Does a unified account mean a unified liquidation?

Recently, the unified account function of OKEx was officially launched. This epoch-making technological product has made a qualitative leap in improving capital efficiency and increasing investment returns, and has received attention and praise from the market. However, because the unified account is a cutting-edge technology leading the development of the industry, some users worry that "unified account means unified liquidation". Is this really the case?

Let's go back to the question itself --- "Unified account means unified liquidation" This sentence, which pursues harmony in rhyme, expresses at least two concerns of users:

1) Will liquidation in the unified account mode affect all assets in the user account?

2) Under the complex rules of the unified account, does the user's position have a higher risk of liquidation?

1

Now let's look at the first question. To answer this question, it involves a core key --- the positioning of the unified account:

The unified account is the deepening of the "cross-margin model", rather than the "single account".

Some users are afraid of "unified liquidation under the unified account". The main reason is that the unified account is regarded as a "single account", that is, the unified account puts all assets under one account. At this time, the assets in the account will "become" the account balance of the opened derivatives position. Once a liquidation occurs, it means that all assets will be lost.

The actual situation is that you can understand "unified account" as "capital account + transaction account (unified account in a narrow sense)". Among them, the capital account is mainly used for withdrawing coins, depositing coins and participating in financial services; the unified account is the "narrowly defined" unified account transaction mode that everyone understands.

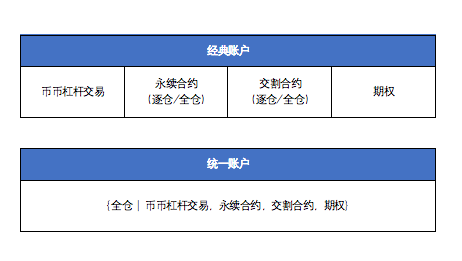

Therefore, the unified account and the classic account are consistent in the design concept of the first-level separation of daily funds and transaction funds; the unified account only realizes the deletion and merger in the second-level separation design of transaction funds. In the classic account, the asset balances in the "delivery contract", "perpetual contract", and "option contract" trading accounts are all at risk of being liquidated to zero, but the funds in the "capital account" are not affected; similarly, Under the unified account mode, the assets in the "capital account" are not affected, only the assets in the "unified account" have the risk of being liquidated and zeroed.

Regardless of whether it is a classic account or a unified account, when the market risk is too high, users will place most of their assets under the "capital account" and only leave a small amount of margin in the "trading account". At this time, the liquidation of the derivatives contract The risk does not spread to the "capital account". Therefore, in terms of liquidation loss of trading funds, there is no essential difference between the unified account and the classic account.

Of course, further, some users still worry about the following two points:

(1) As far as the funds in the trading account are concerned, under the classic account mode, the liquidation of a certain currency contract in the trading account will not affect another currency. For example, the liquidation of the BTC contract will not affect the trading account The USDT asset in the unified account cannot do this.

(2) As far as the funds in the trading account are concerned, under the classic account model, the funds in different trading accounts are independent of each other. For example, the funds in the perpetual contract account will not be affected by the liquidation of the contract in the delivery contract account; the unified account cannot do this;

In fact, the above two concerns are still superfluous.

For the first question, for ordinary OKEx users, due to the asset threshold limit, the single-currency margin mode of the unified account is mainly used; at this time, contracts between different currencies do not share margins, and the liquidation of a certain currency contract It will not affect another currency asset.

Example: The user has a total of 1000 USDT and 1 BTC, of which 900 USDT is placed in the capital account, 100 USDT and 1 BTC, and in the single currency margin mode, 100 USDT is used to buy the BTCUSDT perpetual contract, then in the future even 100 USDT will all explode 1 BTC in the trading account and 900 USDT in the capital account will not be affected.

For the second question, let us return to the essence of the unified account --- the essence of the unified account transaction is the cross-margin mode of all derivatives. For example, in the classic account mode, we can realize the cross-margin mode in the "delivery contract" or "perpetual contract" account; and the essence of the unified account is to realize the "currency (leverage) transaction, perpetual contract, delivery contract , options" various derivatives contracts cross-margin mode. Therefore, the "cross-margin mode" of the unified account has covered the cross-margin mode of the classic account. At this point, we can understand it as:

Since the unified account is the same as the classic account, the isolated margin mode is set. In the isolated position mode, the position margin and profit and loss are calculated independently, isolated from other funds in the account, and will not affect other assets in the account when the position is liquidated.

Therefore, we can convert the single-currency margin mode of the unified account into the classic account trading mode by setting isolated positions, as shown in the table below:

Therefore, we can convert the single-currency margin mode of the unified account into the classic account trading mode by setting isolated positions, as shown in the table below:

At this time, the unified account single currency margin mode is equivalent to the classic account, the liquidation of positions in different contracts will not affect the positions of other contracts.

At this time, the unified account single currency margin mode is equivalent to the classic account, the liquidation of positions in different contracts will not affect the positions of other contracts.

It can be seen from the above that the unified account adopts the design concept of one-level separation of daily funds and transaction funds, and also has an isolated position mode. Therefore, after the correct application of the isolated margin mode setting, the single-currency margin mode will be equivalent to the classic account mode. Whether the liquidation will affect all the assets in the user account is not much different from the classic account in terms of the trading experience of ordinary users. the difference.

2

For the unified account, another concern of users is whether the rules of the unified account are so complicated, whether there will be a risk of premature liquidation of the position. Here, we can use rigorous mathematical formula derivation to analyze.

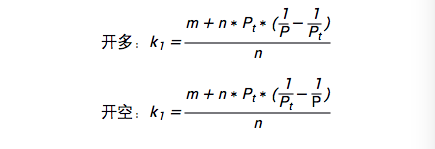

Taking the trading currency-based perpetual contract as an example, here we set the balance in the trading account (that is, the classic account, the currency-based perpetual contract account and the unified account) as m, the position value as n, which is the contract mark price, and P is the contract opening The warehouse price is the spot price, and r is the maintenance margin rate. Find the margin rate k at this time, without considering the liquidation fee.

(1) In the classic account mode:

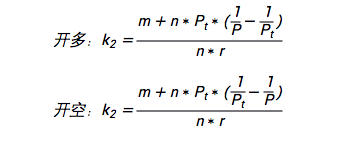

(2) Under the unified account single currency margin mode

(2) Under the unified account single currency margin mode

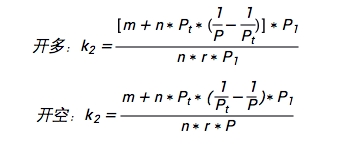

(3) Under the unified account cross-currency margin mode

(3) Under the unified account cross-currency margin mode

In the classic account mode, when margin rate < maintenance margin rate (K1

In the unified account mode, liquidation occurs when the margin rate < 100% (k<100%)

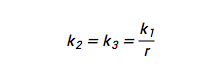

However, we can see from the

At this point, the forced liquidation rules of the unified account model can be transformed into.Therefore, the unified account model will not lead to early liquidation. Similarly, in the USDT margin contract mode, we can still prove that this conclusion is true.