YFI and its IYO Era

too long

too long

This article will be very long, if you don't want to read it, here is the conclusion for you.

1. An unexamined life is not worth living, and an unaudited contract is not worth collecting. ——Socrates Lu Xun

In the current YFI series, except for YFI itself, there is only its only legit forkYFII(It is said that it will be renamed DFI) It has experienced the professional audit of Ambi Labs, and even YFI itself has only passed the community audit in the early stage. Various other projects called Y**I have nothing to do with the original YFI community, and have not undergone code audit, private key destruction/multi-signature,It is possible to pre-mine and unlimited issuance at any time, which is extremely risky. Some people have been cheated, please avoid participating.

2. YFI, and its fork YFII (DFI), bring more than just a little increase in the currency price,It brings a brand new story, a story comparable to 1c0, maybe we can call it IYO (Initial YFI/YFII-Mode Offering).

3. As for YFII (DFI) and YFI itself?

Their first goal is toGet rid of the life of the second-tier CEX (centralized exchange).

first level title

-------

incalculable rate of return

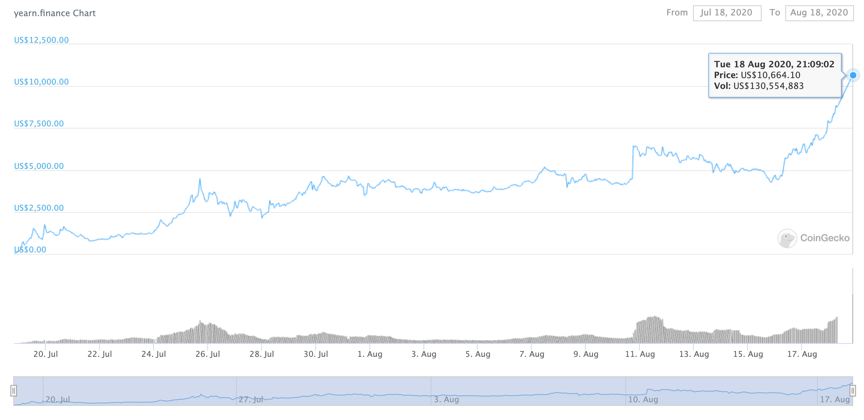

Since liquidity mining started on July 17th, among the marked prices on CoinGecko, YFI has risen from $34.53 to $12,821, the highest on Binance, a 371-fold increase, and the price once surpassed the top-ranked BTC in the currency circle (voice here , Joker Xue: I don’t want to lose face).

In fact, all YFI originally came from miners’ liquidity mining chips, and liquidity mining itself is different from BTC’s high PoW mining costs. Except for investment funds (except for contract risks, almost only gas is required) Fees, principal loss can be relatively ignored), each YFI token, if gas fees and capital costs are not considered, it is only a free chip at first.

From 0 to 12,000 US dollars, if according to the textbook algorithm, the divisor cannot be 0, the rate of return cannot be calculated at all.

Why is this coin that comes from the air able to complete the 12-year journey of BTC in one month, directly TO DA MOON?

image description

first level title

Causes of Inflation (Part 1): Ponzinomics

In fact, the initial skyrocketing price of YFI was not a single phenomenon. YFI’s fork YFII (DFI) and YAM had high-speed skyrocketing in the early stage without exception.

Although, for example, YAM once almost returned to zero due to contract code problems, and YFII (DFI) has also retreated from the high point after the skyrocketing, but there is no doubt that they have all skyrocketed. What is the reason behind this? What?

Is the total amount only 30,000 / 40,000? Is it a hot DeFi concept? Is it the magic of liquidity mining? Is their MEME/expression more attractive? Is their community members too good? Or did Andre just launch an insurance product the day before?

