What is the Ouyi OKEx unified account that has become popular recently?

In the past week, Bitcoin broke through $60,000 again, and the encryption market was rekindled.

In addition, there is another news that has attracted the attention of the industry. On April 6, OKEx announced the full opening of unified accounts, providing three new account modes (simple transaction mode, single-currency margin mode and cross-currency margin mode), which can meet users' different trading habits and demands.

Accompanying the announcement was a swiping video. In the video, the protagonist’s position was liquidated due to untimely operation under extreme market conditions, which truly restored the pain points of investors in the currency circle under the traditional account model, and attracted a large number of users such as Toutiao and Station B to watch.

Behind the onlookers, the expectations of investors in the currency circle for the Ouyi OKEx unified account can be seen.

In fact, the industry has been expecting a unified account for a long time. As early as December last year, OKEx announced the launch of a unified account and launched a global public beta. Since then, many users participated in the test and gave feedback. TokenInsight pointed out in the report that the unified account is expected to help OKEx increase the trading volume by 56%.

After 3 months, the Ouyi OKEx unified account was finally officially launched. Related reports not only frequently occupied the C position of the industry media, but also became the focus of heated discussions among the big V in the circle. Most of the comments focused on "simplifying the transaction process" and "reducing operation threshold", "improve capital utilization" and so on.

Is this really the case? What exactly is Ouyi OKEx Unified Account? What use does it have for currency investors?

Exploring Ouyi OKEx Unified Account

The unified account is a new generation of trading system launched by OKEx for the majority of users. It supports the use of multi-currency assets in one account to trade spot and various derivatives at the same time. This will provide great convenience for users' transactions and will no longer It is necessary to transfer funds between multiple accounts; and the profits and losses of different business lines can offset each other, effectively improving the utilization rate of users' funds.

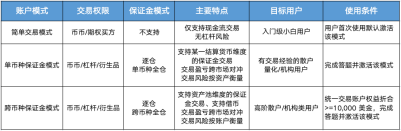

For different types of investors, the Ouyi OKEx unified account provides three new account modes (simple transaction mode, single-currency margin mode and cross-currency margin mode), which can meet users' different trading habits and demands. simpler.

·Simple transaction mode

In the simple trading mode, users can only choose currency trading and option buyer trading. When a user sells an asset in a certain currency or buys an option with that currency as the settlement currency, the available balance of that currency in the account must be greater than or equal to the amount of currency required for the order. The asset display in the trading account is shown in the following figure:

In this mode, users can still participate in the trading of option contracts as option buyers. The simple trading mode only supports option selling to close positions, but does not support option selling to open positions, that is, users can close current buyer positions by selling options, but they cannot directly sell options and hold seller positions. For option seller transactions, the account mode can be switched to single-currency or cross-currency margin mode.

·Single currency margin mode

In the single-currency margin mode, users can choose cross-margin or isolated-margin mode to trade, and the assets in the trading account are displayed as shown in the figure below:

In the cross-margin mode, users only need to transfer assets to the cross-margin account, and they can simultaneously trade the five businesses of currency, leverage, delivery, perpetual swaps, and options. Derivatives of the same settlement currency can share margins, profit and loss offset each other. When the rights and interests of the currency are insufficient, it may lead to all liquidation and liquidation of the currency positions with the currency as the settlement currency, and may lose all the rights and interests of the currency.

Of course, users can also use the isolated position mode to isolate the risks of different positions.

The single-currency margin mode sets up two layers of risk verification. The first layer of verification is called risk control cancellation verification, and the second layer of verification is called pre-decrement verification. This can ensure that users can trade normally, and avoid all pending orders being canceled, positions being partially reduced or even completely liquidated due to insufficient margin.

·Cross-currency margin mode

In the cross-currency margin mode, users can choose cross-margin or isolated-margin mode to trade, and the assets in the trading account are displayed as shown in the figure below:

In the cross-margin mode, the user only needs to transfer the assets into the cross-margin account, and can simultaneously trade the 5 businesses of currency, leverage, delivery, perpetual swap, and options. At this time, the user's assets in different currencies will be uniformly converted into US dollars The value is used as a margin for order verification and position holding.

Users can also choose the isolated position mode to isolate the risks of different positions. At this time, the overall effective margin in the account should be greater than or equal to the occupied margin including the pending order, and the available balance of the currency should be greater than or equal to the amount of the currency margin required for the order.

