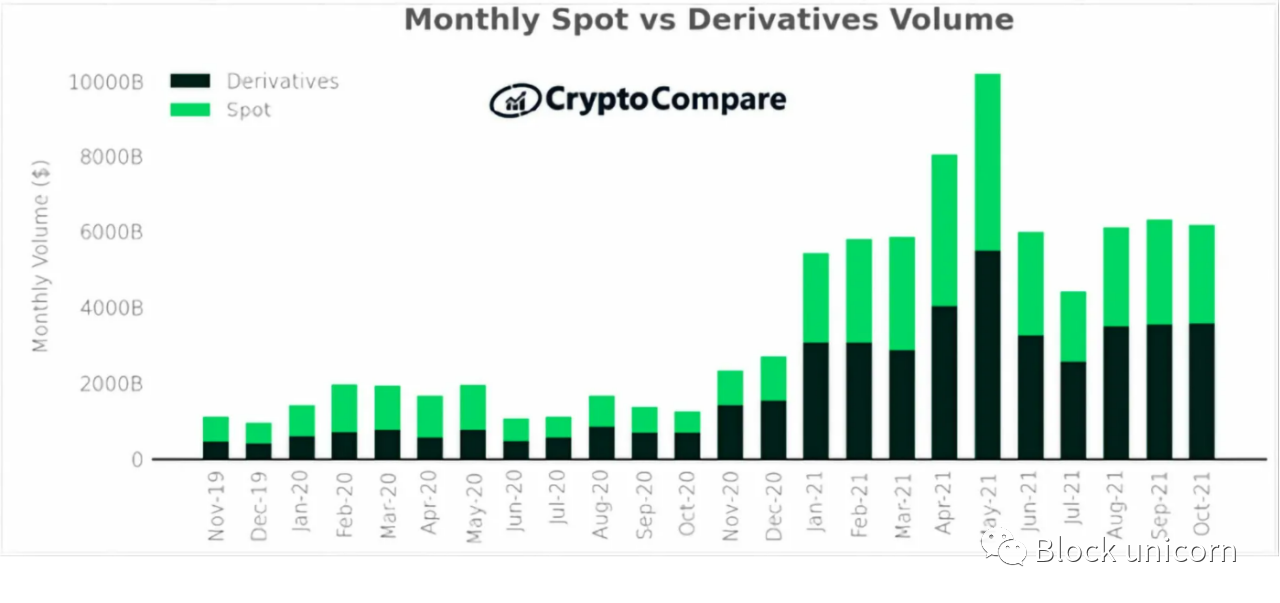

Despite growing trading volumes in the crypto derivatives marketoverview

overview

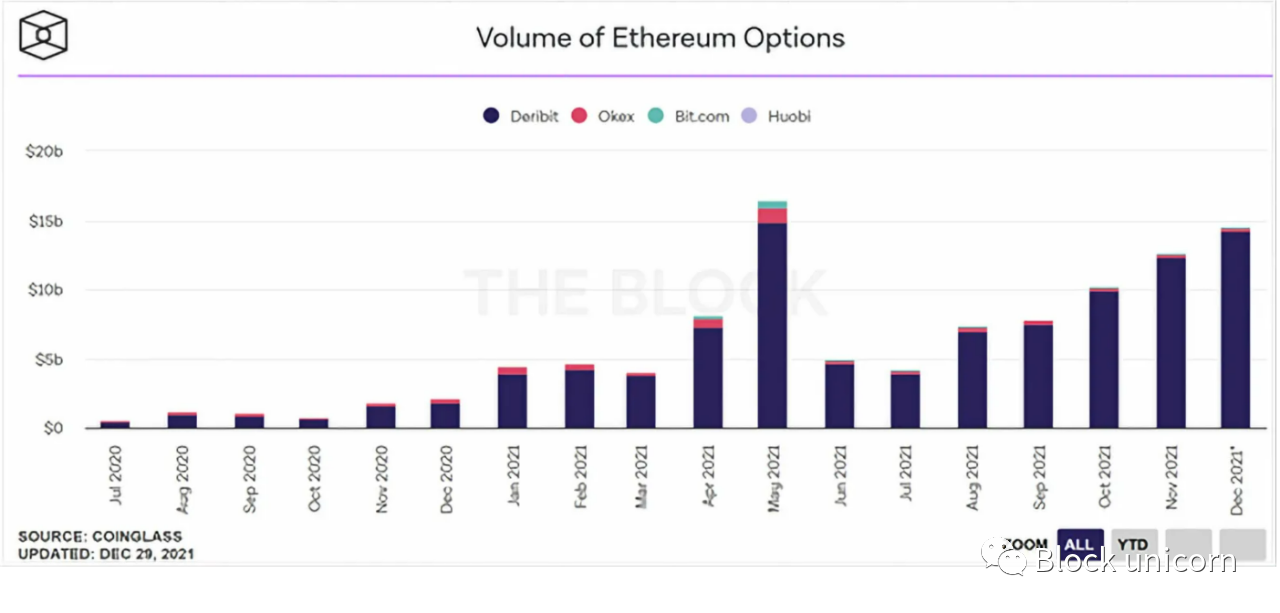

Today, crypto futures and options (“F&O”) account for 57% of total monthly trading volume. While this volume is generally healthy, we can gauge the maturity of the market by looking at the relative distribution of volume across different instruments and venues. Most of today's trading volume is concentrated on centralized perpetual futures exchanges, while options and related instruments are still relatively new. As a measure, crypto options trading volume as a percentage of spot is about 2%; in the U.S. stock market, the figure is about 35 times.