Oh, I mean, all of the above is wrong.

image description

Charles Ponzi (Charles Ponzi), Ponzi Game named source, source: Wikipedia

Let's look back at YFI's token distribution model:

30,000 pieces, end of ten-day distribution

Distributed in three pools (Pool), each with a quota of 10,000, for seven days

Pool1 will go online on July 17th, recharge stablecoins, and distribute according to the proportion of the stablecoin pledge balance in the entire pool (it is a kind of PoS)

Pool2 will go online on July 18, recharge DAI (stable currency), and distribute according to the ratio of the provided liquidity to the entire pool

Pool3 will go online on July 19th, recharge yCRV (stable currency), and distribute according to the ratio of the provided liquidity to the entire pool

Where is the fate of the initial skyrocketing?

Pool1 obviously has no tricks. If there is no problem with the contract, it is just a trick. The mystery lies in Pool2 and Pool3.

What is a liquidity pool? That is, you have to provide liquidity to the pool.

etc.

etc.

Isn't it charging DAI / yCRV? Where did I get YFI?

Automatically bought.

When you mortgage in the Balancer 98:2 liquidity pool, if you only have DAI and choose Single Asset, 2% of YFI will be automatically bought for you.

that's all right,Come in to mine, buy YFI with 2% of the principal first, come in to mine, buy YFI with 2% of the principal first, come in to mine, buy YFI with 2% of the principal first, Do you understand?

Everyone who thought they were gaining no loss bought 2% of YFI, and everyone entered the market to mine, just to pull the market once.

At its peak, YFI had a TVL of close to 500 million US dollars. If half of it is in Pool2 and Pool3, it is equivalent toFrom the "liquidity mining" of Pool2 and Pool3, 5*0.5*0.02 = 0.05, 5 million US dollars of buying orders are provided.

Yes, here is a Ponzi Game (Ponzi Game).

Remember this, I will come back to it later.

If combined with a little FOMO sentiment, the concept of DeFi, and a total amount of 30,000,Pulled to the first $4500 on July 25th, nothing more normal.

first level title

Causes of skyrocketing (below): Concentration of chips

From a common sense point of view, the mode (Ponzinomic) when YFII starts is a double-edged sword, which will make it and destroy it.

Where are the bugs? The liquidity mining ended on 7.27, and the liquidity was withdrawn. For the 98:2 liquidity pool, most of the 2% YFI will be sold when withdrawing. If the currency price does not have a solid value and consensus foundation, it will face risk of crash.

In fact, YFI has experienced exactly this.

20200725 YFI price $4,505, stage peak

20200726 YFI price is $2,483, a drop of nearly half

20200727 YFI Price $2,510

20200728 YFI price $2,120, continue to fall

Why did it rise again?

Because of LINK.

speak English.

