Meme Cultivation Manual: Reborn as a Diamond Hand (Part 4) | Produced by Nan Zhi

- Core Viewpoint: After the copy trading system was upgraded, some accounts have seen significant returns.

- Key Elements:

- Copy Trading Account #6 achieved nearly a 5x gain in one week.

- New "Copy Trading Effectiveness Test" and "Internal Performance Evaluation" modules added.

- The system has only been running for 28 days, with limited data samples.

- Market Impact: Demonstrates the potential and risks of automated copy trading strategies.

- Timeliness Note: Short-term impact.

Original | Odaily (@OdailyChina)

Author|Nan Zhi (@Assassin_Malvo)

Last week, after introducing the Deep Evaluation System, the stability of Copy Trading Accounts #1 and #2 improved significantly. They began providing continuous capital support to other test accounts, and Copy Trading Account #6 achieved a nearly 5x increase in one week.

In this article, the author will update the progress of each wallet, display the copy trading address tracking charts, and update the upgrade status and future plans of the Deep Evaluation System.

Risk Warning: This system was launched on October 8th and has only been running for 28 days. While it has achieved certain results, objectively speaking, the data volume and control experiments are insufficient, and the rigor is limited. It is for reference only.

Capital Progress and Strategy Display

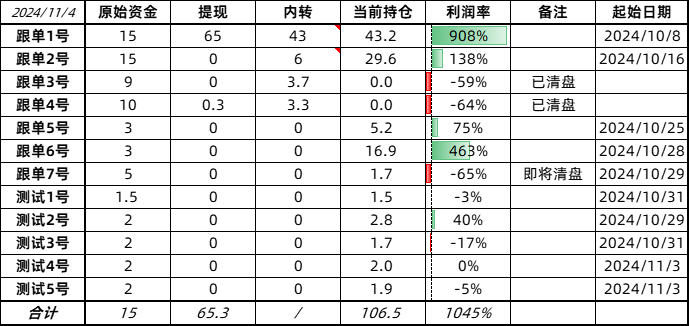

The capital status of each address as of November 4th, 17:30 (UTC+8) is shown below. The profitability and growth curves of each account vary greatly depending on the style and strategy of the copy trading target. Among them, Copy Trading Account #6 achieved a nearly fivefold increase in one week under some special circumstances. Specific details are in the next section.

This section will further display specific copy trading plans and the author's thought process during this period.

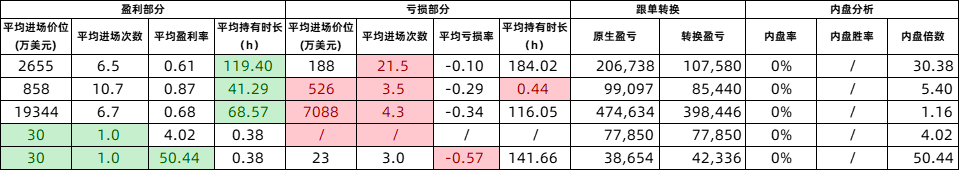

The details of tracking copy trading targets are shown in the figure below.

(Note: The rationale for the settings in the left column can be found in "Diamond Hands, High Risk-Reward Ratio? What are the Winning Factors in Solana Meme Trading?" and "Meme Cultivation Manual: Reborn as a Diamond Hand (Part 2)". The right column details are in "Meme Cultivation Manual: Reborn as a Diamond Hand (Part 3)".)

Brief Description of Copy Trading Strategy

Version Iteration

Deep Evaluation System (Part 1)

In Part Three, the author mentioned introducing the Deep Evaluation System (Part 1) to further analyze an address's ability to "buy at the bottom," risk of losing money from "FOMO at highs," ability to win big with small stakes, stop-loss style, and degree of "diamond hands."

Last week, the system further added two sub-modules: "Copy Trading Effect Test" and "Internal Pump Score Evaluation." The complete system evaluation results are shown in the figure below.

The "Copy Trading Effect Test" is currently still relatively rudimentary. Its calculation method is: Total Profit provided by GMGN ÷ Number of First-Round Transactions, then converting and accumulating the profit for each token to obtain the "Converted Profit" for each address.

(Number of First-Round Transactions = Number of transactions between the first purchase and the first sale, taken from GMGN - Address Data - Token Transaction Details. Transferring tokens is also considered a sale.)

The reason for adopting this calculation method is that the copy trading system mostly only copies a single buy entry. Therefore, it is necessary to evaluate the profit change under this style. A small decrease or even an increase in the converted profit/loss is ideal. The reason for this ideal situation is that the high-profit tokens of the copy target result from "a single well-timed buy," while high-loss tokens come from "multiple rounds of adding to the position."

The calculation method for "Internal Pump Score Evaluation" is also currently quite crude. First, it checks whether the token was purchased in a Pump internal group, then calculates the win rate and multiple based on the token's total profit and total cost. The purpose of this data is to evaluate whether to copy trades from internal groups. Once a situation arises with "high internal group participation rate" + "high internal group win rate" + "low internal group multiple", the address carries the risk of exploiting copy traders. In cases of low win rate and not high risk-reward ratio, it indicates poor trading skill within internal groups, and copying their internal trades is not advisable.

Future Outlook

The copy trading system still has many areas for improvement. Currently planned updates include:

- Copy Trading Effect Test: Secondary adjustment based on the proportion of invested capital, adding upper and lower limits on market cap, aiming to realistically simulate profitability under copy trading conditions.

- Internal Pump Score Evaluation: Introducing the "Copy Trader Exploitation Evaluation System" mentioned in Part Two, further clarifying the value of copying internal group trades while completing skill assessment.

- Accumulation Alert System: Dynamically scanning the holdings of all diamond-hand copy trading targets, broadcasting tokens that are commonly and consistently held or accumulated by multiple wallets, providing information for active trading.