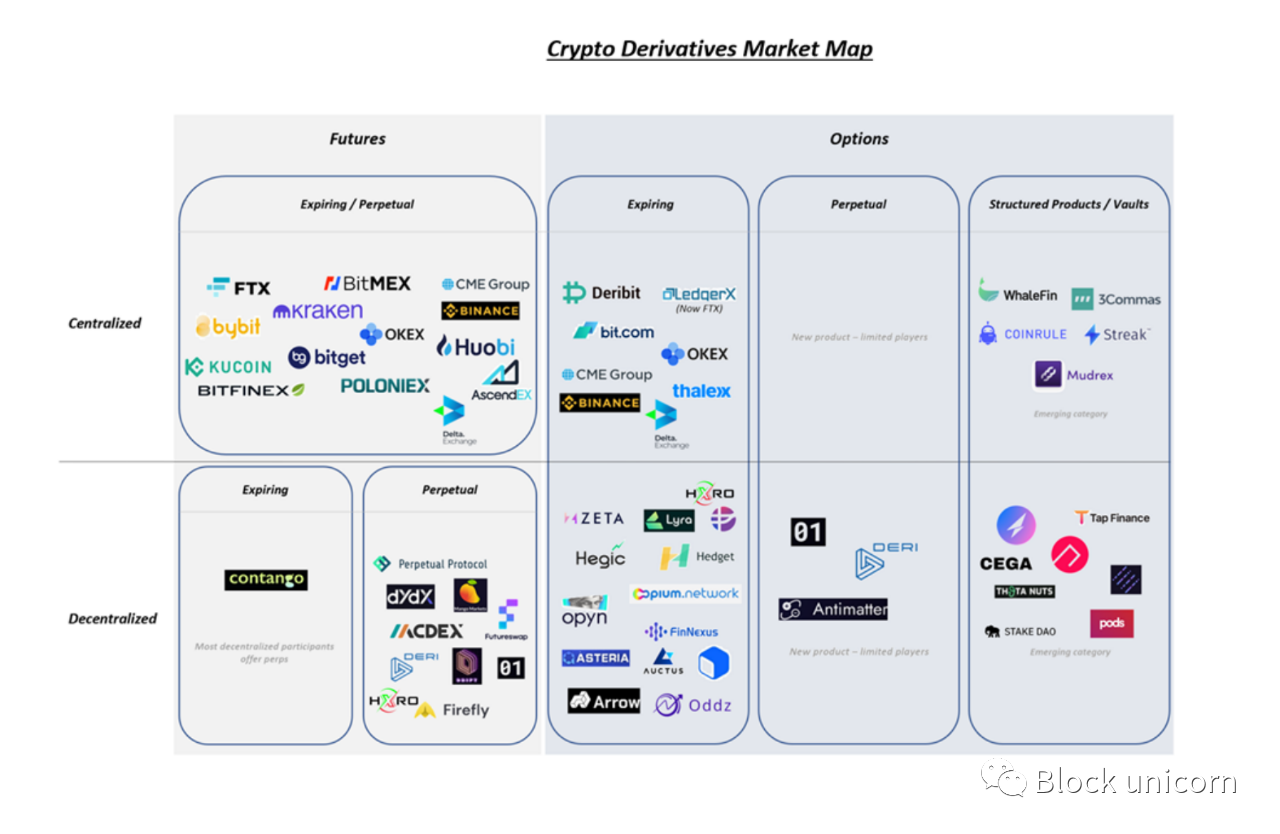

Furthermore, decentralized derivatives markets for futures and options are significantly underdeveloped compared to centralized counterparties. The chart below demonstrates this relative market concentration.

We expect two sets of factors to further drive crypto derivatives volume growth in 2022: 1) the rise of related infrastructure, and 2) increased institutional participation. A valuable exercise in better understanding the latter is understanding why TradFi institutions use derivatives to a greater extent than equity markets.This largely boils down to four reasons:

We expect two sets of factors to further drive crypto derivatives volume growth in 2022: 1) the rise of related infrastructure, and 2) increased institutional participation. A valuable exercise in better understanding the latter is understanding why TradFi institutions use derivatives to a greater extent than equity markets.This largely boils down to four reasons:

1. Capital efficiency:Margin trading is capital efficient as long as the potential drawdown percentage is below the leverage factor.

2. Tax efficiency:In the US, 60% of gains on derivatives contracts are taxed as long-term capital gains, regardless of the length of the contract; conversely, spot positions must be held for at least 1 year to qualify as long-term capital gains.

3. Hedging:Derivatives allow institutions to maintain long-term cash exposure in cash stocks while temporarily hedging.

4. Higher liquidity:Derivatives markets are more efficient for market makers to enter and exit risk, making these markets more liquid

2021 has seen key infrastructure developments to better support and channel institutional liquidity (more on that below), as well as organic interest from more and more institutions to participate in the crypto market. Naturally, increased institutional participation reduces relative volatility, making derivatives trading more capital efficient. Additionally, as more institutions hold crypto assets on their balance sheets, derivatives will become increasingly important in hedging against short-term volatility. The combination of these factors has created a perfect storm that we believe will drive the crypto derivatives market over the next 12-24 months.

Overall, we expect 2022 to be the year of crypto derivatives,There are 3 main trends:

