A New Paradigm Shift in Venture Capital: Infinity Funds and Infinity Games

Original Author: Eric Zhang @ DoraHacks

Original title: The Inevitable Paradigm Shift of Venture Capitalism: Infinite Funds and Infinite Games

Special thanks to Steve Ngok, Unica Yin, Wendy Ding for their review and feedback.

A finite game can be played in an infinite game, but an infinite game cannot be played in a finite game - James Cass

Venture capital is one of the drivers of innovation, technology and human progress. It helps innovators achieve great things by organizing human, scientific, technological and political resources.

Despite its success in supporting businesses and entrepreneurship over the past few decades, venture capital has shown its weaknesses. On the surface, this limitation manifests itself in two ways: the conflict of goals between GPs and LPs; and the lack of alignment between founders and investors. In the stock market, most GPs are limited by the limited number of years (eg 10 years) of the Fund Cycle. In the cryptocurrency market, the funding cycle of a large number of GPs is much shorter (due to the low listing threshold and low market volatility, sometimes even as short as 1 or 2 years), many fund managers are forced to sell their positions quickly. This phenomenon has led some fund managers to be criticized as "Weak Hands" or "Flippers".

In the stock market, an initial public offering (IPO) is often considered a success for venture-stage companies. Many times, the main goal of a fund is to invest in a target and sell it when the target IPOs. Typically, it takes at least 5-7 years for a company to go public. So the fund cycle represents the idea of helping early-stage companies through IPOs. The problem with this approach is that if certain companies have a longer-term vision, the fund may lose out on greater opportunities to work with that company, as well as gain higher returns from that company's development and growth beyond the IPO stage . The same is true of Netflix, Tesla, Apple, Google, and all of the greatest companies. Recently, Sequoia Fund realized this problem. So, in a post, partner Roelof Botha described Sequoia's new management approach that essentially removes LPs' access to its seed and venture capital funds. Instead, Sequoia invests in primary market deals from its secondary market funds, taking back control of venture-stage projects and the ability to hold venture capital as needed.

In the encryption market, the company listing cycle is much shorter than the IPO cycle in the stock market. Most of the time, cryptocurrency projects go public in their early stages (less than 3 years, sometimes within months of being conceived). Investors are attracted by the lucrative returns brought about by the listing hype. Some crypto funds accept a 1-year fund cycle in order to get more LPs. However, a similar situation applies to the crypto market - a successful Web3 venture requires more than one cycle to build, and when the project achieves a real success, the return is much higher than a single hype period.

The above situation exists because there are two types of dislocations. First, there are differences between fund managers and fund LPs. Typically, the greater the knowledge gap between GPs and LPs and the longer the funding cycle, the more difficult it will be. Second, there is a misalignment between funders and fund managers. Selling shares/tokens at a liquidity premium in a listing event is far more attractive than spending years waiting for a project to build value.

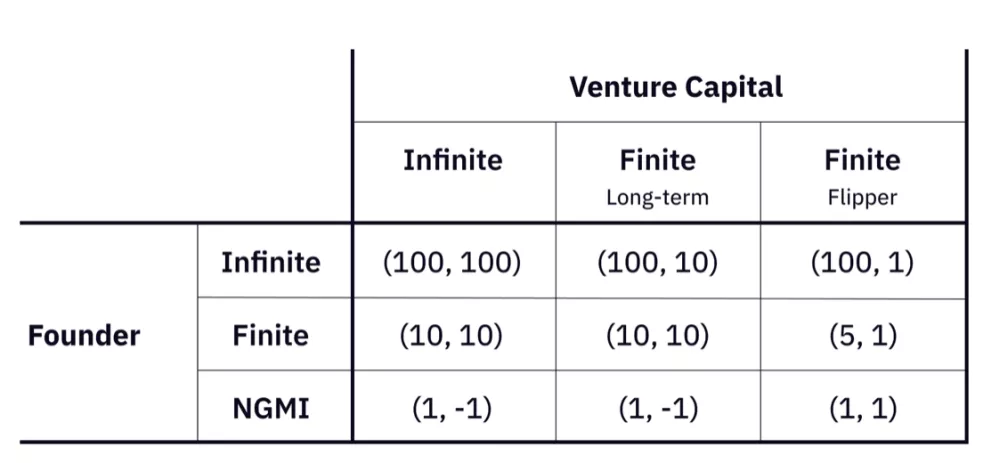

Given the different types of behavior, The Venture Capital Game is as follows:

