The overall financing scale of the blockchain has exceeded 6 times last year: Institutional investment is blooming everywhere, and NFT has become a new trend

Written by Footprint Analyst Simon (simon@footprint.network)

Date: October 2021

Data Sources:Footprint Fundraising Dashboard (https://footprint.cool/fund)

Written by Footprint Analyst Simon (simon@footprint.network)

Date: October 2021

Data Sources:

The total amount of financing and the number of transactions continue to rise

Data source: Footprint Analytics

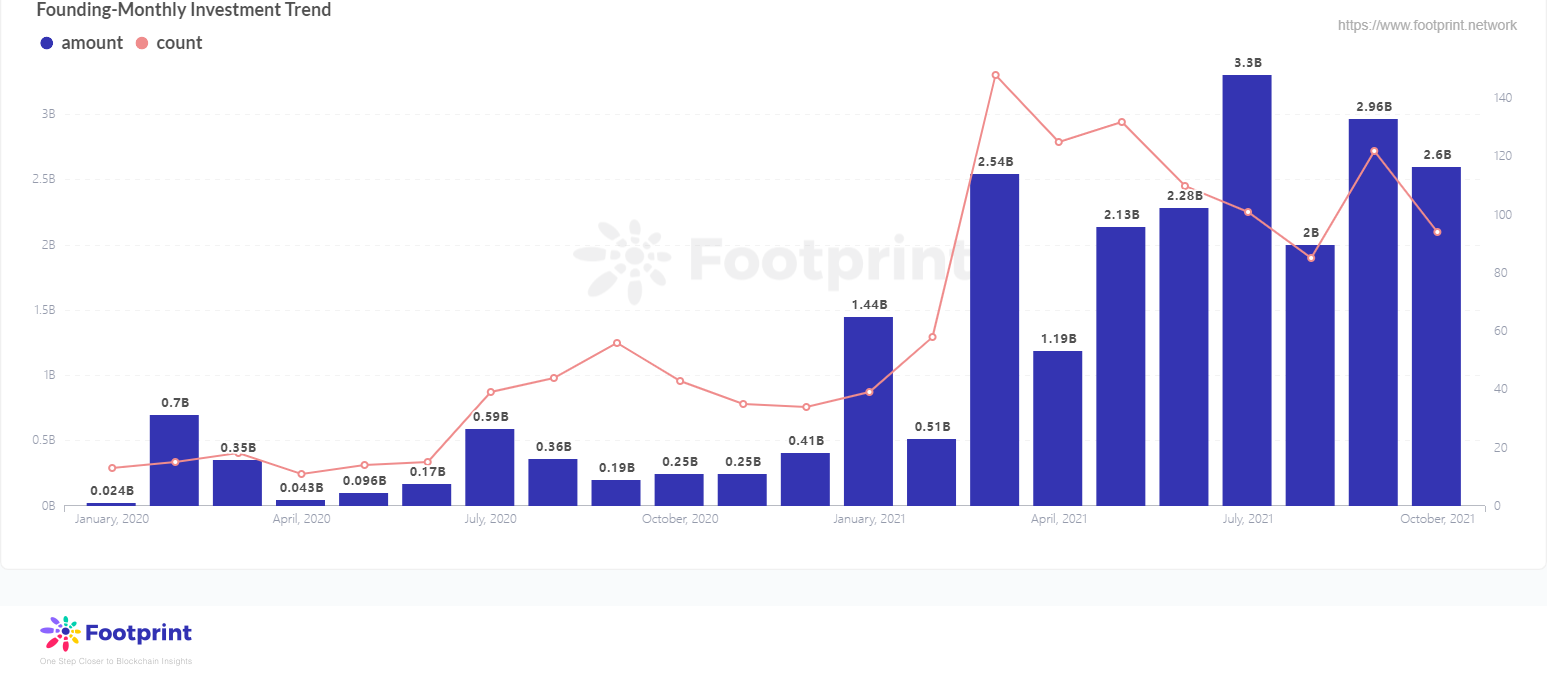

Compared with 2020, the financing amount and number of transactions in 2021 will double. In the first quarter of 2021 alone, the total financing amount for the whole year of 2020 was 3.4 billion US dollars. As of the press date, the financing amount was 20.9 billion US dollars, which is more than 6 times that of the whole year of 2020, and the number of financing transactions has accumulated 1014 times.

