Veteran players reveal the secret: why use Ouyi OKEx unified account to play contracts?

The contract market is fierce.

On the morning of April 18, Bitcoin crashed and plummeted by nearly $8,000 within an hour. At the same time, Ethereum, Litecoin, etc. have staged a crash market, and the cryptocurrency market has been bloodbathed.

image description

Bitcoin market trend on April 18 (source: OKEx)

Judging from the decline, this year's "418" did not exceed last year's "312", but the scale of contract liquidation on the entire network hit a new high. According to bybt.com statistics, the crypto market liquidated 7.6 billion dollars within 1 hour of the flash crash, and nearly 1 million people became victims of liquidation in the past 24 hours.

After a painful lesson, why can’t contract users survive extreme market conditions? Is it simply because of excessive leverage?

the answer is negative. A large number of users tried to increase the margin before liquidation, but suffered from scattered funds and untimely transfers. In addition, the margins of users scattered in different accounts cannot be shared, which is not convenient for cross-market hedging, and also objectively magnifies the risk of liquidation.

This poses a challenge for trading platforms. In today's increasingly competitive contract market, whether the platform can provide a more secure, stable and efficient account system will become the key for investors to vote with their feet.

For contract users, what does the launch of OKEx unified account mean?

Race against extreme quotes

text

Looking back on the "418" plunge just experienced, Li Yanxin has lingering fears.

The day before, he opened Polkadot 10 times more orders on two trading platforms at the same time. The reason is simple. After a long period of consolidation, Polkadot finally hit a new high on the same day. Li Yan was sure that the Polkadot parachain auction market had already started, and entered decisively.

However, the market quickly gave him a resounding slap in the face.

On the morning of April 18, while he was fishing in the countryside, he suddenly received a contract risk reminder text message. Originally thought it was a stop profit message, but when he clicked on the text message, he found that the guaranteed asset ratio of Polkadot was less than 30%.

Li Yan quickly opened the App, hoping to transfer the Polkadot in the spot account to the contract account. As a result, under the flash market, his transfer speed was still slow, and more than 500 Polkadots were wiped out, with a direct loss of over 100,000.

Before he had time to feel annoyed, he immediately opened a long order on another platform. To his relief, although the order was a floating loss, it was still far away from being liquidated, because the exchange uses a unified account, and the margins in different accounts can be shared, greatly reducing the risk of liquidation.

Li Yan decided to "fight to the death" and use the excess funds to buy bottoms in batches. The operation was as fierce as a tiger, and the opening price of the surviving Polkadot orders was greatly reduced. In the afternoon, Li Yan turned losses into profits.

After this "catastrophe", Li Yan deeply realized the importance of unified accounts: "Under extreme market conditions, you will know how good this system is."

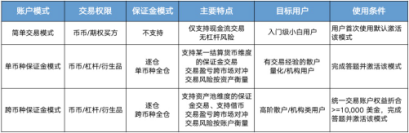

It was the Ouyi OKEx unified account that helped Li Yan "nearly escape". According to the official description, this is a new generation of trading system launched by OKEx for the majority of users. It provides three new account modes (simple trading mode, single-currency margin mode and cross-currency margin mode), which can meet different transactions of users. Habits and appeals make transactions easier.

To put it simply, the OKEx unified account is simplified, and users do not need to transfer funds between multiple accounts, and the profits and losses of different business lines can be offset by each other, effectively improving the utilization rate of funds.

Li Yan revealed that since April, there have been more and more discussions about unified accounts in the industry, and more and more players in the contract exchange group are using unified accounts to post orders. "I have a hunch that unified accounts will soon become the industry standard."

low risk arbitrage

text

Compared with Li Yan, Liu Meng is better at discovering arbitrage opportunities in new products or new functions.

As a senior trader, he participated in the open beta of Ouyi OKEx unified account last year, giving official feedback and summarizing arbitrage strategies at the same time.

In his opinion, the unified account not only simplifies the operation steps, but also can share margins and offset profits and losses, which is very practical for most contract users.

