Analyst | Edited by Carol | Produced by Tong | PANews

For a long time, in the A-share market, "new development" has been one of the important means to obtain high returns. According to public information, in 2020, the average profit per account of "new" A-shares is about 38,631 yuan, and the yield is about 19.32%. In the currency circle, "creating new" is also an important means to obtain excess returns.

In January 2019, Binance took the lead in launching Launchpad, and then major exchanges competed to launch IEO, which set off the first "new" craze in the currency circle. According to PAData’s earlier analysis [1], the average return on early IEO tokens was as high as 7.63 times. For investors, participating in the “innovation” process means earning money when you buy it.

With the emergence of more and more IEO projects, the stock funds in the market are fully consumed, and the income of IEO is not as good as before. That time coincided with the first peak period of DEX development. Affected by this, in June of the same year, Binance launched a new "new" project again, and Binance DEX listed RAVEN (Raven Protocol) through IDO. However, limited by the development of DEX itself, IDO at that time was not as popular as IEO.

secondary title

IDO keywords: DeFi, auction, whitelist

There are many different interpretations of the "D" in IDO. Some people think that IDO is the first token issued through a decentralized exchange (Initial DEX Offering), while others think that IDO is the first token issued through DeFi (Initial DeFi Offering).IDO changes can also be seen from the name controversy. In the initial stage, IDO is indeed mainly completed through decentralized exchanges, but there are some problems and hidden dangers in the initial coin offering on AMM DEX, such as "scientists" rushing away or "giant whales" users trading to cause ordinary users to IDO Loss of income, etc. This has led some projects to migrate their initial tokens to other DeFi platforms with more complex trading algorithms for the sake of community mobilization and fair issuance. After the issuance is completed, they will link to decentralized exchanges for liquidity market making . Therefore, the development of IDO has basically gone through two stages: DEX and DeFi+DEX.Judging from the current main IDO models in the market, Uniswap and Balancer still use swap (Swap). The difference between the two lies mainly in the composition of liquidity. Uniswap is not a DEX specially developed for IDO, so its IDO liquidity is consistent with the liquidity composition of other fund pools. Balancer is a set of template liquidity bootstrapping pools LBP (Liquidity Bootstrapping Pools) specially developed for IDO. Its biggest feature is that it allows the issuer to customize the weight of the capital pool, which can be linear or exponential. Balancer believes that by quickly adjusting the weights, it can reduce the value of the tokens in the pool and prevent the price surge caused by early speculation. Most other emerging platforms use auctions to issue tokens. Here, there are more ways to auction. Currently, there are many platforms that provide fixed exchange rate auction models, including Bounce, Polkastarter, and Sushiswap. Taking Polkastarter as an example, the issuer can set two exchange rates in the two fund pools of Public (public offering) and POLS (private offering). There is usually no minimum amount for issuance, but a maximum amount.In addition, the more noteworthy new methods include Mesa's batch trading auction (Batch Trading). In this model, the issuer does not need to provide buyer liquidity, and buyers can use many different tokens to participate in the sale. This kind of auction will not be lower than the preset limit price. In the auction of the same batch, all orders have the same price, and there is no arbitrage. In addition, Bounce is currently the platform with the most open auction methods. In addition to some auction methods mentioned above, it also provides special auction methods including NFT Lottery (drawing).

Most other emerging platforms use auctions to issue tokens. Here, there are more ways to auction. Currently, there are many platforms that provide fixed exchange rate auction models, including Bounce, Polkastarter, and Sushiswap. Taking Polkastarter as an example, the issuer can set two exchange rates in the two fund pools of Public (public offering) and POLS (private offering). There is usually no minimum amount for issuance, but a maximum amount.In addition, the more noteworthy new methods include Mesa's batch trading auction (Batch Trading). In this model, the issuer does not need to provide buyer liquidity, and buyers can use many different tokens to participate in the sale. This kind of auction will not be lower than the preset limit price. In the auction of the same batch, all orders have the same price, and there is no arbitrage. In addition, Bounce is currently the platform with the most open auction methods. In addition to some auction methods mentioned above, it also provides special auction methods including NFT Lottery (drawing).