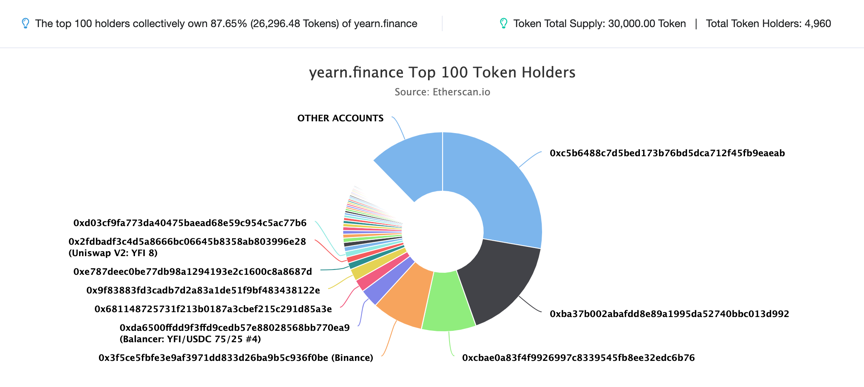

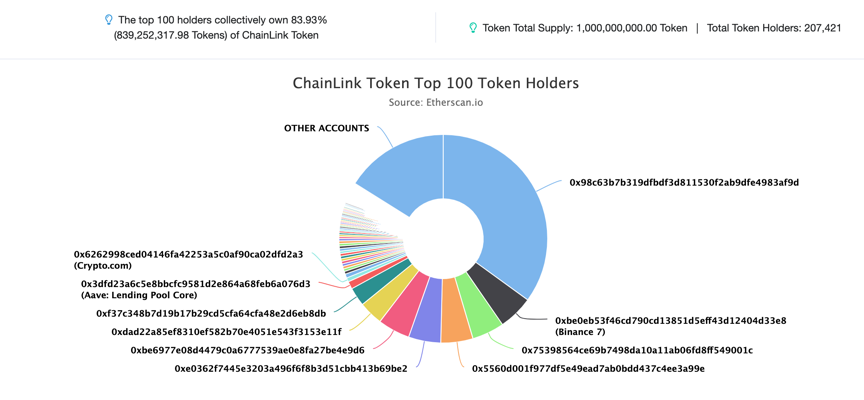

Like LINK, the chip concentration is very high.

What is the concept of high concentration of chips?

I have an ancestral vase, issued a vase coin, and split the ownership of the vase into 100 coins, but only sent 2 to the market, and kept 98 for myself.

If you do more, I will give you the remaining 98.

If you are short, I will buy a little bit, because the circulation is too small, the buying process will gradually explode the price, and you will also be liquidated => the price will increase, you go back and do long => I will sell the remaining 98 you.

The advantage of high concentration of chips and high lock-up degree is that it is extremely easy to pull the market, but there are also hidden dangers similar to Super Mario.

Source: Etherscan

Source: Etherscan

Back to the previous example, LINK, look at the address of LINK, the top 100 token holders own more than 83.93% of the tokens,Source: Etherscan

Source: Etherscan

It looks nice, but it's not a fair game. What if it gives you the remaining "vase coins"?

first level title

Beyond currency prices, IYO is the real start

Since YFII (DFI) was forked from the YIP-8 proposal, various coins referring to YFI have emerged in an endless stream, some of which have been reset to zero, and some are pure fraud, and some like YFII (DFI) are still developing tenaciously. Stable, out of an independent and innovative business model, the community is growing.

Whether successful or not, there is no doubt that the story of YFI and its token distribution model can be replicated.

Let's take a look back at the core of YFI's model:

Pool1: Traditional candy pool, obtained through stablecoin mining,The theory removes the contract risk and has no riskmachine gun poolmachine gun pool)

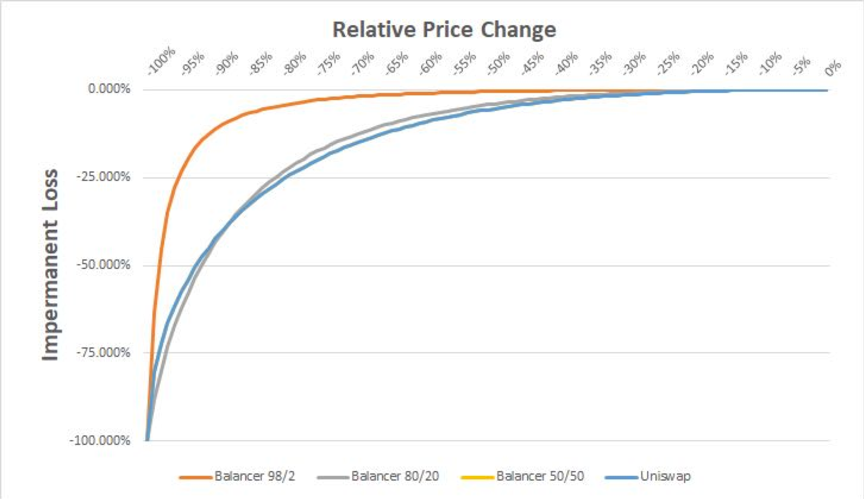

Pool2&3: Liquidity pool in Ponzinomic mode,There is the risk of impermanent loss and direct principal return to zero(The 98:2 pool is okay, especially Uniswap's 50:50 pool)

impermanent lossimpermanent loss, the AMM mechanism of the decentralized exchange is not introduced here, and the conclusion is directly stated:

Q: What is impermanent loss?