In addition, he is very optimistic about the loan function in the cross-currency mode: when the balance or equity of a certain currency is insufficient, but the overall US dollar value is sufficient, you can also sell the currency spot or trade the currency as settlement Currency contracts.

For example, if a user holding BTC wants to open a contract in other currencies, he can directly open the contract with BTC rights and interests, without having to exchange BTC for other currencies, which not only simplifies the operation, but also avoids being dumped by BTC.

Relying on this strategy, Liu Meng has successfully captured the rise of Dogecoin in the near future. Especially on April 16, Dogecoin rose by more than 230%. Although Liu Meng did not hold Dogecoin, he successfully opened orders with other assets in the unified account, and the final return rate exceeded 1000%.

At the same time, Liu Meng also summed up a variety of arbitrage strategies such as the combination of perpetual contracts and currency leverage, and the combination of perpetual contracts and delivery contracts.

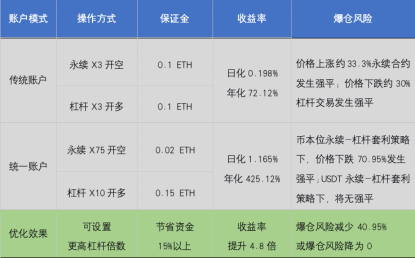

According to this idea, Liu Meng once used the ETH in his hand for arbitrage: when the perpetual contract fee rate is 0.282% and the leverage loan interest rate is 0.05%, the annualized return of this strategy exceeds 400%. In the traditional account mode, this figure is only about 72%.

image description

It is worth noting that since delivery contracts and leveraged transactions can share margins and achieve profit and loss offsetting, higher leverage can be set up to improve capital utilization while reducing the risk of liquidation.

Unified accounts may become the industry standard

text

In fact, both Li Yan and Liu Meng are the epitome of many contract players, reflecting the real demands of current users for trading tools.

Unfortunately, under the bull market, these appeals are being submerged. In order to attract traffic, most exchanges take advantage of the trend to add to the richness of products, striving to provide investors with more choices, but ignoring the continuous iteration of the trading system.

There is nothing wrong with this approach, after all, any exchange aims to make a profit. But in the long run, whoever can continue to innovate from the perspective of user needs will have the last laugh.

From this point of view, Ouyi OKEx's push for a unified account may be a positive attempt, which can at least provide users with two points of value. One is to subtract at the operation level to simplify the operation steps, and the other is to add at the income level to increase funds. usage efficiency.

As early as during the public beta, the financial blogger "Master Li Tony" said: "Ouyi OKEx's new account system is indeed very powerful. The key is that it is very convenient. When the market comes, you can open an order immediately... I believe this will become a currency transaction in the future. All the standard equipment."

TokenInsight also makes relevant assumptions on the improvement of capital efficiency based on the mechanism, and conducts a sensitivity analysis on the impact of the unified account on the platform's trading volume. According to the analysis results, it is optimistically estimated that the trading volume of Ouyi OKEx platform is expected to increase by 56%, even under relatively neutral assumptions, there is still room for 32% growth.

image description

Sensitivity analysis of the unified trading account model to the increase in platform trading volume (source: TokenInsight)

Behind the data growth, it actually stems from the first-mover advantage of OKEx's unified account. According to the official disclosure, the system has been polished for more than 20,000 hours, leading the industry by at least one year.

In other words, if friends invest in research and development from the beginning of the year, it will be fully launched in 2022 at the earliest. But are investors willing to wait for that?

According to Liu Meng, in the recent extreme market conditions, Ouyi OKEx is one of the few leading platforms that has not experienced downtime, and after the unified account is fully opened, most contract players around them have transferred assets from other platforms to the exchange.

This means that although the Ouyi OKEx unified account has not been officially launched for a long time, it has already occupied the minds of many investors in the currency circle, and more and more traders choose to embrace this brand new account model.

As for whether the unified account can really "redefine the transaction", the comment of the senior player "Master Li Tony" may have given the answer: "After using the Ouyi OKEx unified trading account, it is really difficult to adapt to the previous operation... "