To 2021: The Golden Age of the Crypto World

Article authors: Azuma, Qin Xiaofeng, Hao Fangzhou

Produced | Odaily (ID: o-daily)

Produced | Odaily (ID: o-daily)

In 2021, the second year after mankind entered the epidemic era, social life and business activities continued to migrate online on a large scale.

Biden became the President of the United States; the 2020 Tokyo Olympics was postponed until this year; the 93rd Oscar, which was also postponed, awarded the best picture to Zhao Ting's "The Land of Nowhere"...

Global central banks continue to release water, and the three major U.S. stock indexes rose 20% from the beginning of the year; Bezos stepped down as Amazon CEO, and Facebook changed its name to Meta; Musk was elected as the 2021 Person of the Year by Time in the United States. "Digital RMB", "Yuan Universe", "Double Minus" and "Double Carbon" were selected into Xinhua News Agency's "Hot Words 2021"...

We have witnessed the ups and downs of too many business forms, and even their demise. Few fields are as chaotic as Crypto but full of vitality. There are always new stories, new capital, and new traffic.

2021 can be described as the golden age of the encryption world.

Bitcoin and Ethereum have repeatedly set new historical highs, and the total market value of cryptocurrencies once reached 3 trillion U.S. dollars; the primary market is prosperous, and mainstream capital has entered the market. According to statistics, venture capital funds have invested 30 billion U.S. dollars in the encryption industry this year; smart contracts on the chain Applications have exploded, with transactions on the Ethereum network alone exceeding $3.6 trillion.

From the meme currency carnival and NFT craze at the beginning of the year, to the rise of the new public chain ecology in the middle of the year, the continuous evolution of GameFi and DeFi, the leaders and upstarts of various sectors such as Metaverse and DAO took turns, we are feeling the power of innovation every moment .

In 2021, the US SEC finally passed the Bitcoin futures ETF; Bitcoin became legal currency in El Salvador; compliant encryption companies such as Coinbase went public; NFT continued to break through the circle and penetrate the entertainment field. We have to believe that all this is writing the prelude to Web 3.0.

Do you remember how many major events and milestones have occurred in the encryption world during this magical year? Which trends have you accurately grasped, and which opportunities have you missed?

first level title

at the same time,

In 2021, the market value of cryptocurrencies will hit new highs repeatedly.

At the beginning of the year, the total market capitalization of cryptocurrencies was only US$779.5 billion. In January and May, it crossed the US$1 trillion and US$2 trillion mark successively, and reached a record US$3 trillion on November 10 this year; On December 22, the total market value of encryption was tentatively reported at US$2,415.9 billion, an increase of 175% from the beginning of the year.

at the same time,Bitcoin's dominance in the crypto market is weakened, the market value accounted for 70.66% at the beginning of the year, and continued to decline to 38.8%. This is also the first time since the middle of 2018 that the market value of Bitcoin has fallen below 50%.

The main reason behind this is that with the overall development and growth of the encryption ecology, more emerging projects have emerged, and various ecological sectors are blooming. It is worth noting that,Ethereum's market capitalization share has risen sharply this year, from 11% at the beginning of the year to the current 21%.

In terms of price,Mainstream assets such as Bitcoin and Ethereum broke new highs for the first time this year2021,

2021,Total Bitcoin and Ethereum Transactions Hit a Record $7.5 Trillion, an increase of 435% over the previous year.

Let’s look at stablecoins again.The stablecoin market continues to grow in 2021, the supply of U.S. dollar stablecoins soared 388%, from $29 billion at the beginning of the year to more than $140 billion. Stablecoin usage is also at an all-time high. The adjusted annual transaction volume of stablecoins in 2021 exceeds $5 trillion, which is a year-on-year increase of more than 370% compared to the transaction volume in 2020.

The growth of stablecoins is mainly due to the following reasons: First, as stablecoins are used as market hedging tools and payment intermediaries, they naturally grow with the market size; second, under the development of DeFi, people use stablecoins for non-destructive mining; Derivatives markets typically use stablecoins as settlement units.

The stablecoin market is ushering in more regulation and scrutiny. For non-compliant stablecoins, there may be further loss of living space in the future.

The stablecoin market is ushering in more regulation and scrutiny. For non-compliant stablecoins, there may be further loss of living space in the future.

The top ten currencies in the crypto market this year have also undergone earth-shaking changes.The rankings of former bifurcated coins (BCH, BSV) have been falling; EOS and other old chains have been in a slump, and their rankings have been impacted; , was also squeezed out of the top ten.

And the MEME tokens headed by DOGE and SHIB once ranked among the top 10 or even the top 5 in terms of market value under Musk's kind "shouting orders" "The Myth of Making Wealth of the Year".

The strongest "nail house" BNB has always been in the top ten. There are two main reasons: first, the BSC ecology broke out at the beginning of the year, and it found stronger value support and more application scenarios for it; The trading volume surged, and the price of BNB once rose close to US$700, and is currently at US$535, an increase of 1350% within the year.

In addition, Solana, Polygon, Terra, Avalanche, Cardano and other smart contract platform ecosystems other than Ethereum Layer 1 have emerged one after another, occupying seats in the top ten list.

first level title

2. With more than 1,500 investment and financing transactions, VC has started a paradigm shift

Behind the booming secondary market is an even crazier primary market.

VCs who have survived the long bear market made a lot of money in this round of violent bull market, and then turned the profits into "bullets" to "sweep goods like crazy" on major tracks.

According to Odaily's incomplete statistics, as of December 19,In 2021, the encryption industry publicly disclosed 1,529 primary market financings, an increase of 252.3% year-on-year, and the total disclosed amount was approximately US$32.6 billion, an increase of 814.2% year-on-year.

In a market where hot money is surging, the valuations of leading projects have been continuously raised, and the highest single financing record in the industry has been broken many times. Divided according to specific tracks,The projects with the largest single investment amount in each vertical field are as follows:

In the CeFi field, NYDIG completed a round of US$1 billion financing led by WestCap, which is also the largest single financing in the history of cryptocurrency.

In the field of centralized exchanges, FTX received USD 900 million in the B round of financing, and then received a capital injection of USD 420 million in the additional B-1 round of financing.

In the field of stable currency services, Circle, a USDC development company, completed a financing of 440 million US dollars and began to seek an IPO in the form of a SPAC.

In the field of mining, Blockstream completed a US$210 million financing led by Baillie Gifford and iFinex, and part of the new funds will be used to explore clean energy mining methods such as solar energy.

In the field of wallets, Ledger, an established hardware wallet, completed a financing of US$380 million, with a valuation of US$1.5 billion.

In the field of public chains, Solana received US$314 million in financing and became the most eye-catching emerging public chain of the year.

In the Layer 2 field, Arbitrum developer OffchainLabs completed a $120 million Series B round of financing at a valuation of $1.2 billion, and its mainnet was officially launched in the second half of the year.

In the field of DeFi protocols, BitDAO overwhelmed many leading projects and completed a financing of US$230 million jointly led by Peter Thiel, Founders Fund, Pantera Capital and Dragonfly Capital.

The top player in the NFT field belongs to Dapper Labs. In two rounds of financing, Dapper Labs has successively received US$305 million and US$250 million in investment, totaling US$555 million.

In the field of games, the platform project Forte completed a financing of US$725 million led by Sea Capital and Kora Management, surpassing the football game Sorare which received US$680 million in investment.

In the social field, DeSo is the most eye-catching dark horse. This Layer1 public chain specially built for social needs received an investment of 200 million US dollars just after its birth in the second half of the year.

The value of the cross-chain field began to rise at the end of the year. Anyswap also completed a financing of 60 million US dollars while upgrading its brand to Multichain. Sequoia China can be seen in the investment list.

In addition to these relatively mainstream tracks, projects in security, data analysis, on-chain monitoring, communication networks, tax services, freelance markets, and even various development infrastructures have also received huge financing.

Judging from the general trend of track rotation,In 2021, NFT will gradually complete its counterattack to the status of DeFi king.

From the slight weakness at the beginning of the year, to the rivalry in the middle of the year, and then to the massive crushing at the end of the year, NFT has become the hottest theme in the primary market in the second half of the year, and it has also driven games, collections, transactions, lending, and fragmentation. , display terminals and other related derivative directions.