In the cross-currency cross-margin mode, users can choose the borrowing mode or the non-borrowing mode:

· Borrowing mode: users can choose to turn on the "automatic lending" switch in the settings. In this mode, when the effective margin of the overall US dollar value level is sufficient, the user can sell the currency when the balance of the currency is insufficient, or trade derivatives that use the currency as the settlement currency. In this case The next user will generate a potential loan, which will occupy the potential loan margin according to a certain proportion.

·No loan mode: If the user does not want to open a position with a loan transaction, he can turn off the "automatic loan" switch in the settings. In this mode, users can only use the available balance or available margin of the currency to place orders when placing cross-margin and isolated-margin orders for currency, delivery, perpetual, and options. However, due to the cross-currency full position, the account risk is calculated jointly by all currencies, and there may be a situation where the profit of a certain currency contract position causes a loss, and the equity of this currency is not enough to pay. At this time, if the margin of other currencies in the account is sufficient , the overall dollar value is sufficient, the account is still safe, and real liabilities will be generated passively.

What is the use of unified account?

For investors in the currency circle, what value will the launch of the Ouyi OKEx unified account bring? According to the user experience, it generally includes the following points:

1. Lower the threshold of use

At present, the account types of major exchanges are basically designed as follows: currency account, leverage account, fiat currency account, contract account, option account, etc.; they are independent of each other, and when transactions are required, funds must be transferred first, and the process is cumbersome.

The Ouyi OKEx unified account supports various types of transactions under one account, and no longer needs to transfer funds between multiple accounts, which reduces the user's operational complexity.

Especially as the market enters a bull market, more and more new users enter the market, even those who have never done transactions can understand the unified account at a glance. This reduces the use threshold and learning costs, and is more conducive to the "out of the circle" of encrypted transactions.

At the same time, the V5 API corresponding to the unified account also provides more friendly features for quantitative transactions, including: the same function only needs to call the same interface to support operations on all business lines, such as placing orders; order operations (order/ Order cancellation/modification) supports REST and WebSocket at the same time; more flexible WebSocket multi-level parameter subscription method; more unified response data structure; more friendly data push mechanism, etc.

2. Improve capital utilization

In OKEx's original account design, BTC/USDT perpetual contracts, BTC/USDT delivery contracts, and ETH/USDT perpetual contracts are not interoperable, and the fund balance and position income between accounts cannot be shared, occupying More funds.

However, under the unified account, the single-currency margin mode supports the sharing of margins among derivatives of the same settlement currency, while the cross-currency margin mode converts assets in different currencies into US dollar values to realize all derivatives of different settlement currencies. The security deposit is shared between products, thereby reducing capital occupation and improving the efficiency of capital utilization. Users can use these funds to leverage greater profits.

3. Reduce the risk of liquidation and take the initiative to reduce leverage

The sharing of margin and income reduces the risk of user liquidation. In particular, the "pin-in" market often occurs at night, and margin sharing can reduce the situation of pin-outs.

In the cross-currency margin mode, assuming that the account has 1 BTC and 10 ETH, and purchased the BTC perpetual contract; due to the sharp fluctuation of BTC price, when the BTC position is about to be liquidated, the 10 ETH will act as a margin at this time.

On the other hand, under the cross-margin mode, the margin can be shared. If the operation is not careful, the funds may be liquidated and returned to zero. This also makes users more cautious, so that they can actively reduce leverage and avoid forced liquidation.

Of course, there are also many users who are high-risk appetites, who like to use a small amount of funds such as 100 USDT plus a high stake to fight big with a small amount. The unified account also has an isolated position mode, and the liquidation of small positions will not affect the safety of the rest of the funds and isolate risks.

4. Automatic loan function

In the traditional account mode, contract users either choose the currency standard or the U standard to open a position, and cannot use a certain currency as a margin to go long/short of another currency.

epilogue

For example, if a user holding BTC wants to open a contract in other currencies, he can directly open the contract with BTC rights and interests, without having to exchange BTC for other currencies, which not only simplifies the operation, but also avoids being dumped by BTC.

epilogue

On the whole, the launch of Ouyi OKEx unified account can be regarded as a positive attempt, because compared with the traditional account model, Ouyi OKEx simplifies the complexity and allows one account to trade currency, leverage, delivery, The five major categories of perpetual and options can improve the efficiency of users' fund use.

After the official launch of the Ouyi OKEx unified account, it is expected that peers will follow suit, and this is likely to elevate the trading model of the entire market to a new level.