This article explores the development prospects and future challenges of DAO

What the Internet has done for communication, DAO can also do for capital.

The Internet and social networks have made it easier than ever before for like-minded people to connect, regardless of geographic location. The emergence of digitally native currencies and finance has given rise to a new type of social network where like-minded individuals can not only communicate, but also coordinate around capital. Like their predecessors, these new networks are not constrained by geographic boundaries and are able to form at scale or across a small number of selected participants.

The most optimistic academics believe that decentralized autonomous organizations could revolutionize the way humans organize, eventually surpassing the world's largest corporations in size and scope.

In this installment of Around The Block, we explore the current landscape of DAOs and the big questions surrounding their future.

What are DAOs?

Simply put, a DAO is an organization that supports software. They allow people to pool resources for a common goal and share value when those goals are achieved.

Just as the Limited Liability Company (LLC) was the preferred primitive form of organization during the Industrial Revolution, the same can be true for DAOs in Web3. Businesses are rooted in the traditional financial system and organized through legal contracts, while DAOs run on open blockchain networks, such as Ethereum, organized by tokens whose rules are encoded in smart contracts.

DAOs are not tied to a physical location, allowing them to quickly mobilize and attract talent from around the world.

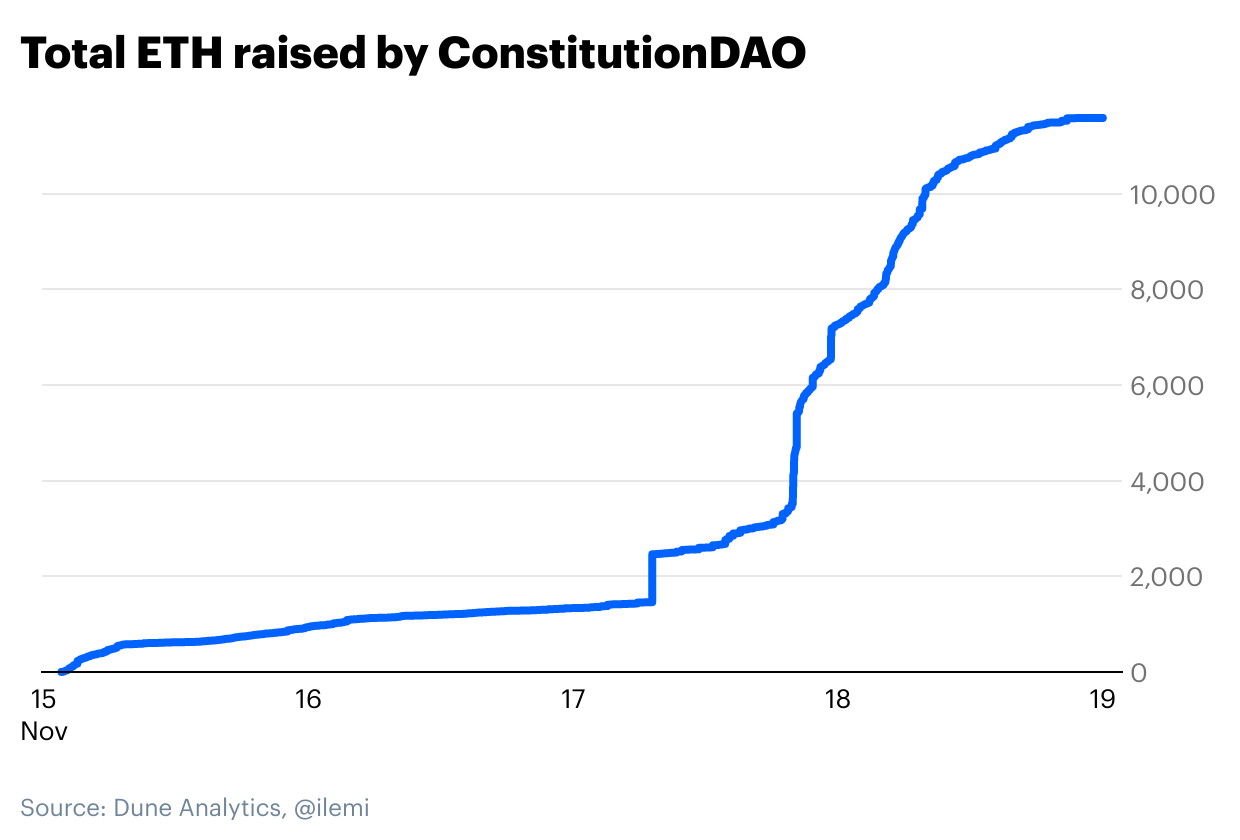

But DAOs can do much more than mobilize online groups to bid for historical documents—they can change the way we organize any economic activity.

What do DAOs do?

