The first Bloomberg Encryption Outlook in 2022: Bitcoin may outperform stocks

This article comes fromBloomberg IntelligenceBy Mike McGlone, Senior Commodity Analyst, BI

Odaily Translator |

Odaily Translator |

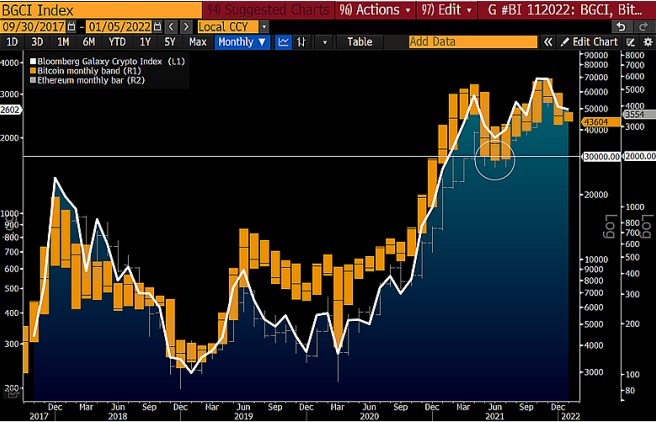

* According to Bloomberg Galaxy Cypto Index (BGCI) data——

* Bitcoin price down 19% in December 2021, up 29% for the year

Ethereum price down 20% in December 2021, up 228% for the year

In 2022, global risk asset prices may rise further as the Federal Reserve faces the worst inflation problem in 40 years, and Bitcoin may benefit in the process. Among the speculative and risky asset classes, Bitcoin is among the highest yielding assets and is on its way to becoming the "world's digital reserve asset." Bloomberg Intelligence predicts that Bitcoin, Ethereum and stablecoins will continue to maintain their dominance in the encryption market, and Binance Coin and Solana may also further consolidate their market leadership.In 2022, the most important sentence to pay attention to is "don't fight the Fed".

secondary title

Risk assets vs. the FedIn 2022, Bitcoin's bottom line may be $30,000, while Ethereum's bottom line may be $2,000.

In 2021, Bloomberg Intelligence found that the market has maintained an upward trend in most cases. For example, the Bloomberg Galaxy Crypto Index has increased by about 150%. Of course, the encryption industry must pay attention to the Fed’s tightening policy. It may bear the brunt of the decline, and it will also have an impact on the cryptocurrency industry, but in general, Bitcoin will perform better than the stock market.

Bottom: In 2022, the encryption industry needs to pay attention to the Fed's deflationary strategyBitcoin and Ethereum have solid fundamentals.

After bidding farewell to 2021, Bitcoin's price base may consolidate at $30,000, while Ethereum's price base may consolidate at $2,000. Bloomberg Intelligence estimates that these two top cryptocurrencies will continue to maintain their market leadership and continue to rise in 2022. Some people think that 2022 may also have the same risk aversion as in 2020, which may play a key role in supporting Bitcoin and Ethereum, but this is actually unlikely. Bloomberg Intelligence believes that it is more likely that Bitcoin will head towards $100,000, while Ethereum will break through the $5,000 resistance level. One of the key issues is the Fed, which may be more inclined to raise rates if risk assets continue to climb as it faces its biggest inflation in four years

Cryptocurrencies are the first choice of risk takers and speculators. If the price of risky assets falls, it means that the Federal Reserve has achieved some success in fighting inflation. In this case, Bitcoin may be the main beneficiary.Bitcoin may outperform stocks in 2022.