Answer: If any currency rises, your currency will be gone;

If any coin falls/returns to zero, you will have a commemorative coin in one hand.

Therefore, "impermanent loss" is also jokingly called "free" loss.

Qualitative analysis is not enough, let’s quantitatively analyze the “impermanent loss”:

As you can see in the picture, for the liquidity pool of Balancer 98/2:

(A non-stable currency that provides liquidity, here is YFI as an example)

Before YFI fell by 90%, the loss was not large

YFI fell 95%, about 20% loss

YFI fell from 95% to zero, and the principal also returned to zero

one inYFII (DFI, the only fork with healthy growth)Such a story appeared in the YFFFFI fork that appeared later,YFFFFI It is a currency issued by an anonymous team and has no community consensus. The price of the currency has fallen completely without support, and it has fallen into a death spiral and returned to zero.A large number of Pool2 miners were cut directly.

Looking at the Uniswap 50:50 pool, this liquidity pool is even more exaggerated:

YFI fell 70%, impermanence lost about 20%

YFI fell 80%, impermanence lost about 25%

YFI fell 90%, the principal loss was about 50%

YFI fell 95%, the principal loss was about 70%

It can be said,

It can be said,Uniswap's 50:50 pool is a big casino with principal gambling, has nothing to do with the seemingly stable income of "mining".

This story also has an example of reality returning to zero, which is YAM, the code has not been audited, the rebalance failed, and the currency price directly died in a spiral. A friend of mine (hey? It’s really not me) YAM Pool2 stepped on the thunder, and the loss was calculated to be one million dollars. .

It takes too much space to explain impermanence loss, but for everyone’s mining safety, I believe it is necessary. According to the speculation in this article,Liquidity mining will continue to be hot, everyone must be careful, the first is to choose audited projects, and the second is to only mine safe Pool1,machine gun poolmachine gun pool, at least there will be a second audit by community developers.

Back to the topic, so far,The biggest contribution of the YFI project is not the increase in the currency price, but a way to demonstrate a cold start liquidity and fair opportunity.

Looking back at YFI / YFII (DFI) / YAM and other projects, no matter whether they are successful or not, they have such characteristics:

Projects no longer require a private placement.

Projects no longer need institutional investors.

The project is not pre-mined.

Items are not inflated anymore.

Even the project token itself has not issued additional private keys.

In the initial stage of the project, there is no need to go to the exchange to list it, and it can be cold-started to obtain a valuation of several million tens of millions of dollars.

Before the appearance of YFI and its first fork YFII (DFI), even though DeFi has been popular for so long, it has never appeared.

Bihu Big V Bitsha and Weibo Big V Super Bitcoin have obviously seen this trend, here are two excerpts:

No pre-mining, no crowdfunding, and no team rewards mean that the media publicity is invalid, the capital advantage of the Token fund is invalid, and the currency listing on the exchange is invalid. Everyone is on the same starting line, with the same information and capital advantages, and Defi instantly Overturned all the ways of playing in the circle for seven years.

——@超级君eating roast goose

Some people in the current exchanges and investors look down on defi, but they don't know that defi is changing the financial infrastructure of tokens. Quietly cutting the lives of Trading Su and private equity investors. At present, using the infrastructure of the public chain and the core protocols of defi, the project party can completely bypass traditional investors and exchanges, and play well. Community, fundraising, and token issuance on dex, all the way without hindrance. This intermediate project party has a lot less possibility of being cut off. Investors in exchanges are basically at the last level of the food chain. The link of private placement is also skipped. The capital ecology of the industry is being deconstructed by the technological development of defi, and things are changing. At the same time, new opportunities are being created.