2021 will be a year of institutional reshuffle.Some established institutions have fallen on the tail of the bear market, and some new faces have been born in the bull market, while some top institutions that have gone through the bull and bear markets have gradually displayed their own "golden signs". With continuous large-scale sales and high-density coverage of leading track players, a16z has become the most powerful investment institution in the cryptocurrency industry in 2021. Its third fund, Crypto Fund III, has a fundraising scale of up to 2.2 billion US dollars ;Research-driven VCs such as Paradigm and Multicoin Capital are not far behind, and continue to output insights to the industry while continuing to exert their strength in their respective areas of expertise; relying on the strong background of leading exchanges to support Binance Labs, Coinbase Ventures, Alameda Research, etc. The performance is equally eye-catching.

Whether it can win the favor of these institutions has become an important indicator for many ordinary investors to judge the quality of a project.

In 2021, we also seeMore and more VCs in the traditional field are beginning to lay out the encryption market.

The most noteworthy VC is of course Sequoia. After the high-frequency deployment of public chains, exchanges, Layer2, and NFT tracks, at the end of the year, they also played a "DAO day tour" on their Twitter profiles.

However, when VC is in full bloom, there is also a wave of anti-VC in the industry, and there are more and more criticisms about "VC's monopoly of early investment".

first level title

3. Events in 2021

After an overview of the primary and secondary markets, we will review the most memorable events and achievements of the year by sector/track.

At the beginning of 2021, Bitcoin continued its upward trend, rising from $29,000 at the beginning of the year, breaking through the $30,000, $40,000, $50,000, and $60,000 barriers, and finally hitting a new high of $65,000 in the first half of the year (April 14). Record; In May, with the tightening of policies and the exit of market profit taking, Bitcoin ushered in a sharp correction. On May 19, Bitcoin fell to a minimum of 30,000 US dollars.

No matter how encrypted finance evolves, Bitcoin, as the cornerstone and vane of the market, will always be the focus.

At the beginning of 2021, Bitcoin continued its upward trend, rising from $29,000 at the beginning of the year, breaking through the $30,000, $40,000, $50,000, and $60,000 barriers, and finally hitting a new high of $65,000 in the first half of the year (April 14). Record; In May, with the tightening of policies and the exit of market profit taking, Bitcoin ushered in a sharp correction. On May 19, Bitcoin fell to a minimum of 30,000 US dollars.

In the next two months, Bitcoin has been consolidating around $30,000, and began to rebound in August, starting to "slow bull".It eventually hit a record high of $69,020 on Nov. 10 — which brought its market capitalization to $1.3 trillion at one pointSince the beginning of this year, the price of Bitcoin has always been above $30,000, which has also made many people full of confidence in the market outlook. The argument that "the market has entered a long bull" has emerged endlessly. Optimists believe that Bitcoin will break through $100,000 in 2022.

Since the beginning of this year, the price of Bitcoin has always been above $30,000, which has also made many people full of confidence in the market outlook. The argument that "the market has entered a long bull" has emerged endlessly. Optimists believe that Bitcoin will break through $100,000 in 2022.

As the price of Bitcoin rises, so does the attention of mainstream institutions.Another representative of a listed company that continues to increase its position in Bitcoin is MicroStrategy, which has started the "crazy buying, buying, buying" mode. In addition, the global payment platform Visa has opened cryptocurrency payments; the asset management company Grayscale published an advertisement for the Bitcoin Trust Fund (GBTC) in the "New York Times" newspaper, promoting Bitcoin... The running admission of institutions successfully raised the Bitcoin price. The recognition of the value of the currency increases.

In February, Tesla submitted a report to the U.S. SEC stating that the company plans to purchase bitcoin worth US$1.5 billion; in March, Tesla’s official website announced that it supports bitcoin payments; A plan to suspend payments for his car in bitcoin was announced on Twitter, citing “not being environmentally friendly.”

Musk, who has repeated attitudes and has real market influence, has also made many crypto investors "love and hate" him.

Another representative of a listed company that continues to increase its position in Bitcoin is MicroStrategy, which has started the "crazy buying, buying, buying" mode. In addition, the global payment platform Visa has opened cryptocurrency payments; the asset management company Grayscale published an advertisement for the Bitcoin Trust Fund (GBTC) in the "New York Times" newspaper, promoting Bitcoin... The running admission of institutions successfully raised the Bitcoin price. The recognition of the value of the currency increases.

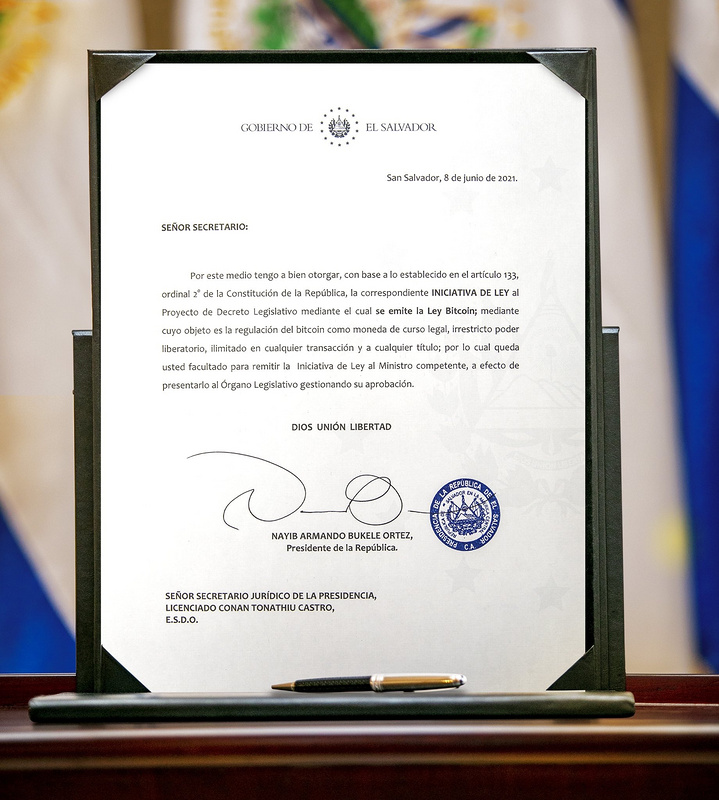

In addition to institutional purchases,(Bitcoin Legalization Act)。

In June, President Nayib Bukele of El Salvador submitted a draft bill to the country's legislature, requiring Bitcoin to become the country's legal tender; on September 7, the bill came into effect and Bitcoin finally became legal tender. Although this plan has caused controversy at home and abroad, it is of great significance to the development of the entire encrypted finance. Bitcoin entered social life in a legal capacity for the first time. El Salvador has also set an example, and more Latin American countries are trying to follow suit and legalize Bitcoin.

(Bitcoin Legalization Act)

In terms of structured products, the long-awaited ETF (Exchange Traded Fund) in the encryption market will finally be realized in 2021. In October this year,The first Bitcoin futures ProShares Bitcoin Strategy ETF was officially launched and landed on the NYSE Arca exchange, and then the SEC successively approved multiple futures ETFs.

Although from the perspective of price feedback, the impact of ETFs on the encryption market has not met expectations. But in any case, with the emergence of such compliant products, the confidence of traditional institutional investors and ordinary users in encryption will continue to increase.

At the technical level, this year Bitcoin ushered in aImportant soft fork to upgrade TaprootIn May of this year, the Financial Stability and Development Committee of the State Council proposed "cracking down on bitcoin mining and trading activities" in a meeting, setting off a new wave of supervision; Xinjiang, Qinghai, Inner Mongolia and other provinces and cities across the country have successively issued bans on virtual currency Mining was rectified and cleaned up, and a large number of mines were shut down or went to sea. In the end, some miners found new mines in Kazakhstan, Texas, and other places in the United States to continue their mining business.

In addition, before the end of the year, the number of Bitcoin non-zero addresses exceeded 40 million, a record high.