Monthly financing status (from January 2020)

Data source: Footprint Analytics

Since May, the total monthly financing amount has exceeded 2 billion US dollars, and the average financing amount has exceeded 20 million US dollars, and the average financing amount has gradually increased. Among them, the financing amount in June was as high as 3.3 billion U.S. dollars. Even in May when the currency price plummeted, the capital was not affected, and the financing amount was still as high as 2.1 billion U.S. dollars, which continued until October. The market remains hot.

Although many countries have introduced different degrees of restrictions on cryptocurrencies this year, this has not affected the capital's optimism about the future of the blockchain, and funds are still pouring into it.

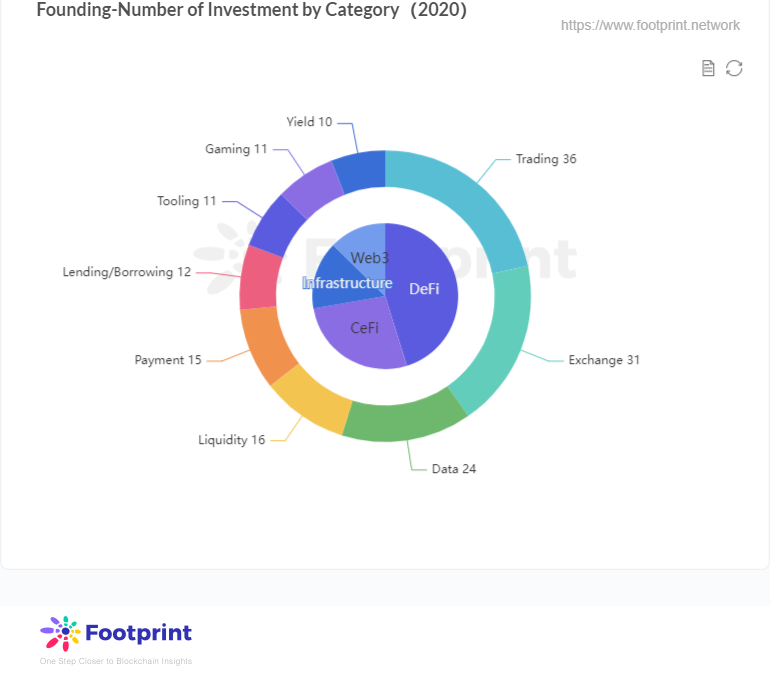

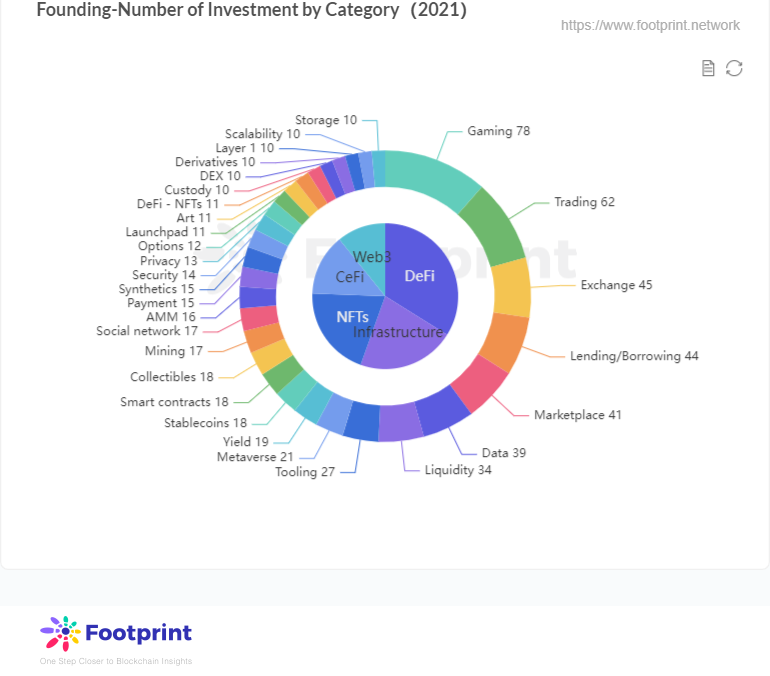

Looking at the distribution of the number of financings in 2021 from the perspective of the investment field, DeFi projects occupy the first place with 229 transactions, followed by infrastructure projects. It is worth noting that the NFT project, which is almost unpopular in 2020, has been favored by many capitals in 2021, surpassing the CeFi project and ranking third, and has received 136 investments.

Data source: Footprint Analytics

Distribution of Financing Quantities in Various Sectors (2020)