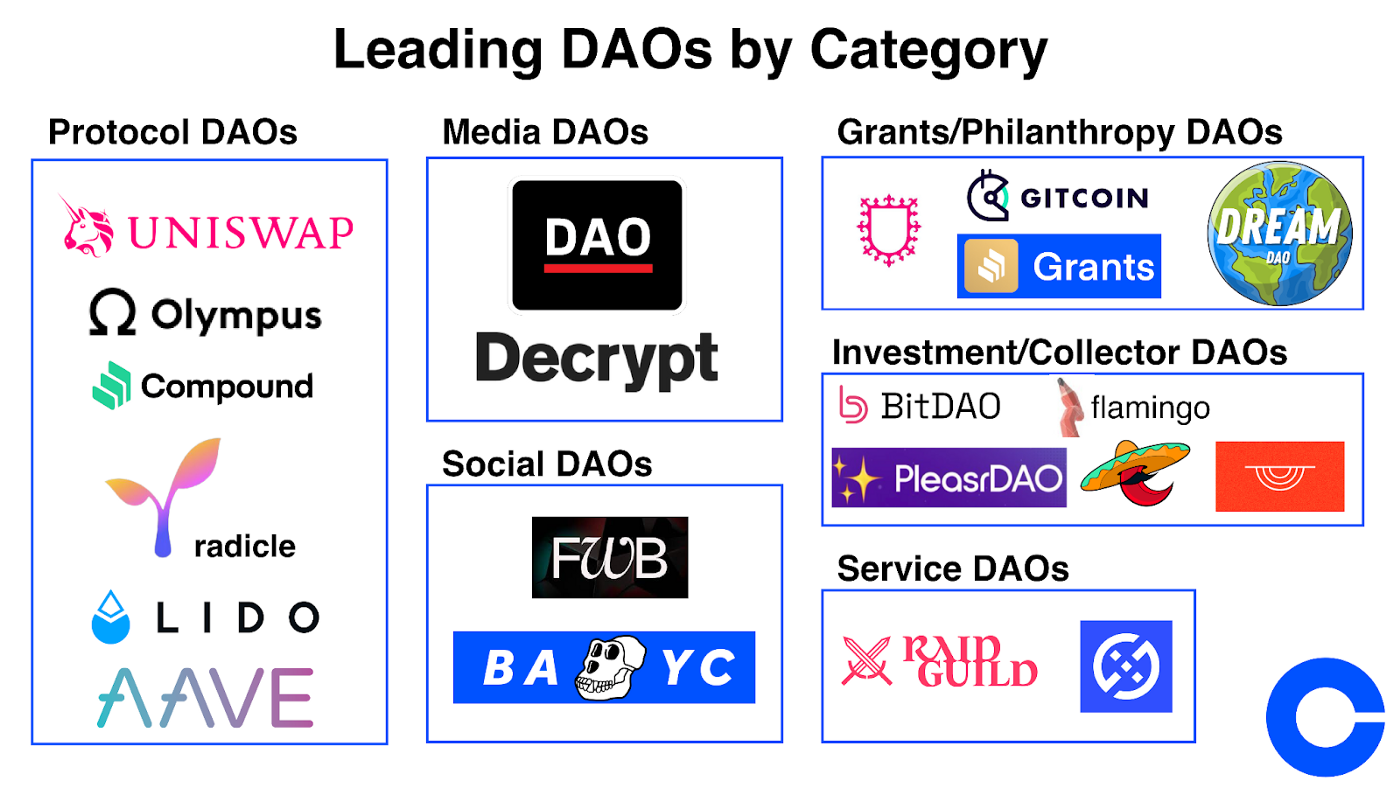

deepDAO.io has tracked more than 180 DAOs, with assets under management of more than $10 billion and nearly 2 million members. These include DAOs that help manage some of the largest crypto protocols, as well as smaller DAOs organized around investments, social communities, media and philanthropy.

Protocol DAO

Ethereum has led to an explosion of new crypto assets. On top of this, developers created protocols (such as Uniswap, Compound, and Aave) that allowed people to trade and lend these new assets. However, the purpose of these protocols is to be decentralized, which requires figuring out how to manage their growth and development.

Rather than handing over all key decisions to a small team of developers, Protocol DAOs serve as a way to give protocol users a collective say in their future direction. Typically, governance tokens are issued directly to users based on past usage and contributions to pass voting power. Any user can suggest ways to improve the project, and token holders can vote on whether the developer should move forward with the proposal. More tokens = more voting power.

