The market has fluctuated recently, but because the overall environment is still a bull market, the basis difference and funding rate are at a historically high level, so there is a considerable room for arbitrage. In addition, Ouyi has launched a unified account function. The capital utilization rate of capital arbitrage has been significantly improved.

secondary title

Arbitrage strategy - spot arbitrage (perpetual-leveraged arbitrage) strategy

The core logic of arbitrage is that there is a price gap in the market. Because of the bull market, in the current cryptocurrency derivatives market, there is a difference between the funding rate of the perpetual contract and the fixed interest rate of the spot leverage, which makes there is a gap between the perpetual contract and the spot leverage transaction. Arbitrage space.Taking the actual situation as an example, the funding rate and loan interest rate of the currency-margined perpetual contract on the OKEx platform are as follows:Let’s take a LV1 user as an example. At this time, the funding rate of the ETH USDT perpetual contract at the next settlement moment is 0.282%, while the loan interest rate of ETH is 0.05%. The transaction fee rate (Taker) for LV1 users is 0.05%, and the arbitrage space that exists at this time is 0.282%-0.05%-0.05%*2 = 0.132%. Of course, for professional users with higher grades, the loan interest rate and transaction fee rate are lower, which means that there is more room for arbitrage.

- Necessary conditions for arbitrage:

Specific operation:

1. When the funding rate > 0, and |funding rate| > lending rate + handling fee rate, the short position of the contract can charge the funding fee to the long position, that is, the perpetual contract is opened short, and the spot leverage buys the spot with the same value as the position

secondary title

The importance of capital utilization

After explaining the logic of arbitrage, we will find a problem. Although the risk of arbitrage is small, the return is very low. This determines the amount of arbitrage funds and the utilization rate of arbitrage funds.Taking the traditional sub-account model as an example, assuming you have 0.2 ETH, in order to use funds more efficiently, you need to divide positions. The best strategy is to place 0.1 ETH in the margin trading account and the perpetual contract account, and at the same time In order to prevent liquidation, the maximum leverage of positions in each account is set to 3 times (that is, to ensure that no liquidation will occur under a rise or fall of about 33.3%). Under the ETH/USDT currency pair, use 0.1 ETH at 3 times Open long ETH with 1x leverage, the total position value is 0.3 ETH, use 0.1 ETH in the currency-based perpetual contract to short 0.3 ETH with 3x leverage, and the total position value is 0.3 ETH.According to the funding rate in the above table (if the funding rate can last for one day, the funding fee will be charged once every 8 hours)The daily arbitrage income is:0.282%*0.3ETH*3-0.005%*2*0.3ETH-0.05%*0.3ETH=0.002493ETHThe single position profit after the position is divided is:0.002493ETH/0.1ETH=2.493%The daily profit of cross warehouse is:Arbitrage income increased by 500%

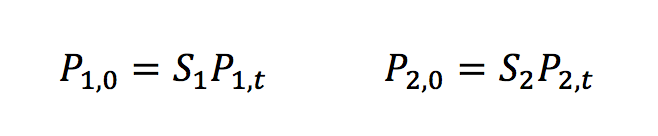

Under Ouyi's new unified account single-currency margin model, since delivery contracts and leveraged transactions can share margins and achieve profit and loss offsetting, we can open higher leverage.We maximize the leverage. In ETH/USDT leveraged trading, the maximum leverage is 10X; in currency-based perpetual contracts, the maximum leverage is 75X. In order to use capital efficiency as high as possible, we can obtain the initial margin of each position by solving the following equations:Among them, x is the initial margin of margin trading, y is the initial margin of perpetual contract, and m is the amount of assets in the currency in the account. In this case, m is 0.2, so it can be solved that x is 0.023ETH and y is 0.177. Considering factors such as handling fees and slippage, we handle it as appropriate in this case, and set the value of x to 0.02 ETH and the value of y to 0.15 ETH. Therefore, we can use 0.15 ETH to go long ETH with 10 times leverage, the total position value is 1.5 ETH, and use 0.02 ETH to short 1.5 ETH with 75 times leverage in the ETHUSD perpetual contract

The daily arbitrage income is:0.282%*1.5ETH*3-0.005%*2*1.5ETH-0.05%*1.5ETH=0.012465ETHThe daily profit of cross warehouse is:

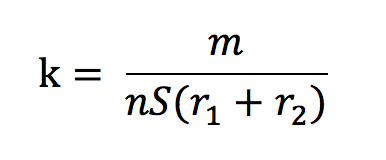

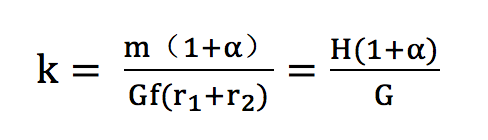

So how high is the risk of liquidation in this arbitrage strategy under the unified account single currency margin mode?The S here can represent the change of the leveraged transaction price and the price of the perpetual contract, then at this time

The S here can represent the change of the leveraged transaction price and the price of the perpetual contract, then at this time

If, that is, the rise and fall of the mark price of the leveraged transaction and the perpetual contract are equal, then

When <=100%, the account will be forced to reduce the position. From the above formula, it can be seen that leverage and price rise and fall are the decisive factors for liquidation.

H in the formula is a fixed value, we can draw the above formula with a three-dimensional surface graph, as shown below, this function is similar to a folded paper foil. Under the unified account single currency margin mode, when kWhen <=100%, the account will be forced to reduce the position. From the above formula, it can be seen that leverage and price rise and fall are the decisive factors for liquidation.Therefore, when users use this strategy, they must first use the interpolation method to obtain the corresponding price increase and decrease and leverage setting range. For example, in the case of this section, the price change range is within [-33%, 33%], using the interpolation method, we can know that the leverage setting needs to be below 20 times, and our average leverage is 15 times (in the unified account single currency In the margin mode, each position of this strategy has already used the highest leverage, so the average leverage is up to about 15 times), which is in a safe range.Next, we substitute G=15 into the above formula to get:Returning to this arbitrage strategy, in order to improve capital efficiency, we make the occupied margin as close as possible to the account balance, that is, at this timeNext, we substitute G=15 into the above formula to get:The actual arbitrage situation is shown in the figure below. It can be seen from the figure that although we have opened long and short positions of 1.5 ETH with the highest leverage of 10X and 75X respectively, our risk has not been significantly increased under the unified account mode. Its estimated liquidation price is 643.47 USD, which means that the above-mentioned arbitrage strategy will only face liquidation when the price of ETH plummets by about 74%.The actual arbitrage situation is shown in the figure below. It can be seen from the figure that although we have opened long and short positions of 1.5 ETH with the highest leverage of 10X and 75X respectively, our risk has not been significantly increased under the unified account mode. Its estimated liquidation price is 643.47 USD, which means that the above-mentioned arbitrage strategy will only face liquidation when the price of ETH plummets by about 74%.Currency-based perpetual-leverage arbitrage under the unified account can significantly reduce the risk of liquidation:To sum up, in the perpetual-leverage arbitrage strategy, it is more cost-effective to use the unified account model for arbitrage, the capital utilization rate has been significantly improved, and the income has increased by 586% compared with the original one. Of course, this optimization effect is only for ordinary users with a level of LV1. For professional users with higher levels, the optimization effect under the unified account will be better due to the lower handling fee and loan interest rate.