Compiler: Zion Editor in charge: karen

Compiler: Zion Editor in charge: karen

I was right to say that I am not worried about the stock market correction triggered by Evergrande Real Estate last month. I mentioned that, to paraphrase Powell, inflation is temporary. People in the crypto space will find something to hype and bear markets won't bore them.

The attractiveness of the crypto space, coupled with its efforts to innovate and grow in terms of net worth and technology, has resulted in a constant flow of new things in the crypto space.

This time, it's DeFi 2.0

The hype for NFTs is slowing down. NFTs are now skirting regulations to avoid being called "securities" (must somehow continue to make money, but that's proving hard).

In short, the crypto space needs something new to spark interest. And DeFi 2.0 is perfect. It came just in time.

first level title

DeFi 1.0, but on a non-Ethereum chain

There are many aspects to DeFi 2.0.

One of them is: it's similar to the original DeFi craze. Only this time, it didn't happen on Ethereum. Instead, on smaller emerging chains like Avalanche, Solana, and Fantom.

People are rushing to these platforms for a reason. High Ethereum gas fees make venturing between protocols and DApps neither feasible nor fun. You'll have a hard time exploring the capabilities of various DeFi apps, simply because, unless paying $40 per smart contract execution is a no-brainer (that is, you're a whale).

When you want to park your funds and wait until your kids are ready for college, you go to Ethereum, not because you want to emulate some new and hyped protocol, get an airdrop, or just satisfy your curiosity. Those are the good old days.

secondary title

Trader Joe

Avalanche's Uniswap is one of the fastest growing protocols in 2021.

On August 12, the total value locked in the Avalanche protocol was just $22 million. As of Oct. 12, the total value locked was $1.2 billion, according to Defillama.

The price of Trader Joe’s native token, JOE, rose from around $0.03 to as high as $1.6, reaching $4 at its peak.

secondary title

Geist Finance

Geist Finance is another DeFi 2.0 star. This is a Fantom lending protocol, which is a fork of AAVE. Appearing seemingly out of the blue, with no venture capital, from anonymous developers, and with a community of respectable individuals, the protocol quickly gained traction. It locked up transaction volume from a few hundred million to two billion in just one day, and subsequently increased the price of Fantom by 30% during the same period.

first level title

Blue Chip DeFi Baby Boomers

secondary title

Not much gain, not many opportunities

The most common complaint about DeFi blue chips is that they have become boring. Yields are not as attractive as they used to be, and DeFi 2.0 offers a lot of creative ways to make money. Even if you are trading their tokens, the price action of tokens like AAVE is not that exciting, especially in the cryptocurrency market where huge volatility is expected.

secondary title

Even less functionality on non-Ethereum chains

A large number of protocols are being deployed on other blockchains and second layers. But they’re just not the same as Ethereum’s. For the most part, it offers limited functionality and opportunities.

Not enough liquidity. Some features - like Sushi staking - are not available and are only available on Ethereum (please correct me as I have tried on Polygon and Arbitrum so far) A person loses money because he transfers funds to MakerDAO vault address, but it turns out there is no Arbitrum version of that vault. So he sends money to a smart contract address that doesn't exist.

secondary title

Become the TradFi they were trying to avoid before

One of the biggest grievances with blue chip agreements is that they have become too big and too "TradFi". Blue-chip DeFi is now the playground for TradFi, which is starting to dabble in cryptocurrencies. Hedge funds starting to research DeFi use AAVE or Yearn as a starting point. A French bank is proposing a $20M loan to MakerDAO, using the bank’s bonds as collateral (please deposit ETH or BTC as collateral like everyone else, not your junk bonds).

It’s no wonder that natives of the crypto space feel left out. One sense is that these blue chip protocols have become too close to TradFi and they are trying to revolutionize this group. And worst of all, they lost all cypherpunk rebel makings.

Innovation of DeFi 2.0

Innovation of DeFi 2.0

I told you, DeFi 2.0 has many faces. In addition to blue-chip agreements, there are some fresh innovations.

One of them that is gaining attention is OlympusDAO.

What OlympusDAO offers is something DeFi has never offered before.

Its goal is to be a stablecoin that is not pegged to a fiat currency. It introduces the concept of bonds. Take your crypto collateral, get OHM at a discount, and Olympus will use the collateral as a reserve asset. The value of OHM relative to that asset will determine whether the protocol increases the supply (mints) OHM or burns them. Like a Reserve Bank.