1. The rise of centralized and decentralized options infrastructure.

2. The trading volume of decentralized perpetual contracts has increased.

3. Continuous innovation around new cryptographic primitives, such as structured vaults, perpetual options, etc.

centralized infrastructure

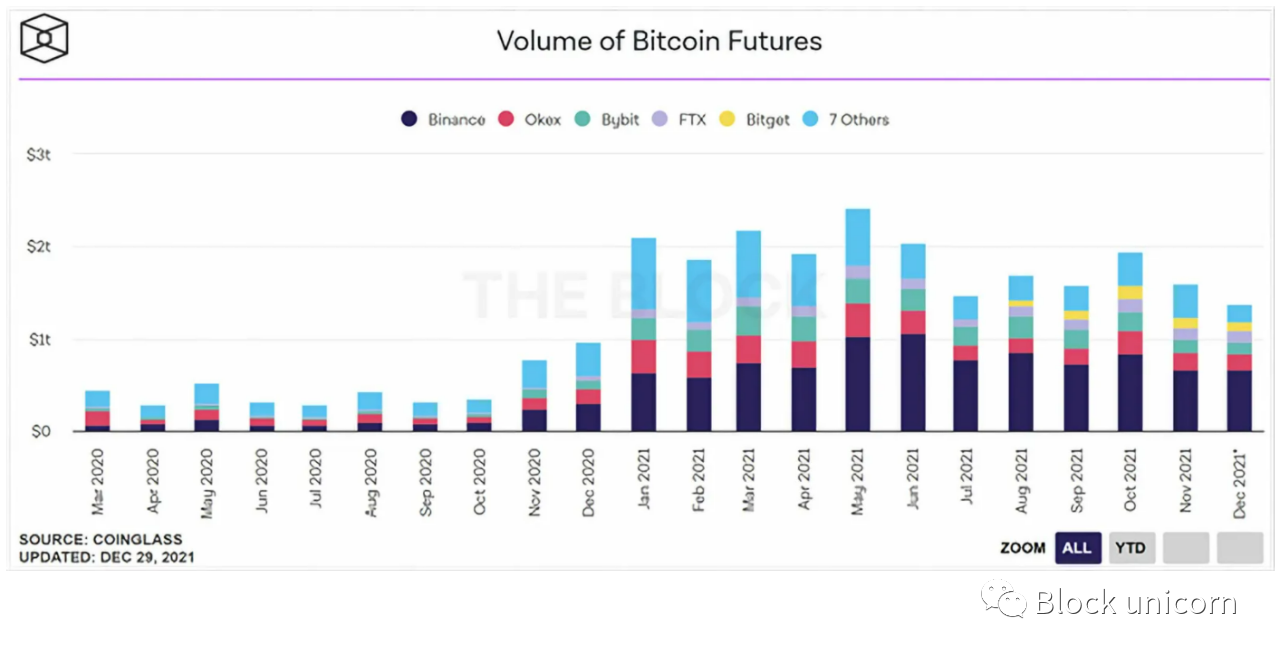

Today, the majority of derivatives trading volume exists on centralized exchanges, much of which comes from perpetual futures. Initially led by BitMEX in 2016, the monthly trading volume of perpetual contract BTC+ETH hovers around $2.5T, led by Binance, CME, FTX, etc.

