Data Decoding: $870 Million Fleeing in a Single Day – Who's Buying the Dip? Who's Retreating?

- 核心观点:比特币与以太坊市场面临显著抛售压力。

- 关键要素:

- 比特币现货ETF单日净流出8.7亿美元。

- 比特币长期持有者正大量获利了结。

- 贝莱德减持比特币与以太坊持仓。

- 市场影响:加剧市场恐慌情绪与价格下行压力。

- 时效性标注:短期影响

Original author: 1912212.eth, Foresight News

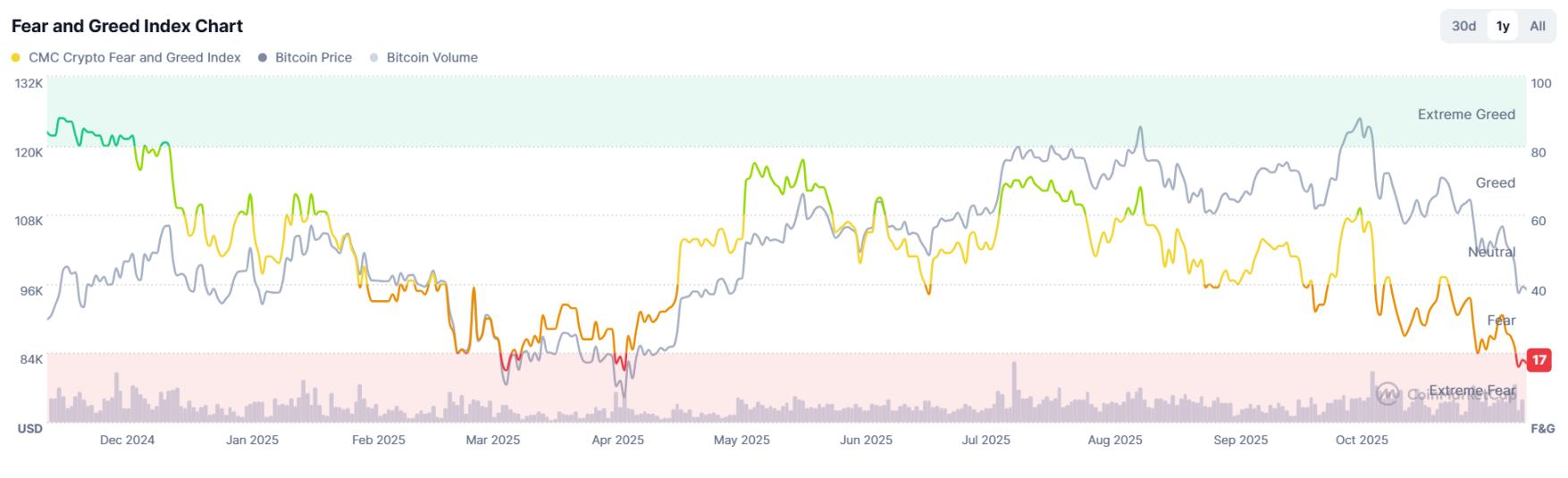

After Bitcoin (BTC) fell below the $100,000 mark, the market situation deteriorated rapidly, once testing the $93,000 level. Market panic continued to spread, with data showing that its fear index once dropped to 17, the last time such panic occurred was in April of this year.

There is growing discussion about whether the four-year cycle will continue and whether the market has turned bearish. So, from a data perspective, what exactly is going on with Bitcoin and Ethereum?

