Status of Web3.0 unicorns: The United States has become a startup center, with a 0.7% chance of becoming a unicorn

Original Author: Altan Tutar

Compilation: Baize Research Institute

Web3.0 is the decentralized iteration of the Internet. The protocols, applications, and communities that run on the blockchain are collectively known as Web 3.0. The first applications to market are decentralized exchanges, prediction markets, stablecoins and blockchain games.

Blockchain can be seen as a global computing platform that can run any program, which is why it is called a platform. It's not just storage, it's a global computer in which many isolated parts can communicate with each other in real time and securely. This has fundamentally changed the way businesses operate. It enables new models of collaboration and value distribution among peers, historically unprecedented, and will enable new innovations that we cannot predict today.

simply put

Web1:

Open source Internet protocols of the 70s and 80s, including TCP, IP, SMTP, and HTTP.

Designed with an open and inclusive spirit in mind.

Anyone can build on top of them without anyone's permission.

Web2:

Open source applications are difficult to monetize.

The Web2 business model relies on building proprietary, closed protocols on top of the Internet's open protocols.

Several of these companies are now the most valuable in history, and while we use them for free, we have to trust the code-opaque model.

Web3:

Like Web1, an open-source protocol, but collectively owned through cryptoeconomics.

Independent of traditional organizations, enforced by code rules.

Value open source software, user ownership of data, and permissionless access.

Create a shared sense of identity and collaboration.

2021 is the year that Web 3.0 enters the mainstream. From the humble Discord community, buying NFT at a high price, to Facebook rebranding to Meta, your relatives and friends may ask why anyone would pay 30 for a digital image of a monkey. Ten thousand U.S. dollars.

This field is exciting for users, and so is the demand for engineers with Web3.0-related skills. In fact, in London, an entry-level blockchain developer familiar with programming languages like Solidity, Rust, etc. earns almost 22% more than the average software engineer salary, regardless of seniority.

Many venture capital funds are launching Web3.0-specific funds. Aside from the excitement, I couldn't resist the urge to analyze and explore the unicorn companies in the Web3.0 field.

In this article, my aim is to provide a fundamental analysis of the current status of Web3.0 unicorns at the end of 2021.

I define Web3.0 as an ecosystem of decentralized applications and all their tools. To find Web3.0 companies, I used the Crunchbase database to obtain information by leveraging (1) industry tags blockchain, cryptocurrency, and bitcoin, and (2) central tags unicorns, emerging unicorns.

Second I did a similar search to find the rest of the companies, except I removed the industry tag to make it industry-agnostic. Again, I need to find the number of companies in the Web3.0 space, so I removed the center label but kept the industry label. To find verticals, I used the panorama provided by The Block Research, which includes an analysis of Web3.0. These verticals are (1) Trading/Brokerage, (2) Infrastructure, (3) Crypto Financial Services, (4) Data & Analytics, (5) NFT/Gaming.

As of December 24, 2021, I found 60 Web3.0-native unicorns, out of a total of 8,785 for all Web3.0 companies.

My analysis in this article focuses on:

(1) Percentage of unicorns among Web3.0 companies;

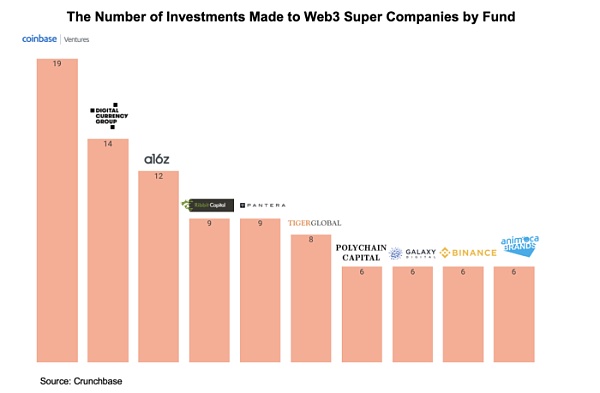

(2) Who are the top investors in the field in terms of the number of investments in Web3.0 unicorns;

(3) Divide these enterprises by region;

(4) The composition of the vertical field of Web3.0;

(5) Preliminary estimates of the total revenue of Web3.0 unicorns.