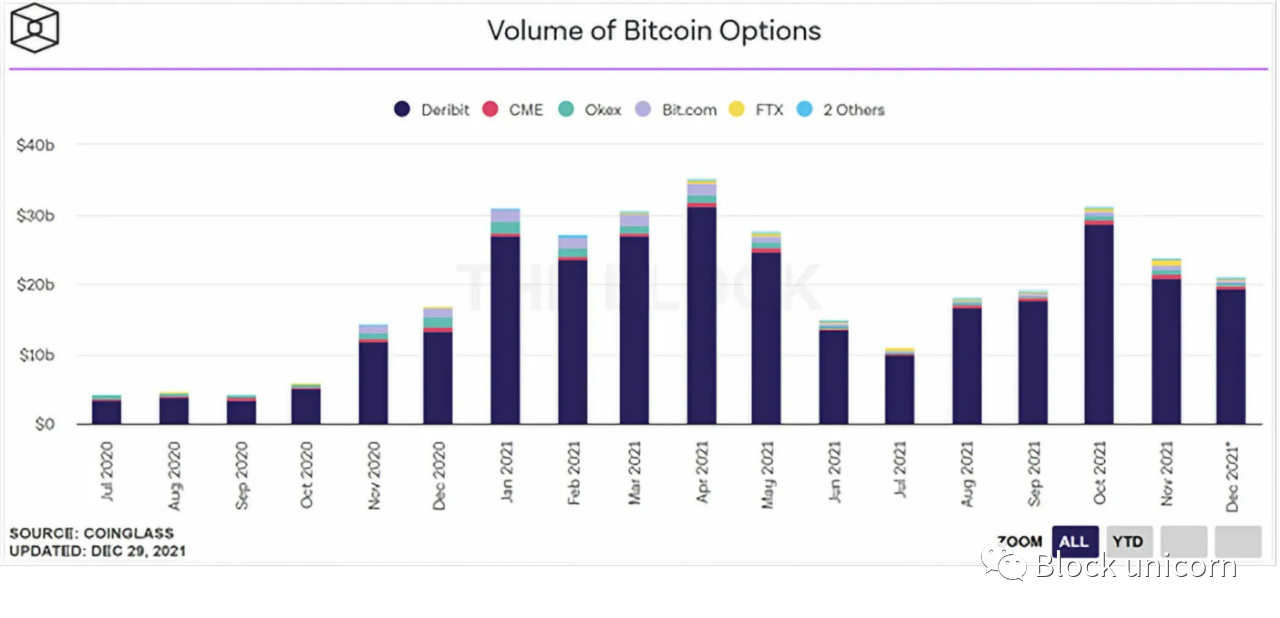

We expect this volume to continue to increase as organized players continue to enter the market, as centralized exchanges provide the regulatory and execution infrastructure these players need. As the perp futures market continues to grow, we expect options platforms to follow suit. In today's encrypted options market, the monthly trading volume of BTC+ETH is $35B, which is relatively nascent compared with the perps market, mainly dominated by Deribit.

A key reason behind this may be that the historical volatility of most coin markets makes futures an adequate tool for traders to express their outlook. Also, with historically less organized parties holding cryptocurrencies on their balance sheets, options have not been in as much demand as hedging tools. We expect both of these factors to change as institutional involvement increases. Over the next 12 months, we expect more organized players to enter the centralized