Since the beginning of this year, the trend of the mainstreaming of encrypted finance has been unstoppable. Institutions have entered Bitcoin one after another. The pace of global and planning has accelerated. Coinbase has been directly listed. The connection between traditional finance and the encrypted world has become increasingly close, and new traders are constantly pouring in.

The outbreak of DeFi has led to the continuous innovation and iteration of native encrypted finance. Up to now, the total amount of locked-up funds has exceeded 120 billion US dollars, involving transactions, lending, asset management, insurance and other vertical directions. The lack of ease of use and friendliness, relatively complex product logic and operation process restrict most products from entering the homes of ordinary people.

However, the current mainstream DeFi product design is more to meet the needs of large users who are familiar with encryption. Compared with the diversification and low threshold of CeFi, it is difficult to expand to a broader user market.

secondary titleStructure。

What is Strucute

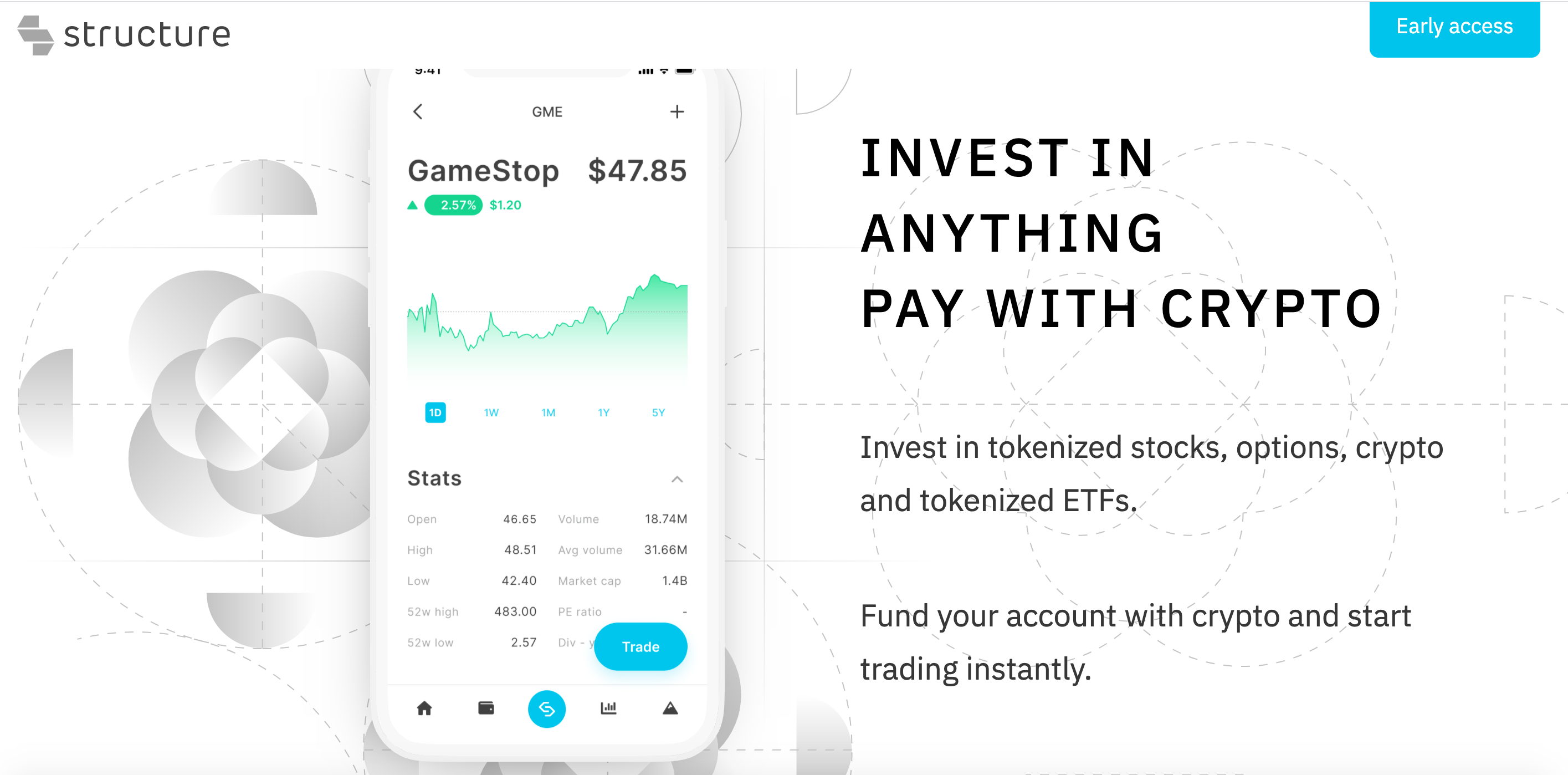

Structure Financial is a secure decentralized trading platform. On Structure, users can trade various traditional assets in the form of tokens 24/7, including stocks, options, ETFs, and other derivatives.

When talking about the tokenization of traditional assets, the first thing many readers will think of is FTX, which is good at derivatives innovation, and Binance has recently announced the news of listing equity tokens. While Structure has similarities with them, there are also great differences in design ideas. In fact, Sturcure is an innovative product that combines DeFi and CeFi (Hybrid).

Logically, Structure is the same as the above-mentioned centralized platform. Equity tokens are tokens that track and anchor the price performance of traditional financial stocks. Behind them are supported by physical stocks, which need to be realized through cooperative custody with asset management institutions. Some are centralized. At the same time, Structure told Odaily that unlike DeFi platforms, because of the particularity of equity tokens, all users of Structure need to pass the KYC/AML review to ensure their product use qualifications.

But in terms of products, Structure is built on the chain, and the trading system and matching are completely decentralized. On FTX, users generally trade through fixed trading pairs, such as USDT-Tesla stock tokens. On Structure, just like Uniswap, users can easily exchange various currencies, equity tokens, and various equity tokens. More importantly, Structure does not charge transaction commissions.

In this regard, Structure told Odaily that retail investors actually do not want to pay commissions, and traditional business models such as commissions as income are indeed lagging behind. Today's blockchain platforms have better and more choices.

secondary title

STXR token economy

STXR is Structure's governance token, just like UNI is to Uniswap. But compared with general governance tokens, it has many system innovations in design,

In ecological governance, users who hold tokens can be rewarded with STXR. At the same time, exchanges, market makers, users who provide asset price discovery, maintain network security, etc. will be able to obtain STXR incentives.

In addition, in terms of governance, Structure has created a new virtual "economic zone" concept: the Structure Economic Bloc, which is equivalent to an autonomous ecosystem.

Refer to the minting rate control algorithm of the Bitcoin network. They will constantly adjust and determine the "minting rate" generated by STXR to ensure the maximum value and growth rate for all participants, as well as to ensure the stability of the structural exchange rate between STXR and the US dollar. At the same time, members of the Structure Economic Bloc enjoy the exclusive right to mine STXR, and can mint new STXR and transfer it to their wallets based on their contributions. Decisions are also voted on by members of this governing body.

In addition, investors can purchase "Farm Share" in Structure, and the share represents the future mining interest rate in the Structure Economic Bloc. This part of the funds will be used to repurchase STXR in the secondary market and destroy it, reducing circulation. For investors, if they are optimistic about the future of Structure ecology, they can invest in advance. For Structure, this is a new form of financing.

official websiteofficial websiteIt is already possible to apply to become the first batch of users, and the specific date, as well as the next Roadmap and financing progress will be announced in the near future, and we will continue to pay attention.