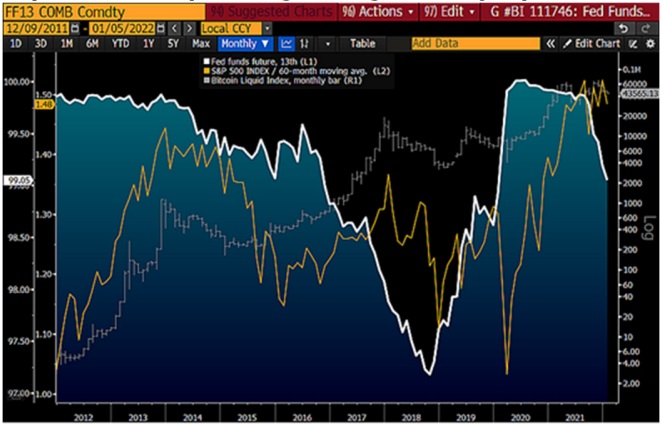

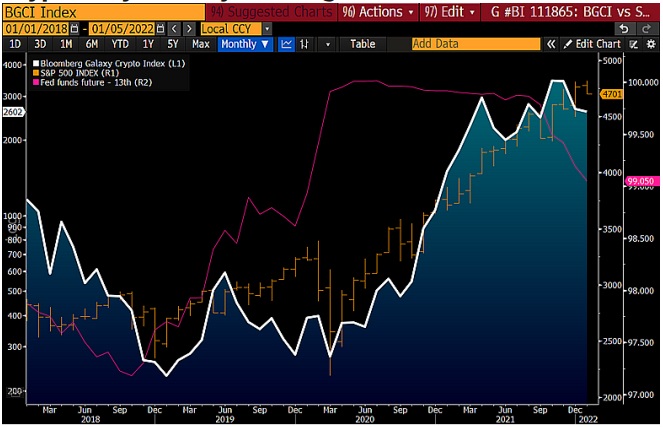

Expectations of Fed rate hikes in 2022 could benefit both Bitcoin and the stock market. The chart below analyzes the 13th fed funds futures. In addition, the S&P 500's 60-month moving average is also at a high level. The question now is whether the bull market can For how long, Bitcoin, the benchmark cryptocurrency, appears to be leading the way.

Bottom: The Biggest Force Stopping Fed Tightening - Swinging Stock Markets

If the rules of traditional economics also apply to the cryptocurrency market, the current market seems to be favorable for the price of Bitcoin to rise. If the Fed returns to monetary easing, the most likely reason is that the stock market continues to decline, but once the Fed does so, it will also benefit digital currencies.

In the fourth quarter of 2021, U.S. Treasury yields fell, which may point to a normalization of stock market returns in 2022. If the S&P 500 pulls back and stays down for a while, Bitcoin could rise ahead of bonds and gold. But it is important to note that of the trio of bitcoin, bonds and gold, bitcoin has the highest volatility. In early 2022, risk assets including bitcoin, bonds and gold could be affected by Fed policy.

Today, cryptocurrencies appear to be the go-to option for investors when it comes to speculative trading, so cryptocurrencies have been an early signal of lower market sentiment. As an example, the timing of Dogecoin and Shiba Inu peaks closely coincides with the timing of market highs.

secondary title

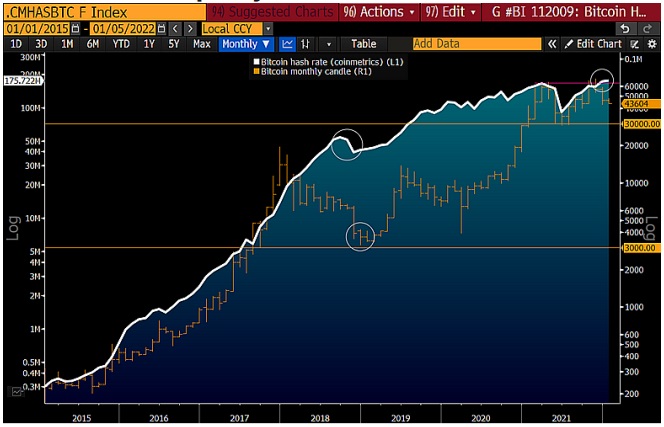

Crypto Market Fundamentals in 2022In 2022, the fundamentals of Bitcoin depend on the reset of computing power in 2021.

At present, Bitcoin has recovered from the collapse of computing power and plummeting prices in 2021. Overall, the fundamentals of Bitcoin in early 2022 are not bad. The price of Bitcoin on January 5, 2022 is about the same as it was in February 2021, and as seen by Bloomberg Intelligence, the Bitcoin bull market is more consolidated and may resume its upward trajectory.Will the Bitcoin price increase by 10 times?

In 2021, Bitcoin has withstood an unprecedented plunge. With the recovery of computing power, the fundamentals of Bitcoin do not seem to be affected much, so it will also help to further consolidate the fundamentals of prices in 2022. Here is a data analogy. In 2018, the 10-day average of Bitcoin’s computing power fell by 30%. At that time, the price of Bitcoin bottomed out in the $3,000 range. According to Coinmetrics data, in 2021, the computing power of Bitcoin’s entire network will also increase by 50%. During the year, the price of bitcoin fell from $60,000 to $30,000.

Bottom: Bitcoin's fall to the $30,000 range in 2021, similar to the 2018 drop to $3,000.

However, similar to 2018, Bloomberg Intelligence believes that the slump in the computing power of the entire network in 2021 will further consolidate the price foundation of Bitcoin. At present, most of the bitcoin mining activities have been transferred to the North American market, and most of the mining companies are listed companies, many of which prefer to hold bitcoins rather than sell them. And those investors who invest in mining listed companies in the stock market are equivalent to indirect exposure to cryptocurrencies.Investors are accumulating bitcoin at an accelerated pace.