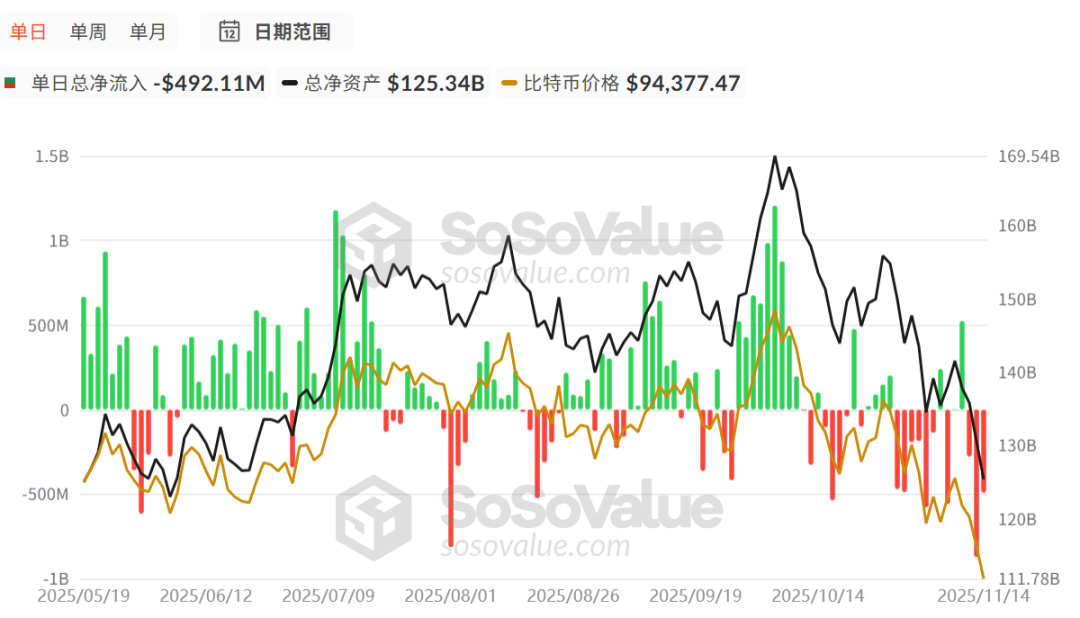

Bitcoin and Ethereum spot ETFs continue to experience large net outflows.

Since October of this year, the performance of Bitcoin spot ETFs, an important indicator for monitoring capital flows, has been far from optimistic.

Specifically, from October 10th to October 14th, there were only eight days of net inflows, and the amounts were not high. Only the single-day inflow of $523.98 million on November 11th can be considered a bright spot. On the other hand, net outflows continued to increase, with a rare single-day net outflow of $869.86 million on November 13th, setting a new high in nine months.

Throughout October, Bitcoin spot ETFs saw a net inflow of $3.419 billion, but in just half a month of November so far, they have seen a net outflow of $2.334 billion.

The performance of the ETH spot ETF was also poor.

Since October 10th, there have only been 6 days of net inflows, with the rest being net outflows. Furthermore, the net outflow amount has remained around $150 million to $200 million. Currently, the total cumulative net inflow is $13.13 billion.

Who is selling, and who is buying?