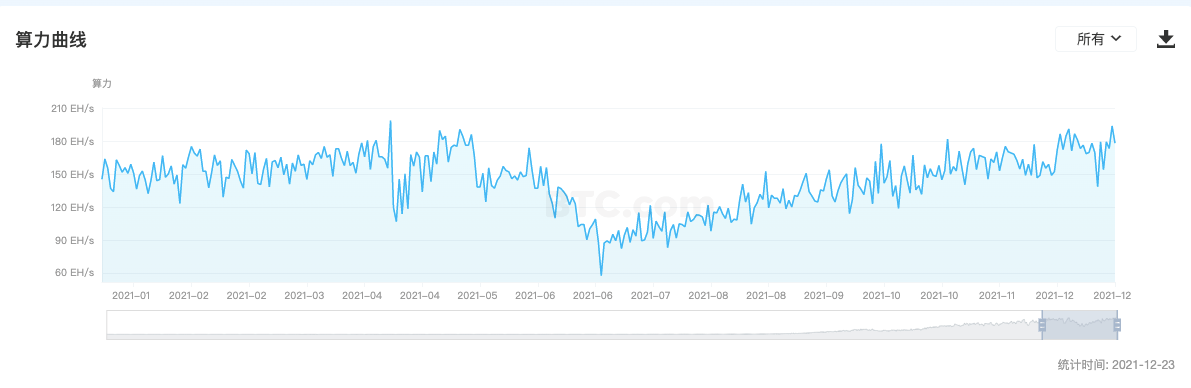

For miners, important participants in the Bitcoin ecosystem, 2021 is a year of migration.

In May of this year, the Financial Stability and Development Committee of the State Council proposed "cracking down on bitcoin mining and trading activities" in a meeting, setting off a new wave of supervision; Xinjiang, Qinghai, Inner Mongolia and other provinces and cities across the country have successively issued bans on virtual currency Mining was rectified and cleaned up, and a large number of mines were shut down or went to sea. In the end, some miners found new mines in Kazakhstan, Texas, and other places in the United States to continue their mining business.

Affected by the shutdown of mines, the computing power of Bitcoin is also changing drastically. In April of this year, the computing power reached its peak, but it fell by nearly 50% between May and July; so far this year, Bitcoin computing power has risen by nearly 20%.

The rise of Meme culture originated from a major event in the traditional financial market at the beginning of this year-the GME defense battle. In a nutshell, Wall Street retail investors joined hands to buy GME shares on Robinhood, resulting in short-selling by institutions and causing losses, which once reversed the status of retail investors and institutions.

If you bought $100 of BTC at the beginning of the year, it will be worth $167.4 now; if you bought SHIB, guess how much it is worth now? The answer is $62 million. This is the ultimate embodiment of the wealth effect of Meme coins.

A new sector was born in the encryption market this year: Meme currency, representative projects include various animal coins such as Doge and SHIB. Meme culture can be commonly understood as"Play meme", any item with the attribute of "joke" can be called Meme currency.

The rise of Meme culture originated from a major event in the traditional financial market at the beginning of this year-the GME defense battle. In a nutshell, Wall Street retail investors joined forces to buy GME shares on Robinhood, resulting in short-selling by institutions and causing losses, which once reversed the status of retail investors and institutions.

The anti-traditional and anti-Wall Street movement sang in the mainstream society. This trend of thought spread to the encryption market and was shaped into a more rebellious Meme culture.Market prospects, business models, technological advantages, product highlights, etc. that were once valued by investors have become interesting marketing and consensus building in the Meme era.

The "Chief Magnification Officer" of Meme Coin is Musk, who tweets every once in a while, "Tucao" Dogecoin, and "reversely attracts" many people outside the circle. Even in the eyes of many overseas "leeks", Dogecoin is the real Bitcoin. As Musk "calls out" again and again,Dogecoin is making great strides, and its market value squeezed into the top ten, surpassing Uniswap, the leading DEX project, with a maximum increase of more than 100 times during the yearfinally,

At the same time, the meme currency represented by DOGE has gradually become part of the multiculturalism of the encryption community. From March to May, various altcoins such as AKITA, Pig Coin (PIG), Dog Coin (DOG), Loser Coin (LowB) etc. were born in batches; It quickly collapses or returns to zero.

finally,Only Dogecoin's "fake" Shiba Inu (SHIB) really survived and "bigger and stronger"Among them, GM's market value rose from zero to 200 million US dollars in just 3 days after it was released (the highest reached 400 million US dollars, and it is still maintained at 100 million US dollars). In the name of DAO, People Coin crowdfunded a bid for a copy of the U.S. Constitution, and after the auction failed, it was converted into Meme Coin, and the price soared more than 50 times at one point.

The rise of SHIB led to the revival of Meme culture and inspired GM (Good Morning), People and other representatives of emerging Meme coins.

Among them, GM's market value rose from zero to 200 million US dollars in just 3 days after it was released (the highest reached 400 million US dollars, and it is still maintained at 100 million US dollars). In the name of DAO, People Coin crowdfunded a bid for a copy of the U.S. Constitution, and after the auction failed, it was converted into Meme Coin, and the price soared more than 50 times at one point.

Generally speaking, Meme culture has been fully integrated into the encryption community, and it has a strong communication influence by virtue of the subcultural consensus. But we should also clearly realize that in order to promote the maturity and development of encrypted finance, marketing and FOMO alone are not enough. Technology and products are the primary productivity of change. thus,Meme coins can be a "seasoning" blindly, but it is difficult to become a "main course".

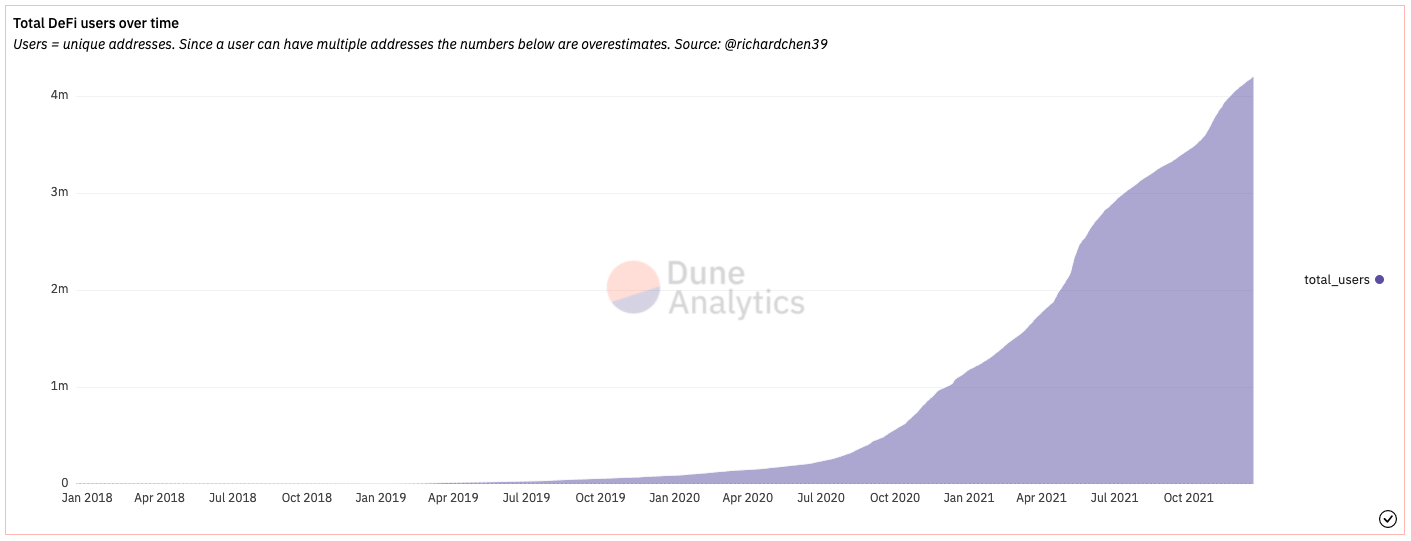

At the macro data level, DeFi has always maintained a positive growth trend.

Compared with the ups and downs of the Meme coin, the DeFi sector is a little deserted, but if you look at the performance of DeFi throughout the year from a higher perspective and more dimensions, it is not difficult to find that the evolution of DeFi has never stopped.

At the macro data level, DeFi has always maintained a positive growth trend.

According to DeFi Pulse data, as of December 21, the total value (TVL) of assets locked in major ecological DeFi agreements has reached 2.432 billion US dollars. Looking closely at the change curve of TVL, the "519" level black swan event is only a small twist in the upward trend.