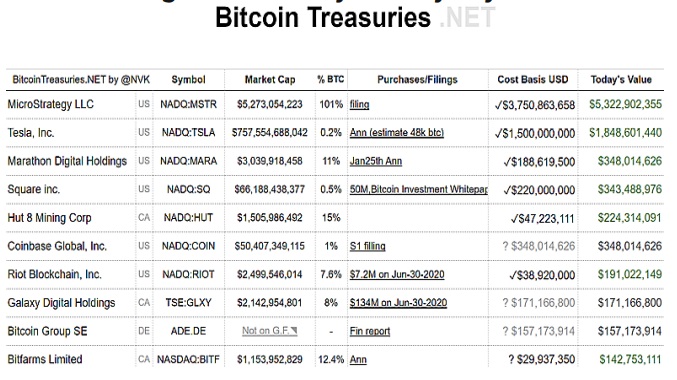

In the digital world, Bitcoin acts as the benchmark crypto asset due to its limited supply. BitcoinTreasuries discloses the holdings of Bitcoin by leading companies. Among the top five, there are listed technology companies such as Tesla and MicroStrategy, as well as mining machine companies. In 2021, encrypted assets have completed a paradigm shift, and the industry has become more mature.

Bottom: More and more listed companies include Bitcoin in their portfolios

In 2021, Bitcoin encountered many challenges, but in the end Bitcoin overcame the obstacles and gained a firm foothold.Why the Bitcoin Bull Market Seems "Complicated"

Quite frankly, Bitcoin was originally a risk asset, but as the world changes, it is evolving into a digital reserve asset, thus having a positive impact on its price. It’s still early days Bitcoin demand and adoption are rising, but supply is falling. The key question in early 2022 is whether Bitcoin is too hot, and according to an analysis chart from Bloomberg Intelligence, Bitcoin should probably be reasonably priced above its 50-week moving average.

Over the past year, the price of Bitcoin has risen somewhat rapidly. Right now, resistance should be around $100,000, backed by favorable demand and supply fundamentals.

secondary title

Three Crypto Backbone - Bitcoin, Ethereum, USDBitcoin, Ethereum, and the U.S. dollar are the "Three Musketeers" in the encryption industry.

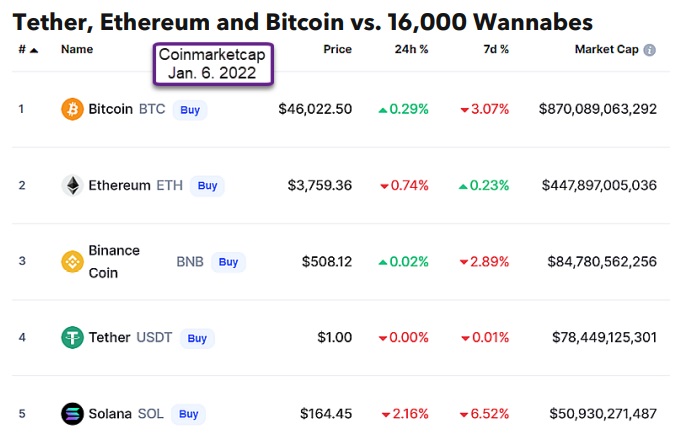

Cryptoassets are the poster child for free market capitalism around the world, and the biggest winner is the dollar. Mainstream bitcoin, ethereum and stablecoins are expected to remain at the top of the crypto ecosystem if past patterns repeat, but there are now around 16,000 competitors vying for speculative leadership. Compared with a year ago, Binance Coin and Solana replaced Litecoin and XRP as the top cryptocurrencies.The three top cryptocurrencies remain: Bitcoin, Ethereum and Tether.

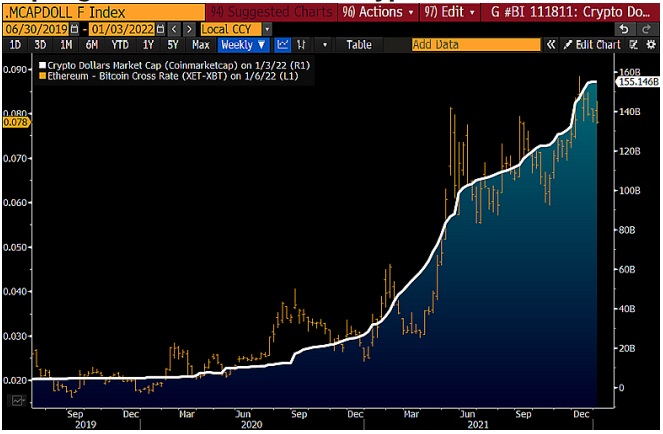

The issuance of stable coins continues to increase, Bitcoin is becoming a general collateral, and Ethereum has become a building platform for DeFi, financial technology and NFT. According to Coinmarketcap data, the three top cryptocurrencies are still: Bitcoin, Ethereum and Tether. It is worth noting that the rapid increase in the issuance and popularity of stablecoins, of which Tether has always maintained a dominant position, also shows the importance of the US dollar in the encryption ecosystem, especially the transaction demand of the US dollar exceeds that of all other fiat currencies. Trading volume.