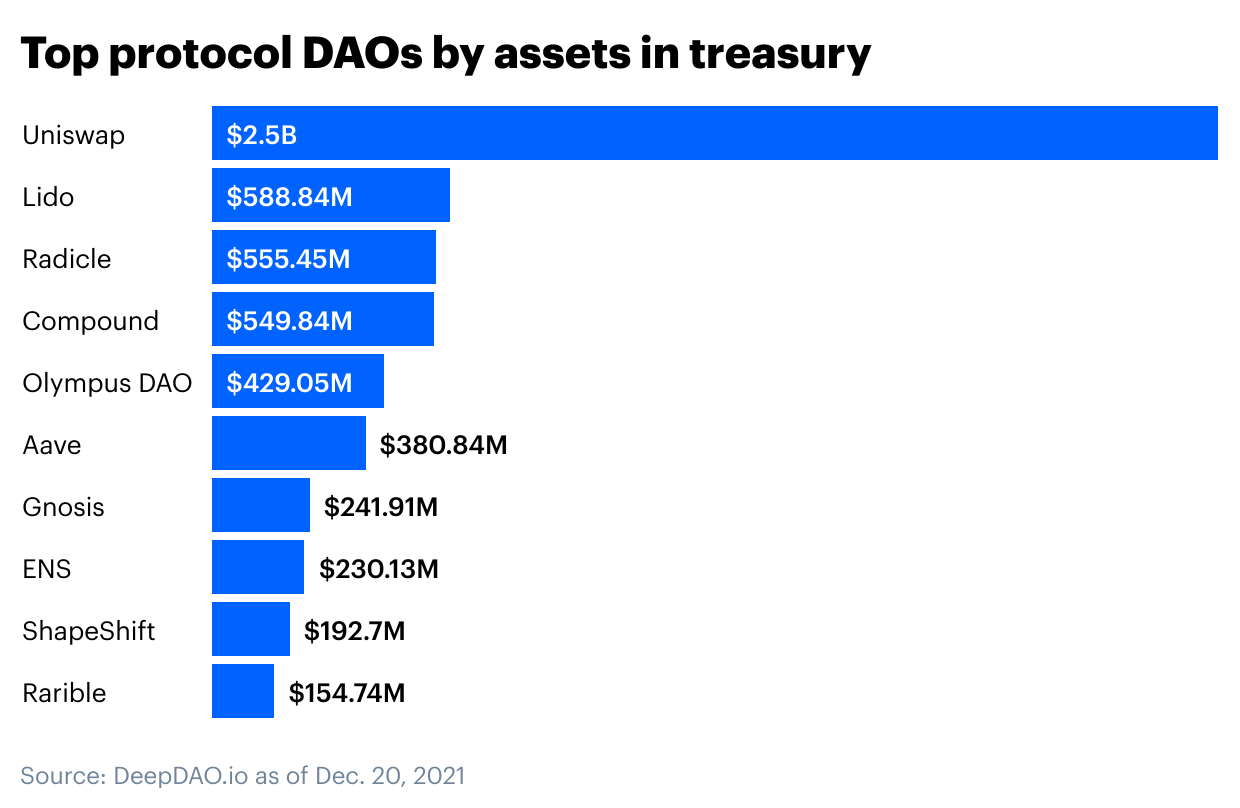

For example, Uniswap token holders are currently voting on which second layer network the decentralized exchange protocol should be deployed on. Token holders also offered advice on everything from marketing plans to how to manage Uniswap’s $2 billion-plus coffers.

Governance tokens align the community around the future success of the protocol, as they should appreciate in value as the protocol grows — or depreciate in value as the protocol fails.

Invest in DAOs

Invest in DAOs

The second largest category is investing and collecting DAOs. These allow people to pool funds to invest in specific assets. Their investments range from ventures like DeFi protocols or NFTs, to buying rare historical documents or even professional sports franchises.

Similar to other forms of crypto crowdfunding, these DAOs offer a quick and easy way to form capital, compared to the expensive and complex legal setup required for typical venture capital funds. These funds are also more transparent than traditional venture funds, as members can audit all transactions on-chain.

PleasrDAO, MetaCartel Ventures, Flamingo,Komerabi, are good examples of DAOs who pool resources, collectively make investment decisions, and share in the proceeds as those investments increase in value. Similarly, Syndicate is a project building a suite of tools to make it easy for anyone to create their own investment DAO.