Data source: Footprint Analytics

Data source: Footprint Analytics

Data source: Footprint Analytics

Data source: Footprint Analytics

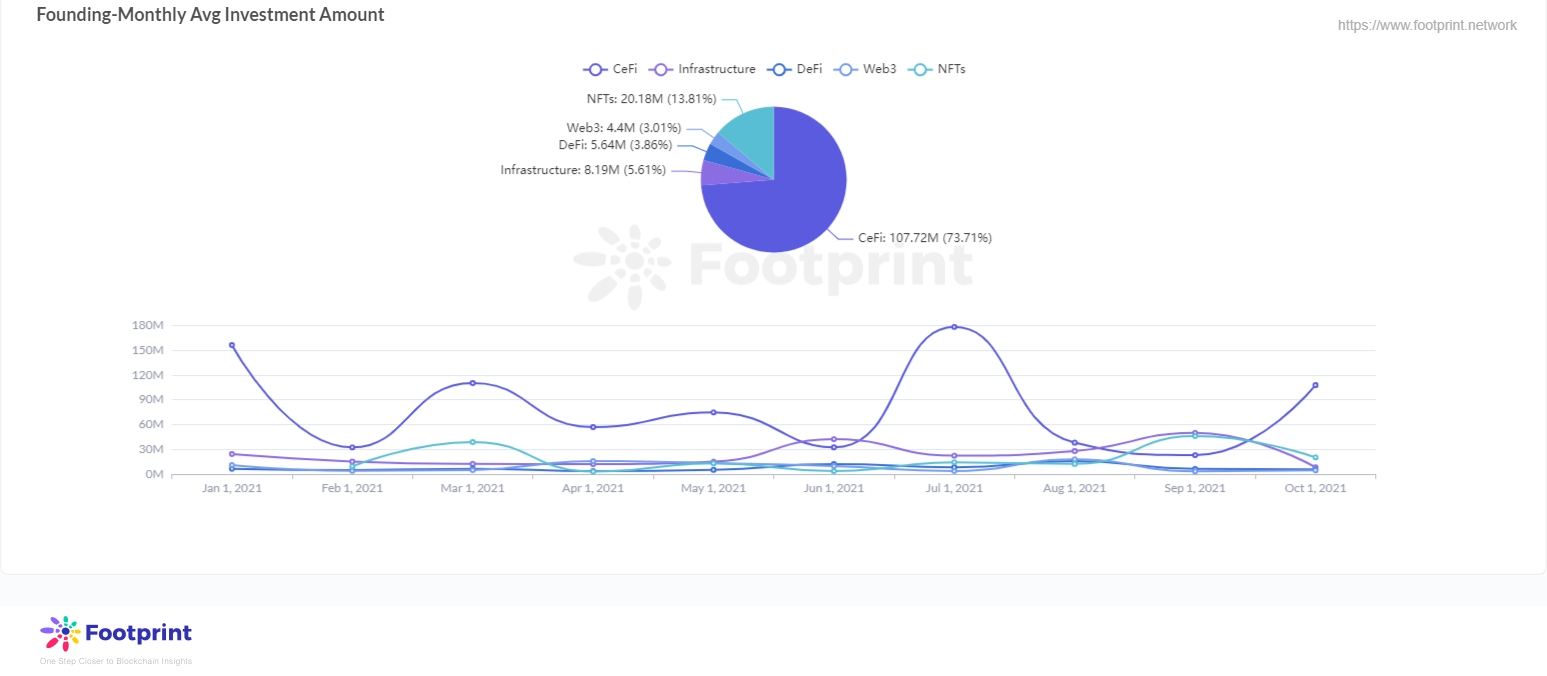

Average financing amount in each field (since January 2021)NFT field。

Data source: Footprint Analytics

It seems that the market's investment in the blockchain is still mainly stable, while exploration is concentrated in areas with high popularity. Investors' investment priority focuses on ensuring the basic operation of the blockchain, as well as CeFi, which is more endorsed and grasped, and secondly around the game field and

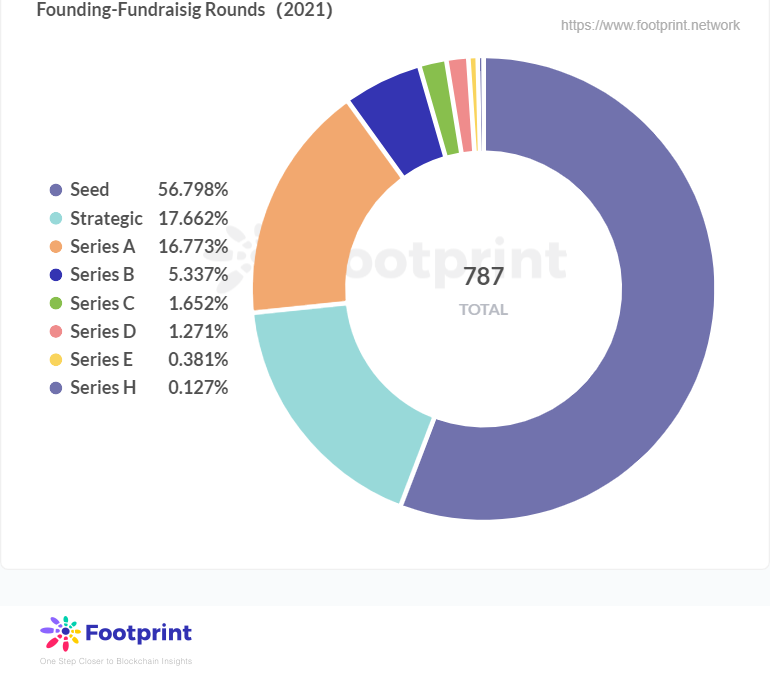

The funding process is still early, dominated by seed and strategic funding

Data source: Footprint Analytics

The financing process in 2021 is still dominated by seed rounds and strategic investments, of which seed rounds account for about 57%, followed by strategic financing at about 18%, A rounds at about 17%, and B rounds and above less than 10%. Investment in the global blockchain field is still in the early stage of investment, and various new projects are constantly sprouting.

Financing progress statistics (2021)

Among them, the highest financing process is the H round, and the only one is Robinhood, which is a stock brokerage company that allows customers to buy and sell stocks, options, ETFs and cryptocurrencies with zero commissions. The type of Robinhood is CeFi. When it was founded, the purpose was to allow many young users with less funds to participate in the stock market without worrying about stock returns being swallowed up by most brokerages. In February this year, Robinhood's 24-hour commission-free digital currency trading fair for Bitcoin and Ethereum received a lot of attention after it was officially launched.

Data source: Footprint Analytics

Except for one of the three companies that have received E-round financing this year is in the infrastructure category, the rest are CeFi. As the CeFi project that won the highest round, Chainanalysis belongs to the infrastructure project and is a data analysis platform.

