This article comes fromThis article comes fromSifchain official

, author Luke Kim, compiled by Odaily Qin Xiaofeng.

About the introduction of Sifchain project, recommended reading:

"What is Sifchain Continuous Liquidity Pool (CLP)?" "

We did not expect that the market was full of interest in Sidchain's upcoming token sale (that is, public offering), and it was quite a bit unprepared. Therefore, we have decided to make some changes to our previous public offering plan and discuss a new token sale structure. This update will be synchronized to the Sifchain website within 24 hours. In addition, interested investors, please pay attention to the legal terms indicated at the end of the article.

secondary title

Rowan public offering model

HegicMode 1: Hegic mode

The public offering method is to have applicants submit their donations to a smart contract, and then distribute Hegic tokens equally based on the donations.

If the Sifchain team does this, and receives $50 million in donations (this is only a theoretical figure, as we cannot confirm whether people will donate in the public sale), then the price per token of Rowan will be: $50 million / 7000 Ten thousand Rowan=0.71 USD/Rowan.

Looks good, we don't want to use this model, because it is actually forcing all public sale investors to pay the maximum price of the public sale. This model also has merit, because it actually reflects people's expectations of Rowan's demand and determines the price.

Perpetual ProtocolModel 2: Perp model

The public sale is conducted through the "Dutch Auction". The price starts out very high, and if buyers buy, the price stays the same; if they don't, the price drops until new buyers join. This process is repeated until the end of the public auction. This is another useful way to assess demand and set a public offering price.

The Sifchain team studied the public sale of the Perp token in detail. Generally, Dutch auctions end with a very low price when there is no utility value. In fact, Perp's token price remained well below its ICO price until it released an actual product and its token had utility value.

We cannot directly use Perp's model, because Rowan's public sale was launched at the same time as Sifchain's BetaNet, thus providing immediate utility.

Model 3: TVL modelThorchainDue to the utility of Sifchain's BetaNet, Rowan's valuation is subject to"Creative"deterministic pricing

Model. The model is not actually deterministic, as market participants are able to exchange tokens at any price they choose, regardless of the model. However, this model does incorporate incentives that rational investors might use when deciding how to allocate their portfolios.

According to this model, the floor of Rowan's market capitalization is three times the total value of external assets on Sifchain."TVL")。

If the value of external assets on Sifchain totals only a measly $10 million, then another measure of Sifchain's liquidity pool must have a total of $10 million in Rowan in order for the pool to maintain a weighted average. This means that Sifchain has a combined liquidity of $20 million (i.e. total locked value

According to Tendermint's consensus algorithm, Sifchain's validators must stake at least $20 million in Rowan, ensuring that the cost of malicious activity (slashing) is greater than any gain the validator receives from fraud, so that the network is safe. This means that for every $10 million of outside capital, we can expect Rowan to have a total float market cap of $30 million.

Here's an analysis based on how the $10 million in outside capital above would affect Rowan's other metrics:

External capital in liquidity pool: $10 million

Value of all Rowan on Sifchain (liquidity pools + validators): $30 million

Minimum circulating market capitalization: $30 million

Total market capitalization of issuance (assuming 7% of all Rowan is liquid): $30 million / 7% = $428 million.

The above analysis puts a lower bound on the price of Rowan, but the actual price may be higher, because the model does not include tokens stored outside Sifchain (such as wallets, exchanges, vaults).

Currently, Thorchain's Rune is trading at 2.7x its deterministic price floor; if Rowan does the same, it should be worth $1.28 at $10M TVL.《 Gauntlet Network’s analysis of Thorchain》For further analysis of the TVL model, you can read this article. exist"Sifchain's Token Economics"

In the paper, this model is also discussed with different values.

Again, the TVL model is not really a deterministic model, but it does help buyers understand how Rowan's utility affects its price.

secondary title

Rowan public offering structure

Rowan will be sold according to the new formula, the new formula is as follows: Ao = Bo* (1-(2,650,000/(2,650,000+Ai))

Bo = the number of Rowan in the public offering pool

Ai = amount of USDT sent by the user

Ao = Amount Rowan sent to the user

This is very similar to the old formula, with two differences:

no exponent of 1/10

Old variable Bi, fixed at 2,650,000.

Through the new curve formula, at any time, any transaction can only purchase a maximum of 2% of the asset pool. Buyers can make multiple transactions above 2%, however, they cannot purchase more than 2% of their funds in a single transaction.