Social DAOs

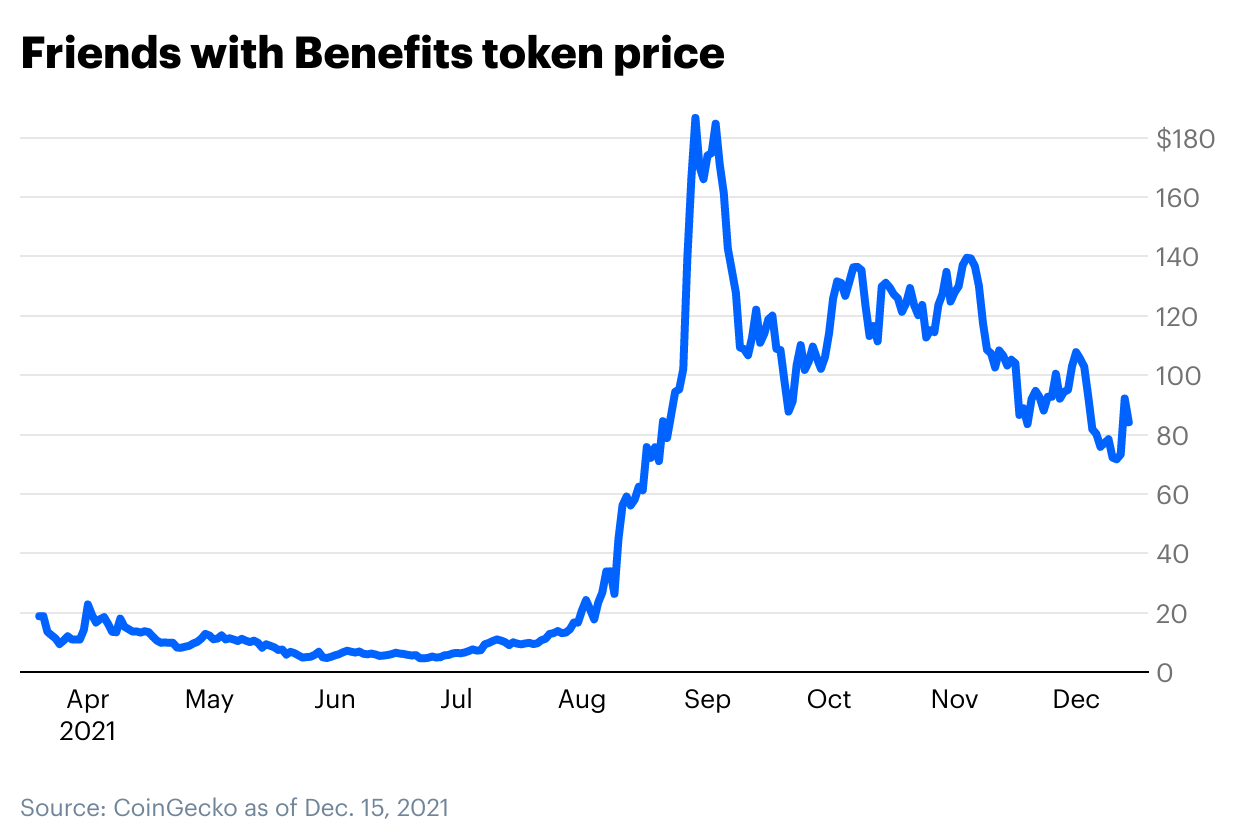

Social DAOs aim to bring like-minded people together into online communities, coordinated around a single token. The prime example is Friends With Benefits and its $FWB token. To join, members must submit an application and receive 75 FWB tokens. When you enter, you gain access to a community filled with renowned cryptocurrency builders, artists and creatives, as well as exclusive events.

By organizing around a token, members are motivated to create a valuable community - sharing insights, hosting meetups and throwing awesome parties, etc. For example, as more and more people realize the benefits of joining the FWB community, the tokens increase in value, raising the price of $FWB from $10 to $75, thus increasing the cost of membership from around $750 to around $6000 .

Other social DAOs use NFTs as a mechanism to unlock access to the wider community. For example, owning a Bored Ape NFT unlocks the Bored Ape Yacht Club Discord, events, NFT airdrops, and merchandise. In this case, the perceived value of the community drives the value collected by the NFT.

These kinds of DAOs are still in their infancy and will take time to understand which models work and which don't, but the rapid rise of these communities suggests that they represent a new and powerful form of social organization.

Service DAOs

Service DAOs look like online talent agencies that bring together strangers from all over the world to create products and services. Perspective clients can issue bounties for specific tasks that, once completed, pay a portion of the fee to the DAO treasury before rewarding individual contributors. Contributors also typically receive governance tokens that pass ownership within the DAO.

Most early service DAOs, such as DxDAO and Raid Guild, focused on bringing together talent to build crypto ecosystems. Their clients include other crypto projects and protocols, requiring everything from software development to graphic design and marketing.

