Will ARCx, which introduces the credit system, recreate the DeFi lending market?

The vision for the birth of DeFi is to provide convenient on-chain financial services for users all over the world (especially those who cannot enjoy traditional banking services). However, the anonymity of blockchain technology determines that all users in the DeFi ecosystem exist as a string of characters, and project developers and service providers cannot correspond to who the real subject behind these characters is. As a result, certain credit risks will also be induced.

It is also because in the DeFi world, there is no trust between lending platforms and users at the traditional level (identity credit + legal protection), decentralized lending platforms such as MakerDAO and Compound are separated from the credit system and rely on "over-collateralization" with low capital utilization Lending mode to ensure the repayment ability of the borrower. From this point of view, anonymity is a double-edged sword for the DeFi world. Although it protects the privacy of users, it also increases the risks and trust costs of platforms and lenders.

That being the case, if each string of characters is regarded as an identity and credit scoring is performed, so as to provide different levels of financial services according to the credit value of the address, can the above problems be solved?

This is the standard operating idea in the traditional financial field, but the object of credit scoring is changed from the user's ID card to the address on the chain. Currently, projects that agree with this solution are not uncommon. Among them, the gameplay of the decentralized credit scoring protocol ARCx is more like moving "Sesame Credit" to the DeFi world.

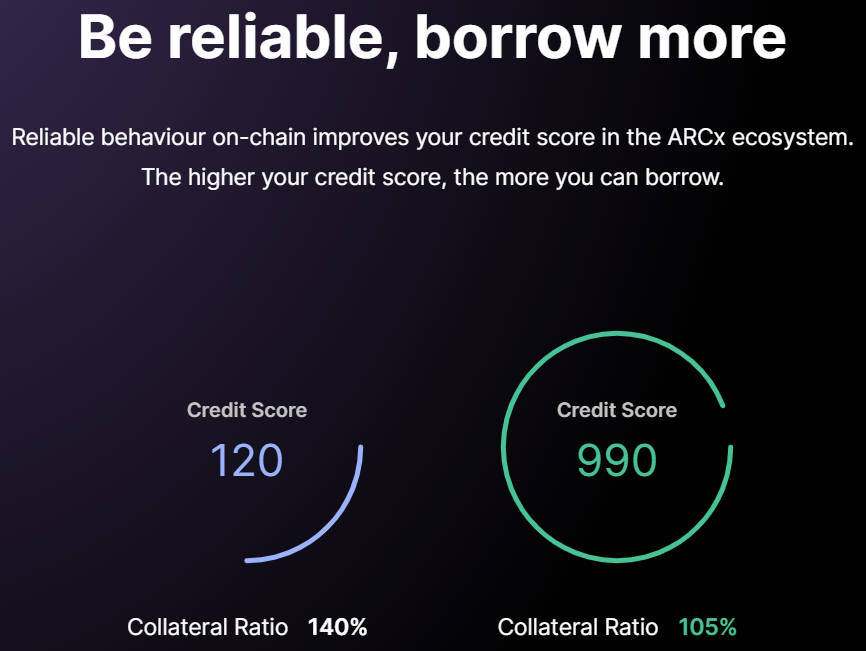

A sentence on the top page of the ARCx official website summarizes its business philosophy:The historical transaction records of the user's Ethereum wallet determine their mortgage rate(In the context of DeFi, mortgage rate = deposited asset value / lent asset value, so the lower the better for borrowers)and the annualized rate of return of liquidity mining.To expand, ARCx intends to use its own scoring method to score users’ credit on the chain. The higher the score, the lower the mortgage rate, which means that more funds can be mobilized with the lowest mortgage assets. thus,An on-chain credit evaluation system is derived to encourage users to maintain personal credit in DeFi, thereby improving the trustworthiness of the entire DeFi ecosystem.