——@bit silly

YFI and YFII (DFI) have proved that the initial liquidity of a project can be established without the need for the old infrastructure in the past. I think that in the future, as long as the bull market continues, there must be a large number of similar coins such as initial liquidity Sex, I named them IYO (Initial YFI/YFII-Mode Offering)

If the value of the project can be put to the ground, how to start it at the beginning, the two pools of Ponzinomic are just one of many methods, and there is no distinction between good and bad. Obviously, YFI and YFII (DFI) are done,And it does have value.

If it is a zero-sum game, the retail investors who originally cut off CEX are now just miners who provide liquidity to Pool2, but at least it is far from fair.The simplest, where do retail investors have the opportunity to participate in the private placement round of the project? But now it does.

Let’s continue to study the YFI model. If a large number of IYO (Initial YFI/YFII-Mode Offering) projects are launched with this model, what difference will there be? The key person (the author's 2020 version) has recently thought about three questions:

1. Must the project type be limited to DeFi?

In fact, it is not limited. This is just the way to start. It is just a token that happens to be traded on DEX and initializes liquidity.The specific currency is completely irrelevant to DeFi.

Of course, because it is launched in DEX in this way, it can label itself as DeFi, and perhaps it can also gain popularity.

2. Must there be a risk-free Pool1?

This question is very interesting. Since everyone knows it, the essence lies in Pool2, why is there Pool1?

My answer is, I think it is still necessary. On the one hand, Pool1 is a relatively risk-free income. The project that only has Pool2 is irresponsible to the holders, which shows that the project party wants to cut a few leeks and run away. Yes, the probability of losing community trust and directly falling into a death spiral is very high.

On the other hand, Pool1 is like a scarecrow, and it is a competitive relationship with Pool2, which should be beneficial to the overall TVL improvement. If both pools distribute 1,000 coins per day, Pool1 has 100 million TVL, and Pool2 only 5 million, then there is a high probability that a rational person will go for Pool2. After all, the odds are very high, and it is worth taking a certain position (This was the case the night YAM crashed, Pool2 once had an APR of tens of thousands), in short, a balance should be reached between the two pools.

It can be represented by such a formula:

Pool2 return = risk-free return (Pool1 return) + risk premium.

When the risk premium is high enough, the TVL of Pool1 will have a promotion effect on Pool2.

3. So, can Pool1 have any other tricks?

Yes, for example, in the design of YAM, the Pool1 stablecoin mining used by YFII (DFI)/YFI has been replaced by the mining of eight DeFi-related tokens, and the time of Pool1 has been changed from the two The month was replaced by a week, and Pool2 was made into the same halving mode as YFII (DFI). It is wise to think carefully, because the interest-earning demand of other DeFi tokens will actually be stronger than that of stablecoins.

4. Why did CRV fail?

CRV did not take the IYO route. They are both called liquidity mining. In fact, the difference is too great. There is no similar incentive model in the design of token economics. At the same time, the total amount is too large, and it is released evenly every week, resulting in a At one time, it was extremely small, and at the same time, CEX was eager to put it on the shelves for hot spots and star projects, which caused the initial overestimation.

first level title

Machine Gun Pool: Deterministic Winner, Maybe Second-tier Exchange Subversive

Since IYO can be started quickly and does not need to pay high listing fees to the exchange, based on the above analysis, it seems predictable that it will become more new token distribution paradigms in this round of bull market, and a large number of top exchanges that cannot be directly listed ( Big Three) coins are likely to be distributed in this way. It is far from and need not be limited to the DeFi field.

So who will be the immediate beneficiaries of this paradigm shift?

The key person's answer is, maybe it is the "machine gun pool" mode.

The smart pool is the name of YFII (DFI). The target is the Vault in the YFI product, which roughly means that it is similar to the smart pool of PoW mining. High-quality currency, similar to Binance Pool, which was once the largest BSV mining pool (Binance’s views on BSV are well known), because BTC/BCH/BSV use the same mining algorithm, mining machines can exchange for BSV Why not mine when there are more BTC. The same is true for YFII's DeFi smart pool, which mines, withdraws and sells projects with the highest instantaneous income and security, and repurchases YFII in the market.It can greatly reduce the investment of gas fees for ordinary liquid mining participants, and at the same time, developers can audit contracts on behalf of retail investors, greatly reducing the risk of participation(Playing DeFi mining toss back and forth to consume a few ETH handling fees, which is not enough at all, and the mining pool can share this cost evenly), and can obtain the highest income.