IDO income: Nearly 10 times the income is much higher than holding currency or holding shares

PAData selected the two main platforms Uniswap and Polkastarter[2] in the two phases of IDO to observe the income performance of IDO tokens. It can be seen that the early AMM DEX IDO income has a large floating range, while the recent Polkastarter fixed exchange rate auction IDO income The floating range is very small.Judging from the earnings on the day of listing (based on the closing price on the first day of Uniswap trading), the average earnings multiple of the three earlier IDO tokens on Uniswap is about 3.27 times, and the three most recent IDO tokens on Polkastarter The average earnings multiple is about 6.75 times, and the overall average first-day earnings are about 3.81 times (median).From the perspective of the highest return in history (based on the highest price in Uniswap’s historical transactions), the average return multiple of the three IDO tokens on Uniswap has reached an astonishing 57.99 times, which is mainly affected by the extreme value of UMA IDO’s as high as 127.2 times. Then the average earnings multiple of the other two tokens is about 23.41 times, which is also very high. The average revenue multiple of the three tokens of IDO on Polkastarter is much lower, about 7.55 times, slightly higher than the day of the initial public offering. The overall average historical highest return is about 13.80 times (median).The current income situation is similar (based on Uniswap’s trading price on March 3). The average income multiple of the three IDO tokens on Uniswap is about 36.22 times, and the average income multiple of the three IDO tokens on Polkastarter About 6.7 times. The overall average current earnings is about 10.07 times (median).In addition to being affected by the time factor, the level of the initial price is also an important reason for the size of the profit range. Since the initial price of AMM DEX depends on the allocation of funds in the liquidity pool, this provides an impetus for "giant whales" and scientists to raise the price of IDO for general investors. Fixed exchange rate auctions or other more complex auction methods control the fluctuation of IDO prices by limiting the qualifications of participants, limiting the initial price, and limiting the maximum sales volume, etc., reducing the space for games between users and narrowing the profit range of IDO .In general, IDO's current average return of nearly 10 times is still significantly higher than other investment methods.PAData has calculated the "new" income of A-share new stocks since February. The results show that the average first-day closing price increase of 17 new stocks is about 1.73 times (median), and the highest among them is only 5.51 times. The average historical highest return is about 2.26 times, of which the highest Mancaron is about 9.43 times. The average current income is only 1.55 times, of which only Guanzhong Ecology, XGIMI Technology and Mancaron exceed 4 times. PAData also counted the currency holding income of other digital currencies this year. The results show that the average currency holding income of the 30 sampled digital currencies this year is about 2.74 times (median), and the market value of digital currencies ranked 90-100 this year Since then, the average return on currency holdings has been the highest, about 2.81 times (median), and the digital currencies ranked 1-10 by market value have the lowest average return on currency holdings this year, only about 1.92 times (median). Without considering the time efficiency, except for the FTM with the highest yield, the holding income of other sampled tokens is lower than the IDO income.