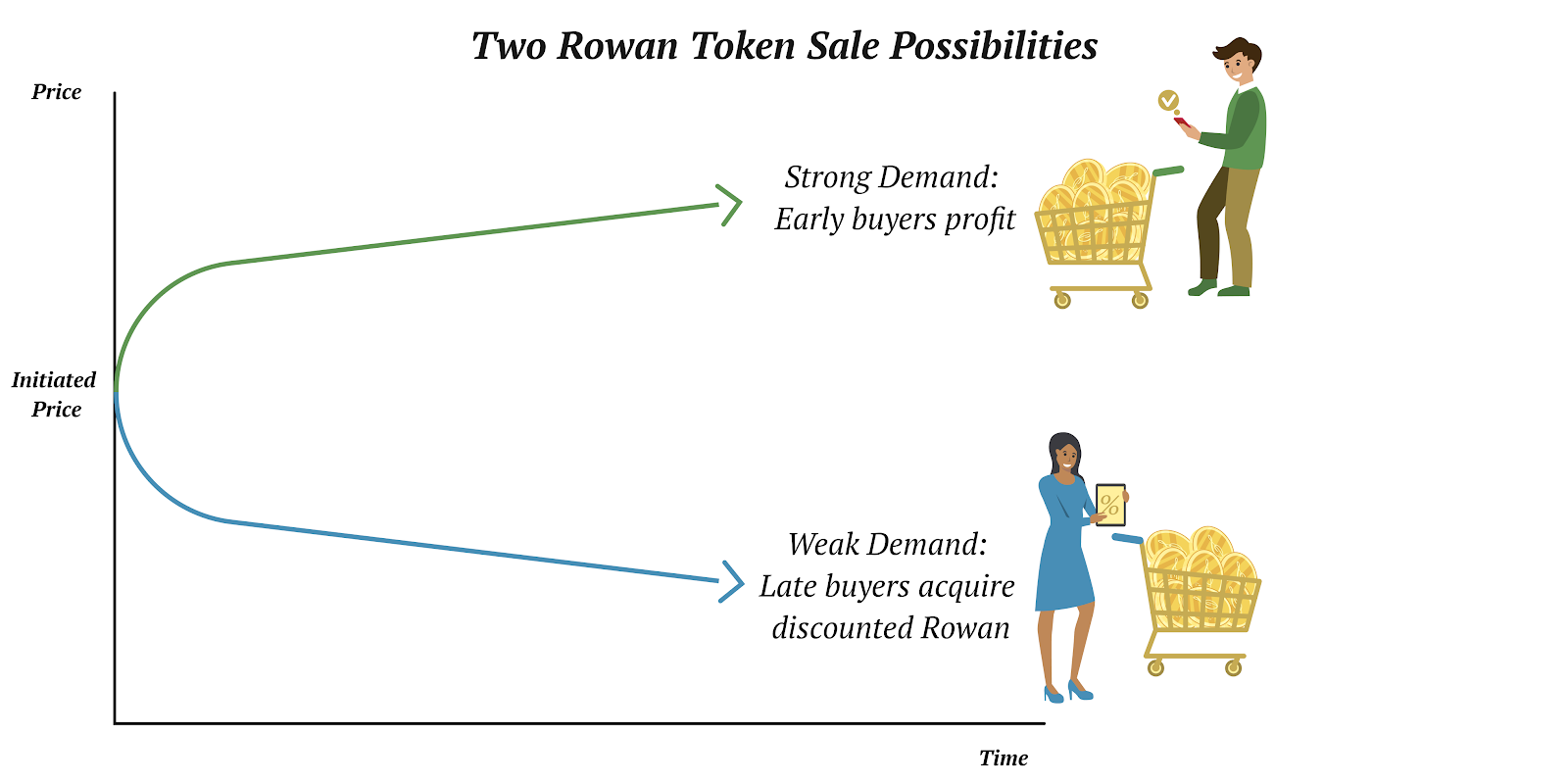

The new public offering curve will still start at 8.75 million Rowan and increase by 3.64 million Rowan every hour for 7 days. As new Rowans are added to the public pool, the price will decrease; as the number decreases, the price will increase.

Bo = 8,750,000 Rowan

Ai = 1,000 USDT

For example, Alice wants to spend 1,000 USDT to purchase Rowan during the public offering. Assuming we are at the very beginning of the public offering, the variables are as follows:

Ao = 8,750,000 * (1 - ((2,650,000 / (2,650,000 + 1,000))

Ao = 3300.64 Rowan

This means that, assuming no other user has purchased before her, Alice will receive the following amount of Rowan:

secondary title

in conclusion

in conclusion

We have included a disclaimer at the end of this article to emphasize that all financial projections are speculative. We want to remind investors that anything can happen in a public offering. We've provided this information and updated the public sale structure to help Rowan buyers understand the public sale, but it's up to you to make a decision based on your preferences.

We are postponing the launch date of the public sale to February 3, 2021 to give investors more time to digest the structure and understand Sifchain’s value proposition. BetaNet will also launch on February 3, 2021.

We hope to allow some time for everyone in the Sifchain community to make the right decision.

PLEASE NOTE: Token sale registration/KYC will still close on January 24th. If you want to participate, be sure to submit your registration by this date.

secondary title

legal information

Nothing in this post shall constitute or be construed as an offer to sell/buy any securities. Nothing in this post should be construed as investment advice, strategy or investment advice for Sifchain or any of its affiliates. This post is for informational purposes only.

Will"Will"、"expected"、"Intend"、"believe"believe

or other similar terms. These statements involve risks, uncertainties, assumptions and other factors that may cause actual results or performance to differ materially. Sifchain cannot assure you that these forward-looking statements will prove to be accurate. These forward-looking statements speak only as of the date hereof. We disclaim any obligation to update these forward-looking statements.

Any financial assessments that may be contained herein have been prepared by Sifchain and are based on assumptions provided by Sifchain which have not been verified by any external accountants. Therefore, any financial projections are limited. Presenting Sifchain's assumptions in the form of forecast information does not include any assessment of the support for the assumptions on which the forecast is based. These financial forecasts are based on information available to Sifchain as of the specific date of preparation, are subject to material uncertainties and should not be considered as predictions or guarantees of actual future performance; therefore, investments should not be made solely on the basis of any forecasts in this document decision making. Any financial projections contained herein will depend on future events, many of which will be beyond Sifchain's control, and therefore, there can be no assurance that Sifchain's assumptions will prove to be true, that its predicted results will be realized, or that the predictions will differ from actual future results. The difference will not be significant.

This blog post does not guarantee that any person has the right to participate in the token sale. Any sale of tokens to you shall be governed solely by the terms and conditions of the express document governing such token sale. All participants must comply with all applicable laws, including completing KYC/AML verification, in order to participate.