For Pool1's mining, sale and withdrawal, the smart pool seems to be the only deterministic income for the entire game of IYO in the future.

So, will the project parties of these new projects launched by IYO welcome such an approach? Will there be any restrictions?

Whether you welcome it or not, in fact, there is no way to make too many restrictions, because the essence of Pool1 and Pool2 is to compete with each other and check and balance each other. If you make a little change to make Pool1 easier to obtain, no one will go to Pool2 and lose Purpose of cold start.

On the other hand, we have also seen that some project parties have indeed seen this clearly and supported the operation of the machine gun pool. Yang Mindao of dForce said:

In fact, some people may think why we welcome machine gun pools to mine. Isn’t this in short DF? My understanding is that the machine gun pool plays a role in the effective allocation of market funds. In the end, it will effectively improve the efficiency of our mining (reflected by the decline in the overall mining return or approaching the market level), which is conducive to more efficient allocation of DF to in the market. Relatively speaking, if there is no efficient market allocation, large households will sell mines after mining, and there will be very high excess returns.

If in the near future, a large number of new projects adopt the IYO method for liquidity cold start, and use the advantages of DEX to establish initial liquidity, there will be no need to go to CEX to pay high listing fees.

The income from the smart pool is actually the DeFi mapping of the original listing fee, but it saves the project party a lot of expenses, and it also disperses the risk of investors being paid back by the private placement round at the opening of the market.

In the entire game, the only one left out is the original second-tier CEX. The first-tier CEX is a long-term fiat currency deposit channel, and it is difficult to shake because it has the core resources of the industry. And CEX, which relies on innovative coins to survive, may have to face a real challenge.

At present, YFII (DFI) has mined YAM and CRV through the machine gun pool, and the original YFI Vault has also dug CRV. Compared with YFI’s entry of 0.5% of the principal, YFII (DFI) looks a bit cute.

As far as the key person knows, the YFII (DFI) community is making a lot of efforts in developing new strategies. Whether YFII (DFI) can surpass YFI, both projects are still relatively early, and no one can predict. As the power of Chinese DeFi, naturally I also hope that it can grow rapidly and become a backbone force in the world's DeFi.

In the recent surge of LINK, other oracles such as BAND and NEST are not to be outdone. When YFI is listed on Binance, can YFII (DFI) take advantage of the launch of Smart Pool to launch a beautiful attack like BAND and NEST?

After the deployment of the YAM smart pool, YFII (DFI) once nearly doubled due to the repurchase. Although it later retreated due to the failure of YAM, it also verified the effectiveness of the smart pool model to a certain extent.

The market value of YFII (DFI) and YFI seems to have a gap of nearly a hundred times, but in fact it may not be that big, and perhaps the gap is where the opportunity for growth lies. Compared with YFI, YFII (DFI) also has an economic model of repurchase and destruction, which is more closely related to the value of the currency price.

at last

-------

at last

The whole article has been written too long, because I want to go through and cover most of the points that I thought of these days, and I can’t keep up with the energy in the end. The logic may be a little confused, but I am sure that most of the points have been expressed.

If there is a gain, then neither your nor my time was wasted.

I'm sorry if it felt like a waste of your time.

Slightly changed a passage from Jiangnan, so let's end it like this.

This is the midsummer of 2020. Some of the selected projects still don't know their fate, and some know it, but they are still unwilling to obey. At that time, the sky was still clear and the sun was warm, as if all the shadows were not enough to erase this peace and happiness. Everything should still have a chance, everything should still be in time, and all bad results can still be changed, before the feast of this bull market finally stops.