Matrixport: The market is currently in a clear deleveraging phase, and the risks of maintaining high positions are increasing.

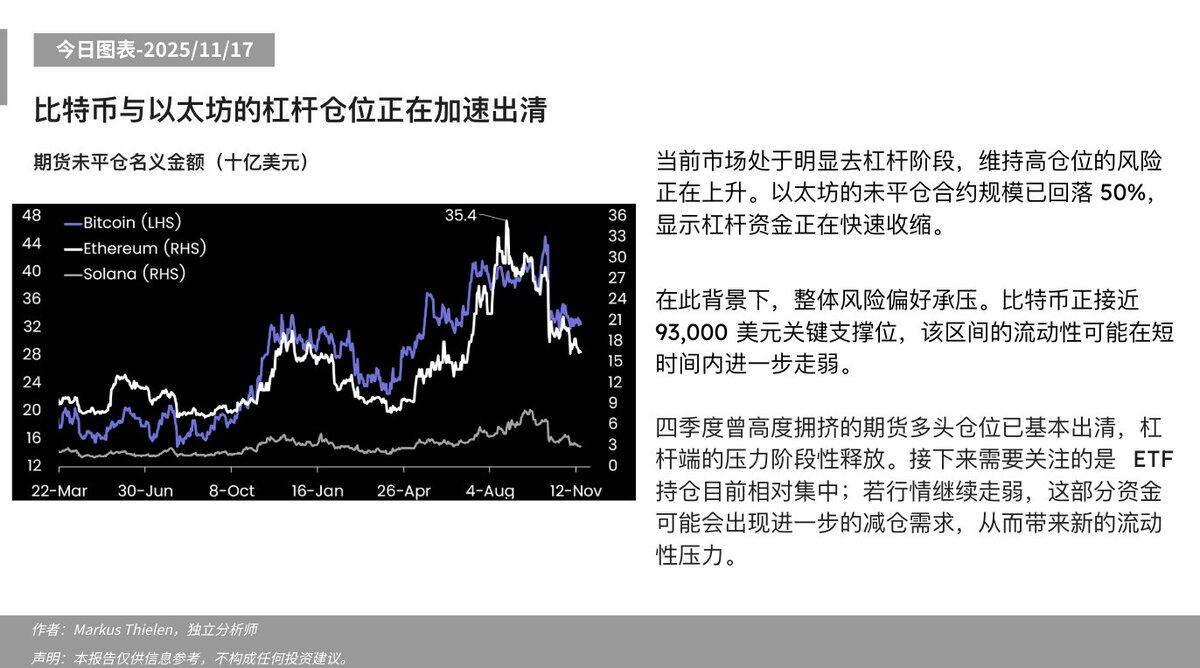

According to an article published by Matrixport, as reported by Odaily Planet Daily, the market is currently in a clear deleveraging phase, and the risks of maintaining high positions are increasing. Ethereum's open interest has fallen by 50%, indicating that leveraged funds are rapidly shrinking.

Against this backdrop, overall risk appetite is under pressure. Bitcoin is approaching the key support level of $93,000, and liquidity in this range may weaken further in the short term.

The highly crowded long positions in futures markets that were predominantly in the fourth quarter have been largely cleared, easing the pressure from leverage. The next area to watch is ETF holdings, which are currently relatively concentrated. If the market continues to weaken, these funds may face further selling pressure, leading to new liquidity challenges.