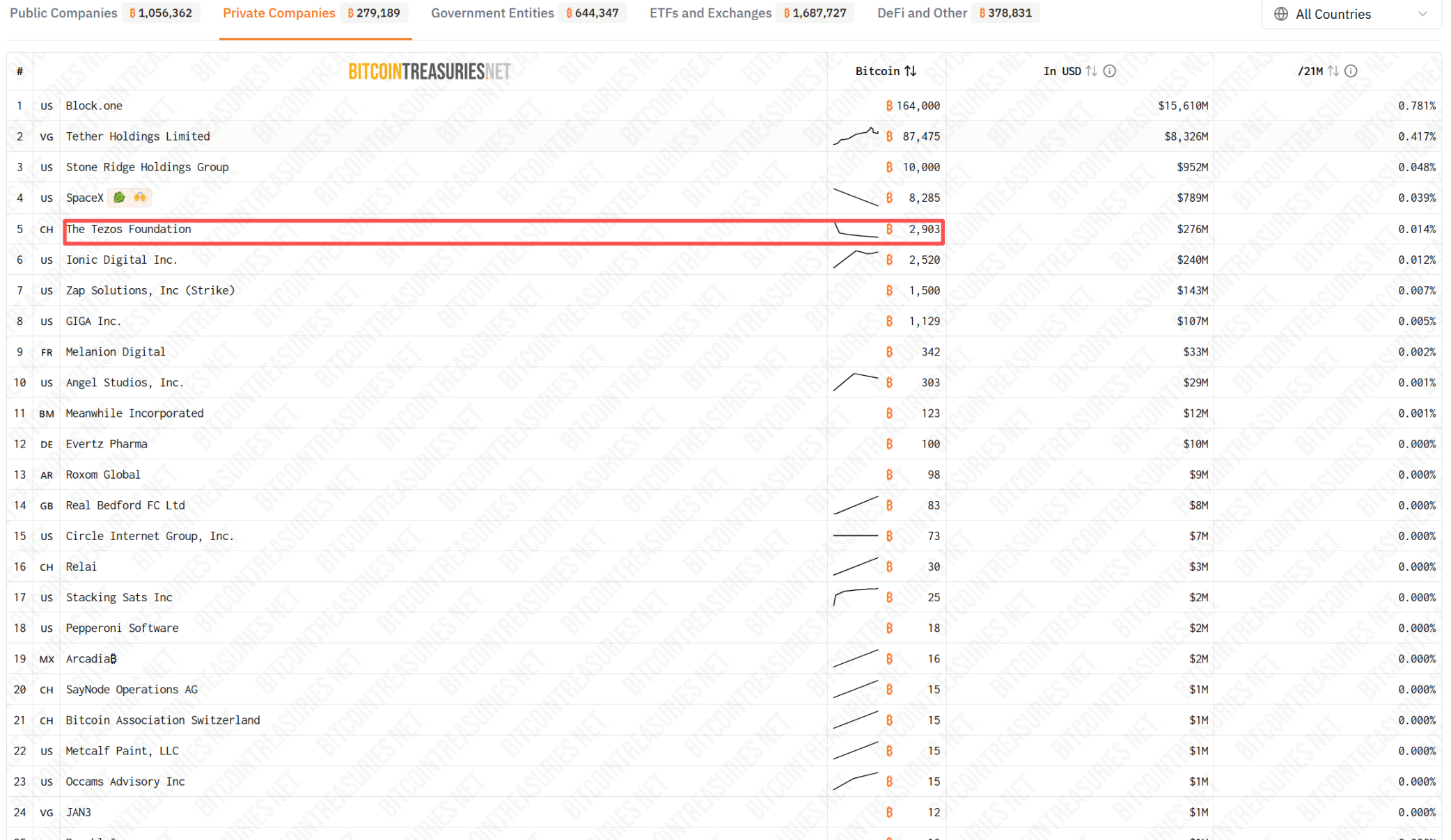

According to bitcointreasuries data, among the top 20 private companies holding BTC reserves, only the Tezos Foundation chose to reduce its BTC holdings, while the rest chose to increase their holdings or maintain their current holdings.

