Original author: mary in sf

Original translation: AididiaoJP, Foresight News

In the short run, the market is a voting machine, but in the long run, it is a weighing machine - Benjamin Graham

We are now in a period of industry consolidation, and everyone can see who is swimming naked.

While liquidity had been declining for some time, on October 10th, it dramatically and completely receded. "Death of a Salesman" is an incredibly apt metaphor for this moment in crypto history. The play focuses on the corrosive illusions of the American Dream, the fragility of family ties, and the psychological toll of societal expectations; all of which mirror the illusions of superstructures, the fragility of crypto companies, and the psychological toll borne by market participants burned by token after token.

Now that we’ve woken up from the fantasies of what 2021 told us crypto could be, we speculators are picking up the pieces instead of facing what crypto actually is.

Last year, I read "Built to Last," a book about what separates companies that last for generations from the average ones. The author discusses the dot-com bubble in detail, and one of the key takeaways is that with every innovation cycle, the masses speculate on "new, mysterious technologies," but it's the people behind each company that truly separate the good from the great. Tokens without clear legal codification of actual token holder rights are somewhat worthless, but the past few weeks have shown which tokens have teams that care about the long-term survival of their tokens, and which are short-term and never really have a plan.

For all these rhetorical questions that have been treated more as memes, now is a moment of reckoning:

- Where does value accumulate?

- If value accrues to the equity entity, why buy tokens?

- So are all tokens just memecoins?

Here’s a mental framework for what I believe will be the enduring tokens of the future:

- Bitcoin

- Revenue-supported: Hyperliquid, etc.

- Social capital, attention tokens

This post will be more observational than my previous more analytical posts, as I found this interesting but didn't have the time to delve deeper like zachxbt did.

Acquisition

This week gave us two examples of token acquisitions: one coin went up (Clanker) and the other went down (Padre).

Clanker

Yesterday, @farcaster_xyz announced the acquisition of Clanker. Clanker is a token launch platform on Base, built by an excellent team, and its token launched about a year ago:

- Protocol fees will be used to purchase and hold $CLANKER

- The Clanker team burned tokens collected as protocol fees in products v0 - v3.1.

- The team permanently locks approximately 7% of the total $CLANKER supply in a one-sided liquidity pool to provide additional liquidity (which reduces the circulating supply).

The token subsequently rallied as it became clear that the Clanker team was treating its tokens as equity in their dealings with Farcaster.

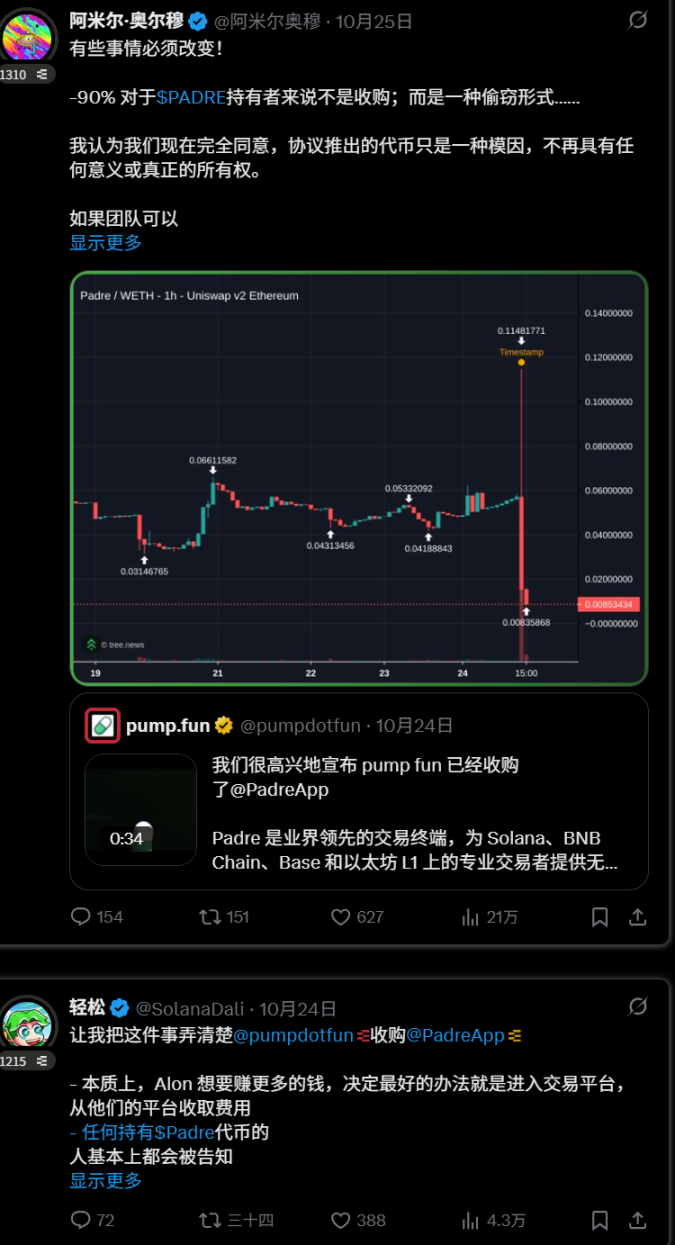

Padre

The market rarely gives you the opportunity to experiment without confounding variables. Clanker and Padre are both products that ostensibly generate revenue. See what happens to a token when a team doesn't act.

The team raised funds on an ICO-like platform, promising buybacks and revenue sharing, only to fail to do so. Instead, the team kept all profits, occasionally promising to resume revenue sharing and buybacks while their tokens continued to trade. Now that Padre has been acquired, token holders have received nothing, and the tokens have been revealed to be worthless.

Ironfish

If anyone has the time to explain the details of this acquisition, I'd love to hear about it. My understanding is that the token is still trading because the network is still maintained by the Iron Fish Foundation, and the core team was acquired by Base. It's a bit strange to see the former founder tweeting about price action. Does this mean Base acquired the Labs entity? Did they purchase any tokens?

collapse

Eclipse and Kadena

The scandals surrounding these companies, which emerged as other blockchains neared their TGEs and mainnet launches, provide a stark reminder that not all blockchains are secure. In fact, they remind us that blockchains trade on trust in their potential, and the strength and conviction of the team is a crucial indicator of this.

I won’t dwell on Eclipse’s token price or any further tweets, but I do find this a bit ridiculous. Eclipse was doomed from the start because its intention was never to operate a blockchain with a long-term vision, it was always to extract liquidity.

There are many different circles in the crypto world. Everyone in our small circle of crypto Twitter knows that Kadena has never been a functioning blockchain. Many employees from various companies have told me that their companies lack viable products and are simply in a state of existential suspension until the music stops.

This is a pretty bad and depressing time for the crypto space. We need to provide token holders with rights and more productive assets in smaller market caps.

I find that if you think of crypto as just an accelerated economic experiment, it becomes slightly less depressing, but a byproduct of that experiment is that believers who believed in the wrong team lost a lot of money.

When decentralized technology relies so heavily on a trusted team, what does that say? It can only go up.

- 核心观点:加密行业正经历价值回归与清算。

- 关键要素:

- 流动性急剧下降暴露项目本质。

- 团队实力决定代币长期价值。

- 收购案例揭示代币权利差异。

- 市场影响:加速劣质项目淘汰,推动行业规范。

- 时效性标注:中期影响