Practical needs + novel concepts have attracted the attention of capital. It is understood that ARCx has completed several rounds of financing before this, and the current total financing amount has exceeded 8 million US dollars, and the product has also undergone several upgrades. At the beginning of this month, ARCx announced the completion of $1.3 million in financing, led by Dragonfly Capital, Scalar Capital and Ledger Prime, and completed with ARCx governance token ARCX. In addition, this round of investors purchased ARCX tokens before the split at a unit price of $7,500 (the price of tokens after the split is $0.75), with a lock-up period of 6 months and monthly unlocks. At the same time as this round of financing, the V3 version of the product ARCx Sapphire was officially launched, and its core component is named“DeFi Passport” (DeFi Passport), the function is similar to "Sesame Credit".

So, how to apply for a DeFi passport? Applicants need to log in to the ARCx official website first, connect their wallets and mortgage 1,000 DAI and wait in line. Only 100 DAI addresses will be issued in the first batch, and the mortgage time may be longer (a disguised test of the user's financial strength and demand/loyalty to the project). But early mortgagers can enjoy certain benefits, such as the lowest mortgage rate, and exclusive liquidity mining opportunities.

Below, we will further disassemble its product details and processes.

Phase 1 (first stage):DeFi passports allow cryptocurrency users to establish and test their reputation anonymously on the chain, and form a preliminary score from this, with a score between 0 and 999. The result of the score can generate a DeFi passport, which is equivalent to a credit report, and Can be integrated into many DeFi applications. Even for users who have not performed corresponding operations, ARCx officials also stated that they will treat each user equally, and consider their scores based on the size of wallet assets, whether they have institutional background, and restrictive KYC. High-scoring addresses can get lower mortgage rates and higher-yield liquidity mining opportunities. These "benefits" will also be shared with other applications integrated with DeFi Passport. Of course, the score is not static and will be updated in real time based on user behavior and asset status. in addition,When applying for an on-chain test, it is also necessary to complete the identity verification - "Trader Scores" (Trader Scores) to verify whether the user is a robot or to "swipe credit".

Phase 2 (second stage):The agreement will update the mortgage rate in real time according to the change of the borrower's credit score. Of course, the current agreement is still in its infancy, and users’ mortgage rates can only be updated on a small scale. In order to control risks, ARCx will set minimum parameters for the mortgage rate. In addition, the quality of high-credit users will be further screened from the following dimensions to increase the loan amount: the duration of borrowing on mainstream decentralized lending platforms, whether the collateral has been liquidated, and whether a large amount of collateral can be maintained while maintaining a high mortgage rate What is the willingness and ability to repay the position and high volatility market? It is worth mentioning that ARCx has also built a machine learning model to backtest the classification of liquidated or unliquidated positions to reflect the correlation between on-chain activities and credit risk.

image description

With a score of 120, the mortgage rate is 140%; with a score of 990, the mortgage rate is 105%

In general, ARCx's on-chain credit scoring mechanism is relatively well-established, and it also combines protocol governance with user incentives well, and has attracted the attention of some industry insiders. Sidney Powell, founder of Maple Finance, once told the media,ARCx will help bring the opportunity of under-collateralized loans to ordinary DeFi users.

However, the current DeFi ecosystem is not yet perfect, and there are still multiple pain points in sectors including lending, trading, and insurance that need to be resolved urgently. The on-chain credit scoring mechanism is more of a supporting role for DeFi applications, and its growth imagination largely depends on the maturity of the entire industry. In addition, credit scoring needs to integrate a large number of users' credible data and be equipped with powerful processing capabilities. Such technical difficulties are quite difficult for a blockchain application. More importantly, credit evaluation also needs to coordinate a large number of uncertain factors, which cannot be controlled by data processing, such as the repayment willingness of the user behind each address, and whether the individual will encounter unexpected situations in the future.

Just as Sidney Powell, the founder of Maple Finance, asked: An address may have a good record of repaying a $10,000 loan on Compound, but if it is a $250,000 loan, what will happen to their credit? Therefore, under this grand vision, it will take time to verify how far ARCx can go.