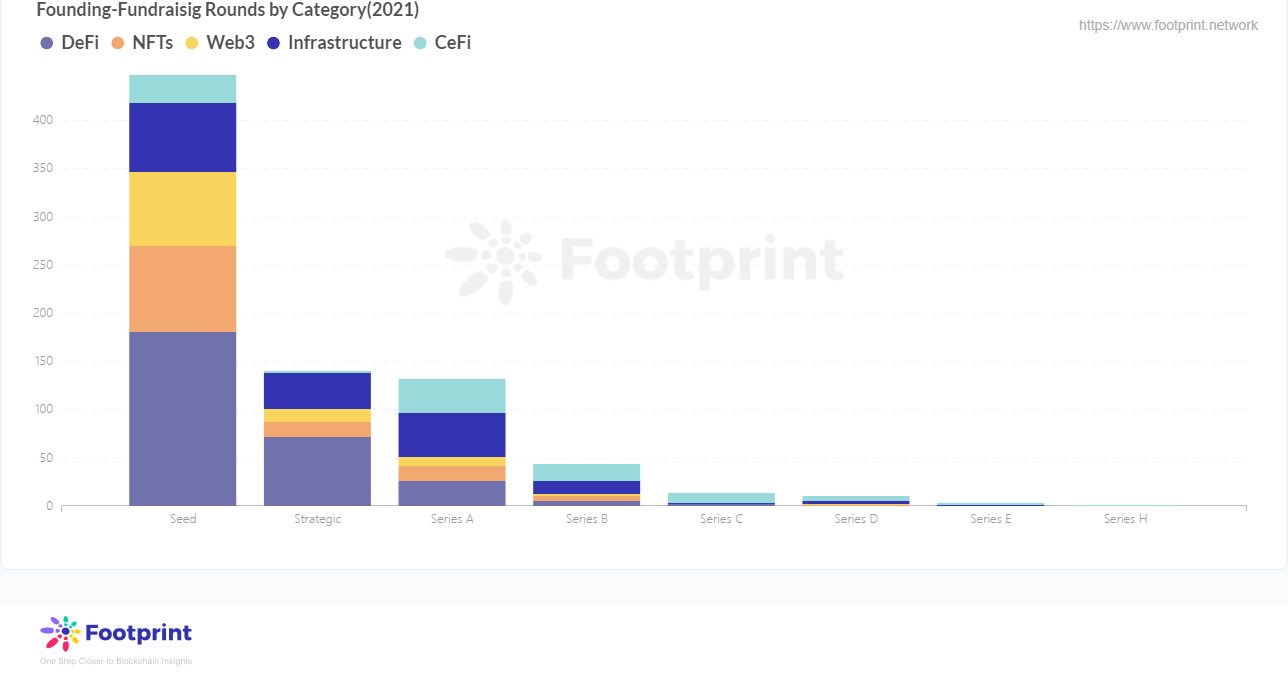

Financing progress statistics (2021)

Data source: Footprint Analytics

Although the CeFi project received more rounds, the incubation market for new projects is still more optimistic about DeFi and NFT. This year, these two types accounted for more than 60% of the investment in the seed round.

The E-round received the most NFT. It was Dapper Labs, which brought CryptoKitties to the blockchain. It once caused congestion and paralysis of the entire Ethereum network. It can be seen that the development of NFT projects should not be underestimated.