Service DAOs can revolutionize the way people work, allowing a global talent pool to work on their own time and take ownership in the networks they care about. While early service DAOs focused on crypto, we can foresee a future where Uber will be replaced by UberDAO, which pairs drivers with riders while paying drivers for network ownership (although more is required before DAOs are integrated beyond the purely digital realm). a period of time).

MediaDAO

Media DAO aims to reshape the way content producers and consumers interact with media. These DAOs do not rely on advertising revenue models, but instead use token incentives to reward producers and consumers for an ownership stake in a given channel.

The idea of decentralized media dates back to 2013's "Let's Talk Bitcoin" podcast, but BanklessDAO is a prime example for 2021. Bankless is an Ethereum-focused medium that produces a popular podcast and newsletter. Recently, the Bankless team airdropped BANK tokens to the audience. After purchasing BANK, readers can play an active role in the media and earn additional BANK income through content production, research, graphic design, article translation, marketing services, and voting on key decisions guiding the DAO.

At a time when many believe the current ad-based media model is broken, media DAOs present a compelling option for realigning interests between readers and producers.

Grants/Charity DAO

Grants DAOs, similar to investment DAOs, pool funds and deploy them to various campaigns. The only difference is that distributions are made without the expectation of a financial return.

Gitcoin is a pioneer of this model, supporting the funding of critical open source infrastructure that might otherwise be difficult to fund. Similarly, large protocols like Uniswap, Compound, and Aave have specific authority DAOs that allow communities to vote on how to deploy their assets in order to pay builders and developers to further advance the protocol.