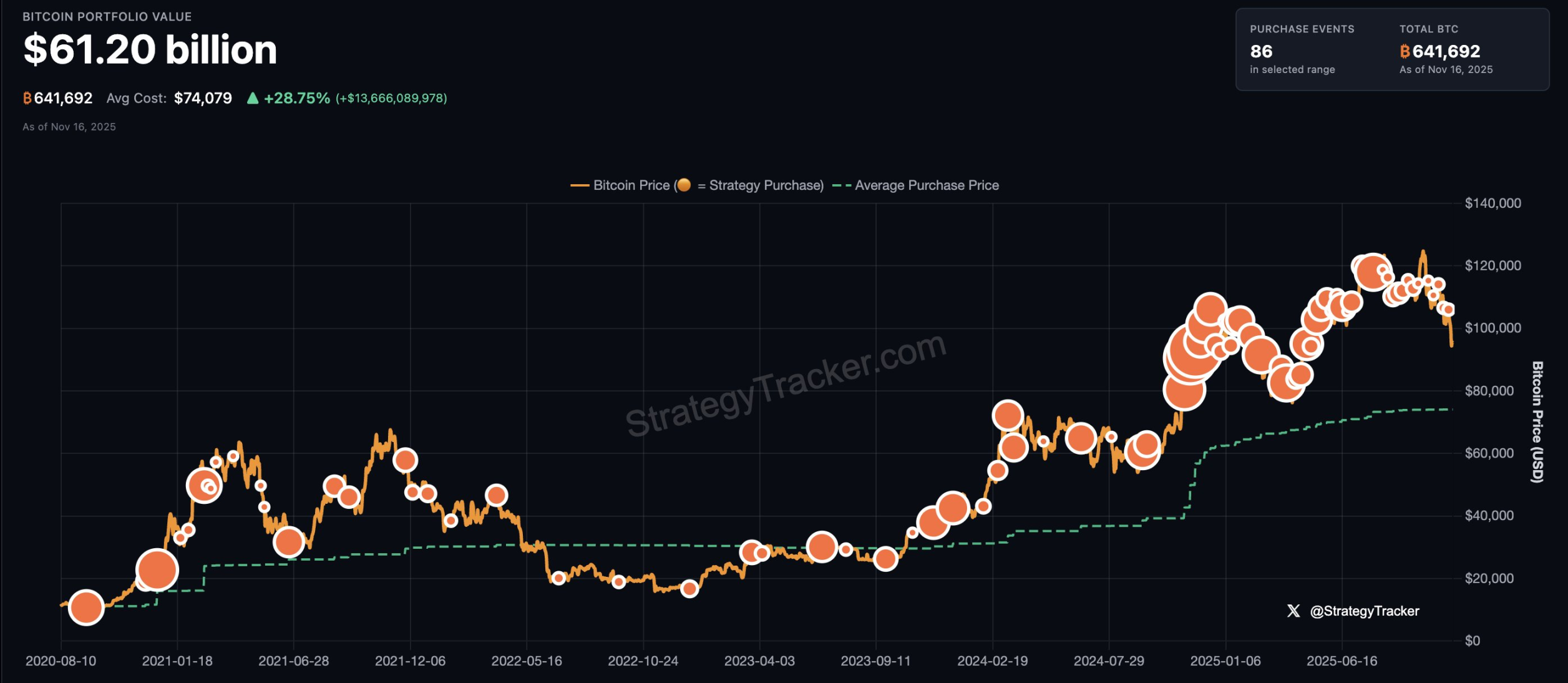

Bitcoin heavyweight Michael Saylor has been consistently buying. A screenshot from his official website shows his BTC holdings have risen to 641,692, with a total value of $61.2 billion, and an average purchase price of $740.79 million. He has also tweeted that he will continue to buy BTC. Currently, MSTR's stock price is $199.7, with a market capitalization of $57.4 billion, and its mNAV (market capitalization as a percentage of total BTC holdings) has fallen below 1.

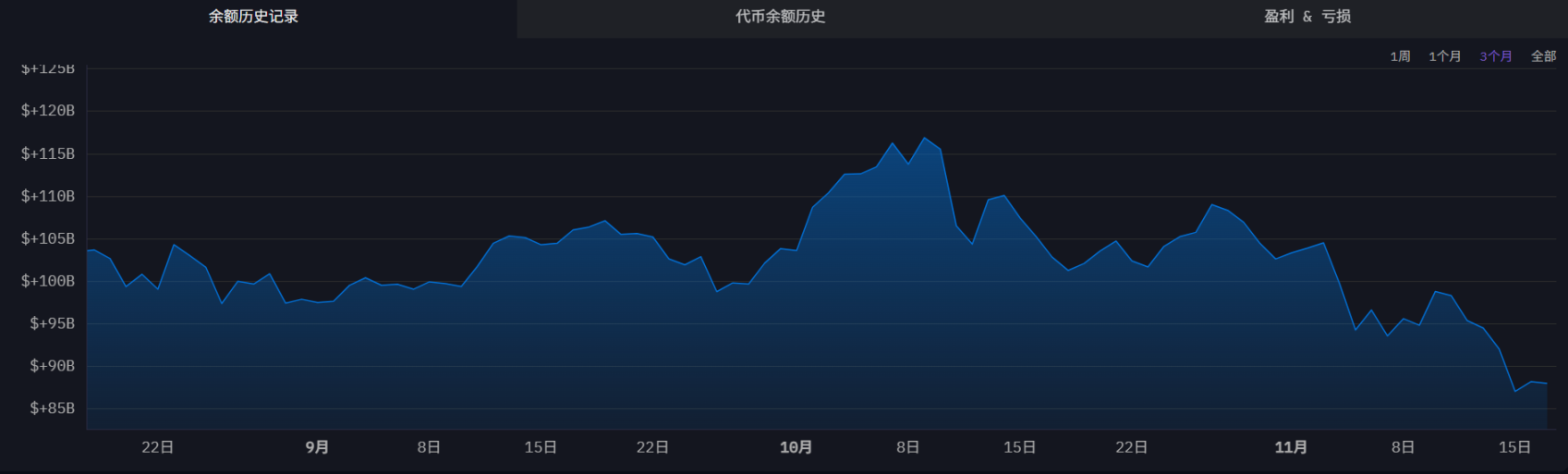

Another market player, BlackRock, opted to sell off its holdings. Arkham data shows that it has reduced its Bitcoin holdings by 0.41% and Ethereum holdings by 0.89% in the past. Its wallet balance has fallen from $115 billion to around $88 billion.