**In the Venture Capital Game, the infinite strategy does not mean that the fund holds all stocks/tokens indefinitely, but on the right, the "Flipper Investor" fast flip strategy does mean that the fund sells all positions for Take profits and leave the game to find other profitable opportunities

In this game, we considered a new behavior - infinity. An infinite game can be explained as not being played to win, but to continue playing (Carse). For founders, the infinite game is obvious. For venture funds, infinity means backing founders to ensure the infinity of the game.

text

So what is Infinity Venture Capital and Venture Funds?

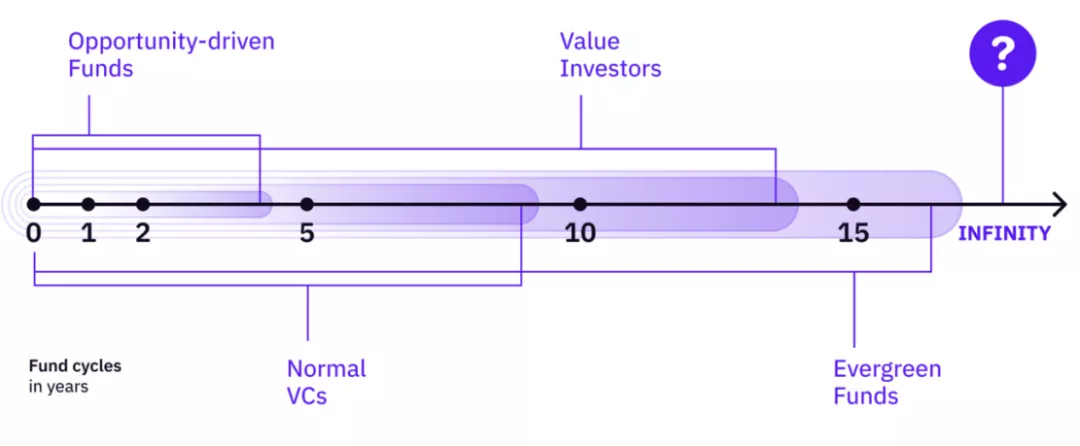

Technically, we can map a range of venture capital investments against fund cycles - from speculative, opportunity-driven funds to "evergreen" funds. From the perspective of the spectrum, an unlimited fund is a fund that extends its fund cycle to unlimited.

However, what does it mean for venture capital funds to be unlimited? How can venture capital funds be infinite? Let's continue exploring further!

Infinite games and subgames

Infinite games contain sub-games. The number of possible subgames contained in any infinite game is infinite. The subgame itself can be an infinite game or a finite game. Here is a table of some infinite games and their corresponding subgames:

Infinity Fund — Funding Infinite Games

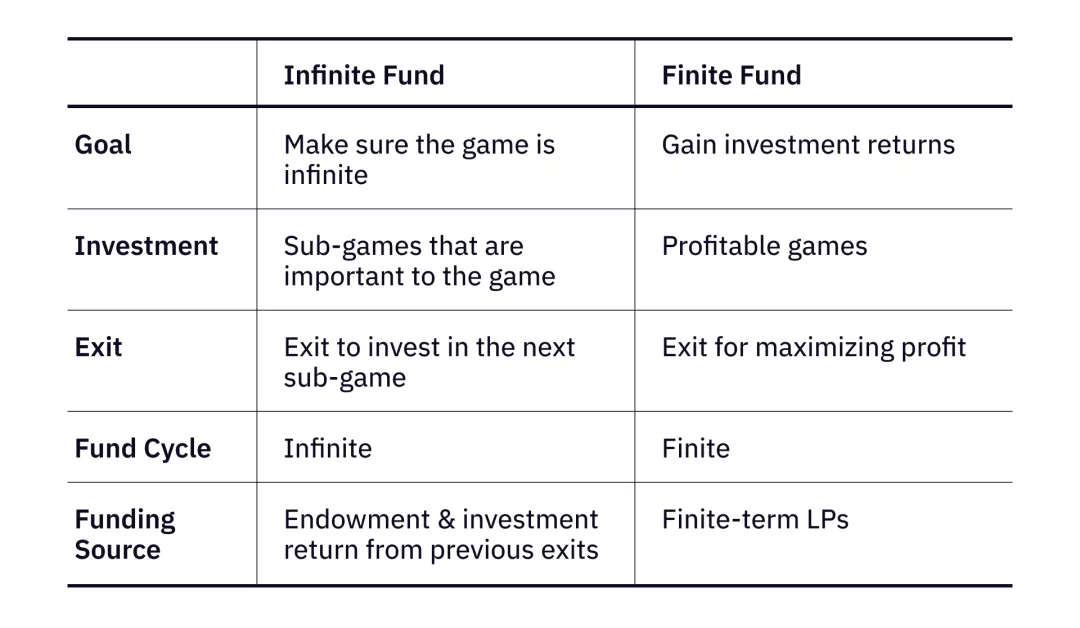

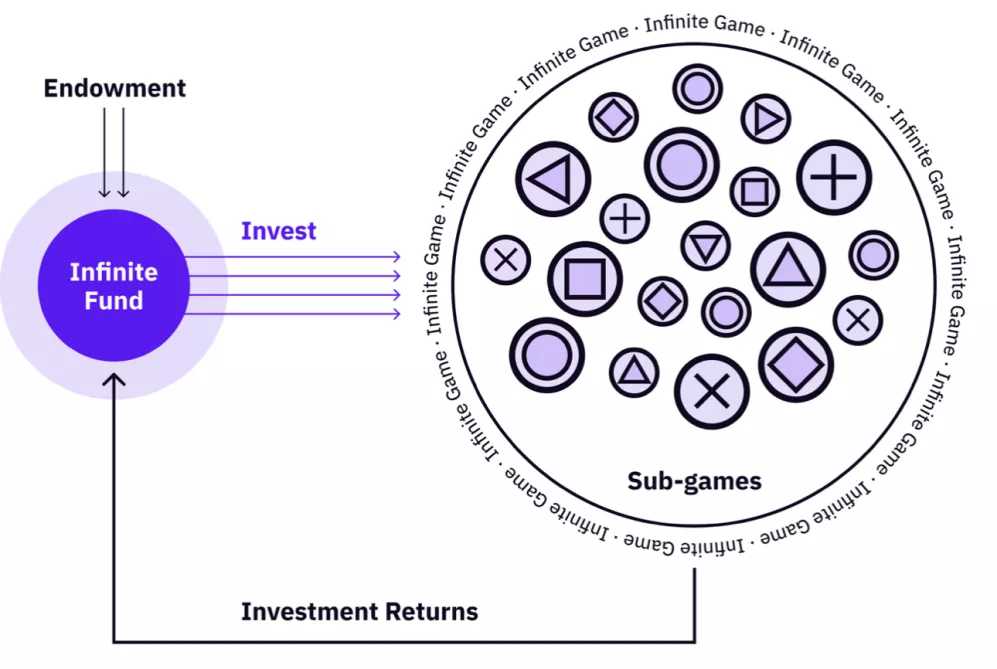

Infinite funds have an infinite fund cycle and invest in infinite games by investing in its sub-games. Subgames can be finite games, but infinite games are the ultimate goal. In order to evaluate and compare the differences between unlimited funds and limited funds, we can consider these five indicators: goals, investment motivations, exit strategies, fund cycles, and funding sources.

The treasury of Nation States is, of course, infinite money, since nation-states themselves are infinite games that (usually) aim to develop the state into a better place for its people to live in. In a way, blockchain protocols are like nation-states in that these protocols have their own governance rules, enforced through code and consensus among the community. In the former case, the treasury is maintained by taxes. In the latter case, the foundation's wealth comes from the appreciation of its native token and revenue at the protocol level.

