King Data: The data predicts that the ETH bull market of $2000 is close at hand

The following content data comes from KingData, please indicate the data source as KingData for reposting and citation. KingData uses data to empower transactions, one step ahead to meet wealth.

Ethereum reached a new high, with the unit price approaching $1,700. What supports the 19-fold increase in the price of ETH, can it be foreseen in advance? How far is the $2,000 Ethereum from us? This article will use the following ten sets of data to reveal the answers to these questions.

secondary title

Expense Consumption Predicts the Bull Market

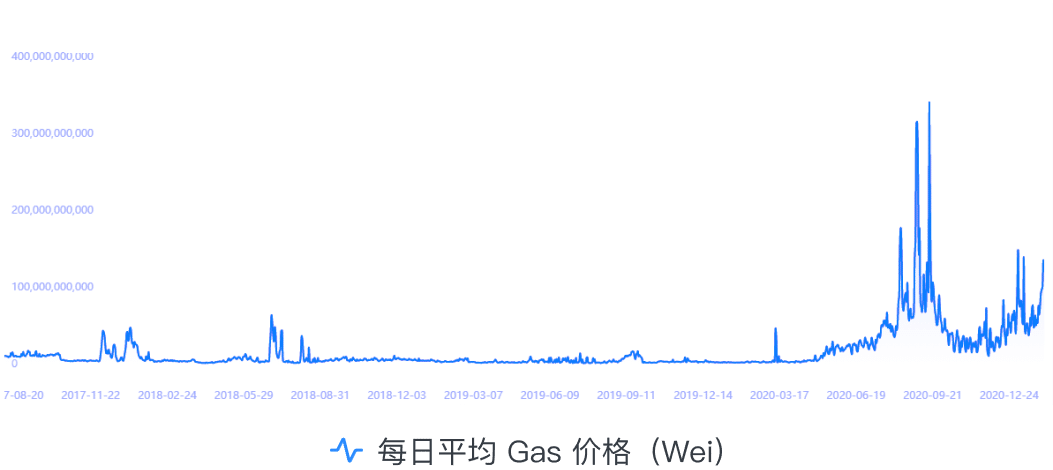

Since June 1, 2020, the total daily Gas (contract execution fuel) consumption has risen sharply, and it has remained high until now, with a daily consumption of about 79 billion Wei.

After the same period, Gas prices also experienced an abnormal rise, far exceeding the bull market launched by ICO in 2017.

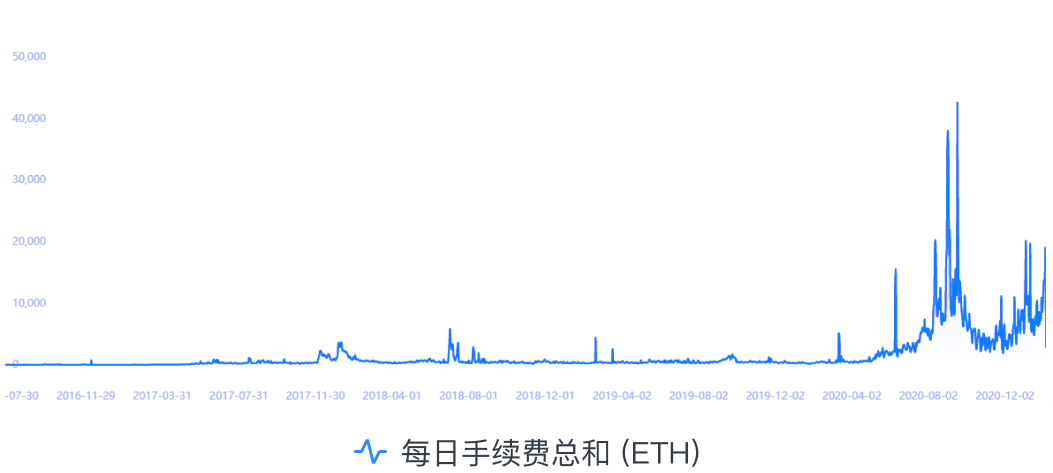

The peak value of daily transaction fee consumption ETH reached 42,800, and the recent average is around 11,000.

It can be deduced from this that starting from June 1, 2020, Ethereum has added a large number of new and called smart contracts, and a wave of projects is brewing.