Data from Dune Analytics shows that towards the end of the year, the number of independent addresses that have interacted with DeFi protocols exceeded the 4 million mark for the first time, and a large number of fresh blood is constantly pouring in.

individual project level,Most of the "blue chip" DeFi have completed their own major iterations in 2021.

first of all

At the track trend level, as the market structure of basic subdivisions such as stablecoins, lending, and DEX is becoming more and more stable, the focus of DeFi is gradually shifting.

first of allThe explosion of derivatives, here I have to mention dYdX’s token issuance and airdrop. As the most concerned project under the concept of derivatives, the market has placed quite high expectations on the value of dYdX. Coupled with the generous amount of the project party (the airdrop ratio is 7.5%), the vast majority of users who have interacted with dYdX have received tens of thousands The airdrop income of US dollars has also set off a new round of fleece frenzy in the market. However, from an industry perspective, although dYdX once surpassed the sum of all other DEXs under the support of the transaction mining strategy, such stimulation is obviously difficult to last for a long time, accompanied by the decline of dYdX’s daily trading volume and currency prices. , The voice of "derivatives explosion" is gradually weakening. We firmly believe that derivatives will explode in the DeFi field like spot products, but it seems that such an explosion cannot be ignited by a single project issuing coins.

The second notable trend is theEmbrace Traditional Finance (TradFi), the better ones in this regard are the three lenders—MakerDAO, Aave, and Compound. The former has been actively exploring how to introduce real-world asset collateral, and the latter two have announced new services for traditional financial institutions in the summer. Aave Pro (now renamed Aave Arc) and Compound Treasury.

at the end of the year,DeFi 2.0 aims to reconstruct liquidity relationship and optimize capital utilization efficiencyIn addition to the above trends, the multi-chain layout is also a major trend in the current DeFi track (see the "Cross-chain" section below for details).

In addition to the above trends, the multi-chain layout is also a major trend in the current DeFi track (see the "Cross-chain" section below for details).

Fan-absorbing NFT × Everything

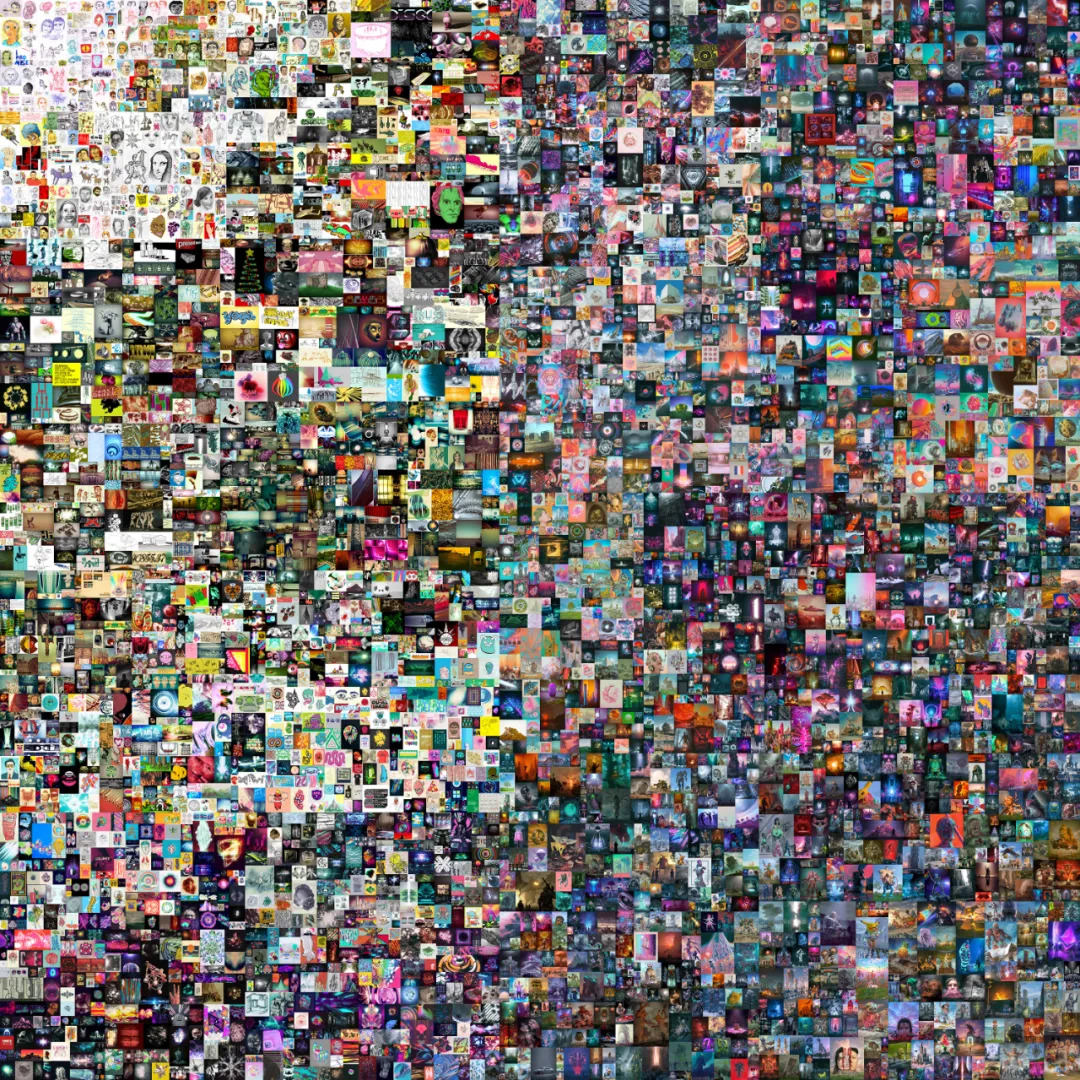

The blockchain industry has spent ten years looking forEnough "out of the circle" killer application directionIn December, artist Pak's project "Merge" was publicly sold on the NFT trading platform Nifty Gateway. The final total turnover was nearly 91.81 million US dollars, making it the most expensive NFT in history, and ranked third among the world's living artists.

In 2021, the annual landmark event in the NFT field should be: In March, artist Beeple's NFT work "Everydays: The First 5000 Days" was auctioned at Christie's for US$69.346 million, successfully attracting the attention of people in various fields such as traditional art.

In December, artist Pak's project "Merge" was publicly sold on the NFT trading platform Nifty Gateway. The final total turnover was nearly 91.81 million US dollars, making it the most expensive NFT in history, and ranked third among the world's living artists.

Like many young and niche "FT", the high price of NFT will also be questioned by hype, marketing, and bubbles, but the high price will "increase" a group of people, andattract more funds(The total transaction volume of NFT this year exceeded 23 billion US dollars)From the initial small-scale influence of NFT to the field of collections, to the economic empowerment of creators, and then to the wider consumer level to transform the fan economy and brand market relations, and gradually expand the radius of radiation.。

This year, many technology giants (Tencent, Alipay, Mega, Microsoft, Twitter, etc.), media platforms (Time Magazine, CNN, Vogue, etc.), many consumer brands and big IP parties (Nike, L’Oreal, Coca-Cola, McDonald’s) , Disney, Sony, etc.), cultural and sports stars (Jay-Z, Whitney Houston, Wong Kar Wai, Jordan Chan, Bailey, Curry, etc.), political and business people (Jack Dorsey, Musk, Snowden, Melanie Ya Trump, etc.) have purchased, issued or deployed NFT.

From the initial small-scale influence of NFT to the field of collections, to the economic empowerment of creators, and then to the wider consumer level to transform the fan economy and brand market relations, and gradually expand the radius of radiation.

While NFT projects are flourishing, itsThis type of NFTFi × DAO innovative product often splits the rights and interests in the form of bundling or collection methods and funds in practice. It does lower the entry threshold for some high-priced NFTs and improve their liquidity, but it also corresponds to custody and display. New risks such as unclear rights, difficulty in exiting or reselling, and imperfect buyout mechanism.。

In July, Opensea, the leading NFT trading market with a US$100 million round of investment led by a16z, has seen exponential growth in monthly turnover. The total number of current users has exceeded 750,000. In December, the market share of ETH trading volume reached 98.2%. The amount is at least 16 billion U.S. dollars, and the total revenue is estimated to reach 400 million U.S. dollars.

The total transaction volume of Art Blocks, an NFT generative art platform, exceeded US$1.1 billion, and its current market value is nearly US$130 million.