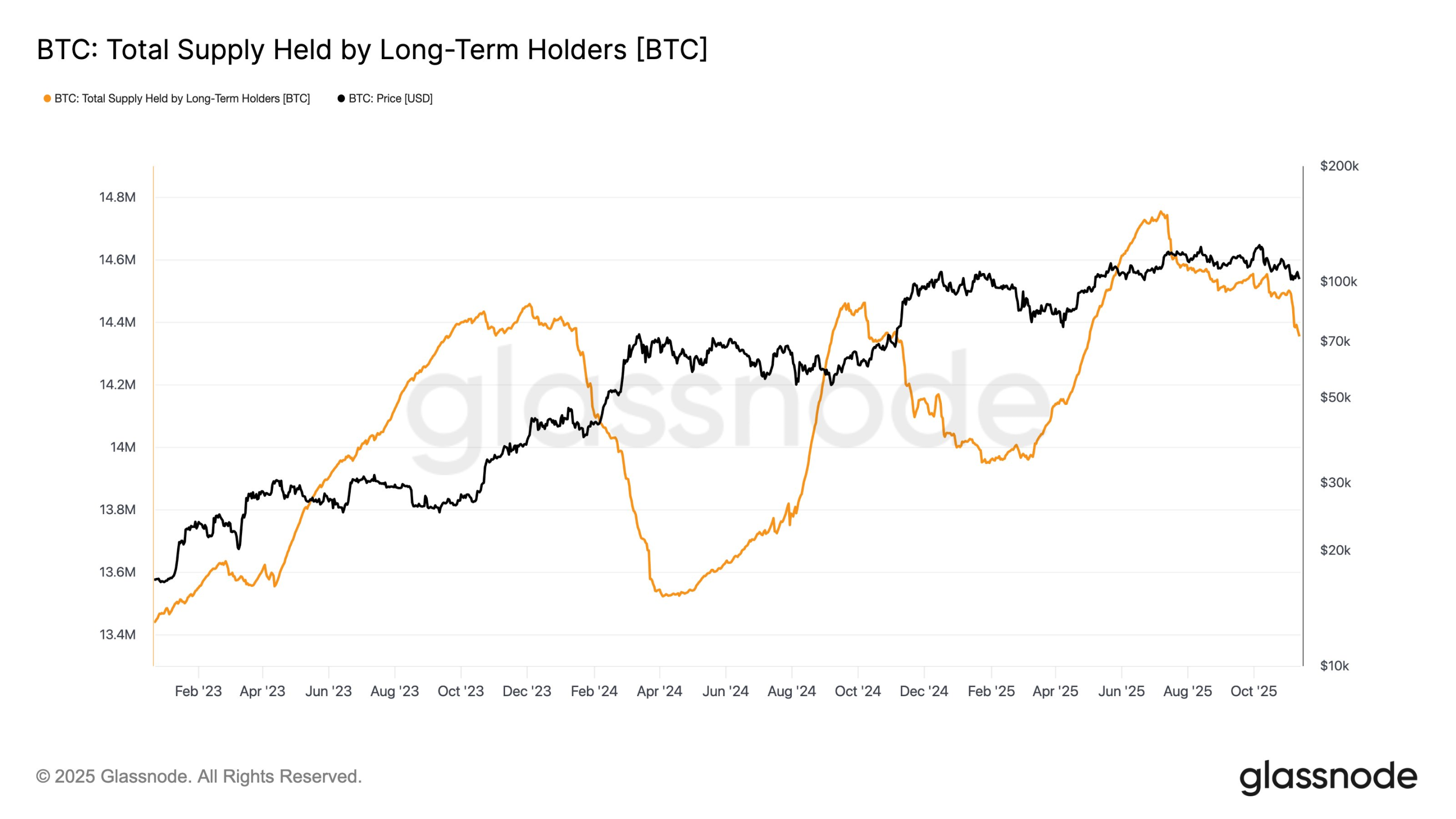

Regarding on-chain data, who is continuously selling BTC?

Glassnode provides the answer: long-term BTC holders. The rapid decrease in Bitcoin supply has caused a sharp shift in net holdings into negative territory.

As bulls defend the $100,000 mark, long-term holders (LTHs) are taking profits.