options market to support growing demand as the overall pie continues to grow. We think FTX’s acquisition of LedgerX in October marked the beginning of this trend.

Decentralized infrastructure

Decentralized infrastructure

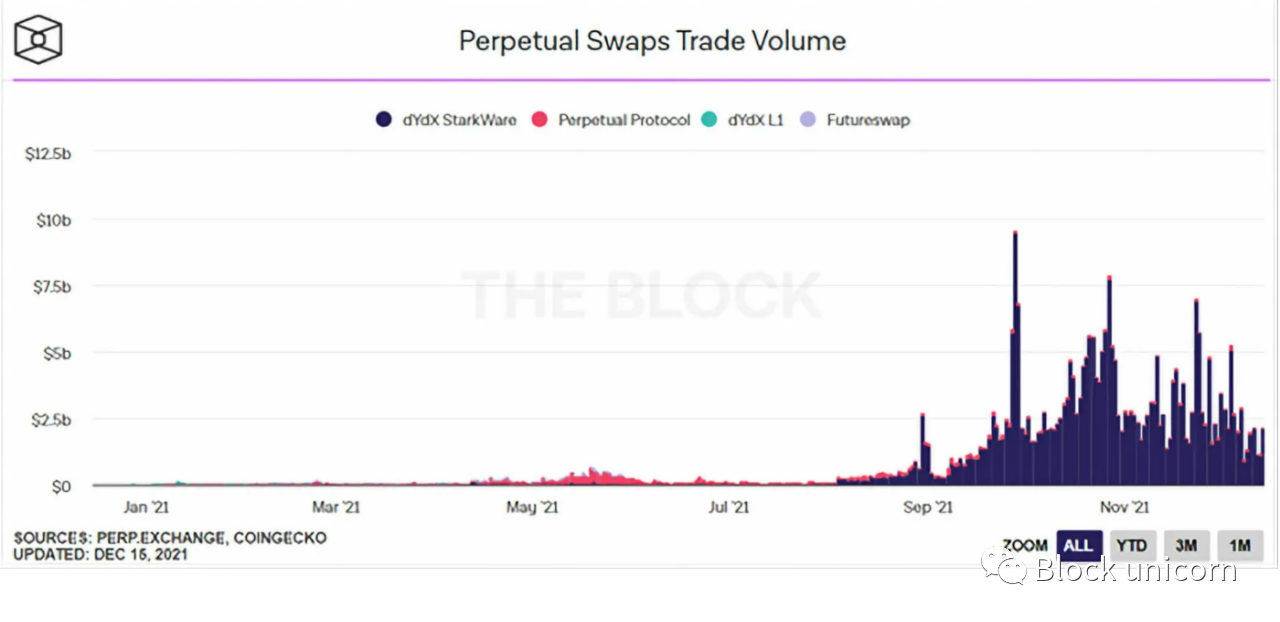

Just like centralized venues, decentralized derivatives trading volume is dominated by perpetual futures. Led initially by the Perpetual Protocol and more recently by dYdX, decentralized perp daily volume typically hovers around $5B. Despite strong growth over the past three months, decentralized perp volumes account for less than 1% of total crypto derivatives volume. We expect meaningful growth in this segment over the next 12-24 months,This is mainly driven by three factors:

1. Composability with other DeFi applications: As other projects and protocols come online and build on top of the decentralized perpetual contract protocol, the value supported by these platforms will continue to grow.