This year, Sotheby's, an art auction house that has undertaken auctions of Pak NFT works, World Wide Web source code NFTs, CryptoPunks, BAYC, etc., earned $100 million from NFT sales.

Finally, we would like to mention a separate segment - NFT crowdfunding DAO. In August, CryptoPunk #173 was sold at 99.9 ETH through community crowdfunding, and People's Punk issued token DDDD thereafter. PleasrDAO, the originator of crowdfunding and buying NFT gameplay, has collected 11 NFT works this year, including Uniswap V3 official announcement video clip NFT, Snowden's first NFT, Dogecoin original photo NFT, Wu-Tang Clan's orphan album "Once Upon A Time In Shaolin" and so on.

This type of NFTFi × DAO innovative product often splits the rights and interests in the form of bundling or collection methods and funds in practice. It does lower the entry threshold for some high-priced NFTs and improve their liquidity, but it also corresponds to custody and display. New risks such as unclear rights, difficulty in exiting or reselling, and imperfect buyout mechanism.

Chain games and GameFi take a big leap forward

In 2021, NFT will also consolidate its position in the gaming industry.

Let’s look at the increase of traditional games to NFT: Ubisoft (Ubisoft) will launch the NFT platform; NetEase’s game “Infinity” IP authorized the release of NFT blind boxes; Epic Games’ digital game platform Epic Games Store will provide blockchain and NFT games open……

This year, there are still many NFT projects that have gained sufficient attention and repeatedly set sales records: the BAYC series of "children and grandchildren", the card game Parallel Alpha, the TXT text version of NFT with randomly generated equipment names representing Loot...

Let’s look at the increase of traditional games to NFT: Ubisoft (Ubisoft) will launch the NFT platform; NetEase’s game “Infinity” IP authorized the release of NFT blind boxes; Epic Games’ digital game platform Epic Games Store will provide blockchain and NFT games open……

This year,In addition, under the strong "play and earn effect" of Axie Infinity, game guilds represented by YGG and others are also based on the main business of "playing gold", and have derived scholarship (scholarship), game asset leasing, investment incubation, etc. business line, and triggered a financing boom in Q4.

In addition, under the strong "play and earn effect" of Axie Infinity, game guilds represented by YGG and others are also based on the main business of "playing gold", and have derived scholarship (scholarship), game asset leasing, investment incubation, etc. business line, and triggered a financing boom in Q4.

Standing in the "First Year of the Yuan Universe" and looking into the distance

Putting the metaverse into the year-end inventory is considered a hot spot for many vertical fields, but who makes the metaverse still a pan-concept with vague concepts, technological integration, and continuous evolution.

The combination of Metaverse and Crypto mainly falls on the lower-level economic system and production relations. Specifically, a considerable number of industry insiders believe that,All assets in the metaverse (identity, data, props, currency, transactions, etc.) should be tokenized (or at least based on a distributed system), and generated, circulated, and destroyed in a decentralized manner.

At present, the three major virtual land platforms in the circle that are closest to this "conceived paradigm", The Sandbox, Decentraland and Cryptovoxels, all ushered in explosive growth this year.

The current market value of The Sandbox exceeds 200 million U.S. dollars, there are more than 630,000 NFTs, and about 34,000 holders. Republic Realm purchased The Sandbox land for 4.3 million U.S. dollars in early December, setting a historical record for the sale price of virtual land. This year, rapper Snoop Dogg, Nipsey Hussle, NFT collector Cozomo de' Medici and others settled in The Sandbox.

Among the publicly-identified buyers are Adrian Cheng, CEO of Hong Kong real estate giant New World Development Group, singer JJ Lin (who also bought the Decentraland plot), Wang Chun, co-founder of Yuchi (to build the headquarters of Dogecoin enthusiasts), etc. The Sandbox has also established cooperation with cartoon character IP "McDull" and Adidas Originals, and received US$93 million in financing led by Softbank Vision Fund 2.

The current market value of Decentraland is about US$74.87 million, and there are more than 160,000 NFTs. The top land transaction list is Fashion Street Estate, which was worth US$2.42 million (618,000 MANA) at the time. This year, Decentraland has hosted the Metaverse Music Festival with 80 groups of artists (virtual avatars), RacingTime's virtual car show, Boson Protocol's virtual mall, and a virtual gallery in cooperation with Sotheby's, etc.

Cryptovoxels currently has a market capitalization of about $26.9 million and nearly 400,000 NFTs. This year, Cryptovoxels began to support Facebook (now Meta) account login, launched Scarcity Island, a virtual land with autonomous voting scenes, and discussed internally or the details of the original Token CV launched in April next year. Metaverse real estate developer MetaEstate also designed and built the TRON ecological complex on Cryptovoxels.

In the last week of November, the four metaverse virtual lands of The Sandbox, Decentraland, CryptoVoxels, and Somnium Space had combined weekly sales of more than $100 million.

Behind these "three majors", more emerging platforms inside and outside the circle are eager to try, setting off waves of "land buying frenzy". At the same time, various "water senders" such as virtual real estate developers/contractors, small prop manufacturers in the Metaverse, and service providers that rely on AR/MR to enhance NFT visual effects have also followed, bringing more cross-field compounding to the encrypted world High-end talents and traffic outside the circle.

In general, it is not an exaggeration to call 2021 the "first year of the metaverse".

Web 3.0: The day of victory is not far away

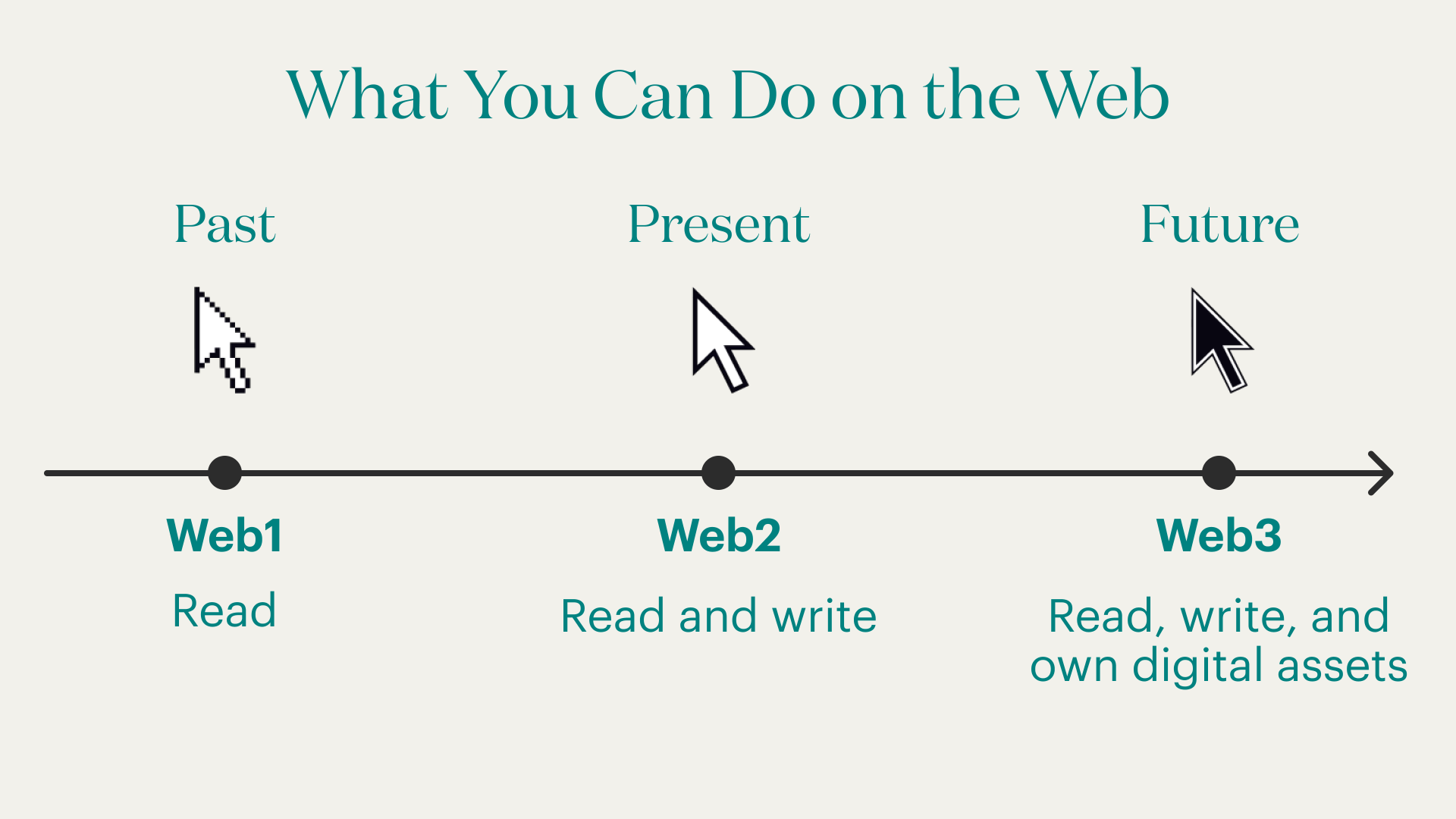

For the next encrypted narrative - Web 3.0, the definition with the highest consensus in the industry is proposed by a16z partner Chris DixonAfter the meeting, the edited video of Brooks’ answer was forwarded and disseminated by people in the industry, like a shot in the arm to help people who are still confused strengthen their beliefs.(read、write、own)”。

