Is "OKEx Unified Account" easy to use? Here comes the first-hand evaluation

Produced | Odaily (ID: o-daily)

Produced | Odaily (ID: o-daily)

Due to its good trading depth and complete product range, OKEx has always been one of the main choices for crypto investors.

But many heavy users of OKEx, including me, (to be honest) have complained about its products. For example, the USDT standard contract margin is not interoperable, the transfer of funds is cumbersome and other issues, which have caused me great trouble.

The responsibility of the exchange is not only to provide matching services for users, but also to simplify the transaction process, lower the transaction threshold, and optimize the transaction experience.

In this regard, OKEx did not do well before. However, since the beginning of last year, OKEx began to detect problems, gradually iterated products, and carried out self-innovation. The "unified account" trading system is an important part of its attack.

secondary title

1. Unified accounts make transactions easier

The so-called unified account means that under one account, you can use multi-currency assets to trade spot and various derivatives (leverage, perpetual, delivery, options) at the same time.

The specific operation process is: the user clicks "Trade" on the OKEx web page or APP, and can choose to switch to the "unified account mode" or "classic account mode" to conduct spot and various derivative transactions.

(The classic account mode retains the original operating habits, which is convenient for users to choose.)

At present, the account types of major exchanges are basically designed as follows: currency account, leverage account, fiat currency account, contract account, option account, etc.; they are independent of each other, and when transactions are required, funds must be transferred first, and the process is cumbersome.

1. Lower the threshold of use

At present, the account types of major exchanges are basically designed as follows: currency account, leverage account, fiat currency account, contract account, option account, etc.; they are independent of each other, and when transactions are required, funds must be transferred first, and the process is cumbersome.

2. Improve capital utilization

Especially as the market enters a bull market, more and more new users enter the market, even those who have never done transactions can understand the unified account at a glance. This reduces the use threshold and learning costs, and is more conducive to the "out of the circle" of encrypted transactions.

At the same time, the V5 API corresponding to the unified account also provides more friendly features for quantitative transactions, including: the same function only needs to call the same interface to support operations on all business lines, such as placing orders; order operations (order/ Order cancellation/modification) supports REST and WebSocket at the same time; more flexible WebSocket multi-level parameter subscription method; more unified response data structure; more friendly data push mechanism, etc.

2. Improve capital utilization

However, under the unified account, the single-currency margin mode supports the sharing of margins among derivatives of the same settlement currency, while the cross-currency margin mode converts assets in different currencies into US dollar values to realize all derivatives of different settlement currencies. The security deposit is shared between products, thereby reducing capital occupation and improving the efficiency of capital utilization. Users can use these funds to leverage greater profits.

However, under the unified account, the single-currency margin mode supports the sharing of margins among derivatives of the same settlement currency, while the cross-currency margin mode converts assets in different currencies into US dollar values to realize all derivatives of different settlement currencies. The security deposit is shared between products, thereby reducing capital occupation and improving the efficiency of capital utilization. Users can use these funds to leverage greater profits.

The sharing of margin and income reduces the risk of user liquidation. In particular, the "pin-in" market often occurs at night, and margin sharing can reduce the situation of pin-outs.

3. Reduce the risk of liquidation and take the initiative to reduce leverage

The sharing of margin and income reduces the risk of user liquidation. In particular, the "pin-in" market often occurs at night, and margin sharing can reduce the situation of pin-outs.

On the other hand, under the cross-margin mode, the margin can be shared. If the operation is not careful, the funds may be liquidated and returned to zero. This also makes users more cautious, so that they can actively reduce leverage and avoid forced liquidation.

On the other hand, under the cross-margin mode, the margin can be shared. If the operation is not careful, the funds may be liquidated and returned to zero. This also makes users more cautious, so that they can actively reduce leverage and avoid forced liquidation.

4. Automatic loan function

4. Automatic loan function

In the unified account, my favorite function is the "automatic loan" function.

secondary title

2. Comparison of competing products under the unified account

It sounds like there is no difficulty in implementing a unified account, but it is simply a collection of various trading accounts. But in fact, the unified account has extremely high requirements for the depth, breadth, technology, risk control and other dimensions of transaction currencies.

For example, suppose you open BTC and ETH perpetual currency-based contracts, but your margin is only OKB. At this time, you need to separate different positions and calculate the two positions according to the real-time market conditions of BTC, ETH and OKB. The margin required for each contract is used for risk control to avoid overrunning. This requires extremely high sensitivity of the system, once an error occurs, tens of thousands of users will be affected.

Especially for top trading platforms such as OKEx, the volume is large, and the overall structure has been set up very early, which affects the whole body. This is also the reason why the unified account has not been launched before. It is necessary to ensure that the current trading system cannot be confused, but also allow the new system to run smoothly and break through the barriers between the two.

Due to various difficulties, there are very few trading platforms that have actually opened a unified account. Odaily has only found that two emerging derivatives platforms, FTX and BitWell, support cross-currency mixed margin.

