Vitalik: If the prediction market can solve the interest problem, a large number of hedging application scenarios will emerge and drive further growth in trading volume

2025-08-25 00:16

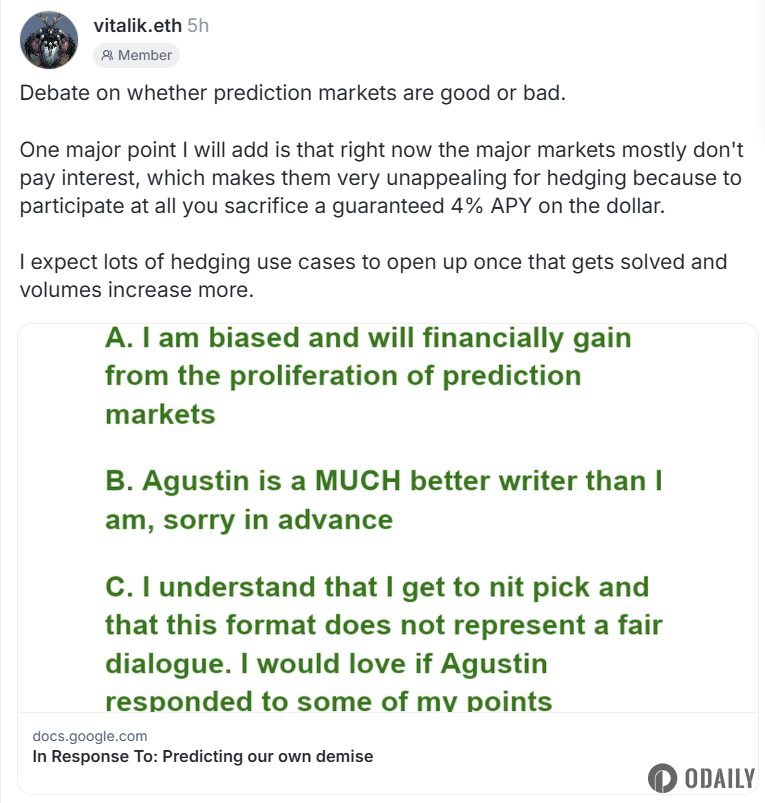

According to Odaily Planet Daily, Ethereum founder Vitalik Buterin wrote on Warpcast: "Regarding the debate over the pros and cons of prediction markets, I would like to add an important point: most mainstream prediction markets currently do not pay interest, which makes them very unattractive for hedging purposes. Because as long as you participate, it means giving up the guaranteed 4% annualized return on US dollars.

I expect that once this problem is solved, a large number of hedging applications will emerge and trading volume will continue to grow.”