On December 8, the House Committee on Financial Services held a hearing on Capitol Hill entitled "Digital Assets and the Future of Finance: Understanding the Challenges and Benefits of Financial Innovation in the United States".

At the meeting, Bitfury CEO Brian P. Brooks also quoted Chris' theory when answering Representative Patrick McHenry's question about Web 3.0. Brooks explained that in Web 1.0, users only read specifically, so this is a "read-only Internet"; in Web 2.0, in addition to reading content, users can also publish content themselves, but these content do not belong to users All, so it is just "the Internet that can only be written"; in Web 3.0, in addition to being able to read and publish content, users will also really own all the rights and interests of the content, realizing the real "readable, writable, and ownable" the Internet".

After the meeting, the edited video of Brooks’ answer was forwarded and disseminated by people in the industry, like a shot in the arm to help people who are still confused strengthen their beliefs.

In 2021, we seeWith the irreversible development of Web 3.0, various infrastructures are becoming more and more mature, and upper-level applications are gradually being promoted.. MetaMask, the preferred entrance to the decentralized world, has achieved a blowout explosion in business volume. After its developer ConsenSys completed a financing of 200 million US dollars, its valuation has risen to 3 billion US dollars (although this does not seem very Web 3.0); Arweave, as a permanent decentralized content storage layer, also completed value discovery in the second half of the year; ENS continued to be popular after the issuance of coins and airdrops, and also triggered in-depth discussions on the imagination of domain names in the market; Mirror has become a popular topic for everyone to read One of the regular channels for premium content in the industry...

Maybe we should go back to that Chris quote: first they ignore you, then they laugh at you, then they fight you (where we are), and then it's your day of victory.

Maybe we should go back to that Chris quote: first they ignore you, then they laugh at you, then they fight you (where we are), and then it's your day of victory.

Ethereum reigns supreme as the king of public chains

Although new ecological public chains have emerged one after another this year, Ethereum’s status as the “king of public chains” remains unshakable.

The data shows that the price of ETH rose from US$750 at the beginning of the year to US$4860 (November 10), and is currently at US$4050, a 450% increase from the price at the beginning of the year; the market value of Ethereum has also increased from 11% at the beginning of the year to the current 21% %, an increase of 10%; in addition, the value of DeFi lockups on Ethereum also rose from US$18.6 billion at the beginning of the year to US$167.5 billion, an increase of as much as 800%.

However, due to the tightening of domestic policies, the Ethereum mining industry was hit in June this year, and the computing power once fell by more than 30%. However, it took only two months for the Ethereum computing power to return to the previous level, and it has continued to hit new highs since then; The computing power is temporarily reported at 947 TH/s, an increase of 223% from the beginning of the year.

In terms of Gas, this yearAffected by NFT mint (casting) and the amount of airdrops, Gas costs have always remained high, which increases the cost of interaction between ordinary users and project developers, and also forces some projects to turn to Layer 2 and other expansion solutions and other public chain ecology.

In order to reduce Gas, the Ethereum community proposed the EIP-1559 proposal, trying to make it easier for users to pay more reasonable fees by changing the basic fee setting.

The proposal has been controversial since it was put forward. Among them, the miners whose income is directly affected have the most intense opposition, and many miners feel that they have become ecological outcasts. To this end, Twitter user @Red Panda Mining launched a campaign, calling on miners who opposed EIP-1559 to switch their computing power to the opposition mining pool and swear their sovereignty; although the action ended in failure - the proportion of opposition computing power It is less than 20%, but it still makes the voice of miners heard in the entire encryption market.

The controversy did not shake the determination of the developers. EIP-1559 was implemented in the "London Upgrade" in August, and the final effect is obvious to all.Since the implementation of EIP-1559, a total of 1.243 million ETH (approximately US$5 billion) has been destroyed, opening a new era of Ethereum "deflation".

In addition to the "London upgrade", Ethereum has also completed two upgrades this year: the Berlin hard fork upgrade in April and the "Arrow Glacier" upgrade in December. The main content of the latter is to postpone the difficulty bomb until June next year .

In addition to Ethereum 1.0,Ethereum 2.0 has also attracted much attention this year. As of the first anniversary of the launch of the Ethereum Beacon Chain (December 3), the Ethereum 2.0 deposit contract address has received 8.502 million ETH, accounting for 7.24% of the ETH supply, and there are more than 264,200 verification nodes on the Beacon Chain. The number of addresses participating in ETH2.0 pledge reached 56,393.

According to the latest plan, the merger of Ethereum 1.0 and 2.0 will be carried out around the second quarter of 2022; after the merger is completed, the ETH locked in the Staking contract will remain locked and cannot be transferred. Although Ethereum has bounced tickets many times, as the king of the public chain, it has never stopped moving forward.

This year,Ethereum Creates a Deeper Connection to Traditional Finance. In April, Canadian regulators approved three Ethereum exchange-traded funds (ETFs); in the third quarter, US SEC documents revealed that holdings of institutional Ethereum products (mainly Grayscale’s Ethereum Trust) increased by 19%; December , the United States CME Group (CME) announced the launch of micro-Ethereum futures. Although the U.S. financial market has not yet officially launched an Ethereum ETF, we believe that day will not be too far away.

Explosion of public chain and Layer 2 new ecology

2021 is the year when the new ecology collectively explodes.

The explosion of the application layer has brought infinite beauty to Ethereum Layer 1, but at the same time it has also caused continuous congestion of transactions on the chain and high gas costs. Affected by this, the value of the Ethereum ecosystem began to spill over. Projects, users, and funds are all looking for faster and cheaper new development soils, which has also become an opportunity for new ecosystems to explode.

In terms of public chains, from BSC to Solana, and then to Avalanche, Fantom, and Terra, the major ecosystems are booming, the infrastructure is gradually mature, and various types of applications are blooming. The value of the secondary market has also been realized while the locked-up funds have repeatedly hit new highs. enlarge.

As the earliest emerging new public chain ecology, BSC has entered a relatively calm and steady growth period after experiencing the early stage of rapid outbreak. From the data point of view, the total value of TVL on the BSC chain has long been at the top of the list of emerging ecology (excluding Ethereum), and it was not surpassed by the dark horse Terra until the end of the year.

With its excellent performance advantages and strong support from SBF, Solana has become the most eye-catching emerging public chain for most of the year. Towards the end of the year, Solana has started another big move - supporting Neon Labs to build an EVM development environment for the chain, which may be another engine for Solana to continue to grow.

The outbreak paths of Avalanche and Fantom have certain similarities. After using the cross-chain bridge to open up the channels for capital in and out, the two emerging public chains have followed Polygon’s example and launched hundreds of millions of liquidity incentive plans to attract projects (especially leading DeFi ) and the entry of users. In hindsight, the strategies of Avalanche and Fantom have been a great success, and "building bridges + throwing money" has also become a classic strategy for the outbreak of public chains, which has been imitated by some new public chains that started later.

As the end of the year approaches, Terra (LUNA) seems to be rushing forward in a "rushing performance". Not only has it reached the top of the TVL ranking list, but it has also entered the top ten in the total cryptocurrency market capitalization rankings. The stablecoin UST surpassed DAI in market value at the end of the year.

