Matrixport: In the current environment, trading tends to focus on top-tier assets with high liquidity and better trading depth.

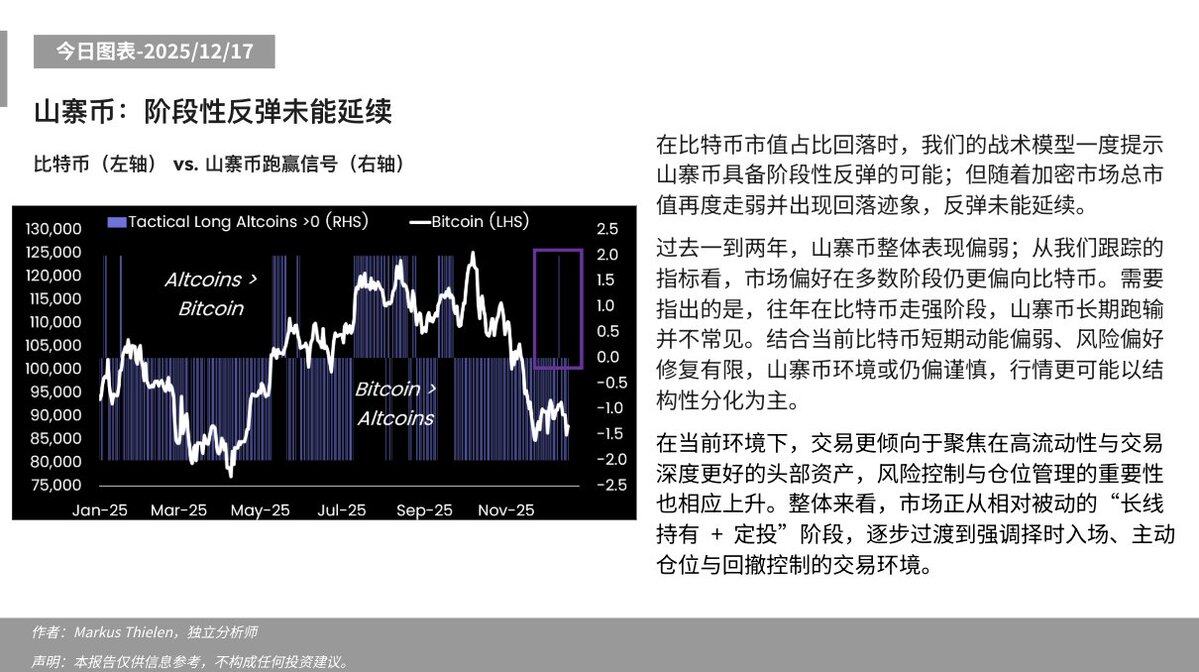

According to a chart released today by Matrixport, as reported by Odaily Planet Daily, our tactical model initially suggested a potential rebound for altcoins when Bitcoin's market capitalization share declined; however, the rebound failed to continue as the total market capitalization of the crypto market weakened again and showed signs of decline.

Over the past one to two years, altcoins have generally underperformed; according to the indicators we track, market preference has remained more inclined towards Bitcoin in most periods. It's worth noting that it's uncommon for altcoins to consistently underperform Bitcoin during periods of strength. Given the current weakness in Bitcoin's short-term momentum and limited recovery in risk appetite, the altcoin environment is likely to remain cautious, with price movements more likely to be characterized by structural divergence.

In the current environment, trading tends to focus on top-tier assets with high liquidity and better trading depth, and the importance of risk control and position management has increased accordingly. Overall, the market is gradually transitioning from a relatively passive "long-term holding + dollar-cost averaging" phase to a trading environment that emphasizes market timing, active position sizing, and drawdown control.