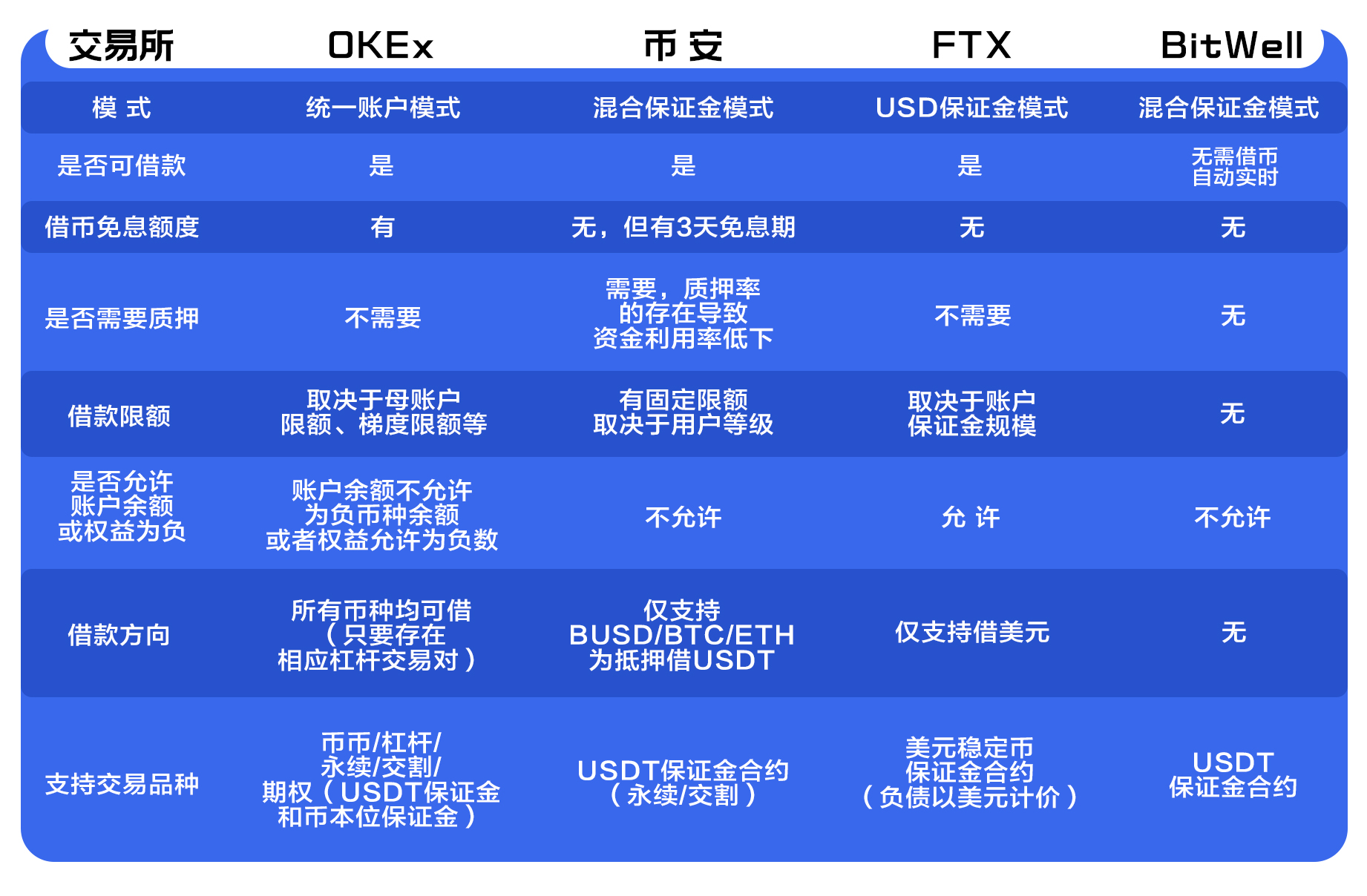

In addition, although Huobi and Binance support the shared margin of USDT standard contracts, they are fundamentally different from the unified account of OKEx. For example, Binance's mixed margin solution only supports BUSD, BTC and ETH as collateral to lend USDT for USDT margin contract transactions. The specific plan is as follows:

Among the above four schemes, OKEx has the highest capital utilization rate, especially the "automatic lending" function saves a lot of handling fees and facilitates large-scale transactions for users.

secondary title

3. Break and then stand, rebirth from the ashes

Established in 2017, OKEx has gone through 4 years and has really gone through bull and bear.

As the trump card in the hands of OKEx, the contract business has always been the top priority. But it is undeniable that with the rise of emerging derivatives exchanges in recent years and the entry of other leading exchanges into the derivatives market, OKEx's contract dominance was once impacted.

In the current fierce competition, the exchange can only win the final victory if it strives to improve products, enhance user experience, and improve service quality.

The "unified account" invested by OKEx this time has lowered the threshold for users to use and is more friendly to derivatives transactions. Whether it is a single-currency margin model or a cross-currency margin model, it is a subversive innovation to the traditional exchange system and will help it further consolidate its contract dominance.

Innovate at the product level, based on user needs, maximize the trading experience and make up for shortcomings. This is OKEx's biggest insight after the turmoil last year, and it has also been put into practice. We look forward to more innovations in the products of leading exchanges such as OKEx, and jointly promote the crypto market transactions to a new stage of maturity.