In terms of other ecology, Polkadot and Kusama finally launched the long-awaited parallel chain slot auction; DFINITY also officially launched the main network this year; Algorand is actively exploring how to combine TradFi and DeFi; vertical application public chains such as Flow and DeSo The rise; teams such as Near, Tron, and Conflux have performed well in hot spots such as DeFi and NFT, and in the market strategy of characteristic IP. A public chain that is worth mentioning is the "heartbreaking" EOS. After expelling B1 and rebranding, this husband chain that has been "sentenced to death" has also shown some new vitality.

Of course, facing the challenges of many public chain ecology, the Ethereum ecology has not stopped.Layer 2 is the strongest counterattack given by Ethereum this year. The four major Rollup expansion solutions (Optimism, Arbitrum, zkSync, and Starkware) have all received tens of millions of dollars or even hundreds of millions of dollars in financing this year. Shan India's financial support of 50 million to 150 million US dollars.

As the first emerging ecology to implement the "sprinkle money" strategy, Polygon (MATIC) can almost be said to be the most eye-catching project in the cryptocurrency market in the first half of the year. Even in "519", the price of MATIC once turned positive. However, because Polygon currently mainly adopts the sidechain solution, it has also been questioned by the Ethereum community whether it belongs to the orthodox Layer 2, but with the successive acquisitions of two ZK Rollup development teams, Hermez and Mir, these disputes have gradually subsided.

Optimistic Rollup duo Optimism and Arbitrum both launched their mainnet this year. As a Layer 2 solution that is more in line with the upper-level consciousness of the Ethereum community, Optimism and Arbitrum have successively welcomed the entry of Uniswap, the leading DeFi leader. However, perhaps because gas prices are still relatively high compared to emerging public chains, the ecological expansion progress of these two Layer 2 networks (especially Optimism) is not as smooth as the community expected.

The two projects that focus on ZK Rollup, zkSync and Starkware, are also active this year. The former’s zkRollup version EVM development work has achieved phased results, and the latter proposed the concept of Layer 3 at the end of the year. Expansion effect.

As 2021 is coming to an end, the pattern of multi-chain coexistence is becoming more and more solid day by day, and the situation of one dominant player may never appear again.

Cross-chain: the clearest outlet at the moment

The inevitable result of the collective outbreak of the new ecology is the expansion of cross-chain demand. In order to pursue the wealth opportunities emerging in the new ecology, users' asset cross-chain demand is also rapidly increasing.

With many advantages such as wider coverage and more flexible docking,The cross-chain bridge has surpassed the centralized service provider and has become the main channel for carrying funds across the chain.

At present, there are no fewer than dozens of cross-chain bridge projects on the market. Avalanche Bridge, Optimism Gateway and other "official cross-chain bridges" that are led by the original underlying development team and mostly only serve a specific ecology are worth mentioning. The third-party cross-chain bridges of concern include Multichain (formerly Anyswap), cBridge, Hop Protocol, etc.

The track leader Multichain recently announced the completion of a new round of financing of 60 million US dollars. In the list of investors, you can see Binance, Sequoia China, IDG Capital, Three Arrows Capital and many other top institutions. Whether this can be the beginning of the journey to discover the value of cross-chain services, let us wait and see.

From the perspective of the evolution trend of the track, we will continue to pay attention to the following small directions.

One is forAggregation across chain bridges, the current rapid increase in the number of cross-chain bridges is just like the increase in the number of DEXs a year ago, so why not make a cross-chain bridge version of 1inch to help users find the cross-chain path with the most ideal price? In fact, many projects have started to try in this field, including ChainSwap, which has recently completed a protocol upgrade, and FundMovr, which has an amazing product performance.

The second is outside the bridging serviceEmbed other financial services, such as the cross-chain + transaction being explored by FibSwap DEx, Li.Finance, XY Finance, Symbiosis Finance, and the cross-chain + lending solution mentioned in the V3 version of the leading DeFi protocol Aave.

The third is to go beyond the simple cross-chain of assets and rise to a higherInformation cross-chainAt the layer level, by realizing cross-bottom contract verification and calling, the interoperability between different ecologies is opened up.

Listed on the centralized trading platform in compliance with regulations

As a traffic entrance and value gathering center, the centralized exchange platform (CEX) plays an indispensable role in the encrypted financial ecology.

The leading compliance trading platform has successfully rang the bell this year, and leading crypto companies have been listed one after another.

In February, Coinbase, the largest compliant encryption trading platform in the United States, submitted the S-1 registration form to the US SEC and listed directly on Nasdaq under the stock code COIN. Coinbase is also known as "the first crypto exchange".

On July 29, Robinhood, a brokerage platform focusing on retail investors in the United States, was officially listed on the Nasdaq Stock Exchange; because it took the lead in opening the Dogecoin trading channel during the Meme wave at the beginning of this year, it has attracted the attention of the encryption market.

On October 19, Bakkt, once known as the "light of the bull market", officially entered the New York Stock Exchange with the stock code BKKT.

According to foreign media reports, Binance founder and CEO Changpeng Zhao said in a recent interview that its US subsidiary (Binance US) may conduct an initial public offering (IPO) within the next three years.

The listing of the compliant encrypted trading platform means that the traditional market affirms encrypted finance, which is equivalent to the SEC opening a door to the entire industry, which has boosted the encrypted world; as the popularity increases in the future, more Funds will enter through these platforms and act on the entire encryption market. For traditional finance, crypto exchanges are one of the few sustainable profitable businesses outside of the mining industry, and they are well-deserved blue-chip stocks.

Traditional finance's favor for encrypted finance is also reflected in the primary market financing of encrypted exchanges.In July this year, FTX Exchange announced the completion of the B-round financing of US$900 million, with a post-investment valuation of US$18 billion. Investors include Sequoia Capital, Softbank, Thoma Bravo, Ribbit Capital, and Circle, etc. More than 60 companies; In March, FTX Exchange raised another US$420 million in the B-1 round of financing at a valuation of US$25 billion (valuation increased by nearly 39%), with 69 investors including BlackRock and Tiger Global participating.

It is worth mentioning that FTX also sponsored several international events and teams this year, including: League of Legends Championship Series (LCS), Mercedes-AMG Petronas F1 Team, Major League Baseball, NBA Golden State Warriors With Miami Heat, International Cricket Council, Super Bowl, TSM e-sports club, etc., the boundaries of the encryption circle are constantly being broadened.

first level title

In the past year, with the diversified development of the encrypted world, global policies have been tightened and regulations have become stricter.

In the past year, with the diversified development of the encrypted world, global policies have been tightened and regulations have become stricter.

On May 21, the Financial Affairs Commission of the State Council proposed to "crack down on Bitcoin mining and trading activities" in a meeting. Since then, Xinjiang, Qinghai, Inner Mongolia, Yunnan, and Sichuan have introduced relevant policies to rectify and clean up virtual currency mining.

As early as 2017, seven ministries and commissions jointly issued the "September 4th Notice", prohibiting the operation and trading of cryptocurrencies in China, but there is no clear restriction on cryptocurrency mining. This year, my country explicitly banned the continued existence of the encryption mining industry in the country.

On May 21, the Financial Affairs Commission of the State Council proposed to "crack down on Bitcoin mining and trading activities" in a meeting. Since then, Xinjiang, Qinghai, Inner Mongolia, Yunnan, and Sichuan have introduced relevant policies to rectify and clean up virtual currency mining.

September 24,Since then, many trading platforms, including Binance, Huobi, OKEx, etc., have announced the withdrawal of mainland Chinese users and withdrawal from the Chinese market.

Since then, many trading platforms, including Binance, Huobi, OKEx, etc., have announced the withdrawal of mainland Chinese users and withdrawal from the Chinese market.

U.S. Penalties Increase, Enlarges Crypto Regulatory Boundaries

In 2021, US encryption regulatory incidents will become more frequent.

In addition to CFTC and SEC, the U.S. Currency General Inspection Office (OCC) also jointly launched a survey called "crypto sprint" (crypto sprint) in October this year, jointly with the Federal Reserve and the Federal Deposit Insurance Corporation, to conduct strict scrutiny of the encryption industry. In the end, it came to a conclusion that was not friendly to the encryption industry, and it also hinted that actions may be taken later.