Bottom: Tether, Ethereum and Bitcoin vs. 16,000 other cryptocurrencies

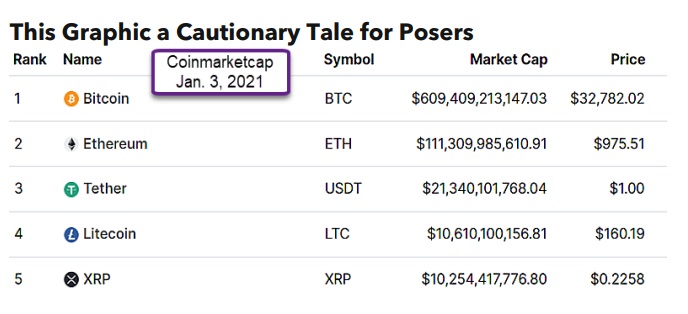

There is little to stop Bitcoin from becoming the world's digital reserve asset, and Ethereum's status has not been shaken by the so-called "Ethereum Killer." On the other hand, the number of cryptocurrencies will grow significantly in 2021, rising to 16,000 from about 8,000 a year ago.Has anything changed in the ranks of top cryptocurrencies?

A year ago Litecoin and XRP were in the top five cryptocurrencies according to Coinmarketcap (chart below), but a year later they have dropped to 22nd and 8th respectively. This phenomenon shows that there are still many speculative elements in the encryption market. Fortunately, the top three cryptocurrencies have not changed, they are still Bitcoin, Ethereum and Tether.

Typical examples of speculative cryptocurrencies: Dogecoin in the first half of 2021 and Shiba Inu in the second half of 2021.Stablecoins continue to expand.

The rate of expansion of stablecoins does not appear to be slowing down, which is a major reason why the entire digital asset market continues to appreciate. In addition, as technology develops faster and faster, stablecoins will also encounter regulatory constraints and market obstacles, which are all normal phenomena.

However, stablecoins will also encounter some challenges, such as central bank digital currencies. The chart above shows the stablecoin uptrend and how it compares to Bitcoin and Ethereum.

secondary title

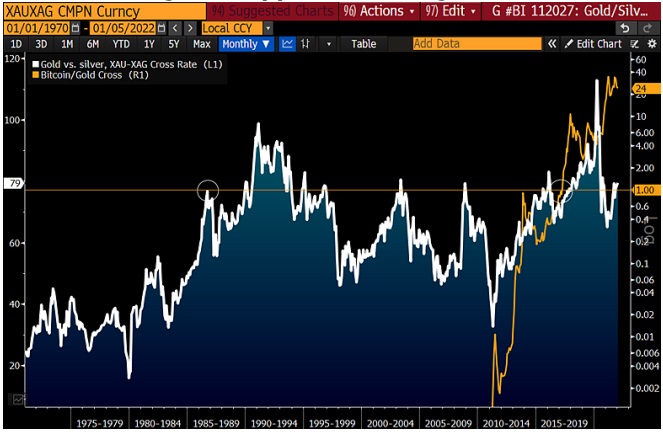

Bitcoin vs. Gold vs. Silver, StocksBitcoin will disrupt gold as gold disrupted silver.

Bitcoin volatility is gradually decreasing compared to most asset classes, so we may see money flow out of gold and into cryptocurrencies such as Bitcoin.As an investment target, can Bitcoin replace gold?

Bitcoin’s impact on gold could be nearly as unstoppable as gold’s impact on silver. In 2017, when the dollar price of Bitcoin surpassed the value of an ounce of gold, people began to take Bitcoin seriously, and this trend seems to be becoming more and more persistent. A Bloomberg Intelligence chart depicting an upward trajectory for the bitcoin-to-gold ratio in early 2022 has now reached 25 times, compared with nearly 18 times a year ago. Clearly, gold appears to be being replaced by Bitcoin, with total gold holdings in exchange-traded funds down about 9% year-on-year as of Jan. 5 — and the numbers bear it out.

Bottom: Bitcoin Beats Gold, Maybe It’s Just a Matter of Time

Gold could rise to $2,000 an ounce in 2022, but Bitcoin should rise even faster.

Compared with the stock market, Bitcoin still has the upper hand. A chart from Bloomberg Intelligence depicting the upward trajectory of bitcoin’s price over the past year has seen its volatility drop compared to the Nasdaq 100 stock index. At the beginning of 2022, Bitcoin's 260-day volatility is about 4 times compared to Nasdaq volatility, while in 2013 this indicator was about 12 times and in 2017 it was 8 times.

Bottom: Bitcoin is becoming less volatile than most assets