In the case of venture capital, donations from organizations or people who want to fund infinite games unconditionally are necessary to establish an infinite fund. Donations can come from a variety of sources: revenue from the organization (e.g. protocol fees for a decentralized project), donations, or token sale events. The fund sustains itself by reinvesting all previous returns into the next subgame.

As a few examples, DoraHacks Ventures was designed as a geek fund with an unlimited funding cycle, as part of DoraHacks, in collaboration with the open source developer funding platform HackerLink, the Hackathon DAO, and the global Hackathon community to support the geek movement. Binance Labs supports the development of the entire blockchain industry through a combination of venture capital and an intensive 8-week incubation program held annually, which will run indefinitely into the future.

Funding public goods with unlimited risk funds

Current venture capital fails to capture a valuable class of venture capital—public goods funding (Public Good Funding).

Public goods have long been undervalued. Because public goods are difficult to make profits, they are usually constructed by the public sector or non-profit organizations. But government funding can be plagued by inefficiencies, as well as attacks such as corruption and political instability, and nonprofits often suffer from unsustainable funding. Traditional DCF-based valuation methods have difficulty properly capturing the value of something that is unprofitable (in the fiat currency space) but beneficial to the community. Thus, in the past, venture capital has focused almost exclusively on profitable businesses, leaving public goods out.

DAOs are changing the way public goods are organized and developed by

DAO can organize and motivate a distributed network of contributors and users, avoiding or reducing friction costs and inefficiencies of centralized organizations. For example, decentralized media can effectively organize a decentralized network of contributors.

DAOs distribute governance rights to participants, including contributors, administrators, users, and funders. Governance is no longer concentrated among shareholders.

DAOs can capture governance value and community-driven value, and in the long run, may create a legitimate way to provide proper valuations for public goods.

Infinite Funds can continuously fund public goods by funding public goods DAOs.

Building Infinite Funds Using Web3 Technology

Further mechanisms could be devised to increase the flexibility of unlimited funds. There are already some practical solutions. LPs joining MolochDAO or The LAO receive shares/Loot from the DAO. The Moloch mechanism allows for angry exits if the collective fund makes a wrong decision. But as long as some members keep playing, the DAO can last indefinitely. Therefore, Moloch Fund can be considered as a kind of unlimited fund with low threshold (it is much easier to join Moloch DAO than Sequoia Fund).

in conclusion

in conclusion

Great adventures are usually infinite games. The purpose of an infinite game is not to win the game, but to keep it going. The fund cycle of a limited fund is limited. Unlimited funds have an unlimited fund cycle. An infinite game contains infinitely many subgames, and the subgames can be infinite or finite. Limited funds invest in games that are expected to win because they are profitable. The Infinity Fund invests in Infinity Games by investing in its subgames. The purpose of the Infinity Fund is to fund Infinity Games so that the game can continue and achieve its goals. As long as it is an infinite game, an infinite fund can finance public goods and businesses. Several ways exist to build and improve Infinite Money using Web3 technologies. The paradigm of venture capital is shifting toward infinity.

Reference (link to original text)

The Sequoia Fund. https://medium.com/sequoia-capital/the-sequoia-fund-patient-capital-for-building-enduring-companies-9ed7bcd6c7da

Vitalik Buterin: Ethereum 2.0.

https://www.youtube.com/watch?v=XW0QZmtbjvs&t=935s

First Review of DAOrayaki — Pioneering Decentralized Media

https://dorafactory.medium.com/first-review-of-daorayaki-pioneering-decentralized-media-8adda4c425b3

Binance Labs ready to kick off season three of pioneering incubator program.

https://www.cityam.com/binance-labs-ready-to-kick-off-season-three-of-pioneering-incubator-program

DoraHacks. https://hackerlink.io

DAOrayaki|Governance power is measured by assigning a "governance premium" to token prices

OlympusDAO: Examining How Community Drives Value

https://daopulse.xyz/olympusdao-examining-how-community-drives-value-b75801868d21

MolochDAO. https://www.molochdao.com

The LAO. https://www.thelao.io