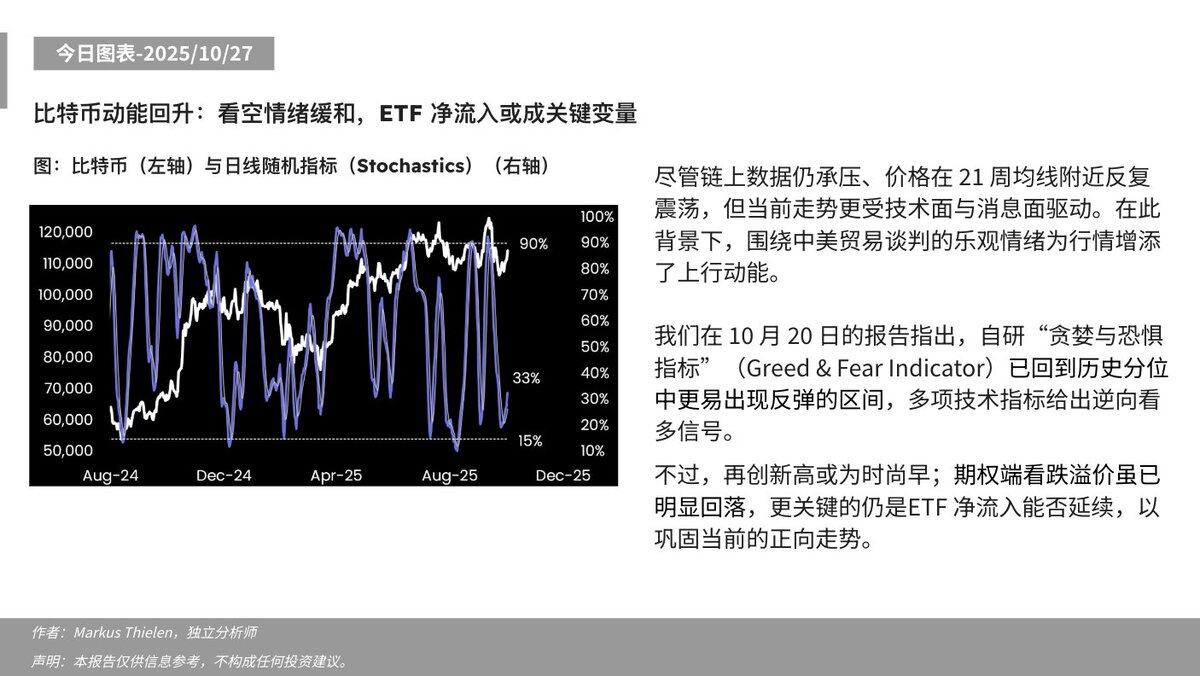

Odaily Planet Daily reports that Matrixport released today's chart, stating that while on-chain data remains under pressure and prices fluctuate around the 21-week moving average, the current trend is driven more by technical factors and news. Against this backdrop, optimism surrounding the Sino-US trade negotiations has added upward momentum to the market.

In our report on October 20, we pointed out that the self-developed "Greed & Fear Indicator" has returned to the range where rebounds are more likely to occur in historical percentiles, and a number of technical indicators have given contrarian bullish signals.

However, it may be too early to set new highs; although the put premium on options has clearly fallen, the key issue is whether the net inflow of ETFs can continue to consolidate the current positive trend.