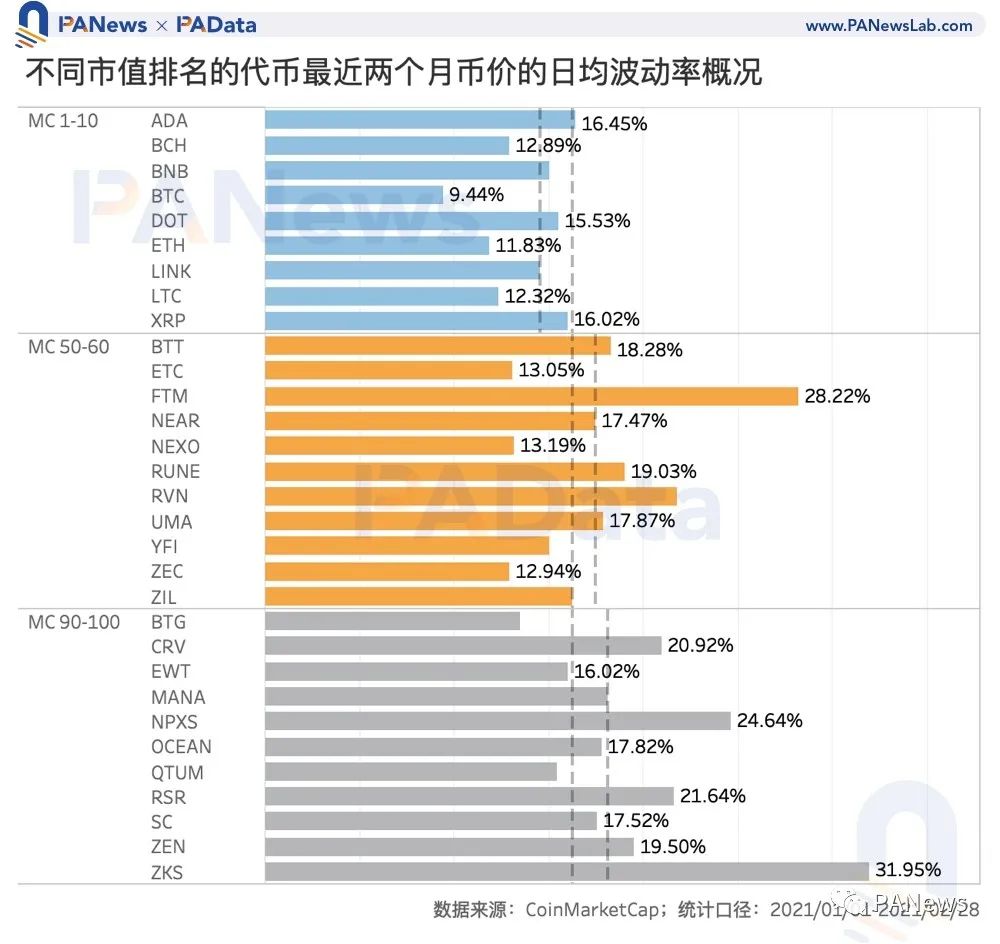

PAData also counted the currency holding income of other digital currencies this year. The results show that the average currency holding income of the 30 sampled digital currencies this year is about 2.74 times (median), and the market value of digital currencies ranked 90-100 this year Since then, the average return on currency holdings has been the highest, about 2.81 times (median), and the digital currencies ranked 1-10 by market value have the lowest average return on currency holdings this year, only about 1.92 times (median). Without considering the time efficiency, except for the FTM with the highest yield, the holding income of other sampled tokens is lower than the IDO income. However, it should be declared that the income multiple calculated here is often the instantaneous lowest/highest price in the disk, which can only provide a range reference for understanding the income range. In fact, the high yield of IDO is accompanied by high volatility. According to statistics, the first-day average volatility of the three tokens on Polkastarter is about 31.61%, and the historical average daily volatility is about 33.27%, which is significantly higher than the volatility of general digital currencies.

However, it should be declared that the income multiple calculated here is often the instantaneous lowest/highest price in the disk, which can only provide a range reference for understanding the income range. In fact, the high yield of IDO is accompanied by high volatility. According to statistics, the first-day average volatility of the three tokens on Polkastarter is about 31.61%, and the historical average daily volatility is about 33.27%, which is significantly higher than the volatility of general digital currencies.

In addition to IDO, there are ITO and IFO worth knowing

IDO has become a popular financing method at present. After IDO, many DeFi projects will immediately connect to the DeFi platform for liquidity market making and start liquidity incentives. This enables IDO to not only complete the financing goal, but also complete the cold start of new projects, and call users to a greater extent participation.In addition to IDO, there are actually other new forms of initial offerings worthy of attention in the near future. The first is the ITO (Initial Twitter Offering), which is famous for the release of MASK. As the name suggests, ITO is the first token issued based on Twitter. Users can participate in the snap-up by linking their Twitter accounts to their wallets. MASK skyrocketed by at least 20 times after its launch, adding fire to the ITO method. After MASK, mTSLA (Mirror) also opened ITO on March 2, Eastern Time. The project side believes that ITO can maximize the exposure of tokens on social media and bring traffic to the project.The second is IFO (Initial Farm Offerings), which is similar to the popular DeFi liquidity mining last year, that is, new tokens are obtained by providing liquidity for the DeFi protocol, but the difference is that the previous liquidity mining Mining can only dig out the governance tokens of this project, which is similar to sowing beans to get beans, but IFO mining uses the liquidity of other assets to mine new project tokens, similar to sowing beans to get melons. For example, the liquid LP of CAKE/BNB on Pancakeswap can be used to purchase Helmet, which is a typical IFO. Pancakeswap has publicly stated that some IFO returns have reached 250%.[1] Refer to "In-depth analysis of IEO: which one has the highest income with an average profit of 7.6 times?" ".[2] Select the initial price of POLS private placement.