secondary title

The surge in pledges boosted the record high of ETH

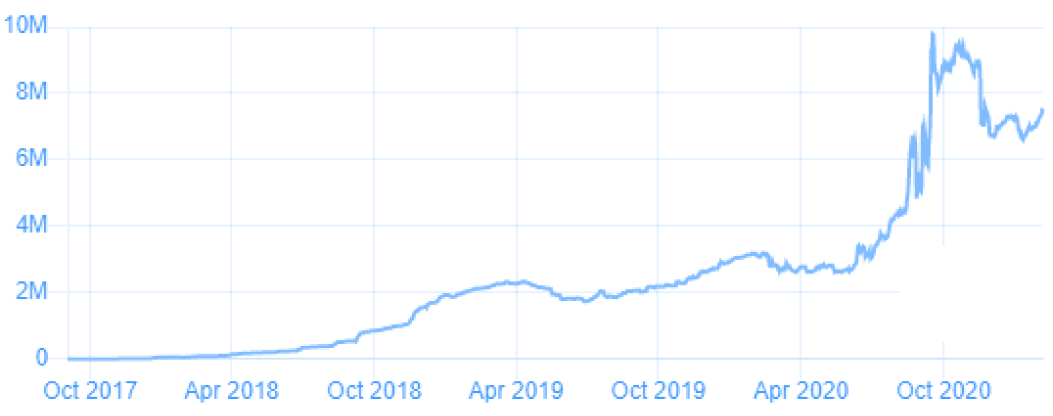

The total amount of ETH locked into DeFi peaked at 9.77 million ETH, accounting for 8% of the circulation. This value was only 2.73 million on June 1, 2020, an increase of 3.57 times in less than 4 months .

At present, the total lock-up value of the DeFi industry has reached 34.86 billion US dollars, which is equivalent to 18.44% of the market value of ETH. Among them, the market value of the DEX sector and the lending sector accounted for 11.5 billion and 17 billion respectively.

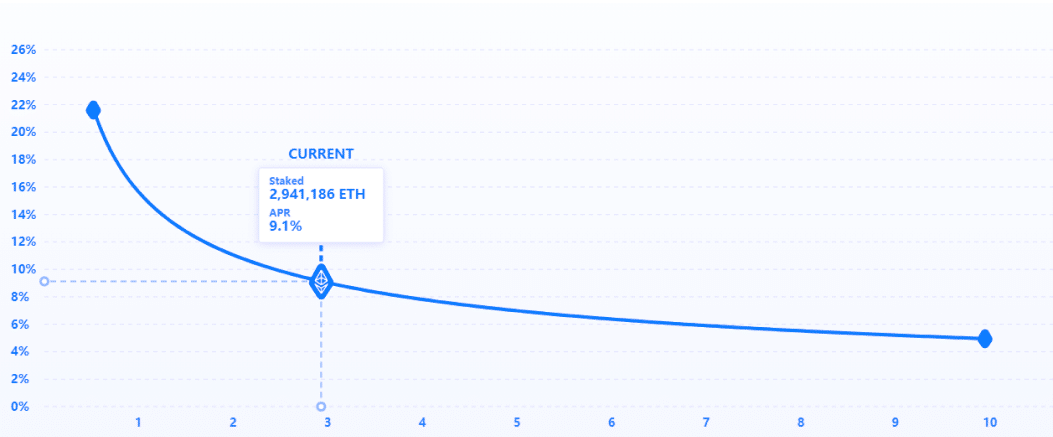

The number of ETH2.0 addresses pledged and the corresponding annualized rate of return

At present, the total pledge amount of ETH 2.0 addresses has reached 2.94 million ETH, and the current annualized rate of return is 9.1%.

secondary title

2000 USD in ETH

The number of daily on-chain transactions on Ethereum is currently only on par with the 17-year bull market. Judging from the development progress of the existing DeFi, this data will inevitably be broken.

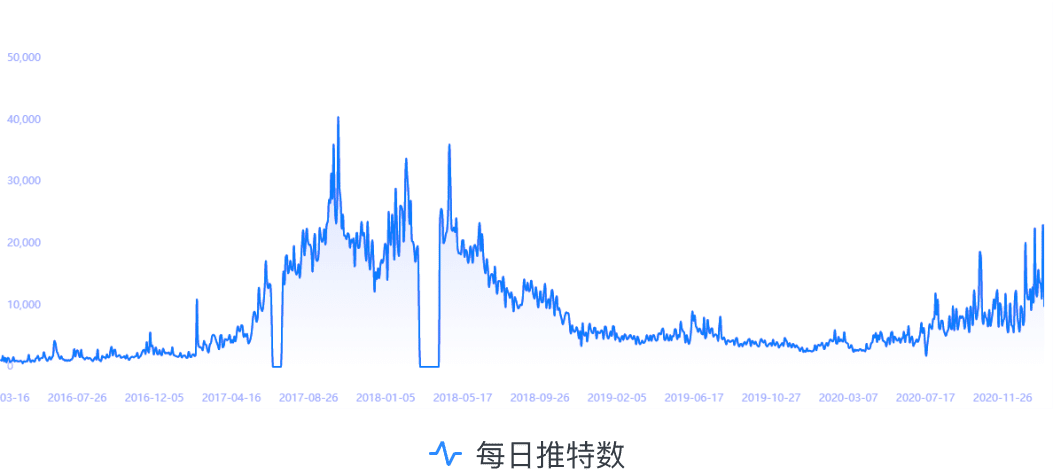

The search index of Twitter ETH is still lower than the bull market period in 2017, at least Musk has not come out to call for Ethereum, hahaha.

The total lock-up market value of DeFi, the lock-up value of the DEX sector, and the lock-up value of the lending sector all showed an upward trend of nearly 90°. In the long run, ETH2.0 has just started. The full implementation of the POS mechanism in the future will freeze the actual circulation of more ETH, the supply will be reduced again, and the demand will further increase. The $2,000 ETH is not far away "tomorrow".

For ETH and DeFi data, go to KingData.https://ikingdata.com/#/home