1 in 150 Web 3.0 companies has become a unicorn

Out of a total of 8,785 Web 3.0 companies, 60 became unicorns. Based on historical data (which may not accurately capture a snapshot of Web3.0 companies), as an entrepreneur starting a Web3.0 company, you have a 0.7% chance of becoming a unicorn founder. From a VC point of view, if you invest in 140 Web3.0 companies, you are very likely to become a unicorn investor. It will be interesting to see how this percentage changes over the next few years.

Coinbase invests in most Web 3.0 unicorns

When we look at the investors investing in Web3.0 unicorns (only the top 5 investors as reported by Crunchbase), we see 152 investment/venture capital firms investing in Web3.0 unicorns. Among the companies with the most investments, Coinbase Ventures (19 investments, 32% of which became unicorns), Digital Currency Group (14 investments, itself a Web3.0 unicorn), Andreessen Horowitz (12 investments), Ribbit Capital and Pantera Capital (9 investments each). It is also possible to see other disruptors in the venture capital industry last year in the list, such as Tiger Global Fund (8 investments, top 6 in the number of investments), SoftBank Vision Fund (4 investments). Not surprising to see Web3.0 native funds like Maven 11 Capital and MultiCoin Capital, some of which I expect to join the list in 2022.

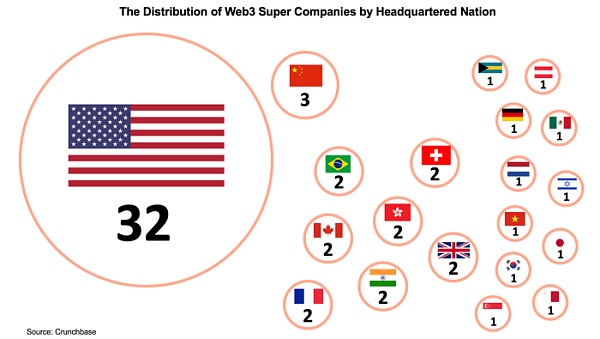

America becomes the center of Web 3.0

With China cracking down on bitcoin this year, the focus of Web 3.0 has shifted to the US. In fact, for the first time, the United States surpassed China as the number one destination for crypto asset mining. Expect Web 3.0 to spark debate in Washington, D.C., as an A16z poll found that voters would prefer candidates who support Web 3.0.

The prevalence of Web 3.0 unicorns, combined with increased Bitcoin mining activity, may be why Web 3.0 is so hot in Washington, DC. Of the 60 unicorns, 53% are headquartered in the US, followed by China with 5% (3 companies) of Web3.0 unicorns. Other countries on the list include Brazil, Canada, Hong Kong, India, Switzerland and the United Kingdom, each with 2 companies.

As Decentralized Finance (DeFi) becomes an integral part of Web 3.0, due to its core philosophy of openness, decentralization, transparency, and permission-free, I see technologists in other countries working on this new protocol. potential, which may increase the diversity of Web3.0 unicorn corporate headquarters locations in the future.

Trading/brokerage firms dominate the space, but NFT/chain games are on the rise

32% of Web3.0 unicorns belong to the trading/brokerage industry. This is mainly due to the popularity of exchanges (Gemini, Coinbase, Bitpanda, etc.) in the crypto trading market.

This is followed by the crypto financial services vertical, which accounts for 28% of Web3.0 unicorns. These companies raised an average of $580 million in total funding, $180 million more than the overall average for Web3.0 unicorns.

Throughout 2021, the key word of the year that the encryption community is discussing is NFT/blockchain games. NFT/blockchain gaming companies make up 13% of Web3.0 unicorns, raising an average of $400 million in funding, but they are 25 months younger than the average Web3.0 unicorn. With members of the global crypto community actively looking for new NFT markets, I predict that the share of companies in this vertical will increase significantly in 2022.

With $27.3 billion in total funding raised for Web 3.0, what's next?

Without a doubt, Web 3.0, with a total funding of $27.3 billion, is a topic that needs to be preserved and is only the beginning of an upward trend in infrastructure and investment for the future of the Internet. The purpose of Web 3.0 is to create a decentralized web where users can transfer their data seamlessly from one service to another without corporate "walled gardens" holding them back.

Blockchain and its associated applications, such as DeFi, NFT, GameFi, etc., are building the backbone of this trend. According to Crunchbase data, the highest and lowest annual revenues of all 60 unicorns are $15.6 billion and $4.2 billion, respectively. The value of Web3.0 unicorn enterprises cannot be measured only by revenue like traditional businesses. One factor, for example, is the Lego-like composability of Web 3.0 companies, which creates unprecedented value.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.