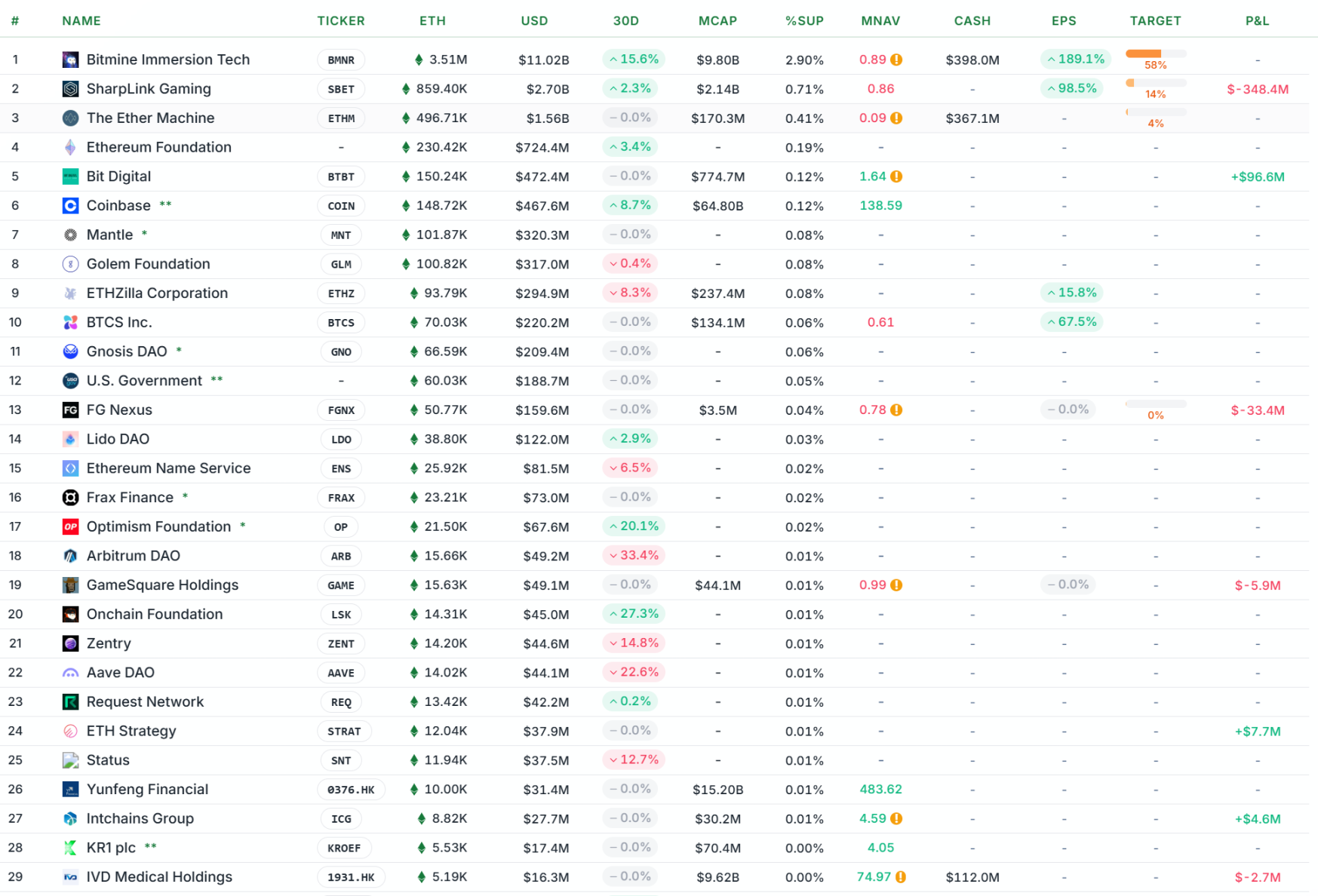

Within the Ethereum Reserve Treasury, however, there are significant differences of opinion.

BitMine, ranked first, aggressively increased its holdings by 15.6% of the total supply within 30 days, raising its reserves to 3.51 million ETH, currently valued at $11.02 billion. SharpLink, ranked second, also chose to increase its holdings by 2.3%, currently holding $859,400. In addition, the Ethereum Foundation, Coinbase, Lido DAO, Optimism Foundation, and Onchain Foundation all chose to increase their holdings, with the last two collectively increasing their holdings by over 20%.

However, some chose to sell, with ETHZilla, ENS, Arbitrum DAO, Zentry, and Aave DAO all experiencing significant reductions in holdings.

It's worth noting that players ranked outside the top 20 reduced their ETH holdings by a much larger margin than they increased them.