Interestingly, according to media statistics, more than 70% of the SEC's enforcement actions eventually ended in settlement (payment of fines), and the most commonly used reason for the SEC is "violation of securities laws." The SEC sued Ripple last year, and there is still no result for more than a year. There is a high probability that a settlement will be reached in 2022.

In addition, Gary Gensler became the chairman of the SEC this year. He is relatively aggressive in the supervision of encrypted finance. Within a month, he launched investigations on Terra development companies Terraform Labs, Marathon Digital and other companies. He has also repeatedly reiterated that the regulatory measures for cryptocurrencies will not be changed in the future, and relevant companies must report and register with the SEC.

In addition to CFTC and SEC, the U.S. Currency General Inspection Office (OCC) also jointly launched a survey called "crypto sprint" (crypto sprint) in October this year, jointly with the Federal Reserve and the Federal Deposit Insurance Corporation, to conduct strict scrutiny of the encryption industry. In the end, it came to a conclusion that was not friendly to the encryption industry, and it also hinted that actions may be taken later.

The voice and law enforcement of multiple departments in the United States have put forward regulatory requirements for the encryption industry. In fact, it is essentially a struggle for administrative power.Regulatory measures in other countries are also gradually becoming stricter. In September this year, relevant financial departments in South Korea strengthened the supervision of cryptocurrency exchanges. All South Korean cryptocurrency exchanges must register with the financial sector before a certain time, provide compliance certificates from Internet security agencies, and cooperate with banks to ensure the real names of accounts. Unregistered exchanges will close their services after September 24. .

Currently, only the SEC has real influence and voice. The U.S. Congress is trying to change that with the Digital Commodity Exchange Act. The bill, introduced last year by U.S. Rep. Michael Conaway, seeks to establish a federal definition for a "digital commodity exchange," putting it in its own legal category and giving the CFTC oversight of it.

At present, the bill has been returned to Congress as a draft, and lawmakers are actively discussing it with encryption practitioners.

In terms of US regulation this year, there is another topic that has attracted much attention: cryptocurrency taxation.

This year, the US Congress proposed the "Infrastructure Investment and Employment Act", which explicitly requires "brokers" to report transaction information exceeding US$10,000 to the US Internal Revenue Service. It has been argued that the bill’s definition of “broker” is “too broad and vague” and could impose those requirements on miners and wallet developers, not just cryptocurrency exchanges like Coinbase. Some crypto-friendly senators began trying to fix the problem, proposing new amendments, but they were ultimately voted down.

At present, the bill has been signed by Biden and will be officially implemented from 2022.

Regulatory measures in other countries are also gradually becoming stricter. In September this year, relevant financial departments in South Korea strengthened the supervision of cryptocurrency exchanges. All South Korean cryptocurrency exchanges must register with the financial sector before a certain time, provide compliance certificates from Internet security agencies, and cooperate with banks to ensure the real names of accounts. Unregistered exchanges will close their services after September 24. .

first level title

In addition, with the popularity of chain games and the establishment of a gold mining ecosystem, Southeast Asia has become a new blue ocean for the crypto gold market this year, and many trading platforms have also migrated here.

5. The shadow of security: the amount of loss increased by 1000% year-on-year

At the end of 2020, we conducted a special annual review of DeFi security incidents. The statistical results showed that the total amount of funds lost due to hacking incidents in the DeFi industry throughout the year was as high as 177.4 million US dollars.

In 2021, we don't even need statistics to know that the total amount of funds lost this year is much higher than last year. In the Poly Network incident alone, hackers stole $610 million.

On August 10, the cross-chain interoperability protocol Poly Network was suddenly attacked. Calculated according to the market price of the relevant assets at the time of the incident, this is not only the largest hacking incident in the history of DeFi, but also the history of the entire cryptocurrency. Gox incident (744,408 BTC, with a total value of about 400 million U.S. dollars at the time), and the Coincheck case in 2018 (523 million XEMs, with a total value of about 534 million U.S. dollars at the time).

Rekt data show that,So far in 2021, there have been 161 hacking incidents in the DeFi field, with losses as high as US$1.86 billion, a year-on-year increase of nearly 1,000%.Among them, the top ten projects with the largest losses are: Poly Network ($610 million), Vulcan Forged ($140 million), Boy X Highspeed ($130 million), Cream Finance ($130 million), BadgerDAO ($120 million) ), Venus ($77 million), Compound ($71.1 million), AnubisDAO ($60 million), EasyFi ($59 million), Uranium Finance ($57.2 million).

From the perspective of the frequency of events,The cross-chain track has become the focus of hackers this year, in addition to Poly Network, Chainswap, Multichain (formerly Anyswap), THORChain, etc. have also encountered poisonous hands. The reason is that firstly, cross-chain service is a capital-intensive track, and secondly, cross-chain service often involves the interaction between multiple chains and multiple contracts, and the structure is more complicated.

In addition, there have been many huge security incidents in the CeFi field in 2021. The most typical case is the theft of three exchanges. Liquid, BitMart, and AscendEX lost US$91 million, US$150 million, and US$77 million respectively.

From the perspective of attack types, hackers use various methods, from the use of logical flaws, to flash loan attacks, transaction crowding out attacks, private key cracking, and even breaking key information through social means... Hackers hiding in the dark are not uncommon. Any vulnerabilities that could be exploited will be missed.

The security situation is getting worse, what can practitioners and users do?

From the perspective of the project side, first, it is necessary to fully test the product in advance, especially to test the pressure of the agreement under extreme circumstances; second, it is necessary to seek a professional third-party audit agency to conduct a comprehensive review of the agreement; third, through some Bug bounty program to actively mobilize community strength; fourth, you can consider integrating some insurance projects; fifth, you can deploy disaster recovery plans in advance for some specific hacking scenarios.

For users, one is to maintain good web access and wallet operation habits; the other is to maintain rational investment thinking and reasonably control their positions; the third is to pay attention to whether the project has completed the audit before using a certain DeFi protocol.

Head exchanges may land on the traditional secondary market; the merger of Ethereum 1.0 and 2.0 will become a landmark milestone in the history of the public chain; legendary encryption funds will usher in a bumper year; talents from the traditional financial and technology fields will Keep pouring in and building the crypto industry...

6. 2022: Crypto maintains innovation and moves towards the mainstream

Looking back on 2021, from the leaders represented by Bitcoin and Ethereum, to various application fields such as DeFi, NFT, and chain games, to infrastructure such as public chains, Layer 2, and cross-chain protocols, great progress has been achieved. At the same time, supporting components and services such as wallets, data analysis and security companies also silently undertake and guard the value.

There are many bright spots in 2021, the sectors rotate rapidly, and there are still many small hot spots and small outlets that cannot be detailed in this article, such as NFTFi, SocialFi, decentralized storage, decentralized oracle, and liquidity release plan……

After 2021 is a link between the past and the future, we look forward to the Crypto industry in 2022 will continue to become the mainstream proposition of globalization, and usher in richer innovations in more vertical industries.

Macroscopically speaking, Web 3.0, metaverse, NFT and DAO will still be the key words of investment, and the combination of big entertainment and consumer fields and blockchain will continue to deepen; various compliant derivatives represented by Bitcoin spot ETF It is expected to be approved and guide more traditional funds into the encryption industry, and custody and compliance services will also grow further; the encryption regulatory policies of major countries are becoming clearer, more central bank digital currencies are entering the stage of implementation, and some countries will follow El Salvador The pace of expanding the application scenarios of Bitcoin...

Head exchanges may land on the traditional secondary market; the merger of Ethereum 1.0 and 2.0 will become a landmark milestone in the history of the public chain; legendary encryption funds will usher in a bumper year; talents from the traditional financial and technology fields will Keep pouring in and building the crypto industry...

GameFi and game guilds will enter the next stage of development, further realizing the initial vision of the metaverse; ownership economy and creator economy will be further verified in SocialFi's attempts; green and privacy will move from concept to mass adoption...

GameFi and game guilds will enter the next stage of development, further realizing the initial vision of the metaverse; ownership economy and creator economy will be further verified in SocialFi's attempts; green and privacy will move from concept to mass adoption...

Odaily will also continue to deepen the field of Crypto, covering the fastest and latest information and the most complete and deepest interpretation, downloadOdaily APP, Master the industry password one step faster.