Charity DAOs are also starting to emerge, rethinking the way charitable giving is done. Dream DAO issues NFTs to raise funds, and then lets NFT holders vote on how to allocate those funds to the DAO's mission.

DAO's Obstacles

As this increasingly diverse situation shows, DAOs can become the organizational foundation of Web3, redefining the way we govern, invest, work, create and donate. We will see huge changes in the type, quantity and quality of DAOs in the future.

Still, they have a long way to go. Today we see 4 main deficiencies:

Lack of clear laws/regulation

Lack of an effective coordination mechanism

lack of infrastructure

Smart Contracts, Fragmentation, and Sustainability Risk

Lack of legal/regulatory transparency

Since DAOs don't exist in any one place and don't operate like businesses, they don't fit cleanly into existing regulatory frameworks.

When the rules around forming a new company are well defined, while protecting members from certain liabilities, DAOs have to deal with a variety of thorny regulatory and legal issues. How does the DAO token and treasury activity look from a tax point of view? How should income paid to DAO members be reported?

All this uncertainty makes it difficult for DAOs to interact with non-crypto/Web3 entities, which is a major downside. At the same time, a16z and OpenLaw have proposed a clear legal framework for the management of DAOs, but in the foreseeable future, DAOs will still be somewhat difficult to operate.

All of this uncertainty underscores the notion that, in the short term, DAO growth will likely only be focused on the digital realm - legal complexities that are amplified when DAOs attempt to leapfrog into the physical realm (e.g. UberDAO) .

Lack of an effective coordination mechanism

Company hierarchies exist because you often need qualified people to make the tough decisions. Many DAOs today exist under some sort of crude governance structure where 1 token equals 1 vote. In larger DAOs with thousands of token holders, this can lead to a chaotic decision-making process where voting power is more about purchasing power than expertise. Likewise, unappointed but high-profile members can gain significant influence over decision-making.

Most agree that for DAOs to be truly effective, they must explore advancements in governance structures, such as moving to a delegated delegation model where token holders can vote for qualified leaders and make key decisions in a transparent manner (this is Orca Protocol* is being explored). In the short term, DAO governance will likely remain chaotic.

lack of developed infrastructure

Just as businesses enjoy a clear legal framework and efficient decision-making processes, they also benefit from a highly developed operating infrastructure. DAOs, on the other hand, are tasked with building much of the same infrastructure from the ground up.

DAO tools for governance, payroll, reporting, financial management, communications, and every other resource a modern company can use are still in their infancy. Thankfully, DAO tools are widely used, with hundreds of teams working through a range of approaches to address these shortcomings.

There are too many teams to name when it comes to governance tools, but we're excited to see Messari's new aggregator that can monitor and participate in governance from a single interface.

Smart Contracts, Fragmentation, and Sustainability Risk

It’s hard not to mention “The DAO” when discussing DAOs: The first DAO on Ethereum was designed around a 2015 venture capital investment that lost $60 million in 40 percent of its funds to hackers. DAO treasuries remain vulnerable to smart contract risk, as demonstrated by the recent $130 million breach of BadgerDAO.

Likewise, the largest crypto networks have a history of schisms due to schisms within their communities. The Bitcoin/Bitcoin Cash split was caused by a technical dispute over the block size. The Ethereum/Ethereum Classic split was caused by a disagreement over how to respond to the aforementioned "DAO" hack. It stands to reason that we will see similar headwinds for the largest DAOs.

On the other hand, how sustainable is the DAO in the face of another possible crypto winter?

Reconnecting the world with DAO

Despite the obstacles, DAOs represent a paradigm shift in economic organization. If Web3 is to become an Internet collectively owned by users, DAOs will be the organizational primitive where ownership is metered.

2021 saw a revival of new DAO experiments and models. At the same time, the profile of projects and companies building the tools DAOs need to realize their true potential is the richest in the industry.

Original link