2. Low-cost/high-speed execution infrastructure: Faster chains, such as Solana, and Ethereum scaling solutions, such as Arbitrum, Optimism, and StarkEx/Net, provide lower transaction costs and better user experience, we expect this Will attract higher transaction volume. A prime example is dYdX's recent implementation of the StarkEx instance, which took computation off-chain and reduced transaction costs by an order of magnitude over the past three months. We believe we are in the early days of scalability, EVM or otherwise, and expect these solutions to make the decentralized derivatives trading experience smoother over the next 12 months. Projects like HXRO are already starting to lay the infrastructure foundations that will be critical to the growth of on-chain decentralized futures and options like Solana.

3. Open Network: Unlike centralized venues, decentralized protocols are permissionless. As cryptocurrency penetration continues to grow and reach more remote parts of the world, we expect that some users who may not have access to centralized infrastructure will begin to interact globally through decentralized protocols.

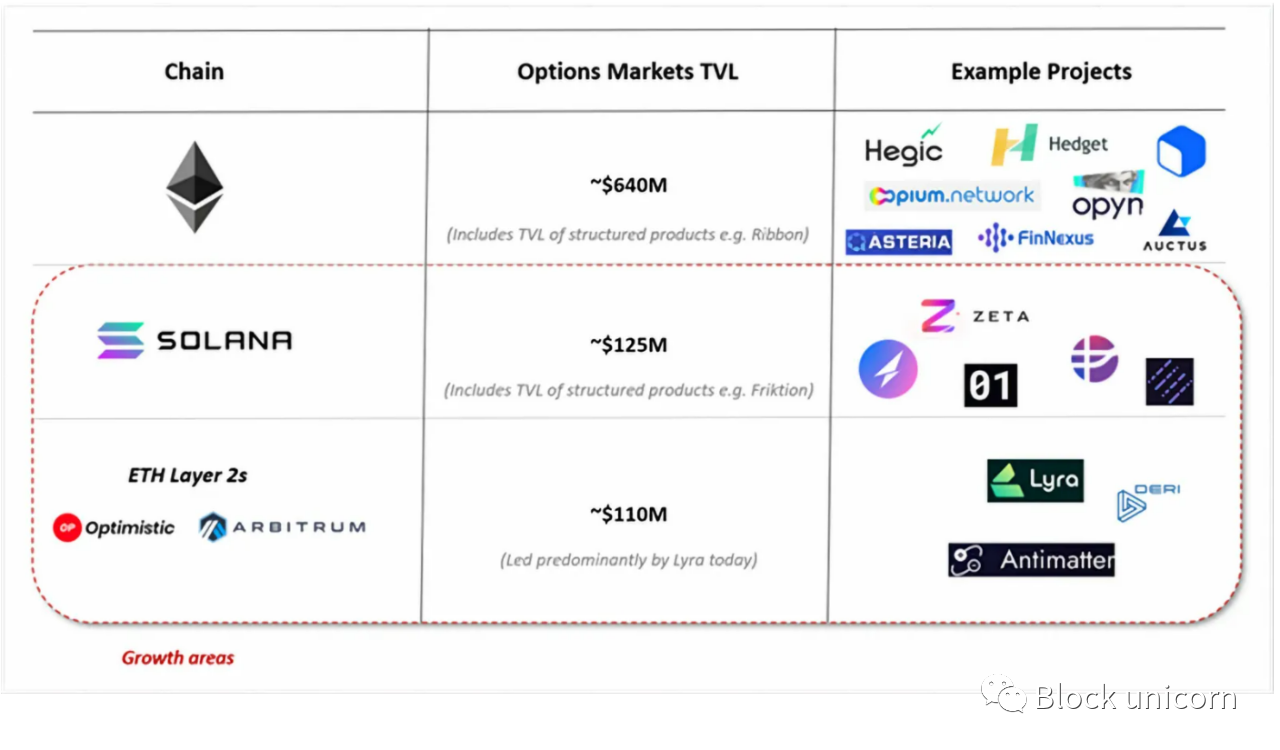

As the decentralized futures market continues to grow, we expect the options market to follow suit. Today, the decentralized options market is only a small part of the overall derivatives market, and most mature protocols exist on the Ethereum mainnet. However, three factors that have long inhibited the growth of the decentralized options market are starting to emerge with viable solutions that we expect will help in the futureUnlock these markets for 12 months:

As the decentralized futures market continues to grow, we expect the options market to follow suit. Today, the decentralized options market is only a small part of the overall derivatives market, and most mature protocols exist on the Ethereum mainnet. However, three factors that have long inhibited the growth of the decentralized options market are starting to emerge with viable solutions that we expect will help in the futureUnlock these markets for 12 months:

1. Transaction fee + block time: Depending on the holding period, the transaction fee of the option contract can have a meaningful impact on the profitability of the transaction. Ethereum’s high transaction fees have historically made decentralized options trading an unfavorable proposition. In addition, longer block times lead to uncertainty in trade execution and can lead to challenges, especially with multi-leg trading (Multi-Leg Options order strategy is a strategy that simultaneously buys and sells multiple strike prices, An order strategy for options that are sensitive to the price of the underlying asset or expiration date.), unless the transaction is atomic. These two challenges also make market making based on order book models difficult. Additionally, agreements that allow leverage require liquidators to take positions that the other party is in danger of going sour. This inhibits participation if liquidators have to pay high gas fees to liquidate positions and reduce platform risk. To mitigate this, the protocol must share a higher percentage of liquidations with them, making the protocol's long-term business model unsustainable. With Solana and Ethereum scaling solutions like Arbitrum and Starkware, we now have low-cost, high-speed execution environments that can alleviate these challenges and facilitate viable options trading.

