Société Générale’s subsidiary plans to raise 20 million through MakerDAO, and these details will determine success or failure

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

Editor | Hao FangzhouproposalProduced | Odaily

On Friday, Societe Generale-Forge (SG-Forge), a subsidiary of Societe Generale (SG), submitted a proposal to the DeFi protocol MakerDAO.

proposal

(Click to view), it is planned to refinance the security token OFH through the latter, with a target amount of 20 million US dollars in DAI.

Considering that SG is one of the Big Three in the French banking industry and one of the largest and largest investment banks in Europe, the Maker community responded positively to the proposal, with many DAO members excited about the potential partnership between DeFi and traditional finance. excited.

“It turns out that this is the future of France! This cooperation is one of the many cases of Maker Governance, which proves that the post-foundation organizational model is more scalable.” Rune Christensen, founder of MakerDAO, said.

Of course, there are also community representatives who believe that although this transaction is very low-risk, it does not bring much return to MakerDAO, and the interest rate of security tokens (0% fixed rate) is lower than that of similar US corporate bonds, which have a yield of 0%. was 1.93%.

As with all Maker Improvement Proposals (MIPs) before it, MakerDAO token holders will ultimately vote on whether SG-Forge's plan will be implemented, and there is no formal vote yet. If the proposal is accepted, this transaction will also become the largest amount of interaction between the DeFi protocol and traditional investment companies, and it will also provide an example for other DeFi protocols to go out of the circle.

Odaily also sorted out some details of the proposal for the reference of readers.

secondary title

1. Re-mortgage of OFH tokens, the process is complicated

The "OFH Token" mentioned in the SG-Forge proposal is issued by the credit institution SG SFH based on Ethereum, the issuance time is May 2020, and the maturity date is May 2025; the nominal amount is 40 million euros (46.3 million U.S. dollars) with a fixed interest rate of 0%; the security tokens comply with French law and are backed by housing loans, and are also rated AAA (the highest credit rating) by the rating agencies Moody’s and Fitch, meaning they have a high Creditworthiness and strong ability to repay investors.

In the proposal, SG Forge stated that the re-hypothecation of security tokens as collateral is based on the open source framework CAST (Securities Token Compliance Framework); DAI as a loan is also recognized by French law.

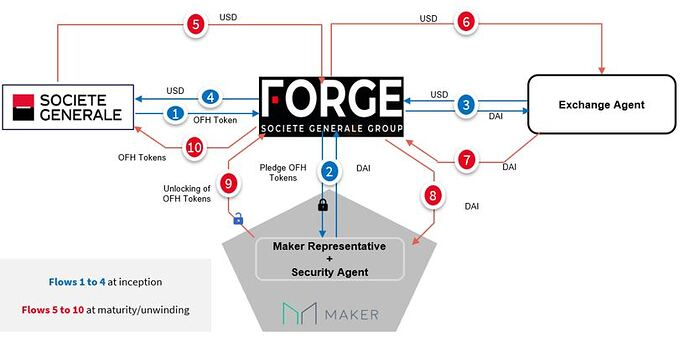

Briefly introduce the mortgage process: the parent company SG transfers the ownership of OFH tokens to SG Forge, and SG Forge will provide SG with a USD loan (“USD Loan”); SG-Forge pledges OFH tokens in the Maker vault to obtain DAI Loans; SG-Forge cooperates with third-party companies to exchange DAI for USD.

The mortgage loan period is 6-9 months, and it is planned to raise 20 million DAI. After expiration, the redemption process is as follows:

SG will redeem the USD loan from SG-Forge;

SG Forge returns DAI to Maker to redeem OFH tokens;

OFH tokens will be transferred back to SG by SG-Forge.

The above transaction process is just a brief description, and the specific transaction process is actually more complicated, because it still needs to comply with legal regulations. The proposal details six separate entities involved in the process, including: registrar SG Forge; parent company SG; MakerDAO protocol; MakerDAO's legal representative; DAI to USD).

(Transaction Flowchart)

“The Maker legal representative is probably one of the legal entities we’ve been experimenting with. I’m not sure which one we’ve settled on, but we have several structures and jurisdictions to choose from,” MakerDAO community representative PaperImperium said in an interview , has not yet appointed a specific legal person.

Considering that MakerDAO currently has no entity or legal person, the proposal suggests that DIIS Group also serve as the legal representative of MakerDAO, but it still needs to be voted by the community.

secondary title

2. How to liquidate?

Earlier we introduced the regular mortgage/redemption process of OFH tokens, but since they are used as collateral, there is a risk of being liquidated.

Generally speaking, on-chain collateral can be liquidated in real time with the help of oracle quotes, and extreme market conditions can be directly liquidated, but this time the mortgage liquidation is more "humane".

From the date of receiving the notice, Societe Generale must complete the margin call within five working days, otherwise it will trigger collateral liquidation.

Upon notification of a liquidation event, the security agent, DIIS Group, will perform the liquidation and may sell OFH tokens or hold OFH tokens for community accounts until maturity date and eventual redemption, provided there is sufficient liquidity.

If the redemption amount paid by SG SFH to the securities agent exceeds the amount payable under the DAI loan plus the liquidation fee, the securities agent will transfer the excess amount to SG; if the redemption amount paid by SG SFH to the securities agent is less than DAI The amount due under the loan plus the closing costs, the difference will be deemed to be zero.

secondary title3. DeFi+TriFi, strong alliance。

In fact, the cooperation between Societe Generale and MakerDAO this time is not surprising. Both of them have tried the DeFi+TriFi landing experiment before.

Back in April, Maker made headlines by issuing a $38,000 loan to finance real-world mortgages; moreover, since last year, MakerDAO has been working with Tinlake and Centrifuge to integrate music rights, accounts receivable, and more Real assets are introduced into the encrypted market. recommended reading

"DeFi introduces real asset pledge, is it reliable? "