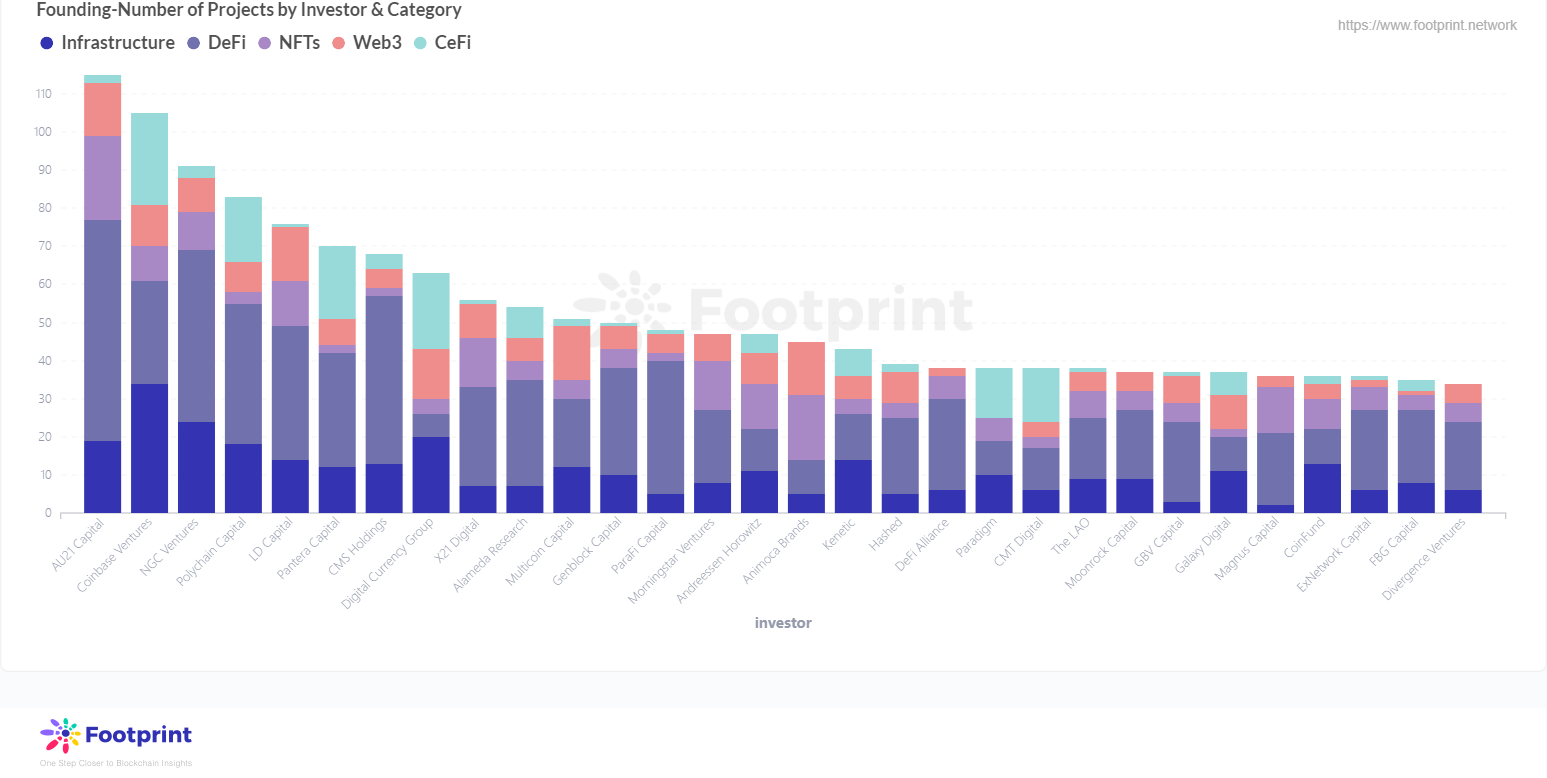

According to the existing statistics of Footprint, AU21 Capital has invested the most among investors, with a total of 115 investments, and Coinbase Ventures has invested more than 100 times.

Data source: Footprint Analytics

According to statistics from a16z (Andreessen Horowitz), a frequent and active investor recently, it has invested in 47 projects, of which more than 70% of the projects were invested in this year, with an average of 3 projects invested in each month. a16z is also relatively average for investment types, with infrastructure, DeFi, and NFT each accounting for about 25%.

Data source: Footprint Analytics

Data source: Footprint Analytics

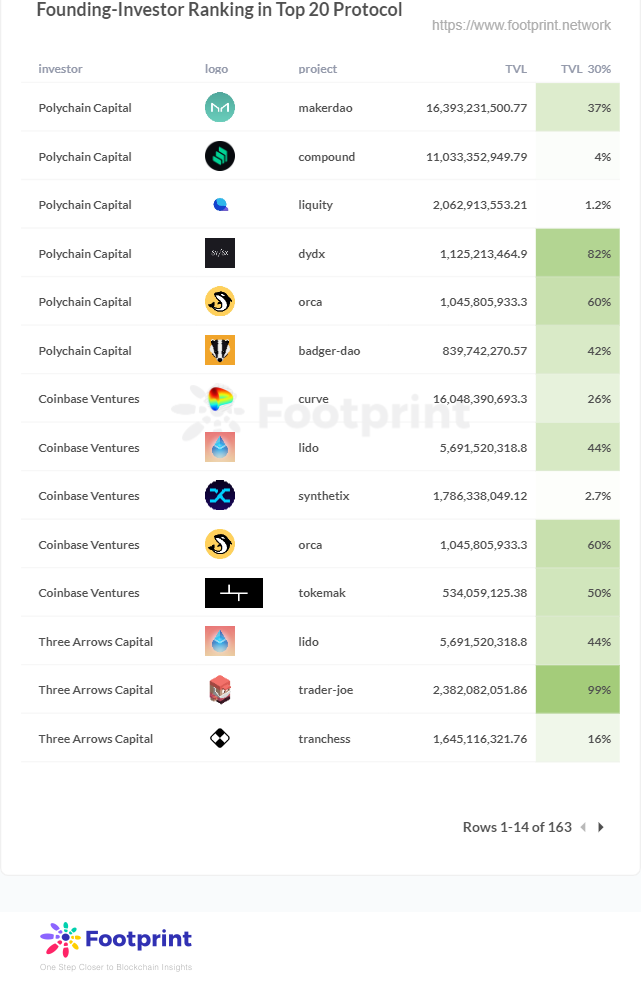

Among the top 20 protocols currently ranked by TVL, Polychain Capital has invested in at most 6 protocols (Makerdao, Compound, Liquity, Orca, Dydx, and Badger dao), and they have maintained an upward trend in the past 30 days. Tied for second place are Coinbase Ventures and Three Arrows Capital, both of which have invested in 5 top 20TVL platforms respectively.Investment status of the top 20 TVL platformsRecently, the TVL of the MakerDao project surpassed Curve and ranked first, with a rise of 42% within a month. a16z is also one of the main investors. As early as September 2018, a16z completed a $15 million investment in the MakerDao project. In the past three years, MakerDao has become a leading project in DeFi with its unique stablecoin lending model. Verified the accuracy of a16z's early judgment on blockchain projects (full form is available

in conclusion

click on this link

As an ordinary user, you may wish to pay more attention to the latest trends of professional investors, understand the macro situation of the market, conduct in-depth research in the fields you are good at, and find high-quality projects earlier before the next market boom to be one step ahead.

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

About Footprint Analytics:

Footprint Analytics is a one-stop visual blockchain data analysis platform. Footprint assisted in solving the problem of data cleaning and integration on the chain, allowing users to enjoy a zero-threshold blockchain data analysis experience for free. Provide more than a thousand tabulation templates and a drag-and-drop drawing experience, anyone can create their own personalized data chart within 10 seconds, easily gain insight into the data on the chain, and understand the story behind the data.

Footprint Analytics is a one-stop visual blockchain data analysis platform. Footprint assisted in solving the problem of data cleaning and integration on the chain, allowing users to enjoy a zero-threshold blockchain data analysis experience for free. Provide more than a thousand tabulation templates and a drag-and-drop drawing experience, anyone can create their own personalized data chart within 10 seconds, easily gain insight into the data on the chain, and understand the story behind the data.https://www.footprint.network/

Discord community:https://discord.gg/3HYaR6USM7

WeChat public account: Footprint Blockchain Analysis (FootprintDeFi)