2. Agreements to sell options typically require liquidity to underwrite these positions. Most operate through AMM structures to access this liquidity. However, this often exposes the pool to unhedged delta (hedging ratio) risk, which can lead to meaningful impermanent losses. Such incidents have caused protocols such as Charm on Ethereum to temporarily halt their options offerings in the past. Like TradFi option sellers, options protocols must delta (hedge ratio) hedge the liquidity pool to limit impermanent losses. This is often done through futures, which until recently were a nascent market in DeFi. As these primitives continue to develop, we expect options protocols to become more liquid and thus more active.

3. Due to the aforementioned block time constraints and the inability to build atomic liquidations, many existing DeFi options implementations require full collateralization. Leveraging faster chains like Solana and a robust liquidation engine built around more frequent market updates, we already expect protocols like Zeta to be able to offer undercollateralized options.

Another set of primitives that we expect to accelerate the adoption of decentralized options are structured DeFi options vaults (“DOVs”). DOVs are game-changing because not only do they democratize the capture of implied volume-driven organic returns, but they also provide a scalable way to manage non-linear risk. Through fundamental strategies such as covered calls and cash-covered puts, DOV venues offer retail traders a way to hedge returns and provide liquidity to the underlying options agreements. Options platforms like Ribbon have scaled to $300M TVL, while new venues like Friktion ($100M+ TVL) and KatanaKatana (over $45M TVL) have grown rapidly within weeks of going live, indicating strong market interest. As these protocols continue to expand, we expect the decentralized options trading experience to become even smoother.

Overall, a boom phase for decentralized options is finally taking hold, and we expect a lot of capital to flow into the space over the next 12-24 months, especially around Solana and Ethereum scaling solutions.

in conclusion

in conclusion

We firmly believe that the decentralized derivatives market will be on the verge of massive growth over the next 12-24 months. The infrastructure to unlock these products and support the next wave of multi-billion dollar agreements is already in place. As we enter 2022, we are very excited to support some of the most fundamental projects driving this revolution including (ParadigmParadigm, Zeta MarketsZeta Markets, FriktionFriktion, LyraLyra, DriftDrift, etc.).