Interestingly, OlympusDAO has no VCs, no presales, and no airdrops (they raise initial funds among existing discord members to prevent gaming and unfair distribution). They plan to never list on a centralized exchange because it just doesn't make sense.

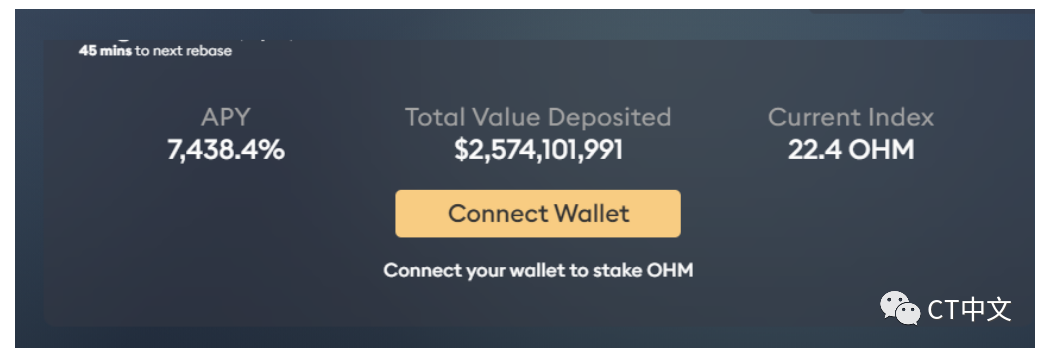

image description

High APY when staking OHM

secondary title

Abracadabra Money

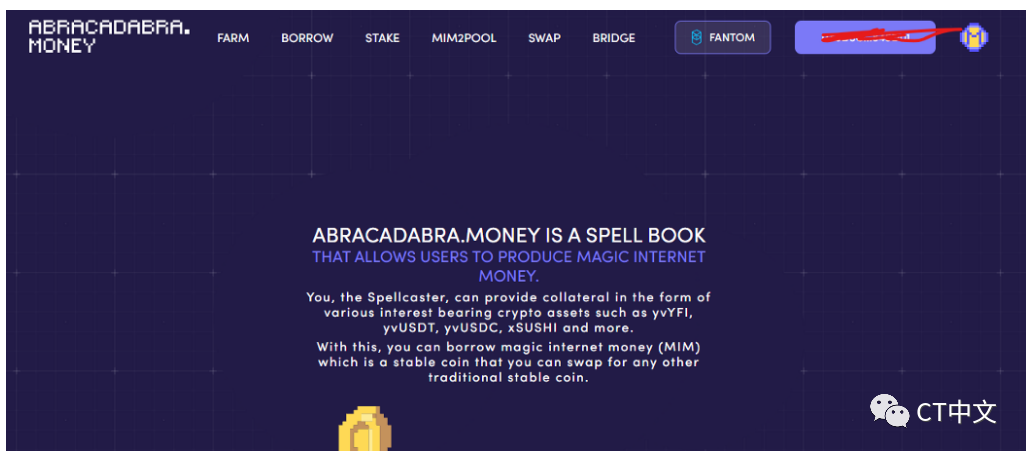

image description

What is this magical Abracadabra Money?

To quote them, the formula is simple, but brilliant. Interest-bearing tokens like xSushi go in, and out comes the magic internet currency known as the MIM dollar. Deposit your tokens and you get a stablecoin that you can later exchange for USDC or DAI and spend them however you want.

People stake their cryptocurrencies to earn interest on interest-bearing tokens (xSushi, yvUSDC). These tokens, on Abracadabra Money, can be used as collateral, earning you money while allowing you to borrow 90% of its value. So it improves your capital efficiency. Since collateral is a productive asset, it can be said that your collateral is actually helping you pay off your debt.

In DeFi 2.0, you will hear more and more "self-paying loans".

Their native token is called SPELL and is used to incentivize users. Invest it and you get sSPELL revenue share and voting rights.

DeFi 2.0 is currently happening on the first layer blockchain. But I can expect that it will also pass to the second layer, such as Arbitrum. A new craze has arrived, and every day one wonders which projects are attracting hordes of users. (Use DefiLlama to track the new protocol).

In particular, the innovation part needs attention. Builders are creatively creating protocols that maximize profit, maximize capital efficiency, and maximize decentralization (the concept of currency Lego). While some things do exist, the trade-offs remain to be seen. Right now, it seems like everyone is just excited.