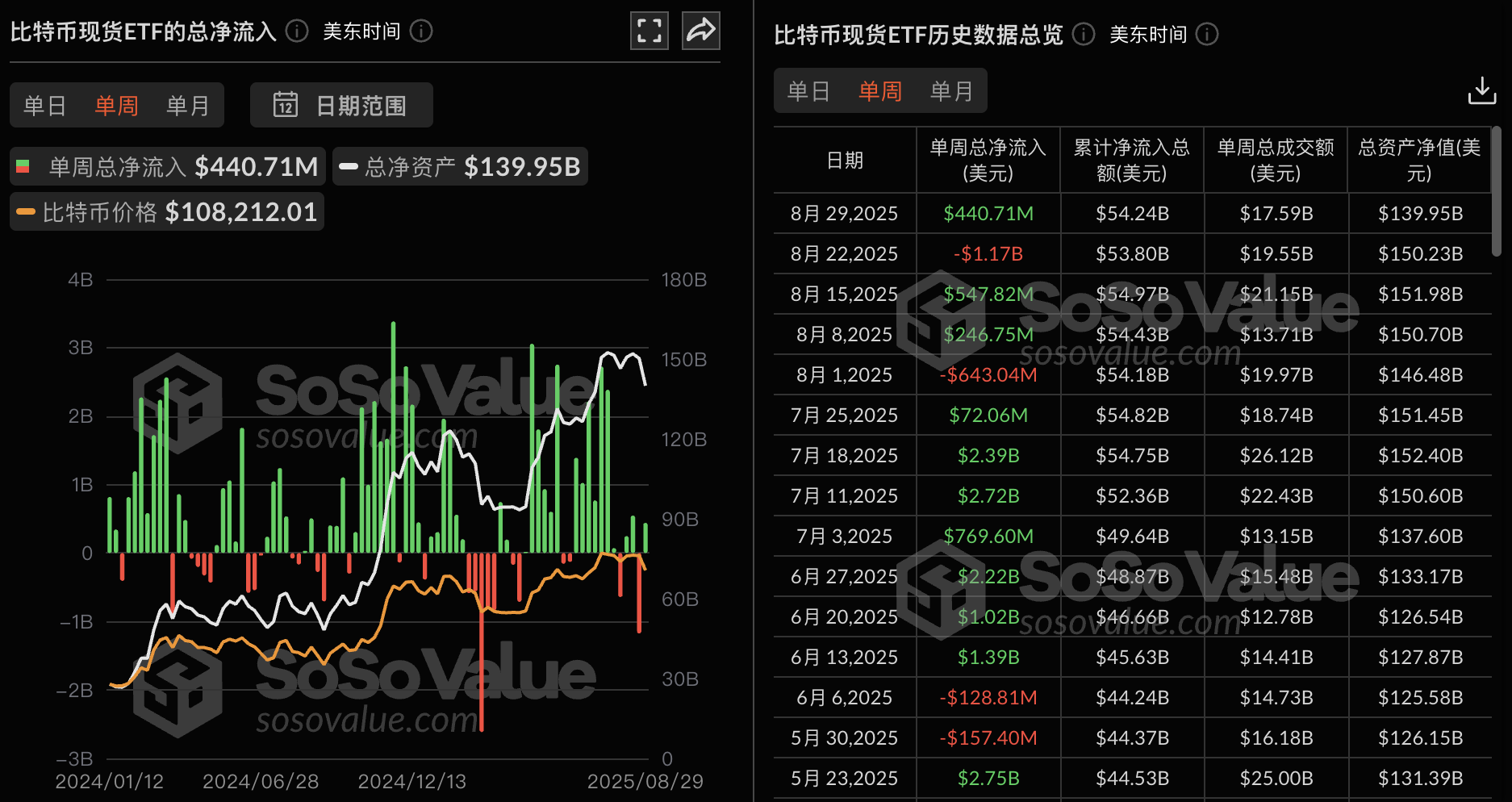

According to SoSoValue data, Bitcoin spot ETFs saw a net inflow of US$441 million during last week's trading days (August 25 to August 29, US Eastern Time).

The Bitcoin spot ETF with the largest weekly net inflow last week was Blackrock's Bitcoin ETF IBIT, with a weekly net inflow of US$248 million. The total net inflow of IBIT in history has reached US$58.31 billion. The second largest was Ark Invest and 21 Shares' ETF ARKB, with a weekly net inflow of US$78.59 million. The total net inflow of ARKB in history has reached US$2.09 billion.

The Bitcoin spot ETF with the largest net outflow last week was the Grayscale ETF GBTC, with a weekly net outflow of US$15.3 million. The total net outflow of GBTC in history has now reached US$23.94 billion.

As of press time, the total net asset value of the Bitcoin spot ETF was US$139.95 billion, the ETF net asset ratio (market value as a percentage of the total market value of Bitcoin) reached 6.52%, and the historical